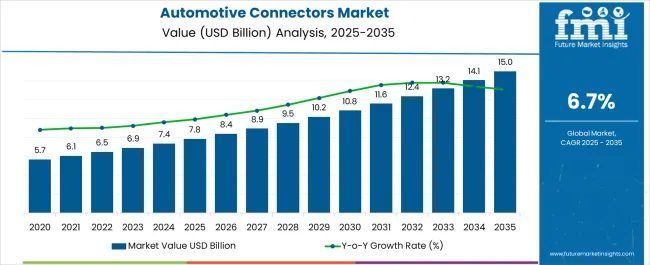

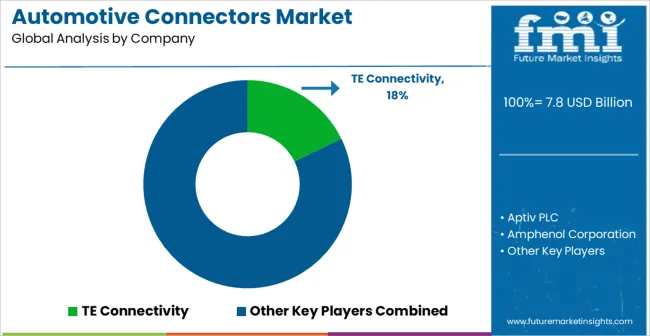

The Automotive Connectors Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 15.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Connectors Market Estimated Value in (2025 E) | USD 7.8 billion |

| Automotive Connectors Market Forecast Value in (2035 F) | USD 15.0 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Automotive Connectors market is experiencing robust growth, driven by the increasing demand for advanced electronic systems, vehicle electrification, and smart mobility solutions. Rising adoption of electric vehicles, hybrid powertrains, and advanced driver-assistance systems is fueling the need for reliable and high-performance connectors that ensure secure signal and power transmission. Technological advancements, including lightweight materials, high-temperature resistance, and corrosion protection, are enhancing the durability and efficiency of automotive connectors.

Integration of connectivity solutions with sensors, infotainment systems, and vehicle control units is further supporting market expansion. Manufacturers are focusing on modular and scalable designs that enable ease of assembly, maintenance, and future upgrades. Regulatory standards emphasizing safety, reliability, and performance in automotive components are reinforcing adoption.

As vehicles become increasingly connected and electronically complex, the demand for innovative connector solutions that can handle higher data rates and power requirements is rising Continuous investment in research, development, and manufacturing technologies positions the Automotive Connectors market for sustained growth across global automotive sectors over the coming decade.

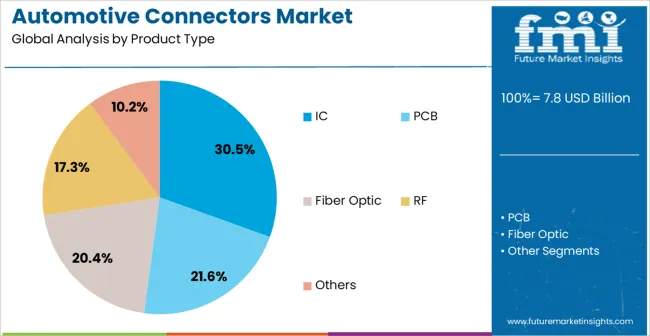

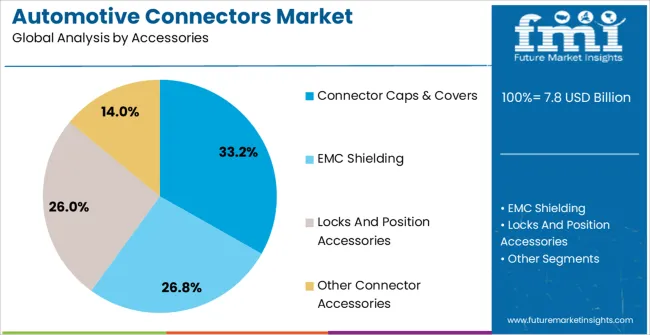

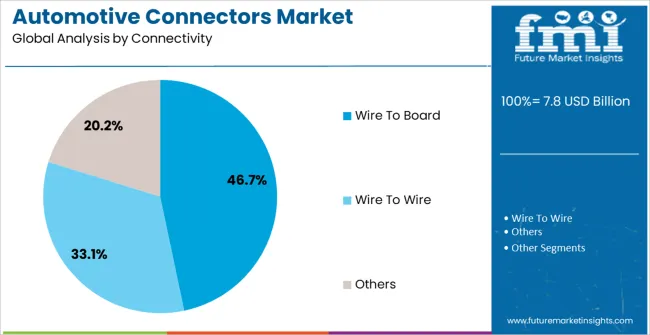

The automotive connectors market is segmented by product type, accessories, connectivity, application, and geographic regions. By product type, automotive connectors market is divided into IC, PCB, Fiber Optic, RF, and Others. In terms of accessories, automotive connectors market is classified into Connector Caps & Covers, EMC Shielding, Locks And Position Accessories, and Other Connector Accessories. Based on connectivity, automotive connectors market is segmented into Wire To Board, Wire To Wire, and Others. By application, automotive connectors market is segmented into Car, Truck, Bus, and Off-Road. Regionally, the automotive connectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The IC product type segment is projected to hold 30.5% of the Automotive Connectors market revenue in 2025, establishing it as a leading product category. Growth is being driven by the increasing use of integrated circuits for signal processing, power management, and communication functions in modern vehicles. IC connectors provide reliable electrical connections that are critical for advanced vehicle systems, including engine management, infotainment, and safety modules.

High precision manufacturing and enhanced material properties ensure performance consistency under challenging automotive conditions, such as high vibration, temperature fluctuations, and moisture exposure. Adoption is further supported by the increasing complexity of electronic systems in electric and hybrid vehicles, which require compact, high-density connectors.

The ability to integrate IC connectors with other components and systems reduces installation complexity while improving overall vehicle efficiency As automotive electronics continue to advance, the IC segment is expected to maintain its leadership, driven by innovation, performance reliability, and widespread deployment across multiple vehicle platforms.

The connector caps and covers accessories segment is anticipated to account for 33.2% of the market revenue in 2025, making it the leading accessories category. Growth is driven by the need for protective solutions that ensure durability, reliability, and safety of automotive connectors. These components prevent contamination from dust, moisture, and debris, which could otherwise impair electrical performance and vehicle safety.

Increasing use of advanced sealing materials, heat-resistant plastics, and modular designs has enhanced the operational lifespan of connectors. The segment benefits from the rising emphasis on regulatory compliance, quality assurance, and long-term performance in automotive electronics.

Integration with high-performance IC and wire-to-board connectors ensures complete system protection while facilitating maintenance and replacement procedures As the automotive industry continues to focus on connector reliability, particularly in electric, hybrid, and autonomous vehicles, connector caps and covers are expected to remain a critical segment, supporting market growth through enhanced safety, compliance, and durability solutions.

The wire-to-board connectivity segment is projected to hold 46.7% of the Automotive Connectors market revenue in 2025, making it the leading connectivity category. Growth is being driven by the increasing integration of vehicle electronic systems, where wire-to-board connectors enable secure and reliable connections between circuits and control modules. High current-carrying capacity, low resistance, and precise mating capabilities make these connectors essential for modern vehicles, including electric and hybrid platforms.

The ability to support high-speed data transmission, efficient power delivery, and modular system design enhances adoption across powertrains, infotainment systems, and safety modules. Advanced manufacturing techniques, corrosion-resistant materials, and improved design standards have strengthened performance reliability and long-term durability.

Increasing vehicle electrification and electronic complexity have further reinforced the importance of wire-to-board connectivity As manufacturers prioritize safety, efficiency, and high-performance system integration, the wire-to-board segment is expected to continue leading the market, driven by technological innovation and widespread application across automotive electronics.

Automotive connectors are of two types such as sealed and unsealed connectors. The sealed connectors are used in engine compartment and unsealed connectors are used under the vehicle body. Rising demand for automotive safety are driving needs for sophisticated automotive sensors during the forecast period.

The maximum electrical connections in a car are made of copper cables. Nowadays, major manufacturers are replacing copper cables with plastic optical fiber (POF) for increase data transmission, design flexibility and reduce vehicle weight. Plastic optical fiber needs sophisticated automotive connectors. Rising demand for plastic optical fiber in the automotive industry is driving the demand for automotive connectors.

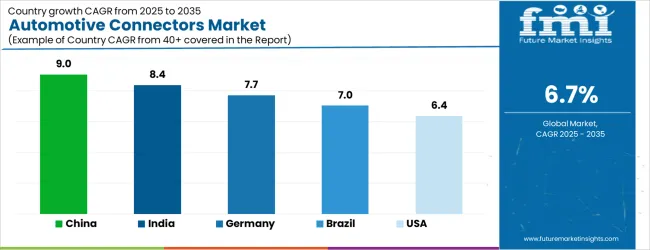

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.0% |

| USA | 6.4% |

| UK | 5.7% |

| Japan | 5.0% |

The Automotive Connectors Market is expected to register a CAGR of 6.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.0%, followed by India at 8.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Automotive Connectors Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.7%. The USA Automotive Connectors Market is estimated to be valued at USD 2.8 billion in 2025 and is anticipated to reach a valuation of USD 2.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 367.9 million and USD 252.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Product Type | IC, PCB, Fiber Optic, RF, and Others |

| Accessories | Connector Caps & Covers, EMC Shielding, Locks And Position Accessories, and Other Connector Accessories |

| Connectivity | Wire To Board, Wire To Wire, and Others |

| Application | Car, Truck, Bus, and Off-Road |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Aptiv PLC, Amphenol Corporation, Yazaki Corporation, Molex Incorporated, Sumitomo Electric Industries, Ltd., Hirose Electric Co., Ltd., JST Manufacturing Co., Ltd., Kyocera Corporation, and Rosenberger Group |

The global automotive connectors market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the automotive connectors market is projected to reach USD 15.0 billion by 2035.

The automotive connectors market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in automotive connectors market are ic, pcb, fiber optic, rf and others.

In terms of accessories, connector caps & covers segment to command 33.2% share in the automotive connectors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Connectors Global Market

Automotive Data Connectors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA