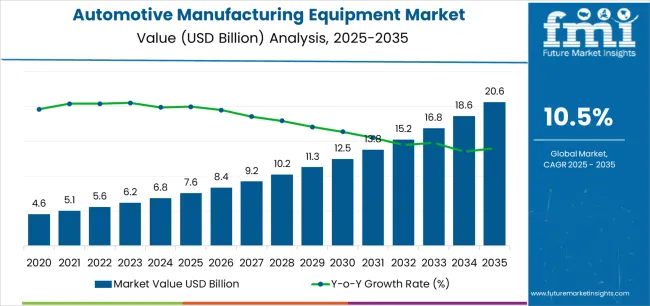

The Automotive Manufacturing Equipment Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 20.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period.

The automotive manufacturing equipment market is witnessing stable expansion, driven by automation trends, precision manufacturing requirements, and the transition toward advanced vehicle technologies. The integration of robotics, CNC systems, and digital production lines has significantly enhanced efficiency, consistency, and scalability across automotive plants.

The market’s current growth is supported by the rising demand for electric and hybrid vehicles, which necessitate new manufacturing layouts and specialized tooling solutions. Ongoing investments in smart factories and Industry 4.0 initiatives have accelerated the adoption of automated systems that improve productivity while reducing operational costs.

Additionally, global competition among automakers to achieve higher throughput and quality standards continues to propel equipment modernization. With sustained growth in vehicle production volumes and increased focus on lightweight materials and high-precision components, the market outlook remains optimistic for both OEMs and equipment suppliers.

| Metric | Value |

|---|---|

| Automotive Manufacturing Equipment Market Estimated Value in (2025 E) | USD 7.6 billion |

| Automotive Manufacturing Equipment Market Forecast Value in (2035 F) | USD 20.6 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

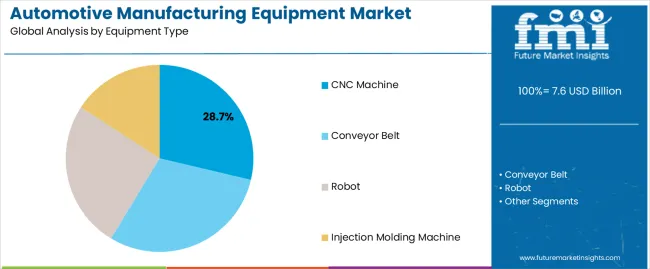

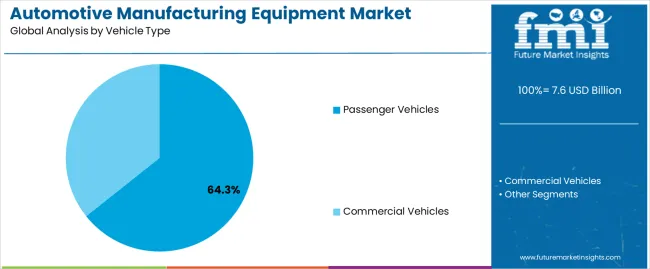

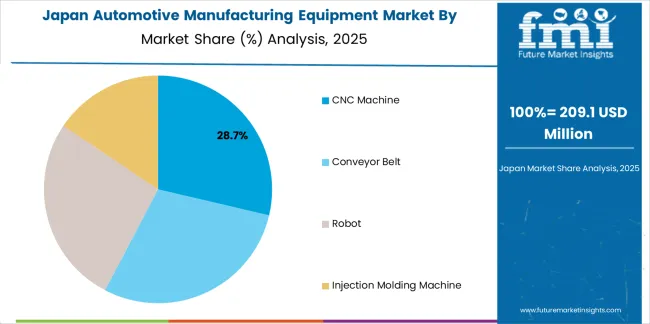

The market is segmented by Equipment Type and Vehicle Type and region. By Equipment Type, the market is divided into CNC Machine, Conveyor Belt, Robot, and Injection Molding Machine. In terms of Vehicle Type, the market is classified into Passenger Vehicles and Commercial Vehicles. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CNC machine segment dominates the equipment type category, accounting for approximately 28.7% share of the automotive manufacturing equipment market. This leadership is attributed to its essential role in machining precision components such as engine blocks, transmission parts, and structural assemblies.

CNC systems provide high accuracy, repeatability, and reduced cycle times, which are critical for automotive mass production. Automation compatibility and integration with computer-aided design and manufacturing systems further enhance productivity.

The segment benefits from continuous innovation in multi-axis machining and digital control technologies, enabling manufacturers to meet complex design tolerances. With increasing use of lightweight alloys and composite materials in modern vehicles, the demand for advanced CNC machining solutions is expected to remain strong, maintaining its central position in automotive production lines.

The passenger vehicles segment leads the vehicle type category, contributing approximately 64.3% share of the automotive manufacturing equipment market. This dominance is supported by the high global production volume of passenger cars and the ongoing introduction of new models across segments.

Equipment demand in this category is primarily driven by automation requirements for mass production, high-quality surface finishing, and component precision. Passenger vehicle manufacturers are investing in flexible manufacturing systems capable of accommodating both conventional and electric vehicle platforms.

Increased consumer preference for technologically advanced and fuel-efficient cars has intensified the need for precision assembly and testing equipment. With rising vehicle electrification and design diversification, the passenger vehicles segment is projected to maintain its leading position in driving equipment investments across global automotive plants.

Rapid Penetration of Automation is a Key Market-shaping Trend

Global sales of automotive manufacturing equipment grew at a CAGR of 13.8% from 2020 to 2025. Total market valuation at the end of 2025 reached about USD 6.0 billion. Over the forecast period, the global market for automotive manufacturing equipment is set to grow at 11.1% CAGR.

During the historical period, top automakers increasingly adopted automation due to the labor shortage caused by the COVID-19 pandemic. For instance, they employed automotive welding equipment, robotic manufacturing systems, and automotive painting equipment. As a result, the demand for automotive manufacturing equipment grew rapidly.

In the assessment period, factors like the growing adoption of smart manufacturing practices and rising demand for autonomous vehicles are expected to boost the automotive manufacturing equipment market growth. Similarly, advancements in CNC machines and robotic manufacturing systems will benefit the market.

Governments across the world are enforcing stringent regulations and emission standards to promote sustainable practices and address environmental issues. Compliance with these regulations often necessitates using novel manufacturing equipment in the automotive industry, fueling their demand.

| Particular | Value CAGR |

|---|---|

| H1 | 10.9% (2025 to 2035) |

| H2 | 10.7% (2025 to 2035) |

| H1 | 11.8% (2025 to 2035) |

| H2 | 10.8% (2025 to 2035) |

Growing Emphasis on Lightweight Materials

Rising demand for fuel-efficient vehicles and growing environmental concerns are prompting the automotive sector to utilize lightweight materials like carbon fiber, aluminum, and advanced composites. This is expected to boost the target market as the adoption of these materials requires specialized manufacturing equipment to handle their unique properties.

Transition toward Electric and Hybrid Vehicles

There is a gradual transition from traditional internal combustion engine vehicles towards electric and hybrid ones. This is anticipated to uplift demand for automotive manufacturing equipment as these vehicles require different assembly processes and equipment.

To capitalize on this trend and boost their sales, top companies are introducing advanced automotive production machinery and robots. For instance, in April 2024, YASKAWA launched a shelf-type robot called MOTOMAN-GP300R.

The new robot lineup will help companies shorten the line length to save space and construct high-value lines during the assembly process of lightweight vehicles or environmentally friendly vehicles.

The table below highlights the automotive manufacturing equipment market revenue in top nations. The United States, China, and Japan are expected to remain the top three consumers of automotive production machinery, with expected valuations of USD 20.6 billion, USD 3.2 billion, and USD 2.1 billion, respectively, in 2035.

| Countries | Estimated Automotive Manufacturing Equipment Market Value (2035) |

|---|---|

| United States | USD 20.6 billion |

| China | USD 3.2 billion |

| Japan | USD 2.1 billion |

| South Korea | USD 1.2 billion |

| United Kingdom | USD 795.1 million |

The below table shows the estimated growth rates of the top countries. South Korea, the United Kingdom, and China are set to record high CAGRs of 13.3%, 12.3%, and 12.1%, respectively, through 2035.

Robust growth of the automotive industry across these countries is a key factor boosting the automotive manufacturing equipment market. Similarly, these countries are witnessing rising adoption of automation and digital twin technology, creating growth opportunities for automotive manufacturing equipment manufacturers.

| Countries | Expected Automotive Manufacturing Equipment Market CAGR (2025 to 2035) |

|---|---|

| United States | 11.3% |

| China | 12.1% |

| Japan | 11.9% |

| South Korea | 13.3% |

| United Kingdom | 12.3% |

The United States automotive manufacturing equipment market size is projected to reach USD 20.6 billion in 2035. It will continue to dominate the global market, with overall demand for automotive manufacturing equipment rising at 11.3% CAGR throughout the forecast period. Some of the key drivers/trends include:

Advanced technologies like automation and robotics are gaining immense traction across industries like manufacturing and automotive in the United States. These technologies help industries increase productivity while reducing labor requirements. This is expected to drive demand for automotive manufacturing equipment in the nation.

Several automakers in the United States are employing robots for welding, painting, and assembly tasks. As per the International Federation of Robotics (IFR), around 30787 industrial robot units were installed in the United States during 2024. Thus, the growing adoption of robots will likely play a key role in fostering the growth of the automotive manufacturing market through 2035.

The strong presence of top automotive manufacturers and rising government support are expected to positively impact sales of automotive manufacturing equipment. Similarly, the growing popularity of electric and hybrid vehicles will likely improve the nation’s automotive manufacturing equipment market share through 2035.

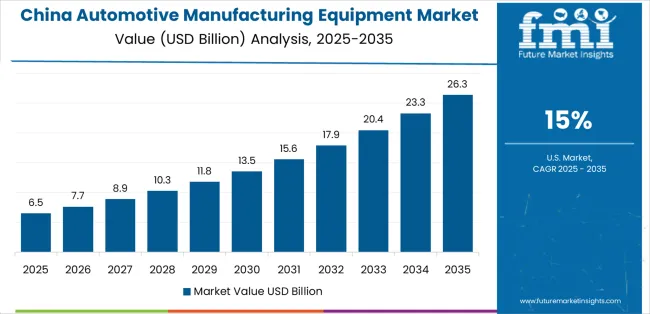

As per the latest analysis, sales of automotive manufacturing equipment in China are projected to soar at 12.1% CAGR during the forecast period. By 2035, China's automotive manufacturing equipment market value is set to total USD 3.2 billion, driven by factors like:

When it comes to automotive manufacturing, China leads from the forefront. It is the world’s leading automotive market and is set to witness robust growth owing to rising vehicle demand. This, in turn, is expected to fuel sales of sophisticated automotive manufacturing equipment.

An increasing push from the government for industrial automation is acting as a catalyst fueling the growth of China's automotive manufacturing equipment industry. Various initiatives and policies are being launched in China to promote the production and usage of robotics.

For instance, China introduced a five-year plan in 2024 to transform the country into a global robotics innovation hub by 2025. From the electronics to the automotive sector, manufacturers constantly embrace automation and robotics. This will likely foster market growth through 2035.

China is home to several leading robot manufacturing companies. As per the USA International Trade Commission, there are around 7,000 robotics companies in China. Easy accessibility and reduction in robot prices are expected to benefit China market during the forecast period.

Japan’s automotive manufacturing equipment market is poised to exhibit a CAGR of 11.9% during the forecast period. It will likely attain a valuation of USD 2.1 billion by 2035. This is attributable to factors like:

Amid rising environmental concerns and the implementation of stringent regulations, Japan’s automotive industry is embracing electrification. This is expected to drive demand for advanced automotive manufacturing technologies.

Electric and hybrid vehicles are gaining wider popularity in the country, which is expected to boost the growth of the automotive manufacturing equipment market. This is because these vehicles require different processes and equipment than traditional internal combustion engine vehicles.

The section below offers profound insights into top segments and their respective growth rates for the assessment period. Based on equipment type, the conveyor belt segment is set to grow at a robust CAGR of 11.0% through 20.634. By vehicle type, the passenger vehicles segment will likely exhibit a CAGR of 10.5% during the forecast period.

| Top Segment | Conveyor Belt (Equipment Type) |

|---|---|

| Estimated CAGR (20.624 to 20.634) | 11.0% |

As per the latest analysis, conveyor belts remain the most sought-after equipment type in the automotive industry. The target segment is projected to grow at a robust CAGR of 11.0% during the forecast period.

The rising usage of conveyor belts for moving materials and parts around automotive factories is a key factor driving the growth of the target segment. Conveyors automate the movement of parts and vehicles, thereby streamlining production flow and reducing labor costs. They operate continuously, maximizing throughput and minimizing downtime.

Demand for robots is also expected to increase significantly during the assessment period. This is attributable to the increasing installation of robots in the automotive sector to handle various tasks due to their efficiency and versatility.

Leading automotive giants are increasingly employing robots, including articulated robots, in their facilities to improve safety and productivity as well as reduce labor costs. Robots are expected to replace around 20.6 million jobs by 20.630, as per the Oxford Economics.

This will create lucrative growth opportunities for automotive manufacturing equipment companies.

As robotic technology continues to advance, the role of robots in automotive manufacturing is set to grow even further. Hence, the robot segment will likely record strong growth during the assessment period.

| Top Segment | Passenger Vehicles (Vehicle Type) |

|---|---|

| Estimated CAGR (20.624 to 20.634) | 10.5% |

Based on vehicle type, the passenger vehicles segment is expected to grow at a CAGR of 10.5% during the assessment period. As a result, it will generate lucrative growth opportunities for automotive manufacturing equipment companies.

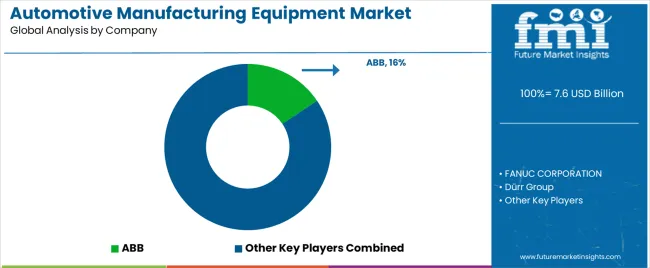

The automotive manufacturing equipment market is highly competitive due to the presence of several players. Top manufacturers of automotive equipment are constantly innovating to develop novel solutions integrated with advanced technologies. For instance, they are introducing advanced automotive robots and CNC machines.

Many automotive production machinery companies are also employing strategies like partnerships, facility expansions, acquisitions, mergers, and collaborations. These strategies will help them boost their revenue and gain a competitive edge in the market. Similarly, they are participating in exhibitions and other events to expand their customer reach.

Recent Developments in the Automotive Manufacturing Equipment Market

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 6.8 billion |

| Projected Market Value (2035) | USD 19.4 billion |

| Anticipated Growth Rate (2025 to 2035) | 11.1% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD billion), Volume (Units), and CAGR for 2025 to 2035 |

| Key Regions Covered | Latin America; North America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; and Middle East & Africa |

| Key Countries Covered | Canada, United States, Mexico, Brazil, Chile, Peru, Argentina, Germany, France, Italy, Spain, United Kingdom, Netherlands, Belgium, Nordic, Russia, Poland, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Central Africa, and others |

| Key Market Segments Covered | Equipment Type, Vehicle Type, and Region |

| Key Companies Profiled | ABB; FANUC CORPORATION; KUKA AG; Dürr Group; AMADA CO; Yaskawa Electric Corporation; Kawasaki Heavy Industries; Schuler Group |

The global automotive manufacturing equipment market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the automotive manufacturing equipment market is projected to reach USD 20.6 billion by 2035.

The automotive manufacturing equipment market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in automotive manufacturing equipment market are cnc machine, conveyor belt, robot and injection molding machine.

In terms of vehicle type, passenger vehicles segment to command 64.3% share in the automotive manufacturing equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA