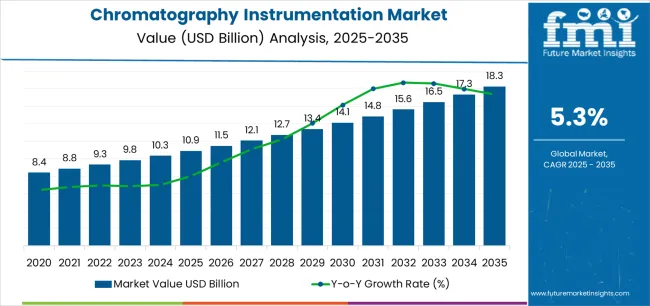

The Chromatography Instrumentation Market is estimated to be valued at USD 10.9 billion in 2025 and is projected to reach USD 18.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The chromatography instrumentation market is witnessing robust expansion, propelled by increasing demand for high-precision analytical techniques across pharmaceutical, biotechnology, and environmental testing sectors. The market is influenced by growing research activities in drug discovery, food safety, and clinical diagnostics. Technological advancements, including automated systems and improved detection sensitivity, have enhanced analytical throughput and accuracy.

The regulatory emphasis on product purity and quality validation further supports market adoption. With continuous expansion of pharmaceutical production and biologics research, chromatography systems are increasingly utilized for complex compound separation and quantification.

Moreover, the integration of digital data management and remote monitoring capabilities is improving operational efficiency. As industries prioritize analytical consistency and process optimization, the market is expected to sustain high growth through widespread application diversification.

| Metric | Value |

|---|---|

| Chromatography Instrumentation Market Estimated Value in (2025 E) | USD 10.9 billion |

| Chromatography Instrumentation Market Forecast Value in (2035 F) | USD 18.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

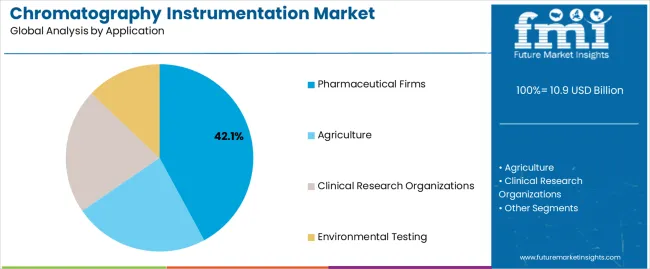

The market is segmented by Devices and Application and region. By Devices, the market is divided into Consumables, Columns, Accessories, and Column Accessories. In terms of Application, the market is classified into Pharmaceutical Firms, Agriculture, Clinical Research Organizations, and Environmental Testing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid chromatography systems segment leads the devices category, holding approximately 56.8% share of the chromatography instrumentation market. Its prominence is driven by its ability to separate and analyze complex mixtures with high accuracy and reproducibility.

Liquid chromatography is extensively employed in pharmaceutical, biochemical, and environmental testing laboratories due to its compatibility with thermally unstable and non-volatile compounds. Continuous technological innovation, including ultra-high-performance liquid chromatography (UHPLC), has enhanced resolution, speed, and sensitivity, improving analytical workflows.

The segment’s growth is reinforced by the increasing global focus on quality assurance and regulatory compliance. With rising application in biologics manufacturing, drug formulation, and food safety testing, the liquid chromatography systems segment is expected to retain its leadership across laboratory and industrial environments.

The pharmaceutical firms segment dominates the application category with approximately 42.1% share, reflecting the central role of chromatography in drug development and quality control. The technique is vital for identifying impurities, ensuring compound stability, and verifying active ingredient concentrations.

The segment benefits from expanding R&D expenditure and increased clinical trial activity across global pharmaceutical hubs. Demand for chromatography systems is further strengthened by regulatory mandates requiring precise validation of pharmaceutical products.

Automation and digital integration have enhanced efficiency and data traceability, aligning with industry trends toward smart laboratories. With continuous innovation in drug discovery and the growth of biologics, the pharmaceutical firms segment is anticipated to remain the largest application area within the chromatography instrumentation market.

The global chromatography instrumentation sales grew at a CAGR of 8.1% from 2020 to 2025. The growth of chromatography instrumentations from 2020 to 2025 can be attributed to a convergence of factors:

By 2035, the market for chromatography instrumentations is expected to rise at a 5.6% CAGR.

The table below shows the estimated growth rates of the top five countries. The United Kingdom, South Korea, and Japan are set to record high CAGRs of 6.6%, 7.6%, and 6.4%, respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

| United Kingdom | 6.6% |

| China | 6.2% |

| South Korea | 7.6% |

| Japan | 6.4% |

The table below explains the chromatography instrumentation market size of the top five countries for 2035. Among them, the United States is anticipated to remain at the forefront by reaching a valuation of USD 18.3 billion. China is expected to reach a valuation of USD 2.7 billion by 2035.

| Countries | Market Values (2035) |

|---|---|

| United States | USD 18.3 billion |

| United Kingdom | USD 676.4 million |

| China | USD 2.7 billion |

| South Korea | USD 1.1 billion |

| Japan | USD 1.9 billion |

The United States chromatography instrumentation industry is poised to exhibit a CAGR of 5.7% during the assessment period. By 2035, the United States market is expected to reach USD 18.3 billion. The factors driving the market growth are as follows:

The demand for chromatography instrumentations in China is anticipated to rise at a steady CAGR of 6.2% during the forecast period. This is attributable to a combination of factors, including:

Japan's chromatography instrumentation market is expected to reach a valuation of around USD 1.9 billion by 2035. Emerging patterns in Japan’s market are as follows:

The demand for chromatography instrumentations is increasing in the United Kingdom, with a projected CAGR of 6.6% through 2035. Top factors supporting the market expansion in the country include:

The chromatography instrumentation market is projected to increase in South Korea at a CAGR of 7.6% through 2035. Key factors supporting the market growth are:

The section below shows the chromatography systems segment dominated by the device category. It is predicted to surge at a CAGR of 5.4% through 2035. Based on application, the agriculture segment is anticipated to generate a dominant share through 2025. It is set to rise at a CAGR of 5.3% through 2035.

| Segment | CAGR (2025 to 2035) |

|---|---|

| Chromatography Systems (Devices) | 5.4% |

| Agriculture (Application) | 5.3% |

Based on devices, the demand for chromatography systems is expected to remain high during the evaluation period.

Based on application, the agriculture segment is expected to surge at a CAGR of 5.3% through 2035.

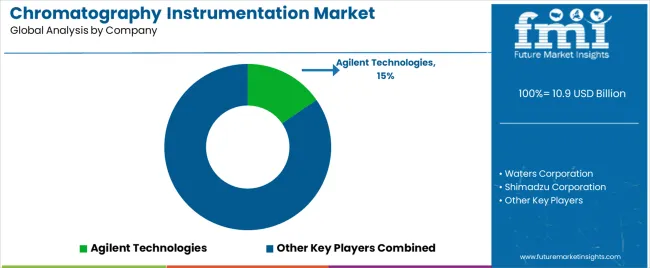

Leading companies and manufacturers in the chromatography instrumentation market are concentrating on introducing cutting-edge liquid chromatography systems and parts. Key companies are concentrating on partnerships, mergers, and acquisitions in order to broaden their market reach. In order to improve their company’s position, they are also investing in a number of growth tactics.

For instance

The global chromatography instrumentation market is estimated to be valued at USD 10.9 billion in 2025.

The market size for the chromatography instrumentation market is projected to reach USD 18.3 billion by 2035.

The chromatography instrumentation market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in chromatography instrumentation market are _liquid chromatography systems, _gas chromatography systems, _fluid chromatography systems, _thin layer chromatography systems, consumables, columns, _solvents/reagents/adsorbents, _syringes/needles, _others, accessories, column accessories, _auto-sampler accessories, _pumps and _other accessories.

In terms of application, pharmaceutical firms segment to command 42.1% share in the chromatography instrumentation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromatography Resin Market Forecast and Outlook 2025 to 2035

Chromatography Accessories & Consumables Market Growth – Trends & Forecast 2025 to 2035

Chromatography Software Market Insights – Trends & Forecast 2025 to 2035

Chromatography Reagent Market Growth – Trends & Forecast 2024-2034

Chromatography Silica Resins Market

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Columns Market

Gas Chromatography Detector Market

Immunochromatography Kits Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Multimodal Chromatography Columns Market

Preparative Chromatography Market Size and Share Forecast Outlook 2025 to 2035

Supercritical Fluid Chromatography Market

Preparative and Process Chromatography Market Forecast and Outlook 2025 to 2035

Hydrophobic Interaction Chromatography Resins Market

Binary High Pressure Gradient Liquid Chromatography System Market Size and Share Forecast Outlook 2025 to 2035

Instrumentation Valve and Fitting Market Trends & Forecast for 2025 to 2035

Instrumentation and Control Devices Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA