The global micron CBN powder market is projected to reach USD 523.5 million by 2035, recording an absolute increase of USD 225.6 million over the forecast period. The market is valued at USD 297.9 million in 2025 and is set to rise at a CAGR of 5.8% during the assessment period. The overall market size is expected to grow by nearly 1.8 times during the same period, supported by increasing demand for advanced abrasive materials in precision machining and grinding applications, driving adoption of high-performance superhard abrasives and expanding investments in automotive component manufacturing and semiconductor processing operations globally.

The market expansion reflects growing requirements for ultra-precision surface finishing capabilities in modern manufacturing systems, where micron CBN powder delivers superior grinding performance and tool life extension compared to conventional abrasive materials. Manufacturing facilities across automotive components, aerospace precision parts, and cutting tool production are implementing micron CBN technology to achieve tighter surface finish tolerances and faster material removal rates. The integration of these specialized abrasive powders with vitrified bond systems and resin bond grinding wheels enables manufacturers to process hardened steels, heat-resistant alloys, and difficult-to-machine materials with exceptional efficiency and dimensional accuracy requirements.

Industrial adoption accelerates as precision manufacturing operations seek to optimize grinding performance and minimize tool wear in high-value component production. The proliferation of hardened steel components in automotive powertrains creates sustained demand for CBN grinding solutions capable of maintaining form accuracy and surface finish quality across extended production runs. Micron CBN powder with particle sizes ranging from 0.5 to 40 microns offers tailored grinding characteristics for specific applications, enabling manufacturers to select optimal abrasive specifications for camshaft grinding, crankshaft finishing, bearing raceway production, and gear tooth surface treatment operations.

Cutting tool manufacturers are incorporating micron CBN powder into vitrified grinding wheels for high-speed steel tool sharpening and carbide insert edge preparation where abrasive hardness and thermal stability directly impact grinding efficiency. Semiconductor manufacturing facilities implement ultra-fine CBN powder for wafer backgrinding and silicon substrate preparation applications requiring atomic-level surface quality and minimal subsurface damage. However, higher material costs compared to aluminum oxide and silicon carbide abrasives and specialized bonding system requirements may pose challenges to market expansion in cost-sensitive grinding applications and markets with traditional abrasive material preferences.

Between 2025 and 2030, the micron CBN powder market is projected to expand from USD 297.9 million to USD 394.9 million, resulting in a value increase of USD 97.0 million, which represents 43.0% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for precision grinding solutions in automotive and aerospace manufacturing, product innovation in powder surface treatment technologies and particle size distribution control, as well as expanding integration with advanced grinding wheel bonding systems and automated surface finishing platforms. Companies are establishing competitive positions through investment in advanced CBN synthesis technologies, powder coating capabilities, and strategic market expansion across automotive component grinding, cutting tool manufacturing, and semiconductor processing applications.

From 2030 to 2035, the market is forecast to grow from USD 394.9 million to USD 523.5 million, adding another USD 128.6 million, which constitutes 57.0% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized powder formulations, including ultra-fine particle distributions for semiconductor applications and customized coating systems tailored for specific grinding wheel bonding requirements, strategic collaborations between CBN powder manufacturers and grinding wheel producers, and an enhanced focus on grinding performance consistency and abrasive cost efficiency optimization. The growing emphasis on precision manufacturing and surface quality requirements will drive demand for advanced, high-performance micron CBN powder solutions across diverse grinding and finishing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 297.9 million |

| Market Forecast Value (2035) | USD 523.5 million |

| Forecast CAGR (2025-2035) | 5.8% |

The micron CBN powder market grows by enabling manufacturers to achieve superior grinding performance and extended tool life while processing hardened materials in precision manufacturing operations. Grinding wheel producers and manufacturing facilities face mounting pressure to improve surface finish quality and production efficiency, with micron CBN abrasives typically providing 3-5 times longer grinding wheel life over aluminum oxide alternatives, making these superhard materials essential for competitive precision machining operations. The automotive and aerospace industries' need for high-precision grinding creates demand for advanced CBN powder solutions that can maintain dimensional accuracy, achieve excellent surface finishes, and ensure consistent grinding performance across hardened steels and heat-resistant alloys used extensively in powertrain components and structural parts.

Precision manufacturing initiatives promoting advanced abrasive technology and surface quality optimization drive adoption in automotive component production, cutting tool manufacturing, and bearing raceway grinding applications, where abrasive performance has a direct impact on component quality and manufacturing costs. The global shift toward hardened steel components and stringent surface finish requirements accelerates micron CBN powder demand as grinding operations seek abrasive solutions that deliver consistent performance in high-removal-rate applications and precision finishing operations where conventional abrasives experience rapid wear. However, higher powder costs compared to conventional abrasives and specialized grinding wheel manufacturing expertise may limit adoption rates among small-scale grinding operations and regions with traditional abrasive grinding practices and limited access to advanced superhard abrasive technologies.

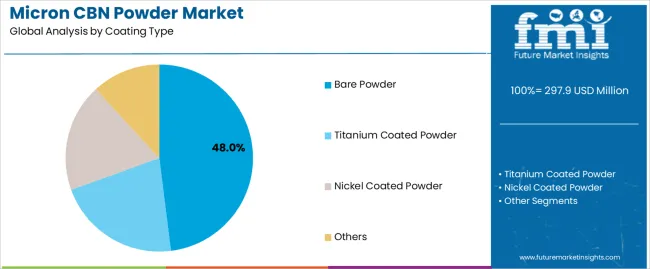

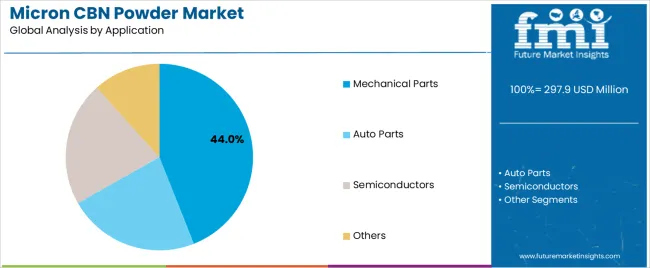

The market is segmented by coating type, application, and region. By coating type, the market is divided into bare powder, titanium coated powder, nickel coated powder, and others. Based on application, the market is categorized into mechanical parts, auto parts, semiconductors, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The bare powder segment represents the dominant force in the micron CBN powder market, capturing approximately 48.0% of total market share in 2025. This advanced category encompasses uncoated CBN particles in various size distributions, mesh ranges, and crystal morphologies optimized for vitrified bond grinding wheel production, delivering excellent bonding characteristics and superior grinding performance in precision machining applications. The bare powder segment's market leadership stems from its versatile bonding compatibility, proven performance reliability in vitrified grinding wheel systems, and cost-effective processing requirements compared to surface-treated alternatives.

The titanium coated powder segment maintains a substantial 28.0% market share, serving applications requiring enhanced bond strength through metallic coating interfaces and improved dispersion characteristics in resin bond grinding wheels. The nickel coated powder segment accounts for 16.0% market share, featuring electroless nickel plating for metal bond diamond tool applications and specialized grinding wheel formulations. Other coating types constitute 8.0% market share, encompassing copper-coated variants and specialized surface treatments for niche grinding requirements.

Key advantages driving the bare powder segment include:

Mechanical parts applications dominate the micron CBN powder market with approximately 44.0% market share in 2025, reflecting the extensive adoption of CBN grinding solutions across bearing raceway production, hydraulic component finishing, and precision mechanical component manufacturing operations. The mechanical parts segment's market leadership is reinforced by widespread implementation in bearing grinding (17.0%), shaft finishing operations (15.0%), and gear manufacturing (12.0%), which provide essential surface quality advantages and production efficiency in demanding mechanical component production environments.

The auto parts segment represents 32.0% market share through specialized applications including camshaft grinding (13.0%), crankshaft finishing (11.0%), and transmission component production (8.0%). Semiconductors account for 14.0% market share, driven by adoption in wafer backgrinding (7.0%), substrate preparation (5.0%), and precision lapping operations (2.0%). Other applications constitute 10.0% market share, encompassing cutting tool manufacturing, aerospace component grinding, and mold finishing requirements.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to precision manufacturing and efficiency outcomes. First, automotive industry expansion creates increasing requirements for efficient grinding solutions, with global automotive component production requiring millions of camshafts, crankshafts, and transmission parts annually in major markets worldwide, demanding reliable micron CBN grinding wheels for hardened steel surface finishing where dimensional tolerances below 5 microns and surface roughness under 0.4 Ra are standard requirements. Second, bearing industry growth and precision requirements drive adoption of advanced grinding technology, with micron CBN powder enabling raceway grinding operations to achieve surface finish specifications below 0.2 Ra while maintaining grinding wheel form accuracy across production runs exceeding 10,000 components per wheel dress cycle. Third, semiconductor manufacturing expansion and wafer size increases accelerate deployment of ultra-fine CBN abrasives, with micron CBN powder providing essential material removal capabilities in silicon wafer backgrinding operations where thickness uniformity requirements below 2 microns and surface damage depths under 5 microns are critical for device yield optimization.

Market restraints include cost premiums affecting high-volume grinding operations and price-sensitive manufacturing applications, particularly where conventional aluminum oxide abrasives provide adequate performance for less demanding grinding requirements and where abrasive cost per component targets below specific thresholds drive purchasing decisions toward commodity grinding wheel solutions. Technical expertise requirements for optimal grinding wheel formulation pose adoption challenges for smaller grinding wheel manufacturers lacking specialized knowledge, as micron CBN powder performance depends heavily on proper particle size selection, concentration optimization, and bond system compatibility that differ significantly from conventional abrasive grinding wheel manufacturing practices. Limited awareness of total cost advantages in traditional grinding markets creates additional barriers, as manufacturing operations focused on initial wheel cost rather than grinding wheel life and total grinding cost per component may overlook productivity benefits available through CBN abrasive technology adoption.

Key trends indicate accelerated adoption in Asian automotive component manufacturing hubs, particularly China and India, where automotive production capabilities and precision grinding operations are expanding rapidly through industry modernization programs and increasing quality requirements in domestic and export automotive supply chains. Technology advancement trends toward nano-scale CBN powder for ultra-precision grinding applications, customized surface coating formulations for enhanced bond strength, and integrated quality control systems ensuring consistent particle size distributions are driving next-generation product development. However, the market thesis could face disruption if advanced ceramic abrasive technologies achieve breakthrough performance capabilities in hardened steel grinding, potentially offering competitive alternatives to CBN powder in specific grinding applications where cost and performance characteristics align with manufacturing requirements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.8% |

| India | 7.2% |

| Germany | 6.6% |

| Brazil | 6.0% |

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.3% |

The micron CBN powder market is gaining momentum worldwide, with China taking the lead thanks to aggressive automotive component manufacturing expansion and precision grinding technology adoption programs. Close behind, India benefits from growing automotive parts production and government manufacturing initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding automotive component operations and precision manufacturing infrastructure development strengthen its role in South American abrasive materials markets.

The USA demonstrates robust growth through advanced manufacturing initiatives and bearing industry investment, signaling continued adoption in precision grinding applications. Meanwhile, Japan stands out for its precision grinding expertise and advanced abrasive technology integration, while UK and Germany continue to record consistent progress driven by automotive engineering excellence and cutting tool manufacturing. Together, China and India anchor the global expansion story, while established markets build stability and technology innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Micron CBN Powder Market with a CAGR of 7.8% through 2035. The country's leadership position stems from comprehensive automotive component manufacturing expansion, intensive precision grinding technology development programs, and aggressive manufacturing quality improvement targets driving adoption of advanced superhard abrasive materials. Growth is concentrated in major automotive production regions, including Guangdong, Jiangsu, Zhejiang, and Shandong, where automotive component suppliers, bearing manufacturers, and cutting tool producers are implementing micron CBN grinding solutions for quality enhancement and productivity improvement.

Distribution channels through abrasive material distributors, grinding wheel manufacturers, and direct powder supplier relationships expand deployment across automotive grinding operations, bearing production facilities, and precision component manufacturing centers. The country's Made in China 2025 initiative provides policy support for advanced manufacturing technology adoption, including subsidies for precision grinding equipment implementation and superhard abrasive material development.

Key market factors:

In the National Capital Region, Maharashtra, Tamil Nadu, and Gujarat industrial zones, the adoption of micron CBN powder systems is accelerating across automotive component manufacturing, bearing production facilities, and precision grinding operations, driven by Make in India initiatives and increasing focus on manufacturing quality competitiveness. The market demonstrates strong growth momentum with a CAGR of 7.2% through 2035, linked to comprehensive automotive sector expansion and increasing investment in precision manufacturing capabilities.

Indian manufacturers are implementing micron CBN grinding technology and advanced abrasive platforms to improve component quality while meeting stringent surface finish requirements in automotive and bearing supply chains serving domestic and export markets. The country's National Manufacturing Policy creates sustained demand for advanced abrasive solutions, while increasing emphasis on precision engineering drives adoption of superhard grinding materials that enhance manufacturing quality standards.

Germany's advanced precision manufacturing sector demonstrates sophisticated implementation of micron CBN powder systems, with documented case studies showing 40-45% grinding wheel life extension in automotive component grinding operations through optimized abrasive selection strategies.

The country's grinding technology infrastructure in major industrial regions, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony, showcases integration of CBN abrasive technologies with existing precision grinding centers, leveraging expertise in automotive component production and bearing manufacturing excellence. German manufacturers emphasize quality standards and grinding performance optimization, creating demand for reliable micron CBN powder solutions that support productivity commitments and stringent surface finish requirements. The market maintains strong growth through focus on precision manufacturing leadership and grinding technology innovation, with a CAGR of 6.6% through 2035.

Key development areas:

The Brazilian market leads in Latin American micron CBN powder adoption based on expanding automotive component manufacturing operations and growing precision grinding infrastructure in major production centers. The country shows solid potential with a CAGR of 6.0% through 2035, driven by automotive sector investment and increasing domestic demand for precision-ground components across vehicle platforms, bearing applications, and industrial machinery sectors.

Brazilian manufacturers are adopting micron CBN grinding technology for compliance with automotive component quality standards, particularly in engine component production requiring precise surface finishes and in transmission part grinding where abrasive performance impacts dimensional accuracy. Technology deployment channels through abrasive distributors, grinding wheel suppliers, and equipment representatives expand coverage across automotive supply chains and precision grinding facilities.

Leading market segments:

The USA market leads in advanced micron CBN powder applications based on integration with sophisticated grinding systems and comprehensive precision manufacturing platforms for enhanced component quality. The country shows solid potential with a CAGR of 5.5% through 2035, driven by bearing industry requirements and increasing adoption of advanced grinding technologies across automotive, aerospace, and cutting tool manufacturing sectors.

American manufacturers are implementing micron CBN grinding systems for high-precision finishing requirements, particularly in aerospace component production demanding tight tolerances and in bearing raceway grinding where surface finish quality directly impacts product performance. Technology deployment channels through abrasive distributors, grinding wheel manufacturers, and direct supplier relationships expand coverage across diverse precision grinding applications.

Leading market segments:

The UK market demonstrates consistent implementation focused on automotive component production and precision engineering applications, with documented integration of micron CBN powder systems achieving 30-35% grinding wheel life improvements in component finishing operations. The country maintains steady growth momentum with a CAGR of 4.9% through 2035, driven by automotive manufacturing presence and precision engineering requirements for advanced grinding capabilities in component production. Major industrial regions, including West Midlands, North West England, and South Wales, showcase deployment of CBN grinding technologies that integrate with existing precision manufacturing infrastructure and support quality requirements in automotive and aerospace supply chains.

Key market characteristics:

Japan's micron CBN powder market demonstrates sophisticated implementation focused on automotive component production and precision bearing manufacturing, with documented integration of advanced CBN grinding systems achieving 35-38% productivity improvements in high-precision grinding operations. The country maintains steady growth momentum with a CAGR of 4.3% through 2035, driven by manufacturing excellence culture and emphasis on grinding quality optimization principles aligned with precision manufacturing philosophies. Major industrial regions, including Aichi, Kanagawa, Osaka, and Shizuoka, showcase advanced deployment of CBN abrasive technologies that integrate seamlessly with precision grinding centers and comprehensive quality control systems.

Key market characteristics:

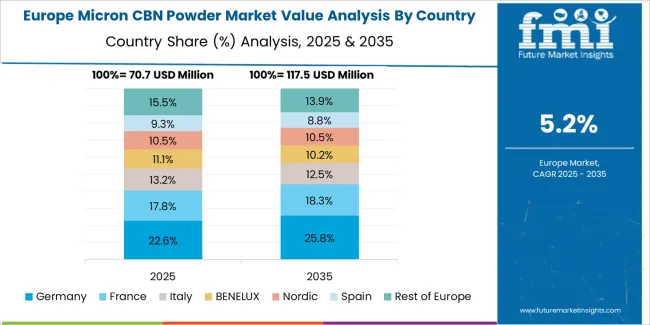

The micron CBN powder market in Europe is projected to grow from USD 109.6 million in 2025 to USD 159.9 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 36.2% market share in 2025, declining slightly to 35.7% by 2035, supported by its extensive automotive component manufacturing infrastructure and major precision grinding centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia production regions.

France follows with a 17.8% share in 2025, projected to reach 18.1% by 2035, driven by comprehensive automotive component production and bearing manufacturing programs in major industrial regions. The United Kingdom holds a 14.3% share in 2025, expected to reach 14.5% by 2035 through automotive component engineering centers and precision grinding facilities.

Italy commands a 12.9% share in both 2025 and 2035, backed by automotive component production and cutting tool manufacturing. Spain accounts for 7.5% in 2025, rising to 7.7% by 2035 on automotive component operations and precision manufacturing growth. The Rest of Europe region is anticipated to hold 11.3% in 2025, expanding to 12.0% by 2035, attributed to increasing micron CBN powder adoption in Nordic countries and emerging Central & Eastern European automotive component manufacturing operations.

The Japanese micron CBN powder market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of bare powder abrasive systems with existing vitrified grinding wheel manufacturing infrastructure across automotive component production, bearing manufacturing, and cutting tool grinding operations. Japan's emphasis on grinding precision and surface quality optimization drives demand for high-performance CBN abrasives that support quality commitments and productivity targets in competitive precision manufacturing environments.

The market benefits from strong partnerships between international CBN powder providers and domestic grinding wheel manufacturers including major abrasive companies, creating comprehensive service ecosystems that prioritize technical support and application engineering programs. Manufacturing centers in Aichi, Kanagawa, Osaka, and other major automotive production areas showcase advanced grinding implementations where micron CBN powder systems achieve 98% surface finish consistency compliance through optimized abrasive specifications and comprehensive grinding parameter control.

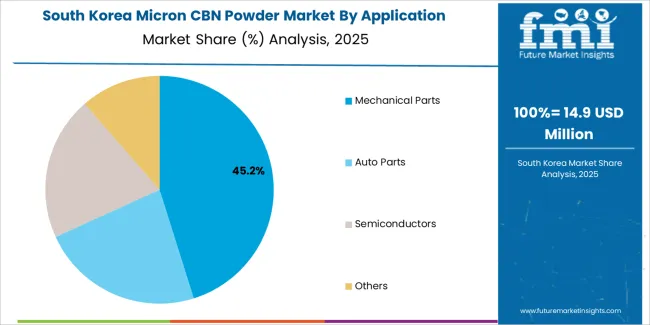

The South Korean micron CBN powder market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical support and application engineering capabilities for automotive component manufacturing and precision grinding applications. The market demonstrates increasing emphasis on manufacturing quality and grinding performance enhancement, as Korean manufacturers increasingly demand advanced CBN abrasives that integrate with domestic precision grinding infrastructure and sophisticated quality control systems deployed across major automotive manufacturing complexes.

Regional abrasive distributors are gaining market share through strategic partnerships with international powder manufacturers, offering specialized services including grinding wheel formulation support and application-specific abrasive recommendations for automotive and bearing production operations. The competitive landscape shows increasing collaboration between multinational CBN powder companies and Korean grinding technology specialists, creating hybrid service models that combine international material development expertise with local technical support capabilities and rapid response systems.

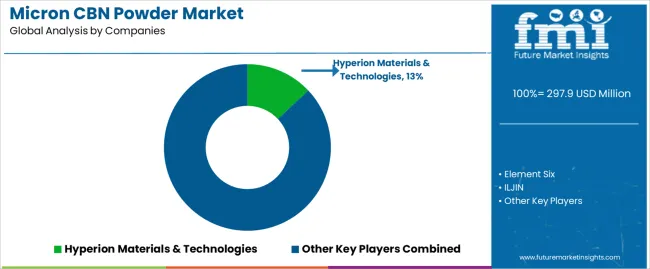

The micron CBN powder market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 32-36% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on powder quality consistency, particle size distribution control, and technical support capabilities rather than price competition alone. Hyperion Materials & Technologies leads with approximately 13.0% market share through its comprehensive superhard abrasive materials portfolio and global grinding wheel industry presence.

Market leaders include Hyperion Materials & Technologies, Element Six, and ILJIN, which maintain competitive advantages through advanced CBN synthesis capabilities, proven powder quality standards, and deep expertise in grinding wheel application engineering across multiple industrial sectors, creating trust and performance advantages with grinding wheel manufacturers and precision grinding operations. These companies leverage research and development capabilities in powder surface treatment optimization and ongoing technical support relationships to defend market positions while expanding into emerging automotive grinding markets and specialized precision manufacturing applications.

Challengers encompass Engis Corporation and Van Moppes, which compete through specialized product offerings and strong regional presence in key precision grinding markets. Product specialists, including LANDS Superabrasives, Tomei Diamond, and E-Grind Abrasives, focus on specific powder grades or application markets, offering differentiated capabilities in ultra-fine powder production, customized coating solutions, and specialized particle size distributions.

Regional players and emerging CBN powder manufacturers create competitive pressure through localized production advantages and rapid response capabilities, particularly in high-growth markets including China and India, where proximity to automotive component clusters provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven powder quality performance with comprehensive grinding application engineering offerings that address the complete grinding wheel development cycle from powder specification through grinding parameter optimization and performance validation.

Micron CBN powder represents advanced superhard abrasive material that enables grinding wheel manufacturers to achieve 3-5 times longer wheel life compared to aluminum oxide alternatives, delivering superior grinding performance and cost efficiency with enhanced material removal rates and surface finish consistency in demanding precision grinding applications. With the market projected to grow from USD 297.9 million in 2025 to USD 523.5 million by 2035 at a 5.8% CAGR, these precision abrasive materials offer compelling advantages - extended wheel life, surface quality enhancement, and grinding efficiency - making them essential for mechanical parts applications (44.0% market share), auto parts production (32.0% share), and manufacturing operations seeking alternatives to conventional abrasives that compromise performance through rapid wear and inconsistent grinding characteristics. Scaling market adoption and technology deployment requires coordinated action across precision manufacturing policy, automotive quality standards, CBN powder manufacturers, grinding wheel producers, and superhard abrasive technology investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 297.9 million |

| Coating Type | Bare Powder, Titanium Coated Powder, Nickel Coated Powder, Others |

| Application | Mechanical Parts, Auto Parts, Semiconductors, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Hyperion Materials & Technologies, Element Six, ILJIN, Engis Corporation, Van Moppes, LANDS Superabrasives, Tomei Diamond, E-Grind Abrasives, Besco Superabrasives, Henan Hengda Superhard Materials, Zhengzhou Beisida Extra-Hard Materials, Zhengzhou Zhongnan Jete Superabrasives |

| Additional Attributes | Dollar sales by coating type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with CBN powder manufacturers and grinding wheel production networks, powder synthesis facility requirements and specifications, integration with precision grinding systems and automated surface finishing platforms, innovations in powder coating technology and particle size control systems, and development of specialized CBN powder solutions with enhanced grinding performance and wheel life capabilities. |

The global micron cbn powder market is estimated to be valued at USD 297.9 million in 2025.

The market size for the micron cbn powder market is projected to reach USD 523.5 million by 2035.

The micron cbn powder market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in micron cbn powder market are bare powder, titanium coated powder, nickel coated powder and others.

In terms of application, mechanical parts segment to command 44.0% share in the micron cbn powder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Diamond and CBN Micron Powder Market Size and Share Forecast Outlook 2025 to 2035

Microneedle Drug Delivery Systems Market Report - Growth & Forecast 2025 to 2035

Micronized Salt Market Trends - Purity 98% to 99.5% and Above 99.5%

Micronutrient Powders Market Trends – Growth & Industry Forecast 2025-2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Crop Micronutrient Market Insights - Precision Farming & Yield Optimization 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Dissolving Microneedle Market Analysis - Size, Share, and Forecast 2025 to 2035

Sulfur-Based Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Botulinum Toxin-coated Microneedles Market Size and Share Forecast Outlook 2025 to 2035

CBN Electroplated Wheels Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA