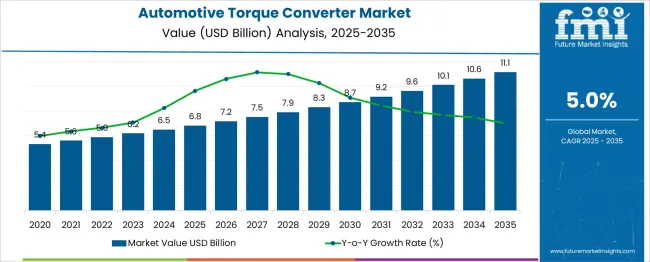

The automotive torque converter market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Focusing on the five-year growth outlook from 2020 to 2025, the market expands from USD 5.4 billion to USD 6.8 billion, contributing an incremental gain of USD 1.4 billion. This growth phase is primarily driven by rising demand for automatic transmissions in passenger vehicles, commercial vehicles, and electric hybrid platforms, which increasingly rely on torque converters for smooth power transmission and enhanced fuel efficiency.

Year-on-year market values during this period, USD 5.6 billion in 2021, USD 5.9 billion in 2022, USD 6.2 billion in 2023, and USD 6.5 billion in 2024, indicate consistent growth underpinned by increasing automotive production globally, especially in emerging markets. Between 2026 and 2030, the market continues to advance from USD 7.2 billion to USD 8.7 billion. This phase benefits from technological advancements, including improved converter designs that reduce energy losses and optimize torque multiplication, aligning with stricter emission regulations and fuel economy standards. The growing popularity of hybrid electric vehicles also boosts demand as torque converters play a crucial role in these drivetrains. From 2031 to 2035, the market accelerates further from USD 9.2 billion to USD 11.1 billion, driven by integration with advanced transmission systems and increased adoption in commercial and off-highway vehicles. Manufacturers focusing on lightweight materials, enhanced thermal management, and compatibility with electrified powertrains are positioned to capture significant market share in this evolving segment.

| Metric | Value |

|---|---|

| Automotive Torque Converter Market Estimated Value in (2025 E) | USD 6.8 billion |

| Automotive Torque Converter Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The automotive torque converter market holds a significant role within multiple drivetrain and transmission system domains. Within the overall automatic transmission components market, torque converters account for approximately 12–14%, highlighting their indispensable function in power transfer and smooth acceleration. In the broader passenger and commercial vehicle powertrain systems category, their share stands at nearly 6–8%, supported by rising demand for fuel efficiency and comfort across automatic and semi-automatic transmission platforms. For the torque management and drivetrain efficiency solutions segment, torque converters contribute about 10–12%, given their ability to enhance vehicle responsiveness and reduce drivetrain shock. Within the hybrid vehicle transmission sub-segment, their share is close to 4–5%, as integrated torque converters optimize energy recuperation and electric-motor blending.

Growth in this segment is reinforced by the increasing penetration of automatic transmissions in emerging markets, coupled with continued consumer preference for smoother driving experiences in urban and highway conditions. The relevance of torque converters is also emphasized by their adaptability in heavy-duty and performance vehicles, where torque multiplication and load-handling efficiency are critical. Recent advancements, including lock-up clutch designs, multi-disc configurations, and improved fluid dynamics, are reducing energy losses while meeting stricter emission norms. These innovations ensure torque converters maintain their pivotal role in next-generation automatic and hybrid drivetrains, shaping future powertrain strategies for global automakers.

The market is experiencing significant growth, driven by increasing demand for smooth and fuel-efficient power transmission systems in modern vehicles. The market outlook remains strong as consumers and manufacturers alike prioritize enhanced driving comfort, improved fuel economy, and reduced emissions. With a growing focus on automatic and semi-automatic transmissions in both passenger and commercial vehicles, torque converters have become essential components in automotive drivetrain systems.

Technological advancements in hydraulic systems and integration with electronically controlled transmissions are supporting this evolution. Furthermore, rising vehicle production volumes in developing economies, along with regulatory pressures for improved performance standards, are accelerating adoption.

OEMs are increasingly integrating advanced torque converters into next-generation vehicle platforms, reinforcing long-term growth prospects. The shift toward electric and hybrid powertrains is also stimulating innovation within the torque converter space, ensuring continued relevance as part of evolving vehicle architectures..

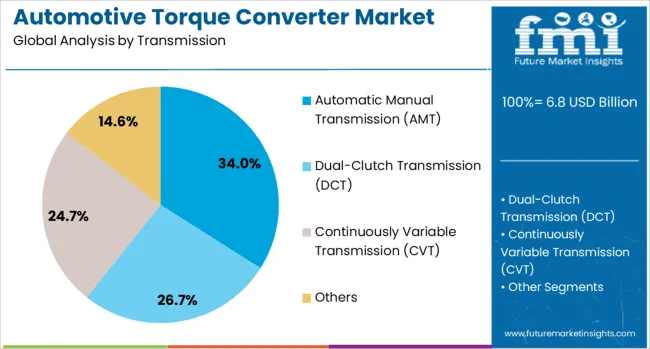

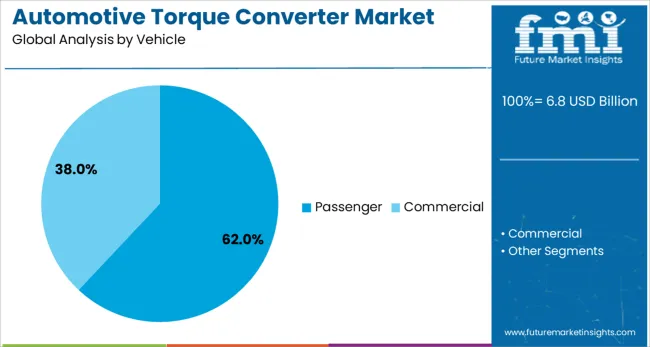

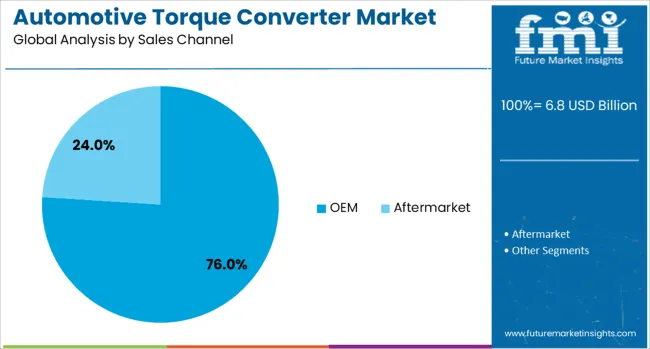

The automotive torque converter market is segmented by transmission, vehicle, sales channel, and geographic regions. The automotive torque converter market is divided into Automatic Manual Transmission (AMT), Dual-Clutch Transmission (DCT), Continuously Variable Transmission (CVT), and Others. In terms of vehicles, the automotive torque converter market is classified into Passenger and Commercial. The sales channel of the automotive torque converter market is segmented into OEM and Aftermarket. Regionally, the automotive torque converter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic manual transmission subsegment within the transmission segment is expected to account for 34% of the Automotive Torque Converter market revenue share in 2025, making it the leading transmission type. This position has been supported by its ability to combine the fuel efficiency of manual transmissions with the convenience of automatic shifting. Automatic manual transmission systems have been favored in both mid-range and premium vehicles due to their dual-clutch architecture, which enhances acceleration without compromising fuel economy.

Integration with torque converters has allowed smoother gear transitions and better performance under variable load conditions. Increased adoption in urban driving environments, where traffic congestion necessitates frequent gear changes, has also contributed to this segment's growth.

Manufacturers have aligned with this trend by offering AMT configurations in high-volume passenger models, further expanding market penetration. The balance between cost-efficiency and driving comfort has positioned automatic manual transmission as a preferred choice across diverse vehicle classes..

The passenger subsegment within the vehicle segment is projected to hold 62% of the Automotive Torque Converter market revenue share in 2025, making it the most dominant vehicle category. The strong position of passenger vehicles in this market has been attributed to rising global vehicle ownership, urbanization, and growing demand for comfortable and efficient driving experiences. Torque converters have become standard in automatic transmissions for passenger vehicles, improving drivability and reducing engine strain.

Increasing integration of electronic controls and compatibility with hybrid drivetrains has strengthened their role in enhancing vehicle performance. Consumers have shown preference for smoother gear transitions and minimal maintenance, leading to broader adoption of torque converter-based systems in sedans, SUVs, and compact cars.

Additionally, the availability of advanced transmission technologies in budget and mid-segment cars has fueled higher volume deployment. With passenger vehicle production expected to rise steadily in emerging economies, this segment remains critical to the long-term growth of the torque converter market..

The OEM subsegment within the sales channel segment is projected to capture 76% of the Automotive Torque Converter market revenue share in 2025, solidifying its leadership in distribution. This dominance has been driven by the widespread integration of torque converters into factory-assembled vehicles, allowing manufacturers to optimize design and performance from the outset. OEMs have prioritized torque converter adoption due to stringent emission standards and customer expectations for smoother driving dynamics.

As part of transmission systems, torque converters are being embedded into increasingly complex powertrain architectures, particularly in automatic and hybrid vehicles. Strategic alliances between transmission system suppliers and automotive manufacturers have enabled customized torque converter designs, improving compatibility and efficiency.

The preference for pre-installed, warranty-covered systems by consumers and fleet operators has further supported the OEM channel. With continued investment in new vehicle platforms and production expansion in emerging markets, OEMs are expected to maintain their commanding position in this segment..

The automotive torque converter market is driven by growing adoption of automatic transmissions and hybrid vehicles. Efficiency-focused innovations and strategic partnerships ensure torque converters remain central to advanced powertrain systems.

The surge in consumer preference for automatic transmission vehicles significantly boosts the automotive torque converter market. Automatic transmissions enhance driving comfort, especially in urban traffic, making them a standard in passenger cars and light commercial vehicles. Torque converters act as a key component, ensuring smooth power transfer from the engine to the transmission system. Their role in improving drivability and fuel efficiency underlines their growing importance. Market expansion is further supported by rising vehicle ownership in emerging economies, where automatic transmissions are becoming more accessible. This trend drives OEMs to integrate advanced torque converter designs into new vehicle models, sustaining steady market growth across various automotive segments.

The rising adoption of hybrid and plug-in hybrid electric vehicles has created new opportunities for torque converter integration. These vehicles require advanced transmission solutions that ensure seamless switching between internal combustion and electric power. Torque converters with lock-up clutch mechanisms optimize energy transfer while reducing losses during hybrid operations. Their integration helps achieve smooth torque management and improved acceleration, enhancing overall driving experience. The market outlook for torque converters in hybrid platforms is positive as global automakers scale production of electrified models. This transition positions torque converters as a critical enabler in hybrid powertrains, combining efficiency with performance consistency across vehicle categories.

Manufacturers are increasingly focusing on improving torque converter designs to enhance performance and efficiency. Features like multi-disc lock-up clutches and optimized turbine blades reduce slippage and improve torque multiplication under varying load conditions. These developments lower energy losses, ensuring compliance with fuel economy standards and emission regulations. Advanced fluid dynamics and friction materials are being utilized to extend durability and maintain operational consistency in demanding environments. With automakers emphasizing cost-effective solutions without compromising on performance, torque converters featuring adaptive control and refined hydraulic systems are gaining traction. These improvements solidify their role as a reliable and efficient component in modern transmissions.

Key players in the torque converter market are forming partnerships with transmission system manufacturers to co-develop integrated solutions. Such collaborations accelerate the introduction of converters compatible with new-generation automatic and hybrid gearboxes. Regional expansion strategies focus on Asia-Pacific, where strong demand for passenger vehicles drives large-scale production. North America and Europe continue to see investments in premium and performance vehicles that rely on high-precision torque converter technology. Aftermarket services, including remanufacturing and refurbishment, also present significant revenue opportunities. Together, these factors create a competitive environment where innovation, scalability, and cost optimization determine market.

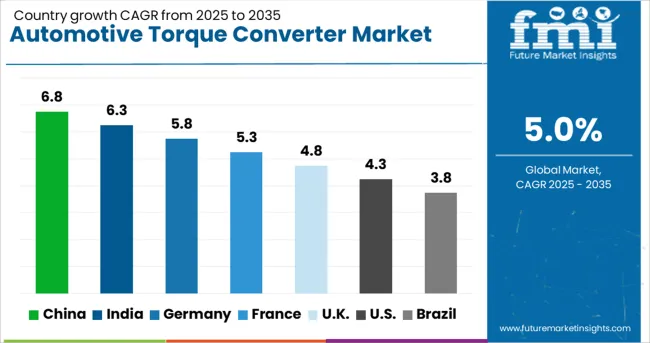

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The automotive torque converter market is projected to grow at a global CAGR of 5.0% from 2025 to 2035, supported by rising demand for automatic transmissions, increased hybrid vehicle production, and improved drivetrain efficiency. China leads with a CAGR of 6.8%, driven by rapid adoption of automatic gearboxes in passenger cars, expansion of premium vehicle segments, and government incentives for hybrid vehicles. India follows at 6.3%, fueled by the increasing popularity of automatic transmissions in urban mobility, rising disposable incomes, and ongoing upgrades in the commercial vehicle sector. France records a CAGR of 5.3%, benefiting from strong hybrid vehicle penetration and the preference for comfort-oriented driving systems. The United Kingdom grows at 4.8%, supported by steady adoption of advanced transmission technologies in passenger and light commercial vehicles. The United States posts a CAGR of 4.3%, reflecting a mature market where replacement demand, premium segment growth, and integration with fuel-efficient drivetrains sustain opportunities. This analysis includes over 40 countries, with these five serving as key benchmarks for strategic investment and growth in the global automotive torque converter market.

China demonstrated a CAGR of 4.7% during 2020–2024, which climbed to 6.8% for 2025–2035, highlighting a substantial growth acceleration. Early growth was supported by gradual adoption of automatic transmissions primarily in urban passenger vehicles, while manual gearboxes continued dominating rural markets. In the next decade, factors such as rising demand for premium vehicles, expansion of hybrid and plug-in hybrid segments, and government support for energy-efficient technologies fueled torque converter adoption. Increased integration of lock-up clutch systems in transmissions to enhance fuel economy further boosted market demand. Continuous growth in vehicle production and a strong aftermarket also supported the outlook.

India posted a CAGR of 4.3% between 2020–2024, which surged to 6.3% during 2025–2035, showing a marked rise driven by structural market changes. The earlier phase recorded modest progress as automatic transmissions were confined to premium and urban passenger cars due to price sensitivity. The next decade saw widespread consumer preference for two-pedal driving comfort and strong OEM investment in affordable automatic variants. Growth was reinforced by the introduction of hybrid technology and enhanced efficiency torque converters in compact cars. Additionally, increasing freight movement supported demand for automatic transmissions in light commercial vehicles, further expanding torque converter usage.

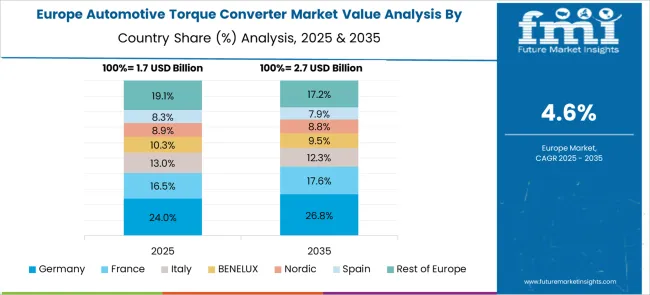

France achieved a CAGR of 3.8% in 2020–2024, which improved significantly to 5.3% during 2025–2035, reflecting a positive trajectory supported by drivetrain modernization. Initial growth lagged due to higher adoption of dual-clutch and manual gearboxes, limiting torque converter demand. However, the next phase saw substantial uptake in hybrids and premium vehicles prioritizing smooth power delivery. Regulatory pushes for fuel efficiency and lower CO₂ emissions drove OEMs to incorporate lock-up torque converters in automatic transmissions. Enhanced production of electrified vehicle platforms integrating advanced converters provided an additional boost, positioning France as an attractive market for transmission component manufacturers.

The CAGR for the UK automotive torque converter market was 3.5% between 2020–2024, increasing to 4.8% for 2025–2035, underlining a notable shift in growth drivers. Early adoption remained limited due to higher costs and preference for manual gearboxes in mainstream segments. In the next decade, zero-emission policies, combined with rising hybrid and automatic vehicle registrations, elevated torque converter demand. Growth was also reinforced by increasing penetration of premium SUVs and fleet modernization trends requiring advanced AT solutions. Supplier collaborations with OEMs and integration of high-efficiency lock-up systems played a key role in sustaining momentum across multiple vehicle categories.

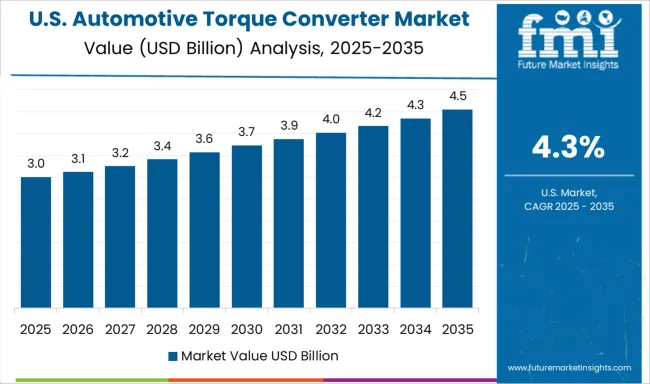

The United States recorded a CAGR of 3.2% during 2020–2024, rising to 4.3% between 2025–2035, indicating steady growth in a mature automotive ecosystem. Initial gains were supported by consistent demand in pickup trucks and SUVs, with torque converters remaining standard in torque-intensive transmissions. Subsequent growth was driven by integration with hybrid systems, compliance with stricter fuel efficiency standards, and modernization of commercial vehicle fleets. Aftermarket remanufacturing services provided incremental value as longer vehicle lifecycles sustained replacement needs. With OEM strategies favoring improved transmission efficiency, torque converters continue to play a crucial role in meeting dynamic powertrain requirements.

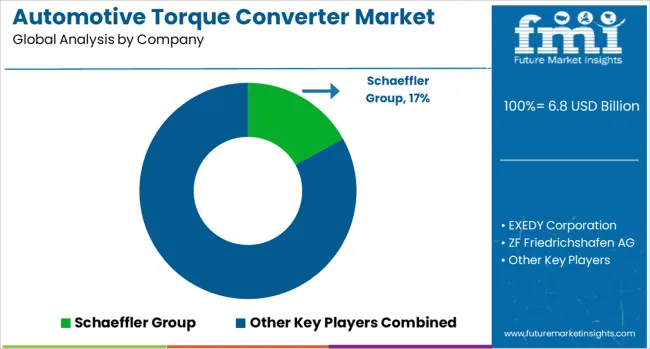

The automotive torque converter market is defined by intense competition among global leaders delivering advanced drivetrain and powertrain components. Schaeffler Group remains a key innovator with torque converter technologies optimized for hybrid and automatic transmissions, focusing on efficiency and durability. EXEDY Corporation specializes in high-performance torque converters for passenger and commercial vehicles, leveraging deep expertise in friction technologies. ZF Friedrichshafen AG dominates with integrated transmission solutions combining torque converters with advanced automatic gearboxes for premium and commercial vehicles. Valeo SA emphasizes lightweight torque converter designs and improved lock-up clutch systems for enhanced fuel economy, while Transtar Industries Inc., Sonnax Transmission Company, and Dynamic Manufacturing, Inc. cater strongly to the aftermarket segment, providing remanufactured and performance-focused torque converters for diverse vehicle applications.

In the hydrogen production and industrial gas domain, global giants such as Air Products and Chemicals, Inc., Linde Plc, and Air Liquide S.A. lead with cutting-edge hydrogen generation, storage, and distribution technologies for industrial and energy transition projects. Companies like General Electric Power, Iwatani Corporation, J‑Power, and Kawasaki Heavy Industries, Ltd. are investing in hydrogen-based power generation and large-scale liquefaction projects. Engineering leaders like KBR, Inc. support turnkey hydrogen production plants, while energy majors such as Shell Global and Sinopec are deploying hydrogen strategies integrated with renewable energy platforms. Regional utilities like Loy Yang Power and industrial gas innovators such as Messer further reinforce supply security.

In July 2024, Shell announced the Final Investment Decision for the REFHYNE II green hydrogen project (100 MW capacity) in Germany, with operations planned for 2027 and investment around USD 161 million.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 Billion |

| Transmission | Automatic Manual Transmission (AMT), Dual-Clutch Transmission (DCT), Continuously Variable Transmission (CVT), and Others |

| Vehicle | Passenger and Commercial |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schaeffler Group, EXEDY Corporation, ZF Friedrichshafen AG, Valeo SA, Transtar Industries Inc., Sonnax Transmission Company, and Dynamic Manufacturing, Inc. |

The global automotive torque converter market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the automotive torque converter market is projected to reach USD 11.1 billion by 2035.

The automotive torque converter market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in automotive torque converter market are automatic manual transmission (amt), dual-clutch transmission (dct), continuously variable transmission (cvt) and others.

In terms of vehicle, passenger segment to command 62.0% share in the automotive torque converter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA