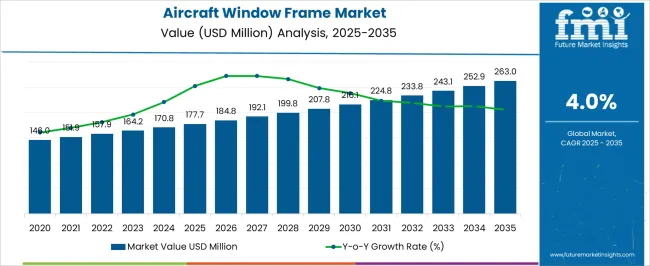

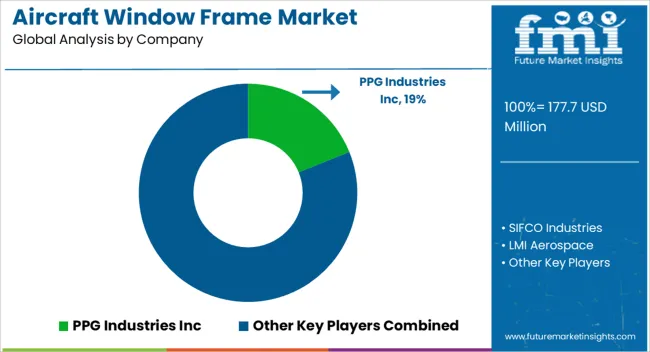

The aircraft window frame market is expected to increase from USD 177.7 million in 2025 to USD 263.0 million by 2035, reflecting a CAGR of 4.0%. This growth momentum is driven by rising commercial aircraft deliveries, modernization of aging fleets, and demand for lightweight, durable cabin components that enhance passenger safety and comfort. Year-on-year analysis highlights consistent progress, with periods of accelerated adoption influenced by regulatory updates and technological innovations in frame materials and designs.

From 2025 to 2027, the market grows from USD 177.7 million to USD 192.1 million, supported by early adoption of advanced composite window frames and OEM initiatives by companies such as Safran, Collins Aerospace, and Diehl Aviation. Momentum during this phase is bolstered by airlines retrofitting aircraft with lighter, corrosion-resistant frames that improve fuel efficiency and cabin durability. Between 2028 and 2031, revenues rise from USD 199.8 million to USD 224.8 million, driven by broader fleet modernization programs, enhanced materials technology, and rising production of narrow- and wide-body aircraft. Growth accelerates as both commercial and business aviation segments demand improved cabin structural components. From 2032 to 2035, the market further strengthens, reaching USD 263.0 million. Adoption expands through new aircraft programs, replacement cycles, and increased focus on energy-efficient, high-strength materials.

| Metric | Value |

|---|---|

| Aircraft Window Frame Market Estimated Value in (2025 E) | USD 177.7 million |

| Aircraft Window Frame Market Forecast Value in (2035 F) | USD 263.0 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The aircraft window frame market is shaped by five interconnected parent markets, each contributing to overall demand and growth. The commercial aircraft manufacturing market holds the largest share at 40%, as passenger planes require strong, lightweight window frames to ensure cabin safety, passenger comfort, and aerodynamic efficiency. The defense and military aircraft market contributes 25%, with fighter jets, transport, and reconnaissance aircraft relying on specialized window frames designed to endure extreme pressures, temperatures, and operational stress.

The business and general aviation market accounts for 15%, as private jets, turboprops, and small aircraft use customized window frames for visibility, comfort, and aesthetic appeal. The aerospace component and materials market holds a 12% share, supplying precision-engineered alloys, composites, and other materials essential for durable and lightweight window frames.

The MRO market represents 8%, supporting inspection, repair, and replacement services to maintain safety and compliance with aviation standards. Commercial, defense, and general aviation segments account for 80% of demand, highlighting that aircraft manufacturing and operational safety remain the primary growth drivers, while materials suppliers and MRO services support continuous innovation and adoption globally.

The aircraft window frame market is witnessing steady growth due to the aviation sector’s recovery post-pandemic, coupled with rising aircraft production and retrofitting programs. Increasing air passenger traffic and the growing demand for fuel-efficient, lightweight aircraft are accelerating investments in advanced window frame materials such as composites and titanium alloys.

Regulatory pressure on safety and structural integrity, particularly in commercial aviation, is pushing OEMs and suppliers to innovate in terms of design durability and performance standards. Emerging markets in Asia-Pacific and the Middle East are witnessing rapid fleet expansion, providing long-term opportunities for aircraft component suppliers.

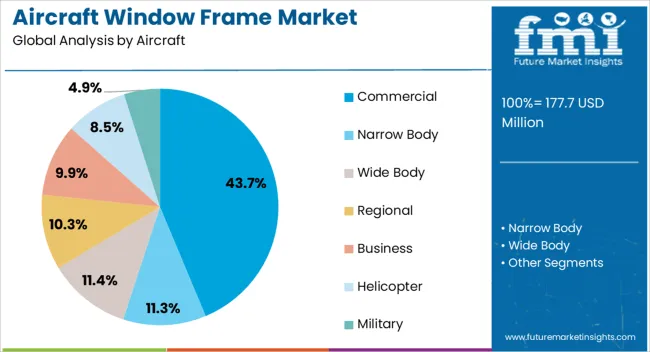

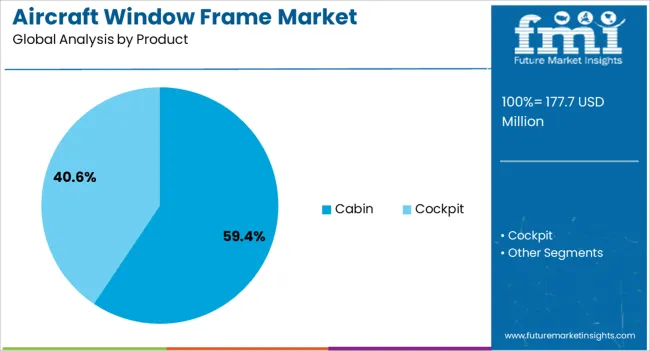

The aircraft window frame market is segmented by aircraft, product, and geographic regions. By aircraft, aircraft window frame market is divided into Commercial, Narrow Body, Wide Body, Regional, Business, Helicopter, and Military. In terms of product, aircraft window frame market is classified into Cabin and Cockpit. Regionally, the aircraft window frame industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Commercial aircraft are expected to account for 43.7% of the aircraft window frame market by 2025, making it the dominant aircraft segment. This is primarily driven by the growing global fleet of narrow-body and wide-body jets, especially from major operators in Asia and North America.

With airlines investing in next-generation aircraft that emphasize both passenger comfort and structural integrity, demand for advanced window frame assemblies has increased. Window frames in commercial fleets must meet rigorous standards for pressurization cycles, UV protection, and aerodynamic compatibility.

As aircraft OEMs scale up production to meet post-COVID travel recovery and backlog orders, the commercial segment remains central to sustained window frame demand.

Cabin applications are projected to represent 59.4% of the total market by 2025, making them the leading product segment. This prominence stems from the critical safety, aesthetics, and passenger experience requirements associated with cabin windows.

Lightweight yet high-strength window frames are essential to maintain fuselage integrity and pressure control while enhancing visibility and cabin ambiance. Innovations in material science, including hybrid composite-metal assemblies, are enabling manufacturers to balance weight, cost, and durability.

Furthermore, trends like larger windows and personalized in-flight lighting are reinforcing demand for structurally sound and thermally efficient window frame solutions for the passenger cabin.

The aircraft window frame market is growing as airlines and OEMs prioritize passenger comfort, cabin aesthetics, and structural integrity. Demand is driven by commercial, business, and military aircraft requiring durable, lightweight frames that integrate with advanced window assemblies.

Challenges include high manufacturing costs, material selection, certification compliance, and complex installation processes. Opportunities exist in advanced composites, modular designs, and corrosion-resistant alloys. Trends highlight lightweight aluminum and composite frames, enhanced sealing technologies, and rapid installation solutions.

Airlines are increasingly focusing on enhancing passenger experience through improved cabin design, including wider windows and better view clarity. Aircraft window frames play a critical role in structural support, noise reduction, and insulation while ensuring aesthetic integration with cabin interiors.

Growth in commercial aviation, regional carriers, and business jets is driving demand for lightweight and durable frames compatible with advanced window technologies, including electrochromic dimming and UV-resistant panes. Passengers expect consistent visibility, comfort, and cabin ambiance, which has prompted OEMs to adopt premium frame materials and designs. These requirements, coupled with fleet modernization initiatives, are positioning aircraft window frames as essential components for passenger satisfaction and operational efficiency.

Constraints in the aircraft window frame market include high production costs associated with aerospace-grade alloys, composite materials, and precision machining. Certification under FAA, EASA, and other regulatory authorities adds complexity, as frames must meet structural, thermal, and pressure-resistance requirements. Supply chain challenges for advanced composites and aluminum alloys can impact production timelines. Installation, maintenance, and replacement processes require specialized training and precision. Technical considerations include sealing efficiency, vibration resistance, and dimensional tolerance to ensure integration with window assemblies. Buyers increasingly seek suppliers offering certified, high-quality frames with predictable delivery schedules and technical support to meet stringent aerospace standards and operational reliability requirements.

Opportunities exist in lightweight aluminum, titanium, and composite window frames that reduce aircraft weight and improve fuel efficiency. Modular designs facilitate faster installation, retrofit, and maintenance, reducing downtime for airlines. Advanced sealing and insulation technologies enhance cabin comfort, temperature control, and noise reduction. Growth in business jets, regional aircraft, and fleet modernization programs across North America, Europe, and Asia-Pacific is fueling adoption. Suppliers offering innovative materials, modular designs, and application support are well positioned to meet the evolving needs of aircraft OEMs, airlines, and maintenance providers. Collaborative development programs with OEMs further strengthen product integration and long-term contracts.

The market is trending toward high-strength, lightweight composites and aluminum alloys for improved durability and fuel efficiency. Advanced sealing systems are being adopted to enhance cabin pressure retention, noise reduction, and thermal insulation. Modular and pre-fabricated frame assemblies allow faster installation and retrofit, minimizing operational downtime.

Collaboration between window frame manufacturers, OEMs, and MRO providers is driving innovation, technical support, and lifecycle management. With increasing passenger expectations and fleet expansion, suppliers that offer certified, lightweight, and customizable window frame solutions are best positioned to capture market growth across commercial, business, and military aviation sectors.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

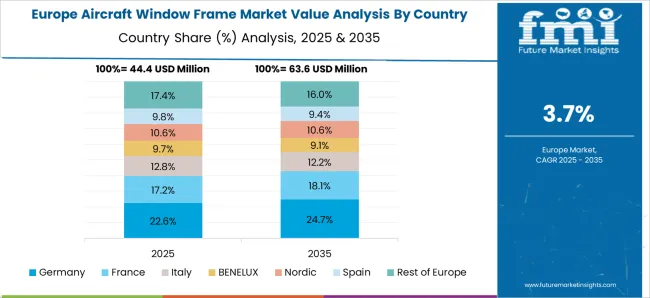

| Brazil | 3.0% |

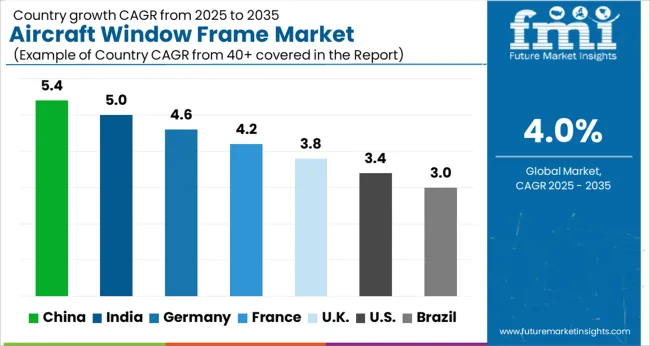

The global aircraft window frame market is projected to grow at a CAGR of 4.0% from 2025 to 2035. China leads at 5.4%, followed by India at 5.0%, France at 4.2%, the UK at 3.8%, and the USA at 3.4%. Growth is driven by fleet expansion, fleet modernization, and replacement of aging aircraft across commercial, regional, and private aviation sectors. BRICS countries, particularly China and India, show rapid adoption due to increasing air travel and new aircraft deliveries.

OECD members such as France, the UK, and the USA focus on lightweight materials, advanced composites, and passenger comfort in design. The analysis covers over 40 countries, with the leading markets shown below.

The aircraft window frame market in China is projected to grow at a CAGR of 5.4% from 2025 to 2035, fueled by the rapid expansion of commercial airlines, regional airports, and the modernization of existing fleets. Domestic aircraft manufacturers are focusing on lightweight aluminum and composite window frames to reduce aircraft weight and enhance fuel efficiency. Retrofit programs for older aircraft are increasing demand for replacement frames, while new production of narrow-body and wide-body aircraft supports OEM requirements. Collaboration with global aerospace suppliers is enabling the integration of advanced materials, improved thermal insulation, and noise reduction features. Airlines prioritize durability, compliance with civil aviation standards, and passenger comfort in design specifications.

The aircraft window frame market in India is expected to grow at a CAGR of 5.0% from 2025 to 2035, supported by the country’s rapidly expanding domestic aviation sector and increasing international connectivity. Airlines are focusing on upgrading existing fleets and procuring frames for new aircraft, especially narrow-body jets used for domestic and regional routes. OEMs are integrating advanced alloys and composite materials to meet performance, safety, and durability requirements. Retrofit programs and maintenance, repair, and overhaul (MRO) facilities are generating significant aftermarket demand for window frames. Passenger comfort and compliance with Directorate General of Civil Aviation standards remain critical. Research initiatives aim at improved UV protection, noise reduction, and scratch-resistant coatings. Partnerships with global suppliers are fostering technology transfer and design improvements.

The aircraft window frame market in France is projected to grow at a CAGR of 4.2% from 2025 to 2035, driven by both civil and regional aircraft manufacturing. Leading OEMs prioritize lightweight, corrosion-resistant, and durable frames to meet European Aviation Safety Agency regulations. Retrofit and replacement programs for aging aircraft fleets are significant contributors to market expansion. The market benefits from advanced materials research, including thermoplastics and carbon fiber composites, which reduce aircraft weight while improving thermal insulation and acoustic performance. Passenger comfort and cabin noise reduction are central to design decisions. Local aerospace suppliers are collaborating with international partners to incorporate next-generation coatings, UV-resistant finishes, and ergonomic designs.

The UK aircraft window frame market is expected to grow at a CAGR of 3.8% from 2025 to 2035, driven by commercial aircraft production and fleet modernization projects. Operators focus on frames that combine lightweight design, thermal insulation, and durability to optimize fuel efficiency and passenger experience. Aftermarket replacement and refurbishment programs contribute to steady demand. Advanced materials such as aluminum alloys and reinforced composites are increasingly used to reduce weight while maintaining structural integrity. OEMs are adopting coatings that resist scratches, UV exposure, and cabin pressure-related wear. Collaboration with European aerospace suppliers supports design innovation, regulatory compliance, and performance testing.

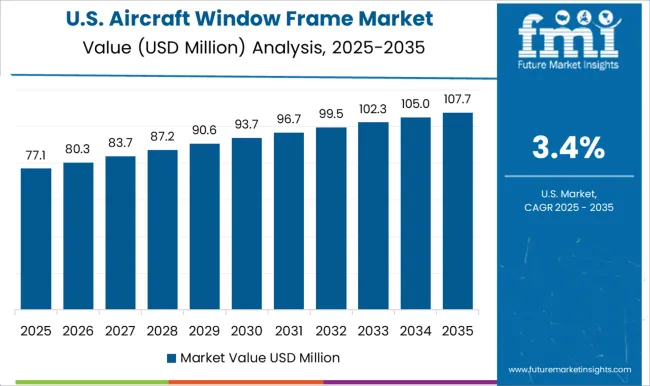

The USA market is projected to grow at a CAGR of 3.4% from 2025 to 2035, supported by commercial airline fleet expansion, MRO activities, and technological advancements in frame materials. Airlines focus on replacing and upgrading window frames to enhance passenger comfort, reduce maintenance costs, and comply with Federal Aviation Administration regulations. Lightweight alloys, composite materials, and scratch-resistant coatings are widely adopted. OEM partnerships with aerospace suppliers enable innovation in UV protection, noise reduction, and improved thermal insulation. The market also benefits from research into aeronautical materials that extend frame lifespan and optimize aircraft performance.

Competition in the aircraft window frame market is being influenced by performance-driven materials, precision manufacturing, and compliance with aviation safety regulations. Market positions are being maintained through aerospace-grade metals, composite materials, and advanced assembly techniques that ensure structural strength and lightweight construction.

GKN Aerospace is being represented with titanium and aluminum window frame assemblies engineered for durability and weight efficiency. Spirit AeroSystems is being promoted with integrated fuselage structures and window frames designed for commercial aircraft. Triumph Group is being applied with precision-machined aluminum frames optimized for fit and fatigue resistance. Safran is being showcased with composite window frames designed for fuel-efficient aircraft platforms. Collins Aerospace is being recognized with structural assemblies incorporating lightweight alloys for enhanced performance. FACC AG, Elbit Systems Cyclone, and EnCore Aerospace are being advanced with composite window frame solutions engineered for reduced weight and improved corrosion resistance. Competition is being shaped by strategic supply partnerships with aircraft OEMs, investment in automated production systems, and development of frames compatible with next-generation aircraft designs. Efforts are being directed toward enhancing structural reliability, lowering maintenance costs, and meeting evolving airworthiness standards to strengthen competitive positions.

| Item | Value |

|---|---|

| Quantitative Units | USD 177.7 Million |

| Aircraft | Commercial, Narrow Body, Wide Body, Regional, Business, Helicopter, and Military |

| Product | Cabin and Cockpit |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPG Industries Inc, SIFCO Industries, LMI Aerospace, Nordam Group, ACE Advanced Composite Engineering GmbH, and GKN Aerospace |

| Additional Attributes | Dollar sales by material type (aluminum, titanium, composite, steel), aircraft type (commercial, military, business jets, helicopters), and application (new aircraft production, retrofits, aftermarket replacements). Demand dynamics are driven by lightweighting initiatives, aircraft modernization programs, and stringent aviation safety regulations. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by increasing airline fleet expansion, defense aircraft upgrades, and rising demand for high-performance, corrosion-resistant window frame solutions. |

The global aircraft window frame market is estimated to be valued at USD 177.7 million in 2025.

The market size for the aircraft window frame market is projected to reach USD 263.0 million by 2035.

The aircraft window frame market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in aircraft window frame market are commercial, narrow body, wide body, regional, business, helicopter and military.

In terms of product, cabin segment to command 59.4% share in the aircraft window frame market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA