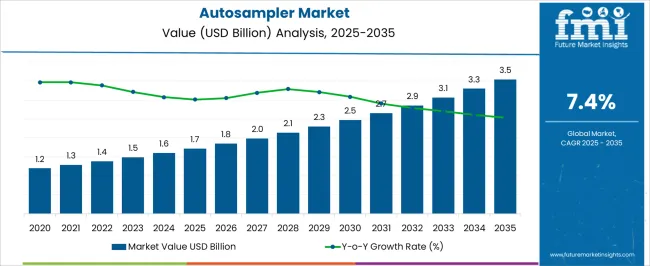

The Autosampler Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Autosampler Market Estimated Value in (2025 E) | USD 1.7 billion |

| Autosampler Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The autosampler market is advancing steadily, fueled by growing demand for automation in analytical laboratories and the rising need for precision and reproducibility in testing. Autosamplers enhance throughput by streamlining sample handling, minimizing human error, and enabling continuous operation, which is particularly valuable in high-volume testing environments.

The market is supported by the increasing complexity of pharmaceutical research, food safety testing, and environmental monitoring, where regulatory compliance and accuracy are critical. Technological advancements such as robotics integration, software-driven scheduling, and multi-sample capacity have improved efficiency and adaptability.

The current outlook reflects heightened adoption by laboratories seeking productivity improvements and operational cost reductions. With expanding applications across life sciences, chemicals, and industrial sectors, the autosampler market is expected to grow further, supported by the dual drivers of automation and quality assurance in global testing workflows.

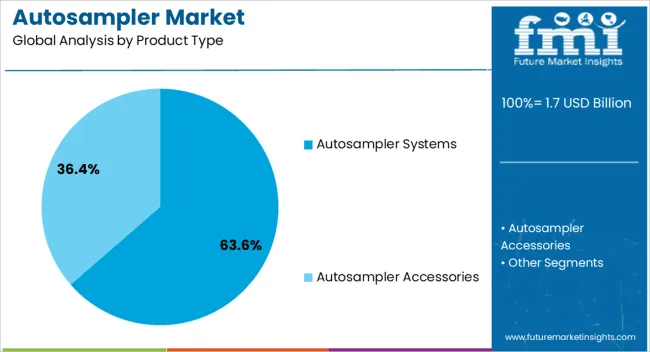

The autosampler systems segment leads the product type category, capturing approximately 63.6% share of the overall market. Its dominance stems from the segment’s ability to provide comprehensive automation solutions across chromatography, spectroscopy, and mass spectrometry workflows.

These systems reduce manual labor, improve consistency in sample injection, and enable laboratories to scale testing operations efficiently. Growth in this segment is also driven by technological innovation, including multi-position sample trays, temperature-controlled compartments, and user-friendly software interfaces.

Adoption is particularly strong in industries where sample volume and throughput requirements are high. With rising investment in laboratory modernization and quality assurance practices, the autosampler systems segment is expected to maintain its commanding position during the forecast period.

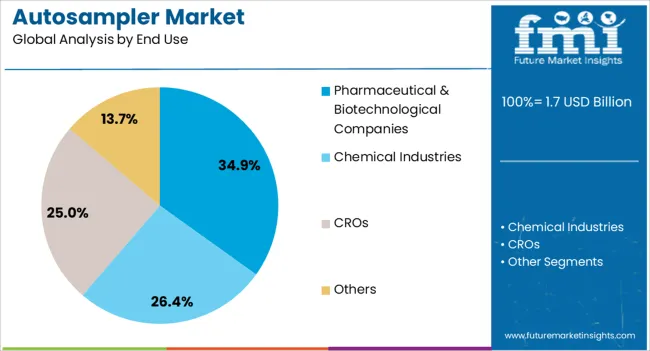

The pharmaceutical and biotechnological companies segment accounts for approximately 34.9% share of the autosampler market’s end-use category. This segment’s strength lies in the industry’s reliance on high-throughput, accurate, and compliant analytical workflows for drug discovery, development, and quality control.

Autosamplers have become integral in handling complex sample matrices in clinical research and production environments. The rising number of drug candidates in pipelines, along with regulatory requirements for rigorous testing, has reinforced the importance of automated systems.

With growing emphasis on reducing turnaround time and increasing reproducibility, pharmaceutical and biotechnological companies are expected to sustain their leading role in autosampler adoption.

Autosamplers Pioneer a Flawless Workflow Experience! Autosamplers are useful for tasks beyond just transferring samples for examination.

Autosamplers are Transforming Environmental Monitoring! The environmental testing industry benefits significantly from autosampler applications.

Autosampler Market Surges with Enhanced Technological Attributes! Advancements in autosampler technology continue to drive market growth as manufacturers consistently develop sophisticated autosamplers with enhanced attributes.

Autosamplers Shine in the Pharmaceutical Revolution! The pharmaceutical sector is conducting extensive research to create new drugs, and the government supports early-stage research, which promotes market expansion.

Insufficient skills and limited knowledge in utilizing the system could impede the market's expansion. Users who lack expertise and techniques might face challenges, hindering the overall growth of the autosampler industry. Moreover, given the high cost of autosamplers, small and medium-sized laboratories may decide to use other sample preparation methods, which could hinder market growth.

From 2020 to 2025, the autosampler systems market showed promising growth, boasting a 9.2% CAGR. During this period, the pandemic has had an advantageous effect on the market. There has been a favorable impact and rise in demand for numerous services, including chromatographic technology, due to the COVID-19 pandemic.

Researchers have been employing chromatography, a potent laboratory-based analytical technique, to comprehend the Sars-CoV-2 virus better and create treatments, vaccines, and diagnostic tools that can help combat the COVID-19 pandemic.

| Historical CAGR (2020 to 2025) | 9.2% |

|---|---|

| Forecasted CAGR (2025 to 2035) | 7.5% |

The market for autosamplers is expected to exhibit a lower CAGR compared to the historical period. While the market has shown resilience in the past, the anticipated CAGR reflects current dynamics. Autosamplers cater to various applications.

These include autosamplers for reactors, autosamplers in cement plants, and autosamplers for wastewater analysis. This highlights their adaptability and widespread utility. This is also expected to have a highly positive impact on the global demand for autosamplers.

The North America autosampler market stands out as a dominant force. The significant spending on research and development and technical developments in analytical methods are associated with this supremacy. Europe is witnessing continuous and steady growth in demand for autosamplers.

The market is growing because chromatographic methods are becoming more widely accepted. There is likely to be momentous progression in the Asia Pacific autosampler industry. The growing number of pharmaceutical and biotechnology industries in the region drives the market expansion.

| Country | United States |

|---|---|

| Forecasted CAGR (2025 to 2035) | 7.7% |

| Market Size by 2035 | USD 602.4 million |

| Country | United Kingdom |

|---|---|

| Forecasted CAGR (2025 to 2035) | 8.5% |

| Market Size by 2035 | USD 135.3 million |

| Country | China |

|---|---|

| Forecasted CAGR (2025 to 2035) | 7.9% |

| Market Size by 2035 | USD 521.6 million |

| Country | Japan |

|---|---|

| Forecasted CAGR (2025 to 2035) | 8.9% |

| Market Size by 2035 | USD 368.6 million |

| Country | South Korea |

|---|---|

| Forecasted CAGR (2025 to 2035) | 9.3% |

| Market Size by 2035 | USD 213.9 million |

Demand for autosamplers in the United States is set to rise with an anticipated CAGR of 7.7% through 2035. Key factors influencing the demand include:

The United Kingdom's autosampler market is expected to surge at a CAGR of 8.5% through 2035. Top factors supporting the autosampler vials market expansion in the country include:

The China autosampler market is forecasted to inflate at a CAGR of 7.9% through 2035. The main factors supporting the autosampler systems market growth are:

Sales of autosamplers in Japan are estimated to record a CAGR of 8.9% through 2035. The primary factors bolstering the autosamplers market size are:

The market in South Korea is likely to exhibit a CAGR of 9.3% through 2035. Reasons supporting the growth of the autosampler accessories market in the country include:

As far as the product type is concerned, the autosampler systems segment is likely to dominate the revenue share of autosamplers through 2035, registering a CAGR of 7.3%. Similarly, the pharmaceutical and biotechnological companies segment is expected to dominate in terms of end use, with a projected CAGR of 7.1% through 2035.

| Segment | Forecasted CAGR (2025 to 2035) |

|---|---|

| Autosampler Systems | 7.3% |

| Pharmaceutical & biotechnological companies | 7.1% |

The autosampler systems segment is anticipated to lead the way, holding an impressive autosampler market share. Factors supporting its sales are as follows:

Pharmaceutical and biotechnological companies take the top spot in the market when it comes to the consumption of autosamplers, a trend substantiated by factors such as:

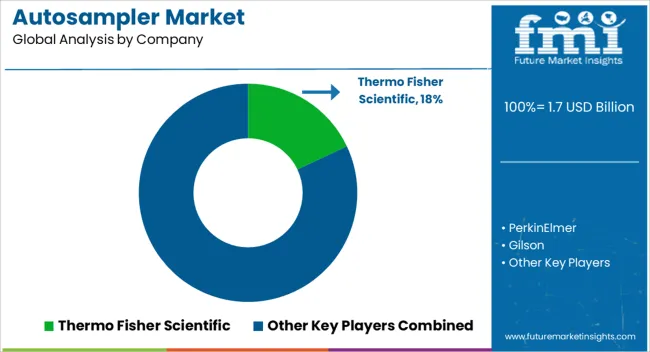

Autosampler market players employ diverse strategies to gain a competitive edge. A few prioritize innovation, consistently launching cutting-edge features and technologies. Some set themselves apart by providing dependable goods at competitive costs. For some, forming strategic alliances and working together is essential to expanding their market reach.

Recent Developments

The global autosampler market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the autosampler market is projected to reach USD 3.5 billion by 2035.

The autosampler market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in autosampler market are autosampler systems, _gc autosamplers, _lc autosamplers, autosampler accessories, _syringes & needle, _vials, _septum and _others.

In terms of end use, pharmaceutical & biotechnological companies segment to command 34.9% share in the autosampler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autosampler Vials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA