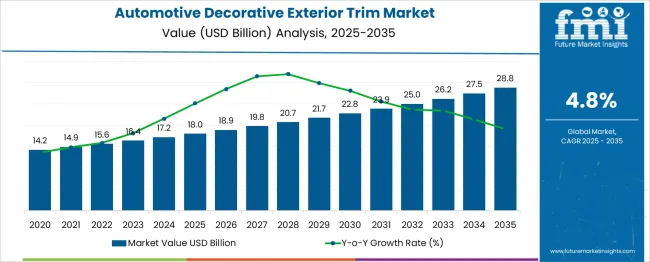

The Automotive Decorative Exterior Trim Market is estimated to be valued at USD 18.0 billion in 2025 and is projected to reach USD 28.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. A 5-year growth block analysis reveals that the first block (2025–2030) contributes a rise from USD 18.0 billion to USD 22.8 billion, adding USD 4.8 billion, or nearly 44% of total incremental growth, driven by growing adoption of chrome, stainless steel, and composite trims to enhance vehicle aesthetics, alongside increasing demand in SUVs and luxury segments. This phase also benefits from the introduction of lightweight polymer trims designed for improved fuel efficiency and aerodynamics. The second block (2030–2035) adds USD 6.0 billion, taking the market to USD 28.8 billion, which accounts for 56% of incremental growth, as OEMs emphasize personalization options, advanced surface finishing, and trims compatible with electric vehicle platforms.

Consumer preference for sleek designs and integrated lighting trims further accelerates demand. Suppliers focusing on cost-efficient manufacturing, recyclable material usage, and advanced coating technologies for durability and scratch resistance will dominate as the market transitions toward trims that combine functionality, aesthetics, and compatibility with evolving automotive design trends globally.

| Metric | Value |

|---|---|

| Automotive Decorative Exterior Trim Market Estimated Value in (2025 E) | USD 18.0 billion |

| Automotive Decorative Exterior Trim Market Forecast Value in (2035 F) | USD 28.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The automotive decorative exterior trim market secures a strategic niche across multiple automotive domains, with varying degrees of influence. It commands approximately 25–30% within the exterior trim and molding segment, driven by the high-value role of grilles, moldings, and body accents that enhance visual appeal and aerodynamics. In the broader automotive components and interiors category, its share is limited to 4–5%, reflecting its supplementary function compared to critical systems like powertrain and safety modules. Within OEM automotive parts, decorative trims account for around 15–18%, underscoring their integration during assembly in premium and passenger vehicles where brand differentiation and aesthetics influence buying decisions.

The aftermarket and replacement sector contributes 5–7%, propelled by rising consumer demand for customization and styling upgrades post-purchase. Commercial vehicle applications remain marginal, at 3–4%, due to limited emphasis on ornamental features in utility-focused designs. Growth momentum stems from design-driven vehicle differentiation, increasing adoption of chrome finishes, integrated lighting elements, and lightweight materials, particularly in SUVs and luxury cars. Regional dynamics favor Asia-Pacific and North America, where styling enhancements significantly impact market competitiveness, while electrification trends and advanced aerodynamics are expected to amplify decorative trim relevance in next-generation vehicle platforms.

The automotive decorative exterior trim market is gaining significant momentum as automakers seek to balance aesthetic differentiation, lightweighting strategies, and material durability. The use of trims for brand identity, functional airflow optimization, and consumer personalization is driving demand across both mass-market and premium vehicle segments.

With regulatory pressures promoting fuel efficiency and reduced emissions, materials and components contributing to weight reduction—while enhancing visual appeal—have come into sharper focus. As automotive OEMs invest in modular platform strategies and design-led differentiation, trims are evolving from cosmetic accessories to functional, lightweight enhancements.

Future growth is expected to stem from innovations in recyclable materials, integrated lighting trims, and trims designed for electric vehicle platforms.

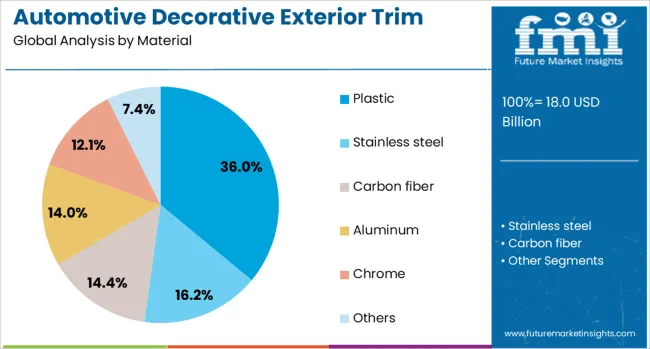

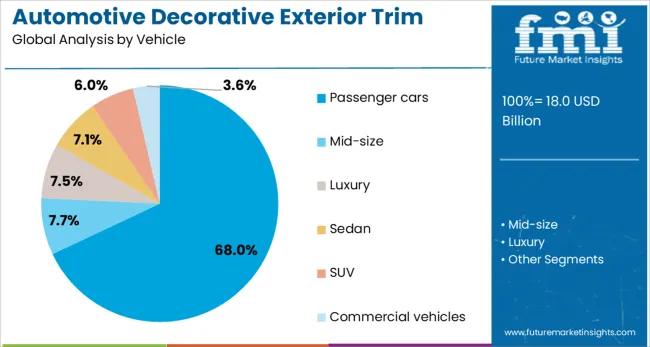

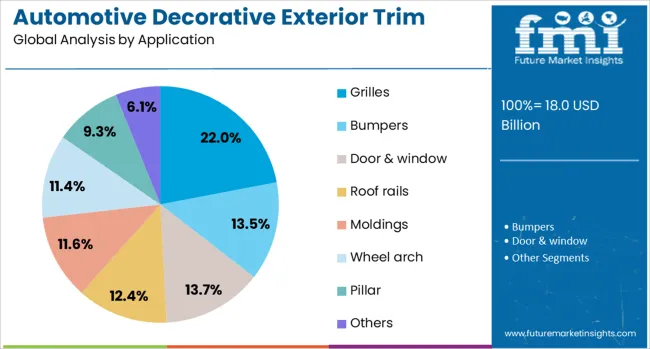

The automotive decorative exterior trim market is segmented by material, vehicle, application, sales channel, and geographic regions. The automotive decorative exterior trim market is divided by material into Plastic, Stainless steel, Carbon fiber, Aluminum, Chrome, and Others. In terms of vehicles, the automotive decorative exterior trim market is classified into Passenger cars, Mid-size, Luxury, Sedan, SUV, and Commercial vehicles. The automotive decorative exterior trim market is segmented into Grilles, Bumpers, Door & window, Roof rails, Moldings, Wheel arch, Pillar, and Others. The automotive decorative exterior trim market is segmented by sales channel into OEM and Aftermarket. Regionally, the automotive decorative exterior trim industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic is projected to hold 36.00% of the revenue share in 2025, making it the leading material in the decorative trim market. The growth of this segment has been fueled by rising demand for lightweight materials that offer design flexibility, weather resistance, and lower production costs.

Plastic’s adaptability in molding complex shapes has enabled automakers to explore bold exterior styling without compromising aerodynamics. Its compatibility with chrome-plating, painting, and texturing technologies has also improved its aesthetic appeal.

The move toward sustainable polymers and recycled plastics in trims has further reinforced the relevance of this material class in next-gen vehicle design.

Passenger cars are anticipated to contribute 68.00% of the total market revenue in 2025, emerging as the dominant vehicle type. This leadership is a result of high vehicle production volumes, especially in Asia and Europe, combined with the rising trend of visual personalization.

Automakers are increasingly differentiating trims across variants to target diverse consumer segments and regional preferences. The higher frequency of model refresh cycles in passenger vehicles compared to commercial counterparts also drives continuous demand for updated trim designs.

Furthermore, the premiumization trend in mid-range vehicles has led to greater exterior trim adoption for visual enhancement and aerodynamic function.

Grilles are expected to account for 22.00% of the total market revenue in 2025, securing their position as the leading application segment. This dominance is supported by their dual role in both engine cooling and brand identity expression.

As EV platforms eliminate traditional engine needs, grilles are being redesigned as signature styling elements that retain brand language while housing sensors and lighting. Automakers have also leveraged grille design to align with evolving pedestrian safety standards.

High customization opportunities and enhanced surface treatments have allowed grilles to become a central focus in trim upgrades across both mass and luxury segments.

Automotive decorative exterior trims include moldings, claddings, badges, chrome accents, and other design elements that enhance the appearance and functional integrity of vehicles. These trims not only provide an aesthetic upgrade but also protect body panels from scratches, corrosion, and external impacts. Growth has been influenced by consumer preference for premium finishes, rising production of SUVs and luxury vehicles, and continuous innovation in lightweight materials. Manufacturers are prioritizing advanced surface finishes, eco-friendly coatings, and integrated styling solutions to cater to both OEM and aftermarket demand globally.

The adoption of decorative exterior trims has been driven by a strong emphasis on vehicle aesthetics and personalization. Consumers are increasingly valuing premium visual elements, which has accelerated demand for chrome-plated, painted, and textured trims. Rising vehicle production, especially in the SUV and crossover categories, has fueled consumption of wheel arch moldings and body side trims. Automakers are utilizing trims to strengthen brand differentiation while meeting safety and protection requirements. Integration of decorative trims into aerodynamic designs enhances both styling and functional performance, making them a preferred choice in modern vehicle architecture.

Expansion in this segment has been restricted by fluctuating raw material prices, especially for plastics, aluminum, and coating chemicals. Compliance with environmental regulations governing plating and solvent-based coatings has increased production costs. Lightweighting targets in automotive design have created challenges in balancing aesthetics with structural efficiency. Integration of trims into electric vehicles, where aerodynamics is a priority, adds engineering complexity. In addition, consumer demand for premium finishes at competitive prices forces OEMs and suppliers to innovate without significantly increasing costs. These challenges have intensified competition among suppliers for delivering cost-effective, high-performance solutions.

Significant opportunities exist in developing trims from advanced polymers and composite materials that reduce weight while maintaining visual appeal. Growth in electric vehicles offers potential for trims optimized for aerodynamic efficiency and energy savings. Integration of smart technologies such as LED lighting within trims for enhanced visibility and branding presents added value for OEMs. Customization trends in both OEM and aftermarket channels are expanding, driving demand for unique designs and finishes. Eco-friendly coatings and recyclable materials are being explored to align with regulatory standards and consumer expectations. Collaborations between material innovators and automotive manufacturers are accelerating product diversification.

Recent trends highlight the increasing adoption of PVD coatings, hydrographic printing, and soft-touch finishes to enhance aesthetics and durability. LED-illuminated trims have gained popularity, particularly in premium and luxury segments. Automakers are incorporating flush-mounted trims to achieve sleek, aerodynamic exteriors for EV platforms. Digital printing technologies are enabling custom graphics and branding on decorative elements, meeting the demand for personalization. The aftermarket segment is witnessing growth in modular trim kits, allowing consumers to easily upgrade vehicle styling. Sustainability considerations have encouraged the use of low-VOC coatings and recyclable substrates, signaling a shift toward environmentally conscious manufacturing practices.

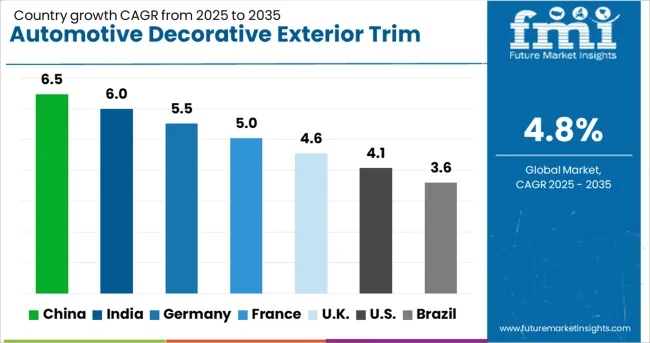

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The automotive decorative exterior trim market is projected to grow at a CAGR of 4.8% through 2035, driven by rising demand for vehicle personalization, improved aesthetics, and premium styling components. China leads with 6.5%, supported by expanding automotive production and consumer preference for advanced exterior enhancements. India follows with 6.0%, propelled by growth in passenger vehicle sales and emerging premium car segments. Among mature markets, Germany records 5.5%, emphasizing high-quality trims for luxury brands, while the United Kingdom posts 4.6%, supported by OEM customization programs. The United States grows at 4.1%, driven by demand for pickup trucks and SUVs with upgraded exterior styling. Material innovation, including lightweight polymers and chrome-finished accents, along with integration of LED elements, is expected to define the next wave of market evolution globally. The analysis includes over 40 countries, with the top five discussed below.

China is expected to grow at a CAGR of 6.5% through 2035, driven by the strong expansion of passenger and commercial vehicle segments. Increasing consumer demand for premium aesthetics, coupled with growing adoption of SUVs and luxury sedans, accelerates exterior trim installations. Domestic manufacturers are focusing on cost-effective, chrome-finished trims and high-gloss components to meet local styling preferences. Integration of LED lighting into decorative trims is emerging as a key trend in higher-end models. Partnerships between global OEMs and local suppliers are supporting high-volume production for both domestic and export markets. Continuous innovation in lightweight material solutions is also enhancing design flexibility, reducing overall vehicle weight without compromising appearance.

The automotive decorative exterior trim market in India is forecasted to register a CAGR of 6.0% through 2035, supported by increasing passenger car production and rising consumer interest in aesthetic upgrades. Growing penetration of compact SUVs and premium hatchbacks has created new demand for chrome appliqués, window moldings, and side protection trims. Domestic manufacturers are introducing affordable yet visually appealing designs to cater to mid-segment buyers. Global OEMs operating in India are offering high-end trims as part of premium variants, encouraging wider adoption. Investments in automated molding processes and advanced surface finishing technologies are enabling local suppliers to meet stringent OEM quality standards while maintaining cost competitiveness.

Germany is projected to achieve a CAGR of 5.5% through 2035, reflecting strong adoption of high-end trims in luxury and premium vehicles. Automotive brands are emphasizing superior surface quality, precision-engineered moldings, and chrome detailing to enhance exterior appeal. Advanced technologies, including laser-etched decorative finishes and embedded lighting, are being integrated into trims to meet evolving design trends. German suppliers are leveraging advanced composite materials and high-strength polymers to reduce weight while maintaining structural durability. Collaborations between OEMs and material specialists are driving innovations in scratch-resistant coatings and glossy finishes, ensuring long-lasting aesthetics under diverse environmental conditions.

The United Kingdom is expected to grow at a CAGR of 4.6% through 2035, supported by consumer interest in personalization and OEM initiatives to introduce trim upgrade packages. Premium automakers are integrating chrome-plated accents, gloss black moldings, and illuminated elements into exterior trims to enhance brand distinction. Aftermarket demand is also rising, with customers seeking styling kits for SUVs and luxury sedans. British suppliers are focusing on precision-fit trims designed for easy installation and compatibility with existing vehicle platforms. High adoption of sustainable coatings and corrosion-resistant finishes is improving product life and maintaining aesthetic appeal across diverse weather conditions.

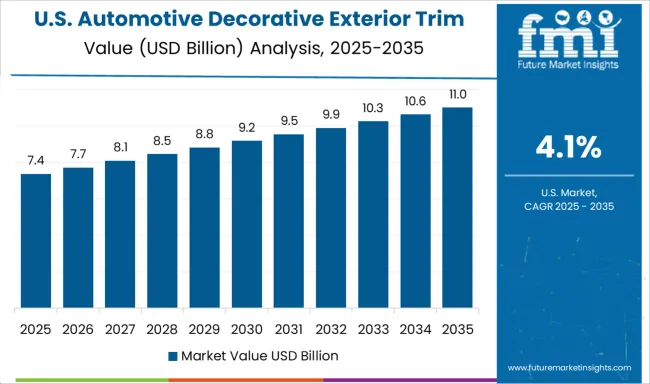

The United States is forecasted to grow at a CAGR of 4.1% through 2035, driven by strong demand for exterior styling upgrades in pickup trucks and SUVs. Consumers are favoring trims with chrome and matte black finishes for enhanced visual appeal. Automakers are incorporating LED-lit moldings and textured surfaces as part of high-end variants to improve brand differentiation. Domestic suppliers are adopting automated coating technologies to deliver uniform surface finishes and weather resistance. Growth in the aftermarket segment, particularly for performance-oriented styling kits, further supports demand. Premium trims offering aerodynamic benefits and integrated lighting features are becoming key elements in design innovation strategies.

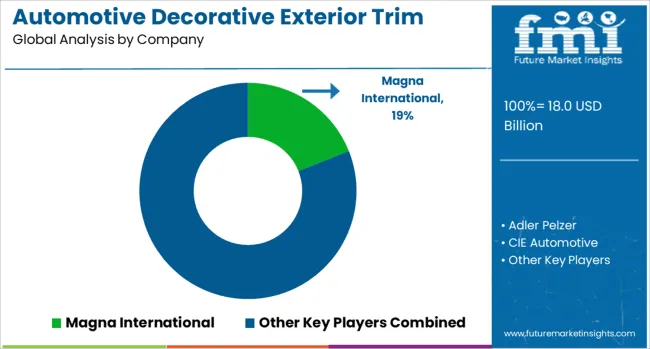

The automotive decorative exterior trim market is dominated by global Tier-1 suppliers and specialized manufacturers delivering high-quality trim solutions for passenger and commercial vehicles. Magna International leads with advanced exterior systems incorporating chrome and painted trim elements designed for durability and aesthetic appeal. Adler Pelzer and Motherson Group maintain strong positions through integrated trim and acoustic solutions, emphasizing lightweight materials and customized designs. CIE Automotive and Flex-N-Gate leverage their strong manufacturing footprints to provide cost-effective trim products for global OEMs. Plasman specializes in plastic-based exterior components with high-precision molding, while Rehau Automotive differentiates through advanced polymer technologies for premium trims and surface finishes. SRG Global, a Guardian Industries company, is a key player in chrome plating and decorative coatings, serving luxury and mid-range vehicle segments.

Toyoda Gosei focuses on weather-resistant and impact-resistant trim components for global automotive platforms, while Yanfeng strengthens its market position through large-scale supply capabilities and collaborations with leading automakers in Asia and Europe. Competitive differentiation centers on material innovation, UV resistance, corrosion protection, and compliance with OEM specifications for design flexibility. Barriers to entry include high tooling costs, stringent quality standards, and the need for global supply chain capabilities. Strategic priorities involve expanding lightweight composite trim solutions, introducing eco-friendly coating technologies, and developing integrated decorative systems compatible with electric vehicle platforms to meet evolving market demands.

Manufacturers are investing in advanced surface treatments, chrome alternatives, and paintable plastics to improve visual appeal and durability while reducing vehicle weight. Strategic collaborations with OEMs for co-design and customization are strengthening brand differentiation. Expansion into electric and luxury vehicle segments is prioritized to capture high-value opportunities. Companies are also focusing on integrating functional elements like aerodynamic enhancements and lighting features into trims. Regional production localization and cost optimization remain critical to maintaining competitiveness and reducing lead times.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.0 Billion |

| Material | Plastic, Stainless steel, Carbon fiber, Aluminum, Chrome, and Others |

| Vehicle | Passenger cars, Mid-size, Luxury, Sedan, SUV, and Commercial vehicles |

| Application | Grilles, Bumpers, Door & window, Roof rails, Moldings, Wheel arch, Pillar, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Magna International, Adler Pelzer, CIE Automotive, Flex-N-Gate, Motherson Group, Plasman, Rehau Automotive, SRG Global, Toyoda Gosei, and Yanfeng |

| Additional Attributes | Dollar sales by trim type (chrome trims, painted trims, polymer-based trims) and application (door frames, window surrounds, grilles, tailgate trims). Demand dynamics are driven by increasing vehicle customization, consumer preference for premium aesthetics, and growing EV production requiring aerodynamic and lightweight trim solutions. Regional trends highlight North America and Europe as key markets for high-end trims, while Asia-Pacific leads in volume production for mass-market vehicles. Innovation trends include use of recyclable thermoplastics, PVD coatings as an alternative to chrome plating, and integration of trims with lighting elements for advanced styling. Environmental initiatives focus on reducing hazardous plating processes and adopting water-based coating systems for sustainable production. |

The global automotive decorative exterior trim market is estimated to be valued at USD 18.0 billion in 2025.

The market size for the automotive decorative exterior trim market is projected to reach USD 28.8 billion by 2035.

The automotive decorative exterior trim market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in automotive decorative exterior trim market are plastic, stainless steel, carbon fiber, aluminum, chrome and others.

In terms of vehicle, passenger cars segment to command 68.0% share in the automotive decorative exterior trim market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA