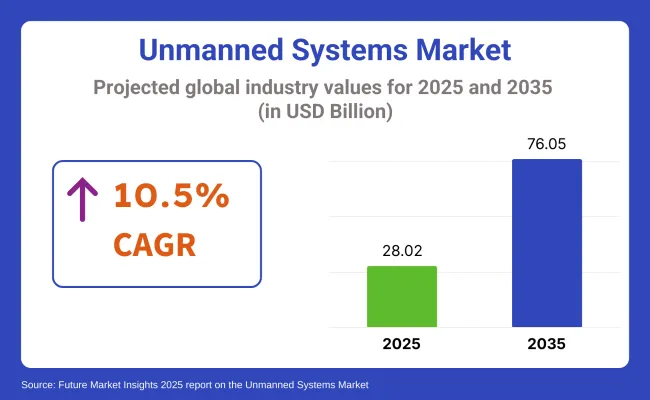

The global unmanned systems market is projected to grow from USD 28.02 billion in 2025 to USD 76.05 billion by 2035, reflecting a CAGR of 10.5% during the forecast period. The increasing demand for autonomous and semi-autonomous platforms in defense, surveillance, logistics, and industrial sectors drives this growth.

Geopolitical uncertainties and the intensification of defense modernization programs are pushing military and law enforcement agencies to deploy unmanned aerial, ground, and maritime vehicles for critical operations, including reconnaissance, surveillance, and tactical missions.

In an official PR published on the company website, ZenaTech announced that ZenaDrone 1000 will accelerate the deployment of its Counter-UAS technology following a USA Executive Order aimed at enhancing airspace control. The drone, originally developed in 2024, will now feature real-time threat detection and neutralization for defense, surveillance, and infrastructure protection. ZenaTech plans to file a patent and expand its engineering teams to support this initiative, capitalizing on the growing demand for USA-made counter-UAS technologies.

The market holds varying shares within its parent markets. In the aerospace & defense market, unmanned technologies, particularly UAVs and UGVs, represent around 15-20%, driven by their increasing use in military and surveillance operations. Within the robotics industry, unmanned technologies account for about 10-12%, as they are a significant subset of autonomous robotic applications. In the artificial intelligence (AI) industry, unmanned technologies contribute approximately 8-10%, as AI plays a crucial role in enhancing the autonomy and decision-making of these systems.

Within the IoTindustry, unmanned technologies represent about 5-7%, given their reliance on IoT for connectivity and data transfer. In the automation & control systems industry, unmanned technologies contribute roughly 12-15%, reflecting their growing importance in industrial automation

These sectors are being propelled by defense modernization programs, the integration of artificial intelligence (AI), and enhanced operational flexibility across various global industries.

Unmanned aerial vehicles (UAVs) are expected to dominate the industry, holding a 25% share in 2025.

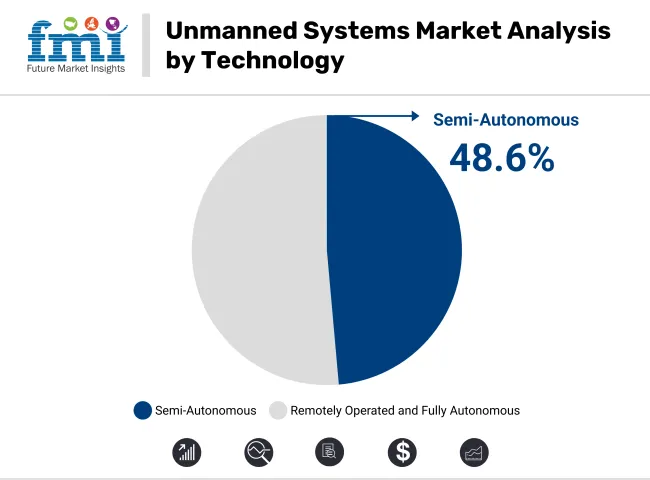

The semi-autonomous segment is forecasted to hold a commanding 48.6% share by 2025, owing to its ability to blend human oversight with automated decision-making. This equilibrium enhances mission reliability while maintaining adaptability in uncertain operational settings.

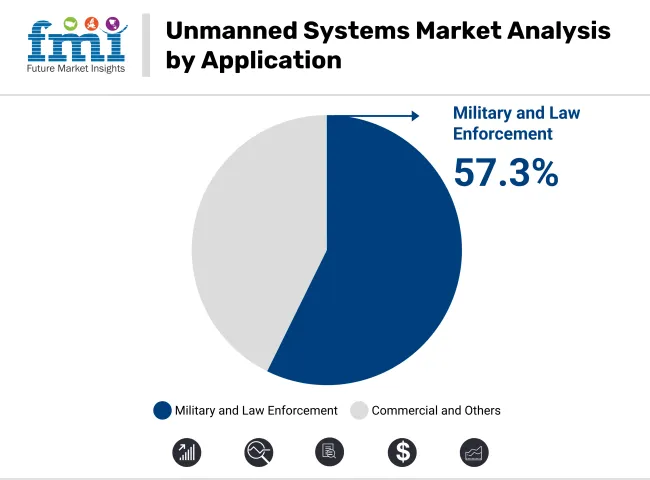

Military and law enforcement applications are projected to dominate the industry, capturing a 57.3% share in 2025. This dominance stems from sustained defense spending increases and the pressing need for advanced security solutions.

Key trends observed in the market include increase in focus on automation, AI integration, and regional manufacturing to meet stringent performance and regulatory needs.

Demand Driven by Defense Amid Industry Overcrowding

Defense interest in small UAVs has surged, with low-cost FPV drones being prioritized by the USA Department of Defense, inspired by lessons from Ukraine. Contracts are being pursued by startups, but large procurement deals are expected to be won by only a few firms due to scalability and capability demands. Acquisitions are now centered around platforms resilient to electronic warfare and affordability.

Commercial and Industrial Adoption Promoting Technological Integration

The enterprise usage of unmanned technologies in sectors like logistics and agriculture is growing, driven by technologies such as AI-powered navigation and sensor fusion. North America leads in adopting semi-autonomous UAVs, UGVs, and UMVs. Investments are being made to supply high-reliability systems to OEMs for various industrial applications.

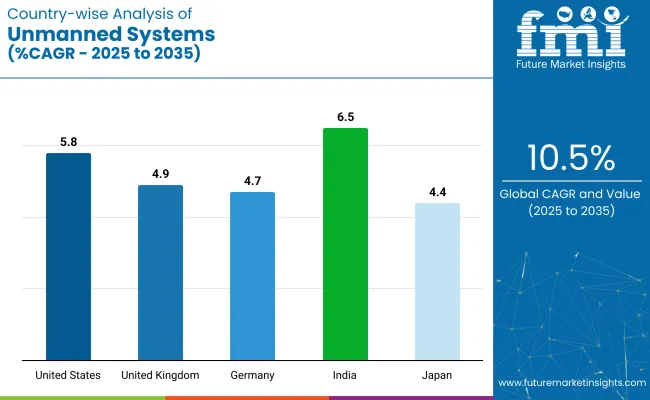

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 4.9% |

| Germany | 4.7% |

| India | 6.5% |

| Japan | 4.4% |

The Unmanned Systems market, with a global CAGR of 10.5%, exhibits significant growth disparities across regions. India (BRICS) leads the growth with 6.5% CAGR, driven by rapid advancements in defense and commercial drone technologies, as well as increased investment in this systems for logistics and surveillance. The United States (OECD) follows with a 5.8% CAGR, supported by strong government and military demand for these systems in both defense and commercial sectors.

The United Kingdom (OECD), Germany (OECD), and Japan (OECD) show slower growth, with 4.9%, 4.7%, and 4.4% CAGR, respectively, reflecting a more mature market with slower integration. While OECD countries display steady but moderate growth, India offers the highest potential due to its expanding defense capabilities and growing industry for commercial unmanned technologies.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The demand for unmanned systems in the United States is forecast to grow at a CAGR of 5.8% from 2025 to 2035. Growth is being supported by large defense budgets, continuous R&D investments, and the strong industry presence of companies such as Lockheed Martin, Northrop Grumman, and General Atomics.

Military adoption for ISR (Intelligence, Surveillance, Reconnaissance), combat, and border patrol remains a core driver. Civil applications in agriculture, energy, and last-mile delivery are accelerating due to favorable FAA guidelines and innovation grants. Technological advances in AI, data processing, and propulsion systems are reinforcing the USA’s leadership.

The UK unmanned systems market is anticipated to grow at a CAGR of 4.9% from 2025 to 2035. Growth is stemming from defense modernization efforts and the deployment of unmanned solutions for civil security. Leading companies like BAE Systems and QinetiQ are developing dual-purpose platforms for both military and commercial operations.

The government’s clear UAV regulations and early adoption of unmanned maritime technologies are contributing to industry strength. Collaboration with European defense entities and a focus on surveillance and search-and-rescue operations are enhancing competitiveness.

The demand for unmanned systems in Germany is projected to grow at a CAGR of 4.7% between 2025 and 2035. The country’s push for Industry 4.0 and automation is stimulating demand for UAVs and UGVs in industrial inspection, logistics, and urban planning. Defense modernization includes upgrading surveillance UAV fleets for reconnaissance missions.

Local companies like Rheinmetall and Airbus Defence and Space are at the forefront of technological innovation. The German government is supporting autonomous mobility research with EU-aligned regulatory policies and public funding, providing a stable environment for unmanned system advancement.

The Indian unmanned systems market is forecast to grow at the highest global CAGR of 6.5% from 2025 to 2035. Growth is being driven by the Make in India initiative and efforts to enhance domestic production of UAVs and UGVs for defense and surveillance.

Organizations like DRDO and private startups are developing cost-effective, versatile unmanned platforms for border security, disaster response, and agriculture. Government reforms, relaxed FDI norms, and rising demand for smart surveillance solutions are encouraging innovation. India is emerging as a center for manufacturing, development, and export in Asia.

Sales of unmanned systems in Japan is expected to grow at a 4.4% CAGR from 2025 to 2035. The country is leveraging its expertise in robotics to integrate UAVs and UGVs into industrial automation, urban air mobility, and disaster response operations. Companies like Yamaha and Mitsubishi Electric are driving innovation in precision agriculture, infrastructure monitoring, and emergency relief solutions.

Government initiatives to promote autonomous technology adoption, combined with labor shortages due to an aging population, are boosting demand across multiple sectors. Japan’s focus on merging robotics with unmanned technologies positions it as a technological leader in next-generation autonomous solutions.

Leading players such as Northrop Grumman, Lockheed Martin, Boeing, General Dynamics, and L3Harris Technologies dominate through large defense contracts, integrated capabilities, and extensive R&D. Emerging companies, including Teledyne Technologies, Textron Inc., Thales, and Israel Aerospace Industries, address specialized defense and commercial segments with flexible, mission-specific platforms.

Key players like DJI and Elbit Systems focus on cost-effective, commercially scalable solutions. While industry fragmentation persists, increasing mergers, collaborations, and cross-sector innovation are steadily fostering consolidation among top industry participants.

Recent Unmanned Systems Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025E) | USD 28.02 billion |

| Projected Industry Size (2035F) | USD 76.05 billion |

| CAGR (2025 to 20 35) | 10.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value & Thousand U nits for Volume |

| By Type (Segment 1) | Unmanned Aerial Vehicles (Small UAVs, Medium UAVs, Large UAVs), Unmanned Ground Vehicles (Wheeled, Tracked, Legged, Hybrid), Unmanned Sea Vehicles (UUVs, USVs) |

| By Technology (Segment 2) | Semi-Autonomous, Remotely Operated, Fully Autonomous |

| By Application (Segment 3) | Military and Law Enforcement, Commercial, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Countries Covered | USA , Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa |

| Key Players | Northrop Grumman, Lockheed Martin Corporation, Teledyne Technologies Inc., BAE Systems, DJI, Thales, Israel Aerospace Industries, Boeing, General Dynamics Corporation, Textron Inc., L3Harris Technologies Inc., Elbit Systems Ltd. |

| Additional Attributes | Dollar sales, share, military modernization programs, commercial drone applications, UGV development trends, AI-powered autonomy, cross-domain unmanned integrations |

The industry segmented into unmanned aerial vehicles (UAVs) (small UAVs, medium UAVs, and large UAVs), unmanned ground vehicles (UGVs) (wheeled, tracked, legged, and hybrid systems), and unmanned sea vehicles (unmanned underwater vehicles (UUVs) and unmanned surface vehicles (USVs)).

The industry covers semi-autonomous, remotely operated, and fully autonomous systems.

The industry encompasses military and law enforcement, commercial, and others.

The industry is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The industry is projected to reach USD 76.05 billion by 2035.

The market size is expected to be USD 28.02 billion in 2025.

The industry is expected to grow at a CAGR of 10.5% from 2025 to 2035.

The semi-autonomous segment is projected to hold a 48.6% share in 2025.

Military and law enforcement applications are expected to account for 57.3% of the industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Surface Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Marine Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Ground Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Aerial Vehicles (UAV) Commercial Drone Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA