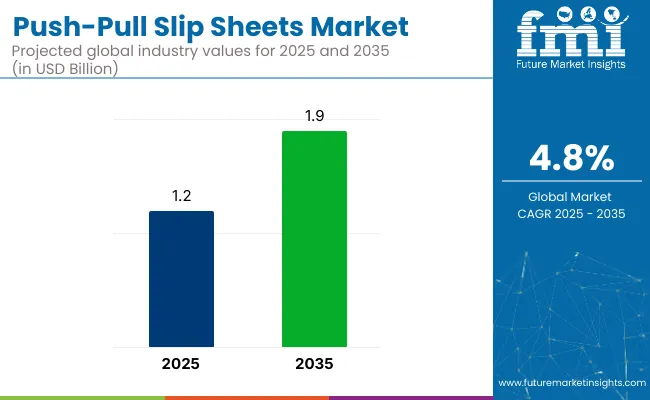

The global push-pull slip sheets market is projected to grow from USD 1.2 billion in 2025 to USD 1.9 billion by 2035, registering a CAGR of 4.8% during the forecast period.

This growth is primarily attributed to the increasing demand for cost-effective and sustainable packaging solutions across various industries, including food and beverage, pharmaceuticals, and e-commerce. Push-pull slip sheets offer significant advantages over traditional pallets, such as reduced material costs, improved space utilization, and enhanced load stability, making them a preferred choice for modern logistics and supply chain operations.

In 2023, ORBIS Corporation, a leader in reusable packaging solutions, announced the completion of a significant expansion of its manufacturing facility in Urbana, Ohio. This expansion added 30% more space to the plant, allowing for increased production of reusable packaging products, including totes and pallets. The expansion also included the addition of new presses and tools, enhancing capacity and reducing lead times.

“This expansion gives us the flexibility and capacity to enhance production of our packaging products,” stated Norm Kukuk, President of ORBIS Corporation. The Urbana plant serves various industries, including automotive, food, beverage, and consumer packaged goods, and the expansion supports ORBIS's commitment to sustainable packaging solutions.

Recent innovations in the push-pull slip sheets market have centered around enhancing sustainability, functionality, and automation compatibility. Manufacturers are increasingly adopting recyclable and biodegradable materials, such as high-density polyethylene (HDPE) and corrugated fiberboard, to produce eco-friendly slip sheets that meet stringent environmental regulations.

Advancements in coating technologies have led to the development of slip sheets with improved moisture resistance and anti-slip properties, ensuring better load stability during transportation. Additionally, the integration of RFID tags and barcode systems into slip sheets is enabling better inventory management and traceability, aligning with the growing trend of smart logistics and supply chain automation.

The push-pull slip sheets market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, driven by rapid industrialization, increasing e-commerce activities, and the expansion of the manufacturing sector. Countries like China, India, and Indonesia are experiencing a surge in demand for efficient and sustainable material handling solutions, fueled by the need to optimize logistics operations and reduce environmental impact.

Manufacturers are anticipated to focus on developing cost-effective, customizable, and automation-compatible slip sheet solutions to cater to diverse industry needs and comply with evolving regulatory standards. Strategic collaborations, technological advancements, and investments in local production facilities are likely to play a crucial role in capturing market share and driving growth in these regions.

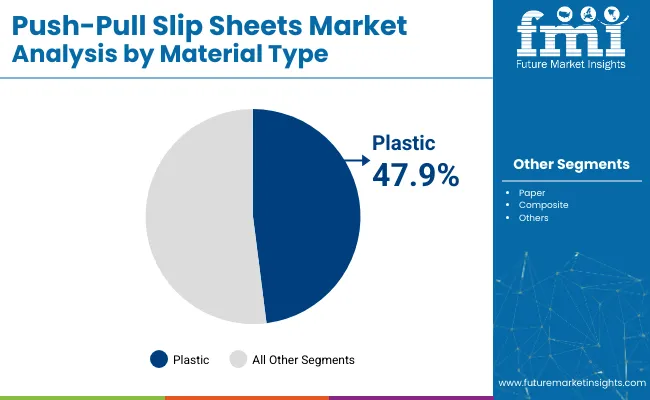

The market has been segmented based on application, material type, end use, product type, and region. By application, food beverages, pharmaceuticals, consumer goods, and textiles represent key sectors adopting slip sheets for space-saving, cost-effective pallet alternatives in warehousing and transit. Material type segmentation includes plastic, paper, and composite variants-each selected based on moisture resistance, tensile strength, and recyclability considerations.

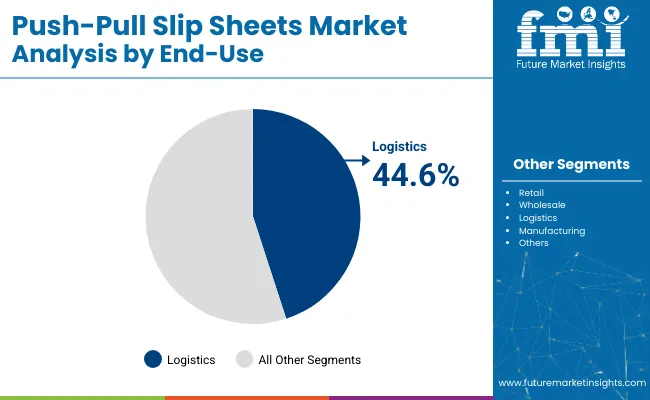

End use sectors such as retail, wholesale, logistics, and manufacturing reflect the growing utility of slip sheets in B2B fulfillment and industrial distribution chains. Product types include single use and reusable formats, allowing businesses to balance cost-efficiency with environmental footprint. Regional segmentation spans North America, Europe, South America, Asia Pacific, and the Middle East and Africa to reflect logistics infrastructure maturity, packaging automation, and sustainability initiatives influencing adoption.

The plastic segment is anticipated to dominate the material type category with a 47.9% share in 2025, supported by its superior durability, water resistance, and extended usability in high-volume, fast-paced supply chains. Compared to paper- or fiber-based alternatives, plastic slip sheets-typically made from HDPE or PP-offer excellent tear resistance and dimensional stability under heavy loads, making them ideal for repeated handling via push-pull attachments.

Plastic slip sheets are especially favored in export logistics and intra-warehouse transfers where ambient humidity, temperature fluctuations, and load security are critical factors. Their non-absorbent surface prevents mold formation and contamination during cross-border shipping of food, beverages, chemicals, and industrial materials.

Another key advantage lies in reusability is that plastic slip sheets can withstand 80-100 cycles under optimal conditions, significantly reducing cost-per-use and supporting sustainability initiatives within corporate logistics frameworks. Lightweight design further contributes to reduced freight weight and lower carbon emissions, aligning with ESG-driven procurement decisions.

With rapid adoption in organized retail supply chains, cold storage environments, and global freight operations, plastic slip sheets are expected to remain the preferred material category throughout the forecast period.

The logistics segment is projected to lead the end-use sector with a 44.6% share in the push-pull slip sheets market by 2025, driven by rising demand for cost-effective, space-saving, and lightweight alternatives to traditional wooden or plastic pallets. Logistics providers-especially in FMCG, 3PL, and export-driven industries-are increasingly shifting toward slip sheet systems to optimize container utilization and reduce material handling costs.

Slip sheets enable seamless push-pull handling using forklift attachments, eliminating the need for bulky pallets while improving storage density in warehouses and shipping containers. This is particularly beneficial for high-frequency shipping operations, where space optimization translates directly into freight cost savings.

As global logistics networks become more digitized and efficiency-focused, the ability to integrate slip sheets into automated loading/unloading systems has become a key competitive advantage. Furthermore, leading logistics players are deploying recyclable and reusable slip sheets to meet clients’ sustainability targets and comply with international phytosanitary regulations that restrict wood packaging materials.

With e-commerce growth, SKU proliferation, and increasing demand for lean supply chain infrastructure, the logistics sector will continue to drive the largest volume and value uptake in the global push-pull slip sheets market.

Equipment Compatibility, Training Needs, and Limited Awareness in Developing Markets

These sheets need specialized forklifts with push-pull attachments, which not all warehouses or distribution centers have. That makes the question of adoption much more difficult, especially in cost-sensitive markets.

Proper operator training is critical to safe and effective handling of goods with slip sheets since improper use can lead to damage to cargo or equipment. Despite these advantages, broad implementation is hindered in developing economies due to lack of awareness and the preference for traditional wooden pallets.

Cost-Efficiency, Export Packaging Growth, and Sustainable Supply Chain Trends

Despite these challenges, the push-pull slip sheets market is projected to grow, driven by the increasing demand for lightweight, low-cost, and space-saving shipping solutions, especially in export-led industries such as food & beverages, chemicals, and consumer electronics. Slip sheets replace wooden pallets to reduce shipping weight, material cost, and storage space.

It is another example of how the global drive to achieve sustainable logistics is benefitting the market, with companies reducing their wood consumption, packaging waste and carbon footprint. Slip sheets are less environmentally damaging than traditional pallets, with items made of recyclable paperboard, corrugated fiberboard, or plastic.

They are also excellent when it comes to single-use, cross-border deliveries, especially in cases where returning pallets is not an option. Learn more about how the demand for interchangeable and recyclable unit load systems is expected to grow considerably as investments in automated warehouses and smart logistics infrastructure continue to grow.

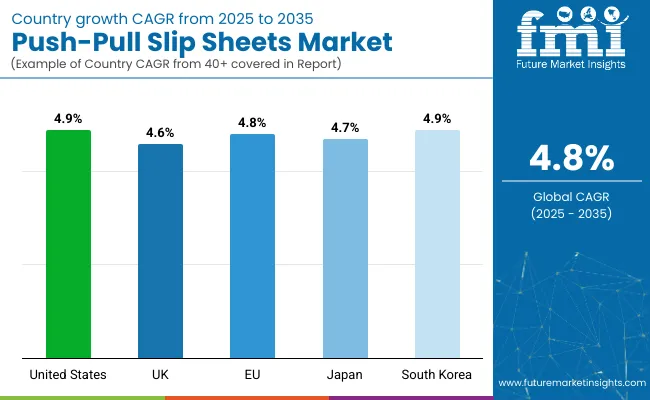

USA market expands companies aim to mitigate shipment weight and address space optimization in transport and export operations. Retailers, food manufacturers, and chemical producers use push-pull slip sheets in automated distribution centers instead of wooden pallets, they save money, and they go easy on the environment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

Meanwhile, in the UK, the market is receiving a boost from growing investments in sustainable packing and smart warehousing solutions. As focus on eco-friendly exports grows and space in urban warehouses decreases, slip sheets can be utilized for the in-hand tight configuration of stackability and lightweight advantage it carries.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.6% |

In the EU, the EU is expected to lead in regulations incorporating use of pallet alternatives to reduce emissions and wood dependency. Backed by strong circular economy policies, Germany, France, and the Netherlands are increasing adoption of recyclable slip sheets in retail, food export, and electronics shipping.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.8% |

Push-pull slip sheets are being adopted in Japan's export-driven economy to support shipping efficiency and curb clutter in the warehouse. Interest in robot-compatible slip sheet systems, particularly for electronics or machinery shipping, is being propelled by the country’s emphasis on automation and robotics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

Semiconductors, Packaged Foods & Cosmetics Exports, South Korea is developing a high-growth market for slip sheets. Government initiatives to promote green logistics and smart manufacturing; and the positive economic impact (reduced costs and increased profits) of shift from wood pallets to recyclable slip sheets for industrial logistics help accelerate the transition.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

With increasing demand for pallet-free material handling, and rising emphasis on cost efficient shipping, as well as growing sustainability initiatives in logistics sector, the push-pull slip sheets market is expanding at a rapid pace.

High-strength fiberboard, anti-slip coatings, and moisture-resistant slip sheets compatible with push-pull forklift attachments are among the three new product areas companies are focusing on. It involves contributions from packaging manufacturers, supply chain solution providers, eco-material innovators, etc. Industry trends range from recyclable slip sheets and plastic-alternative fiber materials to AI-optimized load-stability engineering to enhance global logistics and automate warehouses.

The overall market size for the push-pull slip sheets market was USD 1.2 billion in 2025.

The push-pull slip sheets market is expected to reach USD 1.9 billion in 2035.

The demand for push-pull slip sheets is rising due to increasing preference for lightweight, cost-effective, and eco-friendly alternatives to wooden pallets in material handling. Growth in global exports and the expanding logistics needs of the personal care, home care, and food & beverage sectors are further driving market growth.

The top 5 countries driving the development of the push-pull slip sheets market are the USA, China, Germany, India, and Japan.

Personal Care & Home Care and Food & Beverages are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slip Lid Can Market Size and Share Forecast Outlook 2025 to 2035

Slip Cover Cans Market Size and Share Forecast Outlook 2025 to 2035

Slip Tip Syringe Market Size and Share Forecast Outlook 2025 to 2035

Slipcases Market Size and Share Forecast Outlook 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Slippery Elm Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Competitive Landscape of Slip Tip Syringe Providers

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Anti-Slip Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Anti-Slip Coated Paper Sector

Market Share Breakdown of Anti-Slip Agents Manufacturers

Anti-Slip Floor Tape Market Trends – Growth & Forecast 2024-2034

Pallet Slip Sheet Market Trends, Growth and Forecast from 2024 to 2034

Lubricants / Slip Agents Market Size and Share Forecast Outlook 2025 to 2035

Dryer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Veneer Sheets Market Size and Share Forecast Outlook 2025 to 2035

Mirror Sheets Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Sheets and Coils Market Size and Share Forecast Outlook 2025 to 2035

Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA