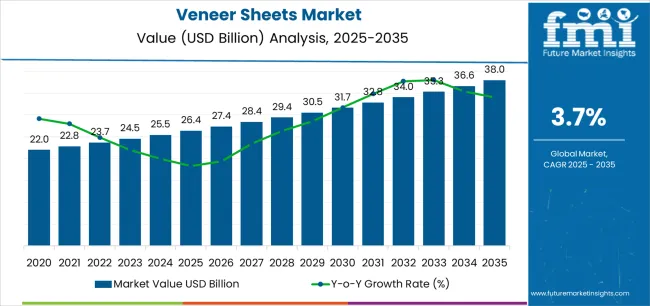

The veneer sheets market is valued at USD 26.4 billion in 2025 and is projected to reach USD 38.0 billion by 2035, rising at a 3.7% CAGR, adding USD 12.3 billion in total. Growth reflects steady expansion in commercial interiors, furniture manufacturing, and architectural millwork, where veneer sheets deliver natural aesthetics, certified sustainability, and efficient material utilization. Between 2025 and 2030, the market increases to USD 31.8 billion, contributing 43.9% of the decade’s growth as commercial construction, office refurbishments, and hospitality fit-outs adopt paper-backed and pre-finished veneer systems. The larger 56.1% contribution during 2030–2035 aligns with expanding engineered and reconstituted veneer production, consistent grain technologies, and demand for antimicrobial, fire-rated, and low-VOC decorative surfaces.

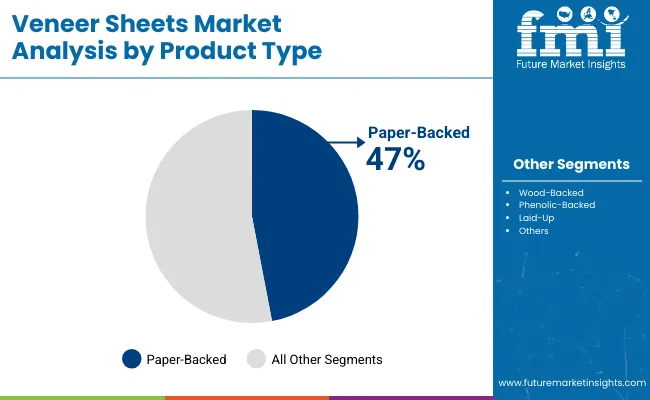

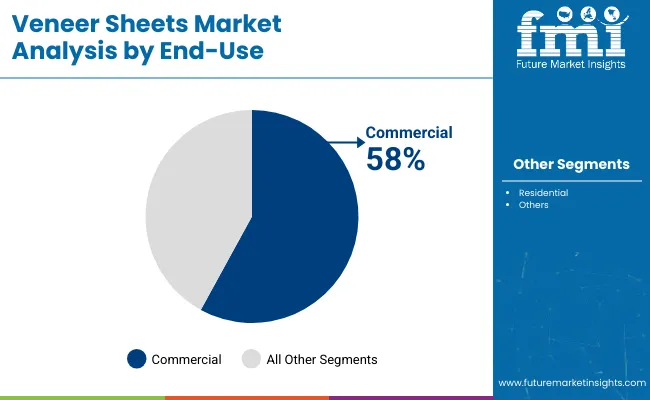

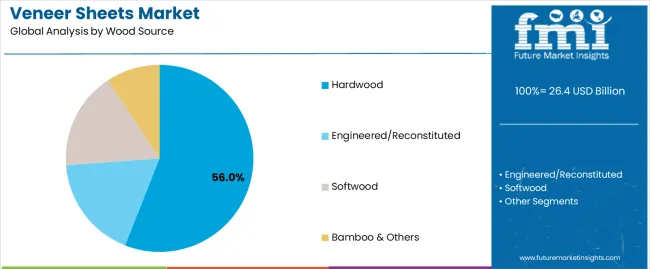

Product segmentation reinforces these design and performance trends: paper-backed veneer sheets hold ~47% share, driven by flexibility, cost efficiency, and compatibility with curved and flat surfaces, while hardwood sources dominate at 56%, supporting premium furniture, high-end interiors, and luxury architectural finishes. Commercial applications remain the core demand center with 58% share, covering offices, hospitality, retail, and institutional environments requiring durable, sustainable, and visually consistent surfacing materials.

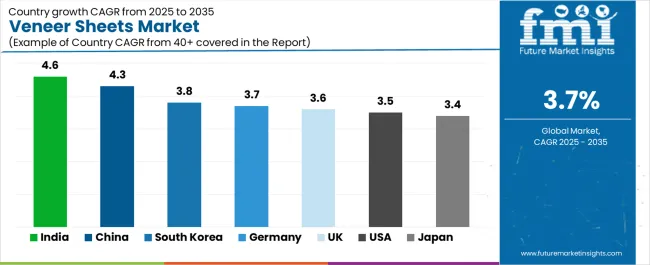

Geographically, the market is led by India (4.6% CAGR) and China (4.3%), supported by commercial real estate expansion, organized furniture manufacturing, and adoption of FSC-certified and low-VOC materials. South Korea (3.8%), Germany (3.7%), and the UK (3.6%) sustain growth through premium interiors, modular furniture, and office refurbishment cycles, while the USA (3.5%) and Japan (3.4%) expand through high-end residential remodeling, engineered veneer adoption, and prefabricated interior systems. The competitive landscape remains moderately fragmented, with leaders such as Decospan, ALPI, Columbia Forest Products, FormWood, and Oakwood Veneer Company differentiating through pre-finished systems, advanced surface treatments, sustainable sourcing, and engineered veneer innovations tailored to commercial and luxury design markets.

Urbanization and housing development, especially in emerging markets, continue to drive the need for high-quality yet economical interior materials. Veneer sheets are widely used in cabinetry, paneling, wall cladding, doors, wardrobes, and modular furniture, sectors that have seen upgraded design expectations from end users. The shift toward modular and customizable furniture is also giving veneer sheets a strong push, as they offer design flexibility and a wide variety of textures, grains, and finishes. Growing hospitality and retail infrastructure projects worldwide are further expanding the use of decorative veneers to create premium-looking interiors at manageable cost.

Advancements in manufacturing technologies, such as improved slicing machinery, rotary cutting techniques, resin systems, and surface finishing processes, are elevating product quality while expanding the range of achievable designs. Engineered and reconstituted veneers are expanding the industry’s appeal by offering uniform patterns, better durability, and resistance to cracking or warping. These technological improvements allow veneer manufacturers to cater to both premium and mass-market segments with differentiated offerings. Digital printing and surface enhancement technologies are also enabling innovative textures and hybrid finishes that mimic exotic wood grains without relying on scarce timber species.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 26.4 billion |

| Forecast Value in (2035F) | USD 38 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

Market expansion is being supported by the increasing global demand for sustainable interior surfacing solutions and the corresponding need for decorative wood finishes that can deliver authentic natural aesthetics, support green building certification programs, and enable efficient material utilization across various commercial office interiors, hospitality projects, retail environments, and high-end residential applications.

Modern architects and furniture manufacturers are increasingly focused on implementing surfacing materials that can provide design versatility, maintain dimensional stability, and offer certified sustainable sourcing while meeting stringent fire safety and emission standards.

Veneer sheets' proven ability to deliver real wood aesthetics, optimize material yield from valuable hardwood species, and support forest stewardship principles makes them essential materials for contemporary interior design and furniture manufacturing.

The growing emphasis on commercial interior refurbishment and office space optimization is driving demand for veneer sheets that can support rapid installation, ensure consistent appearance, and enable comprehensive design customization through diverse species selections and finish options.

Designers' preference for natural materials that combine aesthetic authenticity with performance reliability and sustainability credentials is creating opportunities for innovative veneer sheet implementations across hospitality renovations, corporate office upgrades, and luxury residential projects.

The rising influence of green building certification systems and low-emission material requirements is also contributing to increased adoption of FSC-certified and low-VOC veneer products that can provide documented environmental benefits without compromising design quality or installation efficiency.

The market is segmented by product type, end use, wood source, and region. By product type, the market is divided into paper-backed, wood-backed, phenolic-backed, laid-up, and others. Based on end use, the market is categorized into commercial (including office, hospitality, retail, and institutional) and residential.

By wood source, the market covers hardwood, engineered/reconstituted, softwood, and bamboo & others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The paper-backed segment is projected to maintain its leading position in the veneer sheets market in 2025 with a commanding 47.0% market share, reaffirming its role as the preferred backing system for decorative wood veneers due to flexible handling characteristics, cost-effective production, and versatile application suitability across furniture manufacturing and architectural millwork.

Furniture producers and millwork fabricators increasingly utilize paper-backed veneers for their ease of processing, compatibility with various adhesive systems, and ability to conform to curved surfaces while maintaining grain integrity. Paper-backed veneer technology's proven effectiveness directly addresses manufacturing requirements for efficient production and consistent quality.

This product segment forms the foundation of modern veneer applications, representing the configuration with the greatest versatility across flat and contoured surfaces in cabinet doors, wall panels, and furniture components. Manufacturing investments in paper-backed systems continue to strengthen adoption among furniture makers and millwork shops.

With production processes requiring flexible materials and reliable adhesion, paper-backed veneer sheets align with both operational objectives and cost efficiency requirements, making them the central component of comprehensive furniture finishing strategies.

The commercial end-use segment is projected to represent the largest share of veneer sheet demand in 2025 with 58.0% market share, underscoring its critical role as the primary driver for decorative veneer adoption across office interiors, hospitality properties, retail environments, and institutional facilities. Commercial designers prefer veneer sheets for their design versatility, fire-rated options, durability in high-traffic applications, and ability to deliver consistent aesthetics across large projects while supporting sustainable material procurement.

Within the commercial segment, office applications command 24.0% of total market share, representing corporate headquarters, coworking spaces, and commercial office buildings. Hospitality accounts for 18.0%, encompassing hotels, restaurants, and entertainment venues. Retail holds 12.0%, serving store fixtures and shopfitting applications. Institutional applications represent 4.0%, including healthcare, education, and government facilities.

The segment is supported by continuous renovation cycles in commercial real estate and growing availability of pre-finished veneer systems enabling accelerated installation timelines. As commercial building standards emphasize sustainability and wellness, the commercial application will continue to dominate while supporting green building certification and enhanced interior environmental quality.

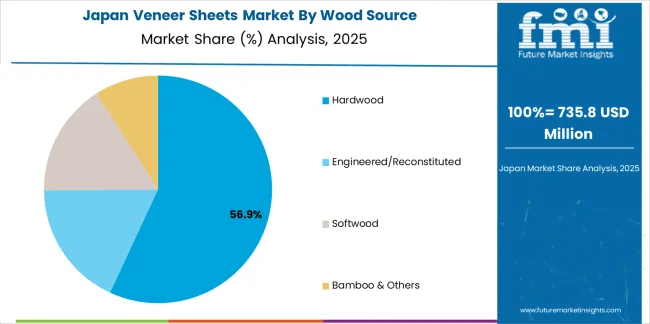

The hardwood segment commands the largest market share at 56.0% in 2025, reflecting its established position as the premium wood source for decorative veneers offering superior grain patterns, rich color variations, and high-value aesthetics demanded in luxury commercial and residential applications.

Hardwood veneers benefit from diverse species availability including oak, walnut, cherry, maple, and exotic species providing unique design characteristics. This segment's dominance stems from architects' and designers' preference for authentic hardwood aesthetics in high-end projects.

Engineered and reconstituted veneers follow with 20.0% share, providing consistent patterns and sustainable alternatives through innovative manufacturing. Softwood accounts for 19.0%, serving cost-sensitive applications and Scandinavian design aesthetics. Bamboo and others hold 5.0%, representing emerging sustainable alternatives.

The hardwood segment's leadership is reinforced by premium positioning in luxury interiors, established supply chains for popular species, and designers' continued preference for natural hardwood grain patterns supporting architectural authenticity and timeless design appeal.

The veneer sheets market is advancing steadily due to increasing commercial construction activity supporting office and hospitality interior fit-outs and growing adoption of sustainable surfacing materials that provide natural aesthetics with improved material efficiency across diverse furniture manufacturing, architectural millwork, and interior design applications.

The market faces challenges, including competition from high-pressure laminates and thermally-fused melamine offering lower costs and enhanced durability, volatility in hardwood timber pricing affecting product economics, and technical limitations including veneer thickness variability and moisture sensitivity requiring careful handling and application. Innovation in engineered veneers and advanced finishing systems continues to influence product development and market expansion patterns.

The growing adoption of pre-finished veneer sheets with factory-applied UV coatings, scratch-resistant topcoats, and antimicrobial surface treatments is enabling faster installation timelines, consistent finish quality, and enhanced performance characteristics addressing commercial project requirements for durability and maintenance efficiency.

Advanced finishing technologies provide superior abrasion resistance while reducing on-site labor and eliminating finishing odors in occupied spaces. Manufacturers are increasingly recognizing the competitive advantages of value-added finishing services for project specification and contractor preference in time-sensitive commercial renovations.

Modern veneer manufacturers are incorporating FSC and PEFC certification programs, comprehensive chain-of-custody documentation, and transparent sourcing practices to enhance environmental credentials, support green building point achievement, and meet corporate sustainability procurement requirements through verified sustainable forest management.

These certifications improve market access while enabling premium positioning for environmentally-conscious projects. Advanced traceability also allows manufacturers to support comprehensive sustainability reporting and differentiate products beyond price competition, creating advantages in specification-driven commercial markets.

The emergence of reconstituted veneer production utilizing fast-growing plantation species and veneer waste creates consistent grain patterns, eliminates natural defects, and enables exotic species replication while reducing dependency on scarce hardwood resources and supporting circular economy principles through material optimization and waste valorization in furniture and millwork manufacturing.

| Country | CAGR (2025-2035) |

|---|---|

| India | 4.6% |

| China | 4.3% |

| South Korea | 3.8% |

| Germany | 3.7% |

| UK | 3.6% |

| USA | 3.5% |

| Japan | 3.4% |

The market is experiencing solid growth globally, with India leading at a 4.6% CAGR through 2035, driven by commercial fit-out expansion, growth in organized furniture manufacturing with modern production capabilities, and shift to FSC-certified and low-VOC interior materials supporting green building adoption. China follows at 4.3%, supported by robust hospitality development pipeline, reconstituted veneer production scaling, and export cabinetry market recovery. South Korea shows growth at 3.8%, emphasizing luxury residential tower development and antimicrobial and fire-rated veneer adoption.

Germany records 3.7%, focusing on premium kitchen manufacturing and shopfitting with strong modular furniture base. The United Kingdom demonstrates 3.6% growth, supported by office refurbishment cycles and bespoke joinery with green building credits favoring veneers.

The United States exhibits 3.5% growth, emphasizing high-end residential remodeling and engineered veneer usage in panels and casegoods. Japan shows 3.4% growth, supported by compact housing and prefabricated interiors with demand for high-grade hardwood faces.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

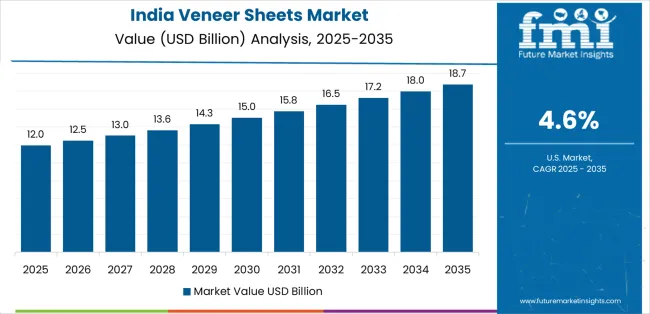

Revenue from veneer sheets in India is projected to exhibit exceptional growth with a CAGR of 4.6% through 2035, driven by expanding commercial fit-out activity across office spaces, hospitality developments, and retail environments, growth in organized furniture manufacturing sector adopting modern production technologies and quality standards, and shift to FSC-certified and low-VOC interior materials supporting green building certification programs and corporate sustainability mandates. The country's rapid urbanization and expanding middle class are creating substantial demand for decorative veneers across commercial and residential applications. Major furniture manufacturers and international veneer suppliers are establishing comprehensive capabilities to serve Indian markets.

Revenue from veneer sheets in China is expanding at a CAGR of 4.3%, supported by robust hospitality development pipeline including hotels and restaurants, reconstituted veneer production scaling enabling consistent supply and cost competitiveness, and export cabinetry market recovery supporting demand for decorative veneers in furniture manufacturing for international markets. The country's established furniture manufacturing infrastructure and growing domestic premium interior segment are driving veneer consumption. Chinese manufacturers and international suppliers are establishing extensive production and distribution capabilities.

Revenue from veneer sheets in the United States is expanding at a CAGR of 3.5%, supported by high-end residential remodeling activity emphasizing kitchen upgrades and custom millwork, engineered veneer usage in architectural panels and casegoods furniture, and established commercial renovation cycles supporting office and hospitality interior refreshment. The nation's mature construction market and design-conscious consumers are driving demand for premium veneer products. Leading veneer manufacturers and millwork suppliers are investing in comprehensive supply chains.

Revenue from veneer sheets in Germany is expanding at a CAGR of 3.7%, supported by premium kitchen manufacturing emphasizing natural wood aesthetics, shopfitting and modular furniture production with comprehensive quality standards, and EN/CE compliance requirements driving specification of certified materials meeting European safety and environmental regulations. Germany's advanced furniture industry and quality focus are driving demand for premium veneers. German furniture manufacturers and veneer suppliers are investing in sustainable sourcing and advanced finishing capabilities.

Revenue from veneer sheets in the United Kingdom is growing at a CAGR of 3.6%, driven by office refurbishment cycles supporting workspace optimization and hybrid work environments, bespoke joinery sector delivering custom architectural millwork for luxury residential and commercial projects, and green building certification systems favoring natural materials with sustainable sourcing credentials. The UK's design-driven interior market and sustainability focus are supporting veneer adoption. British millwork firms and designers are establishing comprehensive natural material specifications.

Revenue from veneer sheets in South Korea is expanding at a CAGR of 3.8%, supported by luxury residential tower development featuring high-end interior finishes, antimicrobial and fire-rated veneer adoption addressing health-conscious consumers and stringent building codes, and sophisticated design culture emphasizing premium materials in residential and commercial interiors. South Korea's quality-focused property market and innovation in functional materials are driving specialized veneer demand. Korean furniture manufacturers and construction companies are establishing advanced veneer application capabilities.

Revenue from veneer sheets in Japan is growing at a CAGR of 3.4%, driven by compact housing design emphasizing efficient space utilization and premium finishes, prefabricated interior systems enabling controlled quality and accelerated construction, and demand for high-grade hardwood veneer faces meeting exacting Japanese quality standards and aesthetic preferences. Japan's quality-conscious market and advanced manufacturing are driving premium veneer consumption. Japanese furniture makers and construction companies are investing in precision veneer processing capabilities.

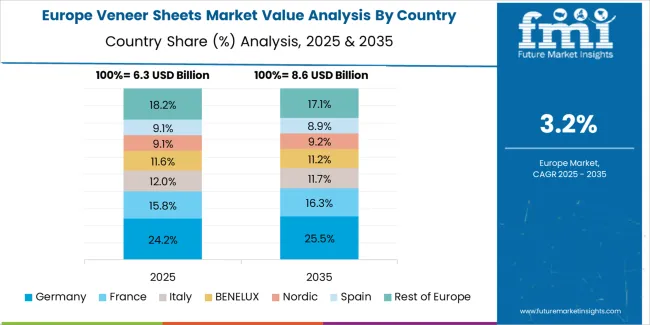

The veneer sheets market in Europe is projected to grow from USD 7.4 billion in 2025 to USD 10.2 billion by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain its leadership position with a 22.0% market share in 2025, holding at 21.8% by 2035, supported by its premium kitchen and furniture manufacturing base, comprehensive shopfitting industry, and strong modular furniture production capacity serving European markets.

Italy follows with 16.0% in 2025, projected to reach 16.2% by 2035, driven by design-led kitchen and furniture manufacturing with established luxury furniture brands and architectural millwork expertise. France holds 14.0% in 2025, rising to 14.3% by 2035, supported by premium interior architecture market and hospitality renovation activity in major cities. The United Kingdom commands 12.0% in 2025, projected to reach 12.4% by 2035, driven by office refurbishment cycles and bespoke joinery sector serving luxury residential and commercial projects.

Spain accounts for 8.0% in 2025, expected to reach 8.2% by 2035, supported by hospitality sector development and residential interior upgrading. Nordics & Benelux maintain 12.0% in 2025, growing to 12.3% by 2035, driven by sustainable design culture and certified wood product specifications. Rest of Europe/CEE holds 16.0% in 2025, moderating to 14.8% by 2035, attributed to commercial construction growth and furniture manufacturing expansion across Central and Eastern European markets implementing modern interior standards.

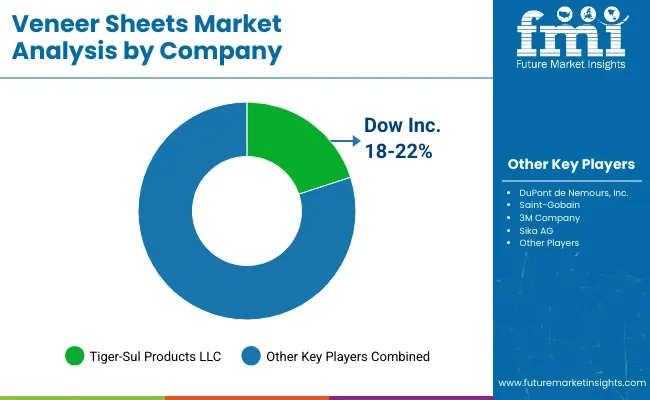

The veneer sheets market features 12–18 players with moderate concentration, where the top three companies collectively account for around 40–46% of global market share, driven by strong sourcing networks, advanced slicing and peeling technologies, and long-standing relationships with furniture, interior décor, and architectural sectors. The leading company, Decospan NV, holds roughly 7% market share, supported by its extensive veneer collections, sustainable wood sourcing programs, and high-quality production capabilities. Competition centers on wood species availability, grain consistency, finishing quality, and sustainability certifications rather than price alone.

Market leaders such as Decospan NV, ALPI S.p.A., and Columbia Forest Products maintain their dominance through innovative veneer technologies, including reconstituted veneers, engineered patterns, and eco-certified offerings. Their strengths include advanced manufacturing processes, wide species portfolios, and the ability to deliver consistent quality for large-scale interior and furniture applications.

Challenger companies such as Greenlam Industries Ltd. (Decowood), Greenply Industries, and FormWood Industries focus on providing high-quality decorative veneers for premium residential and commercial projects, emphasizing aesthetics, customization, and environmentally responsible sourcing.

Additional competitive pressure comes from specialized and regional players including Oakwood Veneer Company, Flexible Materials Inc., Timber Products Company, Fritz Kohl GmbH & Co. KG, Sauers & Company Veneers, Tabu SpA, Turakhia Overseas, Samko Timber Limited, and SR Wood, which strengthen their positions through unique wood species, artisanal craftsmanship, and tailored veneer solutions for niche design requirements.

Veneer sheets represent a specialized decorative surfacing segment within architectural interiors and furniture manufacturing, projected to grow from USD 26.4 billion in 2025 to USD 38 billion by 2035 at a 3.7% CAGR.

These thin wood layers-primarily paper-backed configurations for flexible application- are produced through slicing or peeling hardwood and engineered logs to serve as decorative surfaces providing authentic wood aesthetics in commercial office interiors, hospitality projects, residential furniture, and architectural millwork applications.

Market expansion is driven by increasing commercial renovation activity, growing preference for sustainable natural materials, expanding certified wood product specifications, and rising emphasis on design-led interiors across office, hospitality, retail, and luxury residential sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 26.4 billion |

| Product Type | Paper-Backed, Wood-Backed, Phenolic-Backed, Laid-Up, Others |

| End Use | Commercial (Office, Hospitality, Retail, Institutional), Residential |

| Wood Source | Hardwood, Engineered/Reconstituted, Softwood, Bamboo & Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | India, China, South Korea, Germany, United Kingdom, United States, Japan, and 40+ countries |

| Key Companies Profiled | Decospan NV, ALPI S.p.A., Columbia Forest Products, Greenlam Industries Ltd. (Decowood), Greenply Industries, FormWood Industries, Oakwood Veneer Company, Flexible Materials Inc., Timber Products Company, Fritz Kohl GmbH & Co. KG, Sauers & Company Veneers, Tabu SpA, Turakhia Overseas, Samko Timber Limited, and SR Wood |

| Additional Attributes | Dollar sales by product type, end use, and wood source categories, regional demand trends, competitive landscape, technological advancements in finishing systems, engineered veneer development, sustainable sourcing innovation, and commercial application optimization |

The global veneer sheets market is estimated to be valued at USD 26.4 billion in 2025.

The market size for the veneer sheets market is projected to reach USD 38.0 billion by 2035.

The veneer sheets market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in veneer sheets market are hardwood, engineered/reconstituted, softwood and bamboo & others.

In terms of end use, commercial segment to command 58.0% share in the veneer sheets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Softwood Veneer and Plywood Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Tarpaulin Sheets Market Share & Provider Insights

Greaseproof Sheets Market Size and Share Forecast Outlook 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Insights for Greaseproof Sheets Providers

Cast Acrylic Sheets Market Size and Share Forecast Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Push-Pull Slip Sheets Market Size, Share & Forecast 2025 to 2035

Mesh Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

Disposable Bed Sheets Market Analysis - Trends, Growth & Forecast 2025 to 2035

Flexible Rubber Sheets Market Size and Share Forecast Outlook 2025 to 2035

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA