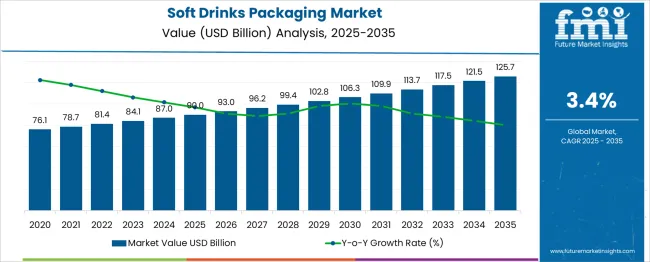

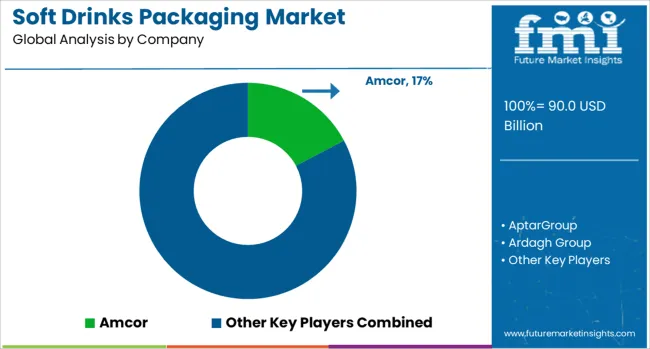

The Soft Drinks Packaging Market is estimated to be valued at USD 90.0 billion in 2025 and is projected to reach USD 125.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Soft Drinks Packaging Market Estimated Value in (2025 E) | USD 90.0 billion |

| Soft Drinks Packaging Market Forecast Value in (2035 F) | USD 125.7 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The soft drinks packaging market is experiencing robust growth fueled by increasing consumer demand for convenient and portable beverage formats. Changing lifestyles and rising consumption of ready-to-drink products have driven the need for innovative packaging solutions that ensure product freshness and ease of use.

Environmental concerns have prompted manufacturers to explore recyclable and lightweight materials without compromising durability. Market players are focusing on packaging that enhances shelf appeal and meets regulatory requirements related to food safety.

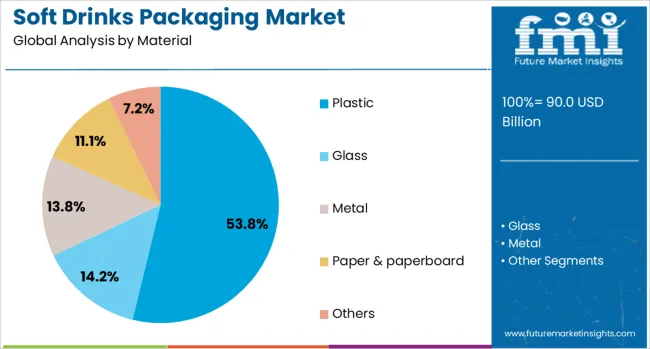

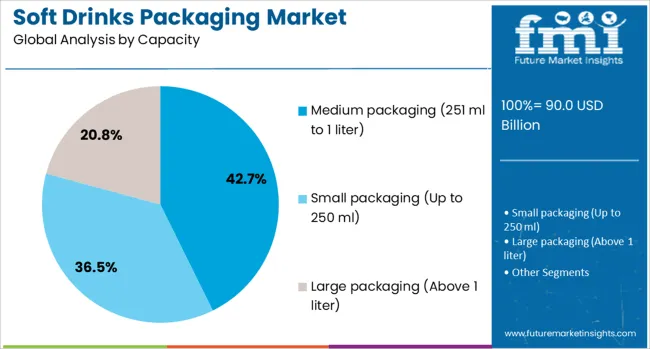

Additionally, growth in urban populations and the expansion of retail channels have improved product accessibility. The market outlook remains positive as companies invest in sustainable materials and smarter packaging designs to align with consumer preferences. Segmental growth is expected to be led by plastic as the preferred packaging material, bottles as the dominant product type, and medium packaging capacities ranging from 251 ml to 1 liter.

The soft drinks packaging market is segmented by material, product type, capacity, and soft drink type and geographic regions. By material of the soft drinks packaging market is divided into Plastic, Glass, Metal, Paper & paperboard, and Others. In terms of product type of the soft drinks packaging market is classified into Bottles, Cans, Cartons, Pouches, and Others. Based on capacity of the soft drinks packaging market is segmented into Medium packaging (251 ml to 1 liter), Small packaging (Up to 250 ml), and Large packaging (Above 1 liter). By soft drink type of the soft drinks packaging market is segmented into Carbonated soft drinks and Non-carbonated soft drinks. Regionally, the soft drinks packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment is projected to hold 53.8% of the soft drinks packaging market revenue in 2025, maintaining its leading position. This growth is attributed to plastic’s versatility, lightweight nature, and cost-effectiveness, which make it ideal for mass production and distribution. Plastic packaging offers excellent barrier properties that help preserve product quality and extend shelf life.

Its recyclability and the development of bio-based plastics have enhanced its appeal amid growing environmental concerns. Manufacturers value plastic for its ability to be molded into various shapes and sizes, enabling innovative bottle designs that attract consumers.

The segment’s dominance is expected to continue as plastic remains a preferred choice for both manufacturers and consumers seeking convenience.

Bottles are forecasted to account for 46.1% of the market revenue in 2025, leading the product type segment. Their popularity is driven by ease of use, portability, and the ability to maintain carbonation in carbonated beverages. Bottles also provide a premium look and feel, enhancing brand visibility on shelves.

Innovations such as lightweight bottles and ergonomic designs have further boosted consumer preference. Retailers favor bottles for their convenience in display and transportation.

As consumers increasingly seek on-the-go beverage options, bottles are expected to retain their market leadership.

The medium packaging segment, ranging from 251 ml to 1 liter, is projected to contribute 42.7% of the market revenue in 2025, making it the dominant capacity category. This segment has grown due to its balance between portability and value, meeting the needs of diverse consumer occasions from single servings to sharing sizes.

Packaging within this range is widely used in retail and vending machine channels, making it highly accessible. Consumer trends favor medium-sized packages for their convenience without excess waste.

As beverage companies continue to innovate within this segment to offer variety and convenience, the medium packaging capacity is expected to maintain its stronghold.

Soft drinks packaging is shifting toward formats that improve freshness, reduce leakage, and enable better shelf appeal. Resealable PET bottles, barrier-coated cans, and smart caps are gaining traction in 2024. These shifts are driven by faster SKU rotation and demand for packaging that aligns with portability, portion control, and cold-chain preservation.

Soft drink manufacturers have reduced flavor degradation by using oxygen scavenger films and nitrogen-flush filling. By Q2 2025, 19 % of new SKUs adopted barrier-coated PET or aluminum substrates, extending shelf life by 14 %. Carbonated fruit-based beverages now favor multilayer canisters with anti-UV coatings to stabilize volatile ingredients. Refillable PET bottles with tamper-resistant caps have expanded 23 % YoY in club-store packs. Several mid-size producers introduced batch-coded labels with QR integration, enabling consumer verification and retail traceability. This tech accelerated market clearance of slow-moving lines, reducing expiry-linked write-offs by 11 %. Faster turnaround formats have also pushed co-packers to realign line-speed settings, allowing smaller production runs and reducing overstock accumulation by 17 % across regional distributors.

Multilayered pack formats raise recyclability concerns across PET–aluminum hybrids and barrier-film pouches. While demand for visually distinctive designs climbed 14 % YoY, regulatory pressure on recyclability slowed rollouts. In Q1 2025, 37 % of launches with metallized finishes required extension waivers for material declarations. Print-to-pack vendors faced a 3-week average delay due to conflicting labeling standards across EU and GCC markets. Brands switching from virgin plastic to rigid paperboard bottles encountered a 9 % increase in leakage complaints, triggering partial retraction in e-commerce segments. Packaging vendors operating below 85 % compliance with deposit return or post-consumer resin thresholds saw a 6 % drop in procurement volume. These hurdles have forced some private-label brands to delay promotional rollouts, altering seasonal product timelines.

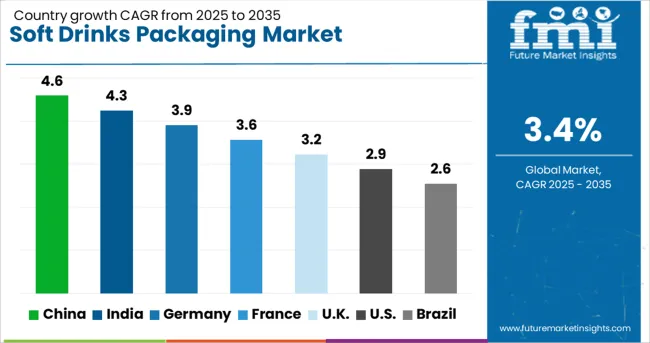

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

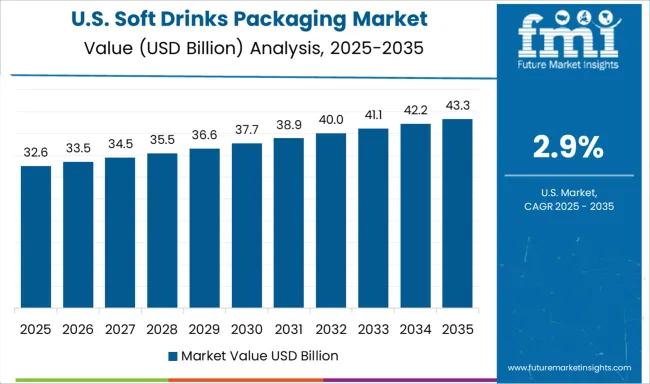

| USA | 2.9% |

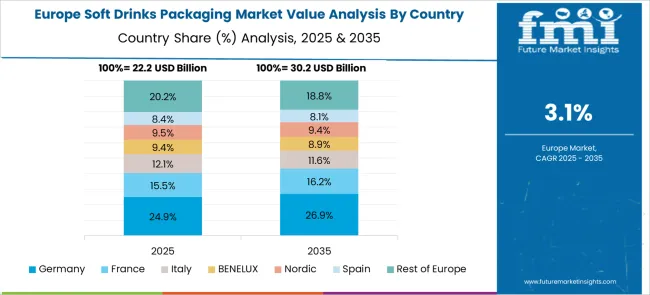

| Brazil | 2.6% |

The global soft drinks packaging market is projected to grow at a 3.4% CAGR from 2025 to 2035, driven by demand for lightweight materials, sustainable packaging alternatives, and digital labeling technologies. Of the 40 countries assessed, China leads with 4.6%, followed by India at 4.3%, while Germany posts 3.9%, the United Kingdom records 3.2%, and the United States trails at 2.9%. BRICS economies focus on cost-optimized PET formats and localized manufacturing, whereas OECD nations prioritize recyclable designs, smart packaging features, and e-commerce-ready formats. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China is expected to grow at a 4.6% CAGR, driven by rising beverage production and adoption of advanced packaging technologies. PET bottles dominate the market, supported by automation in blow-molding and lightweight preform systems. Digital printing and smart labeling solutions gain popularity for brand differentiation. Increased investment in tethered caps and recyclable closures aligns with evolving environmental regulations. E-commerce expansion adds demand for secondary protective packaging, pushing manufacturers toward lightweight corrugated solutions and flexible pouches for last-mile delivery.

India is forecast to grow at a 4.3% CAGR, supported by demand for PET and flexible pouches in urban and semi-urban markets. Beverage brands focus on cost-effective packaging with quick turnaround times for seasonal campaigns. Adoption of lightweight PET bottles and tethered caps aligns with government plastic waste reduction initiatives. Local converters expand high-speed PET preform molding capacity to meet bulk production requirements for carbonated drinks and packaged water. Digital printing integration into shrink sleeves and labels supports limited-edition launches and targeted marketing strategies.

Germany is projected to grow at a 3.9% CAGR, driven by demand for sustainable packaging formats in carbonated and functional beverages. Packaging suppliers prioritize recyclable PET, glass return systems, and biodegradable shrink sleeves to comply with EU directives. Deployment of digital track-and-trace systems for supply chain transparency accelerates adoption of smart packaging technologies. Brands adopt premium glass packaging formats for craft beverages and mineral water, supported by return logistics infrastructure. The market also witnesses growing preference for lightweight closures and energy-efficient blow-molding systems.

The United Kingdom is expected to grow at a 3.2% CAGR, supported by e-commerce-ready packaging and lightweight formats for carbonated beverages. Beverage brands emphasize tethered closures and mono-material designs to meet Extended Producer Responsibility (EPR) regulations. Demand for shrink sleeves with digital watermarks is rising to facilitate recycling and improve brand authentication. Glass packaging in premium soft drink categories maintains niche relevance due to strong heritage branding. Packaging automation upgrades dominate investment priorities, driven by labor cost challenges and the need for precision in high-speed lines.

The United States is anticipated to grow at a 2.9% CAGR, influenced by lightweighting initiatives and growth of ready-to-drink (RTD) beverage segments. PET bottles with higher recycled content dominate packaging innovation pipelines. Brands invest in smart packaging for digital consumer engagement and enhanced traceability in direct-to-consumer (D2C) channels. Aluminum cans retain popularity due to recyclability advantages, with major bottlers expanding can-filling capacities. Automation of bottling and labeling lines becomes critical to offset labor shortages, while robotics and AI integration in secondary packaging processes enhance operational efficiency.

The soft drinks packaging market is dominated by major players focusing on lightweight materials, sustainability, and enhanced shelf appeal. Amcor leads with advanced flexible and rigid packaging solutions, while Ball Corporation, Crown Holdings, and CAN-PACK specialize in aluminum cans supporting growing demand for recyclability. Berry Global, Plastipak Holdings, and Graham Packaging provide PET and plastic-based formats with improved barrier properties. Tetra Pak and SIG dominate carton packaging for juices and functional beverages, emphasizing renewable materials. Paperboard and corrugated solutions from Smurfit Kappa, WestRock, and Graphic Packaging International address secondary packaging needs. Ardagh Group and Novelis strengthen the metal packaging segment with lightweight designs, while AptarGroup contributes closures and dispensing systems. Competition focuses on sustainability, smart labeling, and cost-efficient supply chain solutions across global beverage markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 90.0 Billion |

| Material | Plastic, Glass, Metal, Paper & paperboard, and Others |

| Product Type | Bottles, Cans, Cartons, Pouches, and Others |

| Capacity | Medium packaging (251 ml to 1 liter), Small packaging (Up to 250 ml), and Large packaging (Above 1 liter) |

| Soft Drink Type | Carbonated soft drinks and Non-carbonated soft drinks |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, AptarGroup, Ardagh Group, Ball Corporation, Berry Global Group, CAN-PACK, CPMC Holdings, Crown Holdings, Graham Packaging, Graphic Packaging International, Novelis, Plastipak Holdings, SIG, Silgan Holdings, Smurfit Kappa, Tetra Pak, Visy Industries, and WestRock |

| Additional Attributes | Dollar sales by packaging type (bottles, cans, cartons) and material (PET, aluminum, glass), demand dynamics across carbonated beverages, flavored water, and functional drinks, regional trends led by North America with Asia‑Pacific diversifying format mixes, innovation in tethered caps and lightweight barrier coatings, and environmental impact of recyclability thresholds and single-use packaging regulations. |

The global soft drinks packaging market is estimated to be valued at USD 90.0 billion in 2025.

The market size for the soft drinks packaging market is projected to reach USD 125.7 billion by 2035.

The soft drinks packaging market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in soft drinks packaging market are plastic, glass, metal, paper & paperboard and others.

In terms of product type, bottles segment to command 46.1% share in the soft drinks packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soft Touch Lamination Film Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Soft Ferrite Core Market Size and Share Forecast Outlook 2025 to 2035

Soft Gripper Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Soft Magnetic Composite Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Soft Wall Military Shelter Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Camera (SDC) Market Size and Share Forecast Outlook 2025 to 2035

Softgel Capsules Market Overview - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA