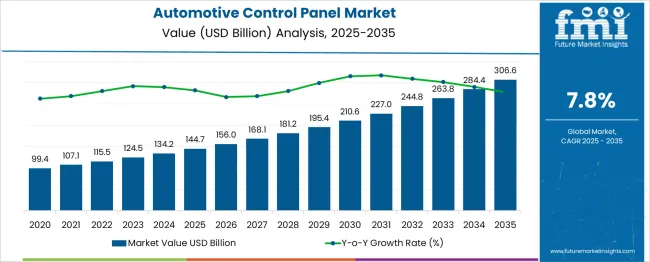

The Automotive Control Panel Market is estimated to be valued at USD 144.7 billion in 2025 and is projected to reach USD 306.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period. The automotive control panel market is projected to create an absolute dollar opportunity of USD 161.9 billion over the forecast period. This growth corresponds to a multiplier of 2.12x, supported by a strong CAGR of 7.8%, driven by the rising integration of advanced infotainment systems, digital displays, and touch-enabled interfaces in vehicles. In the first five-year phase (2025–2030), the market is expected to reach approximately USD 210.8 billion, adding USD 66.1 billion, which accounts for 40.8% of the total incremental growth, fueled by increasing adoption of connected vehicle technologies and enhanced cabin ergonomics.

The second half (2030–2035) contributes USD 95.8 billion, representing 59.2% of incremental growth, signaling accelerated demand as autonomous driving platforms and electric vehicles dominate production lines, requiring more sophisticated control interfaces. Annual increments rise from USD 13 billion in the early years to over USD 19 billion by the end of the forecast period, indicating consistent growth momentum. OEMs and Tier-1 suppliers focusing on haptic feedback systems, multi-functional touch panels, and lightweight designs integrated with ADAS functionalities will be best positioned to capture this USD 161.9 billion opportunity as digitalization reshapes the automotive interior ecosystem.

| Metric | Value |

|---|---|

| Automotive Control Panel Market Estimated Value in (2025 E) | USD 144.7 billion |

| Automotive Control Panel Market Forecast Value in (2035 F) | USD 306.6 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The automotive control panel market holds a significant position within various automotive component and electronics sectors. In the automotive interior components market, its share is approximately 12–14%, as dashboards, door trims, and center consoles make up the core structure. Within the automotive electronics market, it accounts for about 6–7%, since powertrain, safety systems, and infotainment modules dominate this segment. In the vehicle infotainment and HMI market, its share is higher at nearly 15–18%, as control panels serve as the primary interface for managing multimedia, climate, and navigation systems. For the automotive switches and controls market, the contribution stands at 20–22%, given their integral role in operating essential vehicle functions.

In the passenger and commercial vehicle components market, the share is around 4–5%, as this includes a wide range of mechanical and electrical components. Growth in this segment is fueled by increasing demand for advanced infotainment systems, digital instrument clusters, and multi-functional control interfaces. The adoption of capacitive touchscreens, haptic feedback technology, and customizable layouts is redefining user experience and convenience. With rising consumer expectations for connectivity and premium interiors, the automotive control panel market is expected to expand its influence across these parent markets, driven by innovations in design and integration with smart vehicle systems.

Advancements in in-vehicle infotainment systems, integration of telematics, and the proliferation of connected cars have significantly influenced the shift from traditional mechanical designs to intelligent and responsive control panels. As vehicle manufacturers increasingly prioritize driver safety and convenience, the demand for technologically enhanced control solutions is being reinforced across global markets.

OEMs are aligning with digital transformation strategies by incorporating sensor-based panels, capacitive touch controls, and voice-assisted systems, enabling seamless human-machine interaction. Additionally, rising electrification in both passenger and commercial vehicles is creating opportunities for modular control panel configurations that support advanced driver-assistance systems.

Future growth is expected to be driven by the adoption of AI-integrated panels and scalable platforms that can be customized across models, offering both cost efficiency and feature richness. The market outlook remains optimistic with ongoing collaborations between automotive electronics manufacturers and software developers..

The automotive control panel market is segmented by technology, component, vehicle, sales channel, and geographic regions. The automotive control panel market is divided into Analog control panels, Digital control panels, Voice-activated control panels, and Touchscreen control panels. In terms of components, the automotive control panel market is classified into Instrument cluster, Center console, Steering wheel controls, Door panels, and Overhead console. Based on vehicle of the automotive control panel market is segmented into Passenger and Commercial. The automotive control panel market is segmented by sales channel into OEMs and Aftermarket. Regionally, the automotive control panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

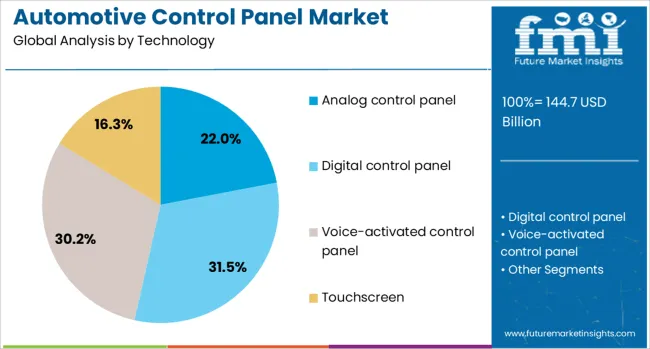

The analog control panel segment is expected to account for 22% of the Automotive Control Panel market revenue share in 2025, making it the leading technology segment. This segment’s position has been sustained by its reliability, cost-effectiveness, and straightforward usability, especially in markets where vehicle affordability and ruggedness are prioritized. Analog control panels have continued to be utilized in entry-level and mid-range vehicle models, where end-users value tactile feedback and mechanical simplicity.

Their adoption has also been reinforced by minimal maintenance requirements and proven durability in diverse operating conditions. Despite the rising penetration of digital interfaces, analog systems have retained their relevance due to their intuitive operation and lower manufacturing costs.

Automotive OEMs have continued to offer analog options to cater to consumer segments that prefer non-digital experiences, particularly in regions with limited digital infrastructure. These factors have contributed to the ongoing demand and sustained market leadership of analog technology within automotive control systems..

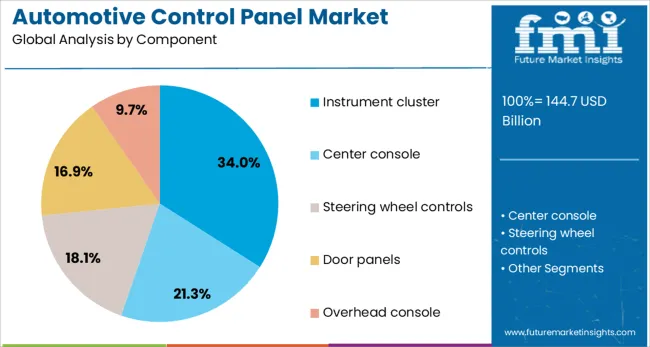

The instrument cluster segment is projected to hold 34% of the Automotive Control Panel market revenue share in 2025, emerging as the dominant component. Growth in this segment has been driven by its central role in vehicle information delivery, offering critical data such as speed, fuel levels, navigation prompts, and driver alerts. Enhanced with digital and hybrid displays, modern instrument clusters have evolved into multifunctional hubs, seamlessly integrating real-time diagnostics and driver-assistance feedback.

The increasing emphasis on vehicle safety, personalization, and regulatory compliance has reinforced investment in high-performance instrument cluster designs. Their compatibility with both analog and digital control architectures allows for wide deployment across vehicle segments.

Additionally, the rising trend toward head-up displays and customizable dashboards has elevated the importance of sophisticated instrument clusters that align with brand identity and user expectations. The ability of this component to enhance driver experience and operational awareness has contributed significantly to its leading position in the market..

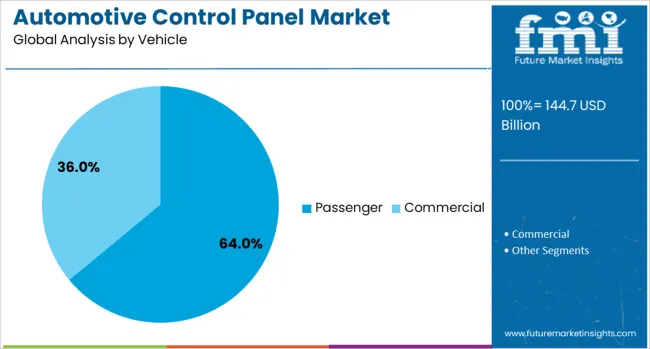

The passenger vehicle segment is expected to capture 64% of the Automotive Control Panel market revenue share in 2025, establishing it as the leading vehicle type. This dominance has been attributed to the high volume production of passenger vehicles globally and the growing demand for comfort, convenience, and personalized driving experiences. Control panels in this segment have increasingly featured interactive designs, touchscreen interfaces, and integrated control for climate, navigation, and entertainment systems.

The rise in consumer preference for premium features, even in compact and mid-size vehicles, has accelerated innovation in control panel aesthetics and functionality. Additionally, the growth of electric and hybrid passenger vehicles has driven the need for advanced panel layouts that support new digital interfaces and energy management systems.

Urbanization, rising disposable incomes, and supportive government policies in emerging economies have further contributed to the expansion of this segment. As automakers strive to differentiate offerings through interior technology, passenger vehicles have remained the primary focus for control panel advancements..

The automotive control panel market is witnessing strong growth driven by rising vehicle production, consumer demand for enhanced in-cabin experience, and increased integration of infotainment and climate control systems. Opportunities are emerging from the growing adoption of touch-based and haptic feedback panels, along with voice-enabled interfaces. Key trends include the development of minimalistic dashboard designs, integration of advanced driver assistance features, and use of customizable digital displays. However, high system costs, semiconductor shortages, and cybersecurity risks in connected vehicles remain major restraints. Overall, the market outlook remains positive with rapid design evolution and feature-rich offerings.

The primary growth driver for the automotive control panel market is the surge in global vehicle production combined with rising consumer expectations for convenience features. In 2024 and 2025, premium and mid-segment cars increasingly featured integrated panels for infotainment, climate control, and navigation systems. Automakers introduced advanced central control units with touchscreens, reducing physical buttons for a streamlined design. Growth in electric vehicles also influenced the demand for multifunctional panels supporting energy management and connectivity. These developments confirm that enhanced in-cabin experience and intuitive controls are critical drivers shaping future adoption.

Significant opportunities exist in digital display panels and connected control interfaces. In 2025, manufacturers introduced next-generation panels with integrated connectivity, enabling real-time diagnostics and wireless updates. Voice-assist features paired with AI-enabled controls gained attention in luxury and high-end vehicles. Expansion in emerging markets also created demand for modular control panels adaptable to different vehicle segments. These opportunities underline the competitive advantage for suppliers offering customizable, software-integrated designs that improve user interaction and vehicle functionality while aligning with the trend of connected mobility solutions in both passenger and commercial vehicles.

Emerging trends highlight the transition toward minimalistic dashboards and fully digital interfaces. In 2024, haptic feedback touchscreens replaced traditional buttons in several premium models, delivering enhanced user experience. Multi-screen configurations combining entertainment, driver information, and vehicle diagnostics became increasingly common. Augmented reality features integrated into control panels also appeared in prototype designs to assist navigation. These shifts indicate that automakers and suppliers are prioritizing aesthetics and functionality, using innovative materials and streamlined layouts to meet rising consumer demand for sophisticated yet user-friendly automotive interiors.

Market restraints include high production costs and supply chain vulnerabilities. In 2024 and 2025, semiconductor shortages delayed the manufacturing of digital control panels, leading to production backlogs for several automakers. The elevated cost of advanced panels incorporating sensors, processors, and displays limited their adoption in budget vehicle segments. Cybersecurity concerns associated with connected control systems further impacted consumer confidence. These challenges emphasize the need for cost optimization, secure architecture, and robust supply planning to ensure scalability and sustained growth in an increasingly competitive automotive electronics market.

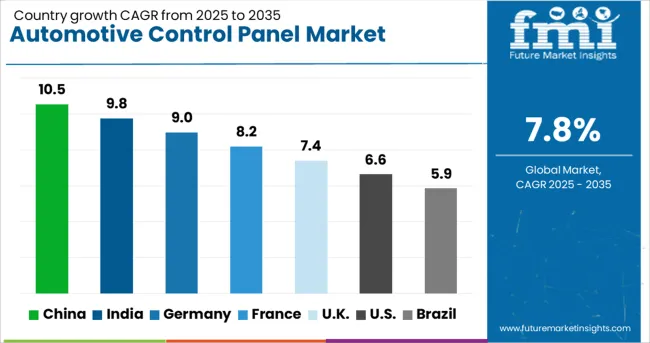

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The global automotive control panel market is forecasted to grow at 7.8% CAGR during 2025–2035. China leads with 10.5% CAGR, driven by EV penetration, premium vehicle demand, and the integration of advanced infotainment systems. India follows at 9.8%, supported by growing sales of connected cars and adoption of touch-enabled control panels in mid-range vehicles. Germany records 9.0% CAGR, emphasizing luxury car production and innovations in haptic feedback and gesture control. The UK grows at 7.4%, while the United States posts 6.6%, reflecting steady growth in smart vehicle features and aftermarket upgrades. Asia-Pacific dominates with rising automotive production and digital cockpit adoption, whereas Europe and North America focus on premium aesthetics, sustainability in materials, and AI-driven interfaces.

China is projected to grow at 10.5% CAGR, leading global demand due to its dominant automotive production base and rapid shift toward electric and smart vehicles. High consumer demand for digital cockpits, large touchscreen interfaces, and advanced infotainment systems drives the adoption of sophisticated control panels. Domestic OEMs prioritize cost-effective designs with customizable options, while premium brands integrate AI-based voice assistants and haptic feedback for enhanced user experience. The rise of EV startups accelerates innovations in control panel designs to accommodate integrated navigation, energy management, and entertainment systems.

The market in India is expected to grow at 9.8% CAGR, supported by the rising preference for connected cars and smart interior systems. Affordable touchscreen-based control panels dominate demand in mid-range vehicles, while luxury segments adopt high-resolution displays and integrated telematics. The government's push for EV adoption and advanced driver assistance systems (ADAS) indirectly supports control panel innovation. Domestic OEMs are collaborating with global tech firms to deliver cost-effective yet advanced solutions, including multi-functional steering controls and smartphone-integrated dashboards. The aftermarket also contributes significantly, with retrofit touchscreen kits for older vehicles gaining traction.

Germany is projected to grow at 9.0% CAGR, fueled by its strong luxury and premium car manufacturing base. Control panels in German vehicles increasingly feature haptic feedback, gesture recognition, and multi-screen configurations to enhance user experience. Automakers integrate sustainable materials and ambient lighting to align with green mobility trends. Digital cockpit systems dominate as electric and autonomous vehicles rise in demand. Leading Tier-1 suppliers focus on software-defined control panels with OTA update capability to deliver long-term value and personalization for customers.

The United Kingdom market is anticipated to grow at 7.4% CAGR, driven by rising adoption of premium EVs and smart mobility initiatives. OEMs prioritize sophisticated control panels featuring voice command, Bluetooth integration, and connected infotainment services. The demand for advanced climate control systems and centralized digital interfaces in SUVs and luxury sedans further supports market growth. Retrofits in older fleet vehicles with touchscreen systems contribute to aftermarket expansion. Integration of AI-powered assistants and compatibility with EV battery management platforms represents the next frontier for control panel innovation in the United Kingdom.

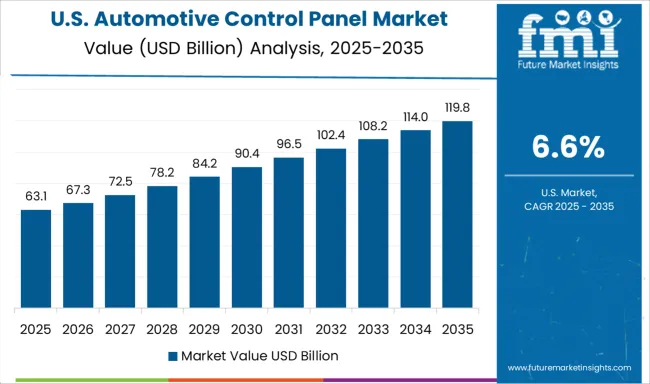

The United States market is forecasted to grow at 6.6% CAGR, reflecting steady demand in a mature automotive industry. Growth is driven by the popularity of large SUVs, crossovers, and luxury sedans featuring multi-screen infotainment systems. Consumer preference for connectivity fosters integration of 5G-enabled dashboards and smartphone mirroring capabilities. Premium automakers are experimenting with augmented reality (AR) head-up displays (HUD) integrated with control panel systems. Aftermarket providers target tech-savvy consumers with advanced retrofit options offering wireless connectivity and customizable user interfaces.

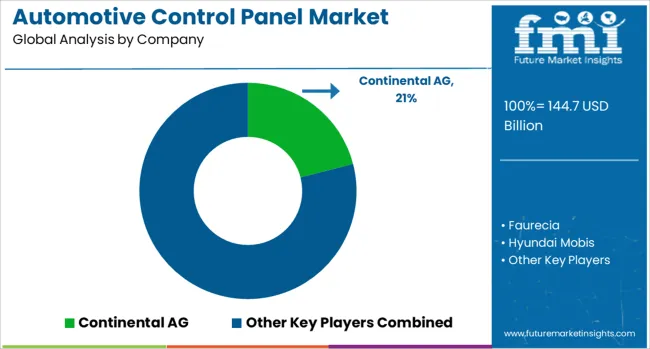

The automotive control panel market is moderately consolidated, with Continental AG recognized as a leading player due to its advanced electronics integration and expertise in delivering user-friendly, high-tech interfaces for modern vehicles. The company focuses on innovative designs combining tactile controls, haptic feedback, and digital displays for enhanced driver convenience and safety. Key players include Faurecia, Hyundai Mobis, Denso Corporation, and Robert Bosch GmbH. These companies provide a broad range of control panel solutions that integrate HVAC systems, infotainment, lighting, and connectivity features into compact and intuitive interfaces. Their designs cater to evolving trends in vehicle interiors, emphasizing seamless connectivity, ergonomic layouts, and premium aesthetics to enhance user experience.

Market growth is driven by rising consumer demand for advanced infotainment systems, increasing adoption of electric and autonomous vehicles, and technological enhancements in vehicle interior design. Leading manufacturers are investing in smart control technologies, multi-functional touch panels, and AI-driven personalization features to deliver next-generation automotive interiors. Emerging trends include the integration of augmented reality (AR) displays, gesture-based controls, and lightweight materials to improve efficiency and design flexibility. Asia-Pacific dominates production and consumption, supported by strong automotive manufacturing bases, while North America and Europe lead in advanced feature integration and premium vehicle segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 144.7 Billion |

| Technology | Analog control panel, Digital control panel, Voice-activated control panel, and Touchscreen |

| Component | Instrument cluster, Center console, Steering wheel controls, Door panels, and Overhead console |

| Vehicle | Passenger and Commercial |

| Sales Channel | OEMs and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Continental AG, Faurecia, Hyundai Mobis, Denso Corporation, and Robert Bosch GmbH |

| Additional Attributes | Dollar sales by control type (manual, touchscreen/infotainment, HVAC) and vehicle segment (passenger cars, LCVs, heavy-duty). Market size was USD 119 B in 2024, projected to reach USD 217 B by 2034 at ~6.2% CAGR. Asia-Pacific leads (~37% share). Buyers favor hybrid HMI, tactile feedback, OTA-enabled diagnostics. Innovations include AI-driven interfaces and modular control clusters. |

The global automotive control panel market is estimated to be valued at USD 144.7 billion in 2025.

The market size for the automotive control panel market is projected to reach USD 306.6 billion by 2035.

The automotive control panel market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in automotive control panel market are analog control panel, digital control panel, voice-activated control panel and touchscreen.

In terms of component, instrument cluster segment to command 34.0% share in the automotive control panel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Control Cables Market Growth – Trends & Forecast 2025-2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cowl Panel Market

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Automotive Airbag Controller Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Sunroof Control Unit Market Size and Share Forecast Outlook 2025 to 2035

Automotive Climate Control Market Size and Share Forecast Outlook 2025 to 2035

Automotive Idle Air Control Valve Market

Automotive Suspension Control Arms Market Growth – Trends & Forecast 2025 to 2035

Automotive Electronic Control Unit (ECU) Market

Automotive Active Roll Control System Market Growth - Trends & Forecast 2025 to 2035

Automotive Oil Pressure Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Automotive Touch Screen Control Systems Market Growth - Trends & Forecast 2025 to 2035

Automotive Connectivity Control Unit Market Growth - Trends & Forecast 2025 to 2035

Automotive Fault Circuit Controller Market Size and Share Forecast Outlook 2025 to 2035

Elevator Control Panelboard Market Growth – Trends & Forecast 2024-2034

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pump Control Panels Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA