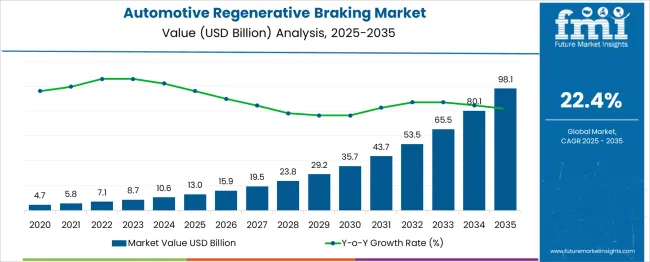

The Automotive Regenerative Braking Market is estimated to be valued at USD 13.0 billion in 2025 and is projected to reach USD 98.1 billion by 2035, registering a compound annual growth rate (CAGR) of 22.4% over the forecast period.

The automotive regenerative braking market is projected to expand from USD 13 billion in 2025 to USD 98.1 billion by 2035, registering a remarkable CAGR of 22.4% over the forecast period. Between 2025 and 2030, the market is expected to grow from USD 13 billion to USD 35.7 billion, reflecting rapid acceleration driven by the widespread adoption of electric and hybrid vehicles. Year-on-year analysis shows robust gains, with values reaching USD 15.9 billion in 2026 and USD 19.5 billion in 2027, fueled by growing regulatory emphasis on energy efficiency and rising consumer demand for low-emission vehicles.

By 2028, the market is anticipated to hit USD 23.8 billion, progressing to USD 29.2 billion in 2029 and USD 35.7 billion by 2030. This growth trajectory is reinforced by advancements in energy recovery systems, integration with advanced driver-assistance systems, and innovations in battery technology that maximize efficiency gains.

OEMs are likely to prioritize regenerative braking systems as a core component of electrification strategies, enhancing vehicle range and reducing operational costs. These trends position regenerative braking as a pivotal technology in the automotive sector’s transition toward sustainable mobility, making it a key enabler for next-generation electric and hybrid powertrains.

| Metric | Value |

|---|---|

| Automotive Regenerative Braking Market Estimated Value in (2025 E) | USD 13.0 billion |

| Automotive Regenerative Braking Market Forecast Value in (2035 F) | USD 98.1 billion |

| Forecast CAGR (2025 to 2035) | 22.4% |

The automotive regenerative braking market holds a crucial yet specialized role within multiple automotive sectors. In the automotive braking systems market, its share is approximately 10–12%, as conventional hydraulic and friction-based systems still dominate. Within the electric and hybrid vehicle components market, the share is significantly higher at 18–20%, since regenerative braking is a key energy recovery mechanism in electrified powertrains.

For the automotive powertrain systems market, it contributes around 6–8%, reflecting its integration with advanced drivetrain technologies. The energy recovery systems market sees a dominant share of nearly 40–45%, given regenerative braking’s primary role in kinetic energy capture for battery recharging. In the automotive electronics market, the share is modest at 3–4%, as the segment also includes infotainment, sensors, and ADAS systems.

The growing demand for fuel efficiency, extended electric vehicle range, and compliance with stringent emission norms is accelerating the adoption of regenerative braking technology across passenger and commercial vehicles. Advancements such as brake-by-wire systems, integration with predictive control algorithms, and compatibility with autonomous driving platforms enhance its value proposition. With global electrification trends and rising hybrid vehicle penetration, regenerative braking is set to increase its influence across these parent markets, making it a cornerstone technology for next-generation mobility solutions.

The automotive regenerative braking market is witnessing strong momentum as manufacturers and consumers increasingly prioritize energy efficiency, emissions reduction, and sustainable mobility solutions. Adoption is being propelled by advancements in electric drivetrains, stringent regulatory frameworks, and growing demand for vehicles with improved range and fuel economy.

Regenerative braking systems are being integrated as standard features in many electric and hybrid vehicles, enabling energy recovery during braking and reducing wear on mechanical braking components. Future growth is expected to be supported by continued investments in electrification, increasing battery capacities, and technological innovations in power electronics and control systems.

Rising urbanization and supportive government policies toward clean transportation are also paving the way for wider deployment across different vehicle classes and geographies.

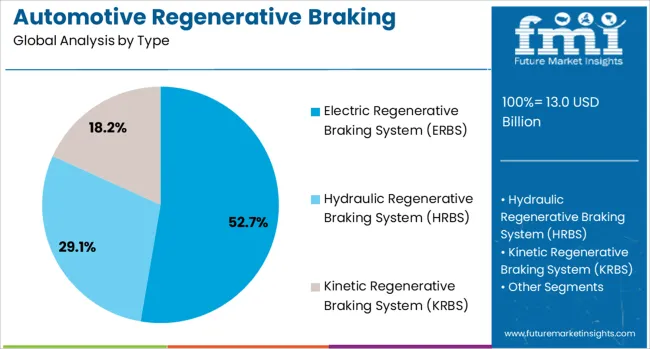

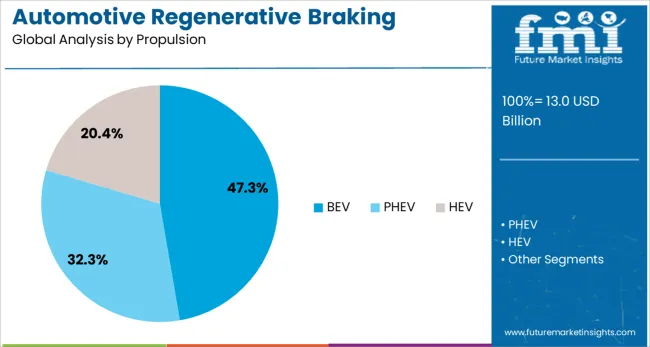

The automotive regenerative braking market is segmented by type, propulsion, and vehicle and geographic regions. By type of the automotive regenerative braking market is divided into Electric Regenerative Braking System (ERBS), Hydraulic Regenerative Braking System (HRBS), and Kinetic Regenerative Braking System (KRBS). In terms of propulsion of the automotive regenerative braking market is classified into BEV, PHEV, and HEV.

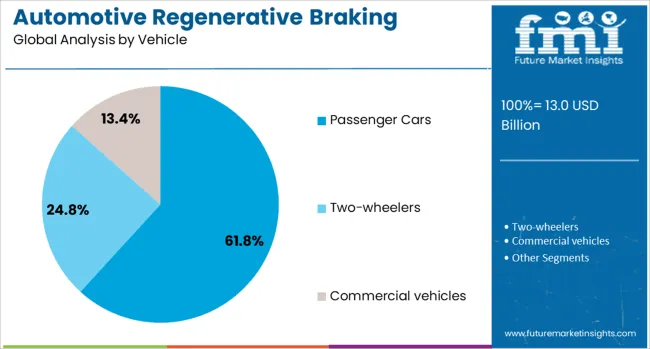

Based on vehicle of the automotive regenerative braking market is segmented into Passenger Cars, Two-wheelers, and Commercial vehicles. Regionally, the automotive regenerative braking industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, the electric regenerative braking system accounts for 52.7% of the total market revenue in 2025, establishing itself as the leading segment. Its dominance is being driven by widespread adoption in electric and hybrid vehicles, where electric systems efficiently convert kinetic energy into electrical energy stored in batteries.

The simplicity of integration with existing electric drivetrains, combined with lower maintenance and improved efficiency over hydraulic or mechanical alternatives, has solidified its preference among automakers. Enhanced control algorithms, compact motor generators, and reduced cost of components have further reinforced this segment’s leadership.

Additionally, the ability to deliver consistent performance across varying driving conditions and its compatibility with next-generation battery technologies have maintained its competitive advantage.

In terms of propulsion, battery electric vehicles hold a 47.3% share of the market revenue in 2025, making them the largest segment. This leadership has been underpinned by the global shift toward zero-emission vehicles and the accelerated rollout of fully electric models by leading automotive manufacturers.

The integration of regenerative braking in BEVs has been critical to extending driving range and improving energy efficiency, which are key purchase considerations for consumers. The absence of internal combustion engines in BEVs allows regenerative systems to operate at maximum potential, recovering substantial energy during deceleration.

Moreover, advancements in battery technology and the expansion of charging infrastructure have encouraged broader BEV adoption, which in turn has fueled the growth of this segment within the regenerative braking market.

Segmenting by vehicle type, passenger cars are forecast to account for 61.8% of the market revenue in 2025, maintaining their position as the dominant segment. This prominence is being reinforced by high production volumes, widespread consumer acceptance, and regulatory emphasis on improving fleet-level fuel efficiency.

Automakers have prioritized the inclusion of regenerative braking systems in passenger cars to comply with emission standards and to offer differentiated value in an increasingly competitive market. The growing popularity of electric and hybrid passenger vehicles has further amplified demand, as these cars benefit most from energy recovery systems in urban and stop-and-go traffic scenarios.

Enhanced affordability, improved performance, and consumer awareness regarding the environmental benefits of regenerative braking have collectively cemented the passenger car segment’s leadership in this market.

The automotive regenerative braking market is expanding rapidly due to rising adoption of electric and hybrid vehicles across regions. In 2024, energy-efficient braking systems became a standard in BEVs and PHEVs to reclaim kinetic energy and enhance driving range. By 2025, commercial fleets and fuel cell electric vehicles began integrating regenerative braking to improve efficiency and reduce wear on conventional braking systems. As demand for energy recapture and operational savings increases, companies supplying validated braking modules and system-level compatibility are poised to lead this high-growth, efficiency-driven sector.

The shift toward BEV and hybrid propulsion formats has been emphasized as the foremost influence expanding market uptake. During 2024, global automakers integrated regenerative braking into new models to boost energy recovery and enhance range in stop‑and‑go driving cycles. In 2025, adoption widened across commercial and light-duty vehicles as battery electric designs proliferated and energy regulations tightened.

This pattern indicates that propulsion geometry—rather than secondary system features—is dictating technology inclusion. Suppliers offering optimized braking units with proven recovery efficiency and integration-tested control modules are being favored in production platforms.

Emerging demand from commercial fleets represents a notable opportunity for system expansion. In 2024, logistics companies and public transit operators began trialing regenerative braking systems in electric buses and delivery vans to reduce operational costs. In 2025, fleets operating frequent stop-start routes scaled deployment to capture braking energy and extend battery life, especially in urban environments.

This evolution shows that fleet economics—not consumer preferences—is creating differentiated value. System providers offering durable, maintenance‑aware regenerative brakes optimized for heavy duty, high‑cycle operation are best positioned to secure contracts across logistics and municipal transportation networks.

In 2024 and 2025, the cost associated with integrating regenerative braking systems was observed as a critical barrier. Installation of advanced energy recovery units and compatibility with hybrid or electric platforms required specialized components and control systems, increasing the overall vehicle cost. Smaller automotive manufacturers and budget-focused segments faced difficulty justifying additional expenses compared to conventional braking systems.

Reports indicated that this pricing pressure limited adoption in entry-level models across Asia and Latin America. Without cost-effective engineering solutions, wider penetration of regenerative braking technology remains constrained, particularly in markets where affordability dominates purchase decisions.

The automotive sector in 2024 and 2025 showcased significant attention toward regenerative systems paired with high-performance energy storage units. Lithium-titanate and solid-state batteries were increasingly utilized to maximize energy capture during deceleration. Automakers in Europe and North America introduced models where enhanced battery chemistry supported rapid charging cycles, improving braking energy utilization.

These developments were positioned as a strategic approach to improve driving range and overall energy efficiency in hybrid and electric vehicles. This trend presents a substantial opportunity for manufacturers to align regenerative systems with next-generation storage solutions to elevate vehicle performance and consumer acceptance.

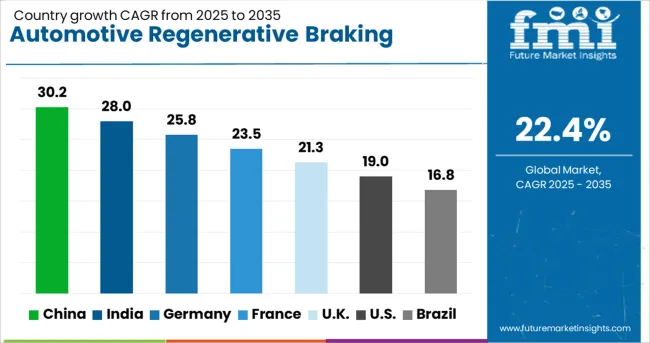

| Country | CAGR |

|---|---|

| China | 30.2% |

| India | 28.0% |

| Germany | 25.8% |

| France | 23.5% |

| UK | 21.3% |

| USA | 19.0% |

| Brazil | 16.8% |

The global automotive regenerative braking market is projected to grow at a CAGR of 22.4% from 2025 to 2035. China leads with 30.2%, followed by India at 28.0% and Germany at 25.8%. France records 23.5%, while the United Kingdom posts 21.3%. Growth is driven by rising EV adoption, stricter emission norms, and advancements in energy recovery systems. China and India dominate due to large-scale EV production and government subsidies, while Germany focuses on premium electric vehicles and hybrid models. France and the UK emphasize sustainable mobility, driving demand for efficient braking systems across passenger and commercial vehicles.

China is forecast to grow at 30.2%, driven by strong EV penetration and aggressive government-backed electrification policies. Advanced regenerative braking systems dominate high-performance electric vehicles. Manufacturers integrate AI-based energy optimization features for maximum recovery. Expansion of domestic EV brands accelerates adoption of regenerative braking in mass-market vehicles.

India is projected to grow at 28.0%, supported by government initiatives such as FAME II and rising demand for electric two-wheelers and cars. Cost-effective regenerative systems dominate small EV platforms to enhance battery efficiency. Domestic OEMs collaborate with global technology providers to develop advanced braking modules. Growing EV charging infrastructure accelerates adoption.

Germany is expected to grow at 25.8%, fueled by premium EV and hybrid vehicle adoption under stringent CO₂ regulations. High-efficiency regenerative systems dominate luxury brands, including performance EVs. Automakers invest in integrating advanced software for seamless braking transition. Focus on bidirectional energy recovery enhances compatibility with vehicle-to-grid (V2G) systems.

France is forecast to grow at 23.5%, driven by growing EV adoption supported by national energy transition goals. Compact regenerative systems dominate city cars and shared mobility fleets. Manufacturers develop integrated braking modules for better energy efficiency in urban driving conditions. Incentives for low-emission vehicles further boost market demand.

The UK is projected to grow at 21.3%, supported by increasing hybrid and EV registrations under Net Zero targets. Modular regenerative systems dominate mid-size passenger vehicles. Manufacturers leverage lightweight materials to reduce energy losses. Strategic alliances with battery suppliers improve regenerative system integration for extended vehicle range.

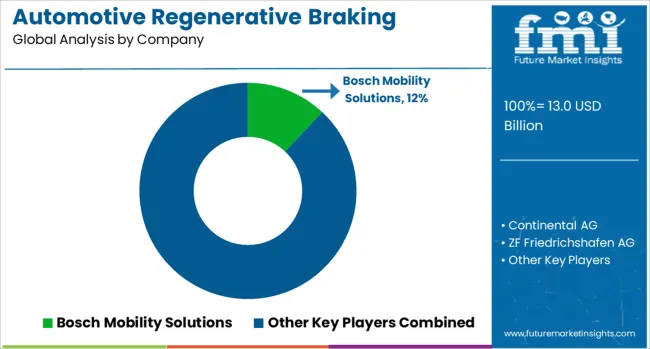

The automotive regenerative braking market is moderately consolidated, with Bosch Mobility Solutions identified as a leading player due to its advanced energy recovery systems integrated into electric and hybrid vehicles. The company’s technology enables efficient conversion of kinetic energy into electrical energy, supporting extended driving range and improved vehicle efficiency.

Key players include Continental AG, ZF Friedrichshafen AG, Punch Powertrain, Denso, Eaton Corporation plc, and Delphi Automotive. These companies deliver regenerative braking solutions tailored for hybrid and battery-electric vehicles, offering systems that combine braking force optimization, motor control, and energy storage integration. Their technologies are widely applied in passenger cars, commercial vehicles, and electric mobility platforms. Market growth is driven by accelerating adoption of EVs and HEVs, stringent emission norms, and the need for energy-efficient systems that enhance overall vehicle performance.

Leading suppliers are investing in innovations such as brake-by-wire systems, integration with advanced driver-assistance systems (ADAS), and lightweight components for better efficiency. Collaborations with automotive OEMs and the development of scalable, modular regenerative braking architectures are key strategies shaping competition in this space. Emerging trends include predictive braking powered by AI and enhanced thermal management for high-energy recovery scenarios, ensuring improved performance and safety standards globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.0 Billion |

| Type | Electric Regenerative Braking System (ERBS), Hydraulic Regenerative Braking System (HRBS), and Kinetic Regenerative Braking System (KRBS) |

| Propulsion | BEV, PHEV, and HEV |

| Vehicle | Passenger Cars, Two-wheelers, and Commercial vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Mobility Solutions, Continental AG, ZF Friedrichshafen AG, Punch Powertrain, Denso, Eaton Corporation plc, and Delphi Automotive |

| Additional Attributes | Dollar sales by system type (electric, hydraulic, pneumatic), regional demand trends, competitive landscape, consumer preferences for energy recovery, integration with EV/ADAS, innovations in brake-by-wire and AI-based regen control. |

The global automotive regenerative braking market is estimated to be valued at USD 13.0 billion in 2025.

The market size for the automotive regenerative braking market is projected to reach USD 98.1 billion by 2035.

The automotive regenerative braking market is expected to grow at a 22.4% CAGR between 2025 and 2035.

The key product types in automotive regenerative braking market are electric regenerative braking system (erbs), hydraulic regenerative braking system (hrbs) and kinetic regenerative braking system (krbs).

In terms of propulsion, bev segment to command 47.3% share in the automotive regenerative braking market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA