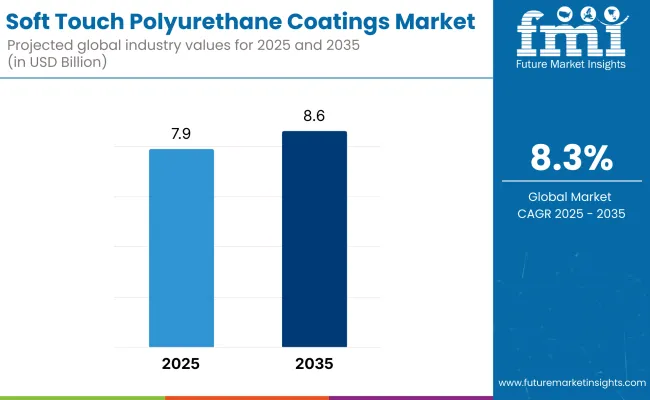

The global market for Soft Touch Polyurethane (PU) Coatings is projected to increase from USD 7.9 billion in 2025 to USD 8.6 billion by 2035, marking a steady CAGR of 8.3% over the forecast period. The expansion is underpinned by surging applications in automotive interiors, consumer electronics, and luxury personal care packaging, where tactile performance and surface durability are critical.

The market is expected to witness robust growth driven by sustainability requirements, material innovation, and targeted deployment in high-touch industries. Regulatory alignment, regional production localization, and brand-led sensory innovation will shape its trajectory through 2035.

In the automotive sector, adoption of soft-touch PU coatings has been accelerated by luxury vehicle manufacturers aiming to enhance interior sensory appeal and resilience. During BASF’s Q1 2025 earnings call, executive vice president Ramkumar Dhruva stated, “Automotive OEMs are actively requesting PU systems that offer not just soft aesthetics but consistent abrasion resistance, which remains a central focus of our new R&D investments.”

AkzoNobel, in its March 2025 sustainability roadmap, confirmed that OEMs in Europe and Japan are favoring solvent-free soft-touch solutions aligned with evolving compliance norms and consumer preferences.

Among end user industries, consumer electronics manufacturers have reported an uptrend in soft touch coating deployment for mid-range and high-end smartphone casings, gaming devices, and wireless earbuds. In a January 2025 press release, Covestro cited a 14% YoY increase in sales of its Bayhydur soft-touch line across South Korea and China, attributing growth to demand for ergonomic device finishes in competitive mobile markets.

The personal care sector has maintained a consistent demand for soft touch polyurethane coatings as their end-users display confidence in packaging. DSM Coating Resins revealed in a February 2025 media statement that “premium packaging coated with sensory-enhancing PU materials improves shelf differentiation and user engagement,” particularly for skincare and cosmetic products sold in Western Europe and North America.

Technological progress in waterborne PU dispersion has enabled coatings with <50g/L VOC content, meeting California Air Resources Board (CARB) and EU REACH thresholds. Allnex, in its April 2024 technical circular, unveiled an updated generation of low-VOC resins with extended pot life and faster curing under ambient conditions, tailored for high-throughput industrial users.

Besides, the positive dynamics, certain challenges have been impacting the industry, although at a lower degree. Raw material cost inflation has impacted supplier margins. To address this, Nippon Paint Holdings announced in its December 2024 investor disclosure the commissioning of two raw material units in Thailand and Mexico to strengthen localized procurement and reduce freight dependency, particularly for polyol feedstocks.

The market is segmented based on base type, end use industry, and region. By base type, the market is divided into water-based and solvent-based. In terms of end use industry, it includes transport and automotive, electrical and electronics, wood and furniture, and others (consumer goods, medical devices, packaging, industrial equipment). Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The water-based segment is projected to grow at the fastest CAGR of 6.3% from 2025 to 2035. This growth is primarily driven by increasingly stringent environmental regulations targeting VOC emissions, especially in North America and Europe. Water-based soft touch polyurethane coatings offer a safer, lower-odor, and more sustainable alternative to traditional solvent-based systems.

Their quick-drying, non-flammable nature makes them ideal for applications in electronics, automotive interiors, and luxury packaging. The segment is also benefiting from rising consumer demand for low-emission products in household furniture and décor. Technological advancements have significantly improved the tactile finish, chemical resistance, and abrasion durability of water-based coatings, allowing them to replace solvent-based coatings in many performance-critical applications.

On the other hand, solvent-based coatings continue to serve industries where extreme durability, resistance to harsh chemicals, and rapid curing are essential, such as in industrial transportation, marine, and aerospace components. However, due to regulatory pressures, adoption is gradually shifting to hybrid or water-based systems.

In regions with lax environmental enforcement, solvent-based coatings still dominate, especially in large-volume manufacturing zones across Asia. Despite this, the long-term market trend favors water-based formulations as industries adapt to sustainability goals and low-VOC compliance frameworks.

| Base Type Segment | CAGR (2025 to 2035) |

|---|---|

| Water-Based | 6.3% |

The transport and automotive segment is expected to grow at the fastest CAGR of 6.6% between 2025 and 2035. This growth is fueled by rising demand for premium, soft-touch finishes in vehicle interiors such as dashboards, armrests, steering wheels, and door trims.

As automakers prioritize tactile comfort, visual appeal, and differentiation, soft touch polyurethane coatings have become a key material choice. Additionally, the shift toward electric vehicles have amplified interest in interior personalization, sustainability, and non-toxic coatings, further boosting the adoption of water-based soft touch systems.

The electrical and electronics industry also contributes significantly to the market, with applications in mobile phone casings, remote controls, wearable devices, and consumer appliances. These coatings provide anti-slip properties, fingerprint resistance, and a premium feel, all critical for enhancing user experience and product aesthetics.

Wood and furniture applications remain strong in high-end interior décor and luxury furniture, especially in office, hospitality, and retail segments. These coatings are valued for their velvet-like texture, stain resistance, and visual appeal. The others category, including cosmetic packaging and personal accessories, is growing gradually as brands increasingly opt for tactile finishes to convey quality and luxury.

| End Use Industry Segment | CAGR (2025 to 2035) |

|---|---|

| Transport and Automotive | 6.6% |

Challenges

High Raw Material Costs

One of the primary challenges in the Soft Touch Polyurethane Coatings market is the high cost of raw Polyurethane resins and specialty additives used to formulate Soft Touch Polyurethane Coatings are relatively more expensive, as they are high performance materials. The volatile crude oil prices reflect on the production costs of polyurethanes, exerting pricing pressure on manufacturers.

Moreover, the availability of sustainable / bio-based coatings also contributes to the increased cost as the research, development and sourcing of eco-friendly raw materials is expensive. These cost barriers are particularly challenging for small and medium-sized enterprises, constraining their market penetration.

Stringent Environmental Regulations

The Soft Touch Polyurethane Coatings market faces a significant challenge due to stringent environmental regulations related to emissions of volatile organic chemicals (VOCs) and hazardous substances. Surely governments and regulatory bodies, the USA and Europe in particular, have made strict compliance requirements to mitigate environmental hazard.

This compels producers to reformulate their products, use low-VOC, waterborne or UV-cured substitutes, a task that can be expensive and quite demanding of the technology. Evolving regulatory frameworks and compliance are leading to an increase in production costs, as well as limiting the availability of solvent-based coatings. To stay competitive and comply with environmental requirements, companies need to continuously innovate while matching the performance and cost of their products.

Opportunities

Growth in Sustainable and Eco-Friendly Coatings

The growing global interest in sustainability offers a sizable opportunity to the Soft Touch Polyurethane Coatings market. Tightening environmental legislation and increasing consumer awareness are driving demand for low-VOC, waterborne, and bio-based and other sustainable coatings. Businesses that focus on green chemistry and sustainable formulations will have some sort of an edge on the competition and be able to meet regulations as well.

Secondly, such sustainable polyurethane coatings have new market opportunities. Moreover, industries like automotive and consumer electronics are favouring sustainable solutions, which will further boost demand. The development of environmentally friendly, high-performance coatings will be critical as technology continues to develop in order to implement market growth in the future.

Expansion in Consumer Electronics and Automotive Industries

Growing consumer electronics and automotive sectors are positively impacting the demand for Soft Touch Polyurethane Coatings in a highly soluble manner. These coatings allow for improved aesthetics, friction, and user experience, and they are more prevalent in smartphones, updates, gaming consoles, and wearables.

Likewise, the automotive industry is applying soft-touch coatings in luxury interiors (in addition to steering wheels and dashboards) on premium and electric vehicles. The growth of electric and self-driving vehicles only increases the demand for superior, long-lasting coatings. As consumers increasingly favor sleek, high-end finishes, manufacturers have the opportunity to innovate and expand their product lines in these high-growth sectors.

USA market for Soft Touch Polyurethane Coatings is also seeing strong demand related to the vital prospects over automotive interior, consumer electronics, and high-end furniture segments. Increase in adoption across industries is due to a shift towards durable, aesthetically appealing, and sustainable coatings.

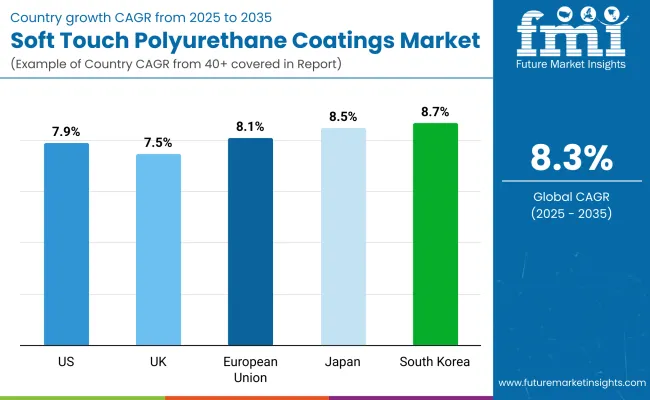

Moreover, stringent environmental regulations pertaining to the VOC emissions are propelling the manufacturers to devise eco-friendly formulations. Innovations in water-based and bio-based polyurethane coatings having many ways for growth. With significant R&D investments and a thriving automotive sector, the market in the USA is projected to grow at a CAGR of 7.9% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

The UK Soft Touch Polyurethane Coatings Market is primarily driven by increasing demand from various applications such as luxury automotive, premium furniture, and consumer goods. The innovations are also driven by the country’s increased focus towards sustainability and circular economy practices to achieve low-VOC and recyclable coatings.

Strict regulatory requirements as established by the EU’s REACH and other environmental policies are forcing manufacturers to seek greener alternatives. Growing demand in electronics and packaging industries also aids market growth. With strong government incentives for sustainable coatings, the UK market is anticipated to grow at a CAGR of 7.5% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.5% |

The European Union (EU) is at the forefront of sustainability-driven advancements in Soft Touch Polyurethane Coatings. EU region leading the charge Key consumers include the automotive, aerospace, and consumer goods industries, driven by demand for high-performance and low-emission coatings.

The stricter regulations of EU Green Deal policies and REACH are driving the transition to bio-based and waterborne PU coatings. Innovation and strict safety regulations in the region are further projected to enhance market growth. Germany, France, and Italy are among the most important countries in driving industrial demand. The EU market is projected to grow at a CAGR of 8.1% from 2025 to 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.1% |

Japan’s Soft Touch Polyurethane Coatings Market is witnessing significant growth due to rising emphasis on high-precision coatings for advanced technologies within the country that increasing on the market growth. Current investments are natural polyurethane coatings for scratch resistance, self-healing, eco-friendly by leading automakers and electronic manufacturers.

As such, the government is working to support low-emission coatings and sustainable materials as part of its carbon neutrality objectives. Moreover, Japan can also further promote the coatings industry with its nanotechnology and polymer science technologies. The market is expected to grow at a CAGR of 8.5% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

The South Korea Soft Touch Polyurethane Coatings Market also is growing very fast due to the market demand in automotive, consumer electronics, and high-end packaging. Domenova has a stronghold in smartphone and automotive sectors in the country, contributing to innovations in its wear-resistant, anti-fingerprint, and soft-feel coatings.

Major companies are pivoting to biodegradable and waterborne polyurethane formulations to cater to eco-friendly initiatives. The growth is further propelled by favourable government policies towards sustainable industrial coatings. With a strong focus on R&D and cutting-edge manufacturing, South Korea’s market is projected to grow at a CAGR of 8.7% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.7% |

The soft touch polyurethane coatings market is highly competitive, with key players focusing on innovation, product differentiation, and sustainability. Over the past few decades, the global soft touch polyurethane (PU) coatings market has witnessed steady growth owing to the rising demand for soft touch PU coatings from automotive interiors, consumer electronics, and furniture applications.

This luxury touch by these coatings being highly durable and scratch-resistant (in some matte/ gloss/ satin finish) is very important for any premium range products. The prominent market players including AkzoNobel, PPG Industries, Axalta Coating Systems, and Sherwin-Williams combat through new product development and regional growth. As regulation becomes stricter, higher-performing, one- and two-pack low-emission coatings will increasingly take a greater share of the growing demand in this sector.

In terms of Base Type, the industry is divided into Water-based, Solvent-based.

In terms of End use industry, the industry is divided into Transport and automotive, Electrical and electronics, Wood and furniture, Others.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global market is expected to reach USD 8.6 billion by 2035, growing from USD 7.9 billion in 2025, at a CAGR of 8.3% during the forecast period.

The water-based segment is projected to dominate due to low VOC emissions, regulatory compliance, superior durability, fast drying properties, and its increasing use in automotive, electronics, and furniture applications.

Key drivers include rising demand for aesthetically appealing and durable finishes, environmental regulations pushing low-emission coatings, and widespread adoption in consumer electronics and luxury automotive interiors.

Automotive, consumer electronics, and furniture industries are contributing most to market growth, given the need for tactile, scratch-resistant, and eco-friendly coating solutions.

Top companies include AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Co., Axalta Coating Systems, and BASF SE-focusing on technological innovation and sustainable product portfolios.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Base Types, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Base Types, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-use industry, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-use industry, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Base Types, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Base Types, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use industry, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-use industry, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Base Types, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Base Types, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use industry, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-use industry, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Base Types, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Base Types, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End-use industry, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End-use industry, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Base Types, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Base Types, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End-use industry, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End-use industry, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Base Types, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Base Types, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product Types, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Product Types, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End-use industry, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End-use industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Base Types, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use industry, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Base Types, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Base Types, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Base Types, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Base Types, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use industry, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-use industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Base Types, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Types, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use industry, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Base Types, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use industry, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Base Types, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Base Types, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Base Types, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Base Types, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use industry, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-use industry, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use industry, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use industry, 2023 to 2033

Figure 45: North America Market Attractiveness by Base Types, 2023 to 2033

Figure 46: North America Market Attractiveness by Product Types, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use industry, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Base Types, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use industry, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Base Types, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Base Types, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Base Types, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Base Types, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use industry, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-use industry, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use industry, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use industry, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Base Types, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product Types, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use industry, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Base Types, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End-use industry, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Base Types, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Base Types, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Base Types, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Base Types, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End-use industry, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End-use industry, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-use industry, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-use industry, 2023 to 2033

Figure 93: Europe Market Attractiveness by Base Types, 2023 to 2033

Figure 94: Europe Market Attractiveness by Product Types, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-use industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Base Types, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End-use industry, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Base Types, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Base Types, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Base Types, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Base Types, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End-use industry, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End-use industry, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-use industry, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use industry, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Base Types, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Product Types, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End-use industry, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Base Types, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Product Types, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End-use industry, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Base Types, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Base Types, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Base Types, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Base Types, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Product Types, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Product Types, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Product Types, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Product Types, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End-use industry, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End-use industry, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End-use industry, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End-use industry, 2023 to 2033

Figure 141: MEA Market Attractiveness by Base Types, 2023 to 2033

Figure 142: MEA Market Attractiveness by Product Types, 2023 to 2033

Figure 143: MEA Market Attractiveness by End-use industry, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Soft Ferrite Core Market Size and Share Forecast Outlook 2025 to 2035

Soft Gripper Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Soft Magnetic Composite Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Softgel Capsules Market Overview - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA