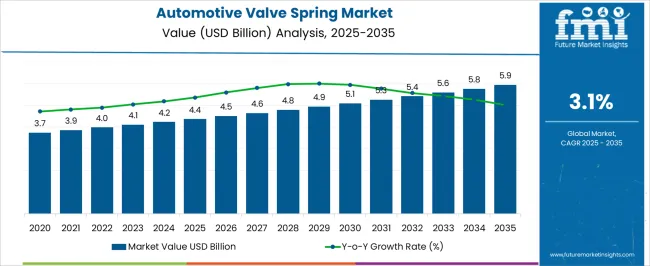

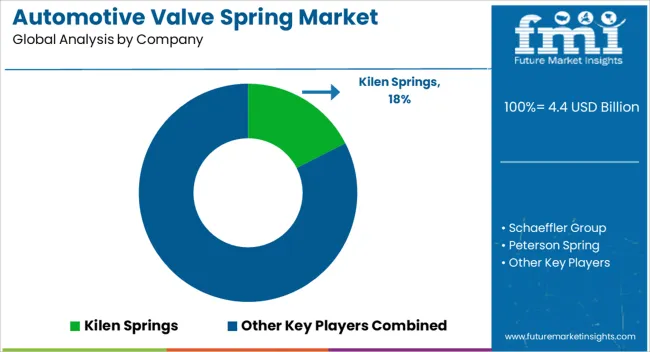

The Automotive Valve Spring Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.1% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Valve Spring Market Estimated Value in (2025 E) | USD 4.4 billion |

| Automotive Valve Spring Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The Automotive Valve Spring market is witnessing steady growth, driven by rising global automotive production and increasing demand for engine performance optimization. The growth is supported by advancements in engine technologies that require high-strength, durable, and lightweight valve springs to improve fuel efficiency and reduce emissions. Rising vehicle sales, particularly in emerging economies, have further contributed to demand across passenger and commercial segments.

Increasing adoption of performance-oriented engines and stricter regulatory requirements for emissions and fuel efficiency are prompting manufacturers to focus on high-quality valve spring materials and designs. Technological innovations in metallurgy and manufacturing processes are enhancing spring performance, reliability, and longevity.

Integration with advanced engine management systems and growing investments in electric and hybrid powertrain development are also influencing market dynamics As automakers prioritize durability, efficiency, and compliance with environmental standards, the Automotive Valve Spring market is expected to sustain long-term growth, with opportunities arising from ongoing innovation and increased replacement demand in existing vehicle fleets.

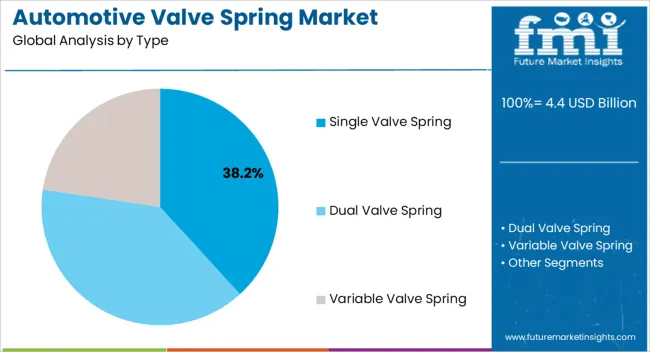

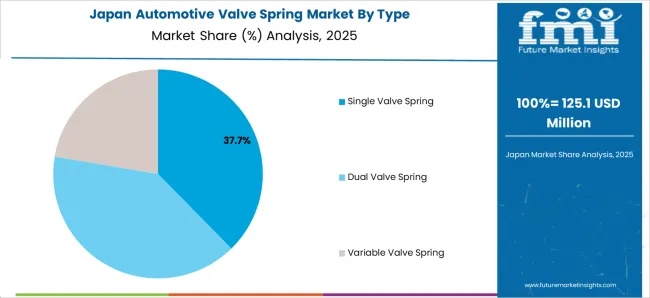

The single valve spring segment is projected to hold 38.2% of the market revenue in 2025, establishing it as the leading type. Growth in this segment is being driven by its simplicity, cost-effectiveness, and reliability in conventional and high-performance engines. Single valve springs provide efficient force control for opening and closing engine valves, ensuring optimal engine performance and reducing mechanical stress.

The manufacturing processes have been optimized for precision, strength, and consistency, further reinforcing preference among automotive OEMs and aftermarket suppliers. Increasing adoption of fuel-efficient and performance-focused engines has strengthened demand for single valve springs due to their ability to deliver reliable operation under varied load and speed conditions.

In addition, maintenance and replacement considerations favor single valve springs because of their ease of installation and long service life As automotive production and engine performance requirements continue to rise globally, the single valve spring segment is expected to maintain its leading market position.

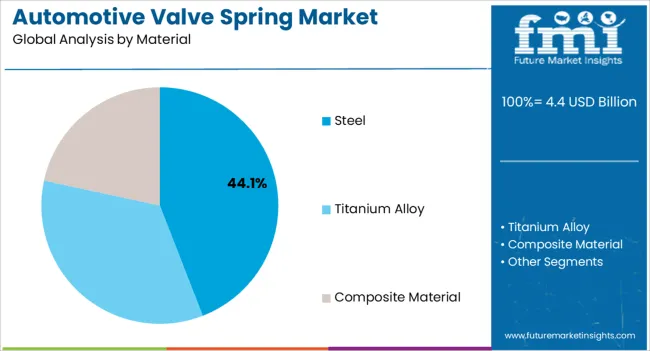

The steel material segment is expected to account for 44.1% of the market revenue in 2025, making it the dominant material category. Growth in this segment is being driven by steel’s inherent mechanical strength, durability, and cost efficiency, which are critical for valve springs subjected to high stress and fatigue during engine operation. Advanced alloying and heat treatment techniques are enhancing performance characteristics, including resistance to wear, fatigue, and deformation under high temperatures.

Steel valve springs enable consistent and reliable valve actuation, ensuring engine efficiency, longevity, and compliance with emission regulations. The widespread availability of high-quality steel and its adaptability for mass production further supports its adoption.

As automotive engines evolve to meet performance, fuel efficiency, and emission standards, steel continues to be the preferred material due to its balance of strength, resilience, and manufacturing feasibility The segment is expected to sustain leadership, supported by ongoing metallurgical innovations and growing demand from OEMs and aftermarket sectors.

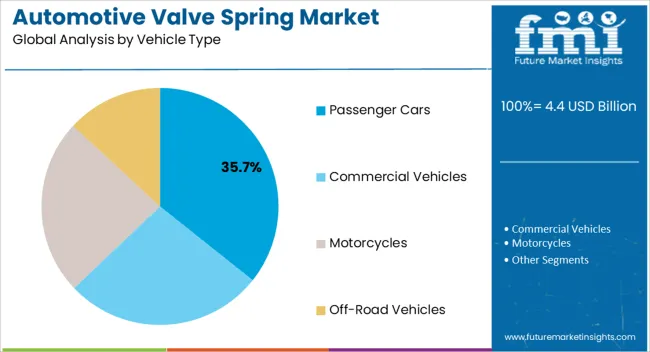

The passenger cars segment is projected to hold 35.7% of the market revenue in 2025, establishing it as the leading vehicle type. Growth in this segment is driven by the increasing global sales of passenger vehicles, including compact, mid-sized, and luxury models, which require high-quality valve springs to ensure engine performance, fuel efficiency, and emission compliance.

Single and multi-valve engine configurations in passenger cars benefit from durable and precisely engineered valve springs to manage valve actuation effectively under variable operating conditions. Rising consumer demand for performance, reliability, and long-term maintenance efficiency has further strengthened adoption.

In addition, replacement demand in the aftermarket, driven by routine maintenance schedules and engine upgrades, is contributing to segment growth As automakers focus on enhancing passenger car engine performance, meeting regulatory standards, and integrating advanced technologies, the passenger car segment is expected to remain the largest contributor to the Automotive Valve Spring market, supported by continued production growth and technological innovation.

From 2020 to 2025, the global automotive valve spring market experienced steady growth, with a CAGR of 1.60%. By 2025, the market reached a value of USD 3781.3 million.

From 2020 to 2025, the demand for automotive valve springs increased due to several factors. The expanding automotive industry, technological advancements in engine technologies and the need for improved performance and efficiency further boosted the demand for high-quality valve springs.

From 2025 to 2035, the forecast for the automotive valve spring market indicates a positive outlook. It is projected to witness a CAGR of 3.30 % during this period, surpassing USD 5.9 million by 2035.

The forecasted growth can be attributed to several factors. The continued expansion of the automotive industry, particularly in emerging economies, will drive the demand for vehicles and subsequently increase the need for automotive valve springs.

Moreover, the ongoing advancements in engine technologies and the increasing focus on environmental sustainability and regulatory compliance will necessitate the development and adoption of advanced valve spring solutions.

Overall, the automotive valve spring market is poised for significant growth in the forecast period, presenting opportunities for manufacturers, suppliers, and investors to capitalize on the expanding automotive industry and meet the evolving demands of the market.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 5.9 million |

| CAGR % 2025 to End of Forecast (2035) | 3.30% |

The automotive valve spring market in the United States is projected to reach a market size of USD 5.9 million by 2035, with a CAGR of 3.30%. The market is poised for significant growth driven by the increasing production of vehicles in the country. Several factors are expected to contribute to the demand for automotive valve springs in the United States:

| Country | The United Kingdom |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 556.4 million |

| CAGR % 2025 to End of Forecast (2035) | 2.20% |

The automotive valve spring market in the United Kingdom is expected to reach a market size of USD 556.4 billion, with a CAGR of 2.20 % during the forecast period. The market is poised for growth due to the increasing demand for automotive valve springs in the powertrain and construction sectors. The market growth is further driven by the rising awareness of the importance of reliable and durable valve springs in optimizing engine performance and fuel efficiency.

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 480.9 million |

| CAGR % 2025 to End of Forecast (2035) | 2.70% |

The automotive valve spring market in Japan is projected to achieve a market size of USD 480.9 million, with a CAGR of 2.70 % during the forecast period. The market is poised for significant growth fueled by the adoption of automotive valve springs across diverse industries, including power generation, automotive manufacturing, and chemical production.

The government's initiatives to enhance industrial efficiency and emission control, coupled with growing awareness about the crucial role of high-performance valve springs in engine optimization, are expected to drive market expansion in Japan.

The market is expected to witness notable growth fueled by the powertrain and manufacturing sectors in China. The powertrain sector demands high-quality valve springs for efficient engine performance and durability, while the expanding manufacturing industry relies on valve springs for various machinery and equipment applications. The market growth is further supported by the government's emphasis on reducing emissions and implementing stringent regulations to enhance air quality.

With its cost-effectiveness, high efficiency, and low maintenance requirements, the single valve spring segment is expected to capture a significant market share in 2025.

Single valve springs play a crucial role in ensuring optimal engine performance, offering precise control and reliable operation. Their excellent durability and stability make them an ideal choice for automotive engines across various vehicle types. Whether its compact cars, SUVs, or heavy-duty trucks, the demand for single valve springs remains steady.

This segment captures a significant market share in 2025 due to the increasing demand for fuel-efficient and high-performance vehicles.

Automotive valve springs are essential components in internal combustion engines, and they are responsible for controlling the opening and closing of the valves. The automotive industry is constantly evolving, and the demand for more fuel-efficient and high-performance vehicles is increasing. This is driving the demand for automotive valve springs that can withstand higher temperatures and pressures.

The automotive valve spring industry is highly competitive, with numerous players striving to maintain their market position. To stay competitive, key players employ various strategies and tactics.

Key Strategies Adopted by the Players

Product Innovation

Key players focus on continuous product innovation to develop advanced and high-performance automotive valve springs. They invest in research and development to enhance the durability, efficiency, and reliability of their products.

Quality Assurance

Maintaining high product quality is crucial for key players in the automotive valve spring industry. They implement stringent quality control measures at every stage of the manufacturing process to ensure that their valve springs meet or exceed industry standards.

Strong Supply Chain Management

Key players in the automotive valve spring industry focus on establishing robust supply chain networks. They collaborate closely with suppliers to ensure a steady and reliable supply of raw materials. Efficient supply chain management helps them maintain competitive pricing, timely delivery, and flexibility to meet customer demands.

Sustainability and Compliance

With increasing emphasis on sustainability and environmental regulations, key players in the automotive valve spring industry prioritize eco-friendly manufacturing processes and materials. They strive to minimize their environmental footprint and ensure compliance with relevant regulations.

Key Players in the Automotive Valve Spring Industry

Key Developments in the Automotive Valve Spring Market:

The global automotive valve spring market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the automotive valve spring market is projected to reach USD 5.9 billion by 2035.

The automotive valve spring market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in automotive valve spring market are single valve spring, dual valve spring and variable valve spring.

In terms of material, steel segment to command 44.1% share in the automotive valve spring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA