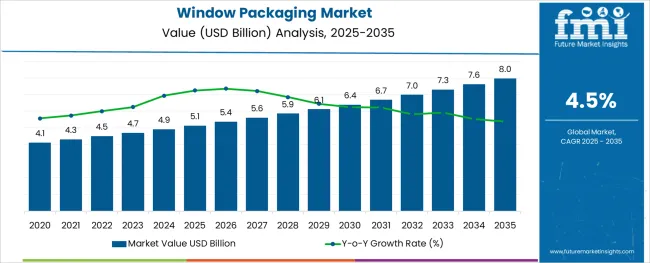

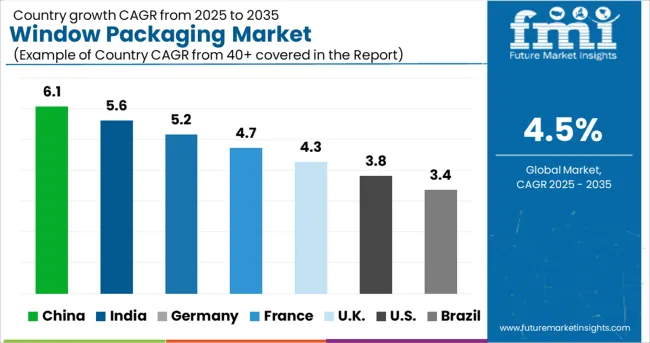

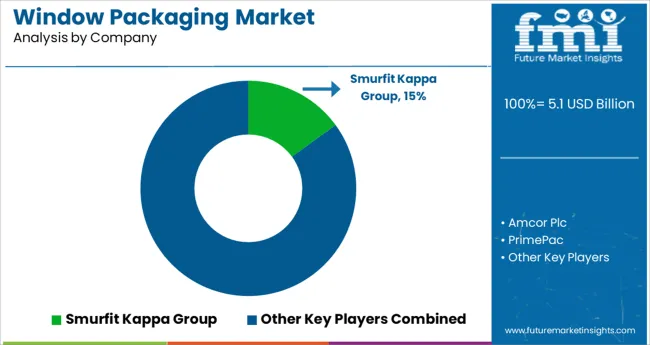

The Window Packaging Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The window packaging market is gaining momentum due to heightened consumer demand for product visibility, growing preference for sustainable materials, and increased adoption across retail, food, and personal care sectors. Brands are leveraging window packaging to enhance shelf appeal and build consumer trust by showcasing product quality without opening the packaging.

Regulatory encouragement toward recyclable and biodegradable materials is influencing manufacturers to shift from plastics to paper-based window formats. Simultaneously, investments in high-speed die-cutting, lamination, and precision finishing technologies are making mass production of customizable window designs more cost-efficient.

Sustainability certifications, along with demand for transparent yet protective packaging, are shaping procurement trends. Moving forward, growth is expected to be driven by demand for premium and eco-conscious packaging formats in e-commerce-ready solutions and retail-ready displays.

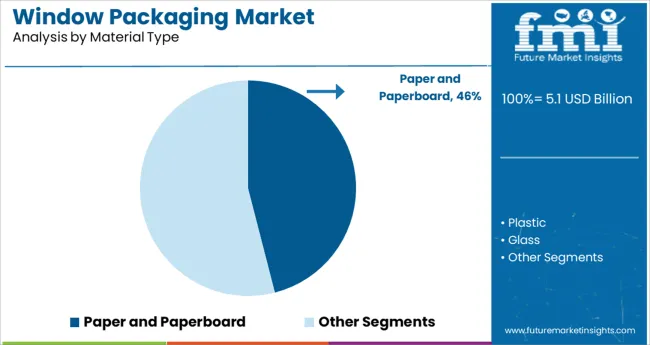

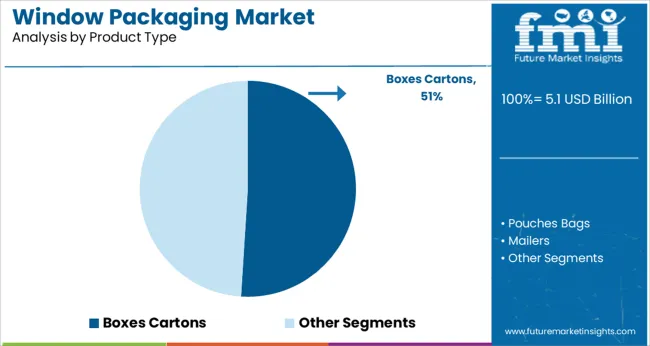

The market is segmented by Material Type, Product Type, and End Use and region. By Material Type, the market is divided into Paper and Paperboard, Plastic, Glass, and Others (Wood, etc.). In terms of Product Type, the market is classified into Boxes Cartons, Pouches Bags, and Mailers.

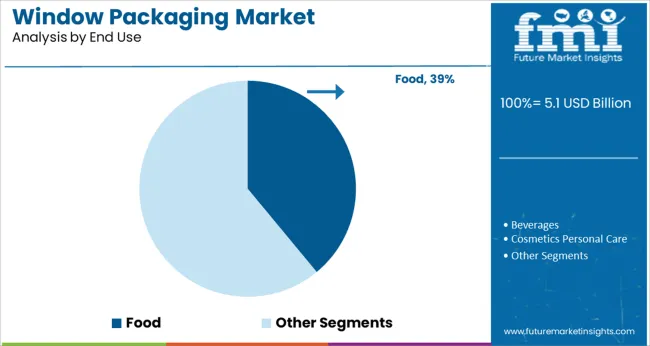

Based on End Use, the market is segmented into Food, Beverages, Cosmetics Personal Care, Garments and Apparels, Electronics, and Others (Consumer Goods, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Material Type, Product Type, and End Use and region. By Material Type, the market is divided into Paper and Paperboard, Plastic, Glass, and Others (Wood, etc.). In terms of Product Type, the market is classified into Boxes Cartons, Pouches Bags, and Mailers.

Based on End Use, the market is segmented into Food, Beverages, Cosmetics Personal Care, Garments and Apparels, Electronics, and Others (Consumer Goods, etc.). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Paper and paperboard are expected to contribute 46.0% of the total revenue in the window packaging market by 2025, establishing them as the leading material category. Their dominance is being supported by a global shift away from plastic packaging toward fiber-based alternatives that align with sustainability goals.

These materials offer excellent compatibility with various finishing techniques, including window patching and embossing, while remaining lightweight and cost-effective. Their recyclability, biodegradability, and renewable sourcing have made them highly favorable among food, cosmetics, and consumer goods brands.

As consumer awareness regarding eco-friendly packaging continues to grow, paper and paperboard are being increasingly adopted in both rigid and flexible window packaging formats, particularly for use in high-turnover retail environments.

Boxes and cartons are projected to account for 51.0% of the market revenue in 2025, making them the top product type in the window packaging market. Their versatility in structural design and high compatibility with transparent window features have positioned them as preferred solutions in food, cosmetics, and electronics packaging.

These formats offer excellent printability, structural strength, and merchandising flexibility, which makes them attractive for both premium and mass-market applications. Advancements in folding carton converting and die-cut window installation have lowered production costs while enhancing design possibilities.

With rising consumer demand for visible packaging and branding differentiation, boxes and cartons continue to outperform due to their shelf appeal, protection, and environmental compliance.

The food segment is expected to hold 39.0% of the window packaging market revenue in 2025, making it the most significant end-use application. This growth is being driven by consumer demand for transparent packaging that assures freshness, quality, and hygiene.

Ready-to-eat meals, baked goods, and fresh produce brands are increasingly utilizing window packaging to enhance trust and drive impulse purchases. Windowed formats allow consumers to assess product quality without compromising safety or tamper resistance.

Furthermore, the use of compostable films and recyclable substrates in food window packaging is aligning with retailer and regulatory sustainability mandates. As food manufacturers emphasize branding through natural, clean-label packaging, window solutions are being widely integrated into primary and secondary food applications.

The global window packaging market witnessed a CAGR of 4.1% during the historic period with a market value of USD 4.9 Billion in 2024 from USD 4.1 Billion in 2020.

Window packaging is an effective way to influence buying behavior. It is estimated that around 85% of consumers' decision-making is mediated through vision. Window packaging is the best form of packaging where customers can visibly have a glance through packed products. The traditional method of packaging has been overthrown by window packaging as in the traditional method the product visibility is hidden. Across the globe, window packaging has become famous. Window packaging is used in various industries such as food, beverage, cosmetics, garments apparel, and others.

According to the United States Department of Agriculture, in the global packaging industry, major packaging will be window packaging as the transparency of food will hold the major segment in the food industry. As Asia-Pacific Economic Cooperation (APEC) is focusing on road mapping towards 2035 for the security of food products.

Thus, window packaging holds a high rate in the packaging industry and is expected to increase in the coming years owing to the increasing food packaging. The continuously growing food beverage industry are preferring to provide a proper packaging segment comparing on quality of the material is important.

Especially in food to avoid contamination and keep the food product for a long-lasting period paper packaging is used as compared to plastic packaging has the chance that the smell changes or the taste of the product may change due to chemical reactions between the food and plastic.

As window packaging focuses on Kraft paper which is durable and can keep the product safe till transportation. Overall, the global window packaging market is anticipated to bolster at a faster pace during the forecast period.

Nowadays, custom packaging is getting more popular. For every business keeping costs low is one of its biggest targets. Window packaging is one of the most effective packaging solutions. According to the consumer's packaging requirements, window packaging types such as boxes cartons, pouches bags, and mailers can be easily customized.

Customized window packaging allows to print of useful information about the manufacturer and product and helps the product to stand out from the competitors. Consumers can choose from various shapes, styles, sizes, artwork, etc. for their window packaging. Customized packaging enhances customer satisfaction levels and loyalty toward the product and brand.

The packaging industries are focusing to provide advanced technology in customized packaging. Various food products, beverages, and cosmetics require proper handling and care during transportation to avoid the improper handling or loss the market is driving customized packaging.

The product packed with proper material and measurement of the box, or pouch size or glass material used for packaging will prevent damage to the items. Thus, the increasing demand for customized packaging has augmented the sales of window packaging.

India growing paper industry is expected to drive the demand for window packaging and is expected to grow the market at the rate of 5.0% CAGR in the forecast period. There has been significant growth in the food packaging industry in India. The reason for it is the availability of the packaging raw materials like paper ; paperboard and others.

According to the Indian Paper Manufacturers Association (IPMA), the Indian industry is the fastest-growing market for paper paperboard and has an annual turnover of around USD 9.0 Billion. Due to innovative technology, paper paperboard are used in the packaging industry.

As paper paperboard is the top material in the window packaging market, the growing paper industry is expected to increase the production of paper paperboard packaging and is projected to drive the window packaging market in India.

FMI analysis states that the China window packaging market is estimated to create an incremental opportunity of USD 5.1 Billion from 2025 to 2035. According to the United States Department of Agriculture, consumers in China are more inclined toward bakery food.

China has the second largest market for baked goods after the USA and the baked goods market will reach USD 5.1 billion by 2025. Many companies are coming forward for innovative packaging of bakery products and packaging that will grab customers visual attention and taste.

The key players operating in the window packaging market are trying to focus on increasing their sales and revenues by expanding their capabilities to meet the growing demand.

The key players are trying to adopt a merger acquisition strategy to expand their resources and are developing new products to meet customer needs. Also, the players are focusing on upgrading their facilities to cater to the demand. Some of the recent key developments by the leading players are as follows -

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Product Type, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Smurfit Kappa Group; Amcor Plc; PrimePac; AR Packaging; Mondi Plc; Wipak; Emenac Packaging; Enterprise Folding Box Co., Inc.; Printex Transparent Packaging; ALYA Packaging; Evergreen Packaging; Knack Packaging Pvt Ltd. |

| Customization Pricing | Available upon Request |

The global window packaging market is estimated to be valued at USD 5.1 USD billion in 2025.

It is projected to reach USD 8.0 USD billion by 2035.

The market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types are paper and paperboard, plastic, glass and others (wood, etc.).

boxes cartons segment is expected to dominate with a 51.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Window Packaging Market Share & Industry Trends

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Window Rain Guards Market

Cat Window Perches & Wall Shelves Market Growth - Trends & Forecast 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Windows and Windshields Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automotive Window Regulator Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Window Regulator Market Growth – Trends & Forecast 2025 to 2035

X-Arm Type Window Regulator Market

Double Hung Windows Market Size and Share Forecast Outlook 2025 to 2035

Solar Control Window Films Market Size and Share Forecast Outlook 2025 to 2035

Automotive Power Window Motor Market Size and Share Forecast Outlook 2025 to 2035

Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Window Display Market

Composite Door & Window Market Growth – Trends & Forecast 2024-2034

Self - Adhesive Carton Window Patch Machine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA