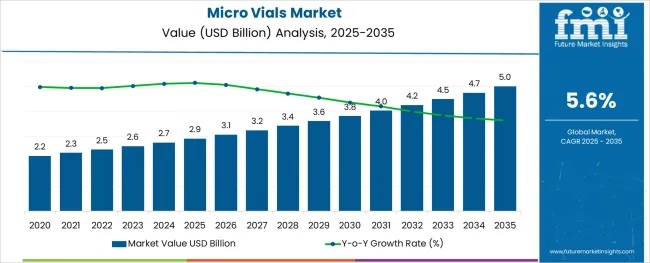

The Micro Vials Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The micro vials market is witnessing notable expansion driven by the increasing demand for precision sampling, low volume diagnostics, and high value pharmaceutical formulations. As biopharmaceutical innovation accelerates, the need for reliable and contaminant free storage solutions for small volume samples is rising across both clinical and laboratory environments.

Micro vials offer enhanced accuracy for sensitive applications in proteomics, genomics, and drug delivery research, making them integral to modern lab operations. Regulatory compliance with good manufacturing practices and the need for traceability in analytical workflows are further reinforcing demand.

The rise in personalized medicine, vaccine research, and microdosing studies has increased the reliance on small capacity containers. Continued advancements in sealing technologies and material compatibility are also strengthening market potential, supporting consistent growth across life sciences, healthcare, and biotechnology sectors.

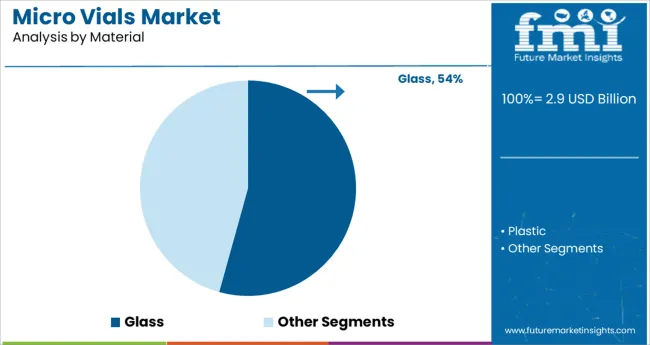

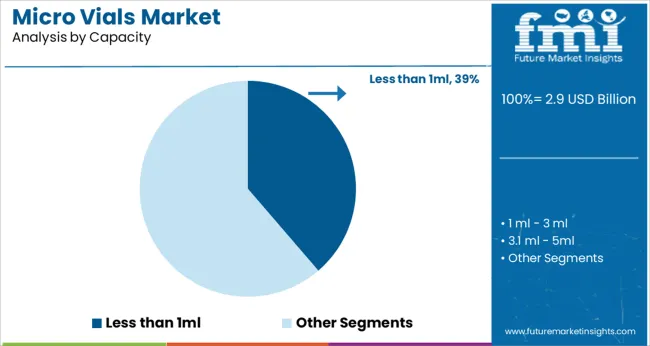

The market is segmented by Material, Capacity, and End Use and region. By Material, the market is divided into Glass and Plastic. In terms of Capacity, the market is classified into Less than 1ml, 1 ml - 3 ml, 3.1 ml - 5ml, and Above 5ml. Based on End Use, the market is segmented into Healthcare, Personal Care, and Chemicals.

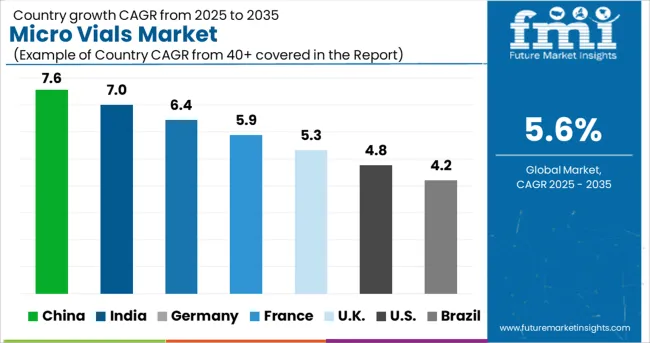

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass segment is projected to account for 54.30% of total market revenue by 2025 within the material category, establishing itself as the dominant material type. This position is supported by glass’s chemical resistance, thermal stability, and non reactivity, which are essential properties for maintaining sample integrity in sensitive pharmaceutical and diagnostic applications.

Glass micro vials provide superior protection against leaching and vapor transmission, making them ideal for long term storage of volatile or high purity compounds. Additionally, their compatibility with a wide range of analytical instruments and sterilization methods contributes to operational reliability and versatility in laboratory workflows.

As quality assurance and purity standards become increasingly stringent, glass remains the preferred material choice across high precision laboratory and pharmaceutical settings.

The less than 1 milliliter segment is expected to represent 38.70% of total market revenue by 2025 under the capacity category, making it the leading volume format. This capacity is favored in applications requiring high accuracy with minimal reagent consumption, such as PCR, genetic sequencing, and micro sampling in drug research.

The miniaturization trend in diagnostics and analytical testing has intensified demand for sub milliliter packaging formats that ensure efficient handling and reduce waste. These vials offer improved compatibility with automated liquid handling systems and microfluidic platforms, streamlining processes in high throughput laboratory environments.

Their growing use in specialized therapeutic areas and advanced R&D workflows reinforces the dominance of this capacity category within the evolving micro vials market.

The global market witnessed a CAGR of 5.1% during the historical period with, overall sales reaching a valuation of USD 2.7 billion in 2024. However, with growing demand for better packaging solutions across industries like healthcare, chemicals, and personal care, sales of micro vials are set to accelerate at a 5.6% CAGR between 2025 and 2035.

Micro vials are small-sized vials used for storing and transporting drugs, chemicals, or sensitive content without getting contaminated. They have gained immense traction, especially across the healthcare industry due to their ability to protect sensitive products like vaccines from external factors. Thus, rising demand for micro vials across the thriving healthcare industry will continue to boost the growth of the global market during the forecast period.

Similarly, increasing research & development activities in the healthcare industry are opening new doors for the market since vials are the first need for such research. Moreover, the development of various drugs & medications by different global pharmaceutical companies across the globe will elevate the demand for micro vials.

Micro vials manufacturers are extremely sensible when choosing the material for the vials manufacturing. Among various materials, glass is the most suitable material for making micro vials due to its excellent barrier properties.

Rising Number of Vaccination Drives across the World to Boost Market Through 2035

In recent years, there has been a rapid increase in the number of vaccination drives across the world aimed at reducing the burden of numerous diseases. Various governments and regulatory bodies are launching new initiatives to provide people access to vaccines.

For instance, the Initiative For Global Vaccine Access (GLOBAL VAX) was launched by the United States Agency for International Development (USAID), in December 2024 to accelerate vaccine access and delivery assistance around the world.

Most of these vaccines need high-end safety packaging solutions like micro vials. Micro vials are the best suitable packaging solution for vaccines and have essential features to protect vaccines from outer reactions. They are helpful for vaccines as they protect them from getting destroyed and extend their shelf life. Thus, the micro vials market is getting lucrative opportunities amid the vaccination drive across the globe.

“Increasing Focus on Child Resistant Packaging to Create Opportunity”

Manufacturers of cosmetics, pharmaceuticals, and other products are attempting to concentrate on creating child-resistant packaging. To prevent the death of a child, which can occasionally result from acute poisoning after the consumption of unsupervised pharmaceutical or cosmetic items, the focus has been placed on child-resistant packaging.

By creating child-resistant packaging, businesses can expand into other sectors, such as the pharmaceutical and cosmetics industries. There are micro vials available with child-resistant seals, which offers some potential for the market's growth.

Additionally, businesses can create several strategies to make the packaging child-resistant; for instance, vial manufacturers may choose single-dose packaging.

Child-resistant packaging is regarded as a crucial safety element that must be taken into consideration because it helps prevent children from ingesting unexpected and harmful pharmaceutical items. Therefore, the introduction of child-resistant packaging by micro vial producers offers a wide range of growth prospects for micro vials among end-use sectors.

Booming Chemical Industry Pushing Demand for Micro Vials in China

China is estimated to hold around 64% value share of the East Asia micro vials market by the end of 2025. This is due to the rapid expansion of the chemical industry and the easy availability of raw materials at much lower costs.

China has a strong position in the global chemical industry. Easy labor availability simplifies the production efficiency of the country. China as a strong economy has strengthened production applications as well as technologies. According to the data collected from the European Chemical Industry Council, China is the leading exporter of chemicals. The country sold USD 1,701 Billion worth of chemicals in 2024. Overall, the expanding chemical industry in China is projected to fuel the demand for micro vials during the forecast period.

Bulk Vaccine Production Boosting Sales of Micro Vials in India

As per FMI, India’s micro vials market is projected to grow 1.8 times the current market value during the forecast period, making it one of the fastest-growing markets across South Asia. Rising production and export of vaccines, favorable government regulations and initiatives, and the strong presence of some of the leading pharmaceutical companies are some of the key factors driving demand for micro vials in India.

After the pandemic hit the global market, Indian pharmaceutical giants grabbed the opportunity to produce vaccines in bulk. The government’s interference has helped the pharmaceutical industry in India to push its operations globally. As per data collected from National Public Radio, India is the largest vaccine producer in the world. The mass production capacity of the Indian pharmaceutical industry is helping the micro vials market to expand.

Excellent Properties of Glass Making It Highly Adopted Material for Making Micro Vials

Based on the material segment, the glass vials segment is projected to hold the major portion of the global micro vials market during the forecast period. The target segment is anticipated to grow 1.7x the current market value by the end of 2035. This can be attributed to the rising usage of glass for making micro vials due to its excellent properties including high chemical and temperature resistance, sustainable nature, and optimum containers closure integrity (CCI)

Similarly, the growing preference of pharmaceutical companies for storing and transporting sensitive compositions in glass-based micro vials is expected to boost the growth of the target segment during the forecast period.

Increasing Research and Development Activities Setting up a Stage for the Micro Vials Market

As per FMI, the healthcare segment in terms of end-use is anticipated to register a robust CAGR of 5.8% during the forecast period (2025 to 2035). This can be attributed to increasing Research and Development activities, the growing prevalence of chronic and infectious diseases worldwide, and the rising need for protecting sensitive healthcare products during storage and transportation.

The healthcare industry is completely focused on extensive research and development to provide the market with effective solutions. The research and development sector of the healthcare industry requires protective storage solutions to store its liquid adhesives or other chemicals during research processes. For this purpose, micro vials are being increasingly used.

Incremental opportunities for the micro vials market arise since the healthcare packaging is more concentrated on serving innovative healthcare solutions to the market. Therefore, the boosted research in the healthcare industry is setting up a huge stage for the micro vials market to perform its highest sales.

Key manufacturers of micro vials are employing various organic and inorganic strategies such as new product launches, mergers, acquisitions, collaborations, facility expansions, and strengthening distribution channels. Further, they are investing rigorously in research and innovations. Some of the recent developments in the market include:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.3 Billion |

| Projected Market Size (2035) | USD 4.0 Billion |

| Anticipated Growth Rate (2025 to 2035) | 5.6% CAGR |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion, Volume in Units, and CAGR from 2025 to 2035 |

| Segments Covered | Material, Capacity, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | The USA, Canada, Mexico, Brazil, Germany, The UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

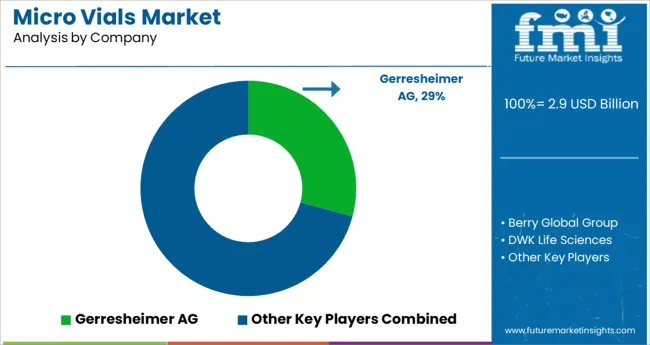

| Key Companies Profiled | Gerresheimer AG; Berry Global Group; DWK Life Sciences; Schott AG; Thornton Plastics; Sigma-Aldrich Co. LLC; West Pharmaceutical Services, Inc.; Adelphi Group; Pacific Vial Manufacturing, Inc.; SGD Pharma; PGP Glass Private Limited; Stevanato Group; Origin Pharma Packaging; Phoenix Glass; Agilent Technologies, Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global micro vials market is estimated to be valued at USD 2.9 billion in 2025.

It is projected to reach USD 5.0 billion by 2035.

The market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types are glass and plastic.

less than 1ml segment is expected to dominate with a 38.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microfilm Readers and Scanners Market Size and Share Forecast Outlook 2025 to 2035

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA