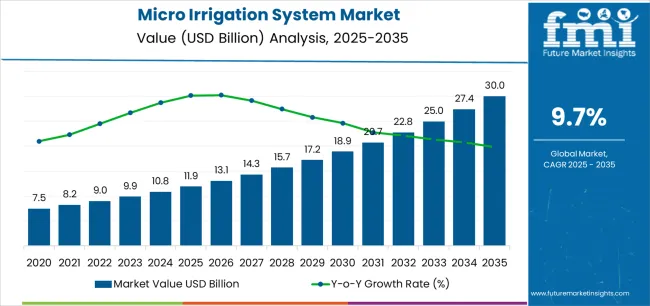

The global micro irrigation system market is projected to reach USD 30.1 billion by 2035, recording an absolute increase of USD 18.2 billion over the forecast period. The market is valued at USD 11.9 billion in 2025 and is set to rise at a CAGR of 9.7% during the assessment period. The overall market size is expected to grow by nearly 2.5 times during the same period, supported by increasing demand for water-efficient agriculture solutions worldwide, driving demand for precision irrigation technologies and increasing investments in sustainable farming and water conservation projects globally. However, high initial installation costs and limited awareness among smallholder farmers may pose challenges to market expansion.

Between 2025 and 2030, the micro irrigation system market is projected to expand from USD 11.9 billion to USD 19 billion, resulting in a value increase of USD 7.1 billion, which represents 39.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for water conservation and precision agriculture solutions, product innovation in smart irrigation controllers and sensor-based systems, as well as expanding integration with IoT technologies and automated farming initiatives. Companies are establishing competitive positions through investment in advanced drip line technologies, sustainable water management solutions, and strategic market expansion across orchards, vineyards, and field crop applications.

From 2030 to 2035, the market is forecast to grow from USD 19.0 billion to USD 30.1 billion, adding another USD 11.1 billion, which constitutes 61.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized micro irrigation systems, including hybrid dripline designs and AI-based irrigation optimization platforms tailored for specific crop requirements, strategic collaborations between irrigation equipment manufacturers and farming communities, and an enhanced focus on water use efficiency and climate resilience. The growing emphasis on precision agriculture and smart farming will drive demand for advanced, high-performance micro irrigation solutions across diverse agricultural applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 11.9 billion |

| Market Forecast Value (2035) | USD 30.1 billion |

| Forecast CAGR (2025-2035) | 9.7% |

The micro irrigation system market grows by enabling farmers to achieve superior water use efficiency and sustainable crop productivity while addressing global water scarcity challenges. Agricultural producers face mounting pressure to optimize water consumption and improve yield quality, with micro irrigation solutions typically providing 40-60% water savings compared to conventional irrigation methods, making these systems essential for long-term agricultural sustainability. The precision agriculture movement's need for automated water delivery creates demand for advanced micro irrigation solutions that can enhance crop performance, reduce labor requirements, and ensure consistent production across diverse climatic conditions.

Government initiatives promoting water conservation programs and sustainable farming standards drive adoption in orchards, vineyards, field crops, and protected cultivation applications, where water management has a direct impact on yield quality and farm profitability. The global shift toward climate-resilient agriculture and efficient resource utilization accelerates micro irrigation demand as farmers seek alternatives to flood and furrow irrigation that waste water and nutrients. However, high upfront investment costs ranging from USD 1,200 to USD 2,500 per hectare and technical complexity in system design may limit adoption rates among resource-constrained smallholder farmers and regions with underdeveloped irrigation infrastructure.

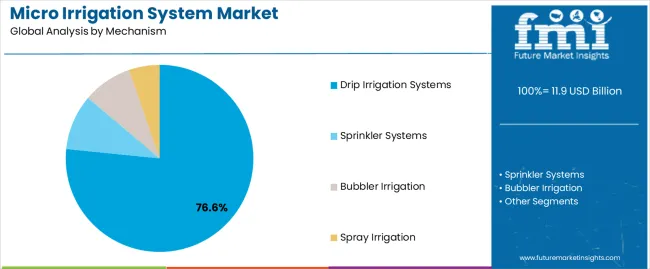

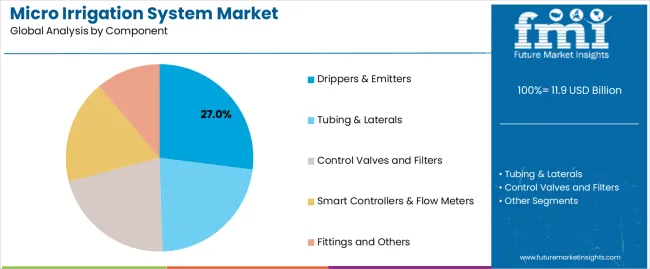

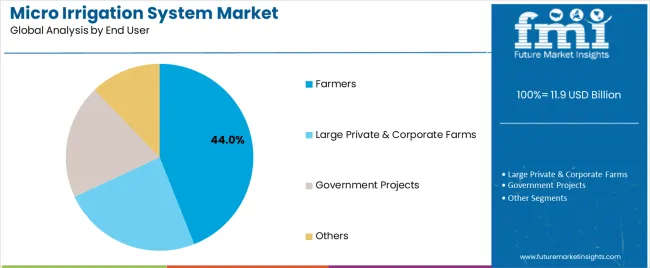

The market is segmented by mechanism, component, crop type, farming technique, end user, and region. By mechanism, the market is divided into drip irrigation systems, sprinkler systems, bubbler irrigation, and spray irrigation. Based on component, the market is categorized into drippers and emitters, tubing and laterals, control valves and filters, smart controllers and flow meters, and fittings and others. By crop type, the market includes orchards and vineyards, field crops, plantation crops, and other crop types. By farming technique, the market is classified into open field cultivation and protected cultivation. By end user, the market comprises farmers, large private and corporate farms, government projects, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The drip irrigation systems segment represents the dominant force in the micro irrigation market, capturing approximately 76.6% of total market share in 2025. This advanced category encompasses formulations featuring surface drip (41% of drip systems), subsurface drip (28%), in-line drip (23%), and gravity/family-fed drip (8%), delivering precise water and nutrient application with enhanced crop performance capabilities. The drip irrigation segment's market leadership stems from its exceptional water use efficiency, fertigation compatibility, and proven ability to increase yields by 20-90% across diverse crop types while reducing water consumption by up to 70% compared to conventional irrigation methods.

The sprinkler systems segment maintains an 18% market share, serving farmers who require flexible irrigation solutions for field crops and large-area applications through center pivot and lateral move systems. The bubbler irrigation segment accounts for 3% market share, while spray irrigation represents 2.4%, featuring specialized applications for greenhouse operations and landscape irrigation.

Key advantages driving the drip irrigation systems segment include:

Drippers and emitters dominate the micro irrigation component market with approximately 27% market share in 2025, reflecting their critical role as the primary water delivery mechanism in precision irrigation systems. The drippers and emitters segment's market leadership is reinforced by continuous innovation in pressure-compensating designs, anti-clog technologies, and flow rate optimization that ensure uniform water distribution across varying topographies and lateral lengths.

The tubing and laterals segment represents 22% market share through polyethylene pipes, PVC mainlines, and specialized thin-wall drip tapes that form the distribution network for micro irrigation systems. Control valves and filters account for 18% market share, providing essential system protection and water quality management. Smart controllers and flow meters command 16.0% share, benefiting from increasing adoption of IoT-enabled irrigation automation and real-time monitoring capabilities. Fittings and others maintain 17.0% market share through connectors, end caps, and pressure regulators essential for system assembly and operation.

Key market dynamics supporting component preferences include:

The farmers segment, encompassing small and medium holders, represents the dominant end user category in the micro irrigation market, capturing approximately 44% of total market share in 2025. This segment includes individual farmers and family-operated holdings typically managing 1-20 hectares, where government subsidies covering 40-90% of installation costs make micro irrigation economically accessible. The farmers segment's leadership reflects the numerical dominance of smallholder agriculture globally and targeted policy interventions promoting water-efficient irrigation adoption among resource-constrained producers.

Large private and corporate farms account for 28% market share, representing commercial agricultural operations with extensive acreage, in-house technical expertise, and capital capacity for unsubsidized system investments. Government projects and agricultural departments maintain 19% share through demonstration farms, research stations, and public irrigation schemes. Others, including cooperatives and agricultural contractors, represent 9% market share through shared infrastructure models and service-based irrigation deployment.

Key advantages driving the farmers segment include:

The market is driven by three concrete demand factors tied to water scarcity and agricultural productivity. First, global water stress conditions intensify across major agricultural regions, with the World Resources Institute identifying 17 countries facing extremely high water stress and micro irrigation offering 40-70% water savings compared to flood irrigation methods. Second, government subsidy programs accelerate adoption, with India's Per Drop More Crop scheme providing 55-90% cost subsidies, China's agricultural modernization initiatives supporting greenhouse drip installations, and California's irrigation efficiency grants offsetting 50% of system costs. Third, climate change adaptation requirements drive farmers toward resilient irrigation infrastructure, with micro irrigation maintaining productivity during drought periods and enabling controlled deficit irrigation strategies that optimize crop quality under water-limited conditions.

Market restraints include high initial capital requirements ranging from USD 1,200 to USD 2,500 per hectare depending on crop type and technology level, creating affordability barriers for smallholder farmers in developing regions without access to subsidized financing programs. Technical complexity in system design, installation, and maintenance poses adoption challenges, particularly in regions lacking trained irrigation technicians and after-sales service networks to address clogging issues, pressure irregularities, and component failures. Water quality limitations affect system performance, as high sediment loads, chemical contaminants, and biological growth require sophisticated filtration solutions that increase operational costs and maintenance requirements beyond capabilities of resource-constrained farmers.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly India and China, where government mandates targeting 10 million hectares of micro irrigation expansion by 2030 drive unprecedented market growth. Technology advancement trends toward smart irrigation controllers with soil moisture sensors, weather-based scheduling algorithms, and mobile app interfaces enable precision water management and remote system monitoring. Integration with renewable energy, particularly solar-powered pumping systems, addresses electricity access limitations while reducing operational costs in off-grid agricultural areas. However, the market thesis could face disruption if climate patterns shift toward increased rainfall in traditionally water-scarce regions or if breakthrough drought-resistant crop varieties reduce irrigation dependency across major agricultural systems.

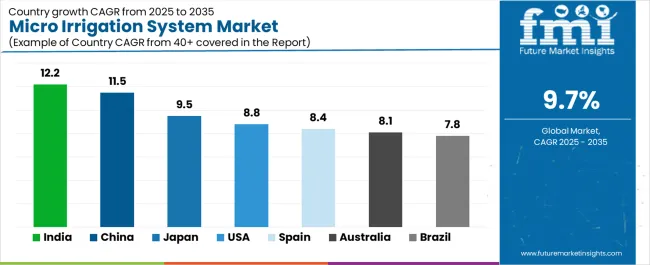

| Country | CAGR (2025-2035) |

|---|---|

| India | 12.2% |

| China | 11.5% |

| USA | 8.8% |

| Japan | 9.5% |

| Spain | 8.4% |

| Australia | 8.1% |

| Brazil | 7.8% |

The micro irrigation system market is gaining momentum worldwide, with India taking the lead thanks to aggressive water conservation schemes and government subsidy programs covering up to 90% of installation costs. Close behind, China benefits from greenhouse vegetable expansion and cost-efficient thin-wall drip line technologies, positioning itself as a strategic growth hub in the Asia-Pacific region. The United States shows strong advancement, where precision farming adoption in California and Florida orchards strengthens its role in advanced irrigation technology deployment. Japan demonstrates robust growth through protected cultivation expansion and automation solutions addressing aging farm workforce challenges, signaling continued investment in greenhouse infrastructure. Meanwhile, Spain stands out for EU-backed water-saving schemes with Murcia and Cartagena regions achieving over 90% micro irrigation coverage, while Australia and Brazil continue to record consistent progress driven by water scarcity mitigation and export crop expansion. Together, India and China anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

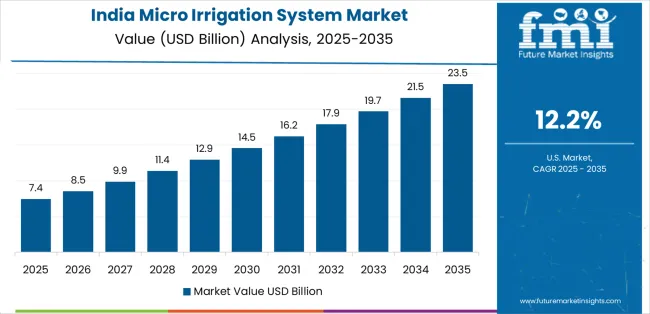

India demonstrates the strongest growth potential in the Micro Irrigation System Market with a CAGR of 12.2% through 2035. The country's leadership position stems from comprehensive water conservation initiatives under the Jal Shakti Mission, extensive government subsidy programs providing 55-90% cost support, and aggressive expansion targets aiming to cover 10 million hectares under micro irrigation by 2030. Growth is concentrated in major agricultural regions, including Maharashtra, Karnataka, Rajasthan, Tamil Nadu, and Andhra Pradesh, where fruit, vegetable, and sugarcane farmers are implementing drip and sprinkler systems for water efficiency and yield enhancement. Distribution channels through agricultural departments, farmer producer organizations, and private irrigation companies expand deployment across diverse farming communities and crop types.

Key market factors:

In Shandong, Hebei, Henan, and Xinjiang provinces, the adoption of micro irrigation systems is accelerating across greenhouse vegetable operations, orchard developments, and large-scale field crop installations, driven by agricultural modernization policies and water resource management mandates. The market demonstrates strong growth momentum with a CAGR of 11.5% through 2035, linked to comprehensive greenhouse agriculture expansion targeting 4 million hectares of protected cultivation by 2030. Chinese farmers are implementing cost-efficient thin-wall drip tapes and automated fertigation systems to improve crop yields while meeting government water use efficiency standards. The country's 14th Five-Year Plan for Agricultural Development creates sustained demand for irrigation modernization, while increasing focus on food security drives adoption of water-saving technologies across diverse agricultural regions.

Key development areas:

The USA market leads in advanced micro irrigation innovation based on integration with precision agriculture technologies, including soil moisture sensors, weather-based controllers, and satellite-based crop monitoring systems. The country shows solid potential with a CAGR of 8.8% through 2035, driven by water scarcity in western states, environmental regulations limiting groundwater extraction, and increasing adoption of sustainable farming practices. Growth is concentrated in California, Florida, Washington, and Arizona, where specialty crop producers including almond, citrus, grape, and vegetable growers implement advanced drip systems with automated fertigation capabilities. Technology deployment channels through irrigation dealers, agricultural cooperatives, and direct manufacturer relationships expand coverage across diverse farming operations from small orchards to corporate farms exceeding 5,000 hectares.

Leading market segments:

Japan's micro irrigation market demonstrates sophisticated implementation focused on greenhouse production systems and high-value vegetable cultivation, with documented integration of automated drip systems achieving 95% water use efficiency in controlled environment operations. The country maintains strong growth momentum with a CAGR of 9.5% through 2035, driven by aging farm workforce requiring labor-saving automation and consumer demand for premium produce with consistent quality. Major agricultural regions, including Hokkaido, Nagano, Aichi, and Kumamoto, showcase advanced deployment of fertigation systems and climate-controlled irrigation that integrate seamlessly with existing greenhouse infrastructure and precision environmental management programs.

Key market characteristics:

In Murcia, Cartagena, Valencia, and Andalusia regions, orchard and vineyard managers have achieved industry-leading micro irrigation penetration rates exceeding 90% of cultivated area, establishing Spain as Europe's benchmark for water-efficient agriculture implementation. The market shows solid growth potential with a CAGR of 8.4% through 2035, linked to European Union Common Agricultural Policy support for irrigation modernization, stringent water use regulations in water-scarce regions, and increasing export demands for high-quality citrus, stone fruits, and wine grapes. Spanish producers are adopting advanced drip systems with pressure-compensating emitters and automated fertigation programs to maintain production quality while complying with reduced water allocation quotas in drought-affected Mediterranean regions.

Market development factors:

Australia's micro irrigation market demonstrates strategic implementation focused on water scarcity mitigation and climate resilience, with documented adoption across cotton, horticulture, and viticulture sectors achieving 30-50% water savings compared to flood irrigation methods. The country shows steady growth with a CAGR of 8.1% through 2035, driven by Murray-Darling Basin Plan water allocation restrictions, government irrigation efficiency programs, and increasing frequency of drought conditions affecting traditional agricultural regions. Major producing areas, including New South Wales, Victoria, Queensland, and South Australia, showcase transition from channel irrigation to pressurized drip and sprinkler systems that optimize limited water resources while maintaining agricultural productivity and export competitiveness.

Key market characteristics:

Brazil's micro irrigation market demonstrates growing implementation focused on export-oriented fruit production, sugarcane cultivation, and coffee plantations, with documented adoption delivering 25-35% yield improvements in irrigated citrus and tropical fruit operations. The market maintains consistent growth with a CAGR of 7.8% through 2035, driven by agricultural export expansion, regional government credit programs providing favorable financing terms, and increasing adoption among medium and large-scale producers seeking productivity enhancement. Major producing regions, including São Paulo, Minas Gerais, Bahia, and Paraná, showcase deployment of drip irrigation systems in mango, grape, coffee, and sugarcane cultivation where water management directly impacts crop quality and export market access.

Key development areas:

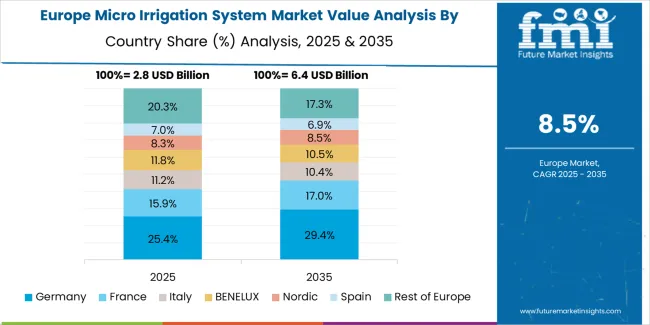

The micro irrigation system market in Europe is projected to grow from USD 2.6 billion in 2025 to USD 6.3 billion by 2035, registering a CAGR of 9.1% over the forecast period. Spain is expected to maintain its leadership position with a 20.0% market share in 2025, rising to 19.0% by 2035, supported by its extensive orchard and vineyard infrastructure and major agricultural centers, including Murcia, Cartagena, and Valencia production regions.

Italy follows with a 17.7% share in 2025, projected to reach 16.7% by 2035, driven by comprehensive citrus and olive plantation drip irrigation programs implementing precision water management. France holds a 15.4% share in 2025, expected to rise to 14.6% by 2035 through ongoing protected cultivation expansion and wine sector modernization. Germany commands a 13.8% share in 2025, declining slightly to 12.7% by 2035, backed by greenhouse vegetable and ornamental crop applications. The United Kingdom accounts for 12.7% in 2025, reaching 11.9% by 2035 on horticulture automation and government subsidy programs. The Netherlands maintains 10.0% in 2025, reaching 9.4% by 2035 on high-tech greenhouse exports and advanced fertigation systems. The Rest of Europe region is anticipated to hold 10.4% in 2025, expanding to 9.4% by 2035, attributed to increasing micro irrigation adoption in Eastern European countries implementing agricultural modernization programs.

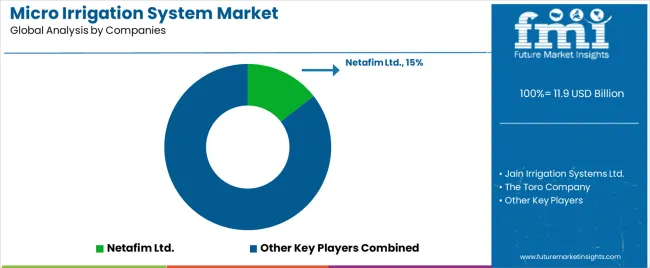

The micro irrigation system market features approximately 20-25 meaningful players with moderate concentration, where the top three companies control roughly 32-35% of global market share through established distribution networks, comprehensive product portfolios, and technical service capabilities. Competition centers on technology innovation, system reliability, and after-sales support rather than price competition alone. Netafim Ltd. leads with approximately 14.5% market share through its comprehensive drip irrigation solutions and global presence across 110 countries.

Market leaders include Netafim Ltd., Jain Irrigation Systems Ltd., and The Toro Company, which maintain competitive advantages through extensive research and development investments, proprietary emitter technologies with anti-clog features, and deep expertise in agronomic advisory services that address complete irrigation system lifecycle from design through operation. These companies leverage vertical integration in component manufacturing, global distribution infrastructure, and strategic partnerships with agricultural cooperatives to defend market positions while expanding into emerging markets and protected cultivation applications.

Challengers encompass Rain Bird Corporation and Hunter Industries, which compete through smart irrigation controllers, IoT-enabled automation platforms, and strong presence in North American and European markets. Technology specialists, including Valmont Industries, Rivulis Irrigation Ltd., and Lindsay Corporation, focus on specific irrigation mechanisms or crop applications, offering differentiated capabilities in center pivot systems, fertigation technologies, and precision agriculture integration.

Regional players and emerging irrigation providers create competitive pressure through localized manufacturing advantages, government relationship management, and rapid response capabilities, particularly in high-growth markets including India and China, where cost-competitive products and extensive dealer networks provide advantages in smallholder farmer segments. Market dynamics favor companies that combine reliable technology performance with comprehensive support services addressing system design, installation training, and ongoing maintenance requirements across diverse agricultural applications.

Micro irrigation systems represent precision water delivery technologies that enable farmers to achieve 40-70% water savings compared to conventional irrigation methods, delivering superior crop productivity and resource efficiency with targeted root zone application in demanding agricultural applications. With the market projected to grow from USD 11.9 billion in 2025 to USD 30.1 billion by 2035 at a 9.7% CAGR, these water-efficient systems offer compelling advantages - reduced water consumption, enhanced yields, and improved crop quality - making them essential for orchards and vineyards production (35.4% market share), field crops (31.0% share), and farming operations seeking alternatives to water-intensive flood irrigation that depletes groundwater resources through inefficient application. Scaling market adoption and infrastructure development requires coordinated action across agricultural policy, irrigation equipment manufacturers, financing institutions, farming communities, and water resource management authorities.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 11.9 billion |

| Mechanism | Drip Irrigation Systems, Sprinkler Systems, Bubbler Irrigation, Spray Irrigation |

| Component | Drippers & Emitters, Tubing & Laterals, Control Valves and Filters, Smart Controllers & Flow Meters, Fittings and Others |

| Crop Type | Orchards and Vineyards, Field Crops, Plantation Crops, Other Crop Types |

| Farming Technique | Open Field Cultivation, Protected Cultivation |

| End User | Farmers, Large Private & Corporate Farms, Government Projects, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | India, China, United States, Japan, Spain, Australia, Brazil, and 40+ countries |

| Key Companies Profiled | Netafim Ltd., Jain Irrigation Systems Ltd., The Toro Company, Rain Bird Corporation, Hunter Industries, Valmont Industries, Rivulis Irrigation Ltd., Lindsay Corporation, Reinke Manufacturing Co., EPC Industries Ltd. |

| Additional Attributes | Dollar sales by mechanism, component, crop type, farming technique, and end user categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with irrigation equipment manufacturers and distribution networks, system installation requirements and specifications, integration with precision agriculture platforms and IoT technologies, innovations in smart controllers and fertigation systems, and development of specialized products with enhanced water efficiency and crop-specific capabilities. |

The global micro irrigation system market is estimated to be valued at USD 11.9 billion in 2025.

The market size for the micro irrigation system market is projected to reach USD 30.0 billion by 2035.

The micro irrigation system market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in micro irrigation system market are drip irrigation systems, sprinkler systems, bubbler irrigation and spray irrigation.

In terms of component, drippers & emitters segment to command 27.0% share in the micro irrigation system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro Hotel Market Size and Share Forecast Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microscope Digital Camera Market Size and Share Forecast Outlook 2025 to 2035

Micro Guide Catheter Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforation Machines Market Size and Share Forecast Outlook 2025 to 2035

Micro Battery Market Size and Share Forecast Outlook 2025 to 2035

Microwave Monolithic Integrated Circuits Market Size and Share Forecast Outlook 2025 to 2035

Microchip Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

Micropipette Puller Market Size and Share Forecast Outlook 2025 to 2035

Microwave Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA