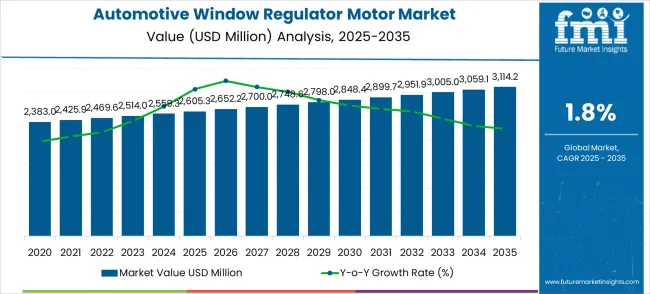

The automotive window regulator motor market, valued at USD 2,605.3 million in 2025 and forecast to reach USD 3,114.2 million by 2035 at a CAGR of 1.8%, presents a growth curve that leans toward a flat or elongated shape rather than a steep upward trajectory. This reflects the maturity of the segment, where technological stability and limited differentiation have reduced the pace of expansion. Unlike emerging markets that demonstrate exponential acceleration, the curve for this sector illustrates a gradual incline, with annual increments adding relatively small absolute value gains.

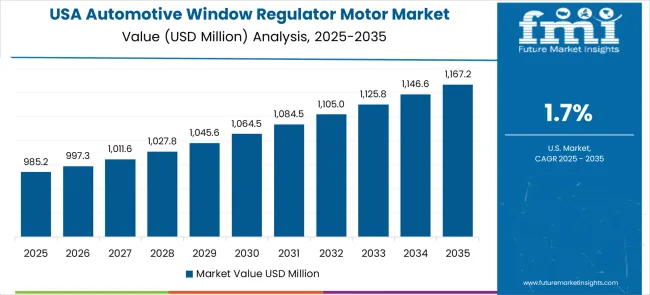

The early years from 2025 to 2030 are expected to follow a low-slope trajectory, driven by stable demand in traditional vehicles and aftermarket replacements. As the industry shifts toward electric mobility and lightweight designs, the growth curve may show marginal tightening in slope, indicating incremental integration of compact and efficient motorized systems. by 2030–2035, the curve will continue its steady but flattened rise, with no significant inflection points. This shape analysis suggests a predictable, low-volatility market, where the focus for stakeholders lies less in explosive volume gains and more in cost efficiency, product reliability, and aftermarket penetration strategies to capture incremental revenue opportunities. The automotive window regulator motor market is on a growth path as vehicles shift toward advanced comfort and convenience features. Rising adoption of electric and luxury cars, along with retrofitting in mid-range vehicles, is propelling demand. Market segmentation spans passenger vehicles (48%), light commercial vehicles (22%), heavy commercial vehicles (16%), and aftermarket replacement (14%). Passenger cars remain the largest revenue contributor, driven by consumer preference for automated window control systems and enhanced cabin ergonomics.

Manufacturers are investing in lightweight, energy-efficient motors that integrate with vehicle electronic architectures. Integration with smart automotive electronics, such as anti-pinch systems and child safety functions, is creating differentiation. With the expansion of EV production platforms, the need for compact regulator motors optimized for low-voltage systems is accelerating. The regional OEM partnerships are shaping localized supply chains, while technological advances in brushless DC motors are improving durability and reducing maintenance costs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,605.3 million |

| Forecast Value in (2035F) | USD 3,114.2 million |

| Forecast CAGR (2025 to 2035) | 1.8% |

Market expansion is being supported by the steady recovery of global automotive production following supply chain stabilization and the increasing standardization of power window systems across vehicle segments including entry-level models. Modern automotive window regulator motors provide enhanced reliability, energy efficiency, and integration capabilities with vehicle electrical systems while supporting growing consumer expectations for comfort and convenience features. Advanced motor technologies enable precise window positioning, anti-pinch safety features, and integration with climate control systems that optimize cabin comfort and energy management.

The growing focus on vehicle electrification and energy efficiency is driving demand for motor solutions that minimize power consumption while providing superior performance and operational reliability. Rising automotive production in emerging markets, increasing vehicle feature content, and growing consumer preference for premium comfort features are contributing to expanded market adoption. The commercial vehicle operators are increasingly incorporating power window systems to enhance driver comfort and vehicle appeal while automotive manufacturers implement standardized motor platforms across multiple vehicle lines to achieve cost optimization and supply chain efficiency.

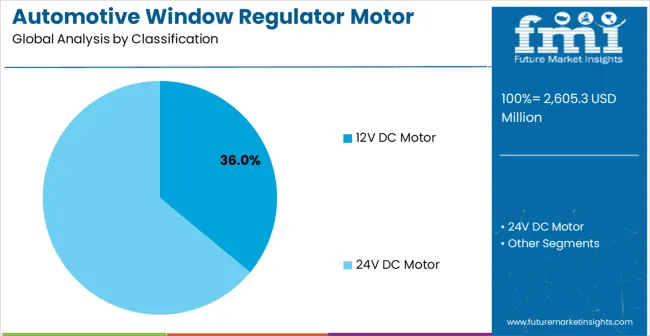

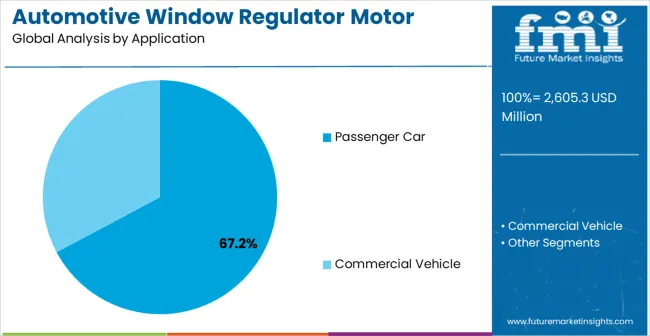

The market is segmented by motor type, vehicle type, and region. By motor type, the market is divided into 12V DC motor and 24V DC motor. Based on vehicle type, the market is categorized into passenger car and commercial vehicle. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

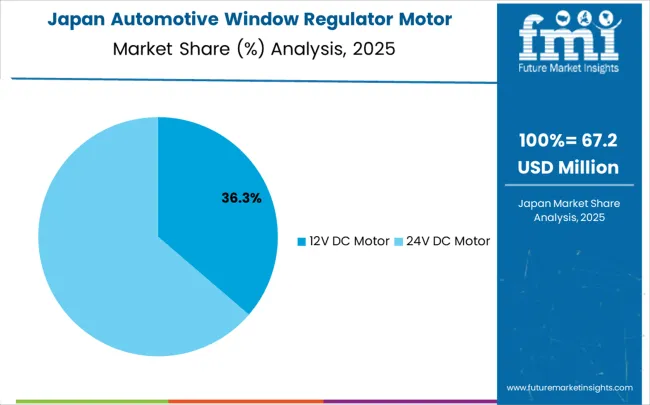

12V DC motor technology is projected to account for 36.0% of the automotive window regulator motor market in 2025. This leading share is supported by the widespread adoption of 12V electrical systems in passenger cars and light commercial vehicles requiring standardized power window solutions. 12V DC motors offer optimal balance between performance, cost-effectiveness, and electrical system compatibility that automotive manufacturers require for high-volume production applications.

The segment benefits from established manufacturing infrastructure, proven reliability, and compatibility with existing vehicle electrical architectures across diverse automotive platforms. These motors provide sufficient torque and speed characteristics for window operation while maintaining energy efficiency that aligns with automotive fuel economy objectives. The standardized voltage platform enables automotive manufacturers to implement consistent electrical system designs across multiple vehicle models and market segments. Manufacturing economies of scale associated with 12V motor production create cost advantages that support competitive pricing strategies while maintaining quality standards. The segment demonstrates resilience through proven performance in diverse climate conditions and extended operational requirements typical of automotive applications.

Passenger car applications are expected to represent 67.2% of automotive window regulator motor demand in 2025. This dominant share reflects the extensive adoption of power window systems in passenger vehicles and the large volume of passenger car production across global automotive markets. Modern passenger cars increasingly feature power windows as standard equipment rather than optional accessories, creating sustained demand for reliable motor solutions. The segment benefits from growing vehicle production, increasing feature content, and consumer preference for convenience and comfort features across all vehicle price segments. Passenger car manufacturers prioritize motor solutions that provide quiet operation, smooth window movement, and integration with safety features including anti-pinch protection systems.

The segment demonstrates consistent demand patterns driven by replacement market requirements and new vehicle production across diverse geographic regions. Global automotive production trends toward platform sharing and component standardization create opportunities for motor suppliers to achieve economies of scale while serving multiple vehicle models and manufacturers. Consumer expectations for power window functionality across all price points eliminate traditional distinctions between basic and premium vehicle segments, requiring standardized motor performance characteristics.

The automotive window regulator motor market is advancing steadily due to automotive production recovery and growing standardization of power window features. The market faces challenges including intense price competition among suppliers, commoditization of motor technology, and pressure from automotive manufacturers for continuous cost reductions. Technological advancement efforts and operational efficiency initiatives continue to influence product development and market expansion patterns.

The growing implementation of intelligent window control systems is enabling automated operation, anti-pinch safety features, and integration with vehicle climate control systems that enhance user experience and safety performance. Advanced control algorithms provide precise positioning, obstacle detection, and coordinated operation with other vehicle systems including air conditioning and sunroof controls. These technological advances enable automotive manufacturers to differentiate their vehicles while providing enhanced functionality and safety features that meet evolving regulatory requirements and consumer expectations.

Motor manufacturers are developing advanced motor technologies that reduce power consumption while maintaining performance characteristics required for reliable window operation across diverse environmental conditions. Next-generation motor designs incorporate improved magnetic materials, optimized winding configurations, and advanced electronic controls that enhance efficiency and operational lifespan. These motor innovations support vehicle electrification goals by reducing electrical system loads while maintaining the performance and reliability standards required for automotive applications.

The automotive window regulator motor market (USD 2,605.3M → 3,114.2M by 2035, CAGR ~1.8%) reflects a mature, volume-driven segment tied closely to global passenger car and commercial vehicle production. Together, motor-type innovation and vehicle-class specialization unlock ~USD 500M in incremental value by 2035, aligned with the ~USD 509M forecast expansion.

Pathway A – 12V DC Motors for Passenger Cars Mainstream application in passenger vehicles, with steady replacement demand and alignment to EV platforms requiring compact, lightweight motors. Bosch, Brose, and Mabuchi dominate this space.

Pathway B – 24V DC Motors for Commercial Vehicles Higher torque demand in trucks, buses, and LCVs drives uptake of 24V motors, especially in Asia and Europe. MITSUBA and Denso are positioned for this segment.

Pathway C – Energy-Efficient Motors for Electric Vehicles (EVs) Shift toward miniaturized, lightweight, and low-power-consumption designs tailored for EV architectures creates incremental demand, particularly in China and India.

Pathway D – Localized Production in Asia-Pacific China (2.4% CAGR) and India (2.3%) anchor manufacturing and adoption growth, supported by cost-competitive suppliers like Ningbo Jingcheng, DYAuto, and HENGTE MOTOR.

Pathway E – Integration with Smart Glass & Advanced Interiors Growing adoption of smart glass windows and automated interior features creates demand for precision motor-regulator systems in premium vehicles.

Pathway F – Aftermarket & Replacement Demand Mature markets such as the USA (1.7% CAGR), UK (1.5%), and Japan (1.4%) drive stable aftermarket sales, with Inteva Products and Johnson Electric key players.

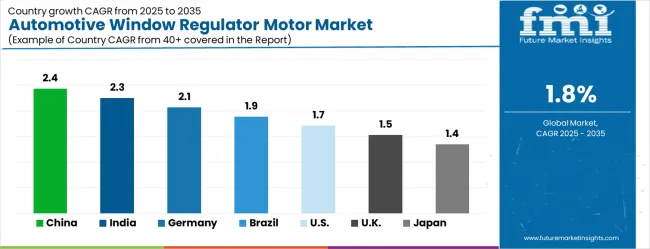

| Country | CAGR (2025-2035) |

|---|---|

| China | 2.4% |

| India | 2.3% |

| Germany | 2.1% |

| Brazil | 1.9% |

| United States | 1.7% |

| United Kingdom | 1.5% |

| Japan | 1.4% |

The automotive window regulator motor market demonstrates modest growth patterns across key countries, with China leading at a 2.4% CAGR through 2035, driven by sustained automotive production growth, expanding domestic vehicle market, and increasing adoption of comfort features across vehicle segments. India follows at 2.3%, supported by growing automotive manufacturing capabilities, expanding passenger car market, and increasing consumer preference for power window systems. Germany records 2.1% growth, prioritizing automotive engineering excellence, premium vehicle production, and advanced motor technology development. Brazil shows steady growth at 1.9%, driven by automotive production recovery and expanding vehicle feature content. The United States maintains 1.7% growth, focusing on automotive market stabilization and technology advancement. The United Kingdom demonstrates 1.5% expansion, supported by automotive manufacturing resilience and premium vehicle production. Japan records 1.4% growth, leveraging advanced manufacturing capabilities and automotive technology expertise.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The automotive window regulator motors market in China is projected to expand at the highest growth rate with a CAGR of 2.4% through 2035, driven by sustained automotive production growth, comprehensive domestic vehicle market expansion, and increasing consumer adoption of comfort and convenience features across diverse vehicle segments. The country's extensive automotive manufacturing ecosystem includes significant investments in component production, supply chain integration, and technology development that support advanced motor solutions. Major automotive manufacturers and component suppliers are implementing comprehensive motor production capabilities to meet growing domestic demand while establishing export capabilities across Asia Pacific and global markets.

The automotive window regulator motors market in India is projected to grow at a CAGR of 2.3%, supported by expanding automotive manufacturing capabilities, growing passenger car market, and increasing consumer preference for power window systems across diverse vehicle segments. The country's focus on automotive sector development and manufacturing competitiveness is driving demand for reliable motor solutions that support domestic production requirements and export opportunities. Government programs promoting automotive manufacturing and component localization are creating favorable conditions for motor suppliers across domestic and international markets. Technology development initiatives are establishing domestic capabilities for advanced motor production and integration with modern vehicle systems.

The automotive window regulator motors market in Germany is likely to expand at a CAGR of 2.1%, supported by the country's leadership in automotive engineering, premium vehicle production, and comprehensive motor technology development across global automotive markets. German automotive manufacturers and component suppliers are implementing advanced motor solutions that meet stringent performance standards while supporting comprehensive vehicle integration and quality requirements. The country's extensive automotive research and development programs are driving technological advancement and commercial deployment of efficient motor systems. Advanced engineering partnerships are facilitating innovation development and knowledge sharing across automotive and motor manufacturing sectors.

The automotive window regulator motors market in Brazil is projected to grow at a CAGR of 1.9%, driven by automotive production recovery, expanding vehicle feature content, and increasing consumer adoption of comfort technologies across diverse market segments. Brazilian automotive manufacturers and suppliers are investing in motor solutions to support production efficiency and vehicle competitiveness while maintaining cost-effective operations. Government programs supporting automotive sector development are facilitating access to advanced motor technologies and manufacturing capabilities. Regional automotive integration is creating opportunities for component sharing and supply chain optimization across South American markets.

Demand for automotive window regulator motors in the United States is projected to expand at a CAGR of 1.7%, driven by automotive market stabilization, technology advancement initiatives, and ongoing innovation in vehicle comfort systems across passenger car and commercial vehicle segments. American automotive manufacturers and suppliers are implementing advanced motor solutions to maintain competitive positioning and meet evolving consumer expectations while addressing regulatory requirements and operational efficiency goals. The automotive industry is driving significant motor demand for production optimization, feature enhancement, and comprehensive vehicle integration applications. Technology development initiatives are creating opportunities for advanced motor innovation and market expansion.

Demand for automotive window regulator motors in the United Kingdom is projected to grow at a CAGR of 1.5%, supported by automotive manufacturing resilience, premium vehicle production focus, and increasing focus on advanced comfort and convenience features across diverse vehicle segments. British automotive manufacturers and suppliers are investing in motor solutions to support manufacturing competitiveness and vehicle differentiation while maintaining quality standards and operational efficiency. The country's established automotive research infrastructure is facilitating motor technology development and commercial deployment through comprehensive testing and validation programs. Industry collaboration initiatives are creating sustained demand for advanced motor technologies that enable efficient production and enhanced vehicle performance.

The automotive window regulator motors market in Japan is projected to grow at a CAGR of 1.4%, supported by advanced manufacturing capabilities, sophisticated automotive technology expertise, and focus on precision engineering across professional and commercial automotive markets. Japanese manufacturers and automotive companies are implementing sophisticated motor solutions that demonstrate superior performance characteristics while supporting diverse applications requiring precision control and system reliability. The country's advanced automotive technology sectors are driving demand for high-quality motor systems that support precision operations and comprehensive vehicle integration requirements. Quality management principles and continuous improvement methodologies are driving adoption of advanced motor technologies that enhance operational excellence and vehicle performance across diverse automotive applications.

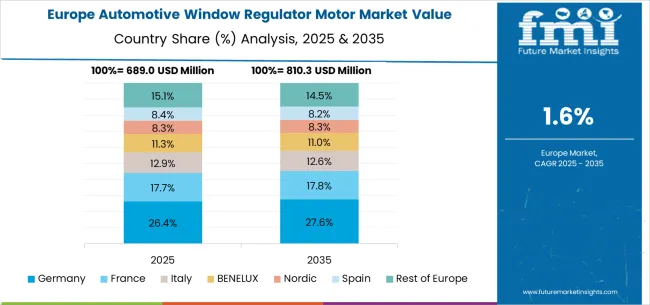

The automotive window regulator motor market in Europe reflects coordinated automotive industry development and technology advancement across member states pursuing common regulatory standards and manufacturing efficiency objectives. Germany maintains technological and manufacturing leadership through comprehensive automotive engineering capabilities and premium vehicle production expertise while prioritizing quality standards and innovation development. United Kingdom focuses on automotive manufacturing resilience and premium vehicle applications despite market challenges from regulatory changes. France develops automotive component capabilities through established manufacturing networks and technology partnerships supporting domestic and European automotive production. Italy prioritize automotive design excellence and specialized vehicle applications while maintaining manufacturing competitiveness across diverse market segments. Eastern European countries demonstrate growing automotive manufacturing capabilities through foreign investment programs and component production expansion supporting European automotive supply chains. The regional market benefits from coordinated automotive policies and cross-border supply chain integration that support efficient production and technology advancement across diverse automotive applications.

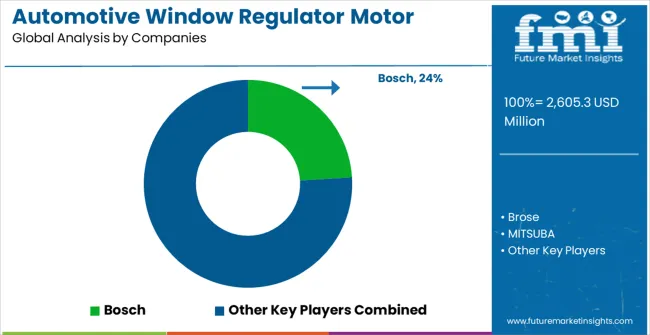

The automotive window regulator motor market operates with moderate concentration creating balanced competitive dynamics between established automotive component manufacturers and specialized motor suppliers. Competition prioritize product reliability, cost optimization, and integration capabilities rather than aggressive pricing strategies that could compromise quality standards essential for automotive applications. Market leaders leverage comprehensive automotive component expertise, established OEM relationships, and global manufacturing capabilities to maintain competitive positioning across diverse vehicle platforms and geographic regions.

Bosch dominates through broad automotive component portfolio and extensive OEM partnerships, offering integrated solutions that combine window regulator motors with electronic control modules and safety systems. Brose competes through specialized focus on automotive mechatronic systems and advanced motor technologies, providing comprehensive window regulator solutions for premium and volume vehicle segments. MITSUBA maintains strong position in Asian markets while expanding global presence through high-quality motor production and automotive industry expertise developed through decades of component manufacturing experience.

Tier 2 challengers focus on specialized market segments, cost-competitive solutions, and regional manufacturing advantages to capture market share from established leaders. Mabuchi focus on small motor expertise and cost-effective manufacturing capabilities targeting high-volume automotive applications requiring standardized performance characteristics. Denso leverages automotive system integration capabilities and Toyota partnership relationships to maintain competitive positioning across Asian and global markets. Johnson Electric competes through precision motor technologies and global manufacturing presence, serving diverse automotive and industrial applications requiring reliable motor solutions.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 2,605.3 million |

| Motor Type | 12V DC Motor, 24V DC Motor |

| Vehicle Type | Passenger Car, Commercial Vehicle |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Bosch, Brose, MITSUBA, Mabuchi, Denso, Johnson Electric, SIIC Transportation Electric, Inteva Products, Ningbo Jingcheng, DYAuto, HENGTE MOTOR, NANTONG LIANKE AUTOMOBILE PARTS |

| Additional Attributes | Dollar sales by motor type and vehicle type segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established automotive component manufacturers and specialized motor suppliers, buyer preferences for different motor technologies and performance characteristics, integration with vehicle electrical systems and comfort features, innovations in motor efficiency and control technologies, and adoption of smart window control systems and energy-efficient solutions for enhanced performance and operational reliability |

The global automotive window regulator motor market is estimated to be valued at USD 2,605.3 million in 2025.

The market size for the automotive window regulator motor market is projected to reach USD 3,114.2 million by 2035.

The automotive window regulator motor market is expected to grow at a 1.8% CAGR between 2025 and 2035.

The key product types in automotive window regulator motor market are 12v dc motor and 24v dc motor.

In terms of application, passenger car segment to command 67.2% share in the automotive window regulator motor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Window Regulator Market Growth – Trends & Forecast 2025 to 2035

Automotive Power Window Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive ABS Motor Market Growth – Trends & Forecast 2025 to 2035

Automotive Seat Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wiper Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Window Display Market

Automotive Starter Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive In-Wheel Motors Market Growth - Trends & Forecast 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Pressure Regulator Market Size and Share Forecast Outlook 2025 to 2035

X-Arm Type Window Regulator Market

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA