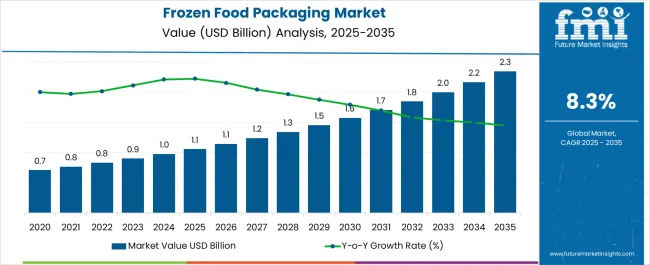

The Frozen Food Packaging Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period.

| Metric | Value |

|---|---|

| Frozen Food Packaging Market Estimated Value in (2025 E) | USD 1.1 billion |

| Frozen Food Packaging Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The frozen food packaging market is expanding steadily as consumer demand for convenient and longer-lasting food options continues to rise. Market dynamics are influenced by rapid urbanization, lifestyle shifts toward ready-to-cook and ready-to-eat meals, and the growing penetration of modern retail and e-commerce platforms.

Packaging innovation is being prioritized to maintain food quality, extend shelf life, and ensure safety compliance, while sustainability pressures are driving the development of recyclable and eco-friendly materials. Manufacturers are investing in high-barrier films, vacuum technologies, and smart labeling to enhance preservation and traceability.

The future outlook is underpinned by strong growth in emerging economies, driven by rising disposable incomes and changing dietary preferences, coupled with continuous improvements in cold-chain logistics. Growth rationale is anchored on the combination of consumer convenience, technological progress in packaging formats, and regulatory alignment with food safety standards, which collectively position the market for consistent expansion and higher adoption across retail, foodservice, and export channels.

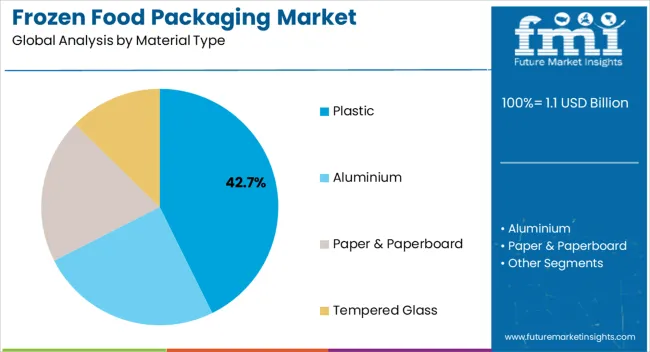

The plastic segment, accounting for 42.70% of the material type category, is leading the market due to its durability, cost-effectiveness, and superior barrier properties against moisture and contaminants. Its dominance has been reinforced by adaptability across a wide range of frozen food products and compatibility with advanced sealing and printing technologies.

The segment’s performance has been sustained by demand from both retail and institutional buyers who prioritize extended shelf life and product safety. Recycling initiatives and the development of bio-based plastics are contributing to improved environmental profiles, which support regulatory compliance and consumer acceptance.

Plastic packaging continues to benefit from economies of scale, enabling cost advantages for manufacturers and distributors. The segment is expected to retain its leadership position as innovations in lightweight materials and sustainable alternatives provide further opportunities for value creation.

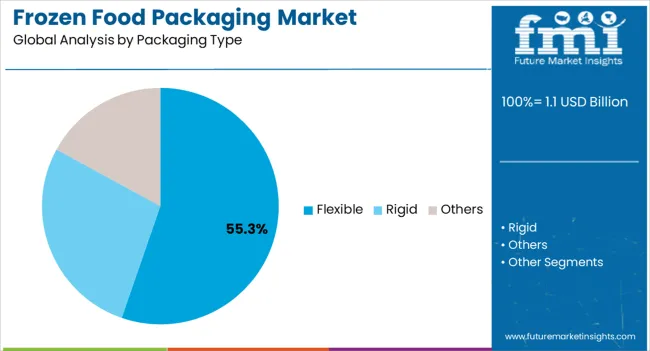

The flexible packaging segment, holding 55.30% of the packaging type category, has emerged as the dominant format due to its lightweight nature, cost efficiency, and space-saving advantages in storage and transport. High-barrier films and pouches within this segment provide strong protection against temperature fluctuations and contamination, ensuring product integrity throughout the supply chain.

Flexible formats are increasingly preferred for portion-controlled packaging, catering to evolving consumer needs for convenience and single-serve options. Enhanced printing capabilities have improved product visibility and branding, strengthening retail performance.

Sustainability-focused advancements, including recyclable and compostable film structures, are addressing environmental concerns and driving broader acceptance. The segment is projected to maintain its market share as demand for user-friendly, portable, and sustainable packaging formats continues to grow across both developed and emerging economies.

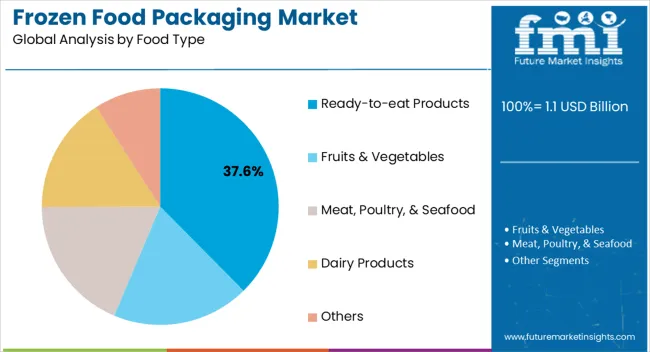

The ready-to-eat products segment, representing 37.60% of the food type category, has been leading growth due to shifting dietary preferences and the rising importance of convenience in consumer lifestyles. Urban populations and working professionals have increasingly adopted frozen ready-to-eat meals as a time-saving alternative to traditional cooking.

Packaging solutions for this category focus on maintaining taste, texture, and nutritional value while ensuring safety through tamper-evident and high-barrier features. Demand stability is being supported by strong retail penetration, expansion of quick-service restaurants, and the proliferation of e-commerce grocery platforms.

Innovation in microwave-compatible and resealable packaging formats is further enhancing consumer appeal. The segment’s future trajectory is underpinned by the convergence of convenience, quality assurance, and lifestyle changes, ensuring its continued dominance within the frozen food packaging market.

The manufacturers are increasing the adoption of sustainable packaging with novel technology to provide different frozen food packaging formats. Manufacturing companies are developing better materials to protect food items, such as using premium quality paper in the food sector.

Small-sized businesses maintain food quality and increase the demand for frozen food packaging. Moreover, the focus on biodegradable materials to secure the environment, such as paper-based frozen food packaging, is growing market expansion. Customized applications and growing awareness of actual food packaging are increasing global market opportunities.

| Attributes | Details |

|---|---|

| Market CAGR (2025 to 2035) | 8.3% |

| Market Valuation (2025) | USD 900 million |

| Market Valuation (2035) | USD 2.0 billion |

According to Future Market Insights, the global frozen food packaging market is projected at a healthy 8.3% CAGR during the forecast period. Historically, the market registered a CAGR of 12.2% between 2020 to 2025.

The consumers shifting preferences from traditional to quick meal cooking are increasing the adoption of frozen food packaging during the forecast period. The benefits of easy and fast cooking trends are surging the market growth. Growing demand for processed foods and adopting western culture are expanding the sales of frozen food packaging.

The recent analysis indicates a monumental rise in demand and consumption of frozen foods. The demand for easy-to-cook foods offers maximum convenience to the final consumer. The factors mentioned above are anticipated to result in the growing market popularity of frozen foods in all parts of the world. In addition, increased awareness regarding food wastage boosted the market opportunities during the forecast period.

| Segments | Material Type |

|---|---|

| Top Category | Plastic |

| Historic CAGR | 12% |

| Forecast CAGR | 7.8% |

| Segments | Packaging Type |

|---|---|

| Top Category | Rigid |

| Historic CAGR | 11% |

| Forecast CAGR | 7.4% |

The plastic category leads the material type segment by capturing a CAGR of 11% during the forecast period. The key producers of frozen food packaging use various materials, but plastic offers them a wide range of options. Some of these are polypropylene, polyethylene, and many others to choose from per their needs. Moreover, using plastic for producing frozen food packaging increases the profit margin of the manufacturers.

Plastic is cost-effective in comparison with aluminum, glass, and other materials. Thus, the flexibility and easy availability make plastic the most preferred material for producing frozen food packaging worldwide. Historically, the global sales of plastic frozen food packaging captured a 12.2% CAGR between 2020 to 2025.

Rigid packaging is leading the market by accounting for a CAGR of 7.4% during the forecast period. The increasing demand for rigid packaging for frozen food to maintain the quality of food items propels market expansion. The manufacturers develop different types and shapes of rigid packaging per consumers' demand.

The increasing advanced technology and sustainable packaging solution are increasing the adoption of rigid packaging during the forecast period. The adoption of rigid packaging by the end user as it easily transferred from one place to another without any harm and hassle. Customized and long last packaging for food items is increasing the demand for rigid packaging. Historically, rigid packaging captured a CAGR of 11% between 2020 to 2025.

Modern-day advancements across the food industry have resulted in the introduction of ready-to-eat foods. The trends of on-the-go consumption patterns increase consumers' demand for food & beverages to be consumed at their convenience. The increasing market popularity of fast foods and pre-cooked foods across the globe fuels the demand for frozen food packaging. Thus, the ready-to-eat foods segment secured 1/3rd of the total sales of frozen food packaging globally in 2025.

| Country | United States |

|---|---|

| CAGR (2020 to 2025) | 11.8% |

| CAGR (2025 to 2025) | 8.1% |

| Valuation (2025 to 2035) | USD 708.6 million |

| Country | United Kingdom |

|---|---|

| CAGR (2020 to 2025) | 10.8% |

| CAGR (2025 to 2025) | 7.4% |

| Valuation (2025 to 2035) | USD 84.2 million |

| Country | China |

|---|---|

| CAGR (2020 to 2025) | 11.4% |

| CAGR (2025 to 2025) | 7.7% |

| Valuation (2025 to 2035) | USD 143.5 million |

| Country | Japan |

|---|---|

| CAGR (2020 to 2025) | 10.3% |

| CAGR (2025 to 2025) | 6.8% |

| Valuation (2025 to 2035) | USD 117.3 million |

| Country | South Korea |

|---|---|

| CAGR (2020 to 2025) | 8.9% |

| CAGR (2025 to 2025) | 6.1% |

| Valuation (2025 to 2035) | USD 69 million |

The United States is estimated to capture a CAGR of 8.1% with a valuation of USD 708.6 million during the forecast period. According to The Centers for Disease Control and Prevention (CDC), there are more than 48 million cases of food-related illness annually. In addition, the alarming range of food wastage across the United States is creating huge awareness to increase the adoption of frozen food packaging. The food waste estimates in the country reach around USD 165 billion each year.

The presence of frozen food manufacturers with increased consumption of frozen foods among all age groups of consumers raises United States market opportunities, accounting for over 4/5th of the total frozen food packaging sold in North America in 2025. The United States frozen food packaging market historically captured a CAGR of 11.8% between 2020 and 2025.

The United Kingdom is estimated to secure a CAGR of 7.4% with a valuation of USD 84.2 million during the forecast period. The latest data from the Centre for the Promotion of Imports shows that the United Kingdom is the leading importer of frozen vegetables in Europe. Moreover, The United Kingdom's import of frozen vegetables in substantial quantities across the globe is expanding the market share.

The popularity of easy-to-prepare foods with replacement of food of animal origin with vegetable alternatives increases the market growth. The growing number of vegetarian and vegan food across Europe drives the United Kingdom's frozen food packaging market size.

The major, small, and medium-sized players are engaged in offering sustainable packaging products for frozen food products. Due to rising environmental concerns, the United Kingdom market manufacturers are adopting rigid packaging solutions for better shelf-life for food items. Historically, the United Kingdom captured a CAGR of 10.8% between 2020 to 2025.

China is estimated to capture a CAGR of 7.7% with a valuation of USD 143.5 million during the forecast period. The rising population, quality products, awareness of food wastage, and increased adoption of frozen food packaging in China. The increasing foodborne and spoilage is influencing the China market opportunities.

The consumers of China prefer the consumption of frozen food packaging due to its premium quality and easy-to-cook trends. Moreover, the rising demand for frozen meat and other items is expanding China's frozen food packaging market size. According to the National Bureau of Statistics of China, frozen food packaging raised around 30% in the historic period in 2020.

The rising numbers of present marketers and new entrances drive market expansion. These players continue to start freezing different food items with their latest innovative skills and expanding market size. Historically, China captured a CAGR of 11.4% between 2020 to 2025.

Key frozen food packaging manufacturers focus on offering recyclable packaging products and entering into collaborations. These players are adopting innovative technology to maintain food quality for a long time. The prominent vendors are using several marketing tactics to increase the market.

Prominent players in the market are:

Recent Developments in the Frozen Food Packaging Market

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, and South Africa |

| Key Segments Covered | Material Type, Packaging Type, Food Type, Region |

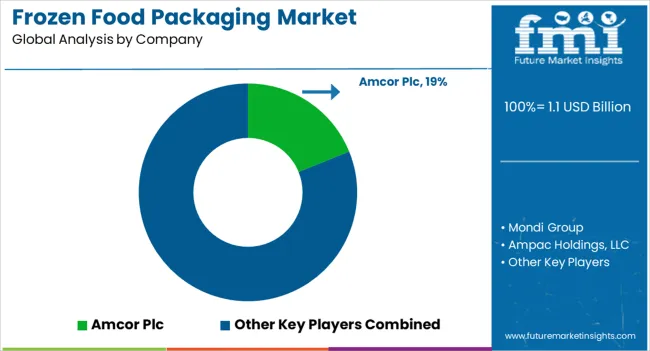

| Key Companies Profiled | Mondi Group; Ampac Holdings, LLC; Amcor Plc; International Paper Company; KOROZO Ambalaj San.ve Tic A.S.; Sealstrip Corporation; Sonoco Products Company; Alto Packaging; Sealed Air Corporation; Huhtamaki Group; MOD-PAC Corp; WestRock Company; Tray-Pak Corporation; Uflex Limited.; Amerplast Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global frozen food packaging market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the frozen food packaging market is projected to reach USD 2.3 billion by 2035.

The frozen food packaging market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in frozen food packaging market are plastic, polyethylene, polypropylene, ethyl vinyl acetate, polyvinyl chloride, polyvinylidene chloride, polystyrene, polyethylene terephthalate, aluminium, paper & paperboard and tempered glass.

In terms of packaging type, flexible segment to command 55.3% share in the frozen food packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Frozen Food Packaging Manufacturers

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Frozen Dough Market Analysis by type, distribution channel and region through 2035

Frozen Sardine Market Analysis Freezing Process, Form, Packaging Type and Distribution channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA