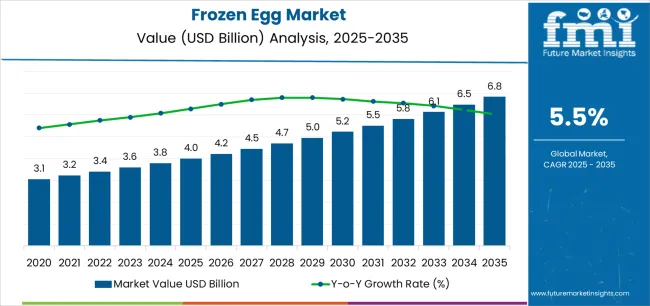

The global frozen egg market is projected to grow from USD 4.0 billion in 2025 to approximately USD 6.8 billion by 2035, recording an absolute increase of USD 2.8 billion over the forecast period. This translates into a total growth of 70.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The market size is expected to grow by nearly 1.7X during the same period, supported by increasing global demand for convenient food ingredients, growing adoption of extended shelf-life egg products in food manufacturing, and rising food safety consciousness driving frozen egg procurement across various food processing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.0 billion |

| Market Forecast Value (2035) | USD 6.8 billion |

| Forecast CAGR (2025-2035) | 5.5% |

| FOOD SAFETY & CONVENIENCE TRENDS | FOOD MANUFACTURING REQUIREMENTS | QUALITY & STANDARDIZATION STANDARDS |

|---|---|---|

| Global Food Safety Awareness Continuous expansion of food safety consciousness across established and emerging markets driving demand for pasteurized frozen egg solutions. Convenience and Labor Efficiency Growing emphasis on reduced labor requirements and standardized ingredient preparation creating demand for ready-to-use egg products. Extended Shelf-Life Benefits Superior storage stability and reduced waste characteristics making frozen eggs essential for operational efficiency in food operations. | Sophisticated Processing Requirements Modern food manufacturing requires egg ingredients delivering precise functional control and enhanced processing consistency. Operational Efficiency Demands Food processors investing in standardized ingredients offering consistent quality performance while maintaining cost efficiency. Quality and Traceability Standards Certified suppliers with proven food safety track records required for advanced food manufacturing applications. | Food Safety Standards Regulatory requirements establishing performance benchmarks favoring pasteurized and temperature-controlled egg solutions. Functional Property Standards Quality standards requiring superior emulsification performance and resistance to quality degradation in frozen storage. Allergen Management Requirements Diverse food manufacturing requirements and safety standards driving need for controlled egg ingredient inputs. |

| Category | Segments Covered |

|---|---|

| By Product Type | Whole Eggs, Egg Whites, Egg Yolk |

| By End-use | Food Processing Industry, Retail, Food Service Providers |

| By Application | Bakery Products, Confectionery, Sauces and Dressings, Ready Meals, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

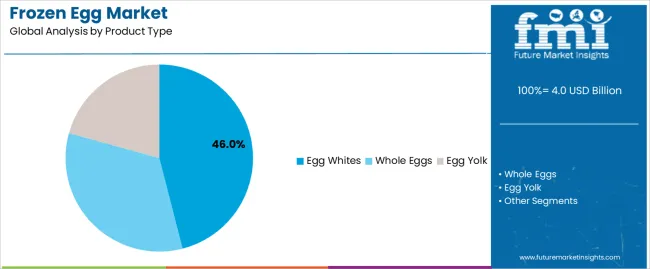

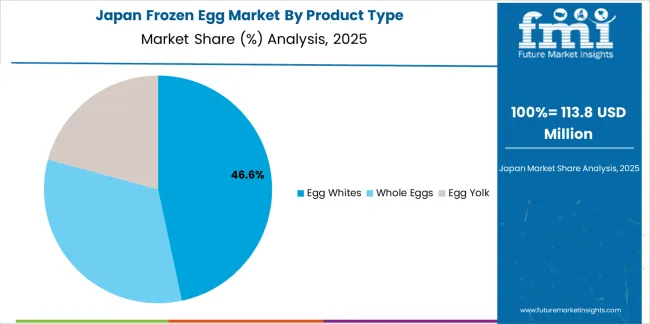

| Egg Whites | Leader in 2025 with 46% market share; likely to maintain leadership through 2035. Broadest use across meringue production, protein fortification, and fat-free formulations with mature supply chain and predictable functional characteristics. Dominant in bakery applications, protein supplements, and health-focused food products requiring fat-free protein sources. Momentum: steady-to-strong growth driven by protein enrichment trends and clean-label formulations. Watchouts: competition from plant-based protein alternatives and price sensitivity in commodity bakery applications. |

| Whole Eggs | Strong segment with 34% share, offering complete egg functionality with balanced protein, fat, and emulsification properties. Preferred for applications requiring authentic egg characteristics including scrambled egg products, custards, and traditional bakery formulations. Provides convenience without compositional modification. Momentum: moderate growth supported by versatile functionality and foodservice demand for egg-based dishes. Watchouts: cholesterol concerns limiting some health-focused applications and competition from separated egg products enabling precise recipe optimization. |

| Egg Yolk | Specialized segment with 21% share, valued for superior emulsification properties, rich flavor contribution, and golden color in premium applications. Critical for mayonnaise, hollandaise sauce, ice cream, and luxury bakery products. Essential for applications leveraging lecithin functionality. Momentum: selective growth in premium food applications and specialty confectionery requiring authentic egg yolk characteristics. Watchouts: health concerns regarding cholesterol and saturated fat limiting mass-market adoption and higher cost versus whole eggs. |

| Segment | 2025 to 2035 Outlook |

|---|---|

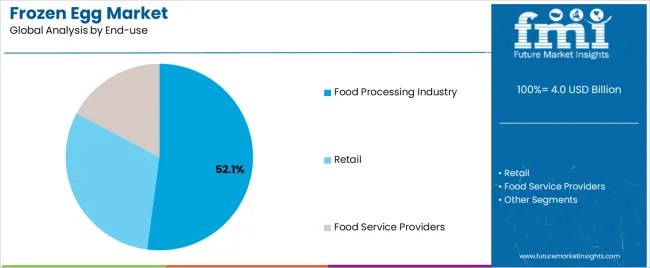

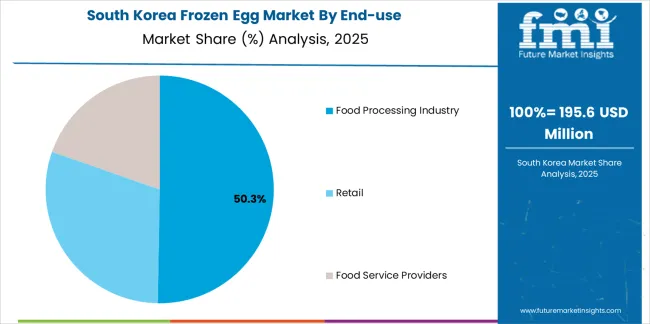

| Food Processing Industry | At 52.1%, largest end-use segment in 2025 with established applications across bakery manufacturing, prepared foods production, and ingredient processing operations. Dominant consumer driving functional requirements and volume procurement. Core market for frozen egg suppliers with consistent demand patterns. Momentum: steady-to-strong growth driven by processed food consumption in emerging markets and manufacturing efficiency optimization in developed regions. Watchouts: clean-label pressures requiring transparent sourcing and cost reduction initiatives in commodity food categories. |

| Retail | Growing segment with 28.6% share encompassing consumer-packaged frozen egg products for home cooking and baking applications. Increasing penetration driven by convenience trends and smaller household sizes reducing fresh egg utilization. Momentum: rising through 2030 driven by urbanization, single-person households, and cooking convenience preferences. Watchouts: limited consumer awareness versus fresh eggs and freezer space competition with other frozen food categories. |

| Food Service Providers | Established segment with 19.3% share covering restaurants, hotels, institutional catering, and quick-service establishments utilizing frozen eggs for operational efficiency. Values labor savings, portion control, and food safety consistency. Momentum: moderate growth via foodservice industry expansion in emerging markets and operational efficiency requirements in labor-constrained developed markets. Watchouts: premium dining preference for fresh eggs and potential customer perception concerns regarding frozen versus fresh quality. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Food Processing Industrialization Continuing expansion of processed food manufacturing across established and emerging markets driving demand for standardized egg ingredients. Labor Cost Optimization Increasing recognition of frozen egg importance in reducing labor requirements and improving operational efficiency in food operations. Food Safety Enhancement Growing demand for ingredients that support both microbiological safety and extended shelf-life in food manufacturing and foodservice. | Fresh Egg Price Competitiveness Shell egg price fluctuations and periods of low fresh egg costs affecting frozen egg value proposition and adoption rates. Cold Chain Infrastructure Requirements Frozen storage and distribution complexity requiring significant infrastructure investments throughout supply chain. Consumer Perception Challenges Preference for fresh products and limited consumer awareness of frozen egg benefits limiting retail market penetration. Energy Cost Pressures Freezing and frozen storage energy requirements affecting production economics and environmental footprint concerns. | Organic and Free-Range Options Integration of specialty egg sourcing, welfare certifications, and organic production enabling premium market positioning. Advanced Pasteurization Technologies Enhanced food safety assurance, improved functional properties, and extended shelf-life compared to traditional processing methods. Sustainable Packaging Solutions Development of recyclable packaging materials and reduced-plastic alternatives providing environmental performance improvements. Value-Added Formulations Integration of fortification, pre-seasoning, and specialized blends for targeted food manufacturing applications. |

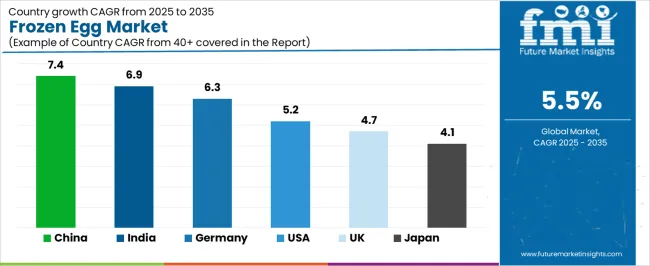

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| United States | 5.2% |

| United Kingdom | 4.7% |

| Japan | 4.1% |

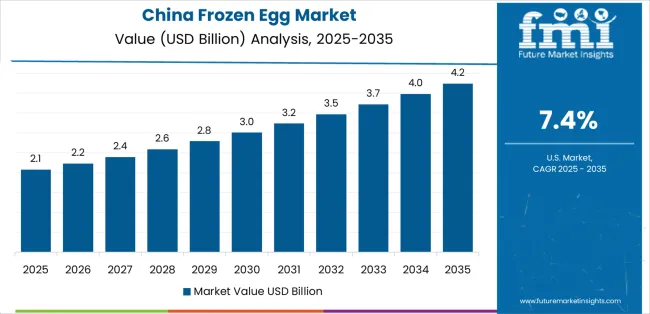

Revenue from frozen egg in China is projected to exhibit strong growth with a CAGR of 7.4% through 2035., driven by expanding bakery manufacturing infrastructure and comprehensive food processing industrialization creating substantial opportunities for frozen egg suppliers across commercial bakery operations, prepared food manufacturing, and foodservice distribution sectors. The country's rapidly growing processed food industry and expanding commercial bakery sector are creating significant demand for both conventional and specialty frozen egg products. Major food companies and bakery chains are establishing comprehensive ingredient procurement systems to support large-scale manufacturing operations and meet growing demand for efficient egg ingredient solutions.

Revenue from frozen egg in India is expected to expand at a CAGR of 6.9% through 2035, supported by extensive organized bakery expansion and comprehensive food processing industry development creating sustained demand for reliable frozen egg ingredients across diverse food manufacturing categories and emerging foodservice segments. The country's rapidly growing bakery sector and expanding quick-service restaurant industry are driving demand for egg ingredients that provide consistent functional performance while supporting cost-effective production requirements. Egg processors and food manufacturers are investing in cold storage facilities to support growing manufacturing operations and food safety compliance demand.

Demand for frozen egg in Germany is projected to grow at a CAGR of 6.3% through 2035, supported by the country's leadership in food processing excellence and advanced ingredient technologies requiring sophisticated frozen egg products for industrial bakery and prepared food applications. German food manufacturers are implementing high-quality egg ingredient systems that support advanced functional requirements, operational efficiency, and comprehensive food safety protocols. The market is characterized by focus on operational excellence, ingredient traceability, and compliance with stringent food quality and safety standards.

Revenue from frozen egg in United States is growing at a CAGR of 5.2% through 2035, driven by foodservice industry efficiency requirements and increasing convenience food innovation creating sustained opportunities for frozen egg suppliers serving both commercial food manufacturers and institutional foodservice operations. The country's extensive foodservice infrastructure and expanding ready-to-eat food market are creating demand for frozen egg products that support diverse application requirements while maintaining food safety standards. Food manufacturers and foodservice distributors are developing procurement strategies to support operational efficiency and labor cost optimization.

Demand for frozen egg in United Kingdom is projected to expand at a CAGR of 4.7% through 2035, expanding at a CAGR of 4.7%, driven by stringent food safety requirements and convenience food capabilities supporting sandwich manufacturing and comprehensive prepared food applications. The country's established food safety culture and growing convenience food consumption are creating demand for high-quality frozen egg products that support operational safety and regulatory compliance standards. Egg processors and food manufacturing suppliers are maintaining comprehensive development capabilities to support food safety requirements.

Demand for Frozen Egg in Japan is projected to reach USD 280.8 million by 2035, expanding at a CAGR of 4.1%, driven by precision food manufacturing standards and sophisticated quality requirements supporting confectionery production and comprehensive bakery applications. The country's established confectionery excellence and meticulous quality standards are creating demand for ultra-consistent frozen egg products that support exacting functional and safety requirements. Egg processors and ingredient suppliers are maintaining rigorous development capabilities to support demanding Japanese food manufacturing specifications.

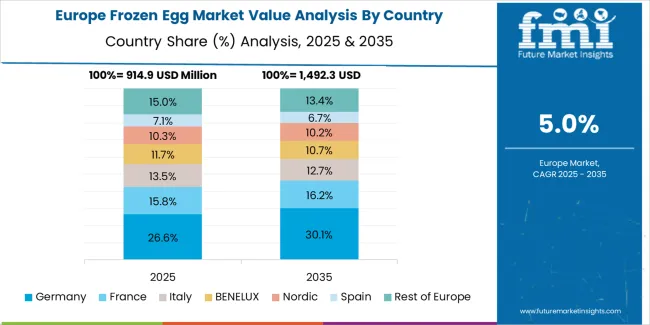

The frozen egg market in Europe is projected to grow from USD 29.7 million in 2025 to USD 50.6 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is expected to maintain its leadership position with a 29.6% market share in 2025, supported by its advanced industrial bakery infrastructure and comprehensive food processing capabilities across major manufacturing clusters in North Rhine-Westphalia, Bavaria, and Lower Saxony regions.

France follows with a 22.4% share in 2025, projected to reach 22.8% by 2035, driven by comprehensive patisserie manufacturing and prepared food production requiring consistent egg ingredients. The United Kingdom holds a 21.4% share in 2025, expected to maintain 21.1% by 2035 due to stringent food safety standards and sandwich manufacturing industry requirements. Netherlands commands a 14.7% share, while Spain accounts for 11.9% in 2025. The Rest of Europe region is anticipated to maintain stable momentum, attributed to increasing frozen egg adoption in Nordic countries and emerging Eastern European food processing facilities implementing modern ingredient sourcing programs.

European frozen egg operations are increasingly polarized between Western European quality-focused processing and Eastern European cost-competitive production. German and French facilities dominate premium frozen egg production for industrial bakery and confectionery applications, leveraging advanced pasteurization technologies and strict quality protocols that command price premiums in food safety-conscious markets. German processors maintain leadership in organic and free-range frozen egg products, with major bakery and food manufacturing companies driving technical specifications that smaller suppliers must meet to access premium supply contracts.

Eastern European operations in Poland, Ukraine, and Hungary are capturing volume-oriented frozen egg contracts through cost advantages and EU regulatory compliance, particularly in standard whole egg and egg white production for commodity food manufacturing. These facilities increasingly serve as production capacity for Western European brands while developing their own processing expertise and cold chain infrastructure.

The regulatory environment presents both opportunities and constraints. EU food safety regulations and pasteurization requirements create barriers for non-compliant suppliers but establish quality standards that favor established European processors over imported products with uncertain traceability. Animal welfare directives regarding cage-free egg production create differentiation opportunities but increase raw material costs and supply complexity.

Supply chain consolidation accelerates as processors seek economies of scale to absorb rising energy costs for freezing operations and cold storage requirements. Vertical integration increases, with major food manufacturers establishing direct relationships with egg processors to secure ingredient quality and supply reliability. Smaller processors face pressure to specialize in organic or specialty egg products or risk displacement by larger, more efficient operations serving mainstream food manufacturing requirements.

Japanese frozen egg operations reflect the country's exacting food safety standards and sophisticated functional requirements expectations. Major food manufacturers including Kewpie, Yamazaki Baking, and hotel groups maintain rigorous supplier qualification processes that exceed international standards, requiring extensive microbial testing, functional property validation, and comprehensive traceability documentation that can take 6-12 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports premium food positioning and safety reputation.

The Japanese market demonstrates unique product preferences, with significant demand for liquid frozen eggs in specialized formats tailored to Japanese confectionery and foodservice applications. Companies require specific functional properties including precise whipping characteristics for castella cakes and controlled emulsification for mayonnaise production that differ from Western applications, driving demand for customized processing parameters.

Regulatory oversight through the Ministry of Health, Labour and Welfare emphasizes comprehensive pasteurization validation and cold chain monitoring requirements that surpass most international standards. The food safety system requires detailed temperature logging and rapid response protocols for any deviation, creating advantages for suppliers with sophisticated cold chain management and real-time monitoring capabilities.

Supply chain management focuses on long-term quality partnerships rather than purely transactional procurement. Japanese companies typically maintain stable supplier relationships spanning years, with contracts emphasizing consistent functional performance and supply reliability over price competition. This stability supports investment in Japan-specific processing specifications and dedicated cold storage infrastructure.

South Korean frozen egg operations reflect the country's advanced food manufacturing sector and growing convenience food culture. Major food companies including CJ CheilJedang, SPC Group, and franchise foodservice operators drive sophisticated frozen egg procurement strategies, establishing relationships with domestic and international suppliers to secure consistent quality for their bakery, prepared food, and foodservice operations targeting domestic and export markets.

The Korean market demonstrates particular strength in bakery applications, with companies integrating frozen egg products into bread manufacturing, cake production, and Korean-style bakery items requiring consistent quality and labor efficiency. This bakery-focused approach creates demand for specific egg white functionality for chiffon cakes and whole egg specifications for castella-style products.

Regulatory frameworks emphasize comprehensive food safety and cold chain compliance, with Korean Food and Drug Administration standards requiring extensive supplier documentation and facility inspections. This creates barriers for unproven suppliers but benefits established egg processors who can demonstrate comprehensive quality management systems and HACCP certification.

Supply chain efficiency remains critical given Korea's competitive food manufacturing environment and labor cost pressures. Companies increasingly pursue frozen egg ingredients to address foodservice labor shortages while maintaining quality standards. Investment in automated egg processing equipment supports consistent quality production and food safety assurance.

The market faces pressure from fluctuating shell egg prices affecting frozen egg competitiveness and consumer preferences for fresh ingredients in premium dining contexts. The convenience positioning of Korean food culture and expanding foodservice industry continue to support demand for frozen egg products that meet stringent quality specifications and provide operational efficiency benefits.

Profit pools are consolidating around integrated egg processing operations combining agricultural production, advanced pasteurization, and cold chain distribution with established food manufacturer relationships and proven food safety compliance. Value is migrating from commodity frozen egg production to specialty products where organic certification, cage-free sourcing, and functional customization command premium pricing. Several archetypes set the pace: vertically-integrated egg producers defending share through farm-to-processor control and supply reliability; specialized frozen egg processors with advanced pasteurization and cold chain expertise; diversified food ingredient companies offering comprehensive protein solutions; and regional processors serving local markets with fresh egg sourcing advantages. Switching costs recipe reformulation, functional validation, supplier qualification stabilize customer relationships for incumbents, while clean-label trends and animal welfare requirements reopen opportunities for specialty egg processors and certified organic suppliers. Consolidation continues among regional processors while organic and cage-free certifications become increasingly important for premium market access. Do now: secure long-term egg supply partnerships with cage-free and organic farm networks and establish comprehensive cold chain infrastructure; hard-wire FSMA compliance and third-party food safety certifications; option: develop value-added egg formulations with functional optimization and co-branded sustainability credentials.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Vertically-integrated egg producers | Farm control, supply reliability, cost efficiency | Long-term food manufacturer partnerships, volume contracts, supply chain transparency |

| Specialized frozen egg processors | Processing expertise, cold chain infrastructure, food safety systems | Custom functional specifications, organic/cage-free certifications, technical support |

| Diversified food ingredient companies | Comprehensive protein portfolio, distribution networks, R&D capabilities | Integrated ingredient solutions, application development, global supply coordination |

| Regional processors | Local sourcing, fresh egg access, market proximity | Rapid response, relationship-based service, regional brand partnerships |

| Specialty and organic suppliers | Premium positioning, welfare certifications, sustainability credentials | Clean-label formulations, premium channel access, brand differentiation support |

| Items | Values |

|---|---|

| Quantitative Units | USD 4.0 billion |

| Product Type | Whole Eggs, Egg Whites, Egg Yolk |

| End-use | Food Processing Industry, Retail, Food Service Providers |

| Application | Bakery Products, Confectionery, Sauces and Dressings, Ready Meals, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, China, India, Japan, and other 40+ countries |

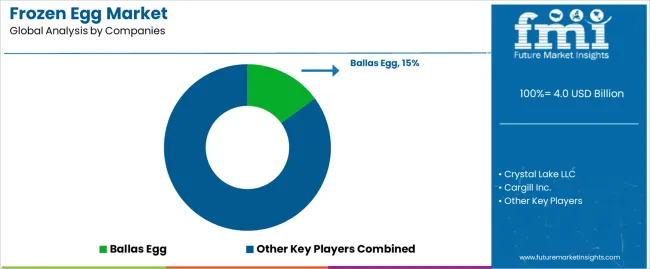

| Key Companies Profiled | Ballas Egg, Crystal Lake LLC, Cargill Inc., Pace Farm, Sonstegard Foods, Michael Foods Inc., Rembrandt Enterprises, Ovobest, Bouwhuis Enthoven, Igreca |

| Additional Attributes | Dollar sales by product type/end-use/application, regional demand (NA, EU, APAC), competitive landscape, conventional vs. organic adoption, cage-free sourcing integration, and cold chain innovations driving food safety assurance, operational efficiency, and functional ingredient development |

The global frozen egg market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the frozen egg market is projected to reach USD 6.8 billion by 2035.

The frozen egg market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in frozen egg market are egg whites, whole eggs and egg yolk.

In terms of end-use, food processing industry segment to command 52.1% share in the frozen egg market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Frozen Dough Market Analysis by type, distribution channel and region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA