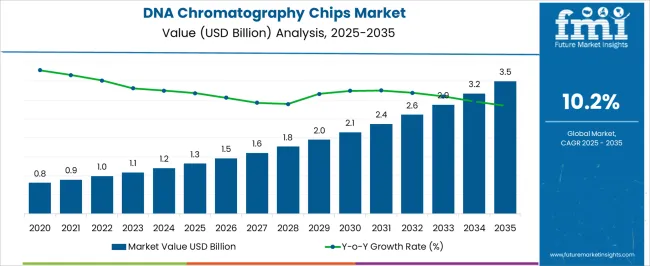

The DNA Chromatography Chips Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.2% over the forecast period.

| Metric | Value |

|---|---|

| DNA Chromatography Chips Market Estimated Value in (2025 E) | USD 1.3 billion |

| DNA Chromatography Chips Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 10.2% |

The DNA Chromatography Chips market is witnessing robust growth due to the increasing demand for high-throughput genomic analysis, accelerated drug discovery, and personalized medicine. The market is being driven by the ability of DNA chromatography chips to perform precise DNA separation, purification, and detection in a compact and automated manner. Innovations in microfluidic design and integration with software-enabled analytics are enabling faster and more accurate experimentation, reducing both time and cost in research workflows.

Expanding applications in genomics, diagnostics, and therapeutic development are further supporting market growth. Rising investments by biopharmaceutical companies in R&D, coupled with the growing emphasis on precision medicine and genomic profiling, are increasing adoption across research and commercial laboratories.

The market outlook is shaped by continuous improvements in chip sensitivity, scalability, and compatibility with downstream sequencing and analytical platforms As global healthcare research continues to prioritize speed, accuracy, and reproducibility, DNA chromatography chips are expected to maintain strong adoption, with opportunities emerging in both academic and industrial research environments.

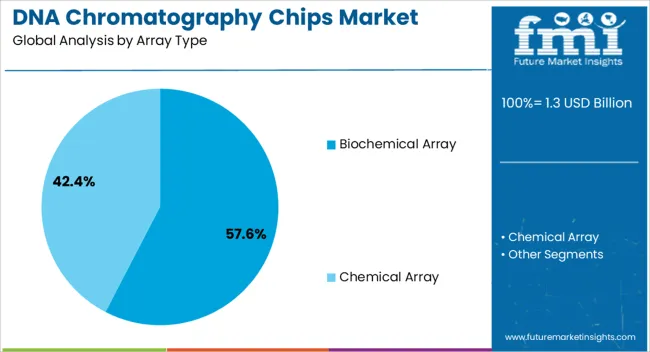

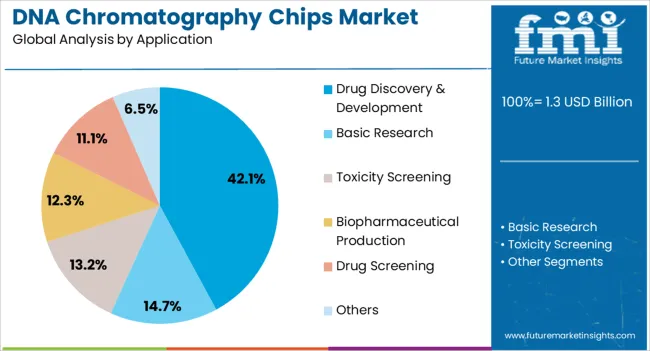

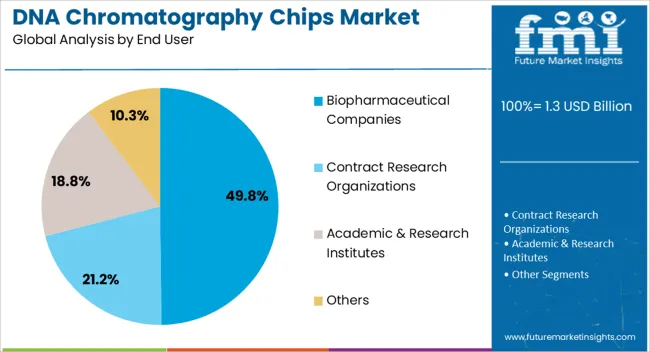

The dna chromatography chips market is segmented by array type, application, end user, and geographic regions. By array type, dna chromatography chips market is divided into Biochemical Array and Chemical Array. In terms of application, dna chromatography chips market is classified into Drug Discovery & Development, Basic Research, Toxicity Screening, Biopharmaceutical Production, Drug Screening, and Others. Based on end user, dna chromatography chips market is segmented into Biopharmaceutical Companies, Contract Research Organizations, Academic & Research Institutes, and Others. Regionally, the dna chromatography chips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Biochemical Array segment is projected to hold 57.60% of the DNA Chromatography Chips market revenue in 2025, making it the leading array type. This dominance is being driven by the versatility and high-throughput capability of biochemical arrays, which enable simultaneous analysis of multiple DNA samples and biomolecules. The growth of this segment has been reinforced by increasing demand from research institutions and biopharmaceutical companies for platforms that can accelerate drug discovery and genomic profiling.

Biochemical arrays allow precise separation and quantification of nucleic acids, which is critical for downstream applications such as PCR, sequencing, and molecular diagnostics. The modularity and compatibility with automated laboratory systems reduce operational complexity and improve experimental reproducibility.

As biotechnology and pharmaceutical R&D investments continue to rise, the adoption of biochemical arrays is expected to expand further, providing scalable and cost-effective solutions for complex genomic workflows The segment’s leading share reflects the preference for array types that offer reliability, sensitivity, and integration potential for high-throughput applications.

The Drug Discovery and Development application segment is anticipated to account for 42.10% of the total DNA Chromatography Chips market revenue in 2025, establishing it as the leading application. The segment’s growth has been driven by increasing demand for rapid and precise genomic analysis to identify therapeutic targets, validate biomarkers, and accelerate preclinical research. DNA chromatography chips enable high-throughput screening of nucleic acids and interactions with drug candidates, improving both the speed and accuracy of drug development pipelines.

The ability to reduce experimental errors and streamline workflows has strengthened adoption in pharmaceutical R&D and translational research environments. Regulatory and compliance pressures for reproducible results have further reinforced preference for chip-based technologies in drug discovery.

As the pharmaceutical industry continues to focus on targeted therapies, precision medicine, and biologics development, the demand for DNA chromatography chips in drug discovery applications is expected to rise steadily The segment’s leading share reflects its critical role in enhancing the efficiency and reliability of modern drug development processes.

The Biopharmaceutical Companies end-user segment is expected to hold 49.80% of the DNA Chromatography Chips market revenue in 2025, making it the largest end-user segment. The segment’s dominance is being driven by growing investment in genomics and biotherapeutics research, including the development of gene therapies, RNA-based drugs, and personalized medicine applications.

DNA chromatography chips provide biopharmaceutical companies with precise, high-throughput tools for nucleic acid purification, separation, and analysis, enabling faster decision-making and cost-effective experimentation. The increasing focus on innovation and pipeline acceleration has encouraged adoption of chip-based platforms for R&D, quality control, and validation processes.

Scalability, integration with automated laboratory systems, and reproducibility of results have further supported widespread deployment within commercial laboratories As competition in the biopharmaceutical sector intensifies and companies seek to shorten drug development cycles while maintaining regulatory compliance, the demand for DNA chromatography chips among biopharmaceutical organizations is expected to grow, reinforcing this segment’s leadership in the market.

DNA chromatography chips are used to monitor transcriptional regulation through transcription factor or histone modification i.e. epigenetics. DNA chromatography chips analyzed the DNA–protein interactions in living cells by treating the cells with formaldehyde. DNA chromatography chips require the understanding of DNA sequence and a target protein.

The PCR primer of DNA chromatography chips responsible for the specific amplification and also the detection of the targeted DNA sequence. In target DNA sequence direct sequencing of the DNA captured by the immunoprecipitated protein. The ability to profile a promoter for different proteins is the key strength of DNA chromatography chips. On other hands, difficulty to adapt for high-throughput screening is the limitation of DNA chromatography chips. The DNA chromatography chips provide researcher an analysis of antibody against the protein of interest.

The primary factor driving the growth of DNA Chromatography Chips market is rising incidences of cancer and the rising number of research and development by the leading contract research manufacturer. Increasing demand for personalized medicine for the treatment of chronic disease is also expected to fuel the demand of DNA chromatography chips market over the forecast period.

The upsurge in the funding by government for the research and development to develop the more efficient drugs for the treatment of chronic disease is expected to propel the growth of DNA chromatography chips market over the next decade. On other hands, few limitations associated with the DNA chromatography chips may responsible for the sluggish growth of DNA chromatography chips market. Also, lack of adoption of life science research in under developing economies is may hamper the growth of the DNA chromatography chips market.

The global DNA chromatography chips market is expected to show significant growth over the forecast period due to the rise in funding for the development of novel drugs. The array type biochemical array is being more preferred by the researcher hence, biochemical array segment by array type for global DNA chromatography chips market is expected to dominate the market in term of value.

By application drug discovery and development and biopharmaceutical segment collectively gain maximum market share for DNA chromatography chips market in term of value. Among all end user, biopharmaceutical companies are expected to be the most lucrative segment for DNA chromatography chips market while contract research organization is projected to grow at the faster rate for DNA chromatography chips market over the forecast period.

On the basis of geography, DNA Chromatography Chips market is classified into eight key regions viz. North America, Latin America, Europe, APECJ, China, Japan, Middle East and Africa. North America is expected to dominate the global DNA Chromatography Chips market due to the rise in research and development for the development of novel drugs. After North America DNA Chromatography Chips market is then followed by Europe due to rising incidences of chronic disease in this region.

APEC and China is the fastest growing region for global DNA Chromatography Chips market owing to rising number of contract research organization in this region. Latin America and Middle East and Africa is the least lucrative region for DNA Chromatography Chips market due to lack of funding by the government for the development of novel drugs in this region.

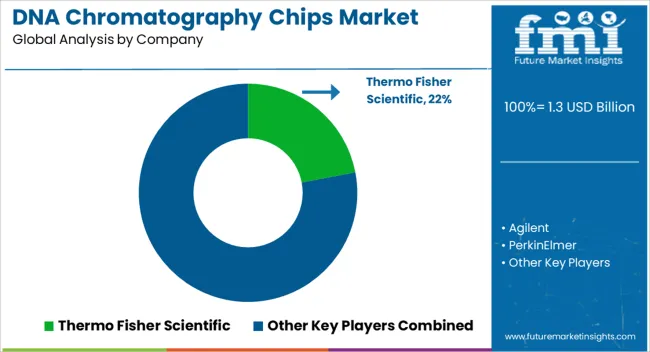

Some of the key players found across the value chain of DNA Chromatography Chips market are Agilent Technologies, Inc., PerkinElmer Inc., Thermo Fisher Scientific, Promega Corporation, Takara Bio Inc., Merck KGaA, and others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

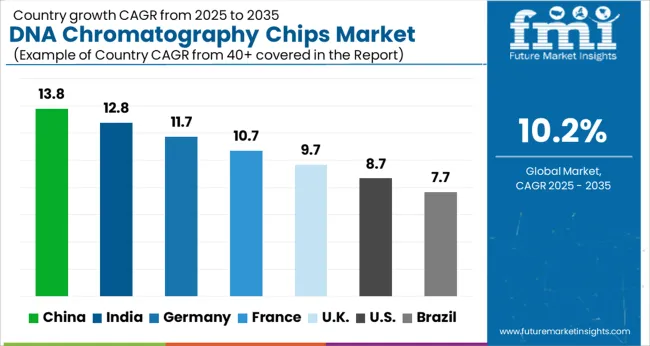

| Country | CAGR |

|---|---|

| China | 13.8% |

| India | 12.8% |

| Germany | 11.7% |

| France | 10.7% |

| UK | 9.7% |

| USA | 8.7% |

| Brazil | 7.7% |

The DNA Chromatography Chips Market is expected to register a CAGR of 10.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 13.8%, followed by India at 12.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 7.7%, yet still underscores a broadly positive trajectory for the global DNA Chromatography Chips Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 11.7%. The USA DNA Chromatography Chips Market is estimated to be valued at USD 462.4 million in 2025 and is anticipated to reach a valuation of USD 1.1 billion by 2035. Sales are projected to rise at a CAGR of 8.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 63.8 million and USD 42.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Array Type | Biochemical Array and Chemical Array |

| Application | Drug Discovery & Development, Basic Research, Toxicity Screening, Biopharmaceutical Production, Drug Screening, and Others |

| End User | Biopharmaceutical Companies, Contract Research Organizations, Academic & Research Institutes, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Agilent, PerkinElmer, Promega, Takara, and Merck |

The global dna chromatography chips market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the dna chromatography chips market is projected to reach USD 3.5 billion by 2035.

The dna chromatography chips market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in dna chromatography chips market are biochemical array and chemical array.

In terms of application, drug discovery & development segment to command 42.1% share in the dna chromatography chips market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

DNA Microarray Market Forecast Outlook 2025 to 2035

Chromatography Resin Market Forecast and Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

DNA Methylation Conversion Kit Market Size and Share Forecast Outlook 2025 to 2035

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DNA Methylation Market Size and Share Forecast Outlook 2025 to 2035

DNA Polymerase Market Analysis - Size, Share, and Forecast 2025 to 2035

DNA Sequencing Services Market Trends - Growth & Forecast 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

DNA-Based Skin Care Market – Trends & Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

Chromatography Software Market Insights – Trends & Forecast 2025 to 2035

Chromatography Accessories & Consumables Market Growth – Trends & Forecast 2025 to 2035

Chromatography Reagent Market Growth – Trends & Forecast 2024-2034

DNA Sequencing Electrophoresis Systems Market

DNA modifying agents Market

Chromatography Silica Resins Market

cDNA Synthesis Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA