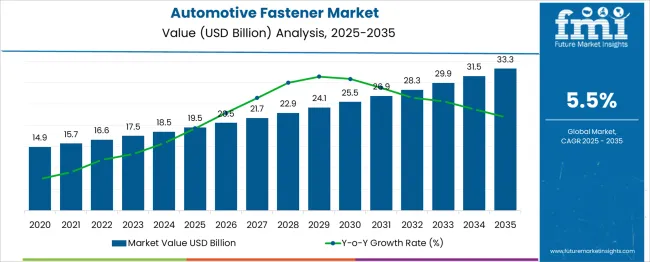

The Automotive Fastener Market is estimated to be valued at USD 19.5 billion in 2025 and is projected to reach USD 33.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. Analyzing the acceleration and deceleration pattern reveals a steady but slightly progressive curve, driven initially by strong adoption of lightweight materials and rising vehicle production in emerging markets. From 2025 to 2030, the market grows from USD 19.5 billion to USD 25.5 billion, adding USD 6 billion, or nearly 43% of total incremental growth, with acceleration fueled by increased use of specialty fasteners in electric vehicles and demand for high-performance fastening solutions to enhance safety and efficiency. During this period, manufacturers invest in advanced materials such as aluminum and composites for weight reduction, supporting faster growth. In the second phase (2030–2035), growth continues but at a slightly moderated pace as the market adds USD 7.8 billion, reaching USD 33.3 billion, signaling gradual deceleration due to mature adoption of fastening innovations and standardization in EV platforms. Future opportunities lie in customized fastening systems for autonomous vehicles, corrosion-resistant coatings, and integration of smart fasteners with real-time monitoring capabilities, enabling predictive maintenance and compliance with advanced safety standards.

| Metric | Value |

|---|---|

| Automotive Fastener Market Estimated Value in (2025 E) | USD 19.5 billion |

| Automotive Fastener Market Forecast Value in (2035 F) | USD 33.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The automotive fastener market represents an essential subset within multiple parent markets. In the industrial fasteners market, automotive applications contribute approximately 35–38%, reflecting the automotive industry’s dominance as a major consumer of fasteners for structural, engine, and body assembly. Within the automotive components and parts market, fasteners account for about 5–6%, as this category includes larger value systems such as powertrain, interiors, and electronics. In the automotive body and structural systems market, the share is significant at 10–12%, given the heavy reliance on mechanical joints for frame integrity and crash safety.

For the automotive aftermarket and spare parts market, fasteners contribute nearly 3–4%, driven by demand for replacements in maintenance and repair services. In the emerging lightweighting and EV materials market, automotive fasteners represent around 6–8%, owing to their growing use of advanced alloys and composites designed for electric vehicles and weight reduction. Growth is reinforced by the rising adoption of hybrid and electric vehicles, increasing preference for lightweight solutions, and the need for high-strength fastening systems to ensure structural durability under stringent safety regulations. These dynamics position automotive fasteners as critical components across manufacturing and aftermarket ecosystems, supporting vehicle performance, safety, and assembly efficiency.

The automotive fastener market is undergoing accelerated expansion, supported by rising global vehicle production, advances in lightweight materials, and demand for modular assembly systems. Regulatory pressures on fuel efficiency and carbon emissions have encouraged OEMs to adopt fastening components that align with weight reduction and recyclability objectives.

Integration of advanced drivetrains, electronic systems, and electric vehicle platforms has also required high-strength, vibration-resistant fastening technologies. Supply chain localization, along with digitization of inventory and procurement processes, is optimizing delivery cycles and reducing lead times.

Future market growth is expected to be shaped by innovations in coating technologies, adoption of precision-engineered fasteners, and the shift toward smart fastening solutions integrated with in-vehicle diagnostics and condition monitoring systems..

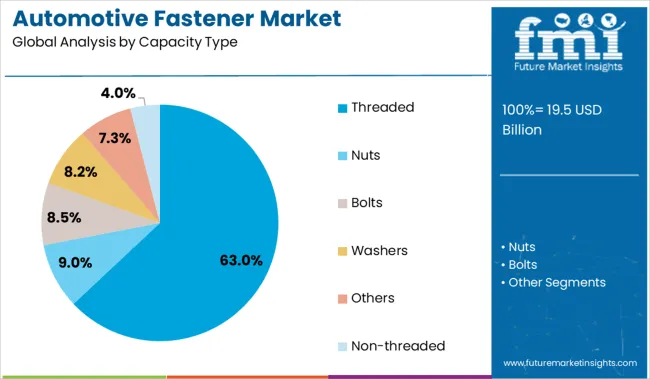

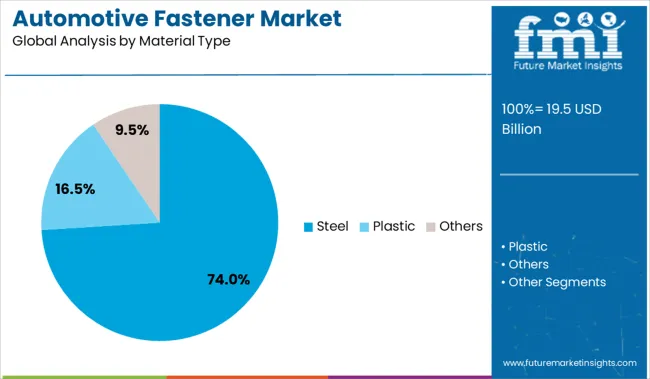

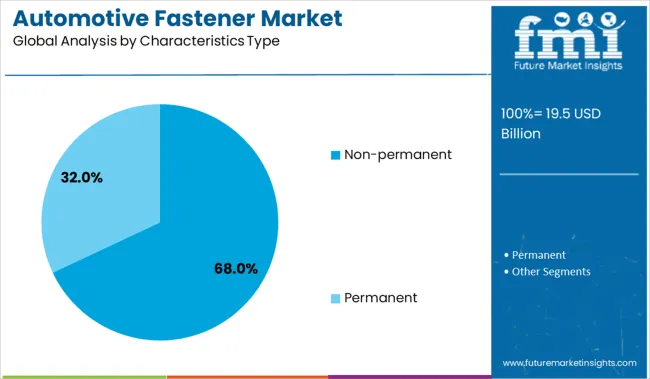

The automotive fastener market is segmented by capacity type, material type, characteristics type, application type, distribution channel, and geographic regions. The automotive fastener market is divided by capacity type into Threaded, Nuts, Bolts, Washers, Others, and Non-threaded. The automotive fastener market is classified by material type into Steel, Plastic, and Others. Based on the characteristics, the automotive fastener market is segmented into Non-permanent and Permanent. The automotive fastener market is segmented by application type into Passenger Car (PC), Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV). The automotive fastener market is segmented by distribution channel into Automotive OEM and Aftermarket. Regionally, the automotive fastener industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Threaded fasteners are projected to account for 63.0% of the total revenue in the automotive fastener market in 2025, making them the dominant capacity type. Their wide applicability across chassis, engine, interior, and transmission assemblies has supported broad adoption in both internal combustion engine (ICE) and electric vehicle (EV) platforms.

The ability to deliver high torque retention, reusability, and consistent clamping force has reinforced the value of threaded fasteners in high-load applications. Compatibility with torque-controlled installation tools and enhanced fatigue resistance have contributed to their preference in dynamic automotive environments.

Moreover, threaded designs allow for greater flexibility in maintenance and disassembly, aligning with aftersales service and repair requirements..

Steel is expected to command 74.0% of the material share in the automotive fastener market by 2025, positioning it as the preferred substrate. This leadership is driven by steel's superior tensile strength, affordability, and machinability, which make it ideal for high-performance fastening in safety-critical zones.

Advances in alloy formulations, including the use of high-strength and corrosion-resistant grades, have enhanced durability under extreme thermal and mechanical stress. Steel fasteners are well-suited for automated production lines due to their structural stability and uniform threading, ensuring reliability in high-speed assembly operations.

Their recyclability and compliance with end-of-life vehicle (ELV) directives have also supported continued market penetration in both conventional and electric mobility segments..

Non-permanent fasteners are expected to contribute 68.0% of total revenue in 2025, making them the dominant characteristics type within the automotive fastener market. Their reversibility and ability to support modular design have made them critical in areas where ease of disassembly, repair, or replacement is necessary.

This characteristic is increasingly valuable as manufacturers adopt lean production and circular economy principles. In EV platforms, where component access and serviceability are crucial, non-permanent fasteners offer operational flexibility and reduced maintenance complexity.

The trend toward vehicle customization and frequent platform updates has further elevated the role of fasteners that support interchangeability without structural compromise. Enhanced by precision manufacturing, these fasteners ensure consistent joint integrity while allowing future reconfiguration or upgrade..

Automotive fasteners are essential components that provide secure connections across structural, mechanical, and electronic systems in vehicles. These include bolts, nuts, screws, rivets, and specialized fastening elements designed for high-strength, vibration-resistant applications. Their role spans critical areas such as body assembly, powertrain integration, interior fittings, and electrical modules. Rising vehicle production, increasing penetration of electric vehicles, and demand for lightweight yet durable fastening solutions have reinforced their importance. Manufacturers are focusing on advanced materials, automated installation technologies, and corrosion-resistant coatings to meet evolving industry standards and improve operational efficiency.

Growth in the automotive fastener market has been driven by the rising production of passenger and commercial vehicles across global markets. Increased demand for lightweight vehicles has promoted the adoption of high-strength and corrosion-resistant fasteners in body assembly and engine components. Regulatory emphasis on vehicle safety and crashworthiness has reinforced the use of standardized fastening systems that ensure structural integrity. Expansion of electric vehicle manufacturing has created demand for specialized fasteners compatible with battery packs and high-voltage components. Modular vehicle platforms introduced by automakers have encouraged suppliers to develop fasteners with greater flexibility in design and performance. Integration of automation in assembly lines has led to the preference for fasteners enabling quick installation and consistent torque performance, reducing overall assembly time.

Market expansion has been restricted by volatility in raw material prices, particularly steel and aluminum, which directly impact manufacturing costs and pricing strategies. Increased pressure on OEMs for cost optimization has placed additional pricing constraints on fastener suppliers, reducing profitability margins. Standardization across diverse automotive platforms has presented complexity, as manufacturers demand both universal compatibility and application-specific solutions. Counterfeit fasteners entering supply chains have raised concerns regarding performance reliability and compliance with safety standards. Advanced fastening systems required for electric vehicles involve higher development costs, posing entry barriers for smaller suppliers. Global supply chain disruptions and logistics delays have further affected timely availability of fasteners, especially in markets dependent on imported components for large-scale production programs.

Significant opportunities exist in developing lightweight fasteners using advanced materials such as titanium alloys and engineered polymers to address rising requirements for fuel efficiency. Electric vehicle proliferation has created demand for fasteners with thermal and electrical insulation properties for battery integration and electronic module assembly. Growth in connected and autonomous vehicle technologies is expected to generate new fastening applications for sensors, cameras, and control modules. Expansion in emerging markets with increasing vehicle production presents avenues for long-term supplier partnerships. Integration of surface treatments for enhanced corrosion resistance and extended lifecycle offers differentiation in competitive segments. Adoption of just-in-time delivery models and digital inventory management solutions creates opportunities for suppliers to enhance value and improve supply chain reliability.

Automation and smart assembly solutions are influencing the development of advanced fasteners compatible with robotic installation and real-time torque monitoring systems. High-performance coatings that deliver superior corrosion resistance and reduced friction have become a focus area for innovation. Standardization initiatives in fastener dimensions and materials are gaining attention to streamline production and reduce assembly complexity. The use of lightweight composites and hybrid metal-plastic fasteners is emerging to support vehicle weight reduction goals. Digital tracking technologies, including RFID-enabled fasteners, are being explored to enhance traceability and prevent counterfeit issues. Collaborative product development between OEMs and fastener manufacturers has accelerated to meet specific design and performance requirements for electric and autonomous vehicle platforms, shaping the next wave of fastening solutions.

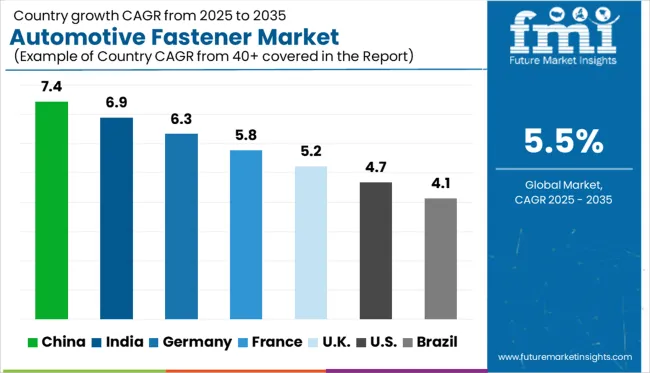

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The automotive fastener market is expected to grow at a CAGR of 5.5% through 2035, driven by rising vehicle production, electrification trends, and demand for lightweight fastening solutions. China leads at 7.4%, supported by large-scale EV manufacturing and extensive supply chain capabilities. India follows at 6.9%, propelled by increasing passenger car and two-wheeler production alongside rapid adoption of hybrid vehicles. Among OECD economies, France posts 5.8%, while the United Kingdom records 5.2% and the United States grows at 4.7%, influenced by investments in advanced fastening systems for electric and premium vehicles. The market outlook remains positive as manufacturers prioritize innovation in material technology, automation-ready fasteners, and corrosion-resistant coatings to address evolving vehicle design. The analysis includes over 40 countries, with the top five detailed below.

China is expected to register a CAGR of 7.4% through 2035, driven by expanding vehicle production, rising adoption of lightweight materials, and growing demand for electric vehicles. The automotive fastener industry in China benefits from a robust domestic supply base, with manufacturers producing both standard and specialty fasteners for passenger cars and commercial vehicles. High-performance fasteners are increasingly being used in EV battery systems, chassis, and structural assemblies to meet weight reduction and safety requirements. Major OEMs are collaborating with fastener suppliers to develop corrosion-resistant and high-torque solutions tailored for next-generation vehicles. Increased automation in assembly lines and the trend toward modular vehicle platforms will further boost demand for precision fasteners in the Chinese automotive sector.

India is forecasted to grow at a CAGR of 6.9% through 2035, supported by rising automotive manufacturing volumes, government-led mobility initiatives, and the expanding two-wheeler and commercial vehicle markets. The shift toward electric and hybrid vehicles is creating demand for lightweight and high-strength fasteners to optimize performance and efficiency. Domestic fastener manufacturers are introducing cost-effective, corrosion-resistant products to serve both OEMs and aftermarket requirements. Growing emphasis on localized production under automotive policies is encouraging strategic investments in advanced fastening technologies, including self-piercing and clinch fasteners for high-strength steel and aluminum components. The increasing adoption of modular platforms and higher penetration of safety-critical systems in vehicles are influencing demand for precision fasteners with enhanced fatigue resistance.

France is projected to achieve a CAGR of 5.8% through 2035, supported by strong demand for premium vehicles, electrification initiatives, and the adoption of lightweight materials in vehicle structures. Automotive fasteners in France are witnessing an increasing shift toward advanced joining solutions, including specialty fasteners for composites and high-strength alloys. Demand for coated and corrosion-resistant fasteners is growing due to environmental regulations and extended vehicle lifecycles. Domestic OEMs are partnering with fastener suppliers to integrate high-precision components compatible with automation and robotic assembly lines. The presence of major automotive design hubs in France is accelerating the development of fastening solutions optimized for weight reduction and safety compliance.

The United States is forecasted to grow at a CAGR of 7.8% from 2025 to 2035, driven by high adoption of AI-powered cattle management solutions in commercial dairy farms. Farmers are deploying cloud-based dashboards for integrated monitoring of herd health, reproduction cycles, and milk yield. IoT-enabled sensors and RFID tagging systems are improving real-time cattle tracking and disease detection. Predictive maintenance tools for milking robots and automated feeding systems are gaining traction. Big data analytics is playing a key role in optimizing genetic selection programs to enhance herd productivity. These advancements are positioning the US as a leading adopter of advanced cattle management platforms globally.

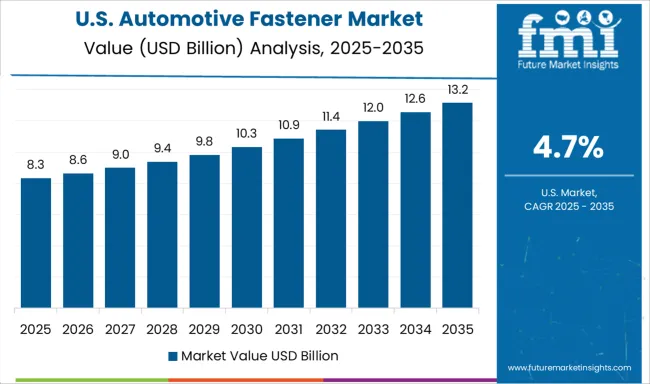

The United States is forecasted to grow at a CAGR of 4.7% through 2035, supported by consistent automotive production, rising demand for SUVs and light trucks, and increasing EV adoption. USA fastener suppliers are focusing on developing advanced fastening solutions that meet high safety, performance, and durability requirements. Demand for lightweight fasteners is increasing as automakers transition to aluminum-intensive body structures and composite materials to improve fuel efficiency. The push toward automation in manufacturing plants is influencing the adoption of fasteners optimized for robotic installation and high-volume production lines. Automotive OEMs are emphasizing fastener systems with enhanced corrosion resistance and fatigue performance for long-term reliability.

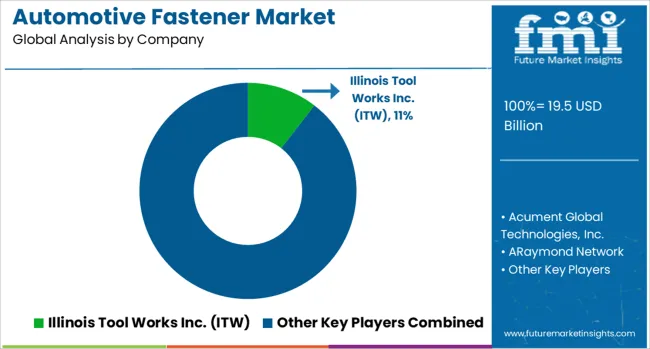

The automotive fastener market is shaped by global manufacturers and regional players delivering high-precision fastening solutions for engine components, chassis, body assemblies, and interiors. Illinois Tool Works Inc. (ITW) remains a dominant player with a broad portfolio of engineered fasteners and innovative joining technologies tailored to lightweight vehicle platforms.

Acument Global Technologies, Inc. specializes in high-strength fasteners for drivetrain and safety-critical applications, leveraging advanced manufacturing processes. ARaymond Network is recognized for quick-connect systems and plastic fastening solutions supporting the shift toward electrification and modular assembly. Bollhoff Group and Bossard Group maintain strong positions in fastening and assembly technologies, focusing on smart inventory and logistics services for OEMs.

Bulten AB, Fontana Gruppo S.p.A., and KAMAX Holding GmbH & Co. KG lead in threaded fasteners, with KAMAX emphasizing high-tensile bolts for powertrain and structural components. LISI Automotive offers advanced fastening technologies for both ICE and EV platforms, while Nifco Inc. focuses on polymer fasteners, reducing vehicle weight and improving assembly efficiency. Norma Group SE and Stanley Black & Decker, Inc. provide specialized clamps, connectors, and engineered fastening systems.

Sundram Fasteners Limited, TR Fastenings Limited, and Wurth Group play significant roles as global suppliers with strong distribution networks, targeting OEMs and aftermarket segments. Competitive differentiation is driven by lightweight material integration, corrosion resistance, high fatigue strength, and compliance with automotive safety standards. Strategic priorities include adoption of digital supply chain solutions, partnerships with EV manufacturers, and development of advanced fastening systems compatible with composite materials and modular vehicle architectures.

Key strategies in the automotive fastener market include developing high-strength and lightweight fasteners to support electric vehicle integration and modular platforms. Companies are focusing on precision engineering and automation for faster assembly and consistent torque. Strategic collaborations with automakers are enabling custom solutions for emerging vehicle architectures.

Regional production expansion is being prioritized to reduce supply chain risks and meet localized demand. Additionally, investments in advanced coating processes and smart fastening technologies are being pursued to enhance durability and reliability under varying operating conditions. Product portfolio diversification remains critical to address both standard and application-specific requirements in the industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.5 Billion |

| Capacity Type | Threaded, Nuts, Bolts, Washers, Others, and Non-threaded |

| Material Type | Steel, Plastic, and Others |

| Characteristics Type | Non-permanent and Permanent |

| Application Type | Passenger Car (PC), Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV) |

| Distribution Channel | Automotive OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Illinois Tool Works Inc. (ITW), Acument Global Technologies, Inc., ARaymond Network, Bollhoff Group, Bossard Group, Bulten AB, Fontana Gruppo S.p.A., KAMAX Holding GmbH & Co. KG, LISI Automotive, Nifco Inc., Norma Group SE, Stanley Black & Decker, Inc., Sundram Fasteners Limited, TR Fastenings Limited, and Wurth Group |

The global automotive fastener market is estimated to be valued at USD 19.5 billion in 2025.

The market size for the automotive fastener market is projected to reach USD 33.3 billion by 2035.

The automotive fastener market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in automotive fastener market are threaded, nuts, bolts, washers, others and non-threaded.

In terms of material type, steel segment to command 74.0% share in the automotive fastener market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Fasteners Market Growth -Trends & Forecast 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA