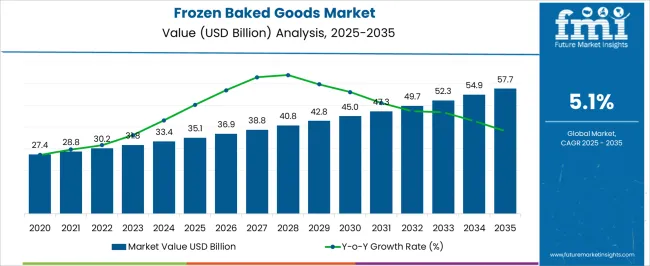

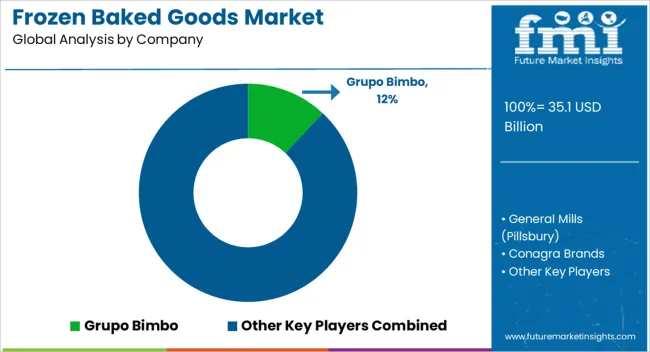

The frozen baked goods market is estimated to be valued at USD 35.1 billion in 2025 and is projected to reach USD 57.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

This growth reflects a compound annual growth rate (CAGR) of 5.1%, supported by rising consumer demand for convenient, ready-to-eat bakery products. The adoption of frozen bakery goods has been boosted by changing dietary preferences and the growing reliance on frozen formats for consistent taste and longer shelf life. Bread, pastries, cakes, and specialty baked products continue to dominate demand, with both retail and foodservice channels driving wider penetration. This early growth phase underscores how manufacturers are responding with product diversification, new flavor profiles, and improved storage technologies to capture market share. Between 2025 and 2035, the absolute sales opportunity highlights consistent gains across both developed and emerging markets, with the market expanding by more than USD 22 billion.

Rising preference for frozen bakery assortments in supermarkets, hypermarkets, and online channels has reinforced consumer trust in these products. Foodservice outlets are also increasingly relying on frozen baked goods to maintain efficiency and ensure product uniformity. Growth is expected to be further supported by innovations in frozen dough and par-baked products, allowing greater flexibility for quick preparation. With convenience and taste consistency remaining strong purchasing motivators, the frozen baked goods market is positioned for stable expansion. This steady trajectory indicates reliable opportunities for producers, distributors, and retailers as consumer confidence in frozen bakery formats continues to grow globally.

| Metric | Value |

|---|---|

| Frozen Baked Goods Market Estimated Value in (2025 E) | USD 35.1 billion |

| Frozen Baked Goods Market Forecast Value in (2035 F) | USD 57.7 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

Within the global frozen bakery products market, the frozen baked goods segment captures a significant portion at around 100%, since it sits entirely within this category. When viewed within the larger bakery products market, which spans both fresh and frozen items, frozen baked goods account for nearly 7%, reflecting their rising importance as convenience-focused offerings among traditional bakery items. In the wider frozen food market, frozen baked goods represent about 8%, showing that they have carved out a meaningful role as part of a broader frozen portfolio. Within the foodservice ingredients and convenience foods market, their share stands at close to 5%, driven by reliance from quick-service restaurants, cafés, and institutional kitchens where consistency and efficiency matter.

In the grocery and retail packaged foods market, which includes shelf-stable, refrigerated, and frozen categories, frozen baked goods contribute around 3%, underlining their smaller but steadily expanding share of store shelves. Collectively, these percentages demonstrate that frozen baked goods dominate within their dedicated space, while maintaining modest shares across larger food categories. Their greater weight in frozen and foodservice channels reflects alignment with evolving consumer demand for practical and ready-to-use solutions, while their more limited share in retail packaged foods underscores ongoing opportunities for expansion as lifestyle shifts encourage broader adoption.

The market is experiencing consistent growth, driven by increasing consumer demand for convenient, high-quality bakery products that require minimal preparation time. Rising urbanization, evolving dietary preferences, and the growing acceptance of frozen bakery products as a viable alternative to freshly baked goods are key factors supporting market expansion.

Technological advancements in freezing methods have significantly improved product quality, texture, and shelf life, encouraging greater adoption among both retail and foodservice operators. The ability to maintain flavor and nutritional value while offering extended storage capabilities has enhanced the market’s appeal across diverse consumer segments.

Moreover, the proliferation of quick-service restaurants, cafés, and in-store bakeries has fueled demand for frozen baked goods as businesses seek reliable, ready-to-use products that can meet fluctuating customer needs As health-conscious trends and premiumization influence product development, manufacturers are expanding offerings with diverse flavor profiles, clean-label ingredients, and innovative packaging formats, paving the way for sustained growth in the coming years.

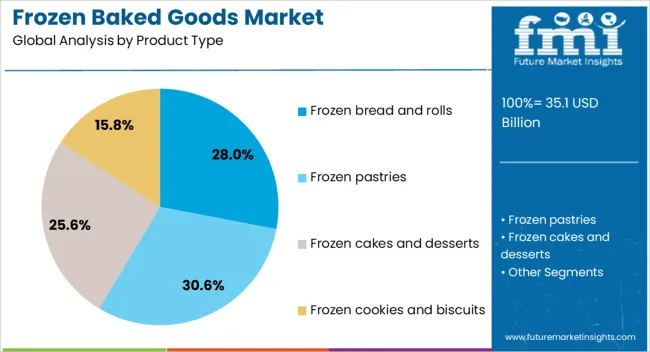

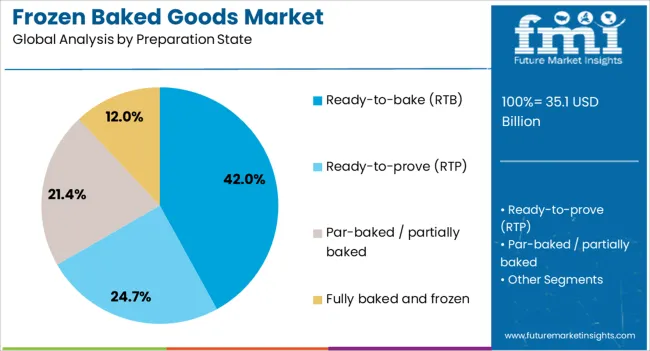

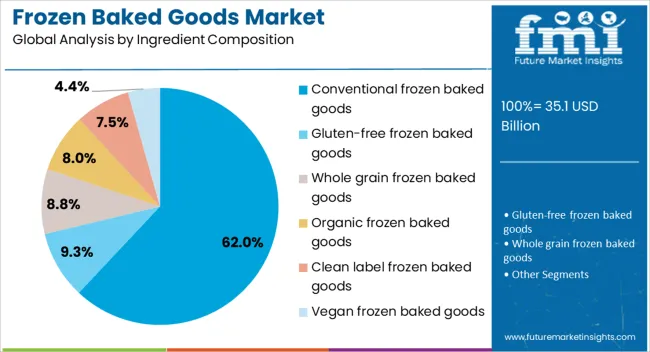

The frozen baked goods market is segmented by product type, preparation state, ingredient composition, packaging type, distribution channel, end use, and geographic regions. By product type, frozen baked goods market is divided into frozen bread and rolls, frozen pastries, frozen cakes and desserts, frozen cookies and biscuits, frozen pizza bases and flatbreads, frozen savory baked goods, and other frozen baked products. In terms of preparation state, frozen baked goods market is classified into ready-to-bake (RTB), ready-to-prove (RTP), par-baked / partially baked, and fully baked and frozen. Based on ingredient composition, frozen baked goods market is segmented into conventional frozen baked goods, gluten-free frozen baked goods, whole grain frozen baked goods, organic frozen baked goods, clean label frozen baked goods, and vegan frozen baked goods. By packaging type, frozen baked goods market is segmented into primary packaging, secondary packaging, bulk packaging, and sustainable packaging. By distribution channel, frozen baked goods market is segmented into supermarkets & hypermarkets, convenience stores, online retail, direct sales (B2B, foodservice), and distributors / wholesalers. By end use, frozen baked goods market is segmented into retail / household consumption, foodservice, and industrial / food processing. Regionally, the frozen baked goods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The frozen bread and rolls segment is projected to hold 28% of the frozen baked goods market revenue share in 2025, making it the leading product type. Growth in this segment has been supported by its universal appeal across retail, foodservice, and household consumption due to its versatility and wide application range. The convenience of frozen bread and rolls, combined with consistent quality and extended shelf life, has encouraged repeat purchases among consumers.

Advances in freezing and storage technologies have ensured that the taste, texture, and aroma remain intact, replicating the quality of fresh bakery products. Demand has been further driven by busy lifestyles that prioritize ready-to-use bakery items without compromising on quality.

The segment has also benefited from strong distribution networks and product availability in both premium and value categories, making it accessible to a wide range of consumers Additionally, the ability to offer varied sizes, flavors, and specialty formulations has strengthened its position as the preferred choice in the frozen baked goods market.

The ready-to-bake preparation state segment is anticipated to account for 42% of the market revenue share in 2025, emerging as the leading preparation format. This segment’s growth has been influenced by the increasing need for fresh-baked quality combined with the convenience of minimal preparation time. Ready-to-bake products allow consumers and foodservice providers to enjoy the aroma and taste of freshly baked goods without the complexity of starting from scratch.

The format offers flexibility, enabling products to be baked on demand, thus reducing waste and ensuring optimal freshness. Retailers and hospitality operators have adopted ready-to-bake items to meet peak demand efficiently while maintaining high quality standards.

Improvements in dough formulations and freezing processes have enhanced the final product’s texture and flavor, matching that of traditional bakery products As more consumers value convenience, customization, and freshness, the ready-to-bake segment continues to strengthen its position within the frozen baked goods industry.

The conventional frozen baked goods segment is expected to represent 62% of the market revenue share in 2025, solidifying its dominance in ingredient composition. This segment’s leadership has been driven by its familiarity, affordability, and mass appeal among consumers who prefer traditional recipes and flavors. Conventional formulations often use well-established ingredients that resonate with consumer preferences and offer a consistent taste experience.

Strong demand from mainstream retail channels and quick-service outlets has reinforced the segment’s growth, as these products meet the expectations of a broad audience. The segment benefits from economies of scale in production and distribution, which help maintain competitive pricing while ensuring wide availability.

Furthermore, the variety offered within conventional frozen baked goods, ranging from basic bread and rolls to pastries and desserts, supports high repeat purchases As the market continues to expand, conventional offerings remain a reliable choice for consumers seeking trusted flavors and consistent quality at an accessible price point.

The frozen baked goods market is expanding as consumer demand for convenient, long-lasting, and high-quality bakery products grows across households and foodservice outlets. Opportunities are increasing in retail channels and international exports, while trends highlight healthier recipes, premium indulgence, and packaging innovation. Challenges persist in cold chain costs, competition with fresh alternatives, and maintaining consistent quality. In my opinion, players that innovate in product formulation, strengthen distribution efficiency, and cater to diverse consumer preferences will secure long-term growth in the evolving frozen baked goods industry.

Demand for frozen baked goods has been driven by the growing preference for convenient and ready-to-eat bakery products. Consumers are turning to frozen breads, pastries, cakes, and cookies due to their longer shelf life, consistent quality, and easy preparation. Foodservice outlets, cafes, and retail chains rely heavily on frozen bakery items to manage inventory and meet fluctuating demand. In my opinion, demand will remain strong as households and businesses prioritize convenience without compromising taste, texture, or freshness, reinforcing frozen baked goods as a staple in modern consumption.

Opportunities in the frozen baked goods market are expanding across foodservice and retail distribution. Quick-service restaurants and cafes are increasingly dependent on frozen bakery items to deliver consistency across outlets. Supermarkets and convenience stores are also stocking larger assortments of frozen breads and desserts, widening accessibility. Export opportunities are growing for suppliers offering certified, high-quality frozen bakery products that meet international standards. I believe companies that focus on distribution partnerships, private-label collaboration, and export expansion will secure a competitive edge, tapping into rising global demand for reliable bakery solutions.

Trends in frozen baked goods emphasize innovation in healthier recipes and premium offerings. Producers are introducing products with reduced sugar, high fiber, and gluten-free options to attract health-conscious buyers. Premium variants featuring artisanal recipes, exotic flavors, and gourmet finishes are appealing to consumers seeking indulgence. Packaging improvements, including resealable and portion-controlled formats, are aligning with evolving buying habits. In my opinion, this trend indicates that frozen baked goods are no longer seen solely as convenience foods but are evolving into lifestyle-oriented choices with broader consumer appeal.

Challenges in this market include the high cost of maintaining cold chain logistics and storage facilities, which limit profitability for smaller players. Frozen baked goods also face competition from freshly baked alternatives that appeal to consumers seeking traditional bakery experiences. Quality consistency during thawing and reheating can be another barrier, impacting consumer perception. In my assessment, companies that optimize logistics, invest in efficient freezing technology, and enhance product quality through R&D will be better positioned to overcome these hurdles and sustain competitiveness in both domestic and international markets.

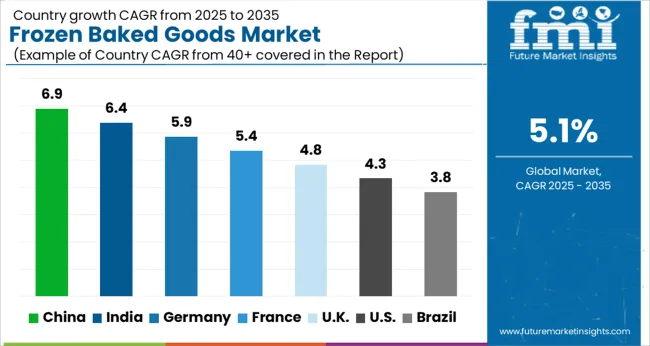

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

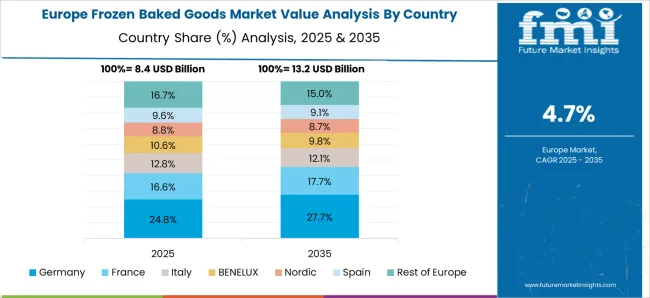

The global frozen baked goods market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and France at 5.4%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Expansion is fueled by the rising popularity of convenience foods, increased demand from foodservice chains, and consumer interest in ready-to-bake and ready-to-eat bakery items. Emerging markets such as China and India are witnessing higher adoption due to changing lifestyles and urban dietary shifts, while mature regions like the USA and UK emphasize premium products, healthier formulations, and innovative flavors.

The frozen baked goods market in China is projected to grow at a CAGR of 6.9%. Rising urban populations, changing dietary habits, and demand for convenient breakfast and snack options are driving growth. Expanding foodservice networks, including cafés, fast-food outlets, and convenience stores, are accelerating the adoption of frozen bakery products. Increasing preference for Western bakery formats such as croissants, pizzas, and pastries is fueling imports and domestic production. Enhanced cold chain infrastructure and online retail platforms are further improving accessibility and boosting consumption in China.

The frozen baked goods market in India is expected to grow at a CAGR of 6.4%. Growth is supported by the rise of modern retail formats, cafés, and quick-service restaurants. Consumer demand for convenient and affordable bakery items such as pizzas, buns, and pastries is increasing. The urban middle-class population is driving adoption, alongside a growing interest in Western-style food products. Investments in cold chain logistics and freezer storage capacity are enhancing product availability across urban and semi-urban regions. The influence of younger demographics, who prefer convenient snacking and ready-to-eat items, adds further momentum to the market.

The frozen baked goods market in France is projected to grow at a CAGR of 5.4%. France’s strong bakery culture, combined with consumer demand for premium and artisanal baked products, is shaping the frozen bakery segment. Growth is driven by retail and foodservice demand for frozen croissants, baguettes, and pastries, which provide consistency and convenience without compromising on quality. Increasing consumer preference for frozen bakery products that maintain authentic taste and texture is supporting adoption. Innovations in healthier formulations, including whole-grain and low-sugar varieties, are also fueling market expansion in France.

The frozen baked goods market in the UK is projected to grow at a CAGR of 4.8%. Rising demand for convenient bakery products, particularly among working professionals, is driving adoption. Frozen pies, pastries, and ready-to-bake bread are popular due to their long shelf life and convenience. Growth is also supported by expanding supermarket and online grocery channels, which improve accessibility to frozen bakery products. Increasing consumer preference for healthier and premium bakery options is reshaping product portfolios, with demand for gluten-free and reduced-sugar varieties gaining momentum.

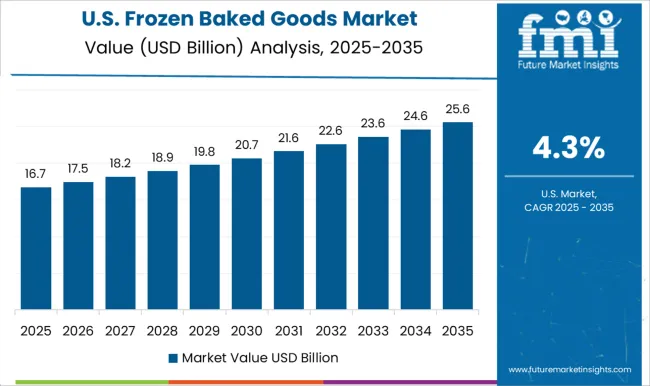

The frozen baked goods market in the USA is projected to grow at a CAGR of 4.3%. While slower compared to emerging economies, growth is supported by steady demand for frozen pizzas, pastries, and bread products. The foodservice sector, including QSRs and cafeterias, remains a significant driver of demand. Consumer interest in premium and health-conscious bakery options is influencing product innovation, with gluten-free, organic, and protein-enriched frozen bakery gaining traction. Retail innovations, particularly in online grocery and convenience channels, are expanding product reach and reinforcing stable growth in the USA market.

Competition in the frozen baked goods market has been structured around multinational food producers and specialized bakery groups that control strong brand portfolios and extensive distribution. Grupo Bimbo has been acknowledged as a global leader, where its vast bakery network and established household names have reinforced dominance across bread, rolls, and pastries. General Mills, through its Pillsbury line, has been building authority with branded convenience formats that highlight consistency, taste, and ease of preparation. Conagra Brands has been recognized for its presence in frozen food categories, embedding frozen baked goods into its diverse portfolio and leveraging strong supermarket relationships.

Vandemoortele and Europastry have been shaping the European segment with a strong emphasis on croissants, viennoiserie, and artisan-style frozen bakery, supplying both retail and foodservice operators. Kellanova has been applying its brand power to breakfast-oriented frozen bakery, where familiarity with consumer staples has created a steady presence. Flowers Foods has been using its regional strength in the United States to expand into frozen bakery niches, offering fresh-baked taste in convenient frozen formats. Aryzta has been positioned as a specialist in frozen bread and pastries, with a reputation for supplying quick-service restaurants and retailers globally. Rich Products Corporation has been focusing on frozen desserts and bakery solutions, serving foodservice outlets with tailored offerings. Strategic positioning among these players has been shaped by their ability to merge brand equity, product variety, and supply reliability.

Grupo Bimbo and General Mills have been leveraging scale and brand loyalty to secure dominance at the consumer level. Vandemoortele, Europastry, and Aryzta have been regarded as experts in premium bakery and foodservice supply, appealing to hotels, cafés, and restaurant chains. Conagra and Kellanova have been balancing frozen baked goods within broader frozen food and breakfast portfolios, ensuring cross-category influence. Flowers Foods has been maintaining strong relationships with regional distributors, while Rich Products has been expanding through customization for foodservice and institutional buyers. Market leadership has therefore been granted to companies that combine efficient frozen supply chains with consistent quality, while competitive intensity has been dictated by the ability to appeal to both mass-market shoppers and premium foodservice channels.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.1 billion |

| Product Type | Frozen bread and rolls, Frozen pastries, Frozen cakes and desserts, Frozen cookies and biscuits, Frozen pizza bases and flatbreads, Frozen savory baked goods, and Other frozen baked products |

| Preparation State | Ready-to-bake (RTB), Ready-to-prove (RTP), Par-baked / partially baked, and Fully baked and frozen |

| Ingredient Composition | Conventional frozen baked goods, Gluten-free frozen baked goods, Whole grain frozen baked goods, Organic frozen baked goods, Clean label frozen baked goods, and Vegan frozen baked goods |

| Packaging Type | Primary packaging, Secondary packaging, Bulk packaging, and Sustainable packaging |

| Distribution Channel | Supermarkets & hypermarkets, Convenience stores, Online retail, Direct sales (B2B, foodservice), and Distributors / wholesalers |

| End Use | Retail / Household consumption, Foodservice, and Industrial / Food processing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grupo Bimbo, General Mills (Pillsbury), Conagra Brands, Vandemoortele / Europastry, Kellanova, Flowers Foods, Aryzta, Rich Products Corporation, and Other regional / private-label brands |

| Additional Attributes | Dollar sales by product type (bread, cakes, pastries, pizzas), Dollar sales by distribution channel (retail, foodservice, online), Trends in convenience-focused bakery consumption and portion-controlled packs, Use in quick-service restaurants and in-store bakeries, Growth of gluten-free and clean-label frozen offerings, Regional demand variations across North America, Europe, and Asia-Pacific. |

The global frozen baked goods market is estimated to be valued at USD 35.1 billion in 2025.

The market size for the frozen baked goods market is projected to reach USD 57.7 billion by 2035.

The frozen baked goods market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in frozen baked goods market are frozen bread and rolls, frozen rolls, frozen loaves, frozen baguettes, frozen pastries, croissants, and others

In terms of preparation state, ready-to-bake (rtb) segment to command 42.0% share in the frozen baked goods market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Frozen Dough Market Analysis by type, distribution channel and region through 2035

Frozen Sardine Market Analysis Freezing Process, Form, Packaging Type and Distribution channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA