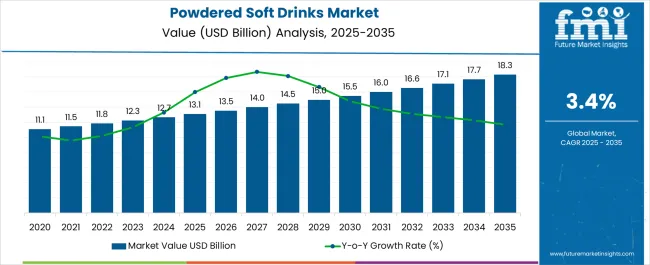

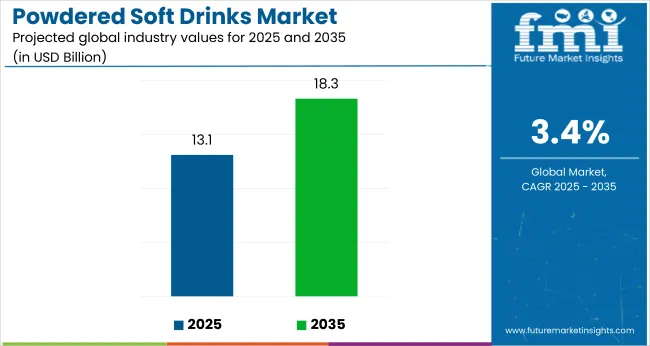

The global powdered soft drinks market is projected to grow from USD 13.1 billion in 2025 to USD 18.3 billion by 2035, registering a CAGR of 3.4%. The market expansion is driven by the increasing consumer demand for convenient, on-the-go beverage options and the growing awareness of health and wellness.

The rising trend of low-calorie, sugar-free, and functional powdered drink mixes is supporting market growth, with consumers opting for healthier alternatives to traditional sugary drinks. Additionally, the increasing popularity of outdoor activities such as hiking, camping, and sports is boosting demand for portable drink options.

The Powdered Soft Drinks Market holds a relatively small but growing share in its parent markets. It accounts for around 4-5% of the overall Beverages Market, as it competes with other beverage types such as ready-to-drink beverages and juices.

In the Powdered Beverage Market, it commands a larger share of about 20-25%, driven by the increasing demand for on-the-go and convenient drink options. Within the Functional Beverages Market, powdered soft drinks contribute approximately 3-4%, as consumers opt for sugar-free or fortified options. It holds roughly 2-3% in the Sports Nutrition Market and about 1-2% in the Health and Wellness Market.

Regulatory mandates in various regions are supporting the adoption of healthier drink options, with governments emphasizing the reduction of sugar consumption and promoting public health initiatives. In the USA, for example, the Food and Drug Administration (FDA) provides guidelines for low-sugar and sugar-free beverages, encouraging manufacturers to innovate in this space.

Similarly, the European Union's food regulations are pushing for the reduction of sugar content in soft drinks, which is aligning with the growing demand for powdered drink mixes with functional ingredients, including electrolytes and vitamins.

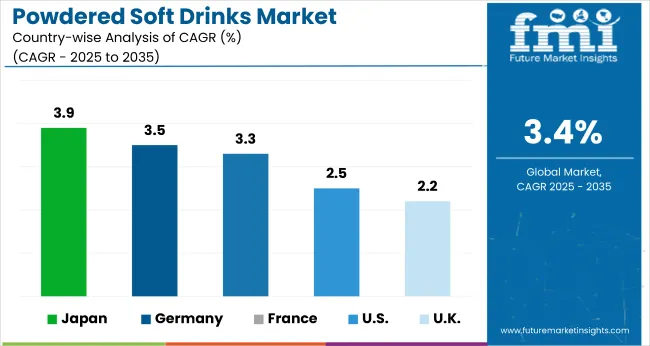

Japan is projected to be the fastest-growing market, expanding at a CAGR of 3.9% from 2025 to 2035. Household End Use will lead the end-use segment with a 40% share, while Pouches & Sachets will dominate the packaging segment with a 35% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 2.5% and 3.2%, respectively. France and the UK are expected to grow at more moderate rates of 3.3% and 2.2%, respectively.

The competitive landscape operates under different parameters compared to premium beverage markets due to the price-sensitive nature of the powdered drink segment and the importance of achieving broad market access through mass retail channels and developing market distribution networks. Success depends not only on taste and convenience but also on regulatory compliance expertise, cost optimization capabilities, and the ability to maintain consistent product quality across different ingredient formulations required for various markets. Market differentiation requires sophisticated understanding of local taste preferences, regulatory requirements, and distribution channel dynamics that extend beyond conventional beverage marketing expertise.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 13.1 billion |

| Projected Market Value (2035F) | USD 18.3 billion |

| Value-based CAGR (2025 to 2035) | 3.4% |

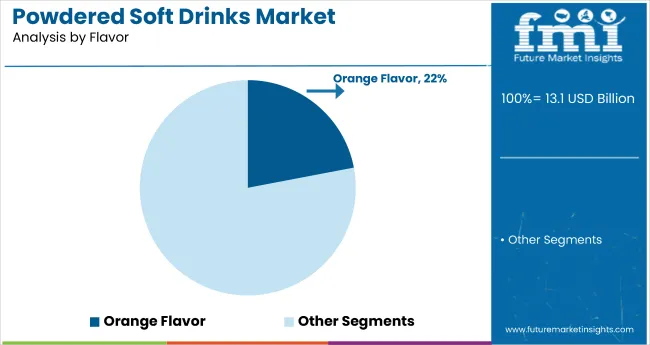

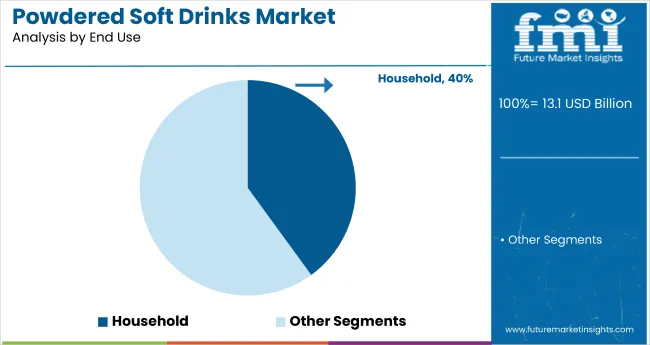

The powdered soft drinks market is segmented by flavor, end use, sales channel, packaging, and region. By flavor, the market is divided into cola, orange, lemon, mango, apple, berry, mixed fruit, and others (Pineapple, Peach, Cherry, and Coconut flavors). In terms of end use, the market is classified into institutional, horeca, and household.

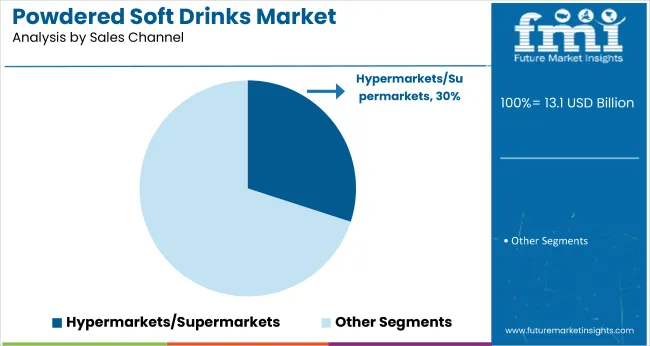

Based on the sales channel, the market is divided into hypermarkets/supermarkets, discount stores, mass grocery retailers, wholesale club stores, foodservice, and others (online stores, direct-to-consumer websites, convenience stores, and specialty retailers).

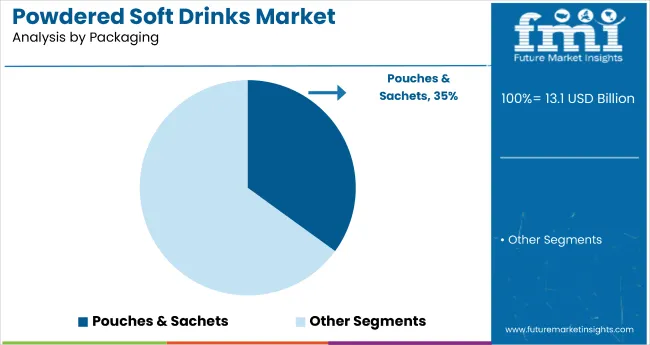

In terms of packaging, the market is segmented into carton boxes, pouches & sachets, cans, and bulk packaging. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific excluding China, China, and the Middle East & Africa.

Orange flavor is expected to dominate the flavor segment of the powdered soft drinks market, capturing 22% of the market share by 2025. This growth is driven by its widespread consumer preference and refreshing appeal.

Pouches & sachets are projected to lead the packaging segment of the powdered soft drinks market, capturing 35% of the market share by 2025. This growth is driven by their convenience, portability, and cost-effectiveness.

Hypermarkets and supermarkets are projected to lead the sales channel segment in the powdered soft drinks market, capturing 30% of the market share by 2025. This growth is driven by broad product availability and consumer preference.

The household segment is expected to lead the end-use category in the powdered soft drinks market, capturing 40% of the market share by 2025. This growth is driven by the increasing preference for DIY beverage options at home.

The global powdered soft drinks market is experiencing steady growth, driven by the increasing demand for convenient, on-the-go beverage options and the growing awareness of health and wellness. Powdered soft drinks are gaining popularity as an affordable and portable alternative to traditional sugary drinks.

Recent Trends in the Powdered Soft Drinks Market

Challenges in the Powdered Soft Drinks Market

Japan’s momentum is driven by a growing health-conscious population, an increasing demand for convenient, on-the-go beverages, and a strong focus on low-calorie, sugar-free, and functional products. Germany and France maintain consistent demand fueled by EU health and wellness mandates, along with funding for sustainability-driven product innovations. In contrast, developed economies like the USA(2.5% CAGR), UK (2.2%), and Japan (3.9%) are expanding at a steady 0.74-1.00x of the global growth rate.

Japan leads the powdered soft drinks market with the highest growth rate, driven by its demand for health-conscious, functional beverages and a focus on hydration products for athletes and outdoor enthusiasts. Germany and France show steady growth, fueled by EU sustainability regulations and the rising consumer demand for clean-label and organic options.

The USA has the slowest growth among the top OECD nations, with its demand largely shaped by convenience and health trends, alongside strong e-commerce growth. The UK sees the most moderate growth, supported by rising awareness of sugar reduction, plant-based drinks, and sustainability.

The report covers an in-depth analysis of 40+ countries, with a focus on the five top-performing OECD markets.

The Japan powdered soft drinks market is growing at a CAGR of 3.9% from 2025 to 2035. Growth is driven by the increasing demand for convenient, portable beverages amidst a busy, health-conscious population.

Japan's preference for low-calorie, sugar-free, and functional powdered drinks is accelerating market growth, with a particular emphasis on hydration products for athletes and outdoor enthusiasts. The market is characterized by a high level of innovation, with new flavors and unique formulations consistently being introduced to meet consumer demand.

The sales of powdered soft drinks in Germany are expanding at 3.5% CAGR during the forecast period, slightly below the global average. The growth is primarily driven by EU sustainability regulations and increasing consumer awareness of health and wellness trends.

The market is seeing a preference for organic and clean-label powdered drink mixes, as well as innovations in packaging for sustainability. Germany’s adoption of powdered soft drinks is also fueled by the growing popularity of outdoor sports and the need for hydration solutions.

The French powdered soft drinks market is projected to grow at a 3.3% CAGR during the forecast period, mirroring the global growth trend. Demand is driven by rising health consciousness, the increasing popularity of fitness activities, and the demand for low-sugar and functional beverages.

France’s market is particularly strong in the sports nutrition segment, with athletes favoring powdered drink mixes for hydration and electrolyte replenishment. The trend for exotic and novel flavors, particularly tropical fruit blends, is gaining traction in France.

The USA powdered soft drinks market is projected to grow at a 2.5% CAGR from 2025 to 2035, translating to 0.74x of the global growth rate. The USA market is mainly driven by the convenience of on-the-go drinks and the increasing preference for healthier, low-calorie options.

The growth in e-commerce is also playing a significant role in shaping the demand for powdered soft drinks, with online stores expected to lead the sales channel segment. The market is competitive, with a high level of innovation in terms of flavor and functional ingredients.

The UK powdered soft drinks market is projected to grow at a CAGR of 2.2% from 2025 to 2035, representing the slowest growth among the top OECD nations. The growth is supported by increasing awareness of health and wellness, particularly in the context of sugar reduction and functional beverages.

The UK market is seeing a rise in demand for plant-based, low-sugar, and fortified powdered drinks. The market's growth is also influenced by sustainability trends, with eco-friendly packaging gaining popularity.

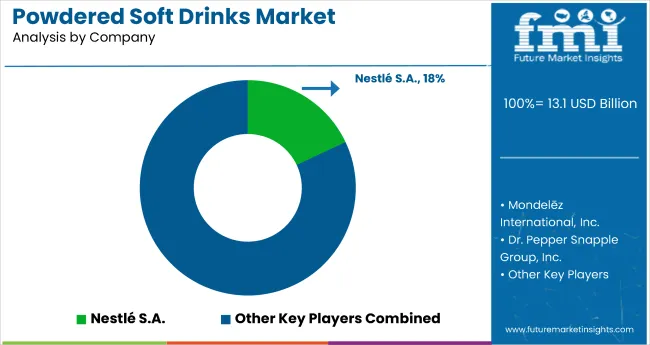

The Powdered Soft Drinks Market is expanding steadily as consumers seek affordable, shelf-stable, and customizable beverage options suited for on-the-go lifestyles. Growth is being driven by demand for convenient refreshment solutions with extended shelf life and reduced storage costs, particularly in emerging economies. Leading global players such as Nestlé S.A., Mondelēz International Inc., and PepsiCo Inc. dominate the market with extensive portfolios of flavored drink mixes enriched with vitamins, electrolytes, and low-sugar formulations aimed at health-conscious consumers. These companies are focusing on flavor innovation, sustainable packaging, and portion-controlled sachets to strengthen their market presence.

Keurig Dr Pepper Inc. and Continental Mills Inc. are expanding their powdered beverage offerings through co-branded formulations and single-serve packaging designed for both home and foodservice applications. AriZona Beverage Company LLC and The Sqwincher Corporation are targeting the functional hydration segment, introducing electrolyte-infused powdered drinks for sports, fitness, and occupational health markets.

Regional manufacturers such as Insta Foods Pvt. Ltd., Sugam Products Pvt. Ltd., and Lasco Foods Inc. are focusing on cost-effective, tropical-flavored mixes tailored to regional taste preferences in Asia, Africa, and Latin America. Grand Brands Inc. is leveraging premium and nostalgia-based branding to appeal to both younger consumers and traditional markets seeking flavorful yet economical drink alternatives.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 13.1 billion |

| Projected Market Size (2035) | USD 18.3 billion |

| CAGR (2025 to 2035) | 3.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Flavor Segments Analyzed | Cola, Orange, Lemon, Mango, Apple, Berry, Mixed Fruit, others (Pineapple, Peach, Cherry, and Coconut flavors) |

| End-Use Segments Analyzed | Institutional, HORECA, Household |

| Sales Channel Analyzed | Hypermarkets/Supermarkets, Discount Stores, Mass Grocery Retailers, Wholesale Club Stores, Foodservice, others (online stores, direct-to-consumer websites, convenience stores, and specialty retailers) |

| Packaging Types Analyzed | Carton Boxes, Pouches & Sachets, Cans, Bulk Packaging |

| Region Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market |

Nestlé S.A., Mondelēz International Inc., Keurig Dr Pepper Inc., PepsiCo Inc., Continental Mills Inc., AriZona Beverage Company LLC, Insta Foods Pvt. Ltd., Sugam Products Pvt. Ltd., Lasco Foods Inc., The Sqwincher Corporation, Grand Brands Inc. |

| Additional Attributes | Market value by flavor, regional demand growth, packaging innovations, competitive benchmarking, flavor trends, online sales growth, consumer preferences |

The global powdered soft drinks market is estimated to be valued at USD 13.1 billion in 2025.

The market size for the powdered soft drinks market is projected to reach USD 18.3 billion by 2035.

The powdered soft drinks market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in powdered soft drinks market are cola, orange, lemon, mango, apple, berry, mixed fruit and others.

In terms of end use, institutional segment to command 39.5% share in the powdered soft drinks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powdered Hand Soap Market

Japan Powdered Cellulose Market, By Type, By Application, By Region, and Forecast, 2025 to 2035

Korea Powdered Cellulose Market Analysis by Source, End-use, Functionality, and Region Through 2035

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Demand for Powdered Cellulose in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Powdered Cellulose Market Analysis by Source, End-use, Functionality, and Country Through 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Soft Start Resistor Market Size and Share Forecast Outlook 2025 to 2035

Soft Touch Lamination Film Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Soft Ferrite Core Market Size and Share Forecast Outlook 2025 to 2035

Soft Gripper Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Soft Magnetic Composite Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA