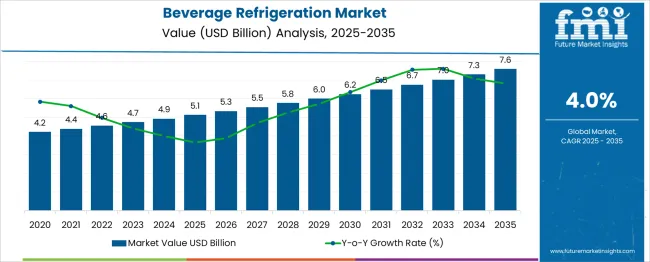

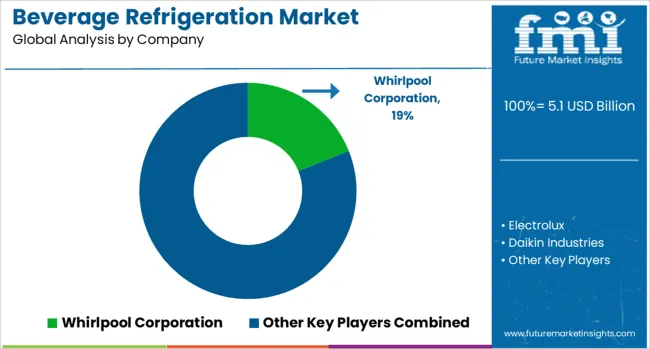

The Beverage Refrigeration Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 7.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. The beverage refrigeration market is projected to grow at a multiplying factor of 1.49× over the forecast period. Despite the modest 4% global CAGR, the trajectory does not reflect high amplitude between peak and trough years. Between 2025 and 2028, the market expands gradually from USD 5.1 billion to USD 5.8 billion, averaging a gain of USD 0.23 billion per year.

This early-phase increment reflects moderate demand saturation and cost-sensitive adoption in price-pressured commercial and retail sectors. The market's trough points occur in the 2025-2026 phase, where growth remains below 4%. From 2029 onward, a relatively stable yet firmer climb is observed, reaching a high of USD 7.6 billion by 2035.

The late-phase adds USD 1.1 billion between 2030 and 2035, averaging USD 0.22 billion annually, which shows that the slope of acceleration does not materially intensify. The overall peak-to-trough distance remains compressed, with no abrupt demand shocks or contractions. The absence of steep declines confirms steady capital budgeting in beverage cold chain upgrades. Segment inertia and regulatory compliance investments contribute to limited risk exposure and minimal deviation from the core path.

| Metric | Value |

|---|---|

| Beverage Refrigeration Market Estimated Value in (2025 E) | USD 5.1 billion |

| Beverage Refrigeration Market Forecast Value in (2035 F) | USD 7.6 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The beverage refrigeration market is experiencing stable growth, driven by increasing demand for energy-efficient cooling appliances across commercial, hospitality, and residential settings. Rising beverage consumption, especially of packaged and chilled drinks, is boosting demand for purpose-built refrigeration units that ensure consistent temperature control and product visibility.

Innovations in inverter compressor technology, low-GWP refrigerants, and compact design are expanding the market’s appeal across small cafés, bars, and modern retail outlets. Additionally, the trend toward modular and under-counter units in space-constrained environments is accelerating adoption.

As energy standards and sustainability goals influence equipment selection, manufacturers are focusing on eco-design and IoT-enabled performance monitoring to support efficiency and reliability.

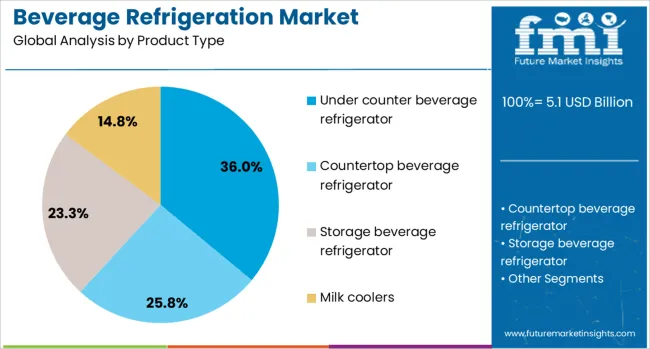

The beverage refrigeration market is segmented by product type, and geographic regions. By product type of the beverage refrigeration market is divided into Under counter beverage refrigerator, Countertop beverage refrigerator, Storage beverage refrigeratorMilk coolers. Regionally, the beverage refrigeration industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Under counter beverage refrigerators are expected to account for 36.00% of the total revenue in the beverage refrigeration market by 2025, making them the leading product type. This segment’s growth is being fueled by increasing preference for compact, space-efficient cooling solutions in hospitality and retail environments where counter space is at a premium.

These units are ideal for bars, cafés, and kitchens requiring quick access to chilled beverages without obstructing workflow. Advancements in dual-zone temperature control, sleek front-venting systems, and noise reduction features are making under counter refrigerators more attractive for upscale interiors and home bars.

As urbanization drives smaller living and working spaces, under counter beverage coolers offer a practical, energy-efficient, and aesthetically adaptable solution.

The beverage refrigeration market has gained traction due to rising demand across foodservice and retail environments requiring efficient cold storage and display equipment. Product visibility, freshness, and temperature stability are being prioritized. Manufacturers have responded with innovations in inverter-driven systems, glass-door formats, and environmentally compliant refrigerants. Rapid deployment in convenience chains and restaurants has been observed globally. Operators are adopting compact, durable solutions that match layout constraints while maximizing promotional space.

Product selection has been influenced by stricter environmental norms and rising electricity costs. Units with R290 or R600a refrigerants are being favored due to their low global warming potential and compatibility with energy-efficiency standards. Inverter compressors have been integrated into newer systems to reduce cycling loss and maintain temperature precision. Businesses have shifted from repair to replacement due to high lifecycle savings. Regulatory shifts across Europe, Asia, and North America have accelerated transition from HFC-based units. Brands are differentiating through lower kWh-per-day consumption ratings and customizable controls. Retailers are demanding systems optimized for ambient heat zones and variable footfall locations to ensure thermal integrity and energy conservation under mixed usage conditions.

Product design has evolved around enhancing product visibility and customer interaction. Merchandisers with panoramic glass panels, LED-illuminated shelves, and tiered product zones are being deployed to encourage impulse purchases. Under-counter chillers and countertop units are used in cafés, bars, and compact stores to preserve beverage accessibility without occupying large footprints. Adjustable shelving systems allow format flexibility to hold multiple beverage types with varied dimensions and cooling needs. Custom finishes, digital temperature displays, and lockable doors are being adopted for aesthetic appeal and inventory control. These equipment upgrades have been prioritized across promotional retail environments, resulting in better brand engagement and point-of-sale conversion rates across beverage categories.

Retailers and restaurants have adopted IoT-enabled beverage refrigeration systems to streamline asset performance and minimize product spoilage. Integrated systems allow real-time alerts on temperature deviations, door status, and compressor activity. Store managers are using mobile dashboards to remotely adjust settings or trigger defrost cycles during off-peak hours. Predictive maintenance algorithms are helping reduce equipment downtime and repair costs. Multi-location operators are using centralized cloud platforms to standardize compliance checks and energy audits. Retail energy programs are promoting adoption of connected units with demand-response readiness. This shift toward automation is improving energy optimization, reducing labor input, and enhancing uptime in beverage preservation environments.

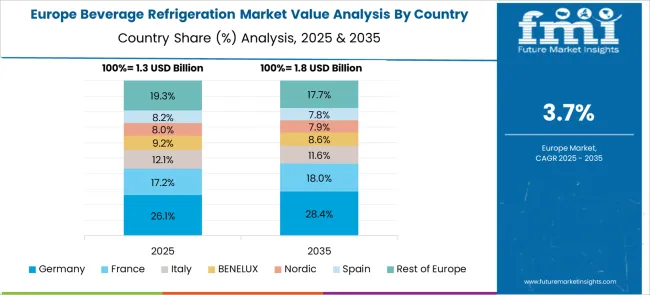

Country-level variation in refrigeration deployment has been influenced by retail format growth, electricity infrastructure, and equipment regulation. North America has moved toward low-GWP retrofits while Europe has emphasized inverter integration. Asia Pacific has emerged as a deployment hotspot due to retail chain expansion and rising quick-service restaurant penetration. Segmentally, glass-door upright coolers dominate supermarkets, while compact reach-in and drawer units are expanding within bars, cafés, and micro markets. Beer towers, wine coolers, and soda dispensers are being selectively used in food-centric hospitality formats. The demand for mobility-enabled, modular refrigeration solutions has intensified across hybrid spaces combining foodservice, retail, and on-premise consumption.

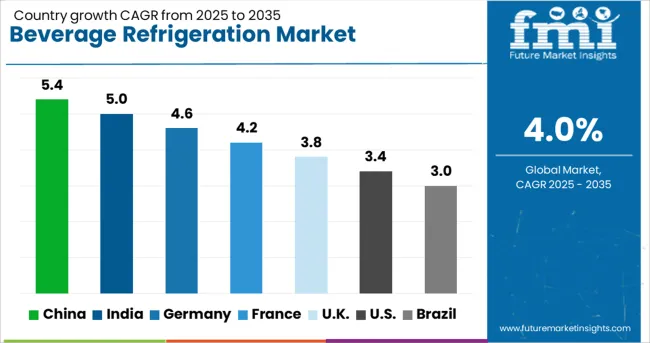

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

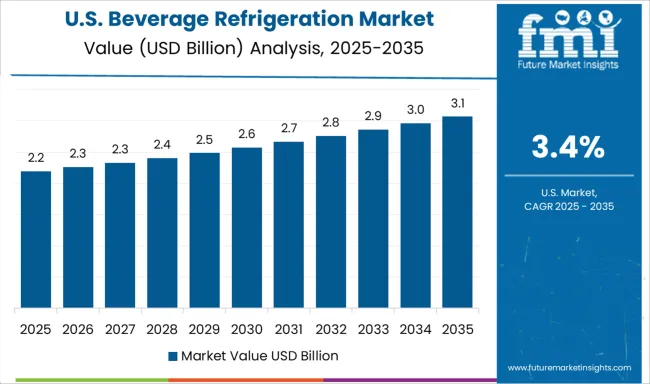

| USA | 3.4% |

| Brazil | 3.0% |

The beverage refrigeration market is forecast to grow globally at a CAGR of 4% between 2025 and 2035. China leads with a CAGR of 5.4%, 35% above the global average, driven by increased production of energy-efficient units. India follows with 5.0%, 25% above trend, benefiting from retail expansion and temperature-sensitive storage needs. Germany grows at 4.6%, 15% higher than average, supported by cold-chain upgrades and foodservice sector modernization. The UK at 3.8% and the USA at 3.4% are growing below the global CAGR due to saturation and longer replacement cycles. ASEAN-linked growth is observed in India through fast-moving consumer goods demand, while OECD-linked modernization supports Germany’s above-average performance. The global market is influenced by eco-regulatory shifts, cost-driven upgrades, and expansion of hybrid retail and dining formats.

China is expected to register a CAGR of 5.4% between 2025 and 2035, surpassing the global average by 35%. Commercial cold storage units are being adopted across retail chains and foodservice providers, driven by rising demand for bottled and functional beverages. Domestic manufacturers are scaling high-efficiency models to meet new refrigerant standards. Smart refrigeration with IoT-integrated control systems is increasing installation across quick-service restaurants and vending networks. Demand from urban markets remains strong, while tier II and III cities are experiencing rapid cold-chain deployment. Energy usage optimization and certification mandates are accelerating equipment replacement cycles in retail and hospitality sectors.

India is forecast to grow at a CAGR of 5.0% through 2035, which is 25% higher than the global average. Rising demand from retail chains and highway service stations has spurred market penetration in new states. The push for cold beverage sales, particularly during extended summer months, is strengthening unit turnover. Refrigeration adoption across Tier I and II convenience stores is supported by financing options and OEM tie-ups. Local manufacturing has improved availability, aided by the government’s production-linked incentives. Demand in quick-service restaurants and kirana stores remains strong, driven by bottled drink storage needs and smaller unit formats.

Germany is expected to post a CAGR of 4.6% from 2025 to 2035, above the global trend by 15%. EU climate policy mandates and energy rating systems are accelerating demand for low-GWP refrigerant models. Food retailers and beverage-focused cafés are adopting modular refrigeration solutions with digital efficiency tracking. Demand is steady in institutional food services, where compliance-linked upgrades remain ongoing. OEMs are focusing on silent-cooling technology and optimized shelving configurations for multi-product displays. The market is shaped by circular economy targets and regulatory pressure on refrigerant lifecycle management. Retail modernization continues to support sales across independent stores.

The United Kingdom is forecast to expand at a CAGR of 3.8% from 2025 to 2035, slightly below the global average. Extended replacement cycles and moderate demand in retail outlets have contributed to slower growth. Consumer-facing beverage coolers are widely deployed, but energy-efficiency retrofitting is progressing unevenly. Market activity is higher in refurbished mixed-use spaces and food hall conversions. Compliance with F-gas rules has led to increased costs, reducing frequency of new unit adoption. Chain-based coffee retailers and pubs continue upgrading to comply with decarbonization guidelines. Imports have risen as UK-based OEM activity remains constrained.

The United States is anticipated to grow at a CAGR of 3.4% from 2025 to 2035, underperforming the global average by 15%. The market remains saturated in large cities, with growth driven primarily by replacements rather than first-time installations. Regulatory focus on refrigerant safety and energy use has slowed the introduction of new units. Smaller café chains and vending operators are adopting compact, energy-optimized models. Beverage refrigeration is concentrated in specialty grocery, convenience stores, and franchised dining. Import dependence and state-level compliance variability continue to create regional disparities in unit turnover and maintenance cycles.

Whirlpool Corporation provides commercial-grade beverage coolers and under-counter refrigeration systems, catering to restaurants, convenience stores, and hospitality chains. Its product strategy emphasizes energy-efficient compressors and enhanced storage flexibility. Electrolux has introduced multi-zone beverage centers targeting the premium residential and foodservice segments.

Its collaboration with appliance dealers and distributors has helped strengthen its regional presence. Daikin Industries, though primarily active in air conditioning, offers commercial refrigeration units for beverage cooling via its subsidiary network, especially in Asia and Europe. Dover Corporation, through its Hillphoenix brand, supplies vertical and horizontal beverage refrigeration units optimized for retail display and bulk storage.

Haier and Edgestar focus on compact and freestanding beverage coolers, targeting small commercial setups and premium residential users. Haier’s distribution partnerships with major electronics retailers support its market scale. General Electric manufactures beverage refrigerators integrated with smart diagnostics and modular shelving systems, promoted via online and big-box retail partnerships.

Ford, through its mobility solutions division, develops specialized cooling compartments for mobile food and beverage vendors, an emerging micro-segment in this category. Across the sector, product differentiation is being driven by adjustable temperature zones, quiet operation features, and digitized control systems tailored to beverage-specific storage requirements.

New models featured IoT-enabled cooling control, low-GWP refrigerants, and energy-saving components to meet modern regulatory and operational demands. Multipurpose units like dual-use kegerators gained popularity in commercial settings. Brands focused on modular and compact formats suited for urban retail and hospitality. Retail refrigeration saw growth in South Asia due to quick-service chains and the expansion of bottled drinks. Intelligent diagnostics and eco-focused engineering reshaped product development trends globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.1 Billion |

| Product Type | Under counter beverage refrigerator, Countertop beverage refrigerator, Storage beverage refrigerator, and Milk coolers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Whirlpool Corporation, Electrolux, Daikin Industries, Dover Corporation, Haier, Edgestar, Ford, and General Electrics |

| Additional Attributes | Dollar sales by unit type and end use, demand trends across hotels and quick service retail, regional gains in Asia-Pacific, innovation in IoT cooling and low-GWP refrigerants, environmental impact of emissions, and new use cases in mobile vending. |

The global beverage refrigeration market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the beverage refrigeration market is projected to reach USD 7.6 billion by 2035.

The beverage refrigeration market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in beverage refrigeration market are under counter beverage refrigerator, countertop beverage refrigerator, storage beverage refrigerator and milk coolers.

In terms of , segment to command 0.0% share in the beverage refrigeration market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Tester Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA