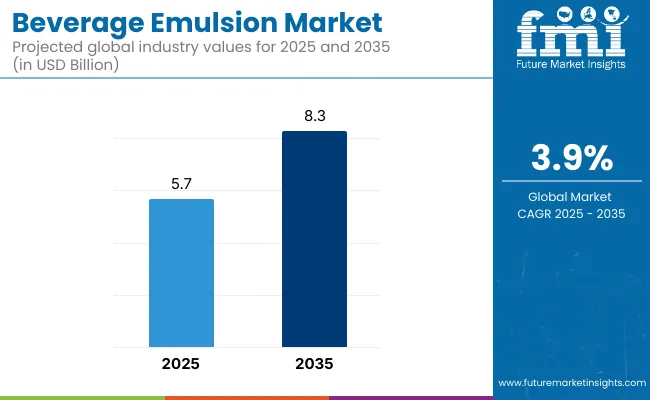

Beverage emulsion market is expected to expand from USD 5.7 billion in 2025 to USD 8.3 billion by 2035, registering a CAGR of 3.9%.

| Market Attribute | Value |

|---|---|

| Market Size in 2025 | USD 5.7 billion |

| Market Size in 2035 | USD 8.3 billion |

| CAGR (2025 to 2035) | 3.9% |

The upswing is expected to be driven by strong consumer appetite for cleaner labels, functional ingredients, and appealing texture in drinks that range from plant-based milks to vitamin-fortified waters. Key trends are being observed in the rapid deployment of AI-assisted nano-emulsion systems that boost bioavailability, alongside a marked pivot toward plant-sourced stabilizers in low-sugar, non-alcoholic formulations.

Stronger demand for healthier drinks is expected to remain the primary driver, as beverage formulators are required to suspend vitamins, probiotics, and botanicals in low-sugar, plant-based liquids without sacrificing clarity or mouthfeel. In response, greater use of hydrocolloids such as xanthan gum and pectin is being favoured, while AI-assisted nano-emulsion technology is gradually being adopted to lift bioavailability and extend shelf life.

A marked trend has been observed toward natural, clean-label stabilizers drawn from fruit or microbial sources, coupled with a shift to multifunctional emulsions that can deliver colour, flavour, and functional actives at once. Rapid diversification of non-alcoholic ranges-sparkling probiotics, vitamin waters, and nutrient-dense dairy alternatives-has pushed producers to invest in advanced cloud and flavour emulsions that retain visual appeal in complex matrices.

On the regulatory front, tighter FDA and EFSA guidance on synthetic additives is expected to accelerate the phase-out of traditional clouding agents that rely on brominated or petroleum-derived oils. Compliance now requires transparent labelling, allergen-free sourcing, and demonstrable reductions in carbon footprint, prompting major suppliers to certify plant-based emulsifiers under organic and clean-label schemes.

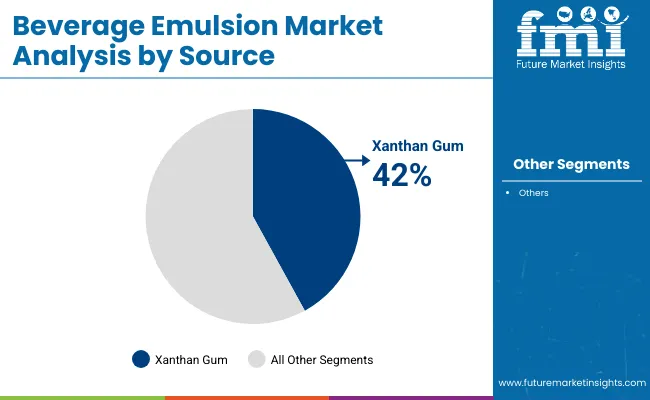

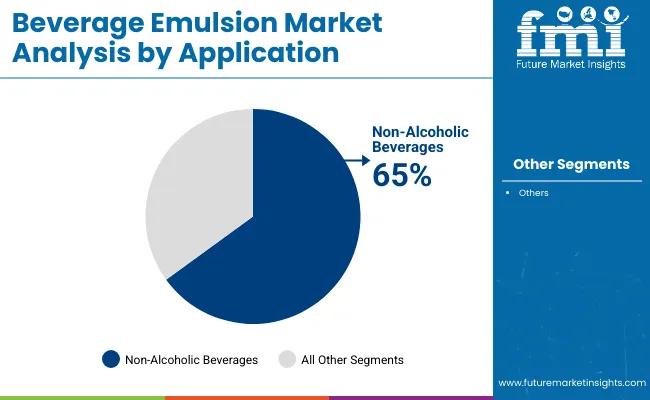

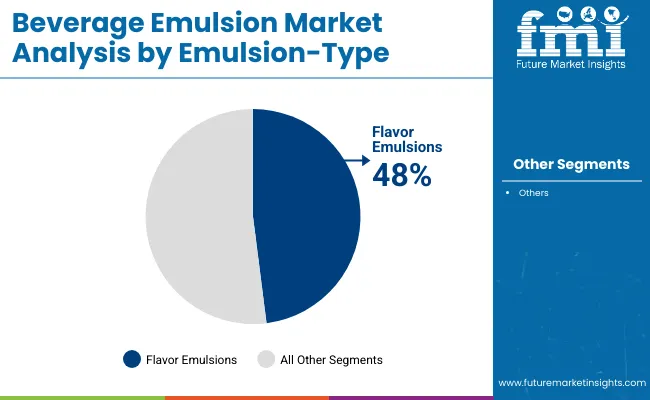

Segmentation of the beverage emulsion market is conducted across three key lenses. By source, formulations rely on xanthan gum, pectin, carboxymethyl cellulose, and carrageenan. By application, usage concentrates on non-alcoholic beverages and carbonated beverages. By emulsion type, commercial offerings are differentiated into color emulsions, flavor emulsions, and cloud emulsions.

Adoption of xanthan gum has been propelled by its exceptional viscosifying and stabilizing properties, allowing beverage formulators to keep particulate, colour, and flavour uniformly suspended even under wide pH and temperature swings.

It is being favoured in low-sugar juices, plant-based milks, and protein-fortified waters because a minimal dose delivers the mouthfeel consumers expect while complying with clean-label demands. As a result, xanthan gum is estimated to command roughly 42% of total source-based revenues in 2025 and is projected to hold its lead through 2035 as demand for shelf-stable, functional drinks rises worldwide.

Flavor emulsions are being adopted extensively because they can encapsulate volatile aroma compounds, prevent ringing, and keep taste profiles consistent across the product’s shelf life. Their use has been intensified as brands introduce exotic fruit blends, botanical infusions, and reduced-sugar formulations that need strong flavor impact at low additive levels.

Consequently, flavor emulsions are estimated to command about 48% of total emulsion-type revenues in 2025 and are expected to maintain a clear lead through 2035 as ready-to-drink teas, sparkling waters, and wellness shots multiply.

Stability Issues, Regulatory Compliance, and High Production Costs

Stability criteria can be a challenge to the beverage emulsion market, the key challenges being ingredient separation, oxidation, and shelf life. Maintaining the same uniform appearance and texture as regular beverage emulsions without losing flavor, aroma or the integrity of nutrients requires cutting edge formulation techniques.

Moreover, stringent food safety regulations by FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and other international regulatory bodies impose compliance to clean-label standards, natural ingredient sourcing, and allergen-free formulations. Production costs are additionally an issue: Emulsifiers, stabilizers, and various encapsulation technologies tend to be prohibitively expensive and require ongoing innovation to meet consumer demand for natural and organic options.

Natural and Clean-Label Emulsifiers, Functional Beverages, and AI-Driven Formulation

However, there are several challenges faced by the beverage emulsion market such as the need for clean-label emulsifiers and rising popularity of plant-based drinks. Driven by the rising demand for minimally processed foods, consumers are on the lookout for naturally-based emulsifiers from plant sources like acacia gum, pectins and lecithin rather than synthetic stabilizers.

The demand for high-performance emulsions is growing with the rise of functional beverages such as those featuring CBD, sports nutrition drinks, and drinks with probiotic properties. AI-based formulation and Nano-emulsion technology to enhance stability, bioavailability, and mouthfeel would also be the future of innovation in the market.

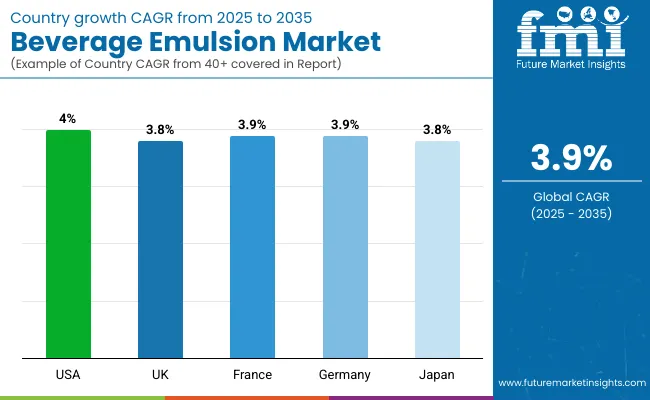

The United States beverage emulsion market is expected to expand at a CAGR of 4.0 % from 2025 to 2035. Growth is being underpinned by consumers’ preference for functional, low-sugar drinks and the rapid scale-up of plant-based dairy alternatives. Capital has been allocated to hydrocolloid systems that can stabilise vitamins, botanicals, and proteins while remaining compliant with FDA clean-label rules. Major suppliers have broadened portfolios of citrus-oil clouding agents and nano-scale flavour emulsions to support continual new-product rollouts by leading bottlers and craft brands.

The United Kingdom beverage emulsion market is forecast to grow at a CAGR of 3.8% between 2025 and 2035. Soft-drink formulators have responded to the Sugar Tax by switching to reduced-sugar emulsions that preserve mouthfeel. Demand for premium hydration, sports-nutrition beverages, and botanical sodas has spurred the adoption of fruit-derived pectin and carrageenan stabilisers. Investment has also been channelled into carbon-neutral manufacturing lines, aligning with the country’s sustainability commitments.

France’s beverage emulsion market is projected to expand at a CAGR of 3.9% from 2025 to 2035, fuelled by premium fruit-based drinks and the country’s long-standing culinary emphasis on natural ingredients. Producers have shifted toward citrus-oil flavour emulsions and xanthan gum systems that provide clarity and shelf stability in reduced-sugar recipes. Regulatory scrutiny of synthetic additives has further encouraged the uptake of plant-sourced hydrocolloids.

Germany’s beverage emulsion market is expected to advance at a CAGR of 3.9% between 2025 and 2035. Functional energy drinks, fortified waters, and alcohol-free craft beers have created steady demand for high-performance flavour and cloud emulsions. The country’s stringent food-safety framework has prompted extensive validation of xanthan-gum and carrageenan systems, while ingredient traceability remains a top procurement priority.

Japan’s beverage emulsion market is anticipated to grow at a CAGR of 3.8% from 2025 to 2035, anchored by demand for ready-to-drink teas, functional dairy beverages, and novel sparkling drinks. Manufacturers favour ultra-stable flavour and cloud emulsions that can tolerate extended ambient shelf life without refrigeration. Preference for natural, minimal-additive formulations has led to broader adoption of pectin and starch-based stabilisers.

The beverage-emulsion arena is organised into two broad tiers. Tier 1 suppliers including Cargill, Kerry Group, ADM, Ingredion, and Tate & Lyle are positioned as full-line ingredient houses. Their global networks are being leveraged to secure botanical hydrocolloids, expand nano-encapsulation capacity, and provide AI-supported formulation services to multinational bottlers.

Tier 2 specialists, such as CP Kelco, Givaudan, DSM-Firmenich, Döhler, Sensient, and DuPont, are concentrating on region-specific flavour systems, customised pectin and xanthan blends, and rapid prototyping for craft beverage brands. Distribution is handled through a mix of direct contracts with major fillers and partnerships with regional distributors that offer just-in-time warehousing for short-shelf-life emulsions.

Competition is being shaped by three strategic moves: first, large players are investing in citrus-fibre and starch-based carriers to replace synthetic clouding oils; second, joint laboratories are being set up with beverage start-ups in Asia and North America to shorten time-to-market for reduced-sugar launches; third, digital formulation platforms are being rolled out so brand owners can model stability, viscosity, and flavour release before pilot runs. As clean-label regulations tighten, tier 1 providers are expected to absorb niche technology firms, while tier 2 operators will focus on high-margin, craft-oriented emulsions and regional taste profiles.

Beverage Emulsion Market News

Chr. Hansen continued its focus on natural, bio-based emulsions in 2025, leveraging fermentation-driven technologies to meet the rising demand for clean-label and natural ingredients in beverages. The company’s advancements ensure enhanced stability and taste profiles, positioning Chr. Hansen as a leader in the shift toward sustainable beverage solutions.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.7 billion |

| Projected Market Size (2035) | USD 8.3 billion |

| CAGR (2025 to 2035) | 3.9\% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Source Segments Analyzed | Xanthan Gum, Pectin, Carboxymethyl Cellulose, Carrageenan |

| Application Segments Analyzed | Non-Alcoholic Beverages, Carbonated Beverages |

| Emulsion Types Analyzed | Flavor, Color, Cloud |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, France, Germany, Japan, South Korea |

| Key Players Profiled | Cargill Inc., Kerry Group plc, ADM, Ingredion Incorporated, Tate & Lyle PLC, CP Kelco, Givaudan SA, DSM-Firmenich, Döhler GmbH, Sensient Technologies, DuPont |

| Additional Attributes | Droplet-size optimisation, organic hydrocolloid adoption, AI-assisted formulation modelling, regional demand trends, clean-label compliance analysis |

The overall market size for beverage emulsion market was USD 5.7 Billion in 2025.

Beverage emulsion market is expected to reach USD 8.3 Billion in 2035.

The demand for Beverage Emulsions is expected to rise due to growing consumption of functional drinks, clean-label trends, and advancements in emulsion technologies.

The top 5 countries which drives the development of beverage emulsion market are USA, UK, Europe Union, Japan and South Korea.

Xanthan Gum and Non-Alcoholic Beverages to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Crate Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA