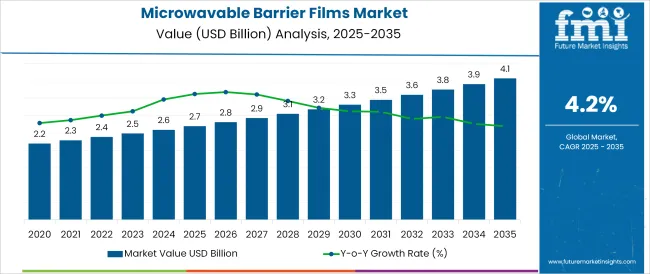

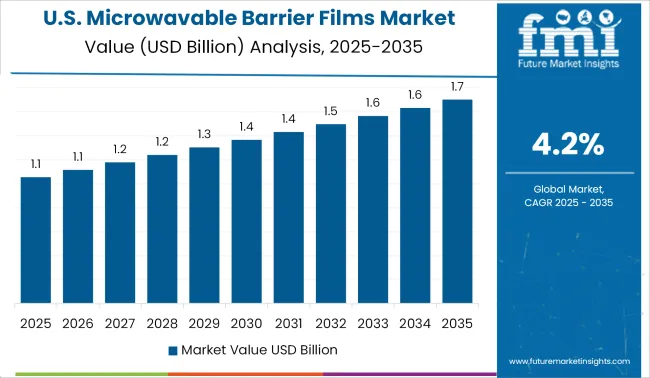

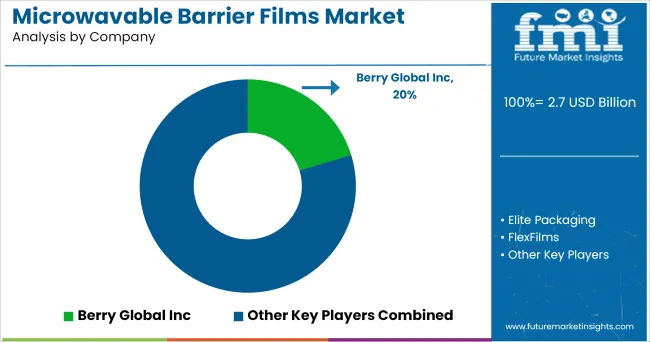

The Microwavable Barrier Films Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The microwavable barrier films market is experiencing significant momentum due to the increasing consumption of ready-to-eat and heat-and-serve meals. Consumer lifestyles are shifting toward convenience, leading to higher demand for packaging solutions that offer both thermal resistance and extended product freshness.

Microwavable barrier films are gaining preference for their ability to maintain flavor integrity, prevent moisture loss, and endure microwave heating without compromising safety. Industry players are investing in multilayer film structures and improved barrier coatings to meet evolving performance standards. Regulatory emphasis on food contact safety and sustainability has further influenced innovation in material compositions and recyclability.

In parallel, growth in meal delivery services and retail-ready packaging is amplifying the demand for high-performance sealing technologies. As the food industry continues to prioritize shelf stability, visual appeal, and compliance with microwave standards, the adoption of advanced barrier films is set to expand across global markets.

The market is segmented by Material Type, Seal Type, and Application and region. By Material Type, the market is divided into PET (Polyethylene Terephthalate), Amorphous PET, Crystalline PET, Recycled PET, PE (Polyethylene), PP (Polypropylene), and Others. In terms of Seal Type, the market is classified into Pealable Seal and Permanent Seal. Based on Application, the market is segmented into Prepared Meals, Frozen Foods, Meat Products, Dairy Products, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

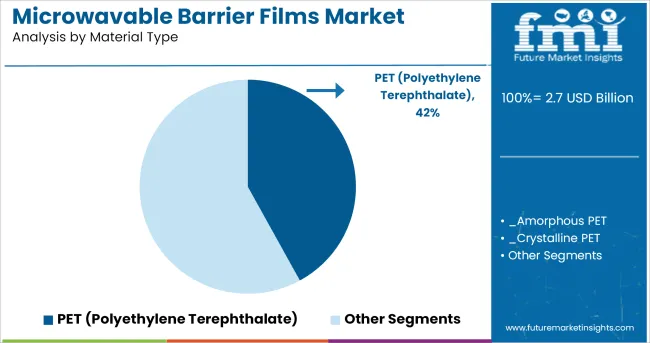

PET (Polyethylene Terephthalate) is projected to account for 42% of the total revenue share in the microwavable barrier films market by 2025, making it the leading material type. This dominance is being supported by PET's high thermal stability, clarity, and robust barrier properties against oxygen and moisture key factors in maintaining food freshness during microwave reheating.

The material's compatibility with multilayer film constructions enables enhanced protection for perishable goods, while its strength ensures durability through transport and handling. PET also offers excellent seal integrity, which is essential for vacuum and modified atmosphere packaging formats commonly used in heat-and-serve meals. Its recyclability and alignment with circular economy goals have further reinforced its adoption in sustainable packaging strategies.

As food brands seek lightweight, cost effective, and high-performance materials for microwavable applications, PET continues to be favored for its consistent performance across a range of food contact packaging environments.

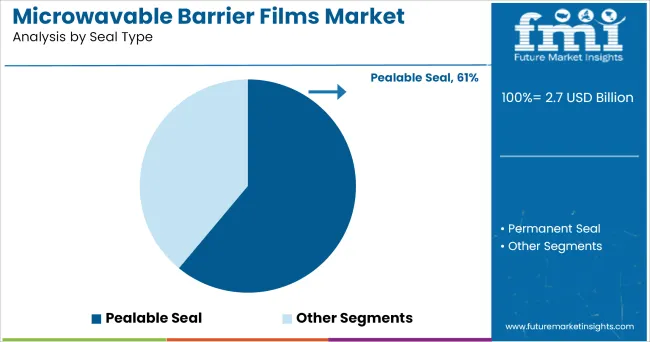

Pealable seal formats are anticipated to hold a dominant 61% revenue share of the microwavable barrier films market in 2025. This leadership is being attributed to their convenience, safety, and tamper-evident properties, which are highly valued in consumer-ready food packaging. Peelable seals allow easy opening without the need for sharp tools or excessive force, enhancing user experience especially in meal kits, single-serve containers, and pre-portioned foods.

Their use helps minimize spillage during microwave heating and ensures product integrity is maintained from production to consumption. In addition, peelable seals support hygienic access, reduce contamination risks, and align with consumer expectations for functional and frustration-free packaging.

As demand grows for senior-friendly and child-safe packaging designs, peelable seals are being increasingly adopted across prepared meals and frozen food categories. The segment’s growth is also being supported by developments in co-extrusion and lamination techniques, enabling strong adhesion during transit and controlled peel strength during opening.

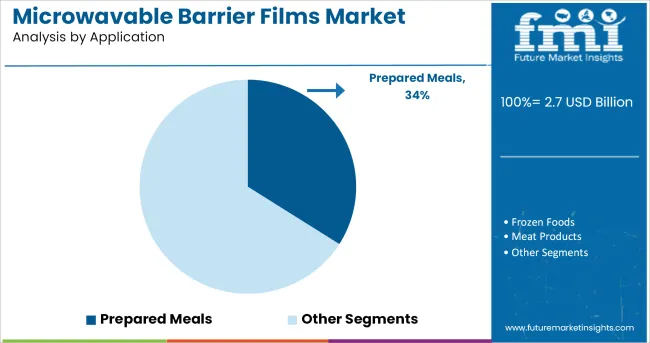

Prepared meals are forecast to hold a 34% share of the microwavable barrier films market in 2025, representing the leading application category. This growth is being driven by increased urbanization, evolving dietary habits, and the global expansion of convenience food options. Microwavable barrier films offer the dual advantage of preserving flavor and extending shelf life while being microwave safe, making them ideal for packaging ready meals.

The segment benefits from the compatibility of barrier films with high-speed filling equipment and modified atmosphere packaging technologies used in prepared meal processing. With rising consumer demand for portion-controlled, time-saving food formats, food producers are leveraging microwavable films to deliver both functionality and visual appeal.

Additionally, strict hygiene and labeling regulations in the food sector have reinforced the need for packaging that ensures seal integrity and traceability. As meal delivery platforms and chilled ready-to-eat categories continue to scale, prepared meals remain the primary driver of barrier film innovations in this space.

Excellent peel ability, high barrier features, and high transparency of microwavable barrier films make them popular for use in everyday life. The food industry across the globe, is expected to witness more than 10% annual growth in over the coming years.

This has reflected positive growth sentiment especially in the emerging economies. Various allied industries such as retail sector, demand customized offerings of food products, which is expected to positively impact sales of microwavable barrier films in the foreseeable future.

Moreover, adoption of microwavable barrier films for packaging of snacks such as burgers & sandwiches, and bakery & confectionery products is rising significantly. In addition, rising demand for convenient and hygienic methods of cooking food that allow processed food to be moved directly from retail shelves to homes, is estimated to augment the demand for microwavable barrier films during the period under review.

Variation in food consumption habits owing to an increase in per capita disposable income has also encouraged packaging companies to develop new product lines with respect to microwavable barrier films. As nearly 60% - 70% of the demand comes from urban areas, there is a lot of growth opportunities in rural and semi-urban regions. Manufacturers and distributors must work on their product segments to come up with economically-viable microwavable barrier films.

Additionally, multinational corporations are collaborating with local players to establish a strong presence in emerging economies, which is also projected to further drive growth of microwavable barrier films in these regions. Rapid growth in the consumption of processed food in emerging economies is creating new opportunities for microwavable barrier film manufacturers to penetrate in these potentially remunerative industries.

The USA is expected to dominate and lead the growth of the North American market, which is expected to increase due to rising usages of microwavable barrier films in wide range of applications. Consumers in developed nations such as USA, are choosing ready-to-eat meals and frozen food products, despite the growing consciousness about health quotient of foods.

Furthermore, convenience in cooking remains a key factor to shape consumers’ purchasing decisions in USA, which is further projected to transform into lucrative growth avenues for stakeholders in the microwavable barrier films industry.

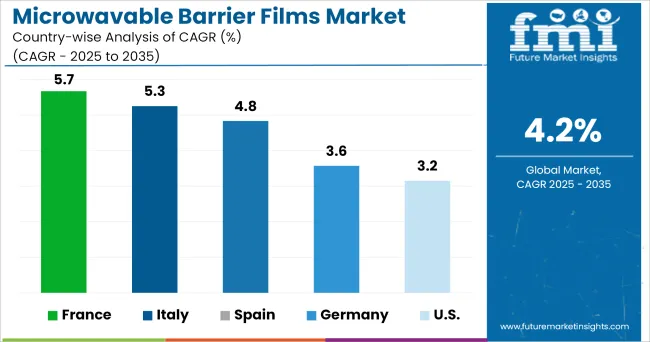

Europe is set to witness a considerable growth in the microwavable barrier films demand owing to rising demand for prepared meals backed by its high quality perception and convenience as compared to canned and frozen foods.

However, nowadays restaurants and other food chains are also more inclined towards frozen food due to rising interest of people in steam-cooked vegetables and various ethnic cuisines which in turn is likely to propel the demand for microwavable barrier films.

Thus, surging demand for convenient and time saving packaging methods and increasing consumption of frozen foods is estimated to flourish the sales for microwavable barrier films at an exponential rate in the European regions.

Some of the leading providers of microwavable barrier films include

The above mentioned players are investing heavily in R&D to bolster innovation in terms of size, shape, technology, and material for microwavable barrier films. Companies are also aiming to gain a competitive edge by employing more sustainable materials and adopting environment-driven business strategies in the production of microwavable barrier films.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global microwavable barrier films market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the microwavable barrier films market is projected to reach USD 4.1 billion by 2035.

The microwavable barrier films market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in microwavable barrier films market are PET (polyethylene terephthalate), amorphous pet, crystalline pet, recycled pet, PE (polyethylene), pp (polypropylene) and others.

In terms of seal type, pealable seal segment to command 61.0% share in the microwavable barrier films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Barrier System Market Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Barrier Material Market Size and Share Forecast Outlook 2025 to 2035

Barrier Shrink Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Market Share Insights for Barrier Shrink Bag Providers

Key Players & Market Share in the Barrier Coated Paper Industry

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Competitive Landscape of Barrier Packaging Providers

Barrier Film Market Trends & Industry Growth Forecast 2025 to 2035

Europe Barrier Packaging Market Growth – Demand & Forecast 2024-2034

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Barrier Bags Market

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Air Barrier Market Size and Share Forecast Outlook 2025 to 2035

Non-Barrier Bag Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA