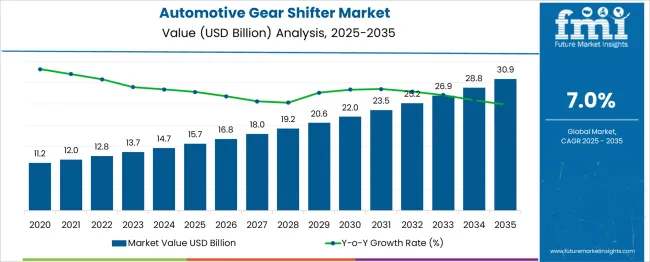

The Automotive Gear Shifter Market is estimated to be valued at USD 15.7 billion in 2025 and is projected to reach USD 30.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The growth trajectory appears steady, without distinct seasonal or cyclical fluctuations typically caused by short-term demand shocks or production pauses. Annual increments range consistently from USD 1.1 billion in early years to approximately USD 2.1 billion toward the end, indicating an absence of sharp dips or peaks that would signal seasonality effects. This suggests the market benefits from continuous demand driven by global vehicle production trends and ongoing transition to advanced transmission technologies. Minor variations in yearly growth are likely linked to broader automotive industry cycles rather than direct seasonality. For instance, gradual increases align with phased adoption of electronic gear shifters and automatic transmission enhancements. The steady upward pattern reflects stable replacement demand and OEM integration of innovative gear shifter designs. Additionally, cyclical factors such as global economic conditions or regulatory changes may influence growth but do not appear to disrupt the consistent expansion within this forecast. The market demonstrates resilience to typical seasonal impacts, driven by its role as a core automotive component with sustained long-term demand.

| Metric | Value |

|---|---|

| Automotive Gear Shifter Market Estimated Value in (2025 E) | USD 15.7 billion |

| Automotive Gear Shifter Market Forecast Value in (2035 F) | USD 30.9 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The automotive gear shifter market accounts for approximately 25–30% of the global automotive transmission systems market, reflecting its role in enabling gear selection across manual, automatic, and electric drivetrains. Within the vehicle interior components segment, gear shifters represent about 15–20%, driven by their integration into cabin design and user interface systems. In the broader automotive parts and accessories market, the gear shifter segment comprises around 5–7%, highlighting its specialized function relative to other components.

The market is also influenced by the increasing adoption of electric and hybrid vehicles, which are expected to drive demand for advanced gear shifting technologies. The industry is experiencing a shift towards electronic and shift-by-wire systems, which offer benefits such as reduced weight, enhanced design flexibility, and improved ergonomics. These systems are increasingly integrated with advanced driver-assistance systems (ADAS) and infotainment platforms, providing a seamless user experience. The growing popularity of electric vehicles (EVs) is also influencing gear shifter design, as traditional mechanical linkages are replaced with electronic controls to accommodate the unique requirements of EV drivetrains. Additionally, there is a trend towards more intuitive and user-friendly interfaces, with features like haptic feedback and customizable controls enhancing driver interaction. These developments indicate a move towards smarter, more integrated gear shifting solutions in the automotive industry.

The automotive gear shifter market is experiencing consistent growth, driven by rising adoption of automatic transmission systems, the electrification of drivetrain technologies, and increased focus on driver ergonomics and safety. Automakers are emphasizing gear shifter innovations that support compact design, reduced mechanical complexity, and smoother gear transitions, particularly in high-volume passenger vehicle segments.

Technological advancements such as shift-by-wire systems, illuminated shift indicators, and integrated control modules are enhancing vehicle interior aesthetics and improving user convenience. Growth in urban mobility and consumer demand for enhanced comfort features are accelerating the replacement of manual shifters with automatic variants.

Additionally, regulatory mandates for fuel efficiency and safety are encouraging the adoption of gear shifter technologies that support intelligent transmission control and adaptive driving systems.

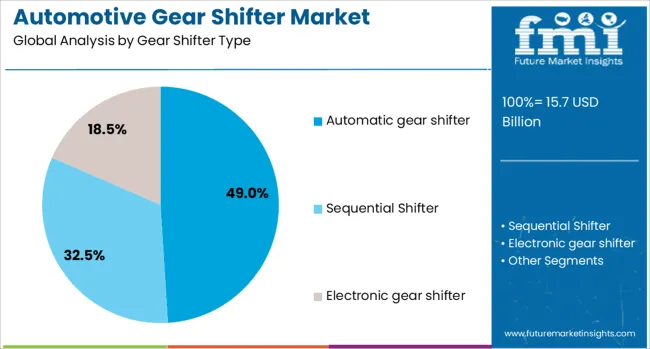

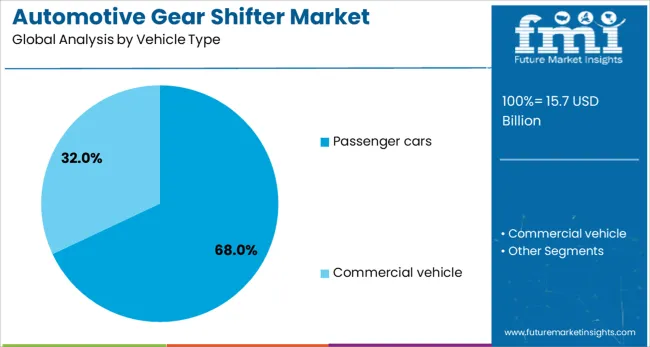

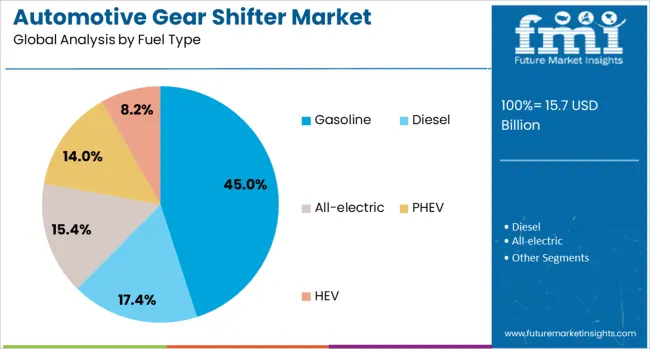

The automotive gear shifter market is segmented by gear shifter type, vehicle type, fuel type, and geographic regions. The automotive gear shifter market is divided by gear shifter type into Automatic gear shifter, Sequential Shifter, and Electronic gear shifter. In terms of vehicle type, the automotive gear shifter market is classified into Passenger cars and Commercial vehicles. Based on fuel type, the automotive gear shifter market is segmented into Gasoline, Diesel, All-electric, PHEV, and HEV. Regionally, the automotive gear shifter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Automatic gear shifters are projected to account for 49.00% of total revenue in the automotive gear shifter market by 2025, making them the leading segment by gear shifter type. Their popularity stems from the increasing consumer preference for convenience, traffic handling ease, and the smoother drive experience offered by automatic systems.

Manufacturers are rapidly integrating advanced electronic and shift-by-wire systems that replace traditional mechanical linkages, enabling more flexible cabin layouts and improved vehicle control.

As OEMs expand offerings in automatic transmission vehicles, the demand for modern, space-saving, and electronically actuated gear shifters continues to rise across both economy and luxury vehicle categories.

Passenger cars are expected to contribute 68.00% of the automotive gear shifter market revenue in 2025, making them the dominant vehicle type. This segment's growth is driven by the global expansion of urban commuting, rising disposable incomes, and increasing preference for vehicles equipped with driver-assistive technologies.

Gear shifters in passenger cars are now being designed not only for performance but also for improved aesthetics, ease of use, and integration with digital dashboards.

With consumer demand shifting toward feature-rich mid-size and compact cars, gear shifter innovations have become a critical part of OEMs’ interior upgrade strategies.

Gasoline-powered vehicles are projected to hold 45.00% share of the automotive gear shifter market by 2025, leading the fuel type category. This is supported by the continued dominance of gasoline engines in emerging and developed markets alike, owing to their affordability, well-established fueling infrastructure, and lower initial cost compared to EVs or diesel variants.

Gear shifter technologies in gasoline vehicles are benefiting from broader drivetrain compatibility and fewer integration challenges, allowing manufacturers to standardize platforms and reduce production complexity.

As hybrid and fuel-efficient gasoline models gain traction, the segment is expected to maintain a strong foothold during the forecast period.

The automotive gear shifter market is experiencing significant growth, driven by advancements in transmission technologies and increasing consumer demand for enhanced driving experiences. The market is projected to expand substantially in the coming years, with a notable compound annual growth rate (CAGR). This growth is attributed to the rising adoption of automatic and semi-automatic transmission systems, which offer improved fuel efficiency and driving comfort. Additionally, the integration of electronic and shift-by-wire technologies is transforming traditional gear shifting mechanisms, leading to more precise and responsive gear changes.

The evolution of gear shifter systems is marked by the transition from mechanical linkages to electronic and shift-by-wire technologies. These innovations eliminate the need for physical connections between the gear lever and the transmission, allowing for more flexible and ergonomic designs. The adoption of electronic control units (ECUs) and solenoid actuators has enhanced the precision and reliability of gear shifting. Furthermore, the development of haptic feedback systems and intuitive user interfaces is improving driver interaction with gear shifters, contributing to a more seamless driving experience.

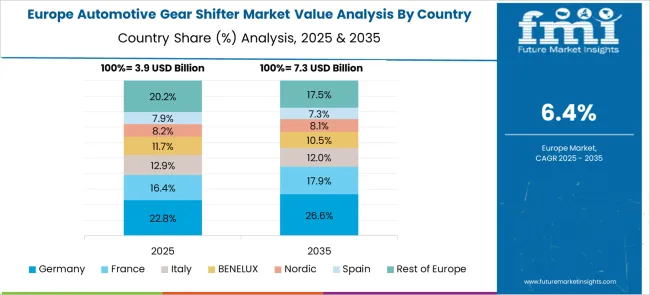

The automotive gear shifter market exhibits varying growth patterns across different regions. North America and Europe are witnessing steady demand, driven by the presence of established automotive manufacturers and consumer preference for advanced transmission systems. In contrast, the Asia-Pacific region is experiencing rapid growth due to increasing vehicle production, urbanization, and rising disposable incomes. Countries like China, India, and Japan are significant contributors to this regional expansion, with a growing inclination towards automatic transmission vehicles and technological innovations in gear shifting systems.

Consumer preferences are shifting towards vehicles equipped with advanced gear shifting technologies that offer enhanced comfort, efficiency, and safety. The demand for automatic and semi-automatic transmissions is on the rise, as they provide smoother driving experiences and ease of use, particularly in urban environments. Additionally, the integration of advanced driver-assistance systems (ADAS) with gear shifting mechanisms is gaining traction, offering features like automated gear selection and adaptive shifting patterns. These trends are influencing automotive manufacturers to invest in research and development to meet evolving consumer expectations.

Despite the positive growth trajectory, the automotive gear shifter market faces challenges such as high manufacturing costs, integration complexities, and the need for standardization across different vehicle models. Moreover, the transition to electric vehicles (EVs) presents both opportunities and challenges, as traditional gear shifting mechanisms may need to be adapted or replaced to suit the unique requirements of EV drivetrains. The ongoing advancements in technology and materials, along with increasing consumer demand for innovative and efficient driving solutions, are expected to drive the market forward, leading to the development of next-generation gear shifter systems that cater to the evolving needs of the automotive industry.

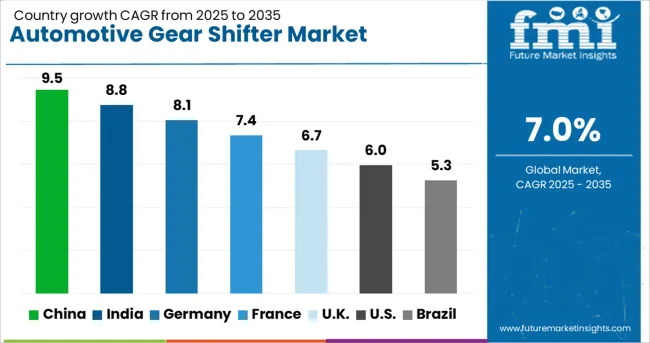

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global automotive gear shifter market is projected to grow at a CAGR of 7% from 2025 to 2035. Growth in China, at 9.5%, exceeds the global average by 36%, driven by expanding vehicle production with advanced transmission technologies. India’s CAGR of 8.8% is 26% above the global rate, supported by rising demand for modern drivetrain systems. Germany’s CAGR of 8.1% surpasses the global figure by 16%, attributed to production in premium vehicle segments and adoption of automated manual transmissions. The United Kingdom’s growth rate of 6.7% falls 4% below the global average, reflecting steady improvements in gear shifter technology. The United States registers a CAGR of 6.0%, trailing the global pace by 14%, influenced by incremental enhancements in mechanical and electronic shifting systems.

China’s automotive gear shifter market is forecast to expand at a CAGR of 9.5% from 2025 to 2035. The growth is supported by increasing vehicle manufacturing volumes and rising integration of automated and electronic gear shifting systems. Local manufacturers are investing heavily in research and development to improve transmission efficiency and user experience. The expanding middle-class consumer base is driving demand for passenger vehicles equipped with advanced transmission technologies. China’s competitive landscape is marked by collaboration between global transmission component suppliers and domestic automotive OEMs, strengthening market presence and innovation capacity. The country’s production of commercial vehicles incorporating improved gear shifters further sustains growth momentum.

India’s automotive gear shifter market is projected to grow at a CAGR of 8.8% between 2025 and 2035. Rising demand for vehicles with improved fuel efficiency and smoother gear transitions is driving market expansion. Domestic automakers are focusing on integrating electronic gear shifting technologies into passenger and commercial vehicles to meet consumer expectations. Government policies encouraging manufacturing innovation and emission reduction are contributing factors. Competitive dynamics include investments by key transmission system suppliers to expand production capacity and localize component manufacturing. The increasing presence of international OEMs in India is accelerating adoption of advanced gear shifting mechanisms.

Germany’s automotive gear shifter market is expected to register a CAGR of 8.1% from 2025 to 2035. Demand is supported by a strong focus on premium and luxury vehicle segments where automated and electronic gear shifting systems are standard. Local manufacturers are investing in research to improve gear shifting precision and energy efficiency. The growing emphasis on emission reduction and drivability is increasing demand for advanced transmission technologies. The competitive environment includes global suppliers collaborating with German automotive companies to produce innovative gear shifter components. Technological advancements in automated manual transmissions contribute significantly to market growth.

The United Kingdom automotive gear shifter market is forecast to grow at a CAGR of 6.7% from 2025 to 2035. Growth is driven by gradual upgrades in traditional mechanical gear shifting systems and increasing adoption of electronic shifting in passenger vehicles. The presence of several domestic and international automotive manufacturers supports steady market development. Government regulations related to vehicle emissions and efficiency indirectly influence the integration of advanced transmission components. Competitive strategies focus on incremental technological improvements and cost optimization to maintain market share. The commercial vehicle segment shows moderate adoption of automated gear shifting technologies.

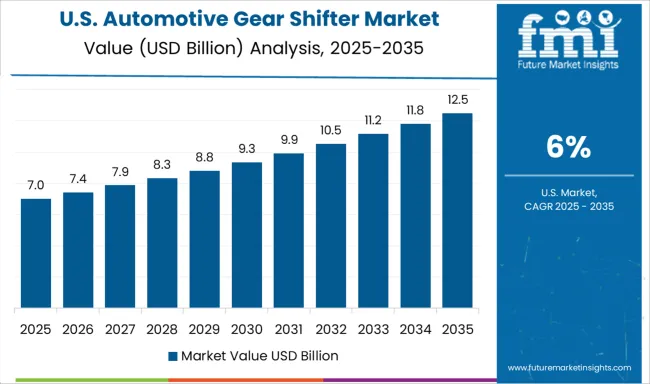

The United States automotive gear shifter market is expected to grow at a CAGR of 6.0% from 2025 to 2035. Market growth is influenced by gradual improvements in mechanical and electronic gear shifting technologies. Consumer preferences for reliability and incremental performance enhancements shape demand patterns. The presence of leading global OEMs and suppliers supports steady innovation and component availability. Regulatory frameworks promoting vehicle efficiency indirectly encourage transmission system upgrades. Competitive dynamics involve strategic partnerships aimed at optimizing gear shifting technologies for both passenger and commercial vehicles. The commercial vehicle segment reflects slower adoption rates compared to passenger cars.

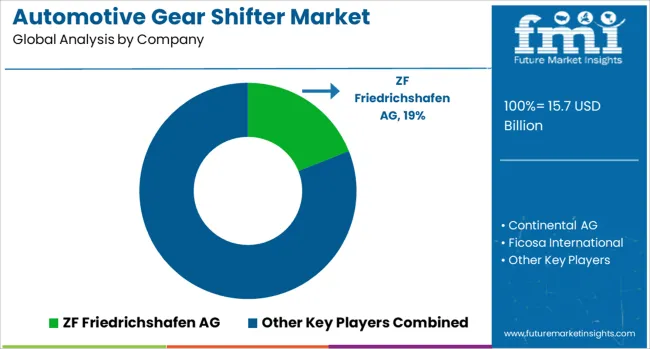

ZF Friedrichshafen AG is a leading supplier of advanced gear shifter systems, integrating electronic shift-by-wire technology in automatic and dual-clutch transmissions. Their focus on reducing mechanical complexity and improving shift precision supports both passenger and commercial vehicles. Continental AG develops a range of gear shifter modules including electronic and manual types, emphasizing ergonomic design and integration with vehicle electronics to enhance driver experience and safety.

Ficosa International specializes in electronic control systems for gear shifting, providing compact shift-by-wire components that support electric and hybrid vehicle platforms. Getrag, part of Magna, delivers high-performance transmission systems paired with gear shifters designed for sport and commercial vehicles, focusing on robustness and seamless gear transitions. GHSP manufactures shift levers and assemblies for manual and automatic transmissions, supplying major automotive OEMs globally. GKN Automotive offers electronically controlled gear shifters with emphasis on lightweight materials and enhanced durability. KOSTAL Group designs intuitive, user-friendly gear shifters combined with electronic control units that integrate with vehicle communication networks.

Kongsberg delivers precision gear shifter components with a focus on customization and OEM-specific adaptations. Orscheln Products and SIGNATA provide aftermarket and specialized gear shifter solutions, serving niche vehicle segments with tailored designs for manual and automatic transmission systems.

Between 2023 and mid 2025, the automotive gear shifter market experienced significant advancements, driven by technological innovation and evolving consumer preferences. Traditional mechanical linkages were increasingly replaced by electronic shift-by-wire systems, offering smoother gear transitions and enabling more flexible cabin designs.

Manufacturers introduced compact, intuitive interfaces such as rotary dials, touch-sensitive panels, and joystick-style selectors, enhancing interior aesthetics and user experience. However, the rapid adoption of these novel designs led to user confusion, particularly among renters and those unfamiliar with specific models, highlighting the need for standardized and intuitive controls across different vehicle brands.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.7 Billion |

| Gear Shifter Type | Automatic gear shifter, Sequential Shifter, and Electronic gear shifter |

| Vehicle Type | Passenger cars and Commercial vehicle |

| Fuel Type | Gasoline, Diesel, All-electric, PHEV, and HEV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ZF Friedrichshafen AG, Continental AG, Ficosa International, Getrag (a Magna company), GHSP, GKN Automotive, KOSTAL Group, Kongsberg, Orscheln Products, and SIGNATA |

The global automotive gear shifter market is estimated to be valued at USD 15.7 billion in 2025.

The market size for the automotive gear shifter market is projected to reach USD 30.9 billion by 2035.

The automotive gear shifter market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in automotive gear shifter market are automatic gear shifter, _manual gear shifter, _traditional stick shifter, sequential shifter, _conventional automatic, _dual-clutch transmission (dct), _continuously variable transmission (cvt), electronic gear shifter, _shift-by-wire, _rotary shifter and _push-button shifter.

In terms of vehicle type, passenger cars segment to command 68.0% share in the automotive gear shifter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA