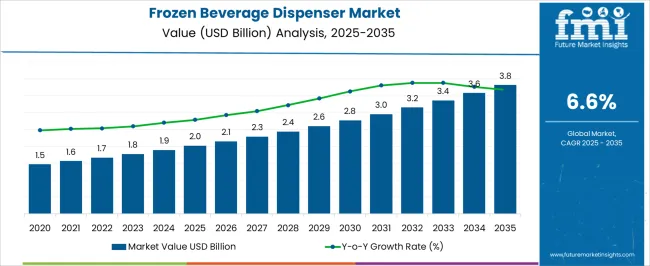

The frozen beverage dispenser market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

The frozen beverage dispenser market shows a steady and moderate growth trend, expanding from USD 1.5 billion in 2020 to USD 3.8 billion by 2035. The market’s compound annual growth rate (CAGR) stands at 6.6%, indicating stable growth, but with certain fluctuations during specific periods. Between 2020 and 2025, the market grows from USD 1.5 billion to USD 2.0 billion, reflecting initial steady growth due to the increasing demand for frozen beverages in the hospitality and retail sectors.

This phase experiences mild volatility, driven by consumer preferences for convenience, and a rise in demand for premium frozen beverages. From 2026 to 2030, the market continues its upward trajectory, expanding from USD 2.1 billion to USD 2.8 billion, driven by technological innovations such as energy-efficient machines, improved designs, and enhanced user experiences. The volatility during this phase can be attributed to fluctuating consumer behavior and economic factors affecting discretionary spending.

Between 2031 and 2035, the market accelerates from USD 3.2 billion to USD 3.8 billion, characterized by more predictable and sustained growth. This period sees the market stabilize, as the adoption of frozen beverage dispensers becomes widespread in both established and emerging markets.

Commercial food service operations encounter equipment management challenges as frozen beverage dispensers require coordination between refrigeration system maintenance, product preparation procedures, and staff training while managing inventory rotation, equipment sanitization, and troubleshooting protocols. Operations managers work with kitchen staff to establish cleaning procedures and product changeover protocols while coordinating with equipment service providers about preventive maintenance scheduling and emergency repair response across peak service periods.

Cross-functional coordination between purchasing departments and operations teams creates ongoing dialogue about equipment specifications versus operational requirements and cost considerations. Food service managers work with equipment vendors to evaluate capacity requirements and energy efficiency features while managing installation considerations, staff training needs, and service support availability that affect both initial investment decisions and long-term operational costs across different venue types and customer volume patterns.

Entertainment venue operations experience service complexity as frozen beverage programs require coordination between beverage preparation, point-of-sale systems, and customer experience management while managing product presentation, portion control, and speed of service requirements. Venue managers coordinate with beverage operations teams to establish serving procedures while working with marketing departments about promotional programs and seasonal menu variations that drive both customer engagement and revenue optimization.

| Metric | Value |

|---|---|

| Frozen Beverage Dispenser Market Estimated Value in (2025 E) | USD 2.0 billion |

| Frozen Beverage Dispenser Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The frozen beverage dispenser market is experiencing steady growth, driven by the rising demand for convenience-oriented foodservice equipment across commercial, institutional, and hospitality sectors. Increasing consumer preference for frozen beverages in quick-service restaurants, entertainment venues, and convenience stores is encouraging businesses to invest in advanced dispensing solutions. The market is benefiting from innovations in refrigeration technology, energy efficiency, and user-friendly controls that improve operational reliability and reduce maintenance costs.

Growing emphasis on product consistency, portion control, and hygiene standards is further influencing purchasing decisions among foodservice operators. The expansion of retail formats and the rise of self-service beverage stations are also supporting market adoption.

Manufacturers are focusing on integrating digital features such as touch-screen interfaces and programmable settings to enhance operational flexibility With consumer demand for flavored frozen beverages and specialty drinks continuing to rise, coupled with the increasing penetration of foodservice outlets globally, the frozen beverage dispenser market is positioned for sustained growth over the coming years.

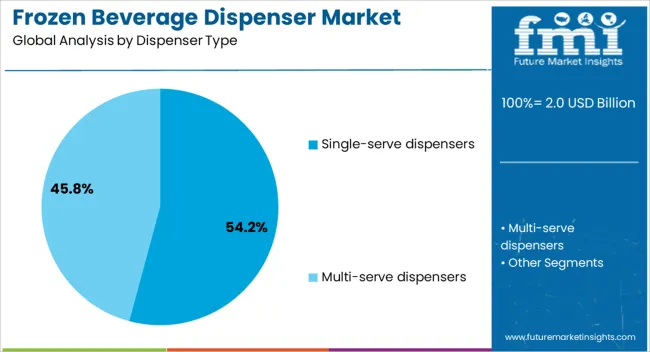

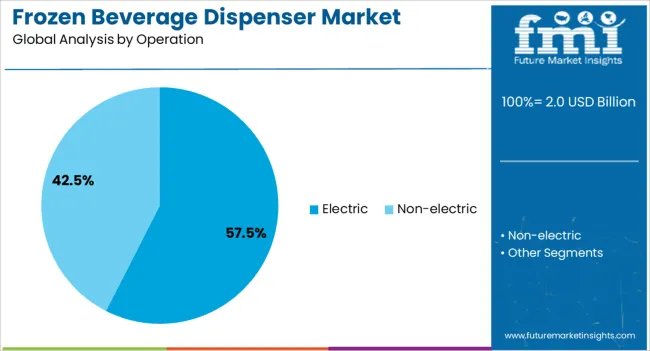

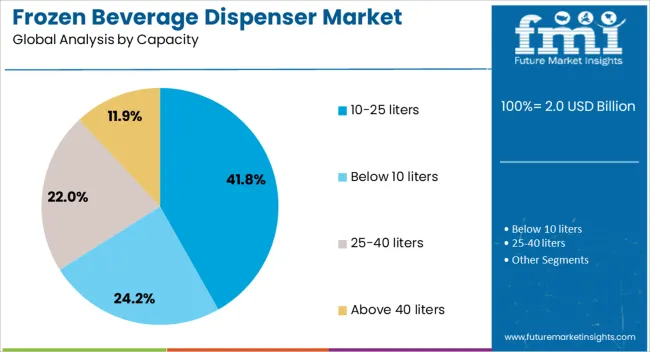

The frozen beverage dispenser market is segmented by dispenser type, operation, capacity, installation, hopper system, frozen dispensed, and geographic regions. By dispenser type, frozen beverage dispenser market is divided into Single-serve dispensers and Multi-serve dispensers. In terms of operation, frozen beverage dispenser market is classified into Electric and Non-electric. Based on capacity, frozen beverage dispenser market is segmented into 10-25 liters, Below 10 liters, 25-40 liters, and Above 40 liters. By installation, frozen beverage dispenser market is segmented into Freestanding, Countertop & under-counter, and Portable. By hopper system, frozen beverage dispenser market is segmented into Single-hopper and Multi-hopper. By frozen dispensed, frozen beverage dispenser market is segmented into Frozen carbonated beverage (FCB), Frozen uncarbonated beverage (FUB), Soft & hard serve, Frozen novelties, and Others. Regionally, the frozen beverage dispenser industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single-serve dispensers segment is projected to hold 54.2% of the frozen beverage dispenser market revenue share in 2025, making it the leading dispenser type. Its dominance is being supported by the growing demand for portion-controlled beverage preparation, which reduces product waste and ensures consistent flavor quality. Single-serve designs cater to fast-paced service environments where efficiency and quick turnaround are critical.

Their compact footprint allows for easy placement in a variety of commercial settings, from cafes to convenience stores, without requiring large dedicated space. The ability to prepare fresh servings on demand enhances the consumer experience while reducing the need for bulk storage of pre-prepared beverages.

Operational advantages, such as simplified cleaning processes and lower maintenance requirements, are further increasing their appeal to foodservice operators As the trend toward personalized beverage experiences continues to grow, single-serve dispensers are expected to maintain their market leadership, driven by their adaptability and efficiency in meeting diverse customer preferences.

The electric operation segment is anticipated to account for 57.5% of the frozen beverage dispenser market revenue share in 2025, establishing itself as the dominant operational category. This leadership is being driven by the superior performance, consistency, and ease of use offered by electric models compared to manual alternatives. Electric dispensers provide precise temperature control, ensuring uniform texture and flavor across servings, which is critical for maintaining product quality.

Their ability to operate continuously with minimal manual intervention makes them ideal for high-volume commercial environments such as quick-service restaurants, entertainment venues, and retail chains. Technological advancements have also led to energy-efficient designs that reduce operating costs while maintaining high output capacity.

Features such as automated cleaning cycles, digital control panels, and programmable dispensing options further enhance operational efficiency With foodservice operators increasingly prioritizing speed, consistency, and hygiene, the adoption of electric frozen beverage dispensers is expected to remain strong, reinforcing their market dominance.

The 10 to 25 liters capacity segment is expected to capture 41.8% of the frozen beverage dispenser market revenue share in 2025, positioning it as the leading capacity category. This range strikes a balance between storage volume and operational flexibility, making it suitable for both medium and high-traffic service environments. It allows operators to meet peak demand periods without excessive refilling while avoiding product wastage from oversized units.

The capacity range supports a wide variety of frozen beverages, including slush drinks, frozen cocktails, and specialty flavored beverages, catering to diverse consumer preferences. Its adaptability to different service models, from self-service retail stations to back-of-house preparation, enhances its appeal across the foodservice industry.

Manufacturers are offering models in this category with advanced cooling systems, ergonomic designs, and easy-to-clean components, further driving adoption As businesses seek to optimize space utilization, product variety, and operational efficiency, the 10 to 25 liters capacity segment is expected to sustain its leadership in the market.

The frozen beverage dispenser market is expanding due to the growing demand for frozen drinks like slush beverages, frozen cocktails, and iced coffee. This rise is especially prominent in sectors such as quick-service restaurants, cafes, and convenience stores. Technological advancements, including touch-screen controls, self-cleaning features, and IoT integration, are improving both operational efficiency and the overall user experience. Consumer preferences for customizable, on-the-go beverage options are also contributing to market growth. While North America remains a key player, the Asia Pacific region is experiencing rapid development due to urbanization and shifting consumer behaviors.

One significant barrier is the high initial investment required for advanced dispensers, which can be a deterrent for small and medium-sized enterprises. Additionally, the maintenance and operational costs associated with these machines can be substantial, impacting the overall cost-effectiveness for businesses. The complexity of integrating new dispensers into existing infrastructure, particularly in establishments with limited space or outdated equipment, poses another challenge. Fluctuations in raw material prices and supply chain disruptions can affect production costs and profitability. The market is also characterized by intense competition, with numerous players vying for market share, leading to pricing pressures and the need for continuous innovation to differentiate offerings.

The growth of the frozen beverage dispenser market is primarily driven by the increasing demand for convenient and customizable beverage options. The expansion of the foodservice industry, particularly quick-service restaurants and cafes, has significantly contributed to the market's growth . Consumers' preference for on-the-go, refreshing beverages has led to a surge in the adoption of frozen beverage dispensers. Technological advancements have also played a crucial role, with innovations such as energy-efficient machines, touch-screen interfaces, and automated cleaning systems enhancing the appeal of these dispensers. The growing trend of health-conscious consumption has led to the development of dispensers capable of handling a variety of beverage types, including low-sugar and organic options, further driving market expansion.

The frozen beverage dispenser market presents numerous opportunities for innovation and expansion. One key opportunity lies in the development of compact and portable dispensers, catering to the growing demand for mobile and flexible beverage solutions. The integration of smart technologies, such as IoT-enabled monitoring and predictive maintenance, can enhance operational efficiency and reduce downtime . The increasing popularity of frozen beverages in residential settings opens new avenues for growth. Manufacturers can explore partnerships with e-commerce platforms to reach a broader consumer base. The growing trend of health-conscious consumption presents an opportunity for the development of dispensers capable of handling a variety of beverage types, including low-sugar and organic options, catering to the evolving preferences of consumers.

The integration of smart technologies, such as IoT-enabled monitoring and touch-screen controls, is enhancing the user experience and operational efficiency . There is also a growing emphasis on energy-efficient dispensers, driven by both environmental concerns and cost considerations. The demand for customizable and on-the-go beverage options continues to rise, influencing the design and functionality of dispensers. Additionally, the increasing popularity of frozen beverages in residential settings is prompting manufacturers to develop compact and user-friendly models suitable for home use. These trends indicate a shift towards more intelligent, adaptable, and consumer-centric frozen beverage dispensing solutions.

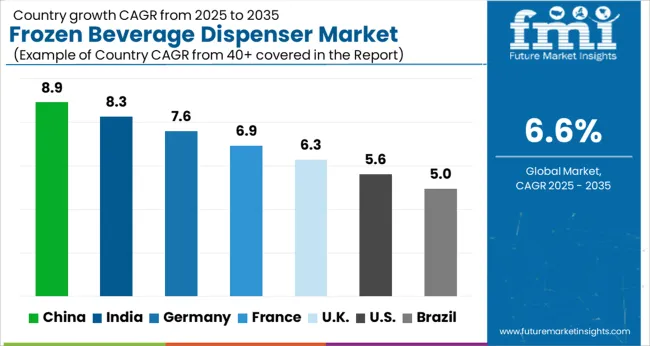

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global frozen beverage dispenser market is projected to grow at a CAGR of 6.6% from 2025 to 2035. Among the key markets, China leads with a growth rate of 8.9%, followed by India at 8.3%, and Germany at 7.6%. The United Kingdom and the United States show more moderate growth rates of 6.3% and 5.6%, respectively. The market is driven by increasing demand for frozen beverages in foodservice operations, convenience stores, and retail outlets. The consumer preferences for customized and healthier frozen beverages are further fueling market growth across these regions. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global frozen beverage dispenser market, with a projected growth rate of 8.9% CAGR from 2025 to 2035. The growing demand for frozen beverages in restaurants, cafes, and convenience stores is driving market growth. As consumer preferences shift towards more diverse and indulgent beverage options, the need for frozen beverage dispensers in the foodservice sector is increasing. Furthermore, China’s rising middle class, urbanization, and increasing disposable income are fueling the demand for frozen beverages. The expansion of modern retail outlets and fast-food chains is also contributing to the market’s expansion.

The frozen beverage dispenser market in India is projected to grow at a CAGR of 8.3% from 2025 to 2035. The demand for frozen beverages, particularly in the fast-food and beverage sectors, is driving the market’s growth. As the middle class expands and consumer preferences shift towards convenience food and beverages, the need for frozen beverage dispensers in restaurants, cafes, and quick-service restaurants (QSRs) continues to rise. The increasing popularity of frozen drinks, such as slushes and ice creams, is contributing to the market’s expansion. Additionally, the growing influence of international food chains and foodservice operations is further driving demand.

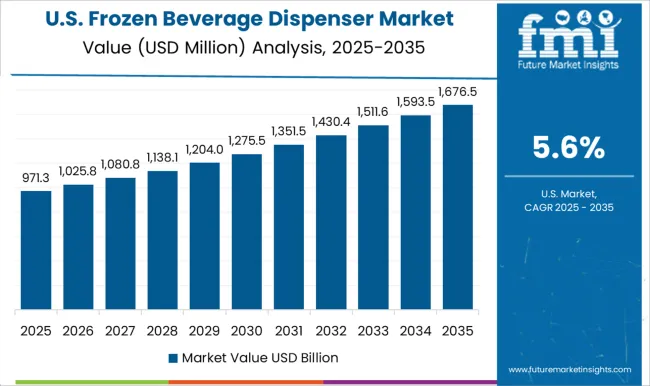

The USA frozen beverage dispenser market is anticipated to expand at a CAGR of 5.6% from 2025 to 2035. The market is driven by the growing demand for frozen beverages, particularly slushes, smoothies, and frozen cocktails, in both foodservice operations and retail outlets. The increasing preference for customized beverages and healthier options is driving innovation in the market. Additionally, the rise of convenience stores, quick-service restaurants (QSRs), and foodservice operations offering frozen drinks is contributing to the market’s growth. The demand for energy-efficient and easy-to-use dispensers is also increasing in the market.

The frozen beverage dispenser market in the United Kingdom is projected to expand at a CAGR of 6.3% from 2025 to 2035. The increasing popularity of frozen drinks like slushes and smoothies in cafes, fast-food outlets, and convenience stores is driving market growth. As consumers look for refreshing beverages and more indulgent options, the demand for high-quality and efficient beverage dispensers is rising. The market is further supported by the growing presence of international food chains and the shift in consumer preferences towards healthier beverage choices in the UK

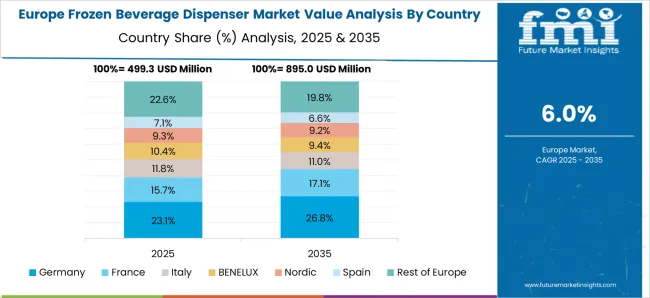

The frozen beverage dispenser market in Germany is expected to grow at a CAGR of 7.6% from 2025 to 2035. The demand for frozen beverages in Germany is primarily driven by the increasing popularity of slushes, smoothies, and frozen cocktails, especially in cafes, restaurants, and convenience stores. As Germany’s foodservice industry expands and diversifies, the adoption of frozen beverage dispensers is increasing. The country’s focus on sustainable and high-quality food products, combined with the rise in health-conscious consumers, is contributing to the growth of the frozen beverage marke

The frozen beverage dispenser market is witnessing robust global growth, fueled by rising consumption of frozen drinks, smoothies, and slush beverages across restaurants, cafés, quick-service chains, and convenience stores. The market is moderately fragmented, with several established manufacturers and emerging innovators offering customizable, energy-efficient, and high-performance dispensing solutions tailored to the evolving needs of the foodservice industry.

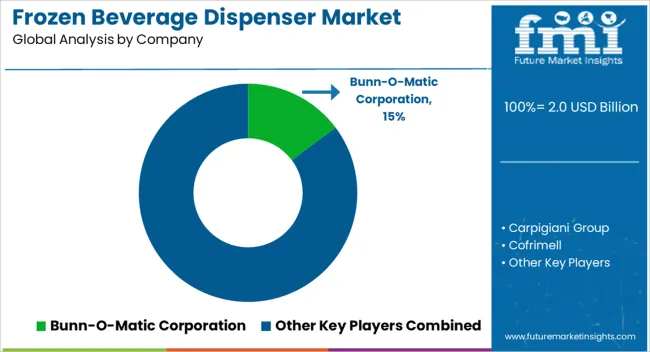

Bunn-O-Matic Corporation leads the market with its reliable, high-capacity dispensing systems, widely adopted in hospitality and commercial foodservice environments for their durability and consistent output. Carpigiani Group and Donper America are recognized innovators, providing premium frozen beverage and ice cream dispensing systems known for quality engineering, temperature precision, and efficiency. Electro Freeze holds a strong position with advanced, energy-efficient designs that enhance product texture and operational performance.

Elmeco, Grindmaster-Cecilware, and Sencotel focus on versatile dispensers that cater to both small and large-scale beverage outlets, offering reliability and ease of maintenance. Jet-Ice and Magimix emphasize multi-functionality and intuitive operation, while SPM Drink Systems and Stoelting Foodservice Equipment excel in custom-engineered solutions that meet specific operator requirements.

Taylor Company and Ugolini stand out for their technological innovation and energy-saving features, helping operators maintain product consistency with reduced operating costs. Zoku, an emerging consumer-oriented brand, expands the category into the home appliance segment with compact, user-friendly dispensers.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Dispenser Type | Single-serve dispensers and Multi-serve dispensers |

| Operation | Electric and Non-electric |

| Capacity | 10-25 liters, Below 10 liters, 25-40 liters, and Above 40 liters |

| Installation | Freestanding, Countertop & under-counter, and Portable |

| Hopper System | Single-hopper and Multi-hopper |

| Frozen Dispensed | Frozen carbonated beverage (FCB), Frozen uncarbonated beverage (FUB), Soft & hard serve, Frozen novelties, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Bunn-O-Matic Corporation, Carpigiani Group, Cofrimell, Donper America, Electro Freeze, Elmeco, Grindmaster-Cecilware, Jet-Ice, Magimix, Sencotel, SPM Drink Systems, Stoelting Foodservice Equipment, Taylor Company, Ugolini, Zoku |

| Additional Attributes | Dollar sales by product type (single, double, and multi-flavor dispensers), application (restaurants, cafes, convenience stores, and home use), and power source (electric). Demand dynamics are driven by the growing popularity of frozen beverages, increasing consumer preference for innovative drink options, and expanding foodservice industry needs. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with a focus on energy-efficient, cost-effective, and high-performance machines. |

The global frozen beverage dispenser market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the frozen beverage dispenser market is projected to reach USD 3.8 billion by 2035.

The frozen beverage dispenser market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in frozen beverage dispenser market are single-serve dispensers and multi-serve dispensers.

In terms of operation, electric segment to command 57.5% share in the frozen beverage dispenser market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Commercial Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA