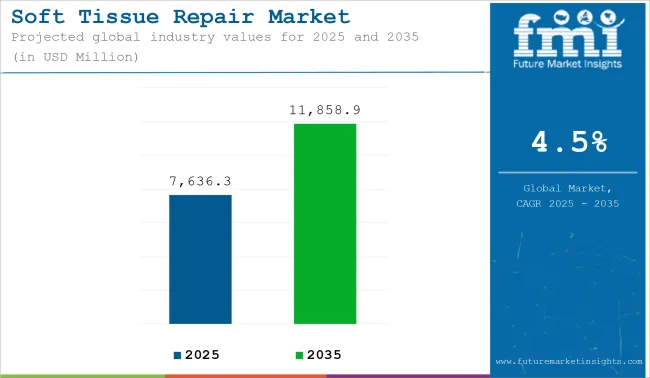

The global Soft Tissue Repair market is estimated to be valued at USD 7,636.3 million in 2025 and is projected to reach USD 11,858.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7,636.3 Million |

| Industry Value (2035F) | USD 11,858.9 Million |

| CAGR (2025 to 2035) | 4.5% |

The market is expanding steadily as a result of rising surgical volumes, higher incidence of sports injuries, and advancements in biomaterials designed to improve healing outcomes. An increased focus has been observed among healthcare providers on reducing postoperative complications and accelerating functional recovery timelines.

Hospitals and ambulatory surgical centres have prioritized investments in synthetic grafts and biologic matrices that support robust integration with native tissues while minimizing inflammatory responses. Regulatory approvals and favourable reimbursement frameworks have encouraged the adoption of novel repair materials across diverse applications, including orthopedic reconstruction, hernia repair, and dental soft tissue regeneration.

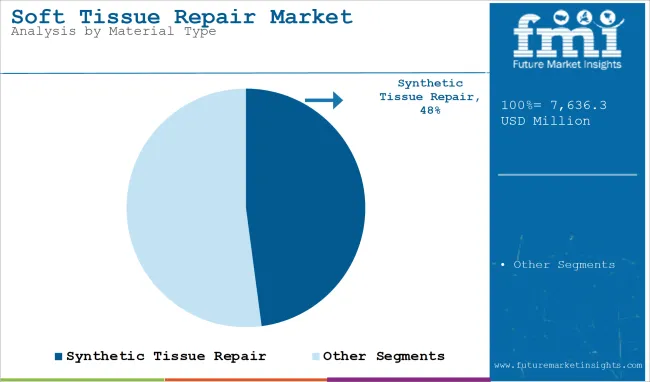

Synthetic Tissue Repair dominates with a revenue share of 47.9% which has been attributed to synthetic tissue repair materials in 2025, supported by their established role in delivering consistent mechanical strength and predictable degradation profiles. Adoption has been influenced by the perception that synthetic implants reduce the risk of disease transmission and immunologic reactions associated with allograft and xenograft materials. Advances in polymer science and textile engineering have resulted in improved biocompatibility and design flexibility, enabling tailored solutions for diverse anatomical sites.

Hospitals and ambulatory surgical centers have prioritized synthetic products for their ease of handling, reproducible outcomes, and favorable cost-benefit profile. Regulatory clearances have been secured across multiple indications, reinforcing clinician confidence and facilitating integration into surgical protocols.

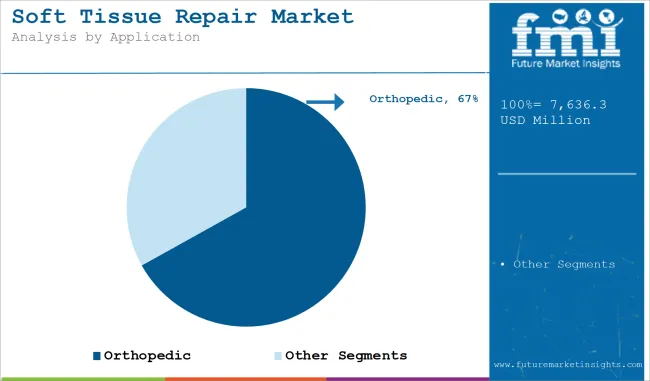

Orthopedic segment holds a leading revenue share of 66.9% that has been attributed to rising procedural volumes for tendon, ligament, and cartilage repair. Growth has been sustained by increasing participation in athletic activities and an aging population experiencing degenerative musculoskeletal conditions. Surgical departments have prioritized comprehensive soft tissue management strategies to reduce reinjury rates and restore mobility.

Clinical guidelines have recommended early intervention for soft tissue damage, encouraging hospitals and specialty centers to invest in advanced repair technologies. Technological improvements in suture anchor systems, scaffolds, and fixation devices have contributed to consistent procedural success and faster rehabilitation timelines. These factors have collectively supported the dominance of orthopedic applications within the soft tissue repair market and are expected to sustain demand over the forecast horizon.

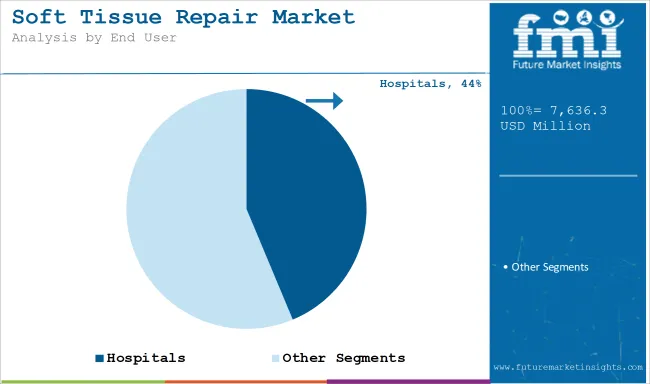

Hospitals have accounted for 43.7% of market revenue, supported by their capacity to provide comprehensive surgical care and maintain multidisciplinary teams focused on reconstructive procedures. Investments have been directed toward upgrading surgical infrastructure and expanding the availability of minimally invasive techniques to improve patient outcomes and reduce length of stay. Procurement strategies have prioritized products with demonstrated safety, regulatory approval, and compatibility with existing instrumentation.

Reimbursement policies and bundled payment models have been leveraged to support the integration of advanced soft tissue repair solutions in orthopedic, general, and plastic surgery departments. These factors have reinforced hospitals as the principal end users in soft tissue repair procedures and are anticipated to sustain their leadership in adoption.

High Cost and Limited Reimbursement of Advanced Biologic Hinders the Adoption of Soft Tissue Repair

Clinicians work with materials such as grafts and biologics syntheses that are primarily ortho biologics that are high in costs and has low reimbursement rates. Australia, North America and some parts of Europe are faced with their own unique reimbursement obstacles that will further hinder the usage of such lucrative technologies by patients and health-care-providers alike.

However, affordability becomes a much more serious issue in some of the developing nations, and such issues have led to a great number of patients giving delayed or suboptimal solutions. The barriers due to cost erode the degree of autonomy patients have, thereby inhibiting having newer technology accepted amongst softer tissue repair could, especially where health care is resource and cost-constrained.

Increasing Integration of Regenerative Medicine and Biologics into Standard Surgical Practices Poses Opportunity for Soft Tissue Repair

The other opportunity is that the most prospective one within soft tissue repair is entering into the merge of regenerative medicine and biologics with standard surgical practices. The technological development in stem cell therapy, PRP, and bioactive scaffolds is a paradigm shift towards faster and cheaper healing outcomes.

These procedures offer low scarring, few reoperations, short recovery times, and positive perceptions and therefore are preferred by both the patients and the physician. With increasing clarity in regulatory pathways as well as an ever-growing clinical evidence base supporting the technology, these applications are being accepted more rapidly into the orthopedic, sports medicine, and reconstructive surgery communities.

Concurrently, there is a greater acceptance of outpatient and minimally invasive procedures worldwide. This opens up substantial growth opportunities in established markets like North America and Europe, as well as emerging markets in the Asia Pacific region, where the impetus for health care innovation is gaining traction

Surge in Sports Medicine and Orthopedic Procedures anticipates the Growth of the Market

Soft tissue repair is creating a formidable growth market due to the ever-increasing incidence of soft tissue injurious events fueled mostly by increasing participations in professional and amateur sporting events. Add to that the rising number of soft-tissue injuries among middle-aged and young people, people of all ages are affected by such injuries.

Examples of these injuries include rotator cuff tears, ligament sprains, and tendon ruptures, all of which can be repaired using soft tissue repair. Most orthopedic centers and sports clinics have high-speed surgical devices and biologic grafts that would predispose to healing, thus creating a demand for innovation in sutures, fixation devices, and biologic implants.

Companies are also looking at incorporating recovery options personalized to an individual athlete, which would be used to take the business of soft tissue repair to the healthcare sector through sports medicine, especially in North America, Europe, and Asian Pacific regions.

Advancements in Biologic and Synthetic Grafts demonstrates the Growth of the Market

A vital industry-specific highlight in soft tissue repair is the advent of novel biologics and synthetic graft technology. Manufacturers now design next-generation allograft, xenograft, and bioresorbable polymer-based grafts for the purpose of better cellular regeneration and speedy radiance. The advances are most valuable in complex initiatives such as ligament and tendon reconstruction.

Biologic grafts, especially those enriched with growth factors or stem cells, show more promise than standard techniques, owing to the minimization of immune reactions and enhanced healing outcomes. The synthetic alternatives are also being fine-tuned for biocompatibility and mechanical properties, thus widening their recruitment for applications in load-bearing repairs.

Shift Toward Minimally Invasive and Robotic-Assisted Surgery is an Ongoing Trend in the Market

Robotic systems in combination with computer-assisted navigation improve the surgical accuracy for ligament and tendon repairs. Improved patient satisfaction and a fast return to activities propel this technology into acceptance among the specialized disciplines of sports medicine, orthopedic, and general surgery.

Hospitals are also investing in robotic solutions in a bid to stay competitive among peers and to meet the growing demand for outpatient, same-day cases. Innovation is now propelled into development in soft tissue repair devices and implants intended specifically for minimally invasive workflows, encouraging a broader evolution throughout surgery specialties.

Growing Focus on Regenerative Therapies

Another of the emerging prominent trends within soft tissue repair is increasing buy-in toward regenerative therapies, including stem cell-based therapies, platelet-rich plasma (PRP), and growth factor-enriched scaffolds.

More than repairing, these therapies aim for biological restoration of the tissue's original function after injury. Clinical evidence and real-world evidence in some cases has shown promising results in improving recovery time and reducing scar tissue formation, leading both med tech players and biotech-startup companies to invest in regenerative platforms focused on orthopedics, sports medicine, and reconstructive applications.

These therapies previously appeared to be different from the mainstream practice of surgery but are increasingly reaching that point as regulatory agencies clear paths for approvals and clinical evidence accumulates.

Increased market development, such as the high number of sports injuries, and where it has gone ahead in adopting the very latest technologies while having a well-established reimbursement system: all of these are factors contributing to the increased rapid growth within the market in the USA.

The presence of key medical devices' firms and an increasing number of outpatient surgical procedures drives demand. It has also increased awareness regarding regenerative therapies along with huge investments made in R&D, thereby encouraging innovations in soft tissue repair.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

Soft tissue reconstruction in Germany continues to develop into an amazing marketplace owing to the high prevalence of orthopedic conditions infecting its population, which is aging, and healthy investments in technologically advanced centers of surgery.

High-tech biologicals, government initiatives concerning the amendments in healthcare policies, and a very high demand for less invasive procedures are in favor of continued growth in specialized centers for orthopedic and sport medicine.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

The factors responsible for the growth of the Indian soft tissue repair market include an increased incidence of trauma, a growing sports culture, and better healthcare infrastructure. Government policies enhance accessibility to surgical care in rural areas. The investment made by private hospitals and affordability of synthetic grafts also increases demand for them in urban and semi-urban areas.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

The market for soft-tissue repair in China is accelerating fast as a result of increasing urban population, greater sports activities, and growing elderly suffering from musculoskeletal disorders. It is expected that massive demand will be realized in the high-end soft tissue repair products and biologics because of government support for local innovations in medical technology and rising health insurance coverage.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

A rapidly growing aging population in Japan is already associated with a high incidence rate of degenerative soft tissue diseases, hence, building demand in their market. Demand is driven by highly sophisticated surgical techniques coupled with regulatory support for regenerative medicine and growing trend toward robotic-assisted systems. Japan's patient-centric-minimally invasive care is paving the way for future soft tissue repair.

Market Growth Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The competitive landscape has been shaped by companies investing in synthetic and biologic repair materials designed to deliver superior strength and tissue integration. Leading manufacturers have expanded their portfolios through product launches and acquisitions targeting innovative scaffolds and bioresorbable implants. Strategic collaborations with research institutions have been pursued to develop next-generation biomaterials and validate long-term outcomes. With technology, players also focus on ensuring safety, quality, and customer satisfaction to captivate an increased customer base.

Key Development:

Synthetic, Allograft, Xenograft and Alloplast

Breast Reconstruction, Hernia, Dermatology, Orthopaedics (Sports Medicine, Dural Repair and Others), Dental Problems, Vaginal Sling and Others

Hospitals, Ambulatory Surgical Services and Clinics

The overall market size for soft tissue repair market was USD 7,636.3 Million in 2025.

The soft tissue repair market is expected to reach USD 11,858.9 Million in 2035.

Rising incidence of sports injuries and trauma and geriatric population suffering from degenerative condition anticipates the growth of the soft tissue repair market.

The top key players that drives the development of soft tissue repair market are B. Braun Melsungen AG, Baxter, C. R. Bard, Inc., Smith & Nephew and Stryker.

Synthetic segment by product is expected to dominate the market during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soft Touch Lamination Film Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Soft Ferrite Core Market Size and Share Forecast Outlook 2025 to 2035

Soft Gripper Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Soft Magnetic Composite Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA