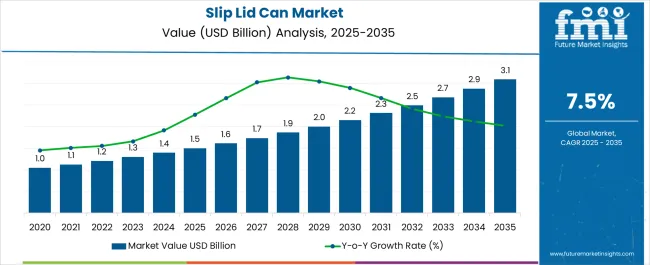

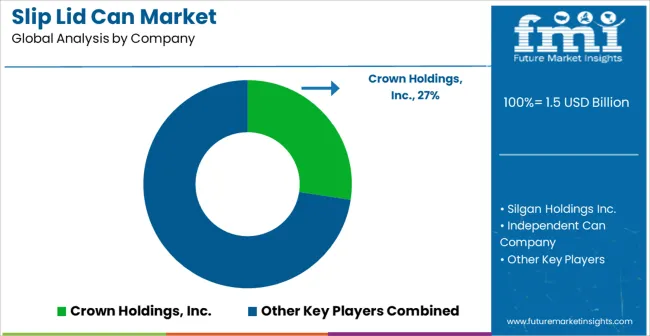

The Slip Lid Can Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Slip Lid Can Market Estimated Value in (2025 E) | USD 1.5 billion |

| Slip Lid Can Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Slip Lid Can market is experiencing notable expansion, supported by rising adoption across food, beverage, cosmetics, and specialty chemical sectors where packaging safety and convenience are prioritized. The demand is being driven by the versatility of slip lid designs that offer airtight sealing, product protection, and aesthetic appeal for branding purposes. Growth has also been reinforced by consumer preference for durable and reusable containers as sustainability gains traction globally.

Manufacturers are increasingly investing in product innovations to enhance durability, lightweight design, and compatibility with eco-friendly coatings, which is strengthening market positioning. The market outlook is further shaped by the growing penetration of slip lid cans in premium packaging segments, where brand differentiation and shelf appeal play a critical role.

With packaging being recognized as a strategic element for both consumer engagement and product preservation, slip lid cans are anticipated to maintain strong growth momentum Continued advancements in material innovation and manufacturing efficiency are expected to pave the way for their increasing adoption across both traditional and emerging end-use sectors.

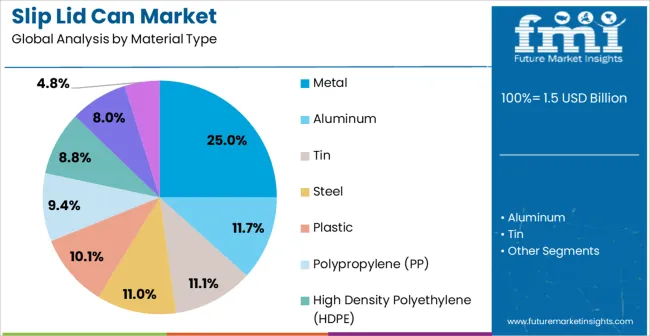

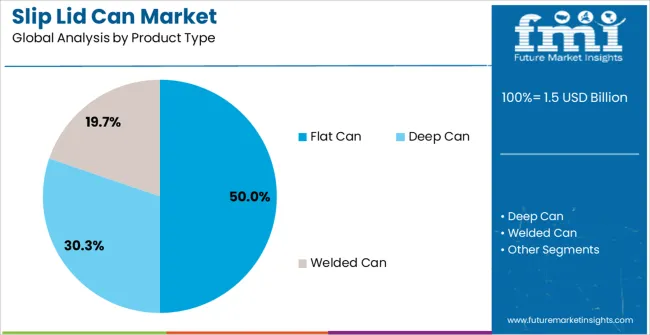

The slip lid can market is segmented by material type, product type, capacity, end use, and geographic regions. By material type, slip lid can market is divided into Metal, Aluminum, Tin, Steel, Plastic, Polypropylene (PP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), and Polyvinyl Chloride (PVC). In terms of product type, slip lid can market is classified into Flat Can, Deep Can, and Welded Can.

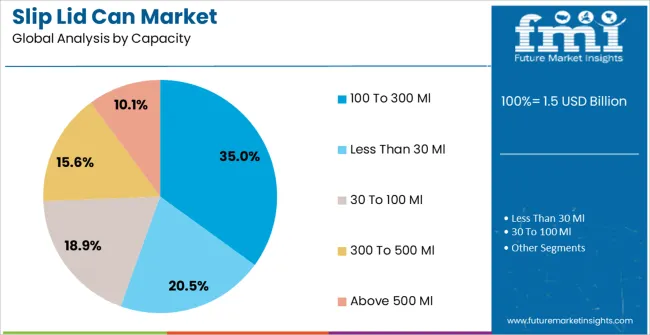

Based on capacity, slip lid can market is segmented into 100 To 300 Ml, Less Than 30 Ml, 30 To 100 Ml, 300 To 500 Ml, and Above 500 Ml. By end use, slip lid can market is segmented into Food, Beverages, Personal Care & Cosmetics, Pharmaceutical, Chemicals & Pesticides, Paints & Lubricants, and Others (Home Care, Toiletries, Etc.).

Regionally, the slip lid can industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Metal material type segment is expected to hold 25.00% of the Slip Lid Can market revenue share in 2025, reflecting its established role in packaging solutions. Growth within this segment has been influenced by the durability and protective properties of metal, which ensure long shelf life and safeguard products against environmental exposure. Metal slip lid cans are widely adopted in applications where resistance to moisture, oxygen, and external contaminants is critical, such as in food preservation, cosmetics storage, and specialty chemical packaging.

The recyclability of metal has further elevated its demand, as both manufacturers and consumers focus on sustainable packaging alternatives. Additionally, metal slip lid cans offer a premium appearance that aligns with branding strategies for products positioned in the higher value segment.

Their robustness and compatibility with varied printing and labeling techniques have supported enhanced consumer engagement As regulations increasingly encourage eco-conscious packaging, the reliance on recyclable metal solutions is expected to continue strengthening the segment’s market share in the years ahead.

The Flat Can product type is projected to account for 50.00% of the Slip Lid Can market revenue share in 2025, making it the leading product category. This dominance is being attributed to its functional design that allows ease of stacking, space efficiency in storage, and user convenience. Flat cans have gained traction in industries such as paints, coatings, confectionery, and personal care where compact packaging with secure closure is highly valued.

The widespread use of flat cans in both commercial and household applications has supported consistent demand. Their structural stability enables seamless transportation and storage while minimizing the risk of spillage or product damage. Furthermore, advancements in printing and surface finishing techniques have enhanced the visual appeal of flat cans, aligning with branding requirements.

Manufacturers have been increasingly adopting this product type due to its cost efficiency in production and scalability across different capacities With their ability to combine practicality, reliability, and visual appeal, flat cans are expected to sustain their leading market position.

The 100 to 300 Ml capacity segment is anticipated to hold 35.00% of the Slip Lid Can market revenue share in 2025, reflecting strong demand across consumer-centric applications. This size category has become the preferred choice in packaging due to its suitability for cosmetics, specialty foods, and premium samples where portability and convenience are essential. The segment’s growth has been driven by rising demand for compact packaging formats that balance functionality with aesthetics, catering to modern consumer lifestyles.

Smaller pack sizes also align with current trends in single-use and trial packaging, enabling brands to attract new customers and promote premium products effectively. Manufacturers benefit from lower material usage and cost savings, making this capacity range economically viable while meeting sustainability targets.

Additionally, consumer preferences for easy-to-carry products in travel and on-the-go scenarios have reinforced adoption With the continued rise of e-commerce and direct-to-consumer models, the 100 to 300 Ml segment is poised to expand further as businesses leverage its practicality and appeal for product differentiation.

Slip lid can are aluminum or tin based cans that are mainly used for storing food items like dry fruits, spices & condiments; paints & lubricants and other chemical products. Slip lid cans also maintains the nutrition level of any food item stored in it for a longer time as compared to most of the food packaging format.

Slip lid can have tiny layer of tin plating which provides shiny silver appearance. Slip lid can are also referred as ointment cans or ink cans. Slip lid can provide cost effective packaging solutions as compared to other types of metal cans.

Slip lid can are available in several shapes, and styles like plain flat or deep. Due to better opening mechanism of slip lid can, the consumers are preferring this cans. In addition, slip lid can provides an option of recyclability which is another factor driving the market during the forecast period.

Nowadays, slip lid can manufacturers are applying window cover or labels which improves the aesthetic appeal of the can. Furthermore many manufacturers are providing electroplating slip lid can with endlessly welded seam side which also provide better appearance to the packaging product.

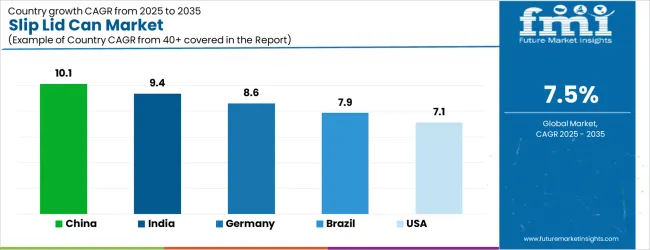

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

The Slip Lid Can Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Slip Lid Can Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%.

The USA Slip Lid Can Market is estimated to be valued at USD 558.2 million in 2025 and is anticipated to reach a valuation of USD 558.2 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 68.2 million and USD 50.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Material Type | Metal, Aluminum, Tin, Steel, Plastic, Polypropylene (PP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), and Polyvinyl Chloride (PVC) |

| Product Type | Flat Can, Deep Can, and Welded Can |

| Capacity | 100 To 300 Ml, Less Than 30 Ml, 30 To 100 Ml, 300 To 500 Ml, and Above 500 Ml |

| End Use | Food, Beverages, Personal Care & Cosmetics, Pharmaceutical, Chemicals & Pesticides, Paints & Lubricants, and Others (Home Care, Toiletries, Etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Crown Holdings, Inc., Silgan Holdings Inc., Independent Can Company, Ball Corporation, Amcor Limited, Ardagh Group, Sonoco Products Company, and Berry Global |

The global slip lid can market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the slip lid can market is projected to reach USD 3.1 billion by 2035.

The slip lid can market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in slip lid can market are metal, aluminum, tin, steel, plastic, polypropylene (pp), high density polyethylene (hdpe), polyethylene terephthalate (pet) and polyvinyl chloride (pvc).

In terms of product type, flat can segment to command 50.0% share in the slip lid can market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Can Lid Market Size and Share Forecast Outlook 2025 to 2035

Slip Cover Cans Market Size and Share Forecast Outlook 2025 to 2035

Lever Lid Cans Market Size and Share Forecast Outlook 2025 to 2035

Vulcanised Solid Rubber Market Size and Share Forecast Outlook 2025 to 2035

Lubricants / Slip Agents Market Size and Share Forecast Outlook 2025 to 2035

Mobile LiDAR Scanner Market Size and Share Forecast Outlook 2025 to 2035

LiDAR Pulsed Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Canine Cancer Screening Services Market Size and Share Forecast Outlook 2025 to 2035

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Can Stack Motors Market Size and Share Forecast Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Canine Arthritis Treatment Market Forecast and Outlook 2025 to 2035

Can Stack Stepper Motors Market Forecast and Outlook 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Canada Compact Wheel Loader Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Canned Wine Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA