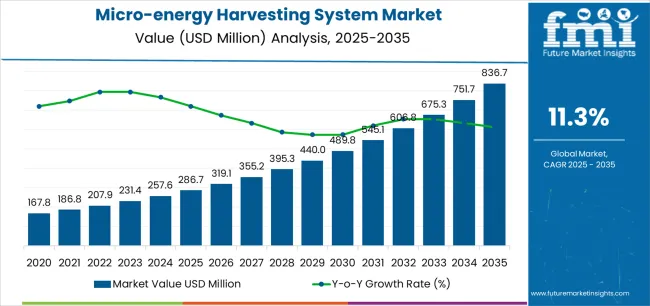

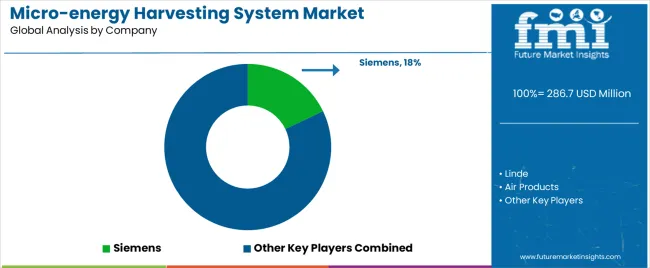

The Micro-energy Harvesting System Market is estimated to be valued at USD 286.7 million in 2025 and is projected to reach USD 836.7 million by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

The micro-energy harvesting system market is gaining momentum due to the growing demand for self-powered electronic devices, advancements in low-power semiconductor technologies, and the expansion of IoT and sensor-based applications. Market growth is being supported by the need for sustainable energy solutions that reduce battery dependence and extend device lifespan.

Current developments focus on optimizing conversion efficiency, improving storage capabilities, and integrating hybrid harvesting mechanisms for consistent energy output. Increasing miniaturization of electronics and the proliferation of wireless sensor networks across industrial, healthcare, and consumer applications are further accelerating adoption.

The future outlook remains positive as industries pursue energy-autonomous systems to lower maintenance costs and enhance operational reliability Growth rationale is anchored in continuous R&D investments, integration of advanced materials for better power density, and the rise of smart infrastructure projects that prioritize energy efficiency and environmental sustainability.

| Metric | Value |

|---|---|

| Micro-energy Harvesting System Market Estimated Value in (2025 E) | USD 286.7 million |

| Micro-energy Harvesting System Market Forecast Value in (2035 F) | USD 836.7 million |

| Forecast CAGR (2025 to 2035) | 11.3% |

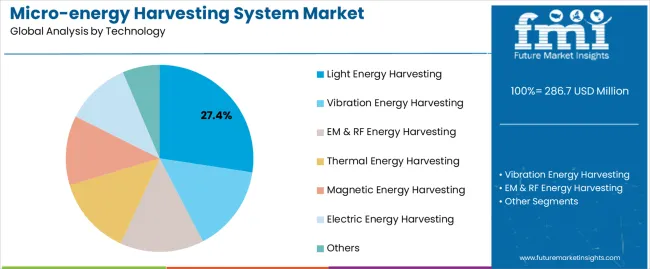

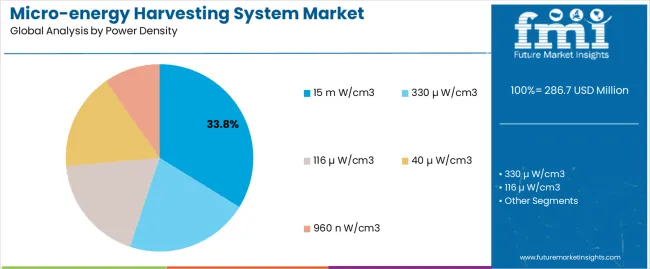

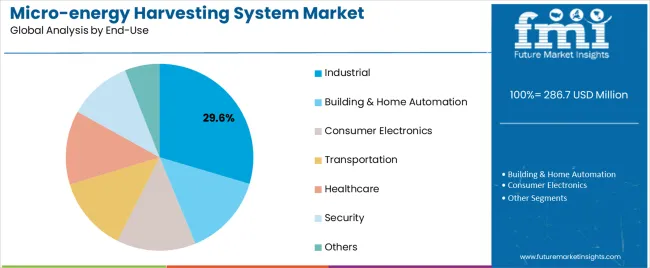

The market is segmented by Technology, Power Density, and End-Use and region. By Technology, the market is divided into Light Energy Harvesting, Vibration Energy Harvesting, EM & RF Energy Harvesting, Thermal Energy Harvesting, Magnetic Energy Harvesting, Electric Energy Harvesting, and Others. In terms of Power Density, the market is classified into 15 m W/cm3, 330 µ W/cm3, 116 µ W/cm3, 40 µ W/cm3, and 960 n W/cm3. Based on End-Use, the market is segmented into Industrial, Building & Home Automation, Consumer Electronics, Transportation, Healthcare, Security, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The light energy harvesting segment, accounting for 27.40% of the technology category, has emerged as the leading technology due to its versatility, scalability, and proven efficiency across a wide range of indoor and outdoor environments. Its market share has been strengthened by advancements in photovoltaic materials and the ability to generate stable energy output from low-intensity light sources.

Adoption has been supported by its integration into wireless sensors, portable devices, and building automation systems. The technology’s compatibility with existing electronic architectures and its reduced maintenance requirements have further enhanced market preference.

Ongoing innovation in thin-film and organic photovoltaic technologies is expected to improve conversion efficiency and reduce production costs As a result, the light energy harvesting segment continues to dominate applications requiring dependable, compact, and cost-effective power generation within the micro-energy harvesting ecosystem.

The 15 mW/cm³ power density category, holding 33.80% of the segment, has maintained leadership owing to its optimal balance between energy output and device compactness. This configuration has proven suitable for low-power electronics such as IoT nodes, wearables, and remote monitoring systems.

Market dominance is being reinforced by consistent R&D focus on optimizing transducer efficiency and storage integration to achieve stable power delivery under varying conditions. Manufacturers have increasingly adopted this specification for commercial and industrial devices, where moderate yet reliable power density is crucial for long-term functionality.

The segment’s scalability, cost efficiency, and alignment with standardized energy requirements are enabling broader application across multiple sectors Continued material innovation and power management advancements are expected to sustain its leading position over the forecast period.

The industrial segment, representing 29.60% of the end-use category, has emerged as the leading application area due to the growing adoption of IoT-based monitoring systems, predictive maintenance solutions, and autonomous sensor networks. Its dominance has been supported by widespread deployment in manufacturing facilities, energy plants, and logistics infrastructure, where uninterrupted power supply for sensors and controllers is essential.

Implementation of energy harvesting systems in industrial environments has reduced dependence on manual battery replacement and improved overall operational efficiency. Integration with automation frameworks and industrial IoT platforms has further enhanced performance reliability.

The segment’s growth is being strengthened by ongoing digital transformation, the expansion of smart factories, and increased focus on sustainability within industrial operations These factors are expected to ensure the industrial segment maintains its leading position and continues to drive the overall market trajectory.

Market to Expand Over 2.1x through 2035

The global micro-energy harvesting system market is predicted to expand by over 2.1x through 2035. Materials science and engineering advances are critical in improving the efficiency and scalability of micro-energy harvesting systems.

The global micro-energy harvesting system market grew at a CAGR of 7.2% between 2020 and 2025.

| Historical CAGR (2020 to 2025) | 7.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 11.9% |

In the forecast period, the worldwide micro-energy harvesting system industry is set to thrive at a CAGR of 11.9%.

Increasing Emphasis on Sustainability and Energy Efficiency

Growing focus on sustainability and energy efficiency are expected to drive the micro energy harvesting industry. Rising demand for energy-efficient solutions, driven by environmental concerns, necessitates the adoption of micro energy harvesting technologies as sustainable alternatives to traditional power sources.

Micro energy harvesting systems convert ambient energy into electrical power, reducing pollution & carbon emissions and lowering reliance on harmful fossil fuels.

Adoption of Micro-energy Harvesting Technologies in Consumer Electronics

Energy harvesting capabilities are becoming increasingly ingrained in consumer electronics as manufacturers respond to consumer requests for sustainability, longer battery life, and enhanced convenience. Increasing popularity of portable electronics like smartphones, smartwatches, fitness trackers, and wireless earphones is a key driver propelling this adoption.

The table below shows the estimated growth rates of several countries in the market. India, China, and the United States are set to record high CAGRs of 8.5%, 8%, and 7.1% respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

| China | 8% |

| United States | 7.1% |

| United Kingdom | 6.8% |

| Germany | 6.5% |

The United States micro-energy harvesting system industry is poised to exhibit a CAGR of 7.1% during the assessment period.

Demand for micro-energy harvesting systems in China is anticipated to rise at a steady CAGR of 8% during the forecast period. This is attributable to a combination of factors, including:

India is expected to surge at a CAGR of 8.5% through 2035. Top factors supporting the market expansion in the country include:

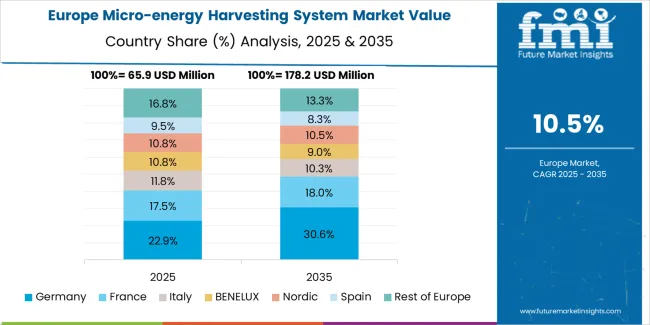

The micro-energy harvesting system market is projected to increase in Germany at a CAGR of 6.5% through 2035.

Demand for micro-energy harvesting systems is increasing in the United Kingdom, with a projected CAGR of 6.8% through 2035. Emerging patterns in the United Kingdom market are as follows:

The section below shows the light energy harvesting segment dominating based on technology. It is forecast to thrive at 9.2% CAGR between 2025 and 2035. Based on end-use, the consumer electronics segment is anticipated to thrive at a CAGR of 9.1% during the forecast period.

| Top Segment (Technology) | Light Energy Harvesting |

|---|---|

| Predicted CAGR (2025 to 2035) | 9.2% |

| Top Segment (End-use) | Consumer Electronics |

|---|---|

| Projected CAGR (2025 to 2035) | 9.1% |

The global micro-energy harvesting system market is fragmented, with leading players accounting for around 25% to 30% share. ABB Ltd., EnOcean GmbH, STMicroelectronics N.V., Cymbet Corporation, and Powercast Corporation are the leading companies listed in the report.

Key micro-energy harvesting system companies invest in continuous research to produce new products and increase their production capacity to meet end-user demand.

They are directed toward adopting growth strategies such as acquisitions, partnerships, mergers, and facility expansions to strengthen their footprint.

Recent Developments

The global micro-energy harvesting system market is estimated to be valued at USD 286.7 million in 2025.

The market size for the micro-energy harvesting system market is projected to reach USD 836.7 million by 2035.

The micro-energy harvesting system market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in micro-energy harvesting system market are light energy harvesting, vibration energy harvesting, em & rf energy harvesting, thermal energy harvesting, magnetic energy harvesting, electric energy harvesting and others.

In terms of power density, 15 m w/cm3 segment to command 33.8% share in the micro-energy harvesting system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cell Harvesting Systems Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Vessel Harvesting System Market Size, Share, and Forecast 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Post Harvesting Technologies Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA