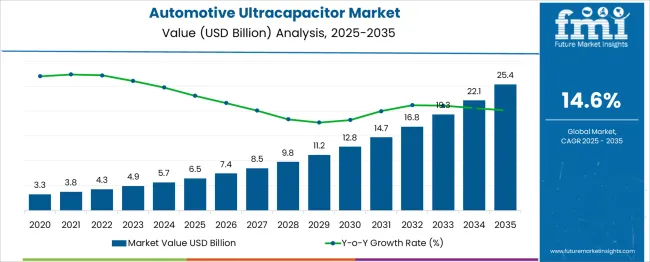

The Automotive Ultracapacitor Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 25.4 billion by 2035, registering a compound annual growth rate (CAGR) of 14.6% over the forecast period. The year-by-year progression shows strong and accelerating growth, reflecting rapid technology adoption and expanding application areas in electric and hybrid vehicles. From 2025 to 2030, the market expands from USD 6.5 billion to USD 12.8 billion, nearly doubling in value.

This five-year phase corresponds to a CAGR of roughly 14.8%, with annual gains increasing from USD 0.9 billion in the first year to USD 1.6 billion by 2030. Growth in this period is largely driven by OEM integration of ultracapacitors for regenerative braking, power buffering, and start-stop systems, along with rising energy efficiency requirements.

Between 2030 and 2035, the market grows from USD 12.8 billion to USD 25.4 billion, delivering a similar CAGR of about 14.4%. Annual value additions accelerate further, reaching nearly USD 3.3 billion in the final year. This suggests widening penetration in high-performance EVs, heavy-duty transport, and grid-connected vehicle technologies.

The CAGR trend over the decade confirms sustained high growth without significant deceleration, indicating a technology in the scaling phase. For investors and manufacturers, this points to a prolonged window of opportunity with compounding returns from early and continued participation.

| Metric | Value |

|---|---|

| Automotive Ultracapacitor Market Estimated Value in (2025 E) | USD 6.5 billion |

| Automotive Ultracapacitor Market Forecast Value in (2035 F) | USD 25.4 billion |

| Forecast CAGR (2025 to 2035) | 14.6% |

The automotive ultracapacitor market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.1% of the global automotive energy storage market, driven by demand for rapid charge discharge capabilities in hybrid and electric vehicles. Within the automotive power electronics sector, a share of approximately 2.9% is assessed due to integration with regenerative braking and start stop systems. In the electric and hybrid vehicle components market, around 2.6% is observed reflecting the role of ultracapacitors in supporting peak power demands.

Within the automotive lightweighting and efficiency solutions segment, about 1.9% is evaluated as ultracapacitors improve energy efficiency without significant weight addition. In the commercial vehicle electrification market, a contribution of roughly 2.4% is calculated supported by adoption in buses, delivery fleets, and heavy duty trucks. Market development has been influenced by the push for high efficiency energy storage solutions that complement batteries.

Innovations have focused on hybrid energy storage systems combining ultracapacitors with lithium ion batteries for extended cycle life and improved power density. Interest has been growing in graphene based ultracapacitors and advanced electrode materials that increase performance while reducing size.

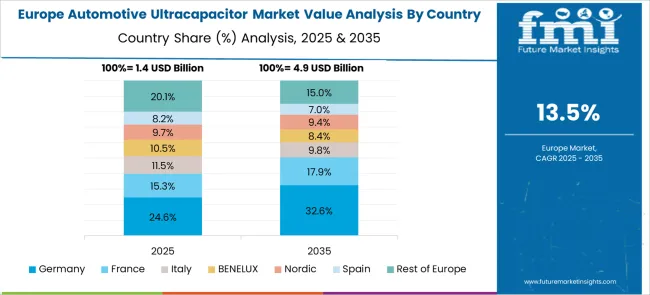

The Europe region has been observed to lead early adoption in premium automotive segments, while Asia Pacific is emerging as a key production and consumption hub. Strategic initiatives have included partnerships between ultracapacitor manufacturers and automotive OEMs to develop application specific modules, optimize power management systems, and enable faster, more efficient vehicle electrification.

The automotive ultracapacitor market is gaining strong momentum due to increased electrification across mobility platforms, a growing focus on decarbonization, and the need for energy storage systems that complement lithium-ion batteries. Heightened regulatory pressure on vehicle emissions, especially in urban regions, has prompted OEMs to deploy ultracapacitor solutions for regenerative braking and short-burst power delivery.

These systems are being preferred for their high power density, long cycle life, and ability to perform under wide temperature ranges-key factors in automotive applications. Additionally, R&D initiatives focused on hybridizing powertrains and enhancing energy recuperation technologies are expanding the adoption of ultracapacitors across electric and hybrid vehicle segments.

As governments push for EV infrastructure and manufacturers prioritize performance-efficiency balance, the role of ultracapacitors as critical power-assist modules is becoming more prominent.

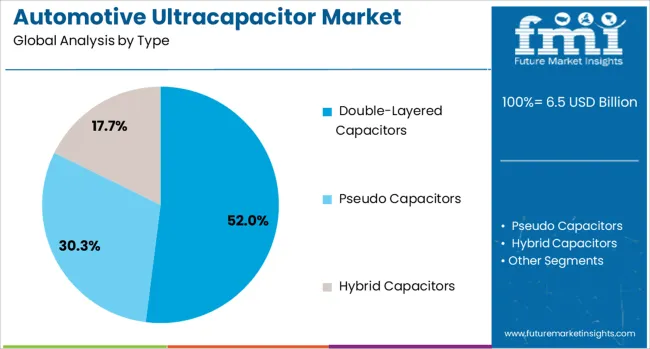

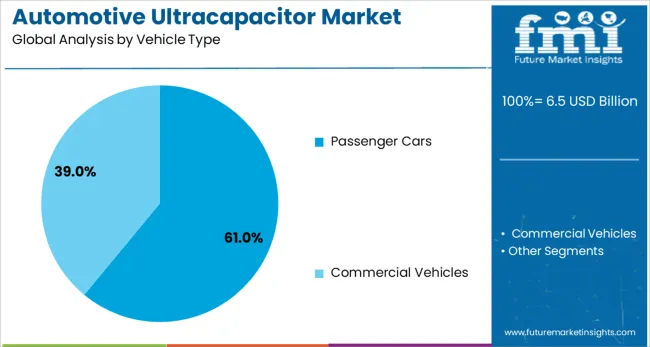

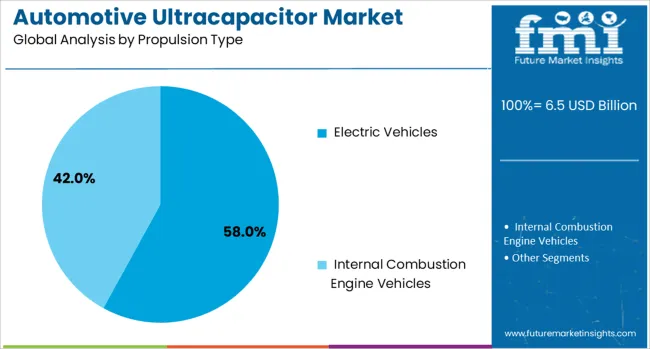

The automotive ultracapacitor market is segmented by type, vehicle type, propulsion type, application, sales channel, and geographic regions. The automotive ultracapacitor market is divided by type into Double-Layered Capacitors, Pseudo Capacitors, and Hybrid Capacitors. The automotive ultracapacitor market is classified by vehicle type into Passenger Cars and Commercial Vehicles. Based on the propulsion type, the automotive ultracapacitor market is segmented into Electric Vehicles and Internal Combustion Engine Vehicles. The automotive ultracapacitor market is segmented into Start-Stop Function, Regenerative Braking, Power Steering, Turbocharger Support, and Suspension Systems. The sales channel of the automotive ultracapacitor market is segmented into OEM and Aftermarket. Regionally, the automotive ultracapacitor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Double-layered capacitors are projected to lead the market with a 52.0% share in 2025, driven by their superior energy density and cost-efficiency. Their high capacitance, low equivalent series resistance, and extended operational lifecycle have made them ideal for automotive-grade requirements, particularly in braking energy recovery and voltage stabilization.

This segment’s growth has been supported by advances in electrode material science and system-level integration with lithium-ion batteries.

As vehicle manufacturers focus on modular energy systems that require rapid charge-discharge capabilities, the adaptability of double-layered capacitors has positioned them as the preferred solution across powertrain designs.

Passenger cars are expected to account for 61.0% of the total automotive ultracapacitor market by 2025. The dominance of this segment is being influenced by increased integration of start-stop systems, onboard electronics, and powertrain electrification in the light-duty vehicle category.

Growing consumer demand for fuel-efficient, emission-compliant cars has led to accelerated deployment of ultracapacitor modules to improve energy utilization. The scalability and compact footprint of these systems have enabled smoother integration within passenger vehicle architectures.

Moreover, initiatives by automakers to achieve tighter CO₂ emission targets in internal combustion engines and hybrid platforms have further solidified ultracapacitor use in this segment.

Electric vehicles are projected to hold a 58.0% market share by 2025 in the propulsion type category. Their growth is being shaped by widespread EV adoption, government incentives, and the need for high-efficiency auxiliary energy storage.

Ultracapacitors are being increasingly deployed in EVs to support acceleration, hill-start assist, and to reduce dependency on the main battery for transient power demands. This has enhanced vehicle performance while improving battery longevity.

In high-frequency cycling applications, ultracapacitors’ robustness and rapid energy transfer capabilities have made them essential components in next-generation EV powertrains.

The automotive ultracapacitor market has been expanding steadily as demand for rapid energy storage and discharge solutions has increased in electric, hybrid, and conventional vehicles. Ultracapacitors are being utilized for applications requiring high power density, fast charging, and extended cycle life. Their ability to support regenerative braking, start-stop systems, and peak power demands has improved vehicle efficiency. Rising adoption of electric mobility, alongside stringent fuel efficiency and emission regulations, has created a favorable environment for integration. The combination of enhanced performance, reduced maintenance requirements, and improved durability has driven interest in ultracapacitor deployment across multiple vehicle segments globally.

Continuous advancements in electrode materials, electrolyte formulations, and cell design have significantly improved the performance characteristics of automotive ultracapacitors. The incorporation of graphene-based and carbon nanotube materials has increased energy density while maintaining high power delivery rates. Improvements in thermal management systems have enhanced operational stability across varying temperature ranges. Hybrid energy storage systems combining ultracapacitors with lithium-ion batteries have been developed to balance power and energy demands efficiently. Enhanced module packaging has reduced space requirements, enabling easier integration into compact vehicle designs. These innovations have made ultracapacitors more versatile and attractive for a wider range of automotive applications.

Automotive ultracapacitors have been deployed in a variety of vehicle categories, from passenger cars to commercial fleets and specialty vehicles. In electric and hybrid models, they have been applied to improve regenerative braking efficiency and extend battery life. In conventional vehicles, start-stop systems and voltage stabilization functions have benefited from ultracapacitor support. Heavy-duty trucks and buses have integrated them for cold start assistance and auxiliary power support. Specialty vehicles such as construction and mining equipment have adopted ultracapacitors to handle high power surges. This diverse application range has broadened the customer base and increased demand across both developed and emerging automotive markets.

Regional market trends have been influenced by varying levels of electrification, government policies, and automotive manufacturing capacity. Asia-Pacific has led adoption due to strong electric vehicle production in China, Japan, and South Korea. Europe has demonstrated significant demand, driven by aggressive emission reduction targets and the presence of leading automotive OEMs. North America has experienced steady growth, supported by innovation in energy storage technologies and increasing adoption in commercial fleets. Emerging markets in Latin America and the Middle East are gradually integrating ultracapacitors as part of modernization efforts. Partnerships between technology developers and automakers have accelerated product adoption and reduced integration timelines.

Despite strong potential, the automotive ultracapacitor market has faced challenges such as high production costs and limited energy density compared to advanced batteries. Raw material price fluctuations, particularly for high-performance carbons, have affected manufacturing economics. Integration into existing vehicle platforms has required design modifications, adding to development costs. Competition from evolving battery chemistries offering improved power capabilities has pressured market positioning. The need for standardization in performance metrics and safety testing has further complicated procurement decisions for automakers. Addressing these challenges through economies of scale, technological optimization, and collaboration with automotive OEMs has been recognized as critical to sustaining growth.

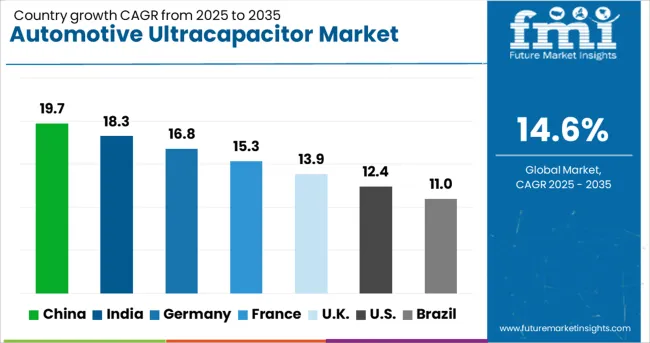

| Country | CAGR |

|---|---|

| China | 19.7% |

| India | 18.3% |

| Germany | 16.8% |

| France | 15.3% |

| UK | 13.9% |

| USA | 12.4% |

| Brazil | 11.0% |

The automotive ultracapacitor market is expected to grow at a global CAGR of 14.6% between 2025 and 2035, driven by rising demand for energy storage solutions, rapid electrification of vehicles, and need for high-power delivery in hybrid and electric models. China leads with a 19.7% CAGR, supported by large-scale EV manufacturing and strong domestic supply chains. India follows at 18.3%, fueled by growing adoption of electric mobility and government incentives. Germany, at 16.8%, benefits from advanced automotive engineering and integration of ultracapacitors in premium vehicles. The UK, projected at 13.9%, sees growth from adoption in performance and electric vehicle segments. The USA, at 12.4%, reflects steady use in hybrid systems and regenerative braking applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 19.7% from 2025 to 2035, supported by rapid electrification of passenger and commercial vehicles. Local manufacturers such as Shanghai Aowei Technology and CRRC are producing ultracapacitors with higher energy density and extended lifecycle. Government-backed EV subsidies and fleet electrification programs are fueling demand. Integration of ultracapacitors in electric buses for regenerative braking is becoming standard in major cities. Collaborations between automakers and component suppliers are accelerating product innovation for hybrid and pure electric platforms.

India is forecasted to achieve a CAGR of 18.3% from 2025 to 2035, driven by growing adoption of electric three-wheelers, buses, and passenger cars. Companies like Exide and Amara Raja are exploring ultracapacitor-based solutions to improve acceleration and regenerative braking efficiency. Public transport projects in metropolitan areas are increasingly specifying hybrid energy systems combining batteries and ultracapacitors. Domestic R&D is focusing on cost-effective designs to improve adoption in budget EV segments. Government EV policies and incentives are further propelling the market.

Germany is expected to post a CAGR of 16.8% from 2025 to 2035, led by premium automotive manufacturers integrating ultracapacitors for high-performance energy recovery. Players such as Skeleton Technologies and Daimler AG are developing ultracapacitors with advanced graphene-based electrodes for improved power density. Applications in regenerative braking and start-stop systems are expanding. Export opportunities in Europe are growing due to Germany’s reputation for automotive engineering excellence. Partnerships with Tier 1 suppliers are advancing production efficiency and integration capability.

The United Kingdom is projected to expand at a CAGR of 13.9% from 2025 to 2035, with adoption driven by hybrid bus fleets, luxury EV brands, and motorsport applications. Companies like Cap-XX and Hyperdrive Innovation are focusing on ultracapacitors optimized for high power output and rapid charge cycles. Integration in London’s public transport upgrades has accelerated commercial use. Research funding from government innovation programs supports advancements in energy storage technology.

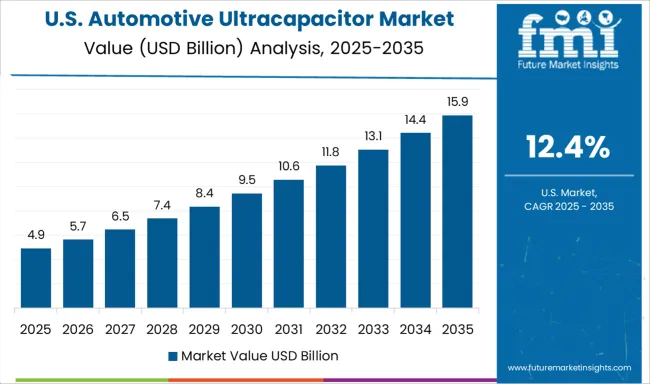

The United States is expected to grow at a CAGR of 12.4% from 2025 to 2035, with demand coming from electric trucks, SUVs, and performance EVs. Maxwell Technologies and Ioxus are leading developments in large-format ultracapacitors for heavy-duty applications. Integration in regenerative braking systems for electric school buses and delivery fleets is gaining momentum. Military vehicle programs are also exploring ultracapacitor adoption for peak power requirements.

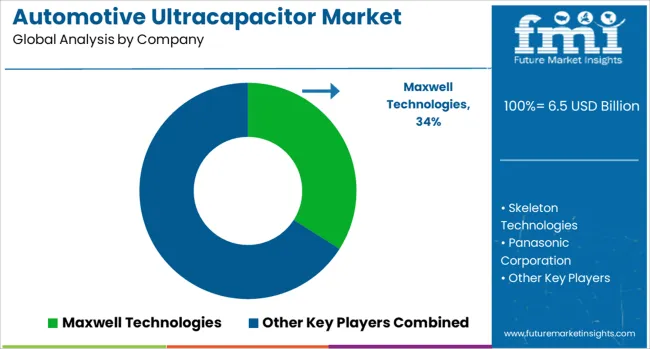

The automotive ultracapacitor market is led by energy storage technology companies and component manufacturers supplying high-power, rapid-charge solutions for hybrid vehicles, start-stop systems, and regenerative braking applications. Maxwell Technologies, now part of Tesla, is a major player with a wide range of ultracapacitors optimized for automotive power bursts and energy recovery.

Skeleton Technologies specializes in graphene-based ultracapacitors, offering higher energy density and extended lifecycle for electric mobility applications. Panasonic Corporation, Nichicon Corporation, and Nippon Chemi Con Corporation integrate ultracapacitors into broader automotive electronic systems, leveraging established supply relationships with global automakers. KEMET Corporation and AVX Corporation deliver compact, high-reliability units for advanced driver assistance systems (ADAS) and onboard electronics.

Ioxus, Inc. and Yunasko Ltd focus on tailored ultracapacitor modules for specific vehicle applications, including heavy-duty transportation and performance vehicles. NEC Tokin and Murata Manufacturing Co., Ltd. supply components with high temperature tolerance and long cycle life for harsh automotive environments. CAP XX Limited is known for its ultra-thin supercapacitors designed for integration into space-constrained automotive electronics, while LS Mtron Ltd and Eaton Corporation produce high-capacity modules for commercial and off-highway vehicles.

Key strategies include developing hybrid energy storage systems combining ultracapacitors with lithium-ion batteries, expanding production capacity for automotive-grade components, and partnering with OEMs for system-level integration. Entry into this market is limited by high R&D requirements, stringent automotive qualification standards, and the need for proven performance under extreme operating conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Type | Double-Layered Capacitors, Pseudo Capacitors, and Hybrid Capacitors |

| Vehicle Type | Passenger Cars and Commercial Vehicles |

| Propulsion Type | Electric Vehicles and Internal Combustion Engine Vehicles |

| Application | • Start-Stop Function - 47.0%, • Regenerative Braking, • Power Steering, • Turbocharger Support, and • Suspension Systems |

| Sales Channel | • OEM - 68.0% and • Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Maxwell Technologies, Skeleton Technologies, Panasonic Corporation, KEMET Corporation, Nippon Chemi‑Con Corporation, Ioxus, Inc., Yunasko Ltd, NEC Tokin, CAP‑XX Limited, AVX Corporation, LS Mtron Ltd, Eaton Corporation, Murata Manufacturing Co., Ltd., and Nichicon Corporation |

| Additional Attributes | Dollar sales by capacitor type and vehicle category, demand dynamics across passenger cars, commercial vehicles, and electric mobility platforms, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in hybrid energy storage systems, graphene-based electrodes, and fast-charging architectures, environmental impact of raw material sourcing, recycling, and lifecycle energy efficiency, and emerging use cases in regenerative braking, start-stop systems, and peak load power support for EVs and hybrid vehicles. |

The global automotive ultracapacitor market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the automotive ultracapacitor market is projected to reach USD 25.4 billion by 2035.

The automotive ultracapacitor market is expected to grow at a 14.6% CAGR between 2025 and 2035.

The key product types in automotive ultracapacitor market are double-layered capacitors , pseudo capacitors and hybrid capacitors.

In terms of vehicle type, passenger cars segment to command 61.0% share in the automotive ultracapacitor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA