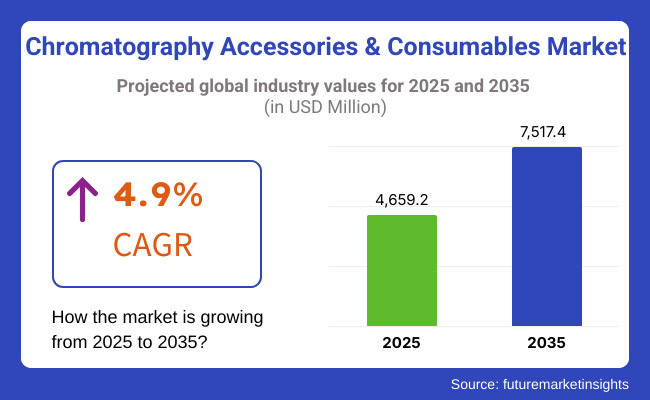

As more analytical technologies are being used, the expansion of R&D in the pharmaceutical industry, along with biotechnology and food, safety chromatography accessories, and consumables market, is expected to expand between 2025 and 2035. The net worth of the market amounts to USD 4,659.2 Million in 2025 and will grow at a CAGR of 4.9% during the forecast period, reaching an overall market value of USD 7,517.4 Million by the end of 2035.

Chromatography is a crucial technique for chemical analysis, drug discovery and quality control, among other uses in different industries. The increasing relevance of personalized medicine and biopharmaceutical developments, coupled with tight regulatory requirements over drug safety and food analysis, is expected to propel the demand for chromatographic accessories like columns, vials, syringes, and filters. In addition, chromatography technology applied to consumables like HPLC (high-performance liquid chromatography) and GC (gas chromatography) is streamlining the consumables.

Nevertheless, the exorbitant cost of advanced chromatography equipment, supply chain limitations, and the necessity for skilled manpower could dampen the market forces. The key players in the market are focusing on automated systems, economical consumables, and training sessions for laboratory technicians to counteract the challenges.

North America is currently the largest market for chromatography accessories and consumables due to the greater number of companies adopting the technology, especially in the United States. Demand is being driven by the presence of major pharmaceutical and biotechnology companies, as well as significant research activities related to drug discovery and development. Driving market growth is the USA FDA's stringent regulatory requirements for pharmaceutical quality control and food safety applications.

Moreover, rising investments in academia and research institutes as well as the development of advanced bioanalytical methods are creating growth avenues for the new chromatography consumable products. This, along with increasing adoption of AI-based analytical tools in forensic and clinical applications, will continue to create lucrative opportunities in the market.

Germany, the UK, and France are driving the chromatography accessories and consumables market in Europe. For example, the region's robust pharmaceutical and life sciences sectors, along with stringent EU food safety and environmental monitoring regulations, are increasing demand for high quality chromatography consumables. Further advancements in chromatography technologies and principles exploring green and sustainable lab practices are primarily the focus of research institutions across Europe.

Moreover, growing collaborations between market players and academic institutes are contributing to the development of innovative chromatography systems focused on high-throughput screening and proteomics research. The well-established healthcare infrastructure along with increasing investments in personalized medicines is also anticipated to drive the market growth.

The Asia-Pacific region is projected to offer the highest growth rate for the chromatography accessories and consumables market, fuelled by the increasing production of pharmaceuticals, growth of biotechnology research and boosted government investment in healthcare and environmental safety.

The chromatography technique is in high demand in countries including China, Japan, and India in drug quality control drug testing, food testing, and forensic analysis. Growth in the market is further supported by the rapid expansion of contract research organizations and biopharmaceutical firms in the region. Furthermore, the government's initiatives to promote research and innovation in life sciences and chemical industries are expected to fuel the demand for advanced chromatography technologies.

The growing trend of academic research, in addition to laboratory automation in South Korea and Australia, further drives market growth along with the rising adoption of chromatography in the fragmentation of cannabis testing and new biopharma applications.

Challenge

High Costs and Technical Complexity

High operational costs are one of the major challenges faced by the chromatography accessories and consumables market, as these instruments and consumables require high maintenance expenses. For instance, laboratories and research institutions, more so in developing parts of the world, may not have adequate budgets to purchase high-performance chromatography columns, detectors, and sample preparation kits. Moreover, the complexity of chromatography techniques requires skilled professionals, making it difficult for organizations without trained personnel. Industry solutions will need to focus on cost-efficient manufacture, training schemes, and simple-to-use chromatography hardware and chromatography software aiding both local and remote users.

Opportunity

Growth of Green and Automated Chromatography Solutions

Increasing demand for green and automated chromatography solutions creates growth opportunities. Pharmaceutical and food safety industries are slowly adopting sustainable lab practices, such as reducing solvents and using reusable chromatography material. Automation of laboratory processes is another significant trend, including the development of AI-driven chromatography data analysis with at-line and in-line sample preparation techniques, ensuring enhanced cost efficiency, turnaround time, and accuracy in various chemical and biological tests. The development of next-generation chromatography accessories and consumables is widely anticipated as cost-effectiveness, precision, and sustainability become key focus areas for laboratories.

Over the forecast period of 2020 to 2024, the global Chromatography Accessories and Consumables Market continued to grow due to increased demand for analytical testing in industries such as pharmaceuticals, food safety, environmental monitoring, and biotechnology research. These types of consumable demands were filling HPLC demand for the high expansion of biopharma drugs and even as far as including territories like cannabis tests and proteomics research with gas chromatography (GC) and thin-layer chromatography (TLC) consumables also added in. Improved ultra-high-performance liquid chromatography (UHPLC) columns, automated sample preparation tools, and green solvents increased the accuracy and efficiency of analytical techniques. However, the high cost of advanced chromatography instruments, supply chain disruptions, and regulatory challenges are hindering market growth.

As we transition from 2025 to 2035, the market will be transformed by AI-driven chromatography, laboratory automation, and next-generation sustainable consumables. Advancements in these areas will include AI-based fast predictive analytics methods for chromatographs and predicted chromatographic methods, 3D printed chromatography accessories, chromatics packing materials, and biodegradable packing materials at the column. Futuristic advances in miniaturized, portable chromatography systems, blockchain-centric lab data security, and automated microfluidic-based separation techniques will augur efficiency, accuracy, and sustainability for the realm. Moreover, separation science and analytical workflows will be redefined by the application of nanotechnology, bioengineered affinity resins, and self-cleaning chromatography columns.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EMA, and ISO standards for analytical testing in pharmaceuticals, food safety, and environmental monitoring. |

| Technology Adoption | Widespread use of HPLC, GC, TLC, and capillary electrophoresis for analytical testing. |

| Industry Adoption | Growth in biopharmaceuticals, food testing, forensic analysis, and clinical research applications. |

| Sustainability & Eco-Friendly Consumables | The initial shift toward low-solvent, recyclable chromatography columns and greener mobile phase alternatives. |

| Market Competition | Dominated by analytical instrument manufacturers, consumables suppliers, and specialty chromatography service providers. |

| Market Growth Drivers | Demand is fuelled by pharmaceutical quality control, expanding cannabis testing, and growing proteomics and metabolomics research. |

| Sustainability and Environmental Impact | Early adoption of solvent reduction strategies, energy-efficient chromatography instruments, and recyclable consumables. |

| Integration of AI & Automation | Limited AI use in chromatographic data interpretation and instrument maintenance. |

| Advancements in Materials & Consumables | Use of silica-based, polymeric, and reverse-phase chromatography media. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter green chemistry regulations, AI-driven quality assurance frameworks, and blockchain-based data traceability. |

| Technology Adoption | Transition to AI-assisted chromatography systems, automated microfluidic-based separations, and nanotechnology-enhanced stationary phases. |

| Industry Adoption | Expansion into real-time portable chromatography for point-of-care diagnostics, personalized medicine, and environmental toxin detection. |

| Sustainability & Eco-Friendly Consumables | Large-scale adoption of biodegradable column packing materials, zero-waste separation techniques, and AI-optimized solvent reuse systems. |

| Market Competition | Increased competition from AI-powered chromatography firms, 3D-printed consumables start-ups, and nanotechnology-based separation companies. |

| Market Growth Drivers | Growth was driven by AI-powered predictive analytics, portable chromatography innovations, and blockchain-backed data security solutions. |

| Sustainability and Environmental Impact | Large-scale implementation of carbon-neutral chromatography labs, biodegradable separation phases, and AI-assisted waste management for lab operations. |

| Integration of AI & Automation | AI-driven real-time chromatographic optimization, predictive troubleshooting, and autonomous lab workflow management. |

| Advancements in Materials & Consumables | Evolution of smart surface-modified stationary phases, bioengineered affinity resins, and self-cleaning chromatography columns. |

The USA remains the leading market for chromatography accessories and consumables, bestselling Chromatography accessories and consumables in the USA owing to increasing research activities in pharmaceuticals, biotechnology, and environmental testing. Factors such as the high presence of major chromatography instrument manufacturers and the growing investments in drug discovery and forensic analysis are expected to drive the growth of the market.

The increasing development of FDA and EPA regulatory standards is also propelling the demand for quality chromatography consumables to maintain the accuracy of analytical procedures and to remain compliant. Market growth is also being supported by the growing adoption of chromatography in food safety testing and clinical diagnostics. Trends in the industry are due to automation and digital integrated chromatography workflows.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

With pharmaceutical research, academic institutions, and clinical diagnostics driving demand, the UK chromatography accessories and consumables market will expand steadily. A focus on precision medicine and biologics manufacturing in the country is driving the demand for advanced chromatography techniques.

Moreover, government support for analytical laboratories and life sciences research bolsters market growth. Increasing applications of chromatography consumables also include food safety testing and environmental monitoring, which will boost demand for high-performance chromatography consumables. The co-operation between universities and private companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Countries such as Germany, France, and Italy dominate in the European Union due to the presence of strong pharmaceutical and biotechnology sectors, emphasis on compliance with regulatory frameworks, and increased investment in research, accounting for a key share of the region for the chromatography accessories and consumables market.

This trend is driving demand for chromatography solutions, given the EU's rigorous quality standards for pharmaceutical manufacturing and food safety. Moreover, the growing use of chromatography in proteomics and metabolomics research is also expected to create growth avenues for application in the market.

The rising adoption of high-performance liquid chromatography (HPLC) and gas chromatography (GC) across clinical diagnostics and forensic science sectors is another promoter of market growth. Increasing investments into laboratory automation and intelligent analytical technologies are also serving to bring increased processing throughput to chromatography workflows.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

Due to its robust landscape of analytical instrumentation for precision analytics, rising investments in pharma R&D, and advancements in chemical analysis, Japan's chromatography accessories and consumables market is witnessing significant expansion. Increasing demand for chromatography from environment monitoring, food safety & forensic science is driving the market growth. Japanese advancement in robotics and automation technology is also causing an impact in propelling next-generation chromatography systems with improved efficiency and accuracy.

Growing usage of chromatography methods in biotechnology and proteomics sectors is further fuelling the market growth. The country’s focus on quality control in industrial applications is driving demand for high-performance chromatography consumables as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea

Chromatography accessories and consumables are witnessing the fastest growth in South Korea, attributed to the rising investments in life sciences, increasing demand for quality testing of pharmaceutical products, and growing applications used in clinical diagnostics. Indonesia's growing biopharmaceutical industry and government efforts to boost research and development infrastructure are also driving growth in the market. The development of chromatography-based analytical methods is driven by growing demand for these methods in environmental and food safety testing.

Due to digital laboratory integration and automation, chromatography workflows are becoming more efficient. The expansion of the market is likely to be further anchored by collaborations with global pharmaceutical companies and local academic institutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

As high-performance chromatographic workflows are these institutions' main focus, the Columns, and Autosamplers segments dominate the Chromatography Accessories and Consumables Market. As they are integral to improving separation accuracy, enhancing sample injection precision, and providing the reliability needed for analytical workflows, the corresponding consumables and accessories are key components. With the increasing usage of chromatography in the pharmaceutical, food safety, and environmental testing sectors, demands for advanced columns and autosamplers are growing.

Chromatography columns have been widely used with superior resolutions, improved sample retention performance, and peak symmetry for chromatographic analysis. Column-based chromatography ensures reproducible responses that differ from conventional techniques, making it essential for qualitative and quantitative applications.

Rising requirements for HPLC and GC analytical separation columns, majorly in pharmaceutical quality control, biotechnology research, and forensic analysis, have driven the market demand. Studies show that more than 70% of analytical laboratories use chromatography columns to increase separation, minimize sample loss, and comply with regulations.

Market demand has significantly strengthened due to the growing availability of next-generation pre-packed chromatography columns, which include optimized stationary phase compositions, an increased surface area and improved pressure tolerance that provide better analytical reproducibility and enhanced peak resolution.

AI-Driven Column Performance Tracking, providing predictive column longevity analytics, static calibration alerts, real-time pressure optimization, etc. has also contributed to its adoption, driving operational efficiency and cost savings in lab workflows.

The focus on innovative assessments, characterization of the different synthetic routes, rise of hybrid chromatography columns, dual-mode separation and temperature and chemically inert coatings of different substrates have revitalized the market growth for this innovative technology with a push from pharmaceutical, food safety sectors, and clinical diagnostics.

The implementation of sustainable column production, such as environmentally friendly stationary phases, recyclable column casings, and solvent-free column regeneration processes, has boosted the growth of the market to comply with green analytical chemistry guidelines.

However, while the chromatography column segment has benefited from some of the advances above, such as having a high resolution, better separation of samples, and flexible analytical timing, it has the drawbacks of being expensive to replace, vulnerable to contamination, and limited by a relatively short column lifespan. Nonetheless, advances such as AI-driven column lifetime predictions, automatic column cleaning units, and advanced polymer-based stationary phases are increasing longevity, lowering costs, and ensuring widespread use in labs, cementing massive international sales growth of chromatography columns.

Upcoming Sales in Chromatography Accessories and Consumables Market Autosamplers are in high demand in the Chrome Accessories and Consumables Market. These instruments promote automation and allow efficient and error-free analyses. Autosamplers provide accurate and reproducible loading of samples, unlike most manual sample introduction methods, and as a result, are essential for high-throughput chromatography applications.

The increasing need for workflow automation in chromatography, mainly pharmaceutical drug development, clinical research, and environmental monitoring, has led to the adoption. Over 65% of chromatography labs are using autosamplers to reduce human error, increase sample throughput, and standardize injection volumes, according to studies.

The development of advanced autosampler syringe technologies equipped with high-precision sample handling capabilities, reduced carryover, and temperature-controlled injection mechanisms to ensure reliability in analytical procedures has further bolstered market growth.

The adoption has been further accelerated by the advances of AI-based auto sampler functionalities enabling real time sample tracking and cloud data synchronization, automated dilution and mixing functionalities ensuring improved throughout and reduced probability of human error in chromatographic workflows.

These advancements, including the attachment of both liquid and gas chromatography systems to an auto-sampler, adjustable volume injection and use of solvent-resistant components, have facilitated market growth, allowing for wider application in various industries.

Moreover, the emergence of energy-efficient auto sampler designs, capable of low-power modes and utilising sustainable materials for its components, while also incorporating mechanisms that reduce the overall waste, further fosters market expansion, establishing better alignment with global green laboratory initiatives.

While the automation, sample handling accuracy, and high-throughput benefits provided by these devices are significant drivers of their growth in the auto sampler segment, the market is stymied by high initial investment costs, high maintenance requirements, and incompatibility with older chromatography systems. Conversely, recent advances in AI-enabled autosampler self-diagnosis, intelligent position detection algorithms, and remote-controlled operation of autosamplers will increase usability, reduce cost, and drive wider adoption across laboratories to continue the upward expansion for autosamplers across the globe after this date.

Liquid and Gas Chromatography Technologies Drive Market Growth as Analytical Laboratories Optimize Separation Performance

Analytical laboratories for Chromatography Accessories and Consumables Market in addition to research institutions continue performing every day Chromatography Accessories and Consumables across various application industries, and Chromatography Accessories and Consumables Market Segment by channel, ultimately growing the Chromatography Accessories and Consumables These technologies are important for analyze composition determination, detection sensitivity enhancement and compliance with regulations in pharmaceutical, food, and environmental analyses.

Owing to high sensitivity, versatility, and ability to separate complex sample matrices, liquid chromatography has achieved significant market adoption. Liquid chromatography allows for a wider variety of samples to be used, as it can be used for non-volatile samples while requiring gas chromatography to use volatile samples, which makes liquid chromatography useful for biomolecules, proteins, and small molecules among others.

There has been an adoption due to its increasing demand in pharmaceutical drug development, metabolomics research, food safety testing, and others for high-performance liquid chromatography (HPLC) and ultra-high-performance liquid chromatography (UHPLC). It has been reported that more than 75% of pharmaceutical quality control laboratories employ liquid chromatography methods for batch consistency and regulatory compliance.

The increasing demand for microfluidic liquid chromatography systems, with Nano-scale separations, less use of solvent, and small volume of sample, to ensure better efficiency and save cost of an analytical method is expected to formalize the market growth.

The liquid chromatography segment's advantages in sensitivity, versatility, and analytical precision are countered by challenges including high equipment costs, complex maintenance requirements, and solvent disposal concerns. Yet innovative advancements such as AI-assisted chromatographic optimization, green-solvent-based mobile phases, and self-cleaning liquid chromatography systems are enhancing liquid chromatography’s efficiency, eco-friendliness, and market penetration, helping to guarantee that liquid chromatography continues to grow worldwide.

Gas chromatography remains a fast-growing market, with forensic, petrochemical and environmental laboratories viewing high-resolution separation of volatile compounds as a must. Gas chromatography works at much higher temperatures than liquid chromatography and hence provides a faster analysis while facilitating the detection of trace-level components.

Adoption has corroborated due to the increasing use of gas chromatography in forensic toxicology, air quality monitoring, and hydrocarbon analysis. According to research, more than 65% of the regulatory testing authorities use gas chromatographic methods, when determining contaminants, optimizing fuel compositions, and monitoring compliance with industrial emissions standards.

However, the gas chromatography segment is experiencing a high demand because of the introduction of molecules to be used as active pharmaceutical ingredients but is also a major barrier due to the high instrument calibration requirements associated with it, limited applicability for non-volatile samples, and stringent regulatory compliance for carrier gas usage along with high capital costs. Nevertheless, New technologies in gas chromatography such as AI-enabled gas chromatography evaluation, automated columns, sustainable gas, and helium-free carriers, are increasing operational efficiency, economic viability, and environmental sustainability to promote gas chromatography integration in many regions, ensuring further gas chromatography growth across the globe.

The rising demand for analytical testing, particularly in pharmaceutical, biotechnology, and environmental sciences, fuels the growth of the Chromatography Accessories and Consumables Market. These include improvements in chromatography techniques and the increasing use of automation in laboratories, propelling further growth of the market. Key trends influencing the industry are miniaturization of chromatography systems, environmentally friendly consumables, and integration with digital analytical tools.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Agilent Technologies | 12-16% |

| Thermo Fisher Scientific | 10-14% |

| Waters Corporation | 8-12% |

| PerkinElmer Inc. | 6-10% |

| Shimadzu Corporation | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Agilent Technologies | Develops high-performance chromatography columns, sample preparation products, and detection accessories. |

| Thermo Fisher Scientific | Specializes in chromatography consumables, including vials, syringes, and filtration devices. |

| Waters Corporation | Offers innovative liquid chromatography accessories and consumables for pharmaceutical research. |

| PerkinElmer Inc. | Focuses on gas and liquid chromatography consumables with enhanced sensitivity and automation compatibility. |

| Shimadzu Corporation | Provides advanced chromatography systems with integrated data analysis and high-precision consumables. |

Key Company Insights

Agilent Technologies (12-16%)

Agilent leads in chromatography accessories and consumables, offering a broad range of high-performance columns and sample preparation tools.

Thermo Fisher Scientific (10-14%)

Thermo Fisher excels in chromatography consumables, focusing on filtration, sample handling, and instrument maintenance solutions.

Waters Corporation (8-12%)

Waters specializes in liquid chromatography accessories, catering to pharmaceutical and biotechnological applications.

PerkinElmer Inc. (6-10%)

PerkinElmer strengthens its market presence with innovative chromatography consumables designed for high-precision analytics.

Shimadzu Corporation (4-8%)

Shimadzu integrates advanced data analytics with its chromatography systems, enhancing accuracy and efficiency in laboratory workflows.

Other Key Players (45-55% Combined)

Several analytical instrumentation and consumables suppliers contribute to the expanding chromatography accessories and consumables market. These include:

The overall market size for the Chromatography Accessories and Consumables market was USD 4,659.2 Million in 2025.

The Chromatography Accessories and Consumables market is expected to reach USD 7,517.4 Million in 2035.

The demand for chromatography accessories and consumables will be driven by increasing applications in pharmaceuticals, rising demand for food safety testing, advancements in analytical techniques, and growing investments in biotechnology and life sciences research.

The top 5 countries driving the development of the Chromatography Accessories and Consumables market are the USA, Germany, China, Japan, and the UK.

The Columns & Cartridges segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromatography Resin Market Forecast and Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Software Market Insights – Trends & Forecast 2025 to 2035

Chromatography Reagent Market Growth – Trends & Forecast 2024-2034

Chromatography Silica Resins Market

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Columns Market

Gas Chromatography Detector Market

Immunochromatography Kits Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Multimodal Chromatography Columns Market

Preparative Chromatography Market Size and Share Forecast Outlook 2025 to 2035

Supercritical Fluid Chromatography Market

Hydrophobic Interaction Chromatography Resins Market

Preparative and Process Chromatography Market Forecast and Outlook 2025 to 2035

Binary High Pressure Gradient Liquid Chromatography System Market Size and Share Forecast Outlook 2025 to 2035

Car Accessories Market Size and Share Forecast Outlook 2025 to 2035

Bar Accessories Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA