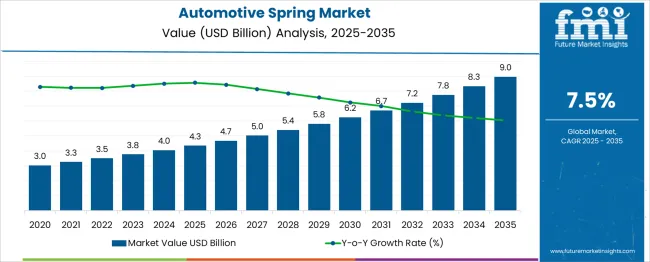

The Automotive Spring Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. Year-on-year (YoY) growth trends in the data point to a steady and reliable upward movement, making this a strong segment in the automotive components industry. Between 2025 and 2028, the market moves from USD 4.3 billion to USD 5.4 billion, with yearly growth staying close to 7.5% to 8.0%.

This early growth is supported by higher vehicle production, demand for stronger and lighter suspension parts, and regular replacement cycles in both passenger and commercial vehicles. From 2029 to 2032, the market reaches USD 7.2 billion, growing at around 7.2% to 7.6% each year. This stage benefits from the use of advanced spring materials such as high-strength alloys and composites, which improve performance, ride comfort, and fuel efficiency.

By 2033 to 2035, the market continues its stable climb, ending at USD 9.0 billion with YoY growth near 7.0% to 7.4%. This consistent momentum is driven by the shift toward electric vehicles, which require stronger suspension systems, and by steady demand from the aftermarket. The market’s YoY growth shows a balanced mix of rising volumes and higher-value products.

| Metric | Value |

|---|---|

| Automotive Spring Market Estimated Value in (2025 E) | USD 4.3 billion |

| Automotive Spring Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The automotive spring market is viewed as a specialized yet steadily expanding category within broader parent industries. It is estimated to represent about 2.5% of the global automotive components market indicating continued reliance on suspension and chassis systems. Within the aftermarket replacement parts sector a share of approximately 3.1% is assessed driven by demand for servicing and maintenance.

In the heavy vehicle suspension and commercial vehicle parts segment around 2.8% is calculated supported by transport and logistics growth. Within the industrial applications segment about 2.2% is evaluated as automotive spring producers diversify into architectural and machinery uses. In the motorsport and performance aftermarket industry a contribution of roughly 3.4% is observed supported by racing and high performance vehicle upgrades.

Trends in this market have been shaped by growing use of high performance materials such as chromium silicone and composite leaf springs to improve strength and reduce weight. Innovations have focused on variable rate coil springs and electronically adjustable suspension springs adapted for adaptive chassis systems.

Interest has increased in modular spring assemblies that can be tuned for ride comfort and load capacity across different vehicle models. The Asia Pacific region has been observed to show the fastest growth while North America has maintained significant demand for performance and OEM grade springs. Strategic initiatives have included collaborations between spring manufacturers and automotive OEMs to deliver validated spring systems featuring predictive stress testing, corrosion resistant coatings and integration into active suspension platforms.

The automotive spring market is advancing steadily, supported by evolving vehicle design standards, weight optimization demands, and increased production of passenger vehicles. A focus on ride quality, load-bearing efficiency, and durability has driven the integration of high-performance suspension components.

OEMs are under pressure to reduce emissions, and this has prompted the adoption of springs that can contribute to weight reduction without compromising safety. Moreover, the growth of electric and hybrid vehicles has necessitated spring systems tailored to accommodate heavier drivetrains and battery loads.

Advances in metallurgy, spring geometry, and corrosion resistance treatments are also enhancing product longevity, aligning with aftermarket and OEM demand trends. With regulatory focus on vehicle safety and handling performance, innovation in spring design and materials will remain central to the market's future expansion.

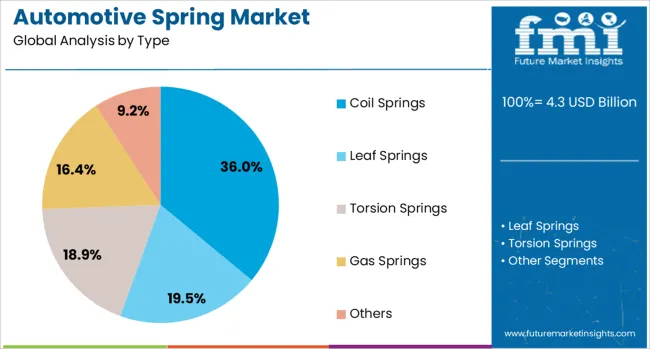

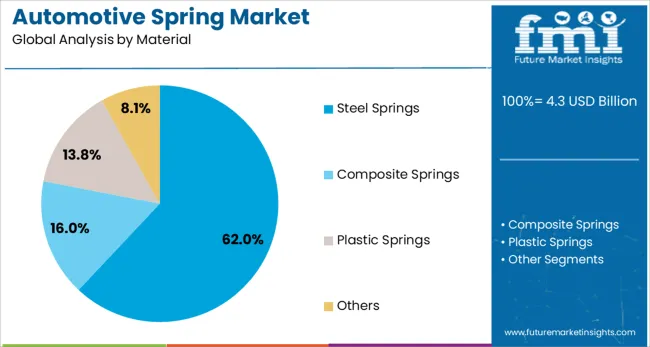

The automotive spring market is segmented by type, material, vehicle type, end-use, sales channel, and geographic regions. The automotive spring market is divided by type into Coil Springs, Leaf Springs, Torsion Springs, Gas Springs, and Others. The automotive spring market is classified into Steel Springs, Composite Springs, Plastic Springs, and Others.

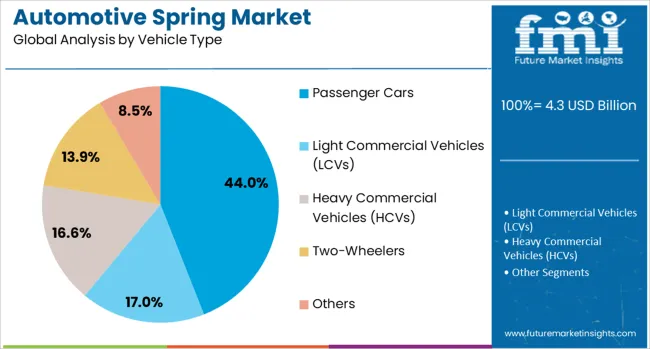

Based on vehicle type, the automotive spring market is segmented into Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-Wheelers, and Others. The automotive spring market is segmented by end-use into Suspension System, Engine Valves, Clutch Assemblies, Transmission System, and Others.

The automotive spring market is segmented by sales channel into Original Equipment Manufacturers (OEMs) and the Aftermarket. Regionally, the automotive spring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Coil springs are projected to hold a 36.00% revenue share in the automotive spring market in 2025, making them the leading spring type. Their dominance is attributed to their versatile load-handling capabilities, compact design, and adaptability across various suspension systems.

These springs are widely used in both front and rear suspensions of passenger vehicles, especially due to their ability to maintain consistent ground contact and absorb shocks efficiently. Coil springs are also cost-effective in mass production, which enhances their appeal for OEMs across both developed and emerging markets.

Their simple architecture allows easier customization for different weight classes and ride performance requirements, making them suitable for passenger cars, light trucks, and SUVs alike.

Steel springs are forecast to command 62.00% of the total market share by 2025, maintaining their lead in the material segment. The sustained use of steel is driven by its tensile strength, durability, and cost-efficiency.

In critical suspension and load-bearing applications, steel’s reliability under repeated stress cycles has proven indispensable. Additionally, advancements in tempering techniques and alloy compositions have extended the fatigue life of steel springs while maintaining lightweight properties.

While composite and hybrid materials are emerging, their high costs and limited field performance in extreme environments have preserved steel’s dominance in mass-market vehicle production. Continued demand from aftermarket segments for robust, affordable replacements also reinforces steel’s position in the automotive spring industry.

Passenger cars are estimated to account for 44.00% of the automotive spring market revenue in 2025, making them the largest consumer group. This is largely due to the volume of passenger vehicle production globally, especially in Asia-Pacific and Europe.

Increasing consumer expectations for driving comfort and noise reduction are prompting manufacturers to improve suspension systems with advanced spring assemblies. Additionally, the rapid penetration of EVs and hybrid passenger cars has necessitated custom spring configurations to manage unique weight distributions.

Regulatory mandates around fuel efficiency and ride stability have also contributed to the demand for precision-engineered springs in this vehicle category. As global urbanization and middle-class car ownership rise, the passenger car segment is expected to remain central to the growth of automotive spring demand.

Automotive springs have been integral components in vehicle suspension systems, providing load-bearing support, shock absorption, and ride stability. These springs have been widely used in passenger cars, commercial vehicles, and specialty vehicles across global markets. Coil springs, leaf springs, torsion bars, and air springs have been selected based on vehicle type and application requirements. Demand has been influenced by rising vehicle production, replacement needs in the aftermarket, and technological upgrades for improved durability. Manufacturers have focused on lightweight materials, corrosion resistance, and fatigue strength to enhance performance.

Automotive springs have experienced consistent demand due to the high volume of global vehicle production and the need for replacement parts in the aftermarket. Passenger vehicles have typically used coil springs for comfort and handling, while heavy-duty trucks and buses have relied on leaf springs for load-bearing capability. In emerging economies, increasing sales of commercial vehicles for goods transport have contributed to higher demand for heavy-duty spring assemblies. The aftermarket has played a significant role, with replacement cycles driven by wear, corrosion, and performance degradation. Vehicle owners and fleet operators have sought high-quality springs to maintain ride comfort, stability, and safety. The combination of OEM demand and a stable aftermarket segment has ensured sustained sales for manufacturers in both developed and developing regions.

Innovations in materials and manufacturing processes have improved the strength, flexibility, and lifespan of automotive springs. High-strength steel alloys, advanced heat treatment processes, and shot peening techniques have been applied to increase fatigue resistance. In premium and performance vehicles, air springs and composite leaf springs have been adopted to reduce weight and improve ride adaptability. Manufacturers in Germany, Japan, and the United States have focused on precision manufacturing for consistent quality and better dimensional tolerances. Corrosion-resistant coatings and surface treatments have extended service life, particularly in regions with harsh climates and road conditions. These technological improvements have positioned modern automotive springs as more durable and efficient, contributing to long-term vehicle performance and reduced maintenance costs.

Automakers have been exploring lighter materials for spring production to meet fuel efficiency and emission reduction targets. Composite materials, such as glass fiber-reinforced plastics, have been used in leaf spring designs to cut weight without compromising strength. In air suspension systems, lighter components have improved ride comfort and load handling. These material shifts have been particularly important in electric vehicles, where weight savings can enhance range and battery efficiency. Manufacturers in South Korea, Europe, and North America have introduced hybrid spring designs combining steel with composite elements. While lightweight materials have been costlier, their potential for improved performance and reduced vehicle weight has encouraged adoption in select vehicle segments.

The automotive spring market has faced challenges from fluctuating raw material prices, particularly for high-grade steel and composite fibers. Increased production costs have pressured profit margins for both OEM and aftermarket suppliers. Market fragmentation, with numerous regional and local manufacturers, has intensified price competition and limited scalability for some players. In cost-sensitive markets, low-priced alternatives with shorter lifespans have competed against premium-grade springs, slowing the shift toward advanced materials. Additionally, uneven adoption of lightweight technologies has created performance disparities across vehicle categories. Without cost optimization, broader standardization, and improved raw material supply stability, the market may continue to experience competitive pressures that hinder widespread adoption of advanced spring technologies.

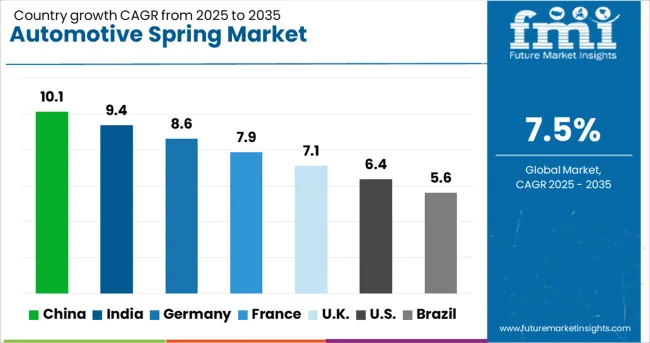

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The automotive spring market is expected to grow at a global CAGR of 7.5% between 2025 and 2035, driven by rising vehicle production, demand for lightweight suspension components, and advancements in spring materials. China leads with a 10.1% CAGR, supported by large-scale automotive manufacturing and expansion in electric vehicle production. India follows at 9.4%, fueled by growing passenger and commercial vehicle demand. Germany, at 8.6%, benefits from advanced engineering expertise and strong OEM collaborations. The UK, projected at 7.1%, sees growth from premium and performance vehicle manufacturing. The USA, at 6.4%, reflects steady demand from replacement markets and adoption in heavy-duty vehicles. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 10.1% from 2025 to 2035 in the automotive spring market, supported by its vast vehicle production base and strong aftermarket demand. Domestic manufacturers such as Zhengzhou Sanhe, Fawer Automotive Parts, and Chongqing Hongyu Spring are scaling production to cater to passenger cars, commercial vehicles, and electric vehicles. Lightweight composite springs are being increasingly adopted to enhance fuel efficiency and vehicle handling. Demand is also driven by suspension upgrades in premium cars and buses. Strategic collaborations between Chinese manufacturers and global tier-1 suppliers are improving access to advanced spring designs and testing capabilities.

India is forecasted to achieve a CAGR of 9.4% from 2025 to 2035, driven by growth in the two-wheeler, passenger car, and light commercial vehicle segments. Key players such as Jamna Auto Industries, NHK Springs India, and IFC Composite Springs are focusing on cost-effective production and localized supply chains. The rise in road freight activity is boosting demand for heavy-duty leaf springs, while the two-wheeler market is generating strong sales of coil and torsion springs. Increasing investment in electric three-wheelers and compact EVs is creating opportunities for lightweight suspension components.

Germany is projected to post a CAGR of 8.6% from 2025 to 2035, supported by its premium automotive manufacturing base. Companies such as Eibach, Thyssenkrupp Springs & Stabilizers, and Lesjöfors Springs are developing advanced materials and manufacturing processes for high-performance suspension springs. Carbon-fiber-reinforced polymer (CFRP) springs are gaining popularity for sports cars and performance SUVs, offering reduced weight and improved ride dynamics. Integration of advanced simulation software in design is enabling optimized stress distribution and extended spring life. OEM partnerships with brands like BMW, Audi, and Mercedes-Benz are shaping demand trends.

The United Kingdom is expected to record a CAGR of 7.1% from 2025 to 2035, driven by demand from luxury car manufacturing and a thriving motorsport industry. Key suppliers such as Owen Springs, Kilen Springs, and Duer Spring & Pressing are delivering custom-made solutions for niche vehicle segments, including classic car restorations. Air suspension-compatible coil springs are gaining attention for premium SUVs. Motorsport teams are increasingly sourcing precision-engineered springs designed for track performance. The aftermarket remains strong, supported by the UK’s large base of used vehicles requiring suspension replacements.

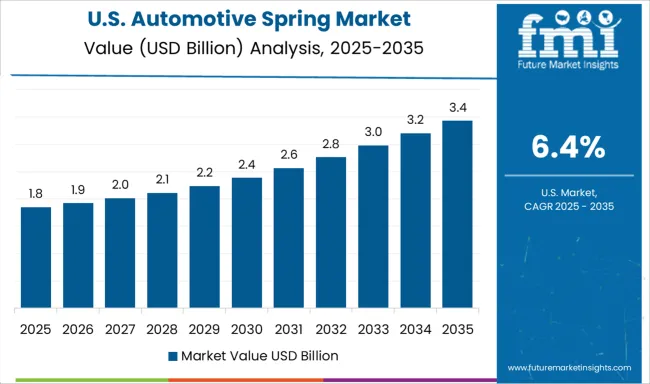

The United States is forecasted to grow at a CAGR of 6.4% from 2025 to 2035, supported by demand in pickup trucks, SUVs, and performance cars. Manufacturers such as Hendrickson, Hyperco, and Dura-Bond are developing heavy-duty leaf springs and performance coil springs tailored to domestic vehicle preferences. The aftermarket for lifted suspension kits is thriving, particularly in off-road and customization segments. OEM adoption of corrosion-resistant coatings and advanced alloy compositions is improving spring durability in diverse climates. Electric pickup truck development is also spurring new design opportunities for load-bearing springs.

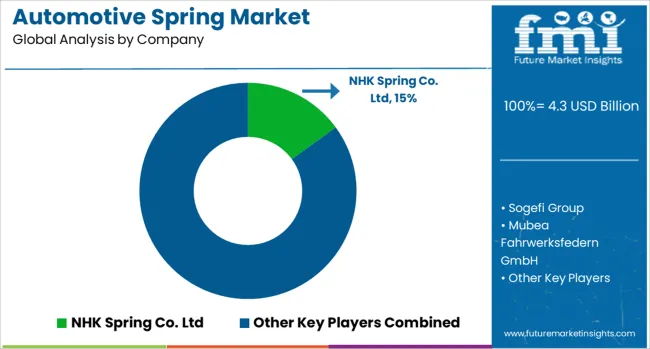

The automotive spring market is led by global suspension component manufacturers and specialized spring producers supplying OEMs, Tier 1 suppliers, and aftermarket distributors. NHK Spring Co. Ltd and Mubea Fahrwerksfedern GmbH dominate with advanced coil and leaf spring technologies designed to improve vehicle handling, load-bearing capacity, and ride comfort, supported by long-term partnerships with leading automakers.

Sogefi Group and Lesjöfors AB offer a wide range of suspension springs, torsion bars, and stabilizer solutions tailored for passenger cars, commercial vehicles, and specialty applications. Hendrickson USA L.L.C and Rassini S.A.B. de C.V. focus on heavy-duty suspension systems, producing multi-leaf and parabolic springs for trucks, trailers, and buses. Jamna Auto Industries Ltd., UNI AUTO-PARTS CO., LTD, and Tata AutoComp Systems Ltd. cater to both OEM and replacement markets in Asia with cost-competitive yet durable spring solutions.

Draco Spring Manufacturing Company, Betts Spring Manufacturing, Hyperco, M W Components, Stanley Spring & Stamping Corporation, and Mack Springs serve niche segments including motorsports, off-road, and custom vehicle applications, offering precision-engineered springs with specialized materials and coatings for enhanced performance.

Key strategies in this sector include expanding production capacity near major automotive hubs, developing lightweight high-strength alloys to improve fuel efficiency, and leveraging computer-aided design for optimized load distribution. Entry into the market is limited by stringent OEM quality standards, the need for advanced manufacturing equipment, and established supplier relationships in global automotive supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Type | Coil Springs, Leaf Springs, Torsion Springs, Gas Springs, and Others |

| Material | Steel Springs, Composite Springs, Plastic Springs, and Others |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-Wheelers, and Others |

| End-Use | Suspension System, Engine Valves, Clutch Assemblies, Transmission System, and Others |

| Sales Channel | Original Equipment Manufacturers (OEMs) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NHK Spring Co. Ltd, Sogefi Group, Mubea Fahrwerksfedern GmbH, Hendrickson USA L.L.C, Jamna Auto Industries Ltd., Rassini S.A.B. De C.V., Draco Spring Manufacturing Company, Betts Spring Manufacturing, Lesjöfors AB, Hyperco, M W Components, UNI AUTO-PARTS CO., LTD, Tata AutoComp Systems Ltd., Stanley Spring & Stamping Corporation, and Mack Springs |

| Additional Attributes | Dollar sales by spring type and vehicle application, demand dynamics across passenger cars, commercial vehicles, light-duty trucks, and EV platforms, regional trends in coil vs leaf vs torsion vs air spring adoption across Asia-Pacific, North America, and Europe, innovation in lightweight alloys, composite and sensor-integrated “smart” springs, environmental impact of raw-material volatility, energy-efficient production, and recyclability, and emerging use cases in adaptive suspension for EVs, aftermarket customization, and autonomous vehicle chassis systems. |

The global automotive spring market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the automotive spring market is projected to reach USD 9.0 billion by 2035.

The automotive spring market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in automotive spring market are coil springs, leaf springs, torsion springs, gas springs and others.

In terms of material, steel springs segment to command 62.0% share in the automotive spring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Coil Spring Market

Automotive Valve Spring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Composite Leaf Springs Market Growth - Trends & Forecast 2025 to 2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

China Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

India Automotive Composite Leaf Springs Market Trends – Size, Share & Growth 2025-2035

Japan Automotive Composite Leaf Springs Market Insights – Growth & Demand 2025-2035

Germany Automotive Composite Leaf Springs Market Report – Demand & Forecast 2025-2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA