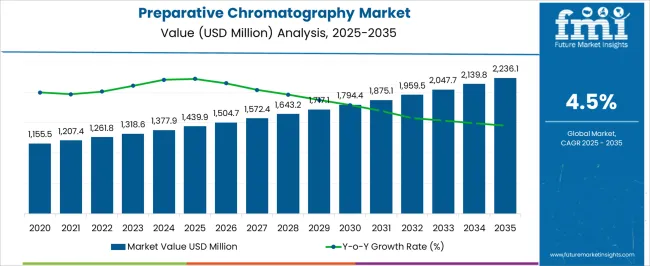

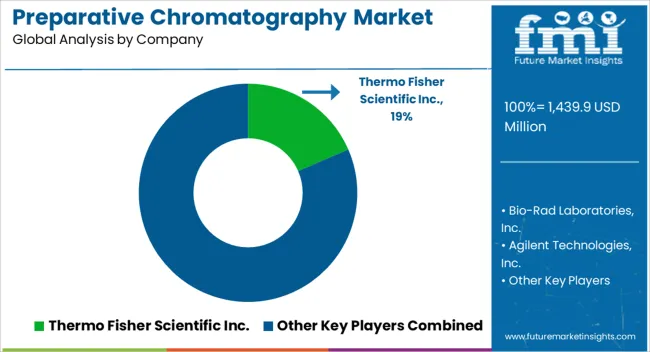

The Preparative Chromatography Market is estimated to be valued at USD 1439.9 million in 2025 and is projected to reach USD 2236.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Preparative Chromatography Market Estimated Value in (2025 E) | USD 1439.9 million |

| Preparative Chromatography Market Forecast Value in (2035 F) | USD 2236.1 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The preparative chromatography market is advancing at a robust pace, driven by the rising demand for high-purity compounds in pharmaceuticals, biotechnology, and research laboratories. Increasing drug development activities, coupled with the growing focus on biologics and advanced therapeutics, has significantly elevated the importance of preparative chromatography in production workflows.

The market is further supported by advancements in column technology, resin development, and automation, which improve scalability and efficiency in compound isolation. Regulatory emphasis on product quality and safety has reinforced the adoption of chromatography techniques across industries.

The current scenario reflects expanding application beyond pharmaceuticals into food, environmental testing, and chemical industries. With ongoing research investments and an expanding pipeline of complex molecules, the preparative chromatography market is poised for sustained growth, underpinned by its critical role in ensuring high-purity outputs for commercial and clinical use.

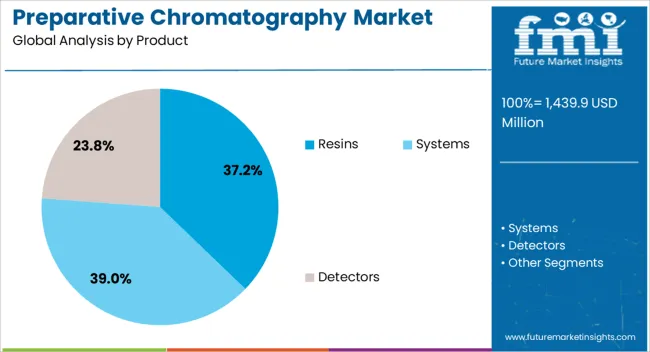

The resins segment leads the product category with approximately 37.2% share, driven by its indispensable role in facilitating efficient separation and purification processes. Resin-based chromatography systems provide high binding capacity, selectivity, and versatility, making them the preferred choice in biopharmaceutical manufacturing.

The segment’s dominance is further supported by continuous improvements in resin formulations that enhance durability and performance in large-scale applications. Increasing adoption in protein purification, monoclonal antibody production, and peptide isolation has reinforced the segment’s strong presence.

With ongoing innovation in advanced resin chemistries and high-throughput systems, the resins segment is expected to maintain its leadership in the market.

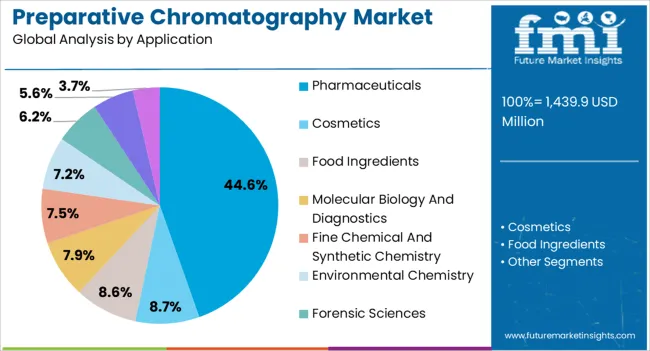

The pharmaceuticals segment dominates the application category with approximately 44.6% share, reflecting the sector’s reliance on chromatography for ensuring drug purity, efficacy, and regulatory compliance. Preparative chromatography is integral in the isolation of active pharmaceutical ingredients (APIs), intermediates, and advanced molecules used in drug development pipelines.

Demand has been reinforced by the growing complexity of therapeutics, including biologics and personalized medicines, which require precise purification methods.

With increased global R&D spending and rising regulatory stringency, the pharmaceuticals segment is expected to remain the largest application area for preparative chromatography.

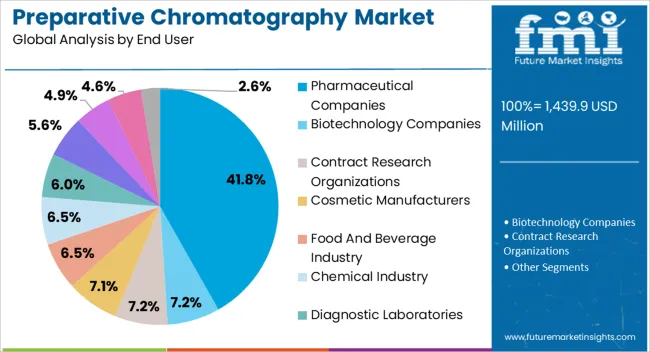

The pharmaceutical companies segment holds approximately 41.8% share in the end-user category, underscoring its central role in driving market demand. Large-scale drug manufacturers rely extensively on preparative chromatography for consistent production of high-purity compounds at commercial volumes.

The segment benefits from the expansion of biologics manufacturing and the increasing outsourcing of purification services to contract manufacturing organizations. Continuous investment in scaling production capacity and maintaining regulatory compliance further reinforces the segment’s leadership.

As pharmaceutical pipelines expand globally, the pharmaceutical companies segment is projected to retain its dominance in the preparative chromatography market.

The preparative chromatography market grew at a CAGR of 4.3% from 2020 to 2025. Several chromatography methods have been created and improved over time, including flash chromatography, simulated moving bed (SMB) chromatography, and high-performance liquid chromatography (HPLC). These advancements have helped to increase scalability and efficiency.

The pharmaceutical industry saw a dramatic change in the late 2024s toward biopharmaceuticals, such as recombinant proteins and monoclonal antibodies. Preparative chromatography is a critical stage in purifying these complex compounds, and this transition fueled its demand.

Improvements in instrumentation, stationary phase materials, and column technology have all been crucial in raising the efficiency and potential of preparative chromatography systems. Regulation of the purification procedures came under more attention as the biotechnology and pharmaceutical sectors grew. The implementation of proven preparative chromatographic procedures has been prompted by stringent product quality and safety laws.

High-throughput preparative chromatography systems were adopted because of the necessity for rapid medication discovery and production. Preparative chromatography has seen a shift in the use of single-use devices in recent years. These systems benefit from flexibility, a lower chance of cross-contamination, and cheaper operating expenses.

The growing focus on customized and precision medicine is driving the need for preparative chromatography. Targeted therapies are advancing, and this method's capacity to handle complicated biological materials like proteins and antibodies matches well with the recent development.

The influx of funds into research & development strengthens the crucial role of preparative chromatography in promoting drug development, ultimately determining the future of pharmaceutical research and patient care. Hence, growing investments in global healthcare infrastructure and research & development activities are creating new opportunities for the growth of the preparative chromatography market.

The table below shows the estimated growth rates of the top five countries. China, India, and the United Kingdom are set to record high CAGRs of 8.6%, 8.8%, and 2.8%, respectively, through 2035.

| Country | Value CAGR |

|---|---|

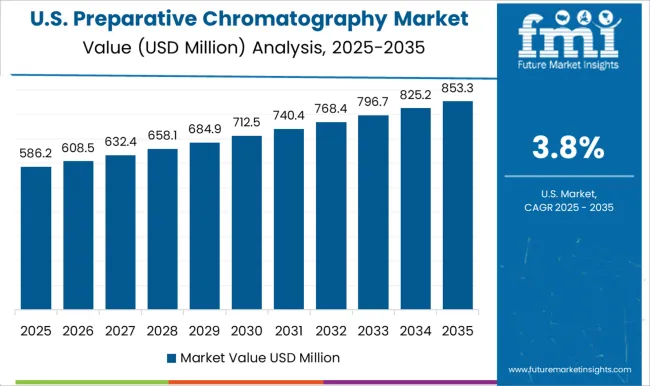

| United States | 2.3% |

| India | 8.8% |

| United Kingdom | 2.8% |

| China | 8.6% |

| Italy | 4.9% |

The United States is expected to surge at a CAGR of 2.3% through 2035. The factors driving the United States market growth are as follows:

Key players are investing significantly in India, as the country offers greater growth opportunities than its counterparts. Through 2035, India is projected to expand at a CAGR of 8.8%, driven by the following factors:

China’s preparative chromatography market is assessed to register a CAGR of 8.6% through 2035. The deployment of preparative chromatography is increasing on account of the following:

The below section shows the detector segment dominated by product type. It is expected to surge at a CAGR of 8.1% from 2025 to 2035. Based on application, the pharmaceutical segment is anticipated to hold a dominant share through 2025. It is set to expand at a CAGR of 2.6% by 2035.

| Product | Detectors |

|---|---|

| Value CAGR | 8.1% |

Based on the product, the detector segment is expected to surge at a CAGR of 8.1% by 2035. Detectors aid in identifying and measuring the separated components according to their distinct properties, such as fluorescence, UV absorbance, and changes in refractive index. This information is essential to evaluate the purity of the components that are gathered.

Detectors also enable operators to make quick modifications to maximize separation conditions by providing real-time monitoring of the elution process. This ability improves the purification process's efficiency in several applications.

| Application | Pharmaceuticals |

|---|---|

| Value CAGR | 2.6% |

Preparative high-performance liquid chromatography (HPLC) is important in reaching the essential purity levels for research, clinical trials, and production, making it a vital technology for pharmaceutical applications. Monoclonal antibodies, peptides, and proteins are frequently purified using preparative chromatography. It guarantees the synthesis of superior, physiologically active therapeutic proteins and aids in the removal of contaminants.

Natural products often contain pharmacological ingredients, typically derived from plants, microbes, or marine organisms. These complicated combinations are subjected to preparative chromatography to separate and isolate bioactive components.

Leading companies are strategically making collaborations and expanding their geographical reach to strengthen their positions. Through acquisitions and collaborations, they are expected to elevate their skills, penetrate new markets, and diversify their portfolios.

Key market players are entering new areas to reach a larger consumer base and take advantage of new opportunities by expanding geographically. By developing revenue sources, these players become stronger, specific to their position and competitiveness in the market, using their strategic growth approaches.

For instance:

The global preparative chromatography market is estimated to be valued at USD 1,439.9 million in 2025.

The market size for the preparative chromatography market is projected to reach USD 2,236.1 million by 2035.

The preparative chromatography market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in preparative chromatography market are resins, _affinity chromatography (ac), _ion exchange chromatography (iex), _size-exclusion resins, _hydrophobic interaction resins, _mixed-mode/multi-mode resins, _other resins, systems, _semi-preparative hplc systems, _preparative hplc systems, detectors, _uv/vis detectors, _diode-array detectors, _refractive index detectors, _fluorescence detectors, _mass spectrometry detectors, _evaporating light scattering detectors, _electrochemical detectors, consumables, columns, _prepacked columns and _empty columns.

In terms of application, pharmaceuticals segment to command 44.6% share in the preparative chromatography market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA