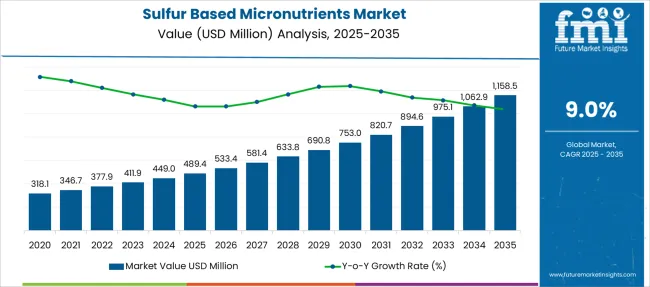

The Sulfur-Based Micronutrients Market is estimated to be valued at USD 489.4 million in 2025 and is projected to reach USD 1158.5 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Sulfur-Based Micronutrients Market Estimated Value in (2025E) | USD 489.4 million |

| Sulfur-Based Micronutrients Market Forecast Value in (2035F) | USD 1158.5 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

The sulfur based micronutrients market is expanding steadily as agriculture sectors focus on improving crop yields and soil health. Growing awareness of sulfur deficiency in soils has led to increased adoption of sulfur-containing fertilizers, especially in regions with intensive cropping. Advances in formulation technologies have enhanced nutrient availability and uptake efficiency, driving preference for high-performance micronutrients.

Demand is further supported by the rising cultivation of oilseeds and pulses, which require adequate sulfur nutrition for optimal growth and protein synthesis. Agricultural extension programs and government initiatives promoting balanced fertilization have also contributed to market growth.

The market is expected to benefit from innovations in nutrient delivery systems and sustainable farming practices. Segmental expansion is anticipated to be led by sulfur-bentonite micronutrients due to their improved nutrient release properties and oilseeds and pulses as the dominant crop application.

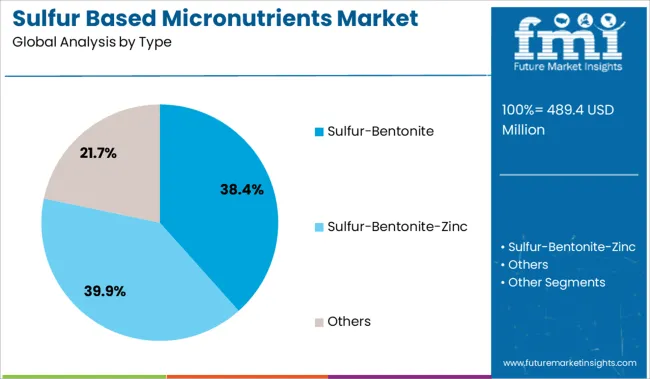

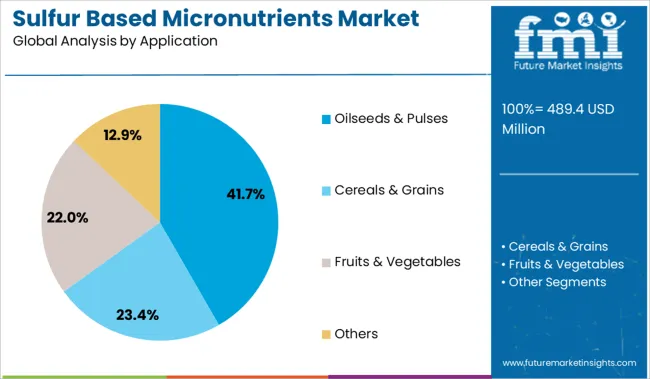

The market is segmented by Type and Application and region. By Type, the market is divided into Sulfur-Bentonite, Sulfur-Bentonite-Zinc, Sulfur-Bentonite-Manganese, Sulfur-Bentonite-Iron, Sulfur-Bentonite-Copper, and Others. In terms of Application, the market is classified into Oilseeds & Pulses, Cereals & Grains, Fruits & Vegetables, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sulfur-bentonite segment is projected to hold 38.4% of the sulfur-based micronutrients market revenue in 2025, emerging as the leading product type. This segment’s growth is driven by the enhanced nutrient retention and controlled release offered by bentonite clay as a carrier material. The improved physical properties facilitate better soil moisture retention and gradual sulfur availability, which supports crop nutrient requirements over longer periods.

Farmers have preferred sulfur-bentonite formulations for their ability to reduce nutrient losses through leaching and volatilization. The material’s compatibility with various soil types and its cost-effectiveness have also helped increase adoption rates.

As precision agriculture gains momentum, sulfur-bentonite micronutrients are expected to remain at the forefront due to their efficiency and environmental benefits.

The oilseeds and pulses segment is expected to account for 41.7% of the sulfur-based micronutrients market revenue in 2025, positioning it as the leading application category. Sulfur nutrition plays a critical role in the growth and protein synthesis of oilseed and pulse crops, influencing both yield and quality. Farmers growing these crops have increasingly incorporated sulfur micronutrients into fertilization programs to address sulfur-deficient soils and improve crop resilience.

Agricultural research has consistently highlighted the positive impact of sulfur application on oil content and seed protein levels, which has driven demand in this segment. Moreover, the segment benefits from the global rise in demand for plant-based protein sources, encouraging expanded cultivation of pulses and oilseeds. With growing emphasis on sustainable crop nutrition and enhanced productivity, the oilseeds and pulses application segment is expected to continue leading market growth.

Growing sulfur deficiency, crop yield pressure, and precision farming adoption drive demand. Opportunities emerge through innovative formulations, regional expansion, and improved access for smallholder farmers in emerging agricultural markets.

A key driver of the sulfur-based micronutrients market is widespread sulfur deficiency in soils caused by intensive farming, reduced atmospheric sulfur, and inadequate fertilizer blends. This deficiency hampers protein synthesis and nitrogen utilization in crops. Rising global food demand has pushed farmers toward micronutrient-enriched inputs to increase yields and quality. Precision agriculture further fuels adoption, enabling targeted sulfur application through foliar sprays, coated granules, and soil-specific formulations. Integration with nitrogen and zinc enhances nutrient efficiency and supports balanced plant growth. Additionally, government policies promoting micronutrient fortification and sustainable farming practices are driving broader implementation. These dynamics position sulfur-based micronutrients as essential tools in modern crop nutrition programs, especially in sulfur-exhausted regions like South Asia, Latin America, and parts of Africa.

Opportunities in the sulfur-based micronutrients market lie in advancing product formulations and expanding accessibility in underpenetrated regions. Innovations like sulfur-bentonite-zinc blends offer dual benefits for crops in zinc- and sulfur-deficient soils. Granular and controlled-release forms improve application efficiency and fit well into mechanized farming systems. Asia-Pacific and Africa represent high-potential markets due to growing food needs, supportive agricultural reforms, and increasing awareness of soil health. However, smallholder farmers often lack access or knowledge about micronutrient benefits. Addressing this gap through education programs, public-private partnerships, and affordable product variants could significantly widen market reach. Additionally, rising interest in organic and climate-resilient agriculture may open new pathways for sulfur-based inputs tailored to eco-friendly farming systems.

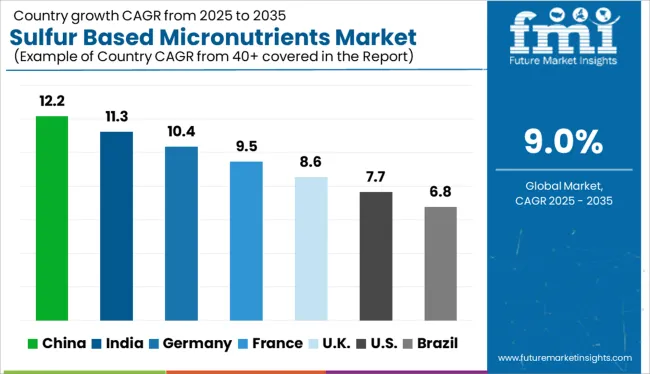

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

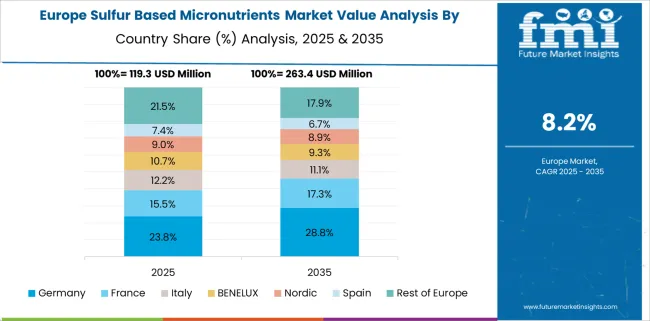

The global sulfur-based micronutrients market is expected to grow at a CAGR of 9.0% from 2025 to 2035, driven by declining soil sulfur levels, demand for balanced crop nutrition, and precision agriculture practices. China leads with a 12.2% CAGR, supported by intensive farming, government-led nutrient management programs, and increased adoption of sulfur chelates. India follows at 11.3%, fueled by micronutrient deficiencies across key agricultural zones and rising use of sulfur-coated fertilizers. Germany, growing at 10.4%, reflects strong demand from high-value crops and environmentally compliant formulations. Among OECD countries, the United States (7.7%) and United Kingdom (8.6%) show steady uptake through fertigation systems and integrated nutrient management programs.

With a projected CAGR of 7.7%, the sulfur based micronutrients market in the United States is gaining momentum as large-scale farms integrate micronutrient programs into precision agronomy systems. Farmers are increasingly addressing secondary nutrient deficiencies, especially sulfur, to support robust nitrogen utilization in high-yield corn and soy fields. Fertilizer manufacturers are launching sulfur-enriched blends tailored for Midwestern soil profiles. Meanwhile, drone-assisted soil mapping is enhancing nutrient deployment strategies. This growing technical sophistication is reinforcing the value of balanced nutrient inputs to maximize both productivity and environmental compliance.

A CAGR of 8.6% highlights the upward trajectory of the sulfur based micronutrients market in the United Kingdom, where evolving regulations are encouraging sustainable fertilizer strategies. With tighter nitrogen controls and an increased focus on nutrient runoff, sulfur is being adopted to rebalance soil nutrition-especially in cereal and oilseed systems. Research-backed formulations combining sulfur with zinc and boron are being trialed for enhanced uptake. Agricultural cooperatives and consultancy firms are collaborating to deliver precision advisory services aimed at maximizing return on micronutrient investments across diversified farms.

The sulfur based micronutrients market in China is forecast to grow rapidly at a CAGR of 12.2%, driven by high fertilizer use intensity and documented micronutrient depletion in major grain-producing provinces. Policymakers are pushing for balanced fertilization to curb chemical overuse while enhancing soil health, leading to a surge in demand for secondary nutrients like sulfur. Domestic producers are scaling up manufacturing of sulfur-blended granules for rice and vegetable crops. Regional agri-tech programs are integrating nutrient management modules to increase smallholder participation in micronutrient adoption.

Registering a CAGR of 11.3%, the sulfur based micronutrients market in India is advancing rapidly, especially across pulse and oilseed-growing regions. Field-level deficiencies are being addressed through micronutrient kits distributed by state-run cooperatives and agri-retail chains. With support from national soil health card initiatives, farmers are transitioning from macronutrient-dominant practices to balanced application strategies. Sulfur-based solutions are being introduced in foliar sprays and coated urea granules to improve absorption and yield outcomes. The affordability and accessibility of these inputs make them highly scalable across smallholder segments.

Germany is expected to see the sulfur based micronutrients market grow at a CAGR of 10.4%, as sustainability-driven regulations and climate concerns reshape fertilization norms. Farmers are investing in micronutrient strategies that support reduced nitrate use while maintaining productivity, particularly in sugar beet, barley, and maize cultivation. Agricultural R&D institutions are testing sulfur-magnesium combinations tailored to Northern European soils. Adoption is further supported by digital nutrient modeling tools that optimize fertilizer planning at field scale. This data-driven transformation is enabling higher sulfur uptake without overapplication.

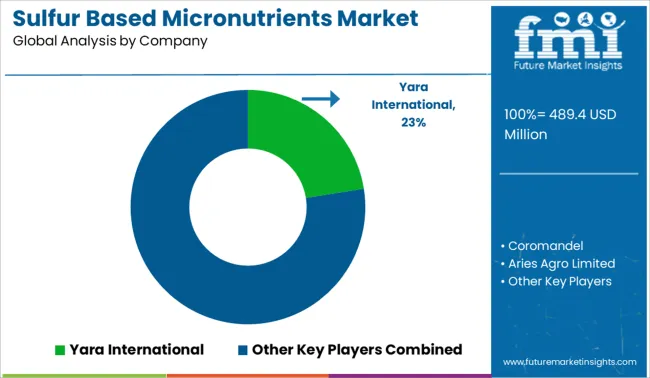

The sulfur-based micronutrients market is moderately consolidated, with a few dominant players and several regional firms competing on formulation and crop-specific effectiveness. Tier 1 companies like Yara International, Coromandel, and IFFCO lead the market, leveraging strong distribution networks, agronomic research, and integrated product portfolios tailored for soil health and nutrient efficiency. Tier 2 players such as Tiger-Sul Products LLC, DFPCL, and Aries Agro focus on targeted micronutrient blends, including sulfur in elemental and sulfate forms, serving horticulture, oilseeds, and cereal crops. Tier 3 companies like HBT India, Agroasia, and Mirabelle Agro cater to localized needs, offering cost-effective formulations and crop advisory services. Market growth is driven by declining soil sulfur levels, precision agriculture trends, and government support for balanced fertilization practices.

In March 2025, Coromandel International expanded sulfur fertilizer production at its Vizag plant to 50,000 MT. Using advanced German technology, the facility enhances sulfur-based micronutrient output, supporting sustainable agriculture and meeting growing demand for fortified bentonite sulfur variants.

| Item | Value |

|---|---|

| Quantitative Units | USD 489.4 Million |

| Type | Sulfur-Bentonite, Sulfur-Bentonite-Zinc, Sulfur-Bentonite-Manganese, Sulfur-Bentonite-Iron, Sulfur-Bentonite-Copper, and Others |

| Application | Oilseeds & Pulses, Cereals & Grains, Fruits & Vegetables, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yara International, Coromandel, Aries Agro Limited, DFPCL, IFFCO, HBT India, Tiger-Sul Products LLC, Agroasia, Sohar Sulphur Fertilizers LLC, and Mirabelle Agro Manufacturing Pvt Ltd |

| Additional Attributes | Dollar sales by nutrient type and crop application, adoption trends across cereals, pulses, and oilseeds, regional demand driven by sulfur-deficient soils, integration with precision agriculture technologies, differentiation between sulfate and elemental sulfur formulations, impact of soil pH and microbial activity on nutrient uptake, regulatory frameworks influencing micronutrient blends, and emerging use in fortified fertilizers and foliar sprays. |

The global sulfur-based micronutrients market is estimated to be valued at USD 489.4 million in 2025.

The market size for the sulfur-based micronutrients market is projected to reach USD 1,158.5 million by 2035.

The sulfur-based micronutrients market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in sulfur-based micronutrients market are sulfur-bentonite, sulfur-bentonite-zinc, sulfur-bentonite-manganese, sulfur-bentonite-iron, sulfur-bentonite-copper and others.

In terms of application, oilseeds & pulses segment to command 41.7% share in the sulfur-based micronutrients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA