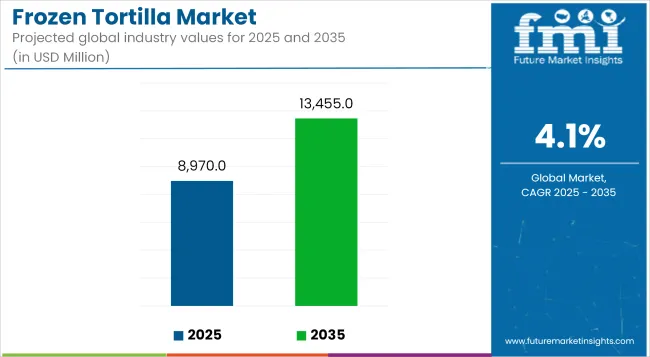

The frozen tortilla market is anticipated to rise from USD 8,970 million in 2025 to USD 13,455 million by 2035, advancing at a CAGR of 4.1%. The market is being positively influenced by the versatility of frozen tortillas in foodservice operations, accelerating their adoption in fast-casual chains, institutional kitchens, and quick-serve restaurants.

A sustained surge in demand for convenient, ready-to-heat meal components has driven frozen tortilla consumption across retail and B2B channels. Food manufacturers have capitalized on tortilla-based product innovation-including wraps, quesadillas, and mini pizzas-to expand SKU variety. However, the market has been restrained by cold chain logistics complexities, especially in developing markets where temperature-controlled distribution is still suboptimal.

Moreover, supply-demand volatility in wheat and corn has introduced price fluctuation risks for manufacturers. Despite this, gluten-free variants, especially corn-based and plant-fiber-infused tortillas, are being increasingly preferred for clean-label positioning. Market players have responded by reformulating products to align with trans-fat-free and additive-free trends while investing in automation and extended shelf-life technologies to enhance operational efficiency and reduce wastage.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 8,970 Million |

| Projected Global Industry Value (2035F) | USD 13,455 Million |

| Value-based CAGR (2025 to 2035) | 4.1% |

It is anticipated that flour-based tortillas will dominate market volume share, particularly within the foodservice sector due to their pliability and broader culinary applications. Frozen corn tortillas, meanwhile, are expected to outperform in retail due to rising demand for gluten-free home-cooked formats.

By 2035, the market will see intensified product segmentation driven by consumer interest in multi-grain, low-carb, and functional tortillas. The foodservice sector is expected to retain a dominant share due to increasing menu innovation in Mexican and Tex-Mex cuisines globally. In the coming decade, private-label penetration is also projected to rise, with mid-size players focusing on regional expansion and SKU diversification supported by cold-chain modernization.

Functional frozen tortillas are expected to represent approximately 7.6% of global market share by 2035, up from 3.4% in 2025. This emerging sub-segment is gaining traction as manufacturers embed added health benefits-such as protein fortification, fiber enrichment, and blood-sugar control properties-into familiar formats. The shift aligns with EFSA and FDA regulatory emphasis on front-of-pack labeling clarity and permissible nutrition claims, encouraging tortilla producers to differentiate with functional positioning.

Players like Hero Bread (USA) and Indian brand Lo! Foods have already commercialized low-carb or keto-compatible tortilla SKUs targeting diabetic and fitness-conscious consumers. The rising demand among older adults for diabetic-friendly, heart-healthy alternatives, particularly in Europe and North America, is opening a premium shelf space within frozen aisles.

While cost competitiveness remains a barrier to mass-market penetration, new entrants using chickpea, oat, or flax-based formulations are leveraging ecommerce platforms to test regional acceptance. Companies are also expected to use fiber-rich upcycled flour blends to meet clean-label and circular economy goals. As front-of-pack health claims gain prominence under stricter EU regulations (Regulation (EU) No 1169/2011), frozen functional tortillas could represent a strategically potent format for nutrition-led convenience food innovation.

The Asia-Pacific frozen tortilla market is forecast to rise from a 9.3% share in 2025 to over 14.8% by 2035, largely fueled by urban retail growth and tourism-driven QSR formats in Thailand, South Korea, and the Philippines. While North America currently dominates with over 55% of total global revenue, trade data from the International Trade Centre (ITC) indicates a compound increase in frozen tortilla imports across ASEAN countries, with Vietnam and Malaysia emerging as key demand nodes.

Regional manufacturers such as Mission Foods (Malaysia) and newcomer brands in India and Indonesia are focusing on locally adapted frozen variants, including thin, spicy, or fusion tortillas infused with seaweed or black sesame. The ASEAN Food and Beverage Alliance (AFBA) has played a pivotal role in promoting intra-regional processed food trade, and FTAs such as RCEP are further reducing non-tariff barriers.

Cold-chain infrastructure improvements under India’s PM Gati Shakti program and Indonesia’s Cold Logistics 2030 Roadmap have bolstered last-mile delivery capacity. These developments suggest a rapid acceleration in regional co-packing operations and OEM partnerships, enabling price-competitive exports to expand. North American suppliers must prepare for more localized APAC competitors leveraging regional taste profiles and government-backed cold-chain investments.

Restaurants and food trucks using frozen tortillas for authentic dishes.

Mexican food is increasingly being consumed all over the world, and therefore restaurants and food trucks have been using frozen tortillas when preparing their meals. Frozen tortillas offer several advantages. Moreover, they are available, distributed, and saves the quality and freshness of the traditional tortillas, and time. These facilities can rapidly cook different meals including tacos, burritos, enchiladas and quesadillas and will not affect the taste and texture.

If fresh tortillas are used, their quality and taste may vary, but by using frozen tortillas this becomes a relatively easy task of ensuring that customers get the same great experience every time. Especially for the food trucks, frozen tortillas are preferable, because they take less amount of space compared to fresh tortillas and have longer shelf-life. This helps to mitigate on food wastage and at the same time helps the operators to have enough stocks most of the time.

Increased demand for tortillas made with plant-based ingredients, supporting vegan and vegetarian diets.

The general increase in demand for tortillas with plant-based ingredients is mainly attributed to increase in the vegan or vegetarian meals. With the increasing information about boosting health and reducing the environmental impacts that come with taking plant-based diets, more consumers turn to look for better products than the traditional wheat or corn tortillas.

Such creations may contain elements such as pea protein, chickpea flour, or cauliflower, making it healthy and taking into consideration, vegan, gluten-free customer, and more.

A consumer may want to consume these tortillas, because they are believed to be healthier, easier to digest, contain higher fiber content and fewer calories than the normal tortilla. Vegan tortillas are also beneficial to those people with some gluten intolerance since other types of tortillas are mostly made from wheat flour.

Furthermore, they share the trends that are attending the growing consumer consciousness of healthier but more ‘pure’ food products which are not tested on animals.

Advances in flash-freezing and vacuum sealing to reduce food waste.

In the recent past, flash-freeze and vacuum seal technologies have become important in helping cut down on wastage in foods by maintaining the quality, taste and other nutrients of foods for a longer period of time. Flash-freezing includes plunging food into remarkably low temperatures; this aids in the formation of the smaller ice crystals in the food product than conventional freezing.

This process stops the destruction of cells thus retaining the texture feel and taste of food when being thawed. It also prevent the growth of bacteria and other microorganisms which helps in increase in shelf life of the product with out adding preservatives.

On the other hand, vacuum removal involves the process of removing air within the packaging before sealing it out forms an airtight environment. When used together with flash freezing, vacuum packaging allows the food to stay fresh for longer times thus reducing loss from spoilage and degradation.

Supermarkets and hypermarkets expanding frozen tortilla sections

The demand with regards to frozen tortillas is constantly rising, supermarket and hypermarket stores are beefing up their frozen food offerings to include more of these products. This expansion is as a result of various factors such as, growth of the Mexican food industry, system convenience, consumer demands of convenience products and products that have a relatively long shelf life.

These big name retailers want to have as many varieties of frozen tortillas and that means there are gluten-free, organic, and multi-grain options available. This trend also correlates with the increasing concern customers are running towards when preparing their meals.

Here at home, frozen tortillas present a shortcut to preparing sundry meals while retaining original taste and quality. Since frozen products have longer life spans than fresh products the probability of them going to waste is smaller, which makes them appealing to the customer and the vendor.

Tier 1 : Three major market leaders dominate the frozen tortilla market which includes Grupo Bimbo SAB de CV, Gruma SAB de CV, and PepsiCo Inc. They have large distribution networks, and hold significant market shares which in turn provide them the luxury of investing greatly in new product development touches on innovations.

These industry leaders define market directions and benchmarks, because their marketing capabilities are solid, and the degree of brand identification is high. With size and financial muscle, they are the giants occupying the largest slice of the market and a diverse product base and mergers to further entrench themselves in the markets they control.

Tier 2 : The companies that fall in Tier 2 include General Mills, Ole Mexican Foods Inc., La Tortilla Factory, Easy Foods Inc., and Tyson Foods Inc. Tier 2 companies are significant in the frozen tortilla market as they have not reached the international level of Tier 1 companies but have high regional presence with quality products.

These companies generally use their knowledge in niche markets to provide a diversified product line for specific consumer tastes. Targeted marketing strategies enhance brand loyalty within local horizons, and by establishing powerful distribution networks in core geographic markets, they provide optimum consumer accessibility.

Indeed, in conformity with tastes and limited supply, such companies have committed themselves to a high-quality or genuine image to carry a significant loyal market for themselves.

Tier 3 : Despite their size, companies found in the third tier, like Aranda's Tortilla Company Inc., Catallia Mexican Foods, and Azteca Foods Inc., have limited reach in the market. But in this limited reach, the companies' dedication to quality, even in the smallest of details, is often more important to local preferences.

It is in fact possible that the limited reach tends to reinforce their bona fides as small, focused producers. Local companies within the Tier 3 tortilla manufacturing market win over smaller local markets by faithful, word-of mouth growth through community outreach. Tier 3 companies bring varieties to the frozen tortilla market even though they would be smaller.

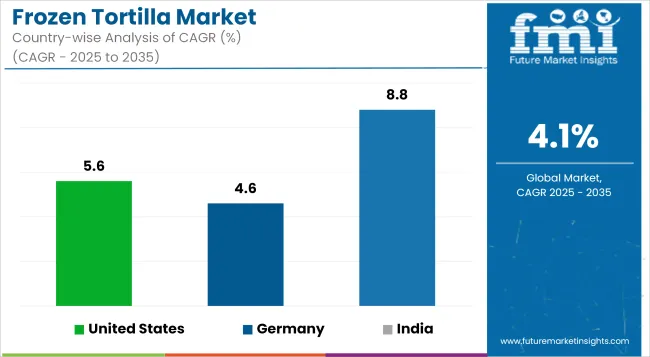

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 5.6% and 4.6%, 8.8% respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.6% |

| Germany | 4.6% |

| India | 8.8% |

An upsurge of the meal kits service providers in USA has also accelerated frozen tortillas utilization due to convenience. Its main advantage is its convenience for people with no time for cooking or grocery shopping in search of freshly prepared tasty meals. Tortillas also fit perfectly within the meal kit options, due to the fact that frozen tortillas for tacos, burritos, enchiladas, or wraps are possible.

Through serving and including the frozen tortillas, the meal kit services can be assured that the customers will get quality products which will be easy to prepare with the right taste and texture. Such convenience assures a vast market base, which includes a group of people interested in a healthy diet, and fans of the Mexican tavern.

In Germany specifically, supermarkets are already making additional efforts to upgrade and diversify the frozen food sector which includes tortilla needs to show responsiveness to increased customer preferences for flexible meal options.

Some of the factors that has led to this expansion include; growth in demand for Mexican food, and ever advancing society that sees people running out of time and seeking easier and convenient solutions to acquire food. With the Supermarkets stocking the different types of frozen tortillas such as the corn, wheat, gluten-free, and the multi-grain, the supermarkets’ aim at reaching a large customer base that may have different needs.

Furthermore, expansion on the range of tortilla products reflects on globalisation and different ethnicities it gives consumers a different experience of having to taste different products. Supermarkets are also seeking better ways of packaging and storing frozen tortillas so that when the customers get them, the products are fresh and of good quality

This has been evident in India where the use of application-based food delivery services has grown fast which in turn has compelled even tortilla sellers to offer the food items in the frozen form. The coming of these application like Zomato, Swiggy and many other has made it possible for people to order all sorts of foods they want.

Through-stock with frozen tortilla-based meals, these platforms ensure that they capture this growing market of convenience food especially among working class in urban areas.

The convenience in its solubility frozen tortilla-based meals is deemed convenient because they are easy to concoct and present as anyone’s favourite lunch or dinner meal. Through tortilla, various type of foods can be made such as tacos, burrito and other international foods which blend Indian food preparation methods with Mexican foods such as tortilla.

This diversity makes this product popular among customers who seek a better diet or who are ready to taste something new.

The nature of frozen tortilla industry involves cutthroat competition in the frozen tortilla market from key industry players including Mission Foods, Gruma, Tortilla King and La Tortilla Factory among others. All these are firms that are always in the quest of creating a niche through product development, quality and networks.

The specific objectives of Mission Foods are to increase distribution channels as well as diversify flavours within its product portfolio, customer groups. This tortilla giant ensures it has a competitive advantage through a well-built brand image and constructed distribution networks that aqua Gruma around the globe.

Currently, he is shocking the market with the tortilla products that are organic and of gluten-free varieties in Tortilla King. On the other hand, La Tortilla Factory is changing product diversification to meet consumers’ needs and wants; currently offering low carb and high protein tortillas.

These competitiveness are expected to encourage more growth and development in the industry as players seek to satisfy increasing customer appetite for convenient, healthy and more varied tortilla products.

The market is expected to grow at a CAGR of 4.1% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 13455 Million.

USA is expected to dominate the global consumption

Azteca Foods Inc., Gruma SAB de CV., Grupo Bimbo SAB de CV., Grupo Liven, S.A.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights in the Frozen Food Industry

Frozen Seafood Market Analysis by Nature, Form, End Use, Distribution Channel and Other Products Type Through 2035

Frozen Sardine Market Analysis Freezing Process, Form, Packaging Type and Distribution channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA