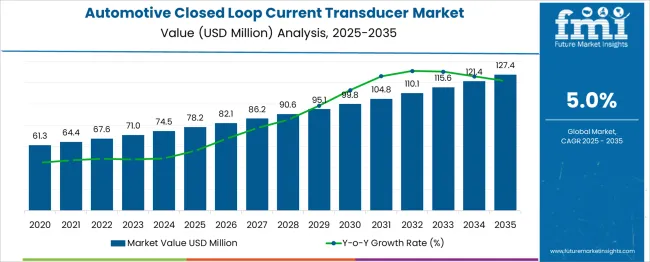

The Automotive Closed Loop Current Transducer Market is estimated to be valued at USD 78.2 million in 2025 and is projected to reach USD 127.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Growth Rate Volatility Index remains low, as annual increases are consistent across the forecast horizon. Market value is anticipated to advance from USD 78.2 million in 2025 to USD 127.4 million by 2035, reflecting gradual demand shifts toward precise current sensing solutions. Incremental growth in the initial phase from 2025 to 2029 indicates stability, driven by the integration of transducers in battery management systems and inverter modules. Mid-period projections suggest uniform acceleration, aligned with electrification initiatives and component standardization in power electronics. The later phase from 2033 to 2035 continues to show predictable gains, reaching USD 121.4 million before crossing USD 127 million in 2035. This trajectory demonstrates minimal volatility, with no abrupt surges or contractions, indicating structural strength and low external risk exposure. The consistent growth pattern underlines the market’s suitability for sustained investment, with opportunities expected in high-accuracy sensing technologies, OEM collaborations, and component optimization for next-generation electric vehicle architectures.

| Metric | Value |

|---|---|

| Automotive Closed Loop Current Transducer Market Estimated Value in (2025 E) | USD 78.2 million |

| Automotive Closed Loop Current Transducer Market Forecast Value in (2035 F) | USD 127.4 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The automotive closed loop current transducer market holds a niche yet increasingly significant position within automotive electronics and sensor systems. Within the broader automotive parts and components market, it makes up around 2–3%, reflecting its specialized application in electric and hybrid vehicle subsystems. Within the automotive current transducer market, closed-loop technology dominates with roughly 60–61% share, underlining its critical role compared to open-loop alternatives. In the electric vehicle component market, it contributes 35–40%, as these transducers are essential for monitoring current in motor drives and battery management systems, especially under high-voltage, high-density conditions.

When considering the total closed-loop current transducer market across industries, the automotive slice is smaller around 3–5% yet growing, supported by rapid EV adoption and demand for precise current sensing. Closed-loop current transducers are emerging as indispensable components in modern vehicle systems focused on electrification, control reliability, and real-time monitoring, reinforcing their position as critical elements of advanced automotive technology.

The automotive closed loop current transducer market is witnessing robust growth, driven by rising electrification across automotive systems, increasing focus on efficiency, and enhanced safety standards. As electric vehicles and hybrid powertrains continue to penetrate mainstream markets, demand for precision current measurement has intensified.

Closed loop current transducers offer high accuracy, low response time, and immunity to external magnetic fields, making them well-suited for critical applications in automotive systems. Additionally, integration of advanced driver assistance systems (ADAS), battery management systems (BMS), and smart motor controls has necessitated high-performance current sensing solutions.

Regulatory emphasis on reducing vehicular emissions and improving powertrain efficiency further supports the adoption of closed-loop designs. With ongoing advancements in GaN/SiC power electronics and compact sensor technologies, the market is set to evolve with higher sensitivity and reliability benchmarks.

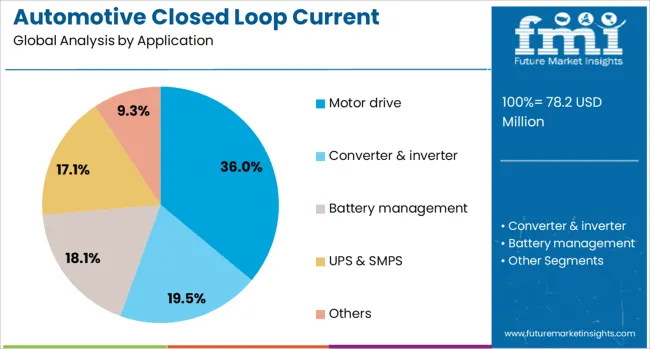

The automotive closed loop current transducer market is segmented by application and geographic regions. By application, the automotive closed loop current transducer market is divided into Motor drive, Converter & inverter, Battery management, UPS & SMPS, and Others. Regionally, the automotive closed loop current transducer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Motor drive applications are projected to account for 36.00% of the total revenue share in the automotive closed loop current transducer market by 2025, establishing them as the leading application segment. This dominance is attributed to the central role that current sensing plays in ensuring efficient motor control, torque optimization, and real-time monitoring in both electric and hybrid vehicles.

Closed loop transducers are increasingly preferred for motor drives due to their high linearity and low temperature drift, which are essential for precision speed and torque control. As the automotive industry shifts toward higher voltage architectures and more compact drivetrains, accurate current measurement in traction motors becomes critical for operational safety and battery efficiency.

Furthermore, OEMs are integrating sensor-based diagnostics and predictive maintenance algorithms, further embedding closed loop current transducers as indispensable components in motor drive systems.

Automotive closed loop current transducers are critical components for precise current measurement and control in electric and hybrid vehicles. These devices use magnetic feedback principles to deliver high accuracy and fast response in monitoring current for battery management systems, traction inverters, and power electronics. Growth has been reinforced by increasing adoption of electric mobility, rising complexity of vehicle electronics, and stringent performance standards for powertrain safety. Manufacturers are focusing on developing compact, high-bandwidth transducers with robust insulation, wide operating ranges, and enhanced fault detection capabilities to meet evolving industry requirements.

Adoption of closed loop current transducers has been driven by the expansion of electric and hybrid vehicle production worldwide. Accurate current measurement is essential for battery health monitoring, thermal management, and energy efficiency, making these devices integral to vehicle safety systems. Regulatory focus on functional safety standards for EV components has further accelerated demand. Increased use of advanced power electronics for regenerative braking and fast-charging systems has strengthened the need for high-speed, precision transducers. Growth in high-voltage architectures in next-generation EV platforms has created additional demand for reliable current sensing solutions with wide dynamic ranges.

Market growth has been restricted by the relatively high cost of closed loop transducers compared to open loop alternatives, which affects their adoption in price-sensitive segments. Integration into compact automotive architectures poses challenges due to size constraints and the need for electromagnetic compatibility with surrounding components. Design complexity is heightened by requirements for high insulation strength and temperature resistance in harsh operating environments. Dependence on rare magnetic materials for core construction introduces supply chain risks and cost fluctuations. Limited awareness among smaller OEMs regarding long-term performance benefits has slowed widespread adoption beyond premium and mid-tier EV platforms.

Significant opportunities exist in the development of current transducers optimized for vehicles using silicon carbide (SiC) and gallium nitride (GaN) power electronics, which operate at higher switching frequencies and demand faster response times. Integration of transducers into compact modules for battery packs and traction inverters offers design flexibility for OEMs. Growth in charging infrastructure and ultra-fast DC chargers creates demand for accurate current sensing solutions, expanding application scope beyond onboard systems. Development of modular sensing platforms and digital output interfaces for seamless connectivity with vehicle control units presents additional revenue potential. Collaborations between sensor manufacturers and EV OEMs for co-designing custom solutions are becoming critical for competitive advantage.

Recent trends emphasize miniaturization of closed loop transducers without compromising accuracy, enabling their use in increasingly compact EV powertrains. Integration of digital communication interfaces such as SENT or CAN is gaining traction to ensure compatibility with modern vehicle networks. Advanced thermal management designs and materials capable of withstanding temperatures above 150°C are being adopted for high-performance applications. Enhanced insulation and fault-tolerant features are being incorporated to improve reliability under high-voltage conditions. Manufacturers are focusing on developing transducers with improved bandwidth to meet the requirements of fast-switching inverters in electric and hybrid vehicles, aligning product evolution with next-generation automotive power systems.

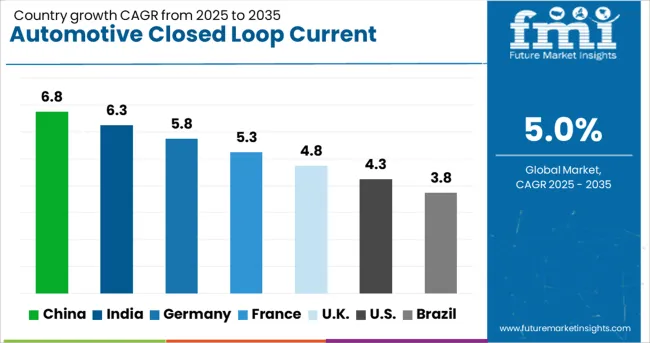

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

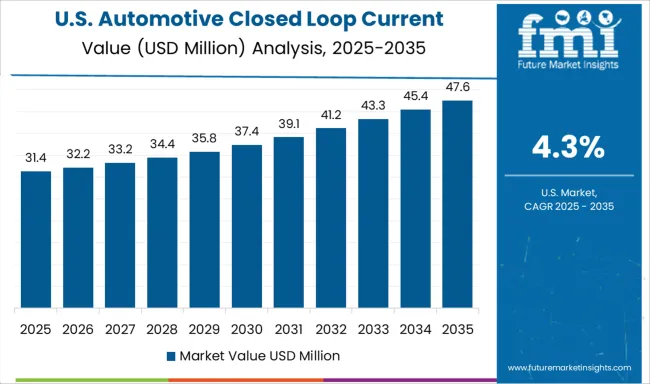

| USA | 4.3% |

| Brazil | 3.8% |

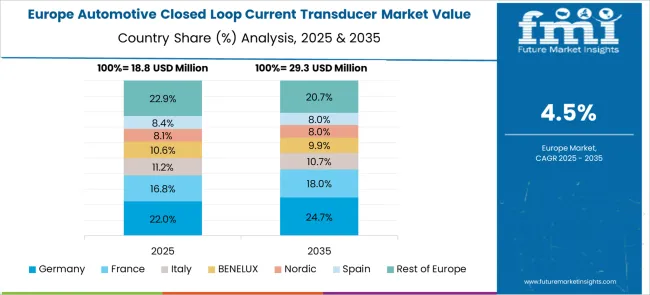

The automotive closed loop current transducer market is expected to grow at a CAGR of 5.0% through 2035, driven by the increasing penetration of electric and hybrid vehicles, advanced driver assistance systems (ADAS), and battery monitoring applications. China leads at 6.8%, propelled by EV production and strong local component manufacturing. India follows at 6.3%, with growth driven by electrification of two-wheelers and passenger vehicles. Germany posts 5.8%, leveraging its advanced automotive engineering and strong OEM presence. The United Kingdom records 4.8%, supported by adoption of electric mobility and fleet electrification initiatives, while the United States grows at 4.3%, driven by EV infrastructure expansion and energy-efficient vehicle technologies. The analysis includes over 40 countries, with the top countries detailed below.

China is projected to grow at a CAGR of 6.8% through 2035, supported by its leadership in EV manufacturing and aggressive adoption of new energy vehicles. Closed loop current transducers are essential for battery management systems, traction inverters, and regenerative braking applications. Local suppliers are scaling production to serve domestic OEMs, while global players are investing in joint ventures for advanced sensor designs. Increasing integration of wide-bandgap semiconductors in automotive electronics further amplifies demand for high-accuracy, high-bandwidth current measurement. Continuous advancements in digital interface compatibility and compact form factors are also influencing purchasing decisions.

India is expected to register a CAGR of 6.3% through 2035, driven by the government’s push for EV adoption and expansion of charging infrastructure. Demand for closed loop current transducers is strong in traction drives, onboard chargers, and high-voltage battery systems for two-wheelers and passenger EVs. Local manufacturers are developing cost-effective solutions, while premium applications rely on imports from global players offering advanced thermal stability and fast response features. Integration of current sensors with safety monitoring systems in EV architectures is creating new opportunities for precision measurement technologies. Partnerships between sensor providers and OEMs are fostering domestic production and R&D investments.

Germany is forecasted to achieve a CAGR of 5.8% through 2035, backed by its advanced automotive sector and focus on premium EV and hybrid models. Closed loop current transducers are widely used in high-voltage architectures, motor control units, and energy storage systems. German OEMs are implementing high-precision, digitally integrated current measurement technologies to support ADAS and thermal management systems. The transition to wide-bandgap devices like SiC and GaN semiconductors in power electronics further strengthens the need for fast-response sensors. Strategic alliances between sensor manufacturers and Tier-1 suppliers are enhancing innovation in compact and lightweight transducer designs.

The United Kingdom is projected to grow at a CAGR of 4.8% through 2035, supported by zero-emission vehicle targets and widespread fleet electrification programs. Closed loop current transducers are essential for battery health monitoring, inverter control, and DC fast charging systems. British OEMs and technology firms are focusing on the development of modular sensor platforms compatible with multiple EV powertrain configurations. Rising demand for high-reliability sensors in heavy-duty electric commercial vehicles also supports market growth. Emphasis on compact, lightweight designs for space-constrained EV platforms remains a critical trend in procurement strategies.

The United States is expected to post a CAGR of 4.3% through 2035, driven by rapid expansion of EV infrastructure and increasing demand for energy-efficient vehicle technologies. Closed loop current transducers play a critical role in traction inverters, battery packs, and DC fast-charging stations. USA manufacturers are focusing on high-accuracy, thermally stable sensors for extreme operating conditions in commercial EV fleets. Adoption of predictive analytics and software integration with sensor systems is advancing smart vehicle energy management. Strategic partnerships between sensor companies and EV OEMs are enabling large-scale deployments in premium and commercial vehicle segments.

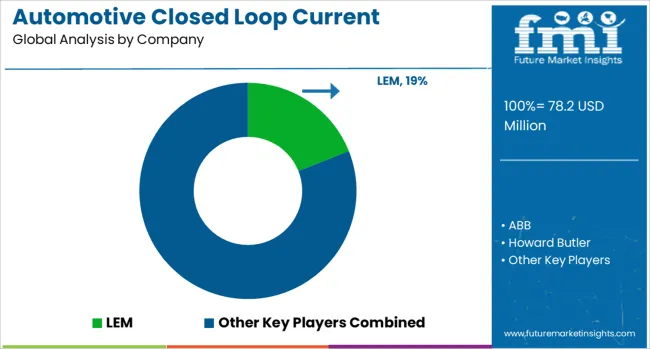

The automotive closed-loop current transducer market is driven by global electronics and power management companies offering precision current sensing solutions for hybrid and electric vehicles, battery management systems (BMS), and advanced driver-assistance systems (ADAS). LEM dominates the market with a comprehensive range of closed-loop Hall effect transducers designed for high accuracy and fast response in EV powertrain and charging systems. ABB and Siemens provide robust current measurement solutions integrated into automotive power electronics, ensuring system safety and efficiency under high-voltage operating conditions. Infineon Technologies and Texas Instruments leverage their semiconductor expertise to deliver high-performance sensors with integrated signal conditioning for precise monitoring in BMS and inverter systems. Johnson Controls focuses on current sensing applications in automotive thermal and energy storage systems, enhancing energy efficiency in electrified vehicles.

NK Technologies and Phoenix Contact cater to industrial-grade automotive applications, offering modular and customizable closed-loop sensors for OEMs. Howard Butler and Topstek serve niche requirements with compact designs suited for high-density electronic architectures in electric vehicles. Competitive differentiation relies on measurement accuracy, wide operating temperature ranges, electromagnetic interference (EMI) immunity, and compliance with automotive safety standards such as ISO 26262. Barriers to entry include stringent quality certifications, reliability requirements, and integration challenges with evolving EV architectures. Strategic priorities include development of miniaturized sensors for space-constrained applications, cost optimization for mass adoption, and integration of digital interfaces for real-time data transmission in connected vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 78.2 Million |

| Application | Motor drive, Converter & inverter, Battery management, UPS & SMPS, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LEM, ABB, Howard Butler, Infineon Technologies, Johnson Controls, NK Technologies, Phoenix Contact, Siemens, Texas Instruments, and Topstek |

| Additional Attributes | Dollar sales by sensor type (Hall effect, fluxgate) and application (battery management systems, traction inverters, DC-DC converters, onboard chargers). Demand dynamics are driven by increasing EV production, regulatory mandates for energy efficiency, and growing electrification of vehicle powertrains. Regional trends indicate Europe and Asia-Pacific leading due to strong EV adoption, while North America shows steady growth supported by government incentives. Innovation trends include wide-bandgap semiconductor compatibility for high-frequency applications, sensors with integrated diagnostics for predictive maintenance, and designs supporting high-voltage platforms exceeding 800V. |

The global automotive closed loop current transducer market is estimated to be valued at USD 78.2 million in 2025.

The market size for the automotive closed loop current transducer market is projected to reach USD 127.4 million by 2035.

The automotive closed loop current transducer market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in automotive closed loop current transducer market are motor drive, converter & inverter, battery management, ups & smps and others.

In terms of , segment to command 0.0% share in the automotive closed loop current transducer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA