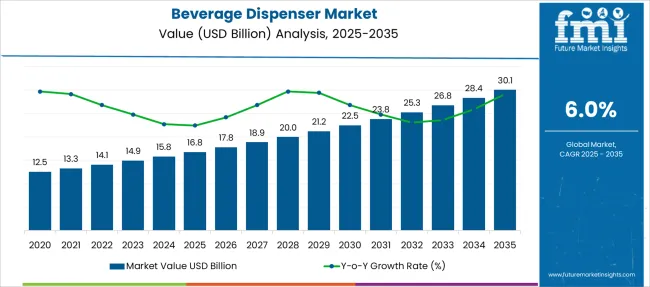

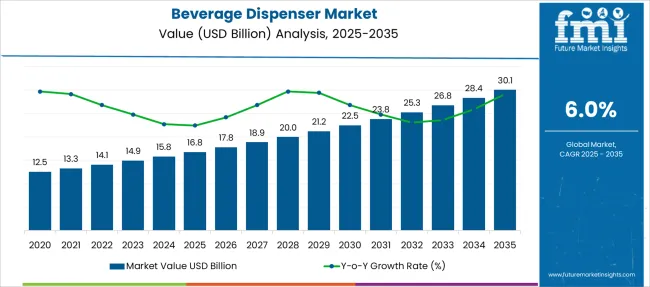

The Beverage Dispenser Market is estimated to be valued at USD 16.8 billion in 2025 and is projected to reach USD 30.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Beverage Dispenser Market Estimated Value in (2025 E) | USD 16.8 billion |

| Beverage Dispenser Market Forecast Value in (2035 F) | USD 30.1 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The beverage dispenser market is experiencing steady growth, supported by increasing demand across commercial, institutional, and household settings. Rising urbanization, expanding foodservice infrastructure, and a growing preference for organized beverage serving systems are key drivers of market expansion.

Technological innovation, particularly in electric dispensers with temperature control and automated features, has played a vital role in enhancing product adoption. The market benefits from seasonal demand surges during events, outdoor functions, and hospitality services, further accelerating product circulation.

Rising focus on hygiene and efficient serving methods has made dispensers a preferred solution over traditional containers in high-footfall environments. Looking ahead, the combination of convenience, durability, and user-centric designs is expected to stimulate sustained demand, with manufacturers leveraging new materials and design efficiencies to meet evolving customer expectations.

The beverage dispenser market is segmented by type, capacity, material type, application, distribution channel, and geographic regions. The beverage dispenser market is divided by type into Electric and Non-electric. The beverage dispenser market capacity is classified into 5 to 10 liters, less than 5 liters, and More than 10 liters. Based on the material type, the beverage dispenser market is segmented into Plastic beverage dispensers, Glass beverage dispensers, Stainless steel beverage dispensers, and Others. The beverage dispenser market is segmented into Commercial and Residential. The distribution channel of the beverage dispenser market is segmented into Supermarkets, Online retail, Specialty stores, Convenience stores, and Others. Regionally, the beverage dispenser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

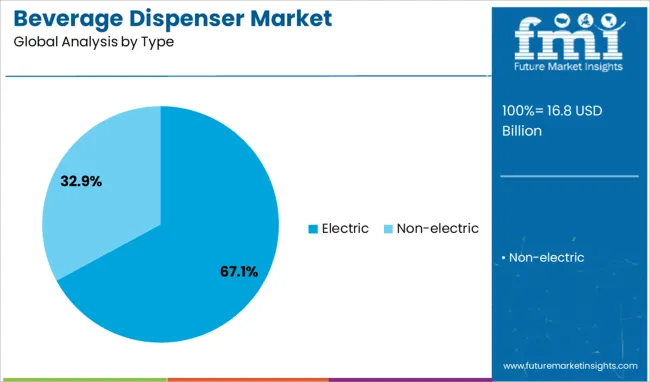

The electric segment dominates the beverage dispenser market with a commanding 67.1% share, attributed to its advanced functionality, consistent temperature control, and increasing presence in commercial and institutional environments. These dispensers are preferred for their ability to maintain beverages at optimal hot or cold conditions, making them ideal for settings such as offices, cafeterias, hotels, and convenience stores.

Integration of smart features, such as digital temperature settings, auto-cleaning, and energy-saving modes, has increased product appeal among consumers seeking long-term operational efficiency. Manufacturers continue to innovate in terms of design compactness and power consumption, responding to both performance demands and space constraints.

As commercial establishments seek to enhance customer service and hygiene, the electric segment is expected to retain its leadership through continued upgrades in safety, design, and automation features.

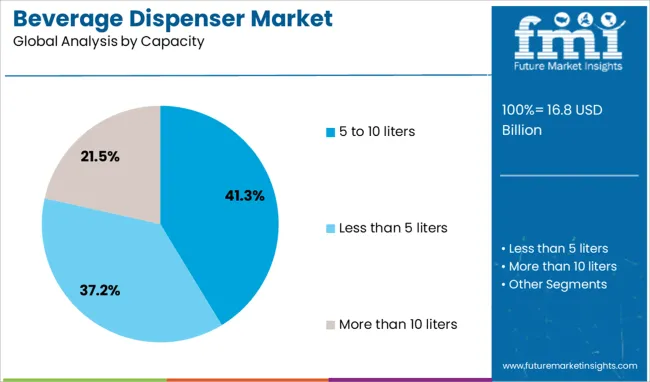

The 5 to 10 liters capacity segment holds a 41.3% share in the beverage dispenser market, reflecting its balanced positioning for both commercial and semi-commercial use cases. This size range offers sufficient volume to serve moderate-sized gatherings without occupying excessive space, making it ideal for mid-scale hotels, catering services, corporate offices, and household functions.

The segment has gained traction due to its versatility and ease of handling, while also supporting temperature control and portioned dispensing in electric models. Manufacturers have focused on enhancing ergonomics, with features like transparent chambers for easy monitoring and detachable parts for cleaning convenience.

The segment’s adaptability to varied beverage types hot or cold and multiple user settings contributes to its steady market demand. Continued adoption in mid-sized operations and growing trends in home entertainment and small event catering are expected to support further expansion of this segment.

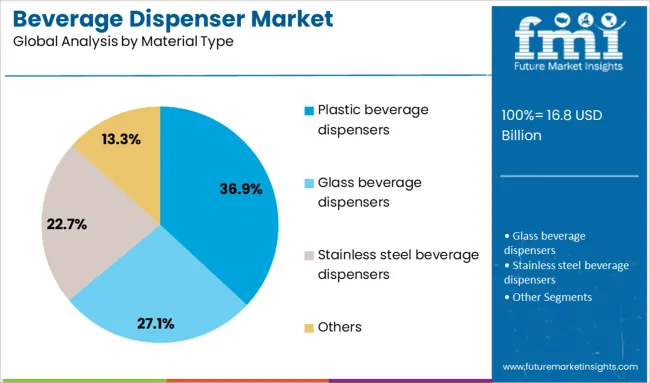

Plastic beverage dispensers account for 36.9% of the market share under the material type category, driven by their affordability, lightweight nature, and resistance to corrosion. This segment has gained popularity across both consumer and commercial segments due to its cost-effectiveness and wide availability in multiple designs and sizes.

Manufacturers have improved product quality by using BPA-free and food-grade plastics, addressing safety and health concerns previously associated with plastic materials. Additionally, plastic dispensers are easy to transport, clean, and store, making them suitable for dynamic usage environments such as outdoor events, canteens, and quick-serve restaurants.

The segment continues to grow as customization options, including branding, color choices, and modular features, attract a broader customer base. Despite competition from stainless steel and glass alternatives in premium settings, plastic dispensers maintain a strong market position due to their practical benefits and evolving material quality standards.

The beverage dispenser market is experiencing robust demand growth driven by rising usage in commercial, hospitality, institutional, and residential sectors. Dispensers serve beverages such as coffee, tea, juice, soft drinks, and water using automatic, semi‑automatic or manual systems. Demand is highest in restaurants, cafes, hotels, and event venues. Manufacturers are focusing on features such as precise portioning, integrated cooling, hygiene controls and modular design to serve diverse end users. Regional markets such as Asia‑Pacific, North America and Europe drive volume while beverage variety expands equipment requirements.

Producers of beverage dispensers must ensure compliance with rigorous hygiene and food safety protocols. Equipment is routinely evaluated for materials that do not contaminate beverages and surfaces that resist bacterial growth. Manufacturers must design dispensers with removable parts for cleaning, use approved nonreactive finishes, and document sanitation procedures. In many jurisdictions operational approval depends on meeting hygiene certification standards and traceability documentation. For dispensers used in healthcare or institutional settings additional testing for biocide resistance becomes necessary. This extends product development timelines, adds engineering cost, and requires close collaboration with health safety authorities. Smaller vendors often lack internal compliance resources and rely on third parties for validation. Maintaining consistent quality across product lines while adhering to varying regional hygiene benchmarks increases operational complexity and slows time to market for new dispenser models.

Growing demand for multiple beverage types prompts dispenser manufacturers to offer configurable solutions. Operators increasingly require equipment capable of dispensing beverages such as carbonated drinks, flavored water, juice, coffee, tea, and cocktails from a single platform. These modular systems must support interchangeable tanks, varied temperature zones, and dosing options. Flexibility in beverage format enables venues to reduce equipment footprint and inventory overhead. Suppliers that offer plug‑and‑play modules or quick conversion kits gain preference. Collaboration with beverage brands and customization for local drink preferences further enhances deployment. Event caterers and mobile operations benefit from compact portable designs with multi-product capacity. Integrating portion control and flavor combination features allows operators to tailor offerings while limiting waste. This trend opens opportunity for manufacturers to develop scalable dispenser systems that serve diverse beverage profiles while providing ease of maintenance and upgrade.

Automation and sensor‑based control systems are becoming standard features in modern dispensers. Touchless interfaces, infrared or capacitive dispensing triggers, and volume sensors improve user experience and reduce cross‑contamination risk. IoT-enabled systems now support remote monitoring, usage analytics, and temperature control scheduling. Some units can detect low supply levels, activate sanitation cycles, and log usage data for quality assurance. Wireless or mobile app control enables real‑time settings adjustment and predictive maintenance alerts. These features align with the needs of high‑volume venues such as hotels and quick‑service restaurants seeking reliability and operational insight. Automation reduces reliance on manual intervention and enables consistent portions across shifts. Data captured via sensors supports inventory forecasting and service scheduling. As operators value uptime and cost monitoring, dispenser models featuring automation and remote diagnostics gain market preference and support efficient operation across diverse use cases.

Although demand is rising, high upfront cost remains a key barrier in cost‑sensitive segments. Fully automated and sensor‑enabled dispensers carry premium pricing for their features and materials. Small businesses, local cafes or residential buyers may find prices prohibitive compared to manual or basic semi‑automatic models. Installation requires trained staff, access to utilities and space planning, increasing deployment complexity. Maintenance and repair services add further expense. Additionally, initial calibration and setup can extend commissioning time and require technical expertise. Buyers may prefer simpler solutions such as ready‑to‑serve beverage cartons or basic glass dispensers instead of investing in complex equipment. Even when operating cost per serving may be lower over time, justification of total cost requires clear volume projections. For lower traffic venues or intermittent use, more affordable alternatives remain more attractive until price points align more closely with value‑focused budgets.

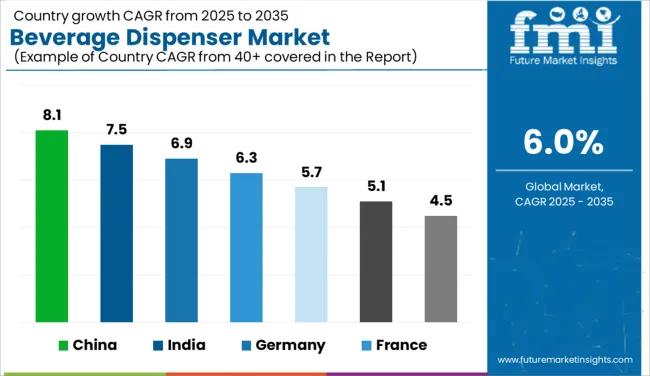

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The global beverage dispenser market is projected to grow at a CAGR of 6.0% through 2035, supported by increasing use in hospitality, institutional catering, and retail environments. Among BRICS nations, China leads with 8.1% growth, driven by mass-scale production and high domestic consumption in commercial venues. India follows at 7.5%, where demand has risen with food service expansion and the adoption of organized refreshment systems. In the OECD region, Germany reports 6.9% growth, supported by demand in corporate foodservice, vending applications, and precise flow-control systems. The United Kingdom, at 5.7%, continues to integrate dispensers in convenience formats and small-chain cafes. The United States, at 5.1%, remains a mature market with developments guided by hygiene compliance and multi-beverage configurations. Market progress has been shaped by food-contact certifications, dispensing accuracy standards, and unit durability guidelines. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Widespread adoption of automated dispensing units has supported steady expansion of the beverage dispenser market in China at a CAGR of 8.1%. Large-scale deployment across quick-service restaurants, convenience chains, and airport lounges has driven consistent sales volume. Beverage retailers have relied on dispensers offering portion control and self-cleaning functionality to ensure operational efficiency. Urban centers like Shanghai and Shenzhen have shown concentrated demand for countertop and multi-valve models. Equipment has been sourced by both international and domestic foodservice operators seeking streamlined customer service. Growth has been further supported by the integration of temperature regulation and refill tracking technologies. Product upgrades targeting hygiene standards have been introduced to meet institutional buyer preferences. Increased demand during sports events and mass gatherings has also encouraged equipment leasing and procurement.

In India, heightened interest in fast-serving formats has contributed to a 7.5% CAGR in the beverage dispenser market. Equipment installations have been observed in corporate canteens, multiplexes, and highway food courts, where efficient beverage management is required. Preferences have shifted toward low-maintenance models with customizable beverage options and digital interfaces. Modular machines have been adopted by educational institutions and hospitality chains to manage high-volume traffic during peak hours. Domestic manufacturers have responded with locally fabricated options that support regional beverage offerings. Increased deployment has occurred in metro cities such as Bengaluru, Mumbai, and Delhi, where footfall at quick-dining outlets remains high. Innovations including sensor-enabled dispensing and anti-spill features have been integrated into newer units. Distribution networks have expanded through OEM partnerships and Horeca channels.

Considerable interest in energy-efficient and space-saving beverage dispensers has driven a 6.9% CAGR in Germany. Compact designs with recyclable components have been introduced by domestic appliance makers, addressing procurement needs of commercial kitchens and cafés. Corporate offices and university campuses have deployed freestanding models offering both hot and cold dispensing. Engineering refinements have focused on temperature regulation and pressure control to maintain consistent beverage quality. Vending operators and franchise businesses have sought equipment that integrates with contactless payment systems. Seasonal fluctuations in beverage consumption have led to flexible rental and return models. Product certifications for safety, durability, and hygiene have influenced institutional purchase decisions. Equipment upgrades have been prompted by aging infrastructure in small and mid-sized dining establishments across key regions like North Rhine-Westphalia and Bavaria.

Increased focus on customer convenience in the United Kingdom has supported a 5.7% CAGR in the beverage dispenser market. The hospitality sector has emphasized machines with rapid dispensing and dual-flavor systems to reduce customer wait times. Public venues, sports arenas, and educational cafeterias have adopted freestanding models to manage crowd-serving effectively. Compact dispensers designed for countertop use have been preferred by cafés and boutique hotels. Importers and domestic suppliers have emphasized easy-clean features and reduced operational noise. In regions such as Greater London and Manchester, leasing models have gained traction with seasonal pop-up cafés and mobile caterers. Enhanced hygiene protocols post-pandemic have resulted in higher demand for touchless and foot-pedal-operated machines. Sales channels have included direct procurement, long-term leasing, and integrated POS system bundles.

In the United States, gradual adoption across mixed-use venues has resulted in a 5.1% CAGR for the beverage dispenser market. Dispensers with multi-beverage capability and real-time usage tracking have gained popularity among fast-casual chains and healthcare facilities. Equipment manufacturers have introduced customizable units offering flavor infusion, temperature control, and portion tracking. Large venues such as airports, shopping centers, and stadiums have transitioned to freestanding models equipped with self-sanitizing features. Emphasis has been placed on reducing downtime and enhancing refill accuracy. West Coast and Midwestern states have shown elevated demand in franchise-based restaurants and university dining halls. Demand has also been shaped by sustainability goals, encouraging refill stations compatible with reusable containers. Service contracts and online procurement options have extended market access across remote buyers.

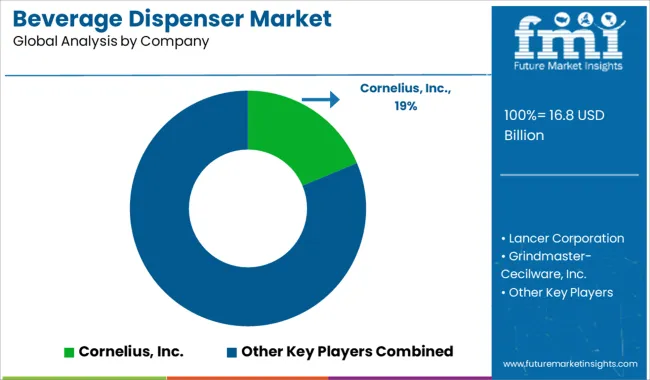

The beverage dispenser market is driven by demand from quick service restaurants, convenience stores, hospitality chains, and institutional foodservice, with leading manufacturers offering solutions for both hot and cold beverages. Cornelius, Inc. is a dominant player, known for its broad range of soda, juice, and frozen beverage dispensers integrated with portion control and energy-saving features. Lancer Corporation specializes in high-volume dispensing systems, offering modular and customizable beverage solutions widely adopted by global fast-food chains and self-service stations. Grindmaster-Cecilware, Inc. caters to both commercial and specialty beverage segments, offering dispensers suitable for coffee, cappuccino, and hot chocolate, with a focus on reliability and ease of use. Cambro Manufacturing Co. supports institutional and catering markets with insulated beverage servers designed for transport and bulk dispensing. Manitowoc Foodservice, Inc., through its Multiplex brand, delivers multi-flavor beverage dispensing platforms tailored for back-of-house automation and high-traffic operations. FBD Frozen Beverage Dispensers leads in the frozen category, supplying slush and frozen carbonated drink dispensers with high uptime and compact designs. Follett LLC contributes to the healthcare and hospitality sectors with dispensers that integrate ice and water functionality in sanitary, user-friendly formats. BUNN-O-Matic Corporation offers a comprehensive line of dispensers, especially for hot coffee and tea, valued for their durability and programmable features. Hoshizaki America, Inc. delivers precise temperature-controlled systems ideal for hotels and fine dining, while Multiplex Beverage emphasizes energy efficiency and centralized dispensing systems to optimize workflow in large-scale foodservice environments.

The Coca-Cola Company officially unveiled Coca-Cola Flex on May 17, 2023, as a Freestyle-powered front-of-house dispenser featuring more than 40 beverage options, 15-inch touchscreen controls, and PurePour™ micro-dosing, designed to simplify operations in the foodservice sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.8 Billion |

| Type | Electric and Non-electric |

| Capacity | 5 to 10 liters, Less than 5 liters, and More than 10 liters |

| Material Type | Plastic beverage dispensers, Glass beverage dispensers, Stainless steel beverage dispensers, and Others |

| Application | Commercial and Residential |

| Distribution Channel | Supermarkets, Online retail, Specialty stores, Convenience stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cornelius, Inc., Lancer Corporation, Grindmaster-Cecilware, Inc., Cambro Manufacturing Co., Manitowoc Foodservice, Inc, FBD Frozen Beverage Dispensers, Follett LLC, BUNN-O-Matic Corporation, Hoshizaki America, Inc., and Multiplex Beverage |

| Additional Attributes | Dollar sales by beverage dispenser type including soda fountain, juice, cold brew, and hot coffee dispensers, by application in restaurants, hotels, QSRs, cinemas, and convenience stores, and by region including North America, Europe, and Asia-Pacific; demand driven by self-service and sustainability trends; innovation in IoT monitoring, touchless tech, and energy-efficient systems; costs influenced by materials and hygiene compliance; emerging use in smart kiosks and personalized beverage delivery. |

The global beverage dispenser market is estimated to be valued at USD 16.8 billion in 2025.

The market size for the beverage dispenser market is projected to reach USD 30.1 billion by 2035.

The beverage dispenser market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in beverage dispenser market are electric and non-electric.

In terms of capacity, 5 to 10 liters segment to command 41.3% share in the beverage dispenser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Commercial Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA