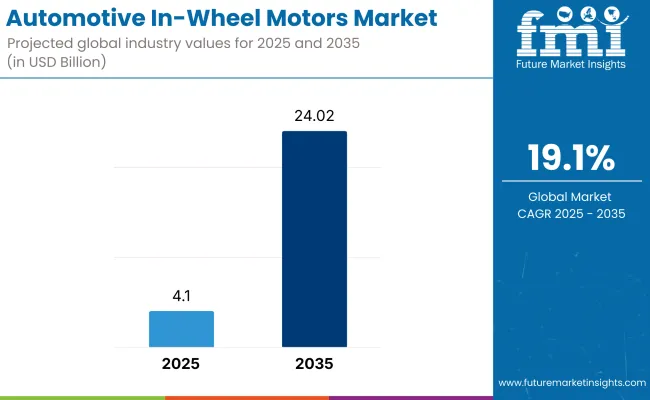

The global automotive in-wheel motors market is projected to grow from USD 4.18 billion in 2025 to USD 24.02 billion by 2035, registering a robust compound annual growth rate (CAGR) of 19.1%. This expansion is being driven by rising electric vehicle (EV) adoption, the push for vehicle platform flexibility, and ongoing innovations in powertrain decentralization.

In-wheel motors, which integrate the propulsion system directly into the wheel hub, eliminate the need for traditional transmission, driveshaft, and differential components. This architecture improves energy efficiency, reduces drivetrain losses, and allows for greater interior cabin space-an essential advantage for urban electric vehicles.

Key automotive OEMs have accelerated efforts in this domain. In 2024, Hyundai filed a patent for in-wheel electric motor technology, aiming to enhance packaging efficiency and vehicle dynamics. As reported by Green Car Reports, Hyundai's system distributes torque directly to each wheel, offering superior traction control and better regenerative braking performance.

Toyota has also been pursuing in-wheel motor development. In 2024, the company’s patent filing described individual motor units within each wheel, a layout that supports four-wheel torque vectoring. This system is designed to optimize cornering, stability, and braking in EVs while reducing mechanical complexity.

Meanwhile, Ferrari, known for its performance engineering, filed a patent in 2024 for a multi-motor electric drivetrain that includes in-wheel motors. As detailed by Motor Authority, the Italian automaker is exploring this technology to improve dynamic handling precision in future high-performance electric models.

Luka Ambrozic, Business Development Officer at Elaphe Propulsion Technologies, underscored the systemic impact of this innovation, stating, “Modern in-wheel motor technology is not only a powertrain technology - it affects the whole vehicle in ways never before imagined”.

With benefits such as precise torque distribution, enhanced modularity, and reduced mechanical complexity, in-wheel motors are expected to become integral to next-generation EV platforms. Increased interest from automakers, combined with improvements in thermal management and lightweight materials, is likely to propel commercialization by the end of the decade.

As demand for smarter, space-efficient, and more agile EVs grows globally, the in-wheel motor market is well-positioned for significant expansion through 2035.

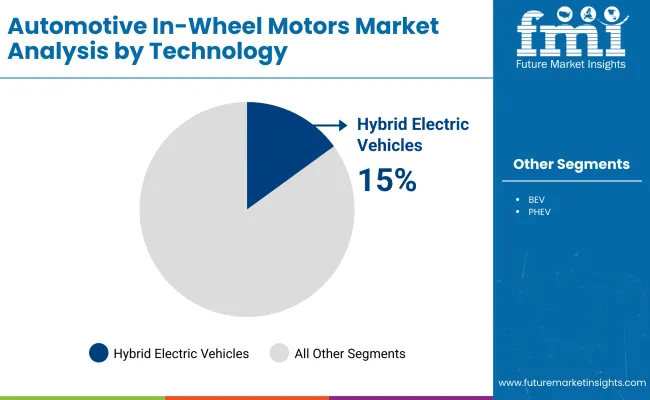

Hybrid Electric Vehicles (HEVs) are expected to contribute a modest 15% share to the global in-wheel motor market by 2035. However, the segment is projected to register a CAGR of 16% over the forecast period from 2025 to 2035. This growth is being supported by the increasing shift toward hybridization in mid-size and performance vehicle categories, where in-wheel motors are being explored as secondary drive units for added efficiency and control.

Automakers are utilizing in-wheel motors in hybrid layouts to enable electric-only propulsion for low-speed driving, regenerative braking, and enhanced traction management. The modular nature of in-wheel motors also offers packaging flexibility-critical for hybrid platforms that house both internal combustion engines and battery-electric systems.

This approach has been particularly relevant in urban-focused hybrids and off-road capable crossovers where independent wheel control improves maneuverability and energy recovery. With advancements in thermal management, motor miniaturization, and vehicle control software, HEVs are expected to serve as a viable deployment ground for in-wheel motor validation before full-scale adoption in BEVs. This dual-drive application is projected to sustain steady demand for in-wheel motors in hybrid vehicle architectures over the next decade.

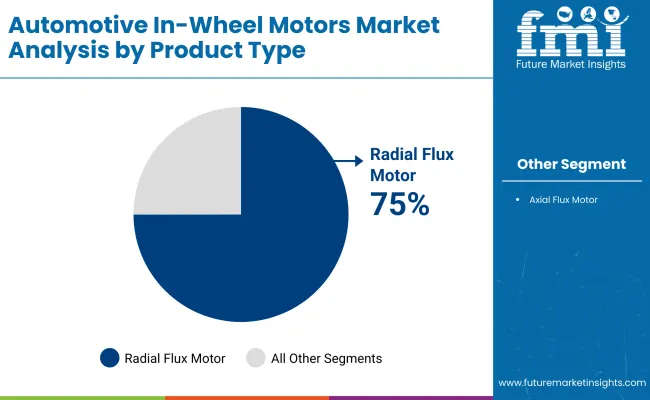

Radial flux motors are projected to account for nearly 75% of the global in-wheel motor market by the end of the forecast period. A CAGR exceeding 18% has been forecast from 2025 to 2035. This dominance is being attributed to the radial flux motor’s well-established design, high power density, and ease of integration into existing wheel hub structures.

In-wheel motor developers have continued to favor radial flux configurations due to their compact form factor, which allows for direct embedding within wheel housings without significant alteration to the chassis. These motors have also demonstrated superior torque output at lower RPMs-an essential requirement for urban EVs and light commercial vehicles.

Several manufacturers, including Elaphe and Protean Electric, have commercialized radial flux in-wheel motor platforms owing to their scalability and efficiency in space-constrained vehicles. Ongoing R&D is focused on optimizing cooling systems and winding technologies to further improve durability and continuous power output.

With OEMs prioritizing proven, production-ready architectures for large-scale electrification, radial flux motors are expected to remain the dominant design choice in the in-wheel motor landscape through 2035.

North America is also an important market for the in-wheel motor, with the United States and Canada being pioneers in electric vehicle and drivetrain technology. Market growth is aided by the growing adoption of EVs, advanced autonomous-driving investment, and government incentives for sustainable transportation.

Several companies including Tesla, Rivian, and General Motors have devised integrated hub motors as a possible solution to enhance the EV range/performance/mobility modularity. Also, the USA Department of Energy (DOE) is supporting research on lightweight, high-efficiency electric propulsion systems, which will accelerate adoption even more.

Germany, France, and UK continue to be among the key contributors to the automotive in-wheel motor market in Europe through sustainable mobility and EV infrastructure development. Other mainstream automakers with all-electric vehicle platforms using in-wheel motor technology under development include BMW, Volkswagen, and Renault.

EU carbon neutrality goals and strict emissions controls push automakers to use smaller, higher-performance propulsion drives that enhance EV efficiency and reduce all-up weight. The growing demand for urban electric mobility solutions, such as small electric vehicles (EVs) and electric vans, is helping to drive innovation in diverse applications of in-wheel motors.

Asia-Pacific is the fastest-growing automotive in-wheel motors market, with China, Japan, South Korea, and India leading the way, as governments in these countries provide incentives and set aggressive EV production targets, and rapid urbanization drives adoption.

China, the world's biggest EV maker, is betting on motor tech to further drive performance gains in future generations of EVs. In addition, Japan and South Korea are at the forefront of integrated e-axle and in-wheel motor systems, with the likes of Nissan, Hyundai, and Toyota integrating hub motors into their prototype and concept vehicles.

Furthermore, the high demand for electric scooters, autonomous delivery vehicles, and urban micro-mobility solutions in the region is extending in-wheel motor applications beyond passenger EVs.

High Costs and Regulatory Complexities

The market is riding on the challenges provided associated with propelling production costs, administrative endorsements, and combination multifaceted nature. Automotive OEMs need to comply with strict ISO and UNECE standards for safety and performance, resulting in long development cycles and high costs.

Thermal Management and Durability Concerns

However, since in-wheel motors must fit in the tight space inside the wheel hub they must balance heat dissipation and durability. However, the absence of conventional cooling systems makes it difficult to maintain ideal motor efficiency and longevity at high speeds and off-road.

Growing Demand for Lightweight and Energy-Efficient Vehicles

As vehicles shift toward electrification and lightweight architectures, in-wheel motors bring energy efficiency, performance and reduced drivetrain complexity. Automakers will benefit from investing in advanced materials and power-dense motor designs as they will have a competitive advantage.

Advancements in Smart Mobility and Autonomous Vehicles

Highly integrated in-wheel motor systems will be needed to meet the demand of connected and autonomous mobility solutions. The in-wheel motors are the right choice for next gen autonomous electric cars due to their precision control, independent torque vectoring and modular scalability.

A gradual introduction of automotive in-wheel motors took place globally from the year 2020 to 2024 only in selected high-performance EVs, concept vehicles, and pilot projects. The direct-drive, hub-mounted electric propulsion was similar to that offered by automotive manufacturers and provided for higher efficiency and improved vehicle maneuverability.

While permanent magnet synchronous motors (PMSM), axial flux motors, and ultra-compact stators had a lot of industry-leading development focused on improving in-wheel performance, these designs could increase the weight of the wheel, making them inefficient. Automakers partnered more with tech providers, semiconductor companies, and battery makers to add smart inverters, regenerative braking, and wireless charging systems. But cost constraints, durability concerns, and lack of large-scale manufacturing capabilities meant that mass adoption was limited.

What the future holds: from 2025 to 2035: The in-wheel motors market will see rapid developments fueled by solid-state batteries, lighter composite materials, and AI-driven powertrain optimization. Next-generation modular EV platforms, AI-based torque vectoring, and 800V+ high voltage architectures will be the main driver for EV in-wheel motor technology.

Innovations such as self-healing coatings, advanced cooling solutions, and graphene-based motor windings will enhance both motor efficiency as well as reliability, solving some of the major durability challenges. In-wheel motor applications are likely to further expand with smart mobility solutions such as vehicle-to-everything (V2X) connectivity and sensor-integrated motor hubs in urban transport, last-mile delivery, and fleet electrification.

Sustainability is key to driving a reduction in rare earth dependency and the development of environmentally safe motor designs. To achieve global carbon neutrality objectives, manufacturers will develop recyclable motor components, low-emission production processes, and circular economy initiatives.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | ISO and UNECE safety regulations influenced in-wheel motor adoption. |

| Technological Advancements | R&D focused on lightweight motor structures and enhanced power density. |

| Industry Applications | Adoption was limited to high-performance EVs and concept models. |

| Environmental Sustainability | Efforts to reduce drivetrain complexity and improve regenerative braking. |

| Market Growth Drivers | Demand for lightweight and space-saving electric propulsion solutions. |

| Production & Supply Chain Dynamics | Supply chain disruptions affected motor component sourcing and cost efficiency. |

| End-User Trends | Consumers showed interest in high-efficiency electric drivetrains and improved vehicle handling. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter efficiency and sustainability mandates reshape manufacturing and material selection. |

| Technological Advancements | AI-driven torque vectoring, graphene-based stators, and 800V+ ultra-fast charging redefine performance. |

| Industry Applications | Mass deployment in autonomous, commercial, and urban mobility EV segments. |

| Environmental Sustainability | Full-scale adoption of recyclable, energy-efficient, and low-carbon motor technologies. |

| Market Growth Drivers | Expansion of AI-integrated mobility, modular EV platforms, and zero-emission transport solutions. |

| Production & Supply Chain Dynamics | Localized production, sustainable material sourcing, and AI-driven inventory optimization improve market resilience. |

| End-User Trends | Growing preference for autonomous-ready, smart in-wheel motor systems with integrated safety analytics. |

The automotive HVAC ducts market in the USA is gradually expanding with growing consumer inclination towards advanced climate control systems in passenger and commercial vehicles. Ford, General Motors, Tesla and other major automakers are adding in lightweight and energy efficient duct materials to improve thermal management and reduce vehicle weight.

Government rules on emissions and fuel efficiency are inspiring HVAC duct designs that boost airflow efficiency while minimizing the energy needed to achieve it. Moreover, growing sales of electric and autonomous vehicles are surging the need for advanced HVAC solutions for optimized battery thermal management.

| Country | CAGR (2025 to 2035) |

|---|---|

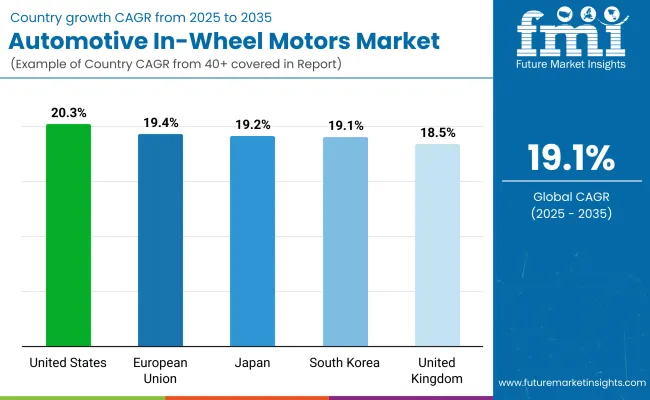

| USA | 20.3% |

UK automotive HVAC ducts market is growing significantly due to the well-established premium and electric vehicle segment manufacturers including Jaguar Land Rover and Aston Martin. The market is being driven by the growing transition to sustainable automotive components as well as lightweight HVAC duct material that are improving vehicle efficiency. Market demand is being further fueled by government policies promoting green vehicle technologies and investments in next-generation climate control systems. Moreover, Connected/ Autonomous vehicles technology are gaining traction on roads that provide a greater opportunity for integrating smart HVAC duct.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 18.5% |

Initiatives taken by domestic players such as Volkswagen, BMW, and Renault in Germany, France and Italy is facilitating the growth of the market in the mentioned European regions. A stronger emphasis on sustainable manufacturing and regulatory policies encouraging the transition of energy-efficient vehicles in the region will further augment the growth of advanced HVAC duct materials and designs. The HVAC size is shrinking to meet this demand, and with strict emissions regulations in place across Europe and production of electric vehicles on the rise, the demand for lightweight and thermally efficient HVAC ducts has skyrocketed. To add sponsor impact, the significant emergence of 3D-printed and bio-based duct materials is changing the market dynamic.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 19.4% |

The Japan automotive HVAC duct market is growing at a healthy rate, with surge in adoption of vehicular climate control systems and a strong demand for fuel-efficient vehicles. Toyota, Honda, and Nissan are using energy management optimized high-performance HVAC ducts. Hybrid and electric vehicles along with improvements in polymer-based and lightweight duct materials provide opportunities for this market to grow in the country. Furthermore, work on AI-based climate control systems would lead to new avenues for H-VAC duct optimization of autonomy vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 19.2% |

The growth rate of automotive HVAC ducts market in South Korea is also driven by Hyundai and Kia being at the forefront in the production of electric and hybrid vehicles. Smart climate control systems and AI-powered vehicle comfort solutions are the next HVAC duct technologies in line to make headlines as the world benefits from the advancements being made in these countries. The market growth is also a result of government policies promoting green mobility and eco-friendly vehicle systems. Moreover, genuine high-performance plastic and composite material solutions have been driving a transformation in lightweight, durability and thermal efficiency in HVAC ducts among automotive OEMs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 19.1% |

The automotive in-wheel motors market is growing rapidly with the transition towards electric vehicles (EV), increase in demand for lightweight and energy-efficient drive trains, and continuous developments in direct-drive propulsion systems. Wheel hub motor tech provides better handling, propulsion response, and more effective regenerative braking, allowing for lighter, smaller chassis.

The best-performing motors coming out of the leading automotive and technology firms have a high torque density, multi-function cooling (the same system cools both the battery and electric motor), and AI-enhanced traction control. Integration of in-wheel motors in passenger cars, commercial fleets, and performance-level electric vehicles will only continue to pick up as the shift to autonomous and electric mobility solutions accelerates.

The global automotive in-wheel motors market CAGR stands at 19.3% from 2024 to 2032, with country-specific growth rates influenced by government EV incentives, advancements in battery technology, and automakers' transition to electric drivetrains.

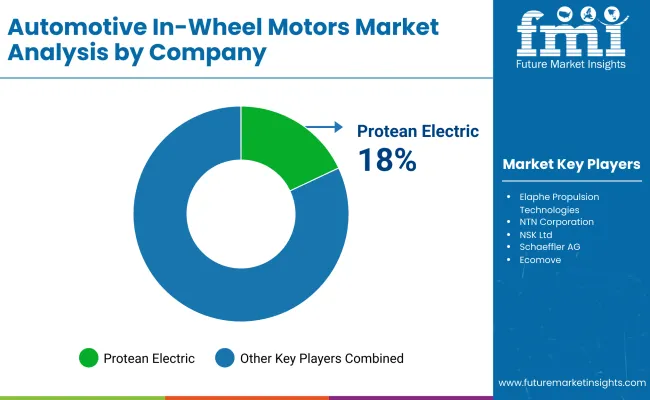

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Protean Electric (SAIC Motors) | 18-22% |

| Elaphe Propulsion Technologies | 12-16% |

| NTN Corporation | 10-14% |

| NSK Ltd. | 8-12% |

| Schaeffler AG | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Protean Electric (SAIC Motors) | Develops high-torque in-wheel motors with integrated power electronics and regenerative braking systems. |

| Elaphe Propulsion Technologies | Specializes in modular in-wheel motor platforms, improving scalability for EV manufacturers. |

| NTN Corporation | Produces hub-integrated motor solutions, ensuring optimized weight distribution and enhanced vehicle dynamics. |

| NSK Ltd. | Innovates compact in-wheel motor units with precision motion control for improved efficiency and traction. |

| Schaeffler AG | Focuses on electrified wheel drive solutions, integrating AI-driven torque vectoring for autonomous EVs. |

Key Company Insights & Competitive Strengths

Protean Electric (SAIC Motors) (18-22%)

Elaphe Propulsion Technologies (12-16%)

NTN Corporation (10-14%)

NSK Ltd. (8-12%)

Schaeffler AG (5-9%)

Other Key Players (35-45% Combined)

Several emerging technology firms and automotive component manufacturers contribute to next-generation in-wheel motor innovations, focusing on power density, smart control systems, and scalability for mass production:

The overall market size for the Automotive In-Wheel Motors Market was USD 4.18 Billion in 2025.

The market is expected to reach USD 24.02 Billion in 2035.

The demand will be fueled by the rising adoption of electric vehicles (EVs), advancements in wheel motor technology, increasing focus on vehicle efficiency and weight reduction, and growing government initiatives promoting clean energy transportation.

The top five contributors are the USA, European Union, Japan, South Korea and UK.

Battery Electric Vehicles (BEVs) are anticipated to command a significant market share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Cooling, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Cooling, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Cooling, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Cooling, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Cooling, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Cooling, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Cooling, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Cooling, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Cooling, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Cooling, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Cooling, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Cooling, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Cooling, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Cooling, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Cooling, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Cooling, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA