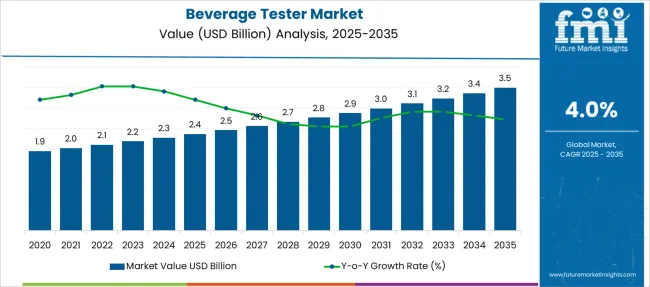

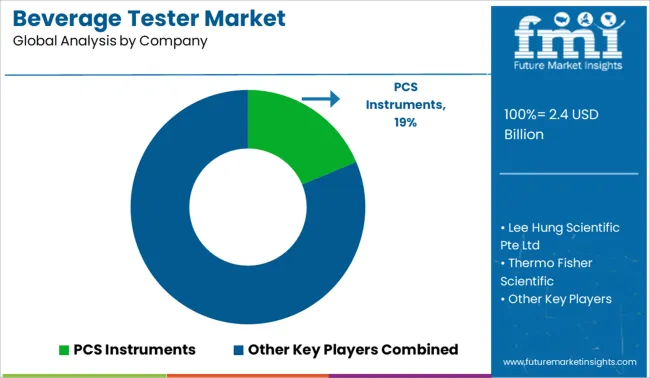

The Beverage Tester Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Beverage Tester Market Estimated Value in (2025 E) | USD 2.4 billion |

| Beverage Tester Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The beverage tester market is gaining traction globally as producers prioritize quality control, product standardization, and consumer safety across increasingly diverse beverage portfolios. The adoption of advanced testing solutions has been influenced by stricter food and beverage regulations, shifting consumer preferences, and the proliferation of functional and craft beverages. Producers are focusing on improving flavor profiling, shelf-life prediction, and ingredient authenticity using both traditional sensory testing and advanced analytical technologies such as spectroscopy and chromatography.

Digital integration within testing platforms and cloud-enabled result tracking have further enhanced decision-making efficiency across production lines. As beverage brands scale globally and adapt to localized consumer palates, the demand for scalable and automated testing equipment has risen.

Additionally, the growing emphasis on clean-label claims, reduced sugar content, and novel formulations has reinforced the importance of precision testing The outlook for the beverage tester market is expected to remain strong, with continuous investment in R&D, laboratory automation, and compliance-driven innovations shaping future growth.

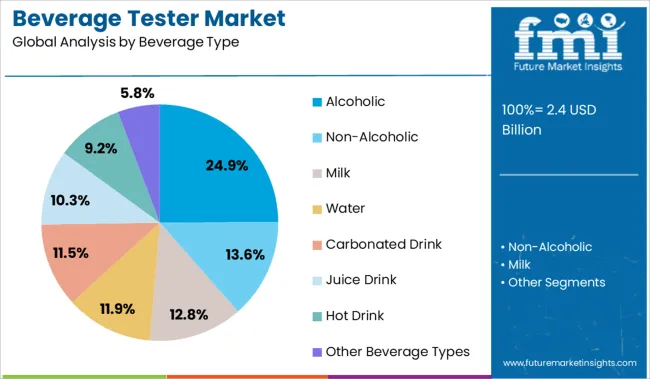

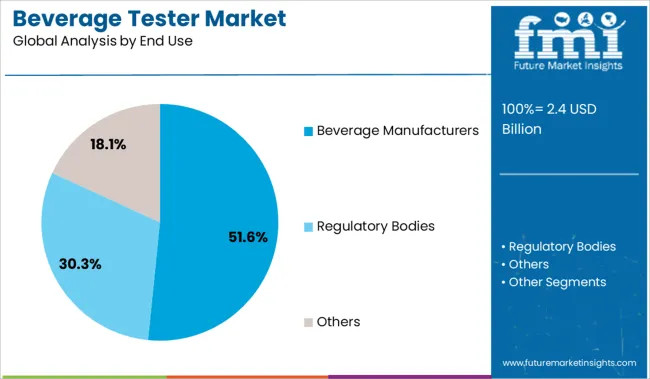

The market is segmented by Beverage Type and End Use and region. By Beverage Type, the market is divided into Alcoholic, Non-Alcoholic, Milk, Water, Carbonated Drink, Juice Drink, Hot Drink, and Other Beverage Types. In terms of End Use, the market is classified into Beverage Manufacturers, Regulatory Bodies, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The alcoholic segment is expected to contribute 24.9% of the total revenue share in the beverage tester market in 2025, reflecting its critical role in ensuring flavor consistency and regulatory conformity. The growth of this segment has been driven by rising global consumption of beer, wine, and spirits, each requiring distinct sensory and chemical evaluation methods. Beverage testers have been adopted widely by alcoholic beverage producers to monitor ethanol concentration, detect impurities, and validate ingredient composition, which are vital for both quality assurance and legal compliance.

Advanced testing solutions have been integrated into distilleries and breweries to support continuous fermentation monitoring, contamination control, and recipe consistency. The emphasis on maintaining flavor profiles across batches and production sites has reinforced the importance of specialized testing protocols in alcoholic beverages.

Moreover, the surge in demand for premium and craft products has elevated the role of testing systems in supporting artisanal quality and traceability These factors have positioned the alcoholic segment as a significant contributor to market growth.

The beverage manufacturers segment is projected to hold 51.6% of the overall revenue share in the beverage tester market in 2025, establishing it as the dominant end-use industry. The segment’s leadership has been supported by the scale and complexity of operations across global beverage production facilities, which require rigorous testing to ensure product integrity. Beverage manufacturers are utilizing integrated testing systems to analyze parameters such as pH level, turbidity, carbonation, sweetness, and microbial stability.

The increasing volume of SKUs, combined with accelerated production timelines, has made real-time quality assessment a critical function on manufacturing floors. Automation in beverage testing equipment has enabled faster feedback loops and enhanced precision, particularly for mass-market products.

Additionally, stringent food safety regulations and global export standards have driven manufacturers to adopt comprehensive testing infrastructure The ability to centrally manage data, reduce product recalls, and improve batch-to-batch consistency has solidified beverage manufacturers as the primary consumers of beverage testing solutions within the market.

The beverage industry has been growing at a furious pace and is one of the healthiest markets. This gives a strong sense of direction to the beverage tester market which will grow significantly over the next ten years. As the beverage tester tests the quality of the beverages by qualitatively finding the flow rate and the pressure loss in m/s to test the solutions with different viscosities.

The rise in demand for carbonated drinks, sports drinks, and flavored water is projected to boost market revenue over the forecast period. Furthermore, the introduction of new products into the market will enhance the market expansion over the years to come. Small players are also leading the industry's progression with limited resources both in the domestic and international markets.

The rising prevalence of infectious diseases is increasing the demand for testing services. Unprotected food carries bacteria and germs which can transmit infectious diseases and testers check the potency of beverages to ensure that the liquid is ingestible.

Lack of awareness regarding the beverage potency is a restraint of the market. Insufficient knowledge on the part of consumers is restricting the market.

The inconsistency in standards is restraining the growth of the beverage tester market. Various standards are impacting growth such as those implemented by FDA and ABA. The standards impact growth adversely during the forecast period.

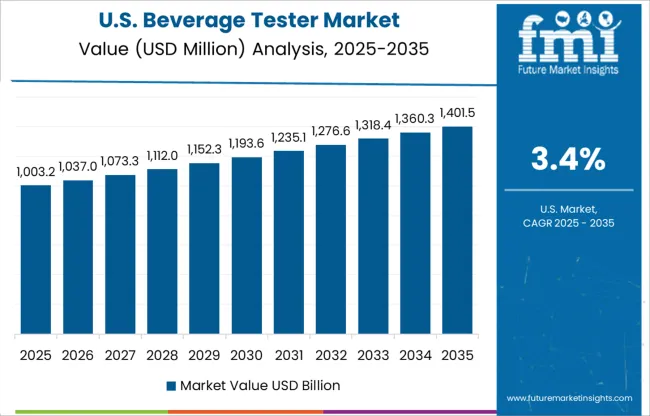

The North American region is home to the maximum market share. The region dominated the global beverage tester market and is expected to reach a high rate. The countries such as the USA, Canada, Mexico, etc. are covered under this region.

The major factors that drive the growth of the North American beverage tester market include increasing demand for quality products and beverages & stringent regulations to ensure food safety across various industries such as pharmaceutical, healthcare, and agrochemicals/pharmaceutical industry among others along with altering lifestyles. The USA has around 9,654 wineries.

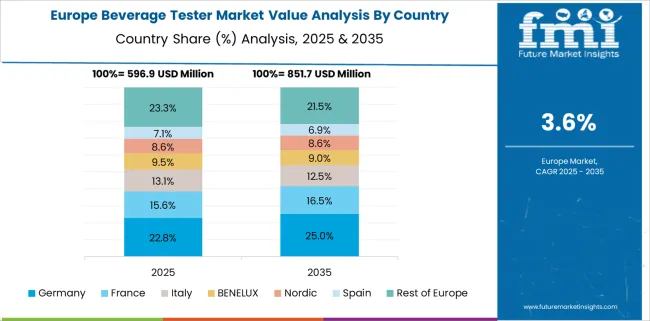

The presence of a large number of players in Europe and the overwhelming fast food industry, especially in countries such as the United Kingdom, Germany, France, and Italy will drive global beverage tester market growth over the forecast period. The United Kingdom's food and drink manufacturing sector is around € 100 billion.

Some of the key players in the beverage tester market include Thermo Fisher Scientific, Fisher Scientific Company, PCS Instruments, Lee Hung Scientific Pte Ltd, VWR, NuAire, Selectech, Q-LAB, steinfurth.de, and others.

With a rising number of players contributing to the market, the market is highly competitive and several key players are making their presence felt in the region, particularly in North America.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4% from 2025 to 2035 |

| Market Value in 2025 | USD 2.4 billion |

| Market Value in 2035 | USD 3.5 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Beverage Type, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, BENELUX, Australia & New Zealand, China, Japan, South Korea, India, ASIAN, GCC Countries, South Africa, Turkey |

| Key Companies Profiled | PCS Instruments; Lee Hung Scientific Pte. Ltd.; Thermo Fisher Scientific; VWR; NuAire; Selectech; Q-LAB; Steinfurth.de |

| Customization | Available Upon Request |

The global beverage tester market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the beverage tester market is projected to reach USD 3.5 billion by 2035.

The beverage tester market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in beverage tester market are alcoholic, non-alcoholic, milk, water, carbonated drink, juice drink, hot drink and other beverage types.

In terms of end use, beverage manufacturers segment to command 51.6% share in the beverage tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beverage Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beverage Carrier Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cartoners Market Size and Share Forecast Outlook 2025 to 2035

Beverage Filter Paper Market Size and Share Forecast Outlook 2025 to 2035

Beverage Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Clouding Agent Market Size and Share Forecast Outlook 2025 to 2035

Beverage Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Beverage Premix Market Size and Share Forecast Outlook 2025 to 2035

Beverage Acidulants Market Size and Share Forecast Outlook 2025 to 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Container Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Ends Market Size and Share Forecast Outlook 2025 to 2035

Beverage Cups Market Size and Share Forecast Outlook 2025 to 2035

Beverage Can Seamers Market Size and Share Forecast Outlook 2025 to 2035

Beverage Aluminum Cans Market Size and Share Forecast Outlook 2025 to 2035

Beverage Stabilizer Market Growth, Trends, Share, 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA