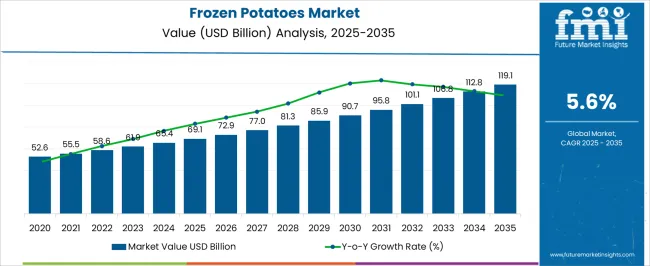

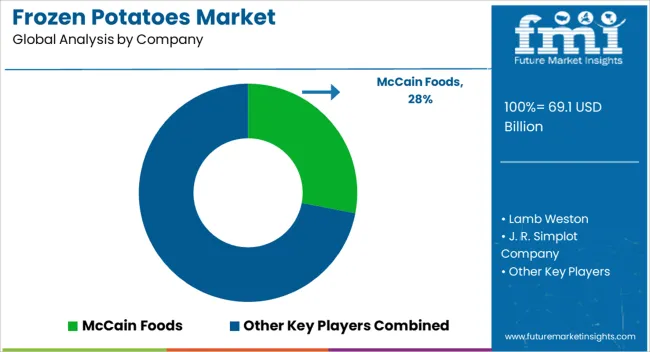

The frozen potatoes market is estimated to be valued at USD 69.1 billion in 2025 and is projected to reach USD 119.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

This steady progression indicates the increasing global demand for frozen potato products across both retail and foodservice sectors. The market's growth is driven by shifting consumer preferences toward convenient and ready-to-eat food products. As urban lifestyles continue to prioritize convenience, the market will see higher consumption of frozen potatoes in various forms, such as fries, wedges, and hash browns, catering to the evolving taste preferences of consumers.

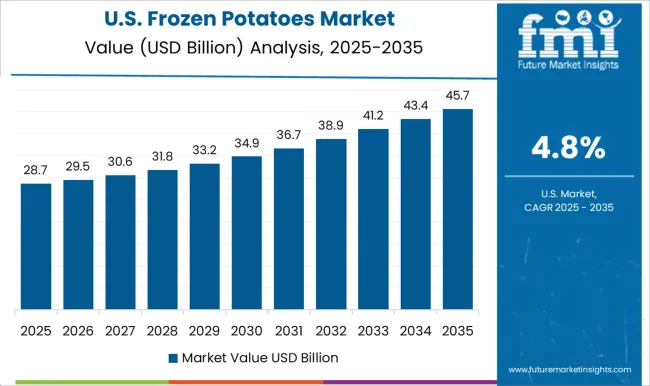

Over the decade, a consistent year-on-year increase in market value is expected, with significant annual gains, from USD 72.9 billion in 2026 to USD 119.1 billion in 2035. This growth trajectory highlights the continued expansion of frozen potato offerings in both emerging and developed economies. The frozen potatoes segment is gaining traction due to increasing availability in retail outlets, online platforms, and quick-service restaurants. The market's expansion will be driven by the growing demand for quick-to-prepare and versatile food options, as well as an increasing reliance on frozen foods as a staple in consumer diets worldwide.

| Metric | Value |

|---|---|

| Frozen Potatoes Market Estimated Value in (2025 E) | USD 69.1 billion |

| Frozen Potatoes Market Forecast Value in (2035 F) | USD 119.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The frozen potatoes market holds a specialized yet significant share within several parent markets. Within the broader potato market, it represents around 6-7%, driven by the increasing consumer preference for frozen potato products like fries, wedges, and hash browns due to their convenience and versatility. In the frozen food market, the share of frozen potatoes is approximately 12-15%, as they are a popular product category within this sector, offering easy preparation and long shelf life. Within the convenience food market, frozen potatoes account for around 5-6%, reflecting their strong presence in fast food chains, quick-service restaurants, and busy households seeking time-saving meal options. In the processed food market, the share of frozen potatoes is about 3-4%, as they are widely used as processed snack items or side dishes in both retail and foodservice sectors.

In the packaged food market, the frozen potatoes market contributes around 4-5%, with packaged frozen potato products often found in supermarkets, meeting the demand for easy-to-prepare meals and snacks. This growth across these markets underscores the increasing consumer demand for frozen, convenient, and ready-to-eat food products, especially in regions with a rising preference for quick meal solutions.

The market is experiencing strong growth as global consumption of convenient and ready-to-cook food products continues to rise. Increasing demand from quick service restaurants, casual dining chains, and institutional foodservice operators has been a significant driver for the market. Advancements in freezing technology and cold chain logistics have enhanced product quality, allowing frozen potato products to retain taste, texture, and nutritional value for longer periods.

Urbanization, changing dietary habits, and the rising adoption of Western-style fast food in emerging markets have further expanded consumption. The ability to maintain consistent supply regardless of seasonality has positioned frozen potatoes as a reliable ingredient for both commercial and retail segments.

With growing investments in manufacturing automation and product innovation, the market is well positioned for sustained expansion The future outlook remains positive, supported by increasing global trade in processed potato products, strategic partnerships between suppliers and distributors, and the ongoing preference for high-quality, time-saving food solutions.

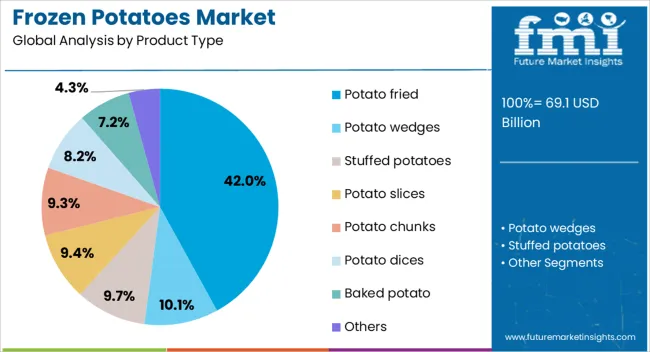

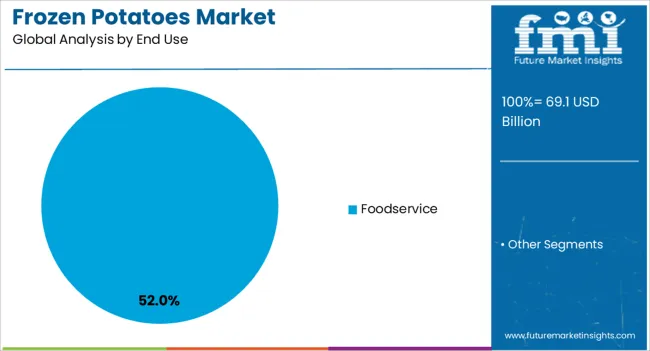

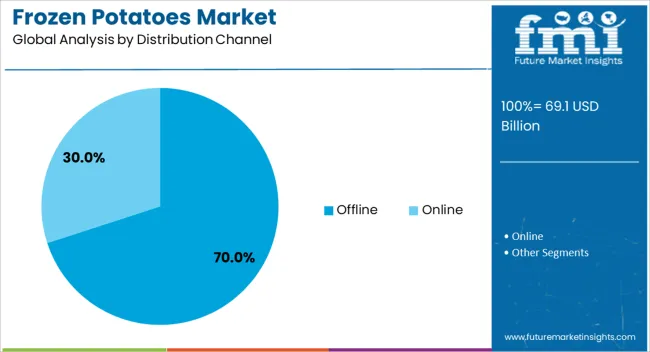

The frozen potatoes market is segmented by product type, end use, distribution channel, and geographic regions. By product type, frozen potatoes market is divided into potato fried, potato wedges, stuffed potatoes, potato slices, potato chunks, potato dices, baked potato, and others. In terms of end use, segmentation includes foodservice. Based on distribution channel, frozen potatoes market is segmented into offline and online. Regionally, the frozen potatoes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The potato fried subsegment within the product type category is expected to account for 42% of the market revenue share in 2025, making it the leading product type. Its growth has been driven by the widespread popularity of fried potato products in quick service restaurants, cafes, and casual dining outlets.

The ability to offer consistent taste, texture, and portion control has made potato fried products a preferred choice for large-scale foodservice operations. Advancements in par-frying and freezing techniques have improved shelf life while preserving product quality, which has further encouraged adoption.

The segment has also benefited from consumer preference for indulgent comfort foods, particularly in urban markets with fast-paced lifestyles Strategic distribution through retail and foodservice channels has ensured strong global availability, while product diversification in terms of cut size, seasoning, and preparation methods has reinforced its dominance in the market.

The foodservice subsegment in the end use category is anticipated to hold 52% of the market revenue share in 2025, positioning it as the dominant end-use sector. This leadership is supported by the extensive use of frozen potato products in restaurants, hotels, catering services, and institutional kitchens.

Foodservice operators have relied on frozen potatoes for their convenience, consistent quality, and ability to meet high-volume demand without compromising taste or presentation. The segment has also benefited from the expansion of global fast food chains and the increasing trend of dining out, particularly in emerging economies.

Operational efficiency is improved through reduced preparation time and waste, making frozen potatoes an economical choice for commercial kitchens The ability to store large quantities without spoilage has further enhanced their value in foodservice operations, ensuring year-round availability and stable pricing.

The offline distribution channel is projected to command 70% of the market revenue share in 2025, making it the leading distribution route. This dominance is attributed to the strong presence of supermarkets, hypermarkets, convenience stores, and wholesale distributors that provide extensive access to frozen potato products.

Retail outlets have played a crucial role in promoting frozen potatoes through attractive in-store displays, sampling activities, and bulk purchase options. The reliability of cold chain infrastructure in offline channels ensures product quality is maintained from storage to sale, further enhancing consumer confidence.

For foodservice buyers, offline channels offer the advantage of direct supplier relationships, negotiated pricing, and timely deliveries The segment’s growth is also reinforced by the preference of many consumers to physically inspect frozen products before purchase, coupled with the habit of combining grocery shopping with impulse frozen food purchases, thereby sustaining strong sales through this channel.

The frozen potatoes market is witnessing growth, fueled by increasing consumer demand for convenient and ready-to-eat food options. Opportunities exist in expanding product varieties, including healthier and gourmet options, to cater to changing consumer preferences. Trends like convenience, flavor diversification, and plant-based alternatives are shaping the market. However, challenges such as raw material price volatility and intense competition remain significant. Despite these hurdles, the market is expected to continue expanding as manufacturers innovate to meet the needs of health-conscious and time-pressed consumers.

The demand for frozen potato products is on the rise, driven by the growing consumer preference for convenient, ready-to-cook food options. As lifestyles become busier, the demand for frozen potato products such as fries, hash browns, and wedges increases, particularly in the fast-food and foodservice sectors. With a higher emphasis on quick meal preparation and extended shelf life, frozen potatoes have become a staple in both households and restaurants. This growing demand is further supported by the increasing number of consumers seeking indulgent yet easy-to-prepare snack options, particularly in emerging markets.

Opportunities in the frozen potatoes market are growing as manufacturers look to expand their product offerings beyond traditional forms like fries and wedges. The rise in health-conscious consumers has prompted an increase in the availability of healthier frozen potato options, such as low-fat or organic varieties. Moreover, the trend of gourmet frozen snacks is also gaining traction, with unique flavors and seasonings being introduced to cater to evolving consumer tastes. As demand for plant-based alternatives continues to rise, frozen potato manufacturers are also exploring new ways to incorporate plant-based ingredients into their product lines, creating new growth avenues.

One of the key trends influencing the frozen potato market is the increasing focus on product diversification. Consumers are becoming more adventurous in their food choices, seeking out new and exotic flavors. This trend is reflected in the expansion of gourmet and spiced frozen potato products. Furthermore, the demand for convenience continues to shape the market, as consumers prioritize quick meal solutions with minimal preparation. Frozen potatoes in various ready-to-eat formats, such as pre-seasoned and pre-cooked options, are expected to see continued popularity due to their convenience and time-saving benefits.

Despite the market’s growth, several challenges persist. Price volatility in raw potato sourcing due to climate conditions and agricultural uncertainties can impact production costs and product pricing. Another challenge is the intense competition from both local and international manufacturers, leading to price wars and thinning profit margins. The frozen potato market also faces challenges in maintaining product quality during the freezing and distribution processes, as maintaining texture and flavor consistency remains difficult, especially across large-scale production. These challenges require strategic innovations to ensure sustained market growth.

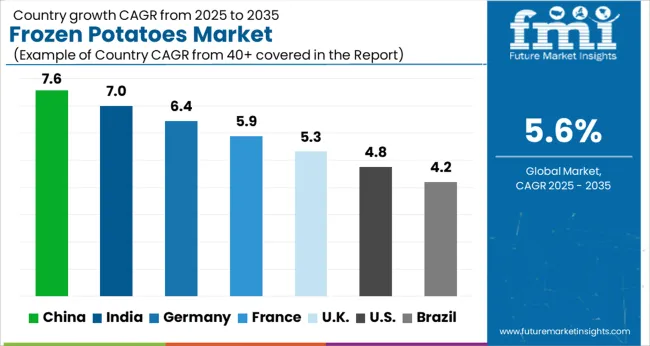

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global frozen potatoes market is projected to grow at a 5.6% CAGR from 2025 to 2035. China leads with a growth rate of 7.6%, followed by India at 7%, and Germany at 6.4%. The United Kingdom records a growth rate of 5.3%, while the United States shows the slowest growth at 4.8%. These varying growth rates are influenced by increasing demand for convenience food, the rising popularity of fast-food chains, and the growing adoption of frozen potato products in both residential and foodservice sectors. Emerging markets like China and India show higher growth rates due to expanding middle-class populations and changing dietary habits, while more mature markets like the USA and the UK see steady growth, driven by the increasing consumption of ready-to-eat meals and the convenience offered by frozen food products. This report includes insights on 40+ countries; the top markets are shown here for reference.

The frozen potatoes market in China is projected to grow at a CAGR of 7.6%. As China’s middle class continues to grow, there is an increasing demand for convenient and ready-to-eat food options, which is driving the consumption of frozen potato products. The rise of fast-food chains and increasing urbanization are further contributing to market growth. Additionally, the growing awareness of frozen potatoes’ long shelf life and convenience, combined with the expanding retail sector, is fueling demand. With China’s focus on improving its foodservice and retail infrastructure, the frozen potatoes market is expected to see significant expansion in the coming years.

The frozen potatoes market in India is expected to grow at a CAGR of 7%. The growing demand for convenience food, particularly in urban areas, is driving the adoption of frozen potato products. As India’s middle class expands, consumers are increasingly seeking quick and easy meal solutions, including frozen snacks and ready-to-eat foods. The rise in fast-food outlets and quick-service restaurants (QSRs) is also contributing to the growing consumption of frozen potatoes. Moreover, the increasing availability of frozen potato products in modern retail outlets and e-commerce platforms is fueling market growth.

The frozen potatoes market in Germany is projected to grow at a CAGR of 6.4%. Germany’s increasing demand for frozen food, driven by busy lifestyles and convenience, is one of the primary factors supporting the growth of the frozen potatoes market. The rise of frozen food consumption in both residential and foodservice sectors, particularly within quick-service restaurants (QSRs) and catering services, is accelerating market demand. Additionally, Germany’s strong preference for high-quality frozen potato products and the increasing focus on healthier frozen food options are also contributing to market expansion.

The frozen potatoes market in the United Kingdom is expected to grow at a CAGR of 5.3%. The UK’s increasing focus on convenience food, driven by busy lifestyles and a preference for ready-to-eat meals, is a key driver of market growth. The rise of frozen potato products in fast-food chains, supermarkets, and foodservice outlets further contributes to this trend. Additionally, the growing interest in healthier frozen food options, including those with reduced salt or fat content, is expected to support steady market expansion in the UK The country’s strong retail and foodservice sectors continue to fuel demand for frozen potatoes.

The frozen potatoes market in the United States is projected to grow at a CAGR of 4.8%. The demand for frozen potato products in the USA is primarily driven by the growing popularity of fast-food restaurants and quick-service restaurants (QSRs), where frozen potatoes are a staple item. The increasing trend of consuming convenience foods, particularly frozen snacks and side dishes, is also supporting market growth. Despite a slower growth rate compared to emerging markets, the steady demand from the foodservice sector, along with the continued preference for frozen potato products in households, ensures that the market remains robust.

The frozen potatoes market is dominated by leading players such as McCain Foods, Lamb Weston, J. R. Simplot Company, Aviko, and Farm Frites. McCain Foods, one of the largest players globally, has a vast portfolio of frozen potato products, catering to both retail and foodservice sectors. The company focuses on product innovation and sustainability, consistently enhancing its offerings with new varieties and healthier options. Lamb Weston is a major competitor, recognized for its premium frozen potato products, including fries and wedges, with a strong presence in North America and Europe. The company’s emphasis on sustainability and operational efficiency sets it apart in the market. J. R. Simplot Company also plays a key role, offering a wide range of frozen potato products for both the retail and foodservice markets. The company’s long-standing relationships with major fast-food chains and its commitment to high-quality products give it a competitive edge.

Aviko, with its European roots, has made significant strides in the frozen potatoes market by expanding its product offerings, which include fries, wedges, and mash, while focusing on sustainability in its operations. Farm Frites, another major player, has built a strong reputation by providing premium-quality frozen potato products that meet the growing demand for convenience and foodservice needs. The competitive landscape is shaped by product diversification, regional market dominance, and strategic initiatives focused on quality, sustainability, and innovation.

| Item | Value |

|---|---|

| Quantitative Units | USD 69.1 Billion |

| Product Type | Potato fried, Potato wedges, Stuffed potatoes, Potato slices, Potato chunks, Potato dices, Baked potato, and Others |

| End Use | Foodservice |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | McCain Foods, Lamb Weston, J. R. Simplot Company, Aviko, Farm Frites, and Others |

| Additional Attributes | Dollar sales by product type (fries, chips, wedges, hash browns), dollar sales by form (pre-cooked, raw, seasoned), trends in convenience foods and fast-food industry growth, use in retail and foodservice sectors, growth in demand for healthier frozen options, and regional patterns of frozen potato consumption across North America, Europe, and Asia. |

The global frozen potatoes market is estimated to be valued at USD 69.1 billion in 2025.

The market size for the frozen potatoes market is projected to reach USD 119.1 billion by 2035.

The frozen potatoes market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in frozen potatoes market are potato fried, potato wedges, stuffed potatoes, potato slices, potato chunks, potato dices, baked potato and others.

In terms of end use, foodservice segment to command 52.0% share in the frozen potatoes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Frozen Dough Market Analysis by type, distribution channel and region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA