The global automobile ABS (Anti-lock Braking System) motor market is expected to experience consistent growth in the face of rising concern over the safety of vehicles, strict automobile safety regulations, and the consistent drive towards electric vehicles and autonomous driving technology.

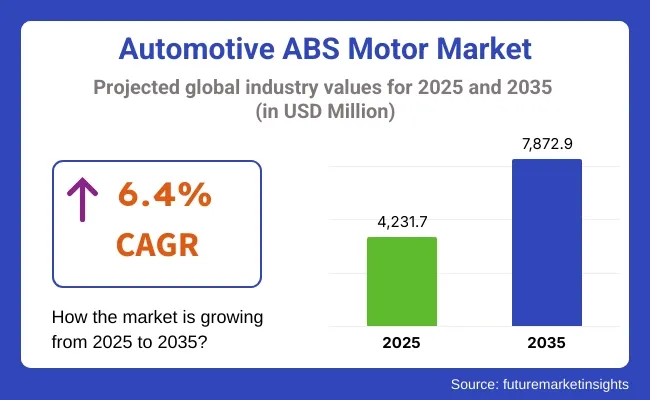

ABS motors are a central component of anti-lock braking systems and provide the hydraulic pressure needed to prevent wheel lock-up during severe braking. As governments all over the world are making ABS integration compulsory on commercial and passenger vehicles, demand for strong, compact, and efficient ABS motors is increasing. Global automotive ABS motor market stood at USD 4,231.7 million in 2025, and by 2035 will reach USD 7,872.9 million with a CAGR of 6.4%.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 4,231.7 million |

| Projected Market Size in 2035 | USD 7,872.9 million |

| CAGR (2025 to 2035) | 6.4% |

Growing demand from consumers for safer cars, along with the desire of vehicle manufacturers to specialize in lighter, module-based, and energy-efficient brake systems, is driving the development of motor technology for ABS. The industry is also benefiting from rising production of vehicles in emerging markets as well as improved take-up of ABS in two-wheelers and electric vehicles, especially in nations where safety regulations are being improved at a rapid rate.

| By Vehicle Type | Market Share (2025) |

|---|---|

| Passenger Cars | 49% |

Passenger vehicles will dominate the motor automotive ABS market in 2025, with 49% of the total demand. The reasons for this demand being contributed so predominantly by passenger vehicles are because there is a greater focus on vehicle safety due to the fact that the government is stricter in terms of regulation and consumers are interested in safe driving experiences.

Anti-lock braking systems (ABS) are now fitted as standard equipment on small, mid-size, and luxury cars because they have been found to be effective in lowering the accident rate and enhancing safety in slippery road conditions. For example, some European carmakers have equipped advanced four-channel ABS systems as standard on their entry hatchbacks to provide better performance in inclement weather.

This is also supplemented by heightened demand for better automobile safety ratings and crash test certifications that are of critical concern to the world's automotive industry. Therefore, the passenger car segment is most likely to stay at the centre of the ABS motor business as more manufacturers incorporate this critical innovation into their models.

| By ABS Type | Market Share (2025) |

|---|---|

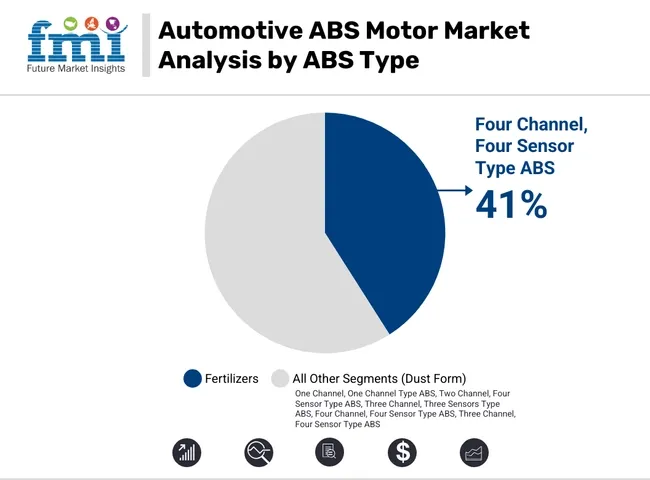

| Four Channel, Four Sensor Type ABS | 41% |

Four-sensor, four-channel ABS will represent 41% of the market in 2025 and will be the leading technology in its class. The system is said to be able to detect braking pressure at all four wheels independently without knowing which corner a signal was coming from, delivering extra safety and performance, most notably in prestige vehicles and SUVs.

A good example is a high-end SUV North American producer who recently implemented this ABS configuration on all their all-wheel-drive models, all for better off-road braking stability and accuracy. Its four-channel configuration's better high-end responsiveness enables the system to be responsive to changing terrain conditions, which is perfect for applications that demand flawless braking quality in changing environments.

Its capacity to provide accurate braking control in high-performance use, like off-road or in extreme weather conditions, is why it is the automakers' first choice when it comes to performance and safety. Its continuous use will also continue to drive its market leadership.

EV-Specific Requirements, System Integration, and Cost Effectiveness

Cost sensitivity is one of the primary issues, especially for low- and mid-market motor vehicle segments in developing nations, which may hinder high-performance integration of ABS motors. ABS motor integration with ADAS, ESC, and brake-by-wire technology also involves complex engineering and calibration. In electric vehicles, there is no engine braking and thus more dependence on regenerative and ABS motors, requiring better durability and miniaturization.

Electrification, Lightweight Construction, and Smart Braking Systems

The transition to electric and self-driving vehicles offers vast opportunities for intelligent ABS motors with sensor integration, energy-efficient, and adaptive braking for varying road conditions. Brushless, light-weight, and high-torque motor technologies are gaining prominence with improved performance. Scalable modular ABS units for various vehicle categories also offer flexibility and faster deployment.

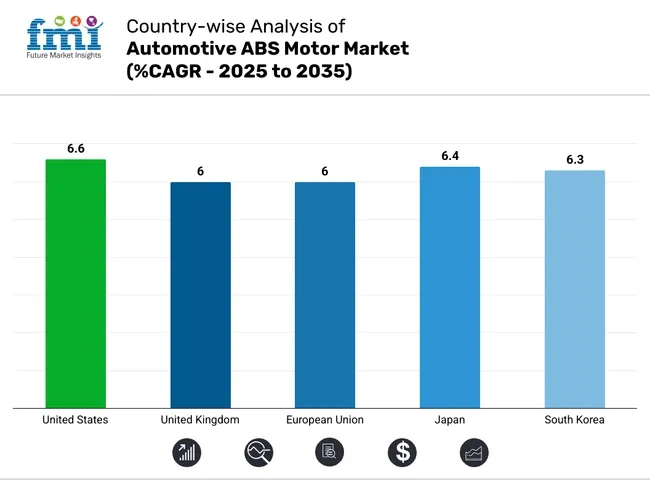

The USA market continues to scale as ABS motor systems are embedded deeper into ADAS suites. OEMs are replacing legacy motors with faster-responding BLDC variants tailored for EV braking. Brands like Tesla and Rivian are working with suppliers to develop compact, digitally tuned ABS units that reduce brake fade and rotor wear, especially for performance EVs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.6% |

UK automakers are aligning ABS systems with growing electric and hydrogen vehicle platforms. ABS motor integration is evolving with drive-by-wire architectures, enabling smoother regenerative braking calibration. British automotive start-ups are sourcing lightweight, modular ABS units that fit seamlessly into microcars and shared urban vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

The EU’s aggressive safety regulations and carbon neutrality goals are pushing ABS motor innovations. German and French automakers are deploying high-efficiency ABS motors compatible with over-the-air calibration. Integration with electronic brake force distribution and AI-based failure diagnostics is becoming standard in mid-segment vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.0% |

Japanese OEMs are focusing on ultra-compact ABS motors to fit Kei cars and hybrid drivetrains. There's a strong push toward ABS motor units that support both regenerative braking and anti-skid response in snowy, mountainous regions. Honda and Toyota are collaborating with robotics divisions to test ABS motors in autonomous delivery pods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

South Korean manufacturers are integrating ABS motor upgrades into their EV and smart mobility ecosystems. Hyundai and Kia are investing in modular brake-by-wire systems, where ABS motor responsiveness is key to delivering smoother autonomous braking. Local component suppliers are also investing in AI-driven testing rigs to fine-tune ABS performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

Increasing interest in car safety rules and autonomous driving momentum are pushing demand for powerful ABS motors at a rapid rate. Auto producers are adopting miniature-size, efficient, and software-driven ABS motors for precise braking, particularly in adverse driving conditions. Suppliers are investing in artificial intelligence-driven control units and across-vehicle compatibility with electric and autonomous vehicles.

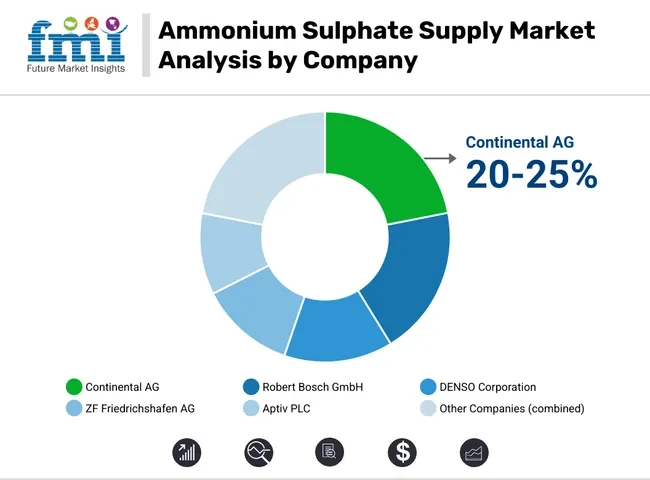

Continental AG (20-25%)

Continental takes the lead with futuristic AI-based ABS motors designed specifically for EVs and autonomous vehicles. Its modularity in platforms and OEM partnerships enhances flexibility across vehicle segments.

Robert Bosch GmbH (18-22%)

Bosch is targeting compact ABS modules focused on autonomous applications. Its Asian expansion includes high-growth automotive centres and stricter safety regulations.

DENSO Corporation (12-16%)

DENSO caters electric and hybrid segments with small, heat-resistant ABS motors and works together with shared mobility companies to introduce adaptive braking.

ZF Friedrichshafen AG (10-14%)

ZF balances innovation and flexibility by striking a midpoint between ABS systems that are appropriate for both ICE and EV cars. Sensor technology purchases enhance its safety suite product offerings.

Aptiv PLC (8-12%)

Aptiv teases with software-defined braking modules but recent poor performance has prompted strategic reorganization and heightened focus on North American OEMs.

Other Key Players (15-25% Combined)

The overall market size for the automotive ABS motor market was approximately USD 4,231.7 million in 2025.

The automotive ABS motor market is projected to reach around USD 7,872.9 million by 2035.

The demand for the automotive ABS motor market during the forecast period is fuelled by increasing vehicle safety regulations, technological advancements, and rising consumer demand for enhanced road safety.

The top 5 countries driving the development of the automotive ABS motor market are the United States, Germany, Japan, China, and South Korea.

On the basis of vehicle type, the passenger cars segment is expected to command a significant share over the forecast period.

Table 1: Global Automotive ABS Motor Market Value (US$ Mn) Forecast by Region, 2017-2032

Table 2: Global Automotive ABS Motor Market Volume (Units) Forecast by Region, 2017-2032

Table 3: Global Automotive ABS Motor Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 4: Global Automotive ABS Motor Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 5: Global Automotive ABS Motor Market Value (US$ Mn) Forecast by ABS Type, 2017-2032

Table 6: Global Automotive ABS Motor Market Volume (Units) Forecast by ABS Type, 2017-2032

Table 7: Global Automotive ABS Motor Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 8: Global Automotive ABS Motor Market Volume (Units) Forecast by Sales Channel, 2017-2032

Table 9: North America Automotive ABS Motor Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 10: North America Automotive ABS Motor Market Volume (Units) Forecast by Country, 2017-2032

Table 11: North America Automotive ABS Motor Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 12: North America Automotive ABS Motor Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 13: North America Automotive ABS Motor Market Value (US$ Mn) Forecast by ABS Type, 2017-2032

Table 14: North America Automotive ABS Motor Market Volume (Units) Forecast by ABS Type, 2017-2032

Table 15: North America Automotive ABS Motor Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 16: North America Automotive ABS Motor Market Volume (Units) Forecast by Sales Channel, 2017-2032

Table 17: Latin America Automotive ABS Motor Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 18: Latin America Automotive ABS Motor Market Volume (Units) Forecast by Country, 2017-2032

Table 19: Latin America Automotive ABS Motor Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 20: Latin America Automotive ABS Motor Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 21: Latin America Automotive ABS Motor Market Value (US$ Mn) Forecast by ABS Type, 2017-2032

Table 22: Latin America Automotive ABS Motor Market Volume (Units) Forecast by ABS Type, 2017-2032

Table 23: Latin America Automotive ABS Motor Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 24: Latin America Automotive ABS Motor Market Volume (Units) Forecast by Sales Channel, 2017-2032

Table 25: Europe Automotive ABS Motor Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 26: Europe Automotive ABS Motor Market Volume (Units) Forecast by Country, 2017-2032

Table 27: Europe Automotive ABS Motor Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 28: Europe Automotive ABS Motor Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 29: Europe Automotive ABS Motor Market Value (US$ Mn) Forecast by ABS Type, 2017-2032

Table 30: Europe Automotive ABS Motor Market Volume (Units) Forecast by ABS Type, 2017-2032

Table 31: Europe Automotive ABS Motor Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 32: Europe Automotive ABS Motor Market Volume (Units) Forecast by Sales Channel, 2017-2032

Table 33: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 34: Asia Pacific Automotive ABS Motor Market Volume (Units) Forecast by Country, 2017-2032

Table 35: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 36: Asia Pacific Automotive ABS Motor Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 37: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Forecast by ABS Type, 2017-2032

Table 38: Asia Pacific Automotive ABS Motor Market Volume (Units) Forecast by ABS Type, 2017-2032

Table 39: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 40: Asia Pacific Automotive ABS Motor Market Volume (Units) Forecast by Sales Channel, 2017-2032

Table 41: MEA Automotive ABS Motor Market Value (US$ Mn) Forecast by Country, 2017-2032

Table 42: MEA Automotive ABS Motor Market Volume (Units) Forecast by Country, 2017-2032

Table 43: MEA Automotive ABS Motor Market Value (US$ Mn) Forecast by Vehicle Type, 2017-2032

Table 44: MEA Automotive ABS Motor Market Volume (Units) Forecast by Vehicle Type, 2017-2032

Table 45: MEA Automotive ABS Motor Market Value (US$ Mn) Forecast by ABS Type, 2017-2032

Table 46: MEA Automotive ABS Motor Market Volume (Units) Forecast by ABS Type, 2017-2032

Table 47: MEA Automotive ABS Motor Market Value (US$ Mn) Forecast by Sales Channel, 2017-2032

Table 48: MEA Automotive ABS Motor Market Volume (Units) Forecast by Sales Channel, 2017-2032

Figure 1: Global Automotive ABS Motor Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 2: Global Automotive ABS Motor Market Value (US$ Mn) by ABS Type, 2022-2032

Figure 3: Global Automotive ABS Motor Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 4: Global Automotive ABS Motor Market Value (US$ Mn) by Region, 2022-2032

Figure 5: Global Automotive ABS Motor Market Value (US$ Mn) Analysis by Region, 2017-2032

Figure 6: Global Automotive ABS Motor Market Volume (Units) Analysis by Region, 2017-2032

Figure 7: Global Automotive ABS Motor Market Value Share (%) and BPS Analysis by Region, 2022-2032

Figure 8: Global Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Region, 2022-2032

Figure 9: Global Automotive ABS Motor Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 10: Global Automotive ABS Motor Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 11: Global Automotive ABS Motor Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 12: Global Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 13: Global Automotive ABS Motor Market Value (US$ Mn) Analysis by ABS Type, 2017-2032

Figure 14: Global Automotive ABS Motor Market Volume (Units) Analysis by ABS Type, 2017-2032

Figure 15: Global Automotive ABS Motor Market Value Share (%) and BPS Analysis by ABS Type, 2022-2032

Figure 16: Global Automotive ABS Motor Market Y-o-Y Growth (%) Projections by ABS Type, 2022-2032

Figure 17: Global Automotive ABS Motor Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 18: Global Automotive ABS Motor Market Volume (Units) Analysis by Sales Channel, 2017-2032

Figure 19: Global Automotive ABS Motor Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 20: Global Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 21: Global Automotive ABS Motor Market Attractiveness by Vehicle Type, 2022-2032

Figure 22: Global Automotive ABS Motor Market Attractiveness by ABS Type, 2022-2032

Figure 23: Global Automotive ABS Motor Market Attractiveness by Sales Channel, 2022-2032

Figure 24: Global Automotive ABS Motor Market Attractiveness by Region, 2022-2032

Figure 25: North America Automotive ABS Motor Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 26: North America Automotive ABS Motor Market Value (US$ Mn) by ABS Type, 2022-2032

Figure 27: North America Automotive ABS Motor Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 28: North America Automotive ABS Motor Market Value (US$ Mn) by Country, 2022-2032

Figure 29: North America Automotive ABS Motor Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 30: North America Automotive ABS Motor Market Volume (Units) Analysis by Country, 2017-2032

Figure 31: North America Automotive ABS Motor Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 32: North America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 33: North America Automotive ABS Motor Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 34: North America Automotive ABS Motor Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 35: North America Automotive ABS Motor Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 36: North America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 37: North America Automotive ABS Motor Market Value (US$ Mn) Analysis by ABS Type, 2017-2032

Figure 38: North America Automotive ABS Motor Market Volume (Units) Analysis by ABS Type, 2017-2032

Figure 39: North America Automotive ABS Motor Market Value Share (%) and BPS Analysis by ABS Type, 2022-2032

Figure 40: North America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by ABS Type, 2022-2032

Figure 41: North America Automotive ABS Motor Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 42: North America Automotive ABS Motor Market Volume (Units) Analysis by Sales Channel, 2017-2032

Figure 43: North America Automotive ABS Motor Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 44: North America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 45: North America Automotive ABS Motor Market Attractiveness by Vehicle Type, 2022-2032

Figure 46: North America Automotive ABS Motor Market Attractiveness by ABS Type, 2022-2032

Figure 47: North America Automotive ABS Motor Market Attractiveness by Sales Channel, 2022-2032

Figure 48: North America Automotive ABS Motor Market Attractiveness by Country, 2022-2032

Figure 49: Latin America Automotive ABS Motor Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 50: Latin America Automotive ABS Motor Market Value (US$ Mn) by ABS Type, 2022-2032

Figure 51: Latin America Automotive ABS Motor Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 52: Latin America Automotive ABS Motor Market Value (US$ Mn) by Country, 2022-2032

Figure 53: Latin America Automotive ABS Motor Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 54: Latin America Automotive ABS Motor Market Volume (Units) Analysis by Country, 2017-2032

Figure 55: Latin America Automotive ABS Motor Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 56: Latin America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 57: Latin America Automotive ABS Motor Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 58: Latin America Automotive ABS Motor Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 59: Latin America Automotive ABS Motor Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 60: Latin America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 61: Latin America Automotive ABS Motor Market Value (US$ Mn) Analysis by ABS Type, 2017-2032

Figure 62: Latin America Automotive ABS Motor Market Volume (Units) Analysis by ABS Type, 2017-2032

Figure 63: Latin America Automotive ABS Motor Market Value Share (%) and BPS Analysis by ABS Type, 2022-2032

Figure 64: Latin America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by ABS Type, 2022-2032

Figure 65: Latin America Automotive ABS Motor Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 66: Latin America Automotive ABS Motor Market Volume (Units) Analysis by Sales Channel, 2017-2032

Figure 67: Latin America Automotive ABS Motor Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 68: Latin America Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 69: Latin America Automotive ABS Motor Market Attractiveness by Vehicle Type, 2022-2032

Figure 70: Latin America Automotive ABS Motor Market Attractiveness by ABS Type, 2022-2032

Figure 71: Latin America Automotive ABS Motor Market Attractiveness by Sales Channel, 2022-2032

Figure 72: Latin America Automotive ABS Motor Market Attractiveness by Country, 2022-2032

Figure 73: Europe Automotive ABS Motor Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 74: Europe Automotive ABS Motor Market Value (US$ Mn) by ABS Type, 2022-2032

Figure 75: Europe Automotive ABS Motor Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 76: Europe Automotive ABS Motor Market Value (US$ Mn) by Country, 2022-2032

Figure 77: Europe Automotive ABS Motor Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 78: Europe Automotive ABS Motor Market Volume (Units) Analysis by Country, 2017-2032

Figure 79: Europe Automotive ABS Motor Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 80: Europe Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 81: Europe Automotive ABS Motor Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 82: Europe Automotive ABS Motor Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 83: Europe Automotive ABS Motor Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 84: Europe Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 85: Europe Automotive ABS Motor Market Value (US$ Mn) Analysis by ABS Type, 2017-2032

Figure 86: Europe Automotive ABS Motor Market Volume (Units) Analysis by ABS Type, 2017-2032

Figure 87: Europe Automotive ABS Motor Market Value Share (%) and BPS Analysis by ABS Type, 2022-2032

Figure 88: Europe Automotive ABS Motor Market Y-o-Y Growth (%) Projections by ABS Type, 2022-2032

Figure 89: Europe Automotive ABS Motor Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 90: Europe Automotive ABS Motor Market Volume (Units) Analysis by Sales Channel, 2017-2032

Figure 91: Europe Automotive ABS Motor Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 92: Europe Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 93: Europe Automotive ABS Motor Market Attractiveness by Vehicle Type, 2022-2032

Figure 94: Europe Automotive ABS Motor Market Attractiveness by ABS Type, 2022-2032

Figure 95: Europe Automotive ABS Motor Market Attractiveness by Sales Channel, 2022-2032

Figure 96: Europe Automotive ABS Motor Market Attractiveness by Country, 2022-2032

Figure 97: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 98: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) by ABS Type, 2022-2032

Figure 99: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 100: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) by Country, 2022-2032

Figure 101: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 102: Asia Pacific Automotive ABS Motor Market Volume (Units) Analysis by Country, 2017-2032

Figure 103: Asia Pacific Automotive ABS Motor Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 104: Asia Pacific Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 105: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 106: Asia Pacific Automotive ABS Motor Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 107: Asia Pacific Automotive ABS Motor Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 108: Asia Pacific Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 109: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Analysis by ABS Type, 2017-2032

Figure 110: Asia Pacific Automotive ABS Motor Market Volume (Units) Analysis by ABS Type, 2017-2032

Figure 111: Asia Pacific Automotive ABS Motor Market Value Share (%) and BPS Analysis by ABS Type, 2022-2032

Figure 112: Asia Pacific Automotive ABS Motor Market Y-o-Y Growth (%) Projections by ABS Type, 2022-2032

Figure 113: Asia Pacific Automotive ABS Motor Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 114: Asia Pacific Automotive ABS Motor Market Volume (Units) Analysis by Sales Channel, 2017-2032

Figure 115: Asia Pacific Automotive ABS Motor Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 116: Asia Pacific Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 117: Asia Pacific Automotive ABS Motor Market Attractiveness by Vehicle Type, 2022-2032

Figure 118: Asia Pacific Automotive ABS Motor Market Attractiveness by ABS Type, 2022-2032

Figure 119: Asia Pacific Automotive ABS Motor Market Attractiveness by Sales Channel, 2022-2032

Figure 120: Asia Pacific Automotive ABS Motor Market Attractiveness by Country, 2022-2032

Figure 121: MEA Automotive ABS Motor Market Value (US$ Mn) by Vehicle Type, 2022-2032

Figure 122: MEA Automotive ABS Motor Market Value (US$ Mn) by ABS Type, 2022-2032

Figure 123: MEA Automotive ABS Motor Market Value (US$ Mn) by Sales Channel, 2022-2032

Figure 124: MEA Automotive ABS Motor Market Value (US$ Mn) by Country, 2022-2032

Figure 125: MEA Automotive ABS Motor Market Value (US$ Mn) Analysis by Country, 2017-2032

Figure 126: MEA Automotive ABS Motor Market Volume (Units) Analysis by Country, 2017-2032

Figure 127: MEA Automotive ABS Motor Market Value Share (%) and BPS Analysis by Country, 2022-2032

Figure 128: MEA Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Country, 2022-2032

Figure 129: MEA Automotive ABS Motor Market Value (US$ Mn) Analysis by Vehicle Type, 2017-2032

Figure 130: MEA Automotive ABS Motor Market Volume (Units) Analysis by Vehicle Type, 2017-2032

Figure 131: MEA Automotive ABS Motor Market Value Share (%) and BPS Analysis by Vehicle Type, 2022-2032

Figure 132: MEA Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Vehicle Type, 2022-2032

Figure 133: MEA Automotive ABS Motor Market Value (US$ Mn) Analysis by ABS Type, 2017-2032

Figure 134: MEA Automotive ABS Motor Market Volume (Units) Analysis by ABS Type, 2017-2032

Figure 135: MEA Automotive ABS Motor Market Value Share (%) and BPS Analysis by ABS Type, 2022-2032

Figure 136: MEA Automotive ABS Motor Market Y-o-Y Growth (%) Projections by ABS Type, 2022-2032

Figure 137: MEA Automotive ABS Motor Market Value (US$ Mn) Analysis by Sales Channel, 2017-2032

Figure 138: MEA Automotive ABS Motor Market Volume (Units) Analysis by Sales Channel, 2017-2032

Figure 139: MEA Automotive ABS Motor Market Value Share (%) and BPS Analysis by Sales Channel, 2022-2032

Figure 140: MEA Automotive ABS Motor Market Y-o-Y Growth (%) Projections by Sales Channel, 2022-2032

Figure 141: MEA Automotive ABS Motor Market Attractiveness by Vehicle Type, 2022-2032

Figure 142: MEA Automotive ABS Motor Market Attractiveness by ABS Type, 2022-2032

Figure 143: MEA Automotive ABS Motor Market Attractiveness by Sales Channel, 2022-2032

Figure 144: MEA Automotive ABS Motor Market Attractiveness by Country, 2022-2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA