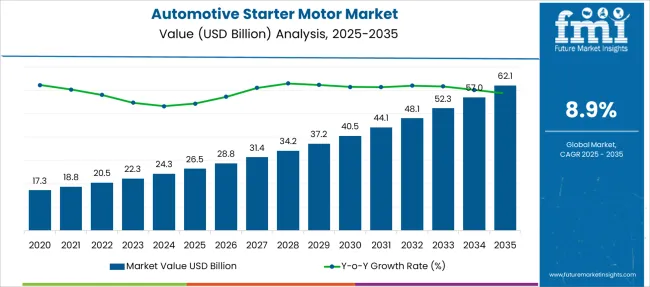

The Automotive Starter Motor Market is estimated to be valued at USD 26.5 billion in 2025 and is projected to reach USD 62.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Starter Motor Market Estimated Value in (2025 E) | USD 26.5 billion |

| Automotive Starter Motor Market Forecast Value in (2035 F) | USD 62.1 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The automotive starter motor market is witnessing consistent growth as global vehicle production rebounds and manufacturers prioritize fuel efficiency and lightweight electrical components. The push toward compact engine architectures and emissions compliance has elevated the importance of reliable and efficient starter systems. Electric starter motors have gained significant ground due to their improved energy efficiency, reduced noise, and compatibility with start-stop technologies.

Additionally, the rise of hybrid vehicles is influencing demand for advanced starter systems capable of frequent ignition cycles. Supply chain localization and collaborations between OEMs and Tier 1 suppliers are further strengthening technology transfer and component standardization.

Regulatory frameworks targeting CO2 reduction and cold start performance are prompting automakers to invest in next-generation starter systems optimized for lower power consumption and durability. The future of the market lies in compact high-torque solutions, integration with auxiliary power modules, and flexible designs that align with evolving drivetrain configurations.

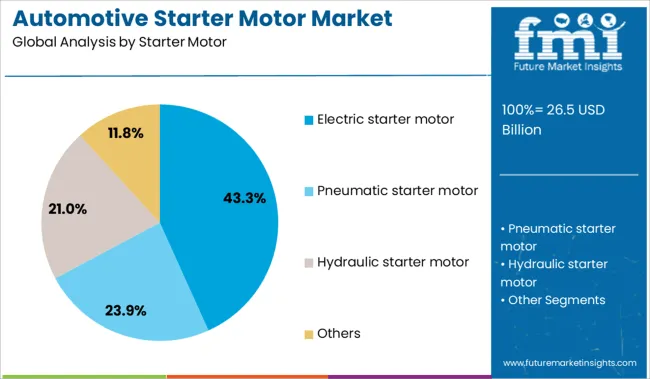

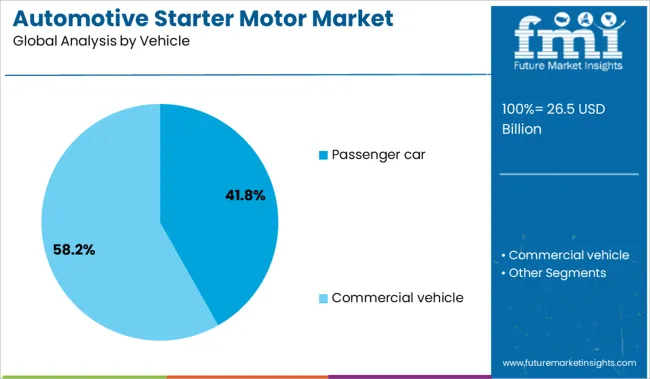

The market is segmented by Starter Motor, Vehicle, Power Rating, Sales Channel and region. By Starter Motor, the market is divided into Electric starter motor, Pneumatic starter motor, Hydraulic starter motor, and Others. In terms of Vehicle, the market is classified into Passenger car, Commercial vehicle, LCV, and HCV.

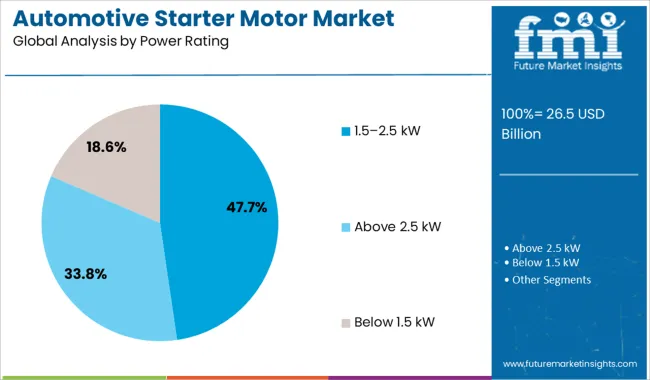

Based on Power Rating, the market is segmented into 1.5-2.5 kW, Above 2.5 kW, and Below 1.5 kW. By Sales Channel, the market is divided into OEM and Aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric starter motor segment is projected to command 43.3% of the overall market share in 2025, making it the leading technology in the starter motor category. This dominance is driven by the segment’s ability to deliver fast and efficient engine ignition, especially in start-stop and mild hybrid vehicle platforms.

Unlike older mechanical systems, electric starter motors offer reduced cranking time, lower emissions during ignition, and improved energy efficiency. Automakers are prioritizing electric starter systems to meet tightening global fuel economy standards and to support downsized engines with higher compression ratios.

Additionally, the segment benefits from cost-effective mass production and compatibility across a wide range of vehicle types. As thermal management and power delivery technologies evolve, electric starter motors are expected to maintain their lead through superior performance and integration versatility.

Passenger cars are expected to account for 41.8% of the total automotive starter motor market revenue in 2025, positioning this vehicle category as the dominant contributor. This share reflects sustained consumer demand, rapid urbanization, and rising vehicle ownership rates in emerging markets.

As passenger vehicles increasingly adopt advanced electronics and emission-reduction technologies, the role of efficient and compact starter systems has grown in importance. OEMs are integrating optimized starter motors to enhance fuel economy and meet performance expectations in compact sedans, SUVs, and crossovers.

Additionally, the widespread adoption of start-stop systems and mild hybrid powertrains in passenger vehicles has further driven demand for reliable, long-life starter motors. The scalability and design flexibility of starter systems tailored to passenger vehicles have ensured their continued preference across global production lines.

The 1.5 to 2.5 kW power rating segment is projected to hold 47.7% of the market share in 2025, establishing it as the leading output category. This range offers an ideal balance between performance and energy consumption, aligning well with the requirements of modern internal combustion engines and small hybrid applications.

The segment supports quick engine cranking while maintaining battery efficiency, which is crucial for vehicles with frequent start cycles. Starter motors in this range are also known for their compact size and cost-effectiveness, making them highly compatible with a wide variety of engine platforms across regions.

Their ability to deliver consistent performance across temperature ranges and driving conditions has reinforced their adoption among vehicle manufacturers targeting middle-segment vehicles. The 1.5 to 2.5 kW category continues to benefit from advancements in lightweight materials and improved winding technologies that extend durability and reduce energy losses.

The automotive starter motor market is being reshaped by the proliferation of start-stop systems, rising hybrid vehicle penetration, and aftermarket refurbishment trends. OEMs are redesigning units to align with fuel efficiency mandates, while rebuild kits and remanufacturing services gain traction in aging fleets. The focus has shifted to compact, brushless designs with higher torque output and multi-platform compatibility, especially across Asia-Pacific, Eastern Europe, and Latin America.

Start-stop integration has been prioritized by major automakers to enhance fuel economy and meet aggressive engine idle control regulations. This trend has pushed starter motor manufacturers to recalibrate their design blueprints and focus on durability, quick restart cycles, and improved clutch engagement. Conventional starter motors are being replaced with tandem or enhanced starter-alternator units, particularly across light-duty diesel and petrol vehicles. The European and Japanese sectors have witnessed a substantial increase in demand for low-resistance, high-RPM starters compatible with micro-hybrids. The warranty-backed starter motor kits are being deployed across fleet service providers, creating downstream demand in regional service networks and dealership-led replacements.

A strong opportunity has surfaced in the refurbishment and remanufacturing segment as commercial transport operators in ASEAN, Africa, and Eastern Europe extend fleet operating cycles. Starter motor rebuild kits and re-engineered solenoids are being actively procured, given the rising costs of new OEM assemblies. The growth of regional remanufacturing hubs is being enabled by favorable import substitution policies and local content mandates. Core return programs and extended warranty reman services are boosting confidence among second and third owners. Brands seen capitalizing on this include those offering teardown guides, component-level servicing, and compatibility across legacy diesel platforms used in haulage, buses, and light-duty pickups.

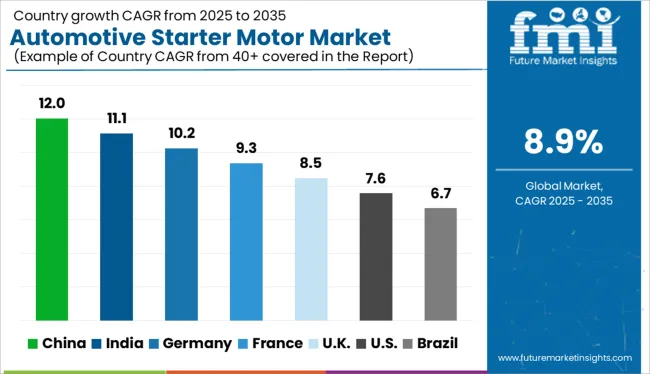

| Country | CAGR |

|---|---|

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

Global CAGR is set at 8.9% through 2035, with BRICS economies outpacing OECD counterparts. China leads at 12.0%, supported by large-scale OEM integration, Tier 1 localization, and rising hybrid vehicle assembly. Plants in Anhui and Shandong are expanding capacity by over 18% annually to meet both domestic and ASEAN demand. India follows at 11.1%, propelled by off-highway vehicle production, two-wheeler electrification, and strong aftermarket consumption. Local suppliers are leveraging PLI schemes to upgrade gear-reduction systems and expand remanufacturing units. Germany records 10.2%, reflecting strength in EV-integrated starter-alternator modules and starter systems for premium ICE models. OEMs in Bavaria are aligning with component firms for modular starter generator designs. France posts 9.3%, driven by demand from small-engine passenger vehicles and LCV segments. Local production is oriented toward lightweight, high-torque units with lower voltage thresholds. The United Kingdom grows at 8.5%, slightly below the global pace, constrained by ICE phase-out policies and tepid aftermarket traction. These five countries represent strategic benchmarks from a wider 40+ country analysis.

Demand for automotive starter motors is expanding at a CAGR of 12.0%, making it the fastest-growing among all major economies. The demand is driven by consistent production growth across domestic OEMs and a clear shift toward locally produced components. Starter motor variants with gear reduction features are being favored due to their cost-performance balance. Despite increased EV penetration, demand remains robust in the ICE and hybrid vehicle segments. Component manufacturers are also investing in high-torque variants to cater to heavy-duty commercial fleets.

Sale of automotive starter motors is growing at a CAGR of 11.1%, driven by the expanding vehicle parc and robust production in entry-level segments. Starter motor demand is accelerating across two-wheelers, small hatchbacks, and light commercial vehicles. Localization efforts by both multinational and domestic manufacturers are intensifying, with growing emphasis on cost-efficient gear reduction types. OEMs are also demanding longer lifecycle performance in hot and dusty environments, prompting new design iterations. Public-sector procurement and commercial transport fleets are contributing to constant aftermarket traction.

Germany is anticipated to register a CAGR of 10.2%, supported by steady demand for high-efficiency starter systems in hybrid and mild-hybrid vehicles. The country’s emphasis on engineering precision continues to influence innovation in lightweight, brushless starter motors. German OEMs are integrating start-stop systems across their sedan and SUV lineups. Despite a shift toward EVs, internal combustion engine exports remain strong in Eastern Europe and South America, steady demand for reliable starter solutions. Local tier-1 suppliers are partnering with semiconductor firms to improve durability and control logic

Demand for Automotive starter motors is expected to expand at a CAGR of 9.3% as hybrid adoption grows across urban and suburban vehicle categories. French OEMs have been fitting start-stop systems as standard, leading to new design requirements for durability under frequent ignition cycles. The domestic demand for compact and lightweight starters is rising, especially in the small car and crossover segments. French suppliers are working with North African manufacturing clusters to support low-cost assembly without sacrificing technical standards. Demand from the retrofitting segment is also gradually increasing.

The UK automotive starter motor market is estimated to grow at a CAGR of 8.5%, slower than other leading economies but supported by specific niches. Demand remains stable for light-duty vans, small hybrids, and vehicles under fleet ownership. Local manufacturers are focusing on corrosion-resistant starter units that meet durability requirements in damp and coastal conditions. Uncertainties related to EU market access have encouraged British firms to adopt dual-channel strategies, with assembly operations maintained both domestically and on the continent.

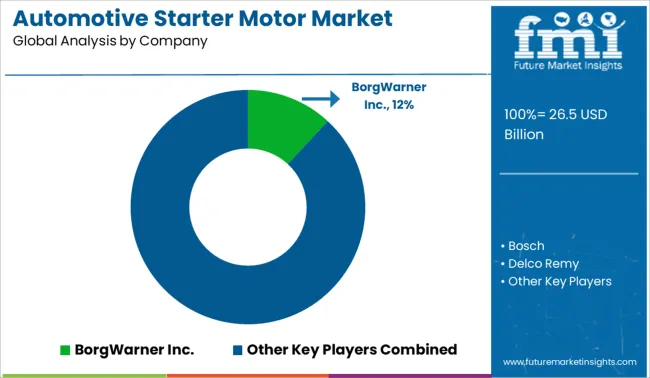

The automotive starter motor market is characterized by intense competition and consolidation, with major OEMs and aftermarket specialists vying for global share. Tier one suppliers such as BorgWarner, Bosch, DENSO, Hitachi Automotive Systems, and Mitsubishi Electric maintain leadership through advanced engineering, high-efficiency designs, and strong OEM relationships. Valeo, Magneti Marelli, and Hella complement these efforts with regionally targeted product lines and integrated vehicle electronics. Delco Remy, a strong player in North America, appeals to both OEM and aftermarket channels. Meanwhile, firms like Dongfeng Motor Parts, GDST Auto Parts, TYK, Unitech, and WAI Global are expanding production capacity in Asia, competing on cost and supply chain integration. Niche players such as Lucas Electrical, MITSUBA, Nikko Electric, Prestolite, Remy International, and Sawafuji offer specialized variants (e.g., heavy-duty, two-wheeled, or construction engine starters) and robust aftermarket support.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.5 Billion |

| Starter Motor | Electric starter motor, Pneumatic starter motor, Hydraulic starter motor, and Others |

| Vehicle | Passenger car, Commercial vehicle, LCV, and HCV |

| Power Rating | 1.5–2.5 kW, Above 2.5 kW, and Below 1.5 kW |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BorgWarner Inc., Bosch, Delco Remy, DENSO, Dongfeng Motor Parts and Components Group Co.,Ltd., GDST Auto Parts, Hella KGaA Hueck & Co., Hitachi Automotive Systems, Lucas Electrical, Magneti Marelli, MITSUBA Corporation, Mitsubishi Electric Corporation, Nikko Electric Industry Co.,Ltd., Prestolite Electric, Remy International, Sawafuji Electric Co.,Ltd., TYK Automotive Electric Co.,Ltd., Unitech Automotive Electrical Appliance Co.,Ltd., Valeo, and WAI Global |

| Additional Attributes | Dollar sales, share by electric and pneumatic starter motor types, increased preference for 1.5–2.5 kW range in compact vehicles, aftermarket demand in aging LCV and HCV fleets, OEM integration in hybrid systems, rise in hydraulic starter motor usage in off-highway applications, retrofitting trends in commercial vehicle platforms |

The global automotive starter motor market is estimated to be valued at USD 26.5 billion in 2025.

The market size for the automotive starter motor market is projected to reach USD 62.1 billion by 2035.

The automotive starter motor market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in automotive starter motor market are electric starter motor, pneumatic starter motor, hydraulic starter motor and others.

In terms of vehicle, passenger car segment to command 41.8% share in the automotive starter motor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA