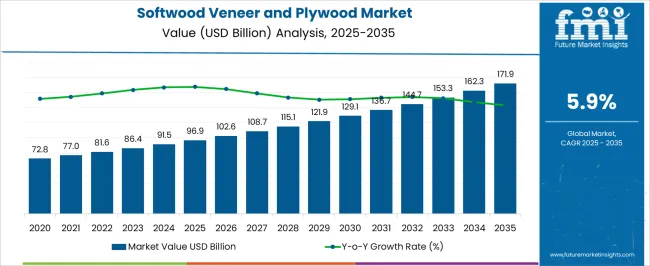

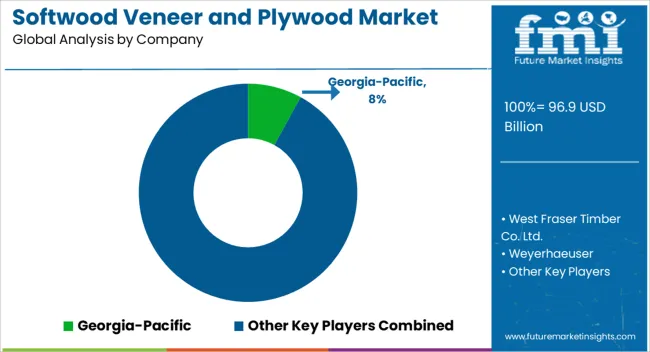

The Softwood Veneer and Plywood Market is estimated to be valued at USD 96.9 billion in 2025 and is projected to reach USD 171.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The softwood veneer and plywood market is projected to grow from USD 96.9 billion in 2025 to USD 171.9 billion by 2035, reflecting a CAGR of 5.9%, offering a significant absolute dollar opportunity. In 2025, the market size of USD 96.9 billion provides a strong base for revenue across construction, furniture, and interior applications. Over the next decade, the incremental opportunity amounts to USD 75 billion, highlighting potential gains for manufacturers, distributors, and suppliers. Early positioning allows stakeholders to secure contracts, expand production, and establish a competitive foothold as demand steadily increases year over year. By 2035, the softwood veneer and plywood market is expected to reach USD 171.9 billion, delivering an absolute dollar opportunity of USD 75 billion from the 2025 baseline, driven by the 5.9% CAGR. The year-on-year growth from USD 96.9 billion in 2025 to USD 171.9 billion in 2035 underscores a consistent upward trend in demand. Companies entering early can capture incremental revenue across high-volume applications, optimize manufacturing capacity, and strengthen distribution channels. This continuous expansion presents stakeholders with tangible financial gains and long-term growth potential throughout the decade.

| Metric | Value |

|---|---|

| Softwood Veneer and Plywood Market Estimated Value in (2025 E) | USD 96.9 billion |

| Softwood Veneer and Plywood Market Forecast Value in (2035 F) | USD 171.9 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

A breakpoint analysis of the softwood veneer and plywood market highlights key phases of growth between 2025 and 2035, emphasizing periods with notable revenue expansion. The market, starting at USD 96.9 billion in 2025, reaches around USD 121.9 billion by 2030, marking the first significant breakpoint where it crosses the USD 120 billion threshold. During this phase, the absolute dollar growth is approximately USD 25 billion, reflecting steady adoption across construction, furniture, and interior applications. Companies entering the market during this early stage can establish supply agreements, build customer relationships, and position themselves for long-term growth as demand gradually scales. The second breakpoint occurs between 2030 and 2035, when the market grows from USD 121.9 billion to USD 171.9 billion. This stage represents the largest absolute dollar increase of about USD 50 billion, highlighting a high-growth phase fueled by cumulative market penetration and increased consumption. Stakeholders focusing on this window can maximize revenue by expanding production capacity, optimizing distribution networks, and capturing high-volume contracts. Overall, the breakpoint analysis illustrates two distinct phases: moderate growth from 2025–2030 and accelerated expansion from 2030–2035, providing clear guidance for strategic investments and operational scaling to fully leverage the absolute dollar opportunity.

The Softwood Veneer and Plywood market is experiencing steady growth supported by increasing demand in construction, furniture manufacturing, and packaging applications. Expansion in residential and commercial infrastructure projects is driving the need for durable, lightweight, and cost-efficient wood materials. Technological improvements in veneer peeling, adhesive formulations, and surface finishing have enhanced the quality and durability of softwood plywood, enabling broader acceptance in high-value applications.

Sustainable forestry practices and the growing use of certified wood products are influencing buyer preferences, particularly in regions with strict environmental compliance requirements. The market is also benefiting from favorable trade policies and the increasing use of engineered wood as an alternative to traditional timber.

With rising urbanization and infrastructure investments, demand for versatile, high-quality plywood is expected to remain strong Future growth will be supported by innovations in panel strength, moisture resistance, and eco-friendly adhesives, positioning softwood veneer and plywood as essential materials for both structural and decorative uses in global markets.

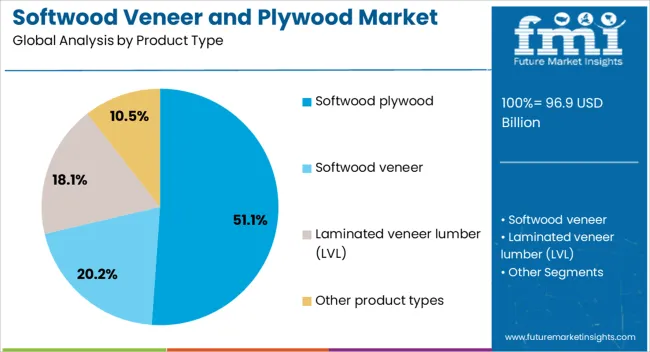

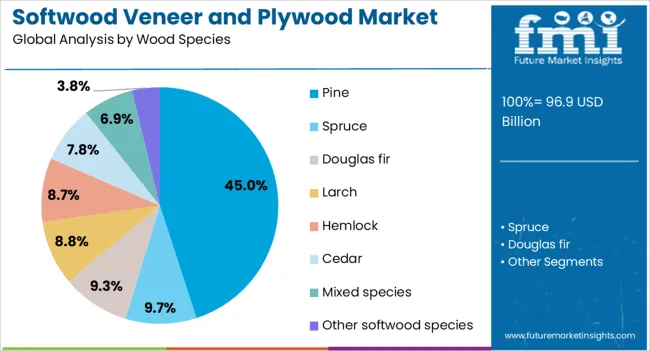

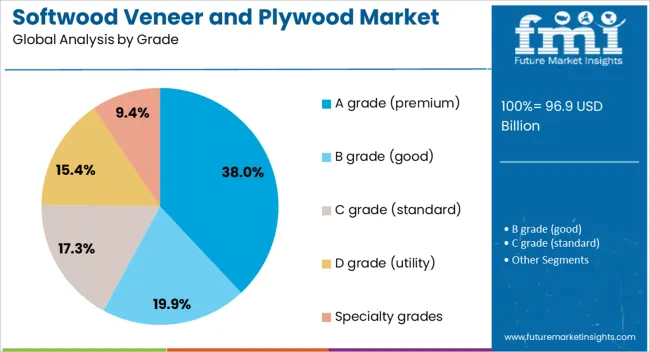

The softwood veneer and plywood market is segmented by product type, wood species, grade, application, end use industry, distribution channel, and geographic regions. By product type, softwood veneer and plywood market is divided into Softwood plywood, Softwood veneer, Laminated veneer lumber (LVL), and Other product types. In terms of wood species, softwood veneer and plywood market is classified into Pine, Spruce, Douglas fir, Larch, Hemlock, Cedar, Mixed species, and Other softwood species. Based on grade, softwood veneer and plywood market is segmented into A grade (premium), B grade (good), C grade (standard), D grade (utility), and Specialty grades. By application, softwood veneer and plywood market is segmented into Construction, Furniture manufacturing, Packaging, Transportation, and Other applications. By end use industry, softwood veneer and plywood market is segmented into Residential construction, Commercial construction, Industrial construction, Furniture industry, Packaging industry, Shipbuilding industry, and Other end use industries. By distribution channel, softwood veneer and plywood market is segmented into Building material retailers, Direct sales, Distributors & wholesalers, Online retail, and Other distribution channels. Regionally, the softwood veneer and plywood industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The softwood plywood product type segment is expected to hold 51.12% of the Softwood Veneer and Plywood market revenue share in 2025, making it the dominant category. This leadership has been attributed to the segment’s versatility, strength-to-weight ratio, and cost-effectiveness in large-scale construction and manufacturing applications.

Its structural reliability has made it suitable for flooring, wall sheathing, and roofing, while its adaptability to various finishes and treatments enhances its appeal in furniture and interior projects. The ability of softwood plywood to be manufactured in large panels with consistent quality has contributed to operational efficiencies for builders and manufacturers.

Increasing availability of sustainably sourced softwood, combined with advancements in bonding technology, has further boosted its adoption With growing infrastructure development and the need for affordable yet durable materials, the segment continues to maintain its competitive edge in both domestic and export markets, reinforcing its position as the leading product type in the industry.

The pine wood species segment is projected to command 45% of the Softwood Veneer and Plywood market revenue share in 2025, establishing itself as the leading wood species. Its dominance is supported by pine’s favorable mechanical properties, workability, and natural aesthetic appeal. Pine offers a good balance between strength and weight, making it ideal for both structural and decorative purposes.

Its ease of processing, coupled with its ability to hold adhesives and finishes effectively, has increased its preference among manufacturers. The availability of pine from sustainable forestry operations ensures a consistent supply, which is vital for large-scale production. Furthermore, pine’s adaptability to various treatments enhances its resistance to moisture, pests, and decay, expanding its suitability across diverse climates and end-use applications.

Growing consumer preference for natural-looking materials in furniture and interior design has also supported demand These combined attributes continue to drive the pine segment’s leading position within the wood species category.

The A grade (premium) segment is anticipated to hold 38% of the Softwood Veneer and Plywood market revenue share in 2025, making it the most prominent grade. This grade’s leadership is underpinned by its superior surface finish, minimal defects, and high aesthetic value, which are critical for visible applications in furniture, cabinetry, and high-end interiors. Manufacturers favor A grade plywood for its uniformity, smoothness, and ability to accept paints, stains, and veneers without compromising appearance.

The premium quality also ensures excellent structural performance, making it suitable for both decorative and load-bearing applications. Demand for this grade has been strengthened by the growing trend toward high-quality, durable, and aesthetically pleasing wood products in residential and commercial projects.

Its use in applications where visual presentation is as important as strength reinforces its market appeal Consistent investment in quality control and surface treatment technologies has further enhanced the value proposition of A grade plywood, solidifying its position as the preferred choice for premium projects.

The softwood veneer and plywood market is expanding as demand grows in construction, furniture, packaging, and interior design industries. Softwood plywood is preferred for its strength-to-weight ratio, versatility, and cost-effectiveness, making it suitable for residential and commercial buildings, transportation, and decorative applications. Rising urbanization, infrastructure development, and increased demand for eco-friendly and sustainable wood products are driving adoption. Technological innovations in veneer processing, bonding techniques, and surface finishing are enhancing durability and aesthetics. Companies investing in high-quality, standardized, and certified plywood products are positioned to capitalize on growth in construction, furniture manufacturing, and industrial applications.

The softwood veneer and plywood market faces challenges in raw material supply, quality consistency, and environmental compliance. Availability of high-quality softwood logs depends on forest management practices, seasonal conditions, and regional regulations. Variations in wood species, moisture content, and growth patterns can affect the strength, uniformity, and finishing quality of veneers and plywood sheets. Strict environmental regulations, including sustainable sourcing certifications and restrictions on logging, add complexity to procurement. Additionally, production processes require careful control to prevent warping, delamination, or defects. Manufacturers must implement sustainable sourcing strategies, quality monitoring systems, and eco-friendly processing methods to meet regulatory standards and maintain product reliability.

The softwood veneer and plywood market is trending toward sustainable production, advanced manufacturing, and product diversification. Increasing consumer and regulatory focus on eco-friendly materials is driving demand for FSC-certified, PEFC-certified, and low-emission plywood. Technological advancements in adhesive formulations, veneer laminating, and automated cutting processes are improving product strength, surface quality, and production efficiency. Pre-finished, decorative, and specialty plywood products are gaining traction in furniture, interior design, and modular construction applications. Integration of digital processing, precision slicing, and quality control tools is reducing waste and enhancing material utilization. These trends are positioning softwood plywood as a versatile and environmentally responsible material for residential, commercial, and industrial applications.

Softwood veneer and plywood present substantial opportunities in construction, furniture manufacturing, and industrial applications. The construction sector benefits from lightweight yet durable plywood for structural, flooring, and wall paneling purposes. Furniture and interior design industries increasingly use decorative and specialty veneers for aesthetic appeal and functional performance. Industrial applications, including packaging, automotive interiors, and modular construction, also provide growth potential. Expansion into emerging markets with rising urbanization and infrastructure projects offers additional opportunities for high-quality plywood products. Manufacturers investing in sustainable sourcing, innovative finishes, and customized veneer options can meet the evolving needs of architects, builders, and furniture makers, driving market adoption.

Market growth for softwood veneer and plywood is restrained by raw material price volatility, competition from alternative materials, and operational challenges. Fluctuating timber costs and transportation expenses can affect product pricing and profitability. Competition from hardwood plywood, engineered wood products, plastics, and metal panels limits market penetration in some applications. Variability in wood quality, processing costs, and labor-intensive production methods further restrict scalability. In regions with strict environmental regulations, sourcing restrictions may increase operational complexity and compliance costs. Until material prices stabilize, alternative materials remain competitive, and production efficiencies improve, market adoption may continue to focus on high-value and regulatory-compliant applications in construction, furniture, and industrial segments.

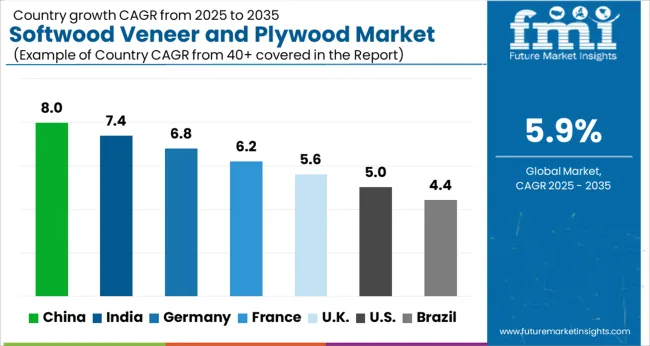

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global softwood veneer and plywood market is projected to grow at a CAGR of 5.9% through 2035, supported by increasing demand across construction, furniture, and interior design applications. Among BRICS nations, China has been recorded with 8.0% growth, driven by large-scale production and deployment in residential and commercial construction, while India has been observed at 7.4%, supported by rising utilization in furniture manufacturing and building projects. In the OECD region, Germany has been measured at 6.8%, where production and adoption for industrial, commercial, and residential applications have been steadily maintained. The United Kingdom has been noted at 5.6%, reflecting consistent use in furniture and construction, while the USA has been recorded at 5.0%, with production and utilization across construction, furniture, and interior design sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The softwood veneer and plywood market in China is growing at a CAGR of 8%, driven by rising demand in residential and commercial construction, furniture manufacturing, and interior design projects. Manufacturers are focusing on high-quality, durable, and eco-friendly plywood solutions that meet structural and aesthetic requirements. Government initiatives promoting sustainable forestry, green building standards, and construction modernization are accelerating adoption. R&D efforts are targeting improved moisture resistance, surface finish, and bonding technologies. Pilot projects in residential housing, commercial offices, and furniture production demonstrate operational benefits such as durability, aesthetic appeal, and cost-effectiveness. Collaborations between domestic manufacturers and international suppliers are enhancing production capabilities and quality standards. Increasing construction activity and furniture demand continues to support steady growth in China’s softwood veneer and plywood market.

Softwood veneer and plywood market in India is expanding at a CAGR of 7.4%, fueled by growing residential and commercial construction, furniture manufacturing, and interior decoration projects. Manufacturers are investing in high-quality plywood, moisture resistant solutions, and eco-friendly production methods. Government initiatives supporting sustainable forestry, housing development, and construction modernization are accelerating adoption. Pilot projects in residential buildings, office interiors, and furniture demonstrate operational benefits including durability, aesthetic appeal, and cost efficiency. Collaborations between research institutions and plywood manufacturers are enhancing material performance, surface finishing, and production efficiency. Rising construction activity, urbanization, and furniture demand are expected to continue driving steady growth across India’s softwood veneer and plywood market.

Softwood veneer and plywood market in Germany is recording a CAGR of 6.8%, supported by demand in construction, furniture, and interior design sectors. Manufacturers are focusing on high-quality, durable, and sustainable plywood products with superior bonding and moisture resistance. Government programs promoting green building standards, sustainable forestry, and energy-efficient construction are encouraging market adoption. Pilot projects in residential and commercial buildings, furniture production, and interior applications demonstrate operational benefits including durability, aesthetics, and compliance with environmental standards. Collaborations between research institutes, industrial manufacturers, and designers are advancing R&D in material optimization, surface finishing, and sustainable production techniques. Germany’s focus on quality, sustainability, and advanced construction methods continues to drive growth in the softwood veneer and plywood market.

The United Kingdom is experiencing a CAGR of 5.6% in the softwood veneer and plywood market, driven by demand in residential construction, commercial interiors, and furniture manufacturing. Manufacturers are investing in high-quality plywood, moisture resistant finishes, and eco-friendly production methods. Government initiatives promoting sustainable forestry, building regulations, and green construction practices are supporting market adoption. Pilot projects in housing, commercial offices, and furniture production highlight operational benefits such as durability, aesthetics, and cost efficiency. Collaborations with research institutions and industrial manufacturers are enhancing R&D in bonding technologies, surface finishes, and production efficiency. Rising construction activity and furniture demand continue to support steady growth across the UK softwood veneer and plywood market.

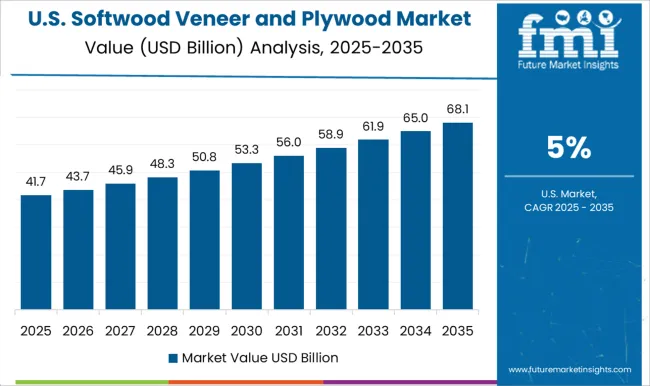

The United States softwood veneer and plywood market is growing at a CAGR of 5.0%, driven by residential and commercial construction, furniture production, and interior design applications. Manufacturers are focusing on durable, high-quality plywood with improved moisture resistance, surface finish, and eco-friendly production methods. Government regulations promoting sustainable forestry, green building practices, and construction standards are encouraging adoption. Pilot projects in housing, office interiors, and furniture manufacturing demonstrate operational benefits such as durability, aesthetics, and cost efficiency. Collaborations between manufacturers, research institutes, and design firms are advancing R&D in bonding technologies, material optimization, and sustainable production techniques. Increasing demand for residential and commercial construction, along with furniture growth, continues to support steady adoption of softwood veneer and plywood in the USA market.

The softwood veneer and plywood market is highly competitive, driven by global forest products companies and regional specialists. Georgia-Pacific is positioned as a market leader, with product brochures emphasizing dimensional stability, consistent quality, and suitability for construction, furniture, and industrial applications. West Fraser Timber Co. Ltd. competes through high-grade softwood veneers and plywood panels, with technical literature highlighting structural performance, moisture resistance, and compliance with building codes. Weyerhaeuser promotes a broad portfolio of plywood and engineered wood products, with brochures detailing strength ratings, bonding types, and processing guidance. Arauco emphasizes sustainable forestry and certified veneers, with product literature providing specifications on density, thickness, and finishing compatibility. Dongwha / Dongwha Group focuses on value-added plywood and specialty panels, with brochures presenting dimensional tolerances, durability, and surface quality. Kronospan / Kronoplus highlights engineered wood solutions and industrial-grade panels, with technical documentation outlining load ratings, fire resistance, and adhesive types. Canfor / Canfor Plywood provides structural and appearance-grade products, with brochures emphasizing mechanical properties, ease of installation, and compliance with North American standards. Century Plyboards / CenturyProwud delivers decorative and structural panels, with literature showcasing surface finishes, bonding quality, and moisture performance. Other regional players compete with niche products, emphasizing local availability, cost efficiency, and customization for specific applications. Strategies in the market are centered on product quality, sustainability certification, and diversified application coverage. R&D investment is directed toward improving moisture resistance, bonding strength, and dimensional stability. Partnerships with construction firms, furniture manufacturers, and industrial OEMs are leveraged to secure long-term adoption. Observed industry patterns indicate emphasis on FSC or PEFC-certified sourcing, low-emission adhesives, and veneer grading consistency to meet evolving building codes and environmental regulations. Expansion into value-added panels and specialty products is pursued to differentiate in mature markets and address specialized industrial needs. Product brochures are used as key instruments to communicate technical capabilities, application guidance, and sustainability credentials. Strength ratings, thickness, density, and bonding types are presented in clear tables and charts. Georgia-Pacific literature emphasizes structural reliability and industrial versatility. West Fraser and Weyerhaeuser brochures focus on building code compliance, durability, and finishing compatibility. Arauco and Kronospan provide sustainability certifications and performance metrics. Dongwha and Canfor brochures highlight surface quality, moisture resistance, and installation guidance. Century Plyboards literature emphasizes decorative finishes and bonding quality. Digital brochures and interactive datasheets are increasingly employed to allow architects, engineers, and procurement specialists to assess suitability quickly. Market success is determined not only by material performance but also by how effectively brochures convey technical reliability, regulatory compliance, and value, making them essential for competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 96.9 Billion |

| Product Type | Softwood plywood, Softwood veneer, Laminated veneer lumber (LVL), and Other product types |

| Wood Species | Pine, Spruce, Douglas fir, Larch, Hemlock, Cedar, Mixed species, and Other softwood species |

| Grade | A grade (premium), B grade (good), C grade (standard), D grade (utility), and Specialty grades |

| Application | Construction, Furniture manufacturing, Packaging, Transportation, and Other applications |

| End Use Industry | Residential construction, Commercial construction, Industrial construction, Furniture industry, Packaging industry, Shipbuilding industry, and Other end use industries |

| Distribution Channel | Building material retailers, Direct sales, Distributors & wholesalers, Online retail, and Other distribution channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Georgia-Pacific, West Fraser Timber Co. Ltd., Weyerhaeuser, Arauco, Dongwha / Dongwha Group, Kronospan / Kronoplus, Canfor / Canfor Plywood, and Century Plyboards / Century Prowud |

| Additional Attributes | Dollar sales vary by product type, including softwood veneers, plywood sheets, and engineered wood panels; by application, such as construction, furniture, interior decoration, and packaging; by end-use industry, spanning residential, commercial, and industrial sectors; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by rising construction activities, sustainable building practices, and demand for lightweight, durable wood products. |

The global softwood veneer and plywood market is estimated to be valued at USD 96.9 billion in 2025.

The market size for the softwood veneer and plywood market is projected to reach USD 171.9 billion by 2035.

The softwood veneer and plywood market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in softwood veneer and plywood market are softwood plywood, _structural plywood, _decorative plywood, _marine plywood, _aircraft plywood, _overlaid plywood, _other plywood types, softwood veneer, _rotary cut veneer, _sliced veneer, _sawn veneer, laminated veneer lumber (lvl) and other product types.

In terms of wood species, pine segment to command 45.0% share in the softwood veneer and plywood market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Softwood Lumber Market

Unbleached Softwood Kraft Pulp Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Unbleached Softwood Kraft Pulp Companies

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

USA and Canada Teak Veneer Sheet Market Analysis by Grade, Application, and End Use Forecast through 2035

Plywood Boxes Market Size and Share Forecast Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA