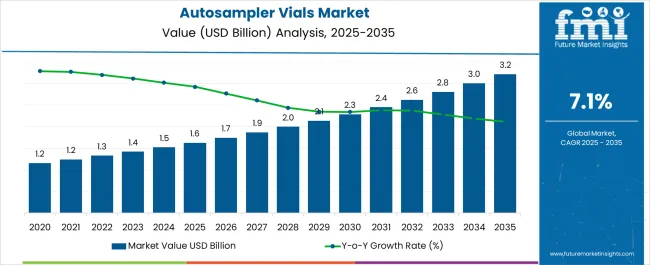

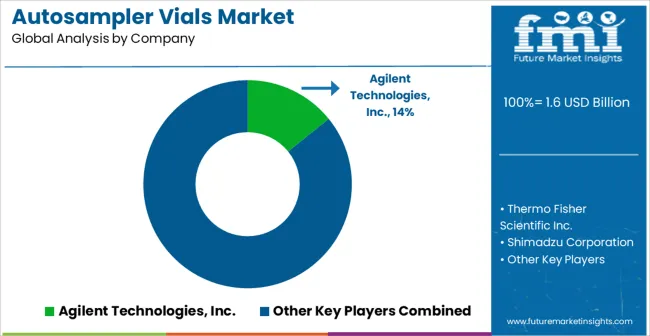

The Autosampler Vials Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Autosampler Vials Market Estimated Value in (2025 E) | USD 1.6 billion |

| Autosampler Vials Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The Autosampler Vials market is witnessing steady growth, driven by the increasing adoption of automated laboratory equipment across pharmaceutical, biopharmaceutical, and chemical industries. Rising demand for precise and reproducible sample analysis in high-performance liquid chromatography and other analytical techniques is supporting market expansion. Technological advancements in vial design, including improved sealing mechanisms, contamination-free materials, and compatibility with automated systems, are enhancing efficiency and accuracy in laboratory operations.

Growing investments in research and development, coupled with increasing pharmaceutical production and quality control testing, are further fueling market adoption. The market is also being influenced by regulatory compliance requirements that mandate stringent sample handling and storage protocols, which make high-quality autosampler vials essential for analytical workflows.

As laboratories prioritize automation, efficiency, and reliability in testing processes, the Autosampler Vials market is expected to maintain sustained growth Increasing emphasis on laboratory standardization, sample integrity, and reproducibility is creating long-term opportunities across multiple sectors, including pharmaceuticals, biotechnology, and environmental testing.

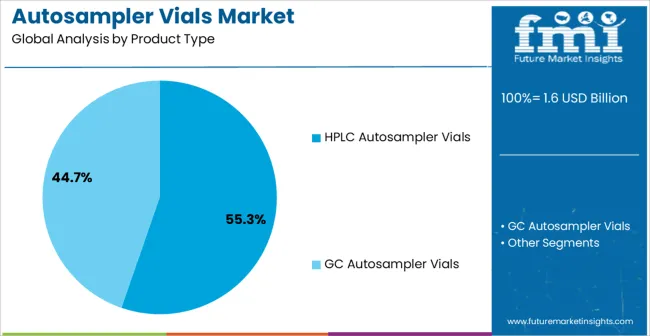

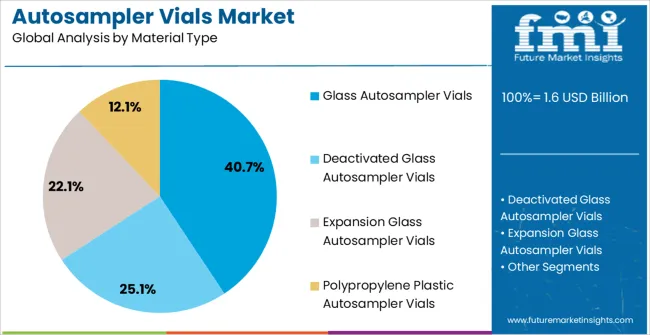

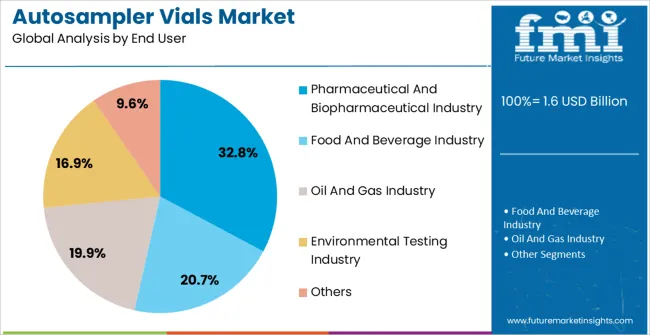

The autosampler vials market is segmented by product type, material type, end user, and geographic regions. By product type, autosampler vials market is divided into HPLC Autosampler Vials and GC Autosampler Vials. In terms of material type, autosampler vials market is classified into Glass Autosampler Vials, Deactivated Glass Autosampler Vials, Expansion Glass Autosampler Vials, and Polypropylene Plastic Autosampler Vials. Based on end user, autosampler vials market is segmented into Pharmaceutical And Biopharmaceutical Industry, Food And Beverage Industry, Oil And Gas Industry, Environmental Testing Industry, and Others. Regionally, the autosampler vials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HPLC autosampler vials segment is projected to hold 55.3% of the market revenue in 2025, establishing it as the leading product type. This dominance is driven by the segment’s critical role in high-performance liquid chromatography applications, which require precise and contamination-free sample handling for accurate analytical results. The design of HPLC autosampler vials allows compatibility with automated sampling systems, ensuring consistent injection volumes and minimizing human error.

Their widespread adoption is supported by increasing demand for quality control and analytical testing in pharmaceutical, biopharmaceutical, and chemical industries. Technological improvements, including optimized cap and septa materials and leak-resistant closures, enhance reliability and extend vial usability.

The ability to maintain sample integrity under varying laboratory conditions further reinforces the preference for HPLC autosampler vials As laboratories continue to prioritize efficiency, reproducibility, and automation in analytical workflows, this product type is expected to maintain its leadership, supported by ongoing innovations and growing adoption across multiple research and industrial applications.

The glass autosampler vials segment is anticipated to account for 40.7% of the market revenue in 2025, making it the leading material type. Growth in this segment is driven by the inherent chemical inertness, transparency, and thermal stability of glass, which make it ideal for handling a wide range of liquid samples without contamination or reaction. Glass vials ensure compatibility with most automated sampling systems and analytical instruments, providing consistent results and minimizing interference with analytical measurements.

The material’s durability, resistance to solvents, and ability to withstand repeated cleaning and sterilization contribute to its preference among laboratories and pharmaceutical manufacturers. Increasing demand for high-precision analysis in quality control, research, and biopharmaceutical production further supports adoption.

Glass vials also facilitate visual inspection of sample clarity and volume, which is critical for laboratory workflows As the need for reliable, contamination-free, and high-performance sample containers continues to grow, the glass autosampler vials segment is expected to maintain its leading market position, supported by technological improvements and sustained demand from analytical laboratories worldwide.

The pharmaceutical and biopharmaceutical industry segment is projected to hold 32.8% of the market revenue in 2025, establishing it as the leading end-user category. Growth in this segment is driven by the critical requirement for accurate, reproducible, and contamination-free sample handling in drug development, quality control, and clinical research applications. Autosampler vials enable high-throughput testing in HPLC and other analytical systems, supporting efficiency in large-scale pharmaceutical and biopharmaceutical operations.

The increasing focus on compliance with Good Laboratory Practice and other regulatory standards has reinforced the adoption of high-quality vials that maintain sample integrity. Advancements in automation and laboratory standardization have further enhanced operational efficiency and reduced human error, increasing reliance on autosampler vials in the sector.

As pharmaceutical and biopharmaceutical research continues to expand globally, the demand for reliable sample management solutions is expected to rise The segment’s emphasis on precision, safety, and reproducibility ensures sustained growth, with autosampler vials remaining a key component in analytical and quality control workflows.

Autosampler vials are broadly used for performing analysis procedures in chromatography. These are essential commercial vials used within autosamplers so they must adhere strictly to specific dimensions. Autosampler vials are manufactured in a way that is compatible with all kind of autosampler systems.

Manufacturing procedures for autosampler vials are highly assured for quality and cleanliness as any contamination in their manufacturing and packaging would result in analytic errors in chromatographic procedures. Autosampler vials are majorly developed to be used in separation laboratories that are involved in impurities investigation, stability testing, and quantitation values and offer high-standard instruments.

These vials are made such that they do not interfere with the accuracy and precision of HPLC and GC procedures. They are made up of pharmaceutical packaging grade glass and are usually bought together with septa and vial caps to offer high-grade performance.

As autosampler vials are made with either glass or plastic, thus they have minimal impact on the processing of sensitive samples. The caps of autosampler vials are fitted with septa that do not allow any leakage from the autosampler under any condition. The autosampler vials must be operated following the appropriate regulations for safe use to ensure no errors in the chromatography procedures.

Autosampler vials commonly find applications in various industries that involve HPLC and GC techniques. They are available in various categories including screw thread vials, screw top vials, snap ring vials, crimp headspace vials, crimp top vials and others. Based on type autosampler vials are categorized into HPLC autosampler vials and GC vials which are further categorized into liquid autosampler vials, headspace autosampler vials and others.

However, based on the end user, they are utilized in the pharmaceutical and biopharmaceutical industry, food and beverage industry, oil and gas, environment testing laboratories and others. The rising demand for technologically advanced autosampler vials and the growing need for improved sample security and integrity are expected to drive revenue generation in the global autosampler vials market. They are manufactured via the most advanced techniques that are 100% automated.

There are several restraining factors associated with autosampler vials that would hamper the growth of the autosampler vials market. Some of these limiting factors include the money constraints of small-size market players in the autosampler vials industry.

However, with the increased advantage of autosamplers over conventional manual injection systems, the autosampler vials market registers robust growth. The Autosampler vials market offers products for various types of industries and is majorly utilized in performing HPLC tests for drug approvals.

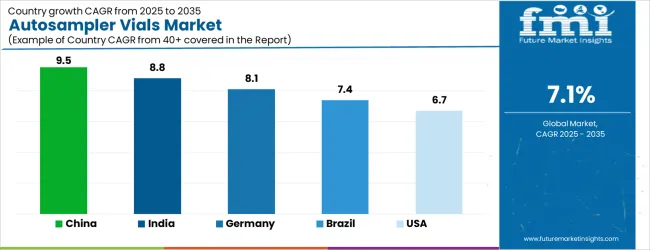

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| Brazil | 7.4% |

| USA | 6.7% |

| UK | 6.0% |

| Japan | 5.3% |

The Autosampler Vials Market is expected to register a CAGR of 7.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.5%, followed by India at 8.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.3%, yet still underscores a broadly positive trajectory for the global Autosampler Vials Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.1%. The USA Autosampler Vials Market is estimated to be valued at USD 607.9 million in 2025 and is anticipated to reach a valuation of USD 607.9 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 84.1 million and USD 46.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | HPLC Autosampler Vials and GC Autosampler Vials |

| Material Type | Glass Autosampler Vials, Deactivated Glass Autosampler Vials, Expansion Glass Autosampler Vials, and Polypropylene Plastic Autosampler Vials |

| End User | Pharmaceutical And Biopharmaceutical Industry, Food And Beverage Industry, Oil And Gas Industry, Environmental Testing Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Shimadzu Corporation, Waters Corporation, PerkinElmer Inc., Bio-Rad Laboratories Inc., Gilson Inc., Restek Corporation, Scion Instruments, Tecan Group Ltd., HTA s.r.l., KNAUER Wissenschaftliche Geräte GmbH, and CTC Analytics AG |

The global autosampler vials market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the autosampler vials market is projected to reach USD 3.2 billion by 2035.

The autosampler vials market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in autosampler vials market are hplc autosampler vials and gc autosampler vials.

In terms of material type, glass autosampler vials segment to command 40.7% share in the autosampler vials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autosampler Market Size and Share Forecast Outlook 2025 to 2035

Micro Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Shell Vials Market Size and Share Forecast Outlook 2025 to 2035

Plastic Vials and Ampoules Market Size and Share Forecast Outlook 2025 to 2035

Polymer Vials Market Insights & Industry Growth 2025 to 2035

Leading Providers & Market Share in Plastic Vials and Ampoules Industry

Flip Top Vials Market Size and Share Forecast Outlook 2025 to 2035

Formalin Vials Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Vials Market Trends - Size & Growth 2025 to 2035

Snap Cap Vials Market

Interlock Vials Market Size and Share Forecast Outlook 2025 to 2035

Cryogenic Vials and Tubes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Interlock Vials Manufacturers

Diagnostic Vials Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Diagnostic Vials Market Share & Industry Insights

Speciality Vials Market

Push-in Plug Vials Market Size and Share Forecast Outlook 2025 to 2035

Scintillation Vials Market Size and Share Forecast Outlook 2025 to 2035

Assessing Scintillation Vials Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA