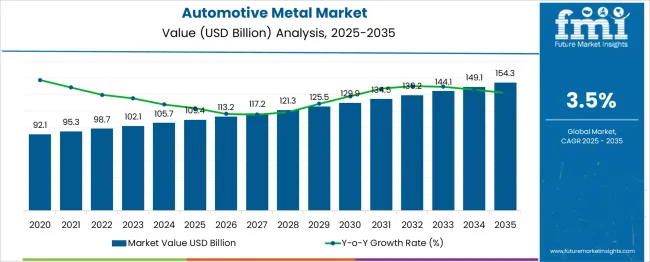

The Automotive Metal Market is estimated to be valued at USD 109.4 billion in 2025 and is projected to reach USD 154.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period. Analyzing contribution from volume versus price growth suggests that early-phase gains (2025–2030), where the market expands from USD 105.7 billion to 125.5 billion, are primarily volume-driven as global vehicle production stabilizes and electric vehicle platforms scale, accounting for roughly 44% of the total incremental value. Incremental annual additions average USD 3.98 billion in this stage, supported by structural demand for high-strength steels and lightweight aluminum in body and chassis applications. In contrast, the later phase (2030–2035) adds USD 28.8 billion, about 56% of the total uplift, increasingly influenced by pricing adjustments and premium material mix shifts such as advanced high-strength steels (AHSS), aluminum extrusions, and magnesium alloys. Annual increments during this period rise above USD 4.8 billion, driven by OEM adoption of performance-grade metals for energy efficiency and crashworthiness compliance rather than pure output growth. This trend underscores that while initial expansion is tied to higher unit volumes, long-term gains are reliant on value-added metallurgy, advanced forming technologies, and differentiated product pricing strategies.

| Metric | Value |

|---|---|

| Automotive Metal Market Estimated Value in (2025 E) | USD 109.4 billion |

| Automotive Metal Market Forecast Value in (2035 F) | USD 154.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The automotive metal market forms the backbone of vehicle fabrication and part manufacturing, commanding a dominant presence in several key sectors. Within the automotive components and parts market metal-based parts represent around 65–70% encompassing high-volume items such as engine and transmission casings, structural chassis, and various mechanical assemblies. When focusing on the body and structural systems market metal’s share escalates to roughly 85–90% as steel and aluminum remain the primary materials for frames, doors, panels, and crash management structures. In the broader materials and raw metals market automotive usage accounts for 10-12% of total demand reflecting its importance amid diversified industrial metal consumption.

In the rapidly evolving light weighting and alternative materials market metals especially high-strength aluminum and ultra-high-strength steel retain a 40-45% share despite growth in composites and polymers driven by performance and fuel efficiency goals. The aftermarket and spare parts market metal components make up 55–60% as replacement parts like body panels, brakes, engine components, and fasteners largely continue to be fabricated from metal. As global automotive production and electrification trends expand metal consumption remains integral prompting innovations around stronger alloys stamping and joining techniques that uphold structural safety while enabling weight reduction.

The automotive metal market is witnessing sustained demand growth, fueled by regulatory focus on vehicle safety, the rising adoption of hybrid and electric drivetrains, and advances in forming and joining technologies. Structural efficiency, crashworthiness, and weight optimization have continued to dictate material selection, with automakers pursuing a balance between performance and cost.

Global OEMs are aligning procurement strategies with modular production and regional supply resilience, supporting consistent demand for core metallic inputs. Lifecycle assessments and recyclability regulations are also accelerating innovation in high-strength and lightweight alloys.

With emerging markets displaying increased passenger vehicle production and developed economies focusing on sustainability-led retrofitting, the industry is poised for material innovation and value chain integration across platforms.

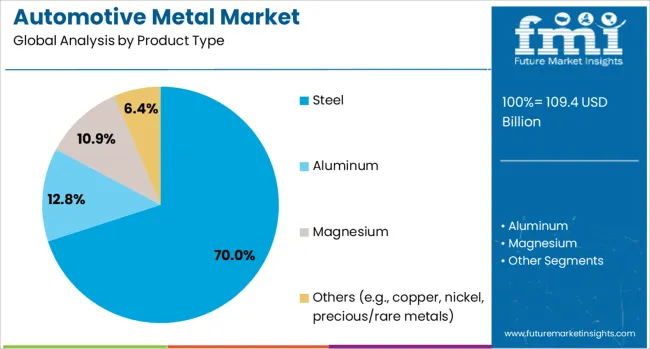

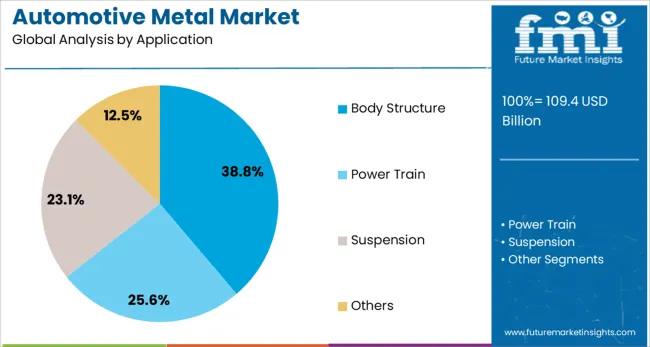

The automotive metal market is segmented by product type, application, end use (vehicle type), and geographic regions. The automotive metal market is divided by product type into Steel, Aluminum, Magnesium, and Others (e.g., copper, nickel, precious/rare metals). The automotive metal market is classified into Body Structure, Power Train, Suspension, and Others. The automotive metal market is segmented based on end use (vehicle type) into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. Regionally, the automotive metal industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Steel is expected to contribute 70% of total revenue in the automotive metal market by 2025, establishing itself as the dominant product type. This position is supported by its cost competitiveness, proven strength-to-weight performance, and extensive availability across global supply chains.

Advances in advanced high-strength steels (AHSS) have enhanced crash performance while enabling manufacturers to meet emission and light-weighting targets. The ability to be hot-formed, cold-stamped, and welded across multi-material structures has ensured the continued adoption of steel in both ICE and EV platforms.

Its recyclability and established processing infrastructure further solidify its lead over emerging alternatives.

The body structure segment is projected to account for 38.80% of the overall automotive metal market in 2025. Structural integrity, occupant safety, and rigidity requirements drive the concentration of metals in body components.

Automakers are investing in optimized load path designs and integrated modules that combine crash zones, pillars, and subframes into unified assemblies. Such applications require materials with predictable deformation behavior and high energy absorption factors, that have strengthened the preference for metallic solutions.

Consistent regulatory upgrades in crash safety norms globally have reinforced investment in metals for structural domains, with high-strength compositions being favored in vehicle architecture.

.webp)

Passenger cars are estimated to represent 70.00% of the automotive metal market revenue in 2025. Their volume dominance across both mature and developing automotive markets underpins this share.

Electrification and platform convergence strategies have prompted automakers to enhance material modularity across sedan, hatchback, and SUV models. The growing demand for lightweight structures to improve energy efficiency in electric passenger cars has also led to the selective use of aluminum blends alongside steel.

Further, consumer expectations around durability, refinement, and safety have continued to anchor the role of metals in both exterior and internal structural components of passenger vehicles.

Automotive metals such as steel, aluminum, and magnesium are essential for manufacturing body structures, chassis components, powertrain parts, and safety reinforcements in vehicles. These materials provide strength, durability, and crash resistance while supporting weight optimization goals. Growth has been influenced by rising vehicle production, demand for performance efficiency, and the shift toward lightweight materials for fuel economy compliance. Manufacturers are focusing on advanced alloys, high-strength steels, and corrosion-resistant coatings to improve structural integrity. Expanding applications in electric and hybrid vehicles have further reinforced demand for specialized automotive metal solutions.

Adoption of automotive metals has been driven by steady growth in global vehicle production and the requirement for materials that offer superior strength and safety performance. High-strength steels are widely used in body structures for enhanced crashworthiness, while aluminum alloys have gained popularity for reducing overall vehicle weight. Demand for metals with thermal conductivity properties in battery enclosures and electric drivetrains has increased with the expansion of EV manufacturing. Regulations promoting structural safety and durability standards have reinforced the use of tested and certified metal grades, ensuring compliance across both mass and premium vehicle categories.

Market growth has been constrained by frequent fluctuations in raw material prices for steel, aluminum, and specialty alloys, creating cost pressures for automakers and suppliers. Production of lightweight metal components often involves complex forming and joining processes, increasing operational expenses. Corrosion management remains critical in regions with high humidity and road salt exposure, adding to material treatment costs. Integration of mixed-metal structures for modern vehicle architectures presents compatibility issues, requiring advanced bonding technologies and design adjustments. Trade restrictions, tariffs, and supply chain disruptions have further impacted raw material availability, influencing lead times and production schedules.

Significant opportunities exist in the development of aluminum-magnesium alloys and ultra-high-strength steels for achieving weight reduction without compromising structural integrity. Expansion of electric and hybrid vehicle platforms creates additional demand for metals in battery housings, thermal management systems, and motor casings. Growth in modular vehicle architectures supports customized metal applications tailored to specific platforms. Adoption of additive manufacturing for lightweight metal components offers further potential in prototyping and small-batch production. Strategic collaborations between automotive OEMs and material technology firms are enabling co-development of innovative metal solutions optimized for performance, safety, and cost efficiency.

Recent trends highlight the use of hybrid material designs combining steel and aluminum to balance weight reduction with structural rigidity. Advanced coating technologies such as galvanization and nano-ceramic layers are being deployed for enhanced corrosion resistance and extended lifecycle. Hot stamping and hydroforming techniques are gaining popularity for shaping ultra-high-strength steels into complex geometries. Increased use of aluminum in body panels and closures, particularly in luxury and electric vehicles, reflects the industry’s preference for lightweight materials. Continuous investment in material simulation software for virtual testing and design optimization is shaping the evolution of automotive metal applications globally.

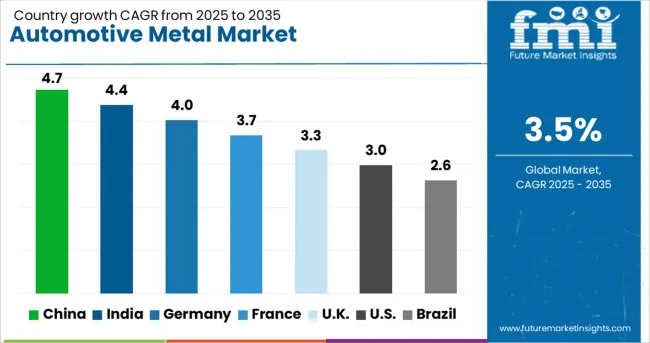

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

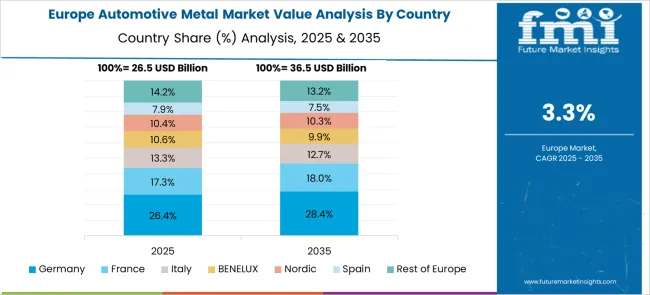

The automotive metal market is projected to grow at a CAGR of 3.5% from 2025 to 2035. Among the top five profiled markets, China leads at 4.7%, followed by India at 4.4%, while Germany posts 4.0%, the United Kingdom records 3.3%, and the United States stands at 3.0%. These growth rates indicate a premium of +34% for China and +26% for India compared to the global average, whereas Germany remains slightly ahead at +14%, while the UK and the US trail behind at –6% and –14%, respectively. Divergence reflects strong automotive manufacturing and EV adoption in BRICS markets, while OECD nations show steady growth driven by lightweighting initiatives, stringent safety standards, and rising demand for aluminum and high-strength steel. The analysis spans over 40 countries, with the leading markets detailed below.

China is projected to grow at a CAGR of 4.7% through 2035, driven by its dominance in automotive manufacturing and rapid transition toward electric vehicles. The market is seeing increasing demand for lightweight metals such as aluminum and magnesium alloys to improve fuel efficiency and meet emission standards. Domestic steelmakers and aluminum producers are ramping up output for high-strength automotive-grade materials, while global suppliers partner with Chinese OEMs to deliver advanced forming technologies. Expansion of EV battery housing production and structural components further boosts consumption of specialty metals. Integration of advanced coatings and corrosion-resistant alloys is gaining traction for durability enhancements in harsh operating environments.

India is forecasted to achieve a CAGR of 4.4% through 2035, supported by rising automotive production, infrastructure development, and strong government policies for clean mobility. Increased focus on reducing vehicle weight to enhance fuel economy is driving higher usage of aluminum sheets and high-strength steel across passenger and commercial vehicle segments. Domestic players are expanding capacity for rolled aluminum products and alloyed steel, while global companies introduce advanced forming technologies to cater to OEM demand for precision components. The growing EV ecosystem in India also reinforces demand for lightweight materials used in battery enclosures and structural frames.

Germany is expected to grow at a CAGR of 4.0% through 2035, driven by its strong position in premium vehicle manufacturing and technological innovation. Lightweighting remains a core strategy, with German automakers prioritizing advanced aluminum alloys, high-strength steel, and emerging magnesium applications. Local suppliers invest heavily in precision stamping, hot forming, and hybrid material technologies to meet stringent CO₂ reduction targets. Increased demand from EV and hybrid platforms is accelerating the use of aluminum in body structures and chassis components. Research into next-generation alloys that balance strength, weight, and recyclability is advancing rapidly, supported by collaborations between OEMs and metal producers.

The United Kingdom is projected to post a CAGR of 3.3% through 2035, with demand supported by luxury car manufacturing and the gradual shift to electric mobility. Aluminum sheet metal usage is increasing in body-in-white applications to reduce weight and enhance vehicle performance. British suppliers are adopting closed-loop recycling processes for aluminum scrap to improve material efficiency and cost competitiveness. EV battery housing and structural components represent new growth areas, supported by investments in gigafactories and related supply chains. Collaborative programs between OEMs and metal producers are focused on developing corrosion-resistant, formable alloys suitable for high-volume EV production.

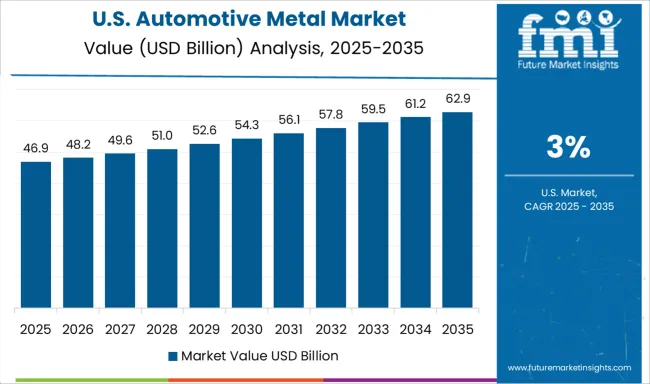

The United States is projected to grow at a CAGR of 3.0% through 2035, supported by steady demand for high-strength steel, aluminum, and emerging magnesium components in automotive manufacturing. Pickup trucks and SUVs continue to dominate production, spurring the adoption of lightweight materials to meet fuel economy standards. USA suppliers are focusing on advanced forming technologies, including hot stamping and tailored welded blanks, to optimize structural integrity and reduce weight simultaneously. The rapid development of EV production facilities and battery manufacturing plants further increases demand for specialized aluminum alloys and lightweight frames.

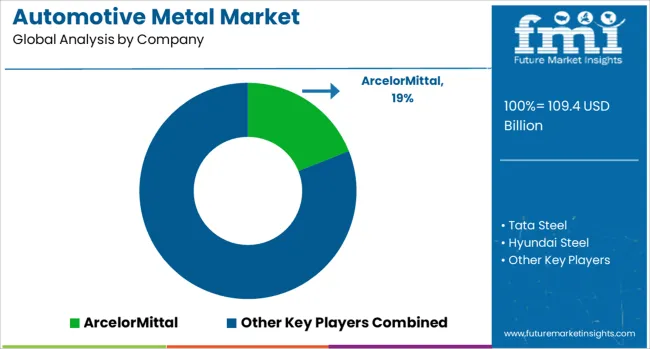

The automotive metal market is dominated by global steel and aluminum producers, supplying high-strength materials to meet the requirements of lightweighting, crash safety, and fuel efficiency. ArcelorMittal leads as the largest automotive steel supplier, offering advanced high-strength steels (AHSS) and press-hardened steel for structural components. Tata Steel and Hyundai Steel provide integrated steel solutions for body-in-white and chassis applications, emphasizing cost efficiency and localized supply networks. Thyssenkrupp AG and Voestalpine Group specialize in engineered automotive steel products, including hot-formed components for enhanced durability and weight reduction. Posco and Nippon Steel & Sumitomo Metal Corporation focus on ultra-high-strength steel grades and corrosion-resistant coatings, serving global OEMs with advanced material innovations.

Novelis, Constellium NV, and Norsk Hydro dominate the aluminum segment, delivering rolled and extruded products for body panels and electric vehicle battery enclosures to support lightweighting initiatives. Kobe Steel and UACJ Corporation strengthen their positions through premium aluminum sheet offerings and advanced forming technologies for electric mobility. AMG Advanced Metallurgical Group supports specialized alloys for high-performance powertrain applications, while Massey Ferguson Ltd. contributes to agricultural and commercial vehicle structures with durable metal solutions Competitive differentiation is driven by material strength-to-weight ratio, corrosion resistance, and forming capabilities for complex geometries. Barriers to entry include high capital costs, stringent automotive quality certifications, and close integration with OEM production systems. Strategic priorities involve expanding aluminum capacity for EV applications, investing in hot-stamping facilities, and developing hybrid material solutions combining steel and aluminum for next-generation vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 109.4 Billion |

| Product Type | Steel, Aluminum, Magnesium, and Others (e.g., copper, nickel, precious/rare metals) |

| Application | Body Structure, Power Train, Suspension, and Others |

| End Use (Vehicle Type) | Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ArcelorMittal, Tata Steel, Hyundai Steel, Essar Steel, Thyssenkrupp AG, Novelis, Posco, Voestalpine Group, Nippon Steel & Sumitomo Metal Corporation, United Steel Corporation, UACJ Corporation, Kobe Steel, AMG Advanced Metallurgical Group, Constellium NV, Massey Ferguson Ltd., and Norsk Hydro |

| Additional Attributes | Dollar sales by material type (steel, aluminum, magnesium alloys) and application (body-in-white, chassis, powertrain, closures). Demand dynamics are driven by rising EV production, lightweighting goals for fuel efficiency, and stricter emission norms globally. Regional trends show Asia-Pacific leading in volume production, while Europe and North America prioritize advanced material adoption for premium and electric vehicles. Innovation focuses on third-generation AHSS for improved crash resistance, aluminum-intensive architectures for EV platforms, and high-recyclability alloys to align with circular economy targets. |

The global automotive metal market is estimated to be valued at USD 109.4 billion in 2025.

The market size for the automotive metal market is projected to reach USD 154.3 billion by 2035.

The automotive metal market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in automotive metal market are steel, aluminum, magnesium and others (e.g., copper, nickel, precious/rare metals).

In terms of application, body structure segment to command 38.8% share in the automotive metal market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA